Late 2000s recession

Encyclopedia

The late-2000s recession, sometimes referred to as the Great Recession or Lesser Depression or Long Recession, is a severe ongoing global economic problem that began in December 2007 and took a particularly sharp downward turn in September 2008. The Great Recession has affected the entire world economy

, with higher detriment in some countries than others. It is a major global recession

characterized by various systemic imbalances and was sparked by the outbreak of the late-2000s financial crisis

.

There are two senses

of the word "recession": a less precise sense, referring broadly to "a period of reduced economic activity", and the scientific sense used most often in economics

, which is defined operationally

, referring specifically to the contraction phase of a business cycle

, with two or more consecutive quarters of negative GDP growth. By the economic-science definition of the word "recession

", the Great Recession ended in the U.S. in June or July 2009. However, in the broader, layperson sense of the word, many people use the term to refer to the ongoing hardship (in the same way that the term "Great Depression

" is also popularly used). In the U.S., for example, persistent high unemployment

remains

, along with low consumer confidence, the continuing decline in home values and increase in foreclosures and personal bankruptcies

, an escalating federal debt crisis

, inflation

, and rising gas and food prices. In fact, a 2011 poll found that more than half of all Americans think the U.S. is still in recession or even depression, despite official data that shows a historically modest recovery.

(the official arbiter of U.S. recessions) the recession began in December 2007. The financial crisis is linked to reckless lending practices by financial institutions and the growing trend of securitization

of real estate mortgages in the United States

. The US mortgage-backed securities, which had risks that were hard to assess, were marketed around the world. A more broad based credit boom fed a global speculative bubble in real estate

and equities, which served to reinforce the risky lending practices. The precarious financial situation was made more difficult by a sharp increase in oil and food prices

. The emergence of Sub-prime loan

losses in 2007 began the crisis and exposed other risky loans and over-inflated asset prices. With loan losses mounting and the fall of Lehman Brothers

on September 15, 2008, a major panic broke out on the inter-bank loan market. As share and housing prices declined, many large and well established investment and commercial

banks in the United States and Europe

suffered huge losses and even faced bankruptcy, resulting in massive public financial assistance.

A global recession

has resulted in a sharp drop in international trade

, rising unemployment

and slumping commodity prices. In December 2008, the National Bureau of Economic Research

(NBER) declared that the United States had been in recession since December 2007. Several economists have predicted that recovery may not appear until 2011 and that the recession will be the worst since the Great Depression

of the 1930s. Paul Krugman

, who won the Nobel Memorial Prize in Economics, once commented on this as seemingly the beginning of "a second Great Depression." The conditions leading up to the crisis, characterized by an exorbitant rise in asset prices and associated boom in economic demand, are considered a result of the extended period of easily available credit and inadequate regulation and oversight.

The recession has renewed interest in Keynesian economic ideas

on how to combat recessionary conditions. Fiscal

and monetary policies

have been significantly eased to stem the recession and financial risks. Economists advise that the stimulus should be withdrawn as soon as the economies recover enough to "chart a path to sustainable growth".

, Wynne Godley

, Fred Harrison

, Michael Hudson

, Eric Janszen

, Steve Keen

, Jakob Brøchner Madsen & Jens Kjaer Sørensen, Kurt Richebächer

, Nouriel Roubini

, Peter Schiff

and Robert Shiller

.

Among the various imbalances in which the U.S. monetary policy contributed by excessive money creation

, leading to negative household savings and a huge U.S. trade deficit, dollar volatility and public deficits, a focus can be made on the following ones:

The decade of the 2000s saw a global explosion in prices, focused especially in commodities and housing

The decade of the 2000s saw a global explosion in prices, focused especially in commodities and housing

, marking an end to the commodities recession of 1980–2000. In 2008, the prices of many commodities, notably oil and food, rose so high as to cause genuine economic damage, threatening stagflation

and a reversal of globalization

.

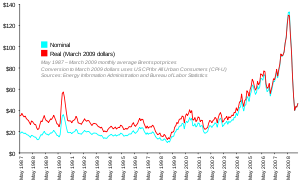

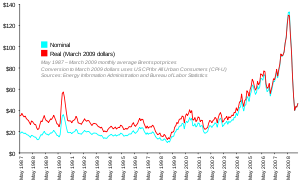

In January 2008, oil prices surpassed $100 a barrel for the first time, the first of many price milestones to be passed in the course of the year. In July 2008, oil peaked at $147.30 a barrel and a gallon of gasoline

was more than $4 across most of the U.S.A. The economic contraction in the fourth quarter of 2008 caused a dramatic drop in demand and prices fell below $35 a barrel at the end of the year. The high of 2008 may have been part of broader pattern of spiking instability in the price of oil over the preceding decade This pattern of spiking instability in oil price may be a product of Peak Oil

. There is concern that if the economy was to improve, oil prices might return to pre-recession levels.

The food and fuel crises were both discussed at the 34th G8 summit

in July 2008.

Sulfuric acid

(an important chemical commodity used in processes such as steel processing, copper production and bioethanol production) increased in price 3.5-fold in less than 1 year while producers of sodium hydroxide have declared force majeure

due to flooding, precipitating similarly steep price increases.

In the second half of 2008, the prices of most commodities fell dramatically on expectations of diminished demand in a world recession.

, United Kingdom, United Arab Emirates

, Italy

, Australia

, New Zealand, Ireland

, Spain

, France

, Poland

, South Africa

, Israel

, Greece

, Bulgaria

, Croatia

, Norway

, Singapore

, South Korea

, Sweden

, Finland

, Argentina

, Baltic states

, India

, Romania

, Russia

, Ukraine

and China

. U.S. Federal Reserve Chairman Alan Greenspan

said in mid-2005 that "at a minimum, there's a little 'froth' (in the U.S. housing market) ... it's hard not to see that there are a lot of local bubbles". The Economist

magazine, writing at the same time, went further, saying "the worldwide rise in house prices is the biggest bubble in history". Real estate bubbles are (by definition of the word "bubble") followed by a price decrease (also known as a housing price crash) that can result in many owners holding negative equity

(a mortgage

debt higher than the current value of the property).

In mid-2007, International Monetary Fund

(IMF) data indicated that inflation was highest in the oil-exporting countries, largely due to the unsterilized growth of foreign exchange reserves

, the term "unsterilized" referring to a lack of monetary policy operations that could offset such a foreign exchange intervention in order to maintain a country's monetary policy target. However, inflation was also growing in countries classified by the IMF as "non-oil-exporting LDCs" (Least Developed Countries

) and "Developing Asia", on account of the rise in oil and food prices.

Inflation was also increasing in the developed countries

, but remained low compared to the developing world.

On October 15, 2008, Anthony Faiola, Ellen Nakashima, and Jill Drew wrote a lengthy article in The Washington Post

titled, "What Went Wrong". In their investigation, the authors claim that former Federal Reserve Board Chairman Alan Greenspan

, Treasury Secretary Robert Rubin, and SEC Chairman Arthur Levitt vehemently opposed any regulation of financial instruments

known as derivatives

. They further claim that Greenspan actively sought to undermine the office of the Commodity Futures Trading Commission

, specifically under the leadership of Brooksley E. Born, when the Commission sought to initiate regulation of derivatives. Ultimately, it was the collapse of a specific kind of derivative, the mortgage-backed security

, that triggered the economic crisis of 2008.

While Greenspan's role as Chairman of the Federal Reserve

has been widely discussed (the main point of controversy remains the lowering of Federal funds rate

at only 1% for more than a year which, according to the Austrian School

of economics, allowed huge amounts of "easy" credit-based money to be injected into the financial system and thus create an unsustainable economic boom) there is also the argument that Greenspan's actions in the years 2002–2004 were actually motivated by the need to take the U.S. economy out of the early 2000s recession

caused by the bursting of the dot-com bubble

— although by doing so he did not help avert the crisis, but only postpone it.

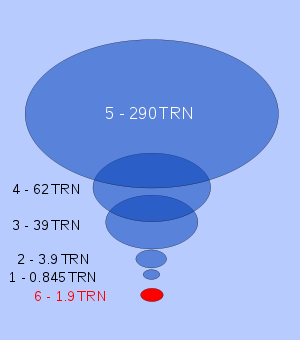

Some economists - those of the Austrian school and those predicting the recession such as Steve Keen - claim that the ultimate point of origin of the great financial crisis of 2007–2010 can be traced back to an extremely indebted US economy. The collapse of the real estate market in 2006 was the close point of origin of the crisis. The failure rates of subprime mortgages were the first symptom of a credit boom turned to bust and of a real estate shock. But large default rates on subprime mortgages cannot account for the severity of the crisis. Rather, low-quality mortgages acted as an accelerant to the fire that spread through the entire financial system. The latter had become fragile as a result of several factors that are unique to this crisis: the transfer of assets from the balance sheets of banks to the markets, the creation of complex and opaque assets, the failure of ratings agencies to properly assess the risk of such assets, and the application of fair value accounting. To these novel factors, one must add the now standard failure of regulators and supervisors in spotting and correcting the emerging weaknesses.

Robert Reich

believes the amount of debt in the US economy can be traced to economic inequality, where middle class wages remain stagnant while wealth concentrates at the top, and households "pull equity from their homes and overload on debt to maintain living standards."

contraction on record:

Business Week in March 2009 stated that global political instability is rising fast due to the global financial crisis and is creating new challenges that need managing. The Associated Press reported in March 2009 that: United States "Director of National Intelligence Dennis Blair has said the economic weakness could lead to political instability in many developing nations." Even some developed countries are seeing political instability. NPR reports that David Gordon, a former intelligence officer who now leads research at the Eurasia Group, said: "Many, if not most, of the big countries out there have room to accommodate economic downturns without having large-scale political instability if we're in a recession of normal length. If you're in a much longer-run downturn, then all bets are off."

Globally, mass protest movements have arisen in many countries as a response to the economic crisis. Additionally, in some countries, riots and even open revolts have occurred in relation to the economic crisis.

For example, the Arab Spring

revolts taking place in the Arab world since December 18, 2010 were ostensibly sparked by the self-immolation of an unemployed Tunisian man named Mohamed Bouazizi

who was prevented from even selling produce from a cart. This act, combined with general discontentment about high unemployment, food inflation, corruption, lack of freedom of speech

and other forms of political freedom, and poor living conditions led to the most dramatic wave of social and political unrest in Tunisia in three decades, resulted in scores of deaths and injuries, and an eventual regime change in Tunisia. To date, there have been revolutions in Tunisia

and Egypt

; a civil war in Libya

; civil uprisings in Bahrain

, Syria

, and Yemen

; major protests in Algeria

, Iraq

, Jordan

, Morocco

, and Oman

, as well as on the borders of Israel

; and minor protests in Kuwait

, Lebanon

, Mauritania, Saudi Arabia, Sudan

, and Western Sahara.

In January of 2009 the government leaders of Iceland were forced to call elections two years early after the people of Iceland staged mass protests and clashed with the police due to the government's handling of the economy. Hundreds of thousands protested in France against President Sarkozy's economic policies. Prompted by the financial crisis in Latvia, the opposition and trade unions there organized a rally against the cabinet of premier Ivars Godmanis. The rally gathered some 10-20 thousand people. In the evening the rally turned into a Riot

. The crowd moved to the building of the parliament and attempted to force their way into it, but were repelled by the state's police. In late February many Greeks took part in a massive general strike because of the economic situation and they shut down schools, airports, and many other services in Greece. Police and protesters clashed in Lithuania where people protesting the economic conditions were shot by rubber bullets. In addition to various levels of unrest in Europe, Asian countries have also seen various degrees of protest. Communists and others rallied in Moscow to protest the Russian government's economic plans. Protests have also occurred in China as demands from the west for exports have been dramatically reduced and unemployment has increased. Beyond these initial protests, the protest movement has grown and continued in 2011.

, the United States, and the European Union

. Bailouts of failing or threatened businesses were carried out or discussed in the USA, the EU, and India. In the final quarter of 2008, the financial crisis saw the G-20 group of major economies assume a new significance as a focus of economic and financial crisis management.

(FDIC) program. Part of the announcements included temporary exceptions to section 23A and 23B (Regulation W), allowing financial groups to more easily share funds within their group. The exceptions would expire on January 30, 2009, unless extended by the Federal Reserve Board. The Securities and Exchange Commission announced termination of short-selling of 799 financial stocks, as well as action against naked short selling

, as part of its reaction to the mortgage crisis.

included a provision which changed the definition of Qualified Default Investments (QDI) for retirement plans from stable value investments, money market funds, and cash investments to investments which expose an individual to appropriate levels of stock and bond risk based on the years left to retirement. The Act required that Plan Sponsors move the assets of individuals who had never actively elected their investments and had their contributions in the default investment option. This meant that individuals who had defaulted into a cash fund with little fluctuation or growth would soon have their account balances moved to much more aggressive investments.

Starting in early 2008, most US employer-sponsored plans sent notices to their employees informing them that the plan default investment was changing from a cash/stable option to something new, such as a retirement date fund which had significant market exposure. Most participants ignored these notices until September and October, when the market crash was on every news station and media outlet. It was then that participants called their 401(k)

and retirement plan providers and discovered losses in excess of 30% in some cases. Call centers for 401(k) providers experienced record call volume and wait times, as millions of inexperienced investors struggled to understand how their investments had been changed so fundamentally without their explicit consent, and reacted in a panic by liquidating everything with any stock or bond exposure, locking in huge losses in their accounts.

Due to the speculation and uncertainty in the market, discussion forums filled with questions about whether or not to liquidate assets and financial gurus were swamped with questions about the right steps to take to protect what remained of their retirement accounts. During the third quarter of 2008, over $72 billion left mutual fund investments that invested in stocks or bonds and rushed into Stable Value investments in the month of October. Against the advice of financial experts, and ignoring historical data illustrating that long-term balanced investing has produced positive returns in all types of markets, investors with decades to retirement instead sold their holdings during one of the largest drops in stock market history.

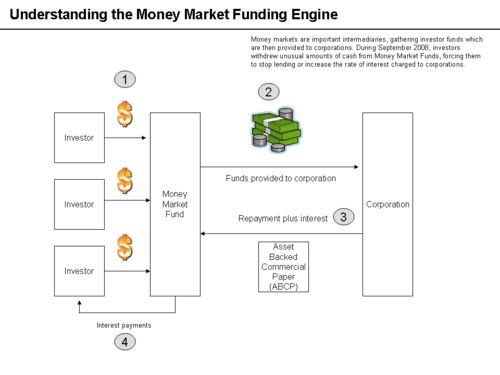

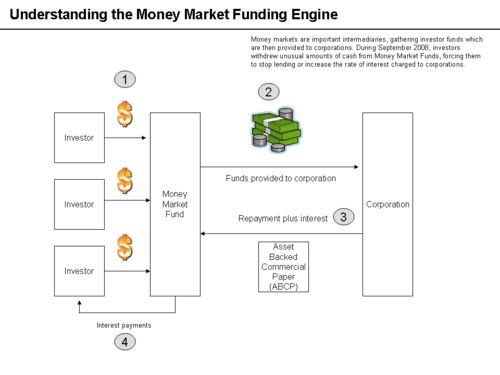

During the week ending September 19, 2008, money market

During the week ending September 19, 2008, money market

mutual funds had begun to experience significant withdrawals of funds by investors. This created a significant risk because money market funds are integral to the ongoing financing of corporations of all types. Individual investors lend money to money market funds, which then provide the funds to corporations in exchange for corporate short-term securities called asset-backed commercial paper (ABCP). However, a potential bank run

had begun on certain money market funds. If this situation had worsened, the ability of major corporations to secure needed short-term financing through ABCP issuance would have been significantly affected. To assist with liquidity throughout the system, the US Treasury and Federal Reserve Bank announced that banks could obtain funds via the Federal Reserve's Discount Window using ABCP as collateral.

– * Part of a coordinated global rate cut of 50 basis point by main central banks.

– See more detailed US federal discount rate chart:

and President George W. Bush

proposed legislation for the government to purchase up to US$700 billion of "troubled mortgage-related assets"

from financial firms in hopes of improving confidence in the mortgage-backed securities markets and the financial firms participating in it. Discussion, hearings and meetings among legislative leaders and the administration later made clear that the proposal would undergo significant change before it could be approved by Congress. On October 1, a revised compromise version was approved by the Senate with a 74–25 vote. The bill, HR1424

was passed by the House on October 3, 2008 and signed into law. The first half of the bailout money was primarily used to buy preferred stock in banks instead of troubled mortgage assets.

In January 2009, the Obama administration announced a stimulus plan to revive the economy

with the intention to create or save more than 3.6 million jobs in two years. The cost of this initial recovery plan was estimated at 825 billion dollars (5.8% of GDP). The plan included 365.5 billion dollars to be spent on major policy and reform of the health system, 275 billion (through tax rebates) to be redistributed to households and firms, notably those investing in renewable energy

, 94 billion to be dedicated to social assistance for the unemployed and families, 87 billion of direct assistance to states to help them finance health expenditures of Medicaid

, and finally 13 billion spent to improve access to digital technologies. The administration also attributed of 13.4 billion dollars aid to automobile manufacturers General Motors

and Chrysler

, but this plan is not included in the stimulus plan.

These plans are meant to abate further economic contraction, however, with the present economic conditions differing from past recessions, in, that, many tenets of the American economy such as manufacturing, textiles, and technological development have been outsourced to other countries. Public works

projects associated with the economic recovery plan outlined by the Obama Administration have been degraded by the lack of road and bridge development projects that were highly abundant in the Great Depression but are now mostly constructed and are mostly in need of maintenance. Regulations to establish market stability and confidence have been neglected in the Obama plan and have yet to be incorporated.

to $300 billion. Because there appeared to be a shortage of U.S. dollars in Europe at that time, the Federal Reserve also announced it would increase its swap facilities with foreign central banks from $290 billion to $620 billion.

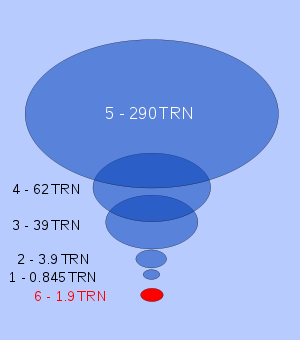

As of December 24, 2008, the Federal Reserve had used its independent authority to spend $1.2 trillion on purchasing various financial assets and making emergency loans to address the financial crisis, above and beyond the $700 billion authorized by Congress from the federal budget. This includes emergency loans to banks, credit card companies, and general businesses, temporary swaps of treasury bills for mortgage-backed securities, the sale of Bear Stearns

, and the bailouts of American International Group

(AIG), Fannie Mae and Freddie Mac, and Citigroup

.

injected nearly $1.5 billion into the banking system, nearly three times as much as the market's estimated requirement. The Reserve Bank of India

added almost $1.32 billion, through a refinance operation, its biggest in at least a month. On November 9, 2008 the 2008 Chinese economic stimulus plan

is a RMB¥ 4 trillion ($586 billion) stimulus package announced by the central government of the People's Republic of China in its biggest move to stop the global financial crisis from hitting the world's second largest economy. A statement on the government's website said the State Council had approved a plan to invest 4 trillion yuan ($586 billion) in infrastructure and social welfare by the end of 2010. The stimulus package will be invested in key areas such as housing, rural infrastructure, transportation, health and education, environment, industry, disaster rebuilding, income-building, tax cuts, and finance.

China's export driven economy is starting to feel the impact of the economic slowdown in the United States and Europe, and the government has already cut key interest rates three times in less than two months in a bid to spur economic expansion. On November 28, 2008, the Ministry of Finance of the People's Republic of China

and the State Administration of Taxation

jointly announced a rise in export tax rebate rates on some labor-intensive goods. These additional tax rebates will take place on December 1, 2008.

The stimulus package was welcomed by world leaders and analysts as larger than expected and a sign that by boosting its own economy, China is helping to stabilize the global economy. News of the announcement of the stimulus package sent markets up across the world.

However, Marc Faber

January 16 said that China according to him was in recession.

In Taiwan, the central bank on September 16, 2008 said it would cut its required reserve ratios for the first time in eight years. The central bank added $3.59 billion into the foreign-currency interbank market the same day. Bank of Japan pumped $29.3 billion into the financial system on September 17, 2008 and the Reserve Bank of Australia added $3.45 billion the same day.

In developing and emerging economies, responses to the global crisis mainly consisted in low-rates monetary policy (Asia

and the Middle East

mainly) coupled with the depreciation of the currency against the dollar. There were also stimulus plans in some Asian countries, in the Middle East and in Argentina. In Asia, plans generally amounted to 1 to 3% of GDP, with the notable exception of China

, which announced a plan accounting for 16% of GDP (6% of GDP per year).

to be implemented at the European level by the countries. At the beginning of 2009, the UK and Spain completed their initial plans, while Germany announced a new plan.

On September 29, 2008 the Belgian, Luxembourg and Dutch authorities partially nationalized Fortis

. The German government bailed out Hypo Real Estate

.

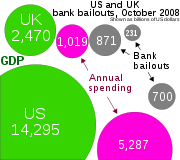

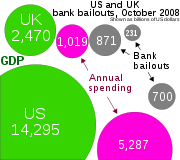

On 8 October 2008 the British Government announced a bank rescue package

of around £500 billion ($850 billion at the time). The plan comprises three parts. The first £200 billion would be made in regard to the banks in liquidity stack. The second part will consist of the state government increasing the capital market within the banks. Along with this, £50 billion will be made available if the banks needed it, finally the government will write away any eligible lending between the British banks with a limit to £250 billion.

In early December German Finance Minister Peer Steinbrück indicated a lack of belief in a "Great Rescue Plan" and reluctance to spend more money addressing the crisis. In March 2009, The European Union Presidency confirmed that the EU was at the time strongly resisting the US pressure to increase European budget deficits.

Most political responses to the economic and financial crisis has been taken, as seen above, by individual nations. Some coordination took place at the European level, but the need to cooperate at the global level has led leaders to activate the G-20 major economies

Most political responses to the economic and financial crisis has been taken, as seen above, by individual nations. Some coordination took place at the European level, but the need to cooperate at the global level has led leaders to activate the G-20 major economies

entity. A first summit dedicated to the crisis took place, at the Heads of state level in November 2008 (2008 G-20 Washington summit

).

The G-20 countries

met in a summit held on November 2008 in Washington

to address the economic crisis. Apart from proposals on international financial regulation, they pledged to take measures to support their economy and to coordinate them, and refused any resort to protectionism.

Another G-20 summit

was held in London on April 2009. Finance ministers and central banks leaders of the G-20 met in Horsham on March to prepare the summit, and pledged to restore global growth as soon as possible. They decided to coordinate their actions and to stimulate demand and employment. They also pledged to fight against all forms of protectionism

and to maintain trade and foreign investments. They also committed to maintain the supply of credit by providing more liquidity and recapitalizing the banking system, and to implement rapidly the stimulus plans. As for central bankers, they pledged to maintain low-rates policies as long as necessary. Finally, the leaders decided to help emerging and developing countries, through a strengthening of the IMF.

is the only member of the European Union

to have avoided a decline in GDP, meaning that in 2009 Poland has created the most GDP growth in the EU. As of December 2009 the Polish economy had not entered recession nor even contracted, while its IMF 2010 GDP growth forecast of 1.9 per cent is expected to be upgraded. Analysts have identified several causes: Extremely low levels of bank lending and a relatively very small mortgage market; the relatively recent dismantling of EU trade barriers and the resulting surge in demand for Polish goods since 2004; the receipt of direct EU funding since 2004; lack of over-dependence on a single export sector; a tradition of government fiscal responsibility; a relatively large internal market; the free-floating Polish zloty; low labour costs attracting continued foreign direct investment; economic difficulties at the start of the decade which prompted austerity measures in advance of the world crisis.

While China

, India

and Iran

have experienced slowing growth, they have not entered recession.

South Korea

narrowly avoided technical recession in the first quarter of 2009. The International Energy Agency

stated in mid September that South Korea could be the only large OECD country to avoid recession for the whole of 2009. It was the only developed economy to expand in the first half of 2009. On October 6, Australia

became the first G20 country to raise its main interest rate, with the Reserve Bank of Australia

deciding to move rates up to 3.25% from 3.00%.

Australia has avoided a technical recession after experiencing only one quarter of negative growth in the fourth quarter of 2008, with GDP returning to positive in the first quarter of 2009.

was the first to raise interest rates after the global recession began. It increased rates in August 2009.

Followed by Norges Bank of Norway

, the Reserve Bank of Australia

in March 2010 and the Reserve Bank of India

on 18 March 2010.

Denmark went into recession in the first quarter of 2008, but came out again in the second quarter. Iceland fell into an economic depression in 2008 following the collapse of its banking system. (see 2008–2011 Icelandic financial crisis)

The following countries went into recession in the second quarter of 2008: Estonia, Latvia, Ireland and New Zealand.

The following countries/territories went into recession in the third quarter of 2008: Japan, Sweden, Hong Kong, Singapore, Italy, Turkey and Germany. As a whole the fifteen nations in the European Union that use the euro went into recession in the third quarter, and the United Kingdom. In addition, the European Union, the G7, and the OECD all experienced negative growth in the third quarter.

The following countries/territories went into technical recession in the fourth quarter of 2008: United States, Switzerland, Spain, and Taiwan.

South Korea "miraculously" avoided recession with GDP returning positive at a 0.1% expansion in the first quarter of 2009.

Of the seven largest economies in the world by GDP, only China and France avoided a recession in 2008. France experienced a 0.3% contraction in Q2 and 0.1% growth in Q3 of 2008. In the year to the third quarter of 2008 China grew by 9%. This is interesting as China has until recently considered 8% GDP growth to be required simply to create enough jobs for rural people moving to urban centres. This figure may more accurately be considered to be 5–7% now that the main growth in working population is receding. Growth of between 5%–8% could well have the type of effect in China that a recession has elsewhere. Ukraine went into technical depression in January 2009 with a nominal annualized GDP growth of −20%.

The recession in Japan intensified in the fourth quarter of 2008 with a nominal annualized GDP growth of −12.7%, and deepened further in the first quarter of 2009 with a nominal annualized GDP growth of −15.2%.

Major economies affected by the recession.

said in an interview that he felt that if banks began lending more freely, allowing the financial markets to return to normal, the recession could end during 2009. In that same interview, Bernanke said Green shoots

of economic revival are already evident. On February 18, 2009, the US Federal Reserve cut their economic forecast of 2009, expecting the US output to shrink between 0.5% and 1.5%, down from its forecast in October 2008 of output between +1.1% (growth) and −0.2% (contraction).

The EU commission in Brussels updated their earlier predictions on January 19, 2009, expecting Germany to contract −2.25% and −1.8% on average for the 27 EU countries. According to new forecasts by Deutsche Bank

(end of November 2008), the economy of Germany will contract by more than 4% in 2009.

On November 3, 2008, according to all newspapers, the European Commission

in Brussels predicted for 2009 only an extremely low increase by 0.1% of the GDP, for the countries of the Euro zone (France, Germany, Italy, etc.). They also predicted negative numbers for the UK (−1.0%), Ireland, Spain, and other countries of the EU. Three days later, the IMF at Washington, D.C., predicted for 2009 a worldwide decrease, −0.3%, of the same number, on average over the developed economies (−0.7% for the US, and −0.8% for Germany).

On April 22, 2009, the German ministers of finance and that of economy, in a common press conference, corrected again their numbers for 2009 downwards: this time the "prognosis" for Germany was a decrease of the GDP of at least −5%, in agreement with a recent prediction of the IMF.

On June 11, 2009, the World Bank Group

predicted for 2009 for the first time a global contraction of the economic power, precisely by −3%.

said that there was a chance that certain countries may not implement the proper policies to avoid feedback mechanisms that could eventually turn the recession into a depression. "The free-fall in the global economy may be starting to abate, with a recovery emerging in 2010, but this depends crucially on the right policies being adopted today." The IMF pointed out that unlike the Great Depression, this recession was synchronized by global integration of markets. Such synchronized recessions were explained to last longer than typical economic downturns and have slower recoveries.

The chief economist of the IMF, Dr. Olivier Blanchard

, stated that the percentage of workers laid off for long stints has been rising with each downturn for decades but the figures have surged this time. "Long-term unemployment is alarmingly high: in the US, half the unemployed have been out of work for over six months, something we have not seen since the Great Depression." The IMF also stated that a link between rising inequality within Western economies and deflating demand may exist. The last time that the wealth gap reached such skewed extremes was in 1928-1929.

have been made, there remain large differences between the two events. The consensus among economists in March 2009 was that a depression was not likely to occur. UCLA Anderson

Forecast director Edward Leamer said on March 25, 2009 that there had not been any major predictions at that time which resembled a second Great Depression:

Differences explicitly pointed out between the recession and the Great Depression include the facts that over the 79 years between 1929 and 2008, great changes occurred in economic philosophy and policy, the stock market had not fallen as far as it did in 1932 or 1982, the 10-year price-to-earnings ratio of stocks was not as low as in the '30s or '80s, inflation-adjusted U.S. housing prices in March 2009 were higher than any time since 1890 (including the housing booms of the 1970s and '80s), the recession of the early '30s lasted over three-and-a-half years, and during the 1930s the supply of money (currency plus demand deposits) fell by 25% (where as in 2008 and 2009 the Fed "has taken an ultraloose credit stance"). Furthermore, the unemployment rate in 2008 and early 2009 and the rate at which it rose was comparable to most of the recessions occurring after World War II

, and was dwarfed by the 25% unemployment rate peak of the Great Depression.

Nobel Prize winning economist Paul Krugman

predicted a series of depressions in his Return to Depression Economics (2000), based on "failures on the demand side of the economy." On January 5, 2009, he wrote that "preventing depressions isn't that easy after all" and that "the economy is still in free fall." In March 2009, Krugman explained that a major difference in this situation is that the causes of this financial crisis were from the shadow banking system

. "The crisis hasn't involved problems with deregulated institutions that took new risks... Instead, it involved risks taken by institutions that were never regulated in the first place."

On November 15, 2008, author and Southern Methodist University

economics professor Ravi Batra

said he is "afraid the global financial debacle will turn into a steep recession and be the worst since the Great Depression, even worse than the painful slump of 1980–1982 that afflicted the whole world". In 1978, Batra's book The Downfall of Capitalism and Communism

was published. His first major prediction came true with the collapse of Soviet Communism in 1990. His second major prediction for a financial crisis to engulf the capitalist system

seems to be unfolding since 2007 with increasing attention being paid to his work.

On February 22, 2009, NYU economics professor Nouriel Roubini

said that the crisis was the worst since the Great Depression, and that without cooperation between political parties and foreign countries, and if poor fiscal policy decisions (such as support of zombie banks) are pursued, the situation "could become as bad as the Great Depression." On April 27, 2009, Roubini expressed a more upbeat assessment by noting that "the bottom of the economy [will be seen] toward the beginning or middle of next year."

On April 6, 2009 Vernon L. Smith

and Steven Gjerstad offered the hypothesis "that a financial crisis that originates in consumer debt, especially consumer debt concentrated at the low end of the wealth and income distribution, can be transmitted quickly and forcefully into the financial system. It appears that we're witnessing the second great consumer debt crash, the end of a massive consumption binge."

In his final press conference as president, George W. Bush

claimed that in September 2008 his chief economic advisors had said that the economic situation could at some point become worse than the Great Depression.

A tent city

in Sacramento

, California

was described as "images, hauntingly reminiscent of the iconic photos of the 1930s and the Great Depression" and "evocative Depression-era images."

reported that the economy had reached a standstill, with 0% growth, during the second quarter of that year.On 24 October, statistics for the third quarter of the year showed the first contraction in the national economy for 16 years.With further contraction in the final quarter of 2008, the recession was officially declared on 23 January 2009.

On 10 February 2009, Ed Balls

, Secretary of State for Children, Schools and Families

of the United Kingdom

, said that "I think that this is a financial crisis more extreme and more serious than that of the 1930s and we all remember how the politics of that era were shaped by the economy." On 24 January 2009, Edmund Conway, Economics Editor for The Daily Telegraph

, had written that "The plight facing Britain is uncannily similar to the 1930s, since prices of many assets – from shares to house prices – are falling at record rates [in Britain], but the value of the debt against which they are held remains unchanged."

On 23 October 2009, it was reported that the British economy had contracted for six successive quarters - the longest run of contraction since quarterly figures were first recorded in 1955.The end of the recession was declared on 26 January 2010, when it was reported that the economy had grown by 0.1% in the final quarter of 2009.

Fears of a double-dip recession were sparked on 25 January 2011 when it was reported that the economy had contracted by 0.5% during the final quarter of 2010 following a full year of growth, although this was largely blamed on the severe weather which affected the nation in late November and almost all of December.These fears were eased on 27 April 2011 when it was reported that the economy had grown by 0.5% in the first quarter of 2011,and then on 26 July 2011 when 0.2% growth was reported for the second quarter of the year. On 01 November 2011, it was reported that the UK economy had grown by 0.5% during the third quarter of the year.

entered into an economic depression

in 2009. The ESRI (Economic and Social Research Institute) predict an economic contraction of 14% by 2010, however this number may have already been exceeded with GDP

dropping 7.1% quarter on quarter during the fourth quarter of 2008, and a possible greater contraction in the first quarter of 2009 with the fall in all OECD countries with the exception of France exceeding the drop of the previous quarter. Unemployment is up 8.75% to 11.4%. Government borrowing and the financial bailout and Nationalisation of one of Ireland's banks which were loaded with debt due to the Irish property bubble

.

The United States entered into recession in December 2007 when job losses began. Unemployment increased drastically starting in September 2008 following the bankruptcy of Lehman Brothers

. In March 2009, U-3 unemployment had risen to 8.5%. In March 2009, statistician John Williams argued that "measurement changes implemented over the years make it impossible to compare the current unemployment rate with that seen during the Great Depression". By December 2010, the official U.S. unemployment rate had increased to 9.8%.

Poll indicated that economists thought the probability of another recession was at 31%, up from 25% the month before. In their article “On the Possibilities to Forecast the Current Crisis and its Second Wave” Askar Akaev, Viktor Sadovnichiy

, and Andrey Korotayev

published a forecast of a second wave of the crisis.

World economy

The world economy, or global economy, generally refers to the economy, which is based on economies of all of the world's countries, national economies. Also global economy can be seen as the economy of global society and national economies – as economies of local societies, making the global one....

, with higher detriment in some countries than others. It is a major global recession

Global recession

A global recession is a period of global economic slowdown. The International Monetary Fund takes many factors into account when defining a global recession, but it states that global economic growth of 3 percent or less is "equivalent to a global recession".By this measure, four periods since...

characterized by various systemic imbalances and was sparked by the outbreak of the late-2000s financial crisis

Late-2000s financial crisis

The late-2000s financial crisis is considered by many economists to be the worst financial crisis since the Great Depression of the 1930s...

.

There are two senses

Word sense

In linguistics, a word sense is one of the meanings of a word.For example a dictionary may have over 50 different meanings of the word , each of these having a different meaning based on the context of the word usage in a sentence...

of the word "recession": a less precise sense, referring broadly to "a period of reduced economic activity", and the scientific sense used most often in economics

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

, which is defined operationally

Operational definition

An operational definition defines something in terms of the specific process or set of validation tests used to determine its presence and quantity. That is, one defines something in terms of the operations that count as measuring it. The term was coined by Percy Williams Bridgman and is a part of...

, referring specifically to the contraction phase of a business cycle

Business cycle

The term business cycle refers to economy-wide fluctuations in production or economic activity over several months or years...

, with two or more consecutive quarters of negative GDP growth. By the economic-science definition of the word "recession

Recession

In economics, a recession is a business cycle contraction, a general slowdown in economic activity. During recessions, many macroeconomic indicators vary in a similar way...

", the Great Recession ended in the U.S. in June or July 2009. However, in the broader, layperson sense of the word, many people use the term to refer to the ongoing hardship (in the same way that the term "Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

" is also popularly used). In the U.S., for example, persistent high unemployment

Unemployment

Unemployment , as defined by the International Labour Organization, occurs when people are without jobs and they have actively sought work within the past four weeks...

remains

99ers

99ers is a colloquial term for unemployed people in the United States, mostly citizens, who have exhausted all of their unemployment benefits, including all unemployment extensions. As a result of the American Recovery and Reinvestment Act passed by Congress in February 2009, many unemployed...

, along with low consumer confidence, the continuing decline in home values and increase in foreclosures and personal bankruptcies

United States housing bubble

The United States housing bubble is an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and may not yet have hit bottom as of 2011. On December 30, 2008 the...

, an escalating federal debt crisis

United States public debt

The United States public debt is the money borrowed by the federal government of the United States at any one time through the issue of securities by the Treasury and other federal government agencies...

, inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

, and rising gas and food prices. In fact, a 2011 poll found that more than half of all Americans think the U.S. is still in recession or even depression, despite official data that shows a historically modest recovery.

Overview

According to the U.S. National Bureau of Economic ResearchNational Bureau of Economic Research

The National Bureau of Economic Research is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic community." The NBER is well known for providing start and end...

(the official arbiter of U.S. recessions) the recession began in December 2007. The financial crisis is linked to reckless lending practices by financial institutions and the growing trend of securitization

Securitization

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or Collateralized mortgage obligation , to...

of real estate mortgages in the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

. The US mortgage-backed securities, which had risks that were hard to assess, were marketed around the world. A more broad based credit boom fed a global speculative bubble in real estate

Real estate bubble

A real estate bubble or property bubble is a type of economic bubble that occurs periodically in local or global real estate markets...

and equities, which served to reinforce the risky lending practices. The precarious financial situation was made more difficult by a sharp increase in oil and food prices

2007–2008 world food price crisis

World food prices increased dramatically in 2007 and the 1st and 2nd quarter of 2008 creating a global crisis and causing political and economical instability and social unrest in both poor and developed nations. Systemic causes for the worldwide increases in food prices continue to be the subject...

. The emergence of Sub-prime loan

Subprime lending

In finance, subprime lending means making loans to people who may have difficulty maintaining the repayment schedule...

losses in 2007 began the crisis and exposed other risky loans and over-inflated asset prices. With loan losses mounting and the fall of Lehman Brothers

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

on September 15, 2008, a major panic broke out on the inter-bank loan market. As share and housing prices declined, many large and well established investment and commercial

Commercial bank

After the implementation of the Glass–Steagall Act, the U.S. Congress required that banks engage only in banking activities, whereas investment banks were limited to capital market activities. As the two no longer have to be under separate ownership under U.S...

banks in the United States and Europe

Europe

Europe is, by convention, one of the world's seven continents. Comprising the westernmost peninsula of Eurasia, Europe is generally 'divided' from Asia to its east by the watershed divides of the Ural and Caucasus Mountains, the Ural River, the Caspian and Black Seas, and the waterways connecting...

suffered huge losses and even faced bankruptcy, resulting in massive public financial assistance.

A global recession

Global recession

A global recession is a period of global economic slowdown. The International Monetary Fund takes many factors into account when defining a global recession, but it states that global economic growth of 3 percent or less is "equivalent to a global recession".By this measure, four periods since...

has resulted in a sharp drop in international trade

International trade

International trade is the exchange of capital, goods, and services across international borders or territories. In most countries, such trade represents a significant share of gross domestic product...

, rising unemployment

Unemployment

Unemployment , as defined by the International Labour Organization, occurs when people are without jobs and they have actively sought work within the past four weeks...

and slumping commodity prices. In December 2008, the National Bureau of Economic Research

National Bureau of Economic Research

The National Bureau of Economic Research is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic community." The NBER is well known for providing start and end...

(NBER) declared that the United States had been in recession since December 2007. Several economists have predicted that recovery may not appear until 2011 and that the recession will be the worst since the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

of the 1930s. Paul Krugman

Paul Krugman

Paul Robin Krugman is an American economist, professor of Economics and International Affairs at the Woodrow Wilson School of Public and International Affairs at Princeton University, Centenary Professor at the London School of Economics, and an op-ed columnist for The New York Times...

, who won the Nobel Memorial Prize in Economics, once commented on this as seemingly the beginning of "a second Great Depression." The conditions leading up to the crisis, characterized by an exorbitant rise in asset prices and associated boom in economic demand, are considered a result of the extended period of easily available credit and inadequate regulation and oversight.

The recession has renewed interest in Keynesian economic ideas

2008–2009 Keynesian resurgence

In 2008 and 2009, there was a resurgence of interest in Keynesian economics among policy makers in the world's industrialized economies. This has included discussions and implementation of economic policies in accordance with the recommendations made by John Maynard Keynes in response to the Great...

on how to combat recessionary conditions. Fiscal

Fiscal policy

In economics and political science, fiscal policy is the use of government expenditure and revenue collection to influence the economy....

and monetary policies

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment...

have been significantly eased to stem the recession and financial risks. Economists advise that the stimulus should be withdrawn as soon as the economies recover enough to "chart a path to sustainable growth".

Pre-recession economic imbalances

The onset of the economic crisis took most people by surprise. A 2009 paper identifies twelve economists and commentators who, between 2000 and 2006, predicted a recession based on the collapse of the then-booming housing market in the U.S: Dean BakerDean Baker

Dean Baker is an American macroeconomist and co-founder of the Center for Economic and Policy Research, with Mark Weisbrot. He previously was a senior economist at the Economic Policy Institute and an assistant professor of economics at Bucknell University. He has a Ph.D...

, Wynne Godley

Wynne Godley

Wynne Godley was an economist famous for his pessimism toward the British economy and his criticism of the British government....

, Fred Harrison

Fred Harrison (author)

Fred Harrison is a British author, economic commentator and corporate policy advisor, notable for his stances on land reform and belief that an over reliance on land, property and mortgage weakens economic structures and makes companies vulnerable to economic collapse...

, Michael Hudson

Michael Hudson (economist)

Michael Hudson is research professor of economics at University of Missouri, Kansas City and a research associate at the Levy Economics Institute of Bard College...

, Eric Janszen

Eric Janszen

Eric Janszen is an economic commentator and former venture capitalist. He founded the financial advisory company iTulip.Janszen wrote an analysis of economic bubbles in a 2008 Harper's Magazine article predicting a future alternative energy bubble bursting in the mid 2010s...

, Steve Keen

Steve Keen

Steve Keen is a Professor in economics and finance at the University of Western Sydney. He classes himself as a post-Keynesian, criticizing both modern neoclassical economics and Marxian economics as inconsistent, unscientific and empirically unsupported...

, Jakob Brøchner Madsen & Jens Kjaer Sørensen, Kurt Richebächer

Kurt Richebächer

Dr. Kurt Richebächer was an international banker and economist. He considered himself a follower of the Austrian School of Economics and was best known for his newsletter, "The Richebächer Letter," which at various times also circulated as "Currencies & Credit Markets."Dr...

, Nouriel Roubini

Nouriel Roubini

Nouriel Roubini is an American economist. He claims to have predicted both the collapse of the United States housing market and the worldwide recession which started in 2008. He teaches at New York University's Stern School of Business and is the chairman of Roubini Global Economics, an economic...

, Peter Schiff

Peter Schiff

Peter David Schiff is an American investment broker, author and financial commentator. Schiff is CEO and chief global strategist of Euro Pacific Capital Inc., a broker-dealer based in Westport, Connecticut and CEO of Euro Pacific Precious Metals, LLC, a gold and silver dealer based in New York...

and Robert Shiller

Robert Shiller

Robert James "Bob" Shiller is an American economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University and is a Fellow at the Yale International Center for Finance, Yale School of Management...

.

Among the various imbalances in which the U.S. monetary policy contributed by excessive money creation

Money creation

In economics, money creation is the process by which the money supply of a country or a monetary region is increased due to some reason. There are two principal stages of money creation. First, the central bank introduces new money into the economy by purchasing financial assets or lending money...

, leading to negative household savings and a huge U.S. trade deficit, dollar volatility and public deficits, a focus can be made on the following ones:

Commodity boom

House

A house is a building or structure that has the ability to be occupied for dwelling by human beings or other creatures. The term house includes many kinds of different dwellings ranging from rudimentary huts of nomadic tribes to free standing individual structures...

, marking an end to the commodities recession of 1980–2000. In 2008, the prices of many commodities, notably oil and food, rose so high as to cause genuine economic damage, threatening stagflation

Stagflation

In economics, stagflation is a situation in which the inflation rate is high and the economic growth rate slows down and unemployment remains steadily high...

and a reversal of globalization

Globalization

Globalization refers to the increasingly global relationships of culture, people and economic activity. Most often, it refers to economics: the global distribution of the production of goods and services, through reduction of barriers to international trade such as tariffs, export fees, and import...

.

In January 2008, oil prices surpassed $100 a barrel for the first time, the first of many price milestones to be passed in the course of the year. In July 2008, oil peaked at $147.30 a barrel and a gallon of gasoline

Gasoline

Gasoline , or petrol , is a toxic, translucent, petroleum-derived liquid that is primarily used as a fuel in internal combustion engines. It consists mostly of organic compounds obtained by the fractional distillation of petroleum, enhanced with a variety of additives. Some gasolines also contain...

was more than $4 across most of the U.S.A. The economic contraction in the fourth quarter of 2008 caused a dramatic drop in demand and prices fell below $35 a barrel at the end of the year. The high of 2008 may have been part of broader pattern of spiking instability in the price of oil over the preceding decade This pattern of spiking instability in oil price may be a product of Peak Oil

Peak oil

Peak oil is the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline. This concept is based on the observed production rates of individual oil wells, projected reserves and the combined production rate of a field...

. There is concern that if the economy was to improve, oil prices might return to pre-recession levels.

The food and fuel crises were both discussed at the 34th G8 summit

34th G8 summit

The 34th G8 summit took place in on the northern island of Hokkaidō, Japan from July 7–9, 2008. The locations of previous summits to have been hosted by Japan include: Tokyo ; and Nago, Okinawa . The G8 Summit has evolved beyond being a gathering of world political leaders...

in July 2008.

Sulfuric acid

Sulfuric acid

Sulfuric acid is a strong mineral acid with the molecular formula . Its historical name is oil of vitriol. Pure sulfuric acid is a highly corrosive, colorless, viscous liquid. The salts of sulfuric acid are called sulfates...

(an important chemical commodity used in processes such as steel processing, copper production and bioethanol production) increased in price 3.5-fold in less than 1 year while producers of sodium hydroxide have declared force majeure

Force majeure

Force majeure or vis major "superior force", also known as cas fortuit or casus fortuitus "chance occurrence, unavoidable accident", is a common clause in contracts that essentially frees both parties from liability or obligation when an extraordinary event or circumstance beyond the control of...

due to flooding, precipitating similarly steep price increases.

In the second half of 2008, the prices of most commodities fell dramatically on expectations of diminished demand in a world recession.

Housing bubble

By 2007, real estate bubbles were still under way in many parts of the world, especially in the United StatesUnited States housing bubble

The United States housing bubble is an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and may not yet have hit bottom as of 2011. On December 30, 2008 the...

, United Kingdom, United Arab Emirates

United Arab Emirates

The United Arab Emirates, abbreviated as the UAE, or shortened to "the Emirates", is a state situated in the southeast of the Arabian Peninsula in Western Asia on the Persian Gulf, bordering Oman, and Saudi Arabia, and sharing sea borders with Iraq, Kuwait, Bahrain, Qatar, and Iran.The UAE is a...

, Italy

Italy

Italy , officially the Italian Republic languages]] under the European Charter for Regional or Minority Languages. In each of these, Italy's official name is as follows:;;;;;;;;), is a unitary parliamentary republic in South-Central Europe. To the north it borders France, Switzerland, Austria and...

, Australia

Australia

Australia , officially the Commonwealth of Australia, is a country in the Southern Hemisphere comprising the mainland of the Australian continent, the island of Tasmania, and numerous smaller islands in the Indian and Pacific Oceans. It is the world's sixth-largest country by total area...

, New Zealand, Ireland

Irish property bubble

The property bubble in the Republic of Ireland began in 2000 and peaked in 2006, as with many other western European countries, with a combination of increased speculative construction and rapidly rising prices....

, Spain

Spanish property bubble

The Spanish property bubble refers to the massive growth of real state prices observed, in various stages, from 1985 up to 2008 in Spain. The housing burst can be clearly divided in three periods: 1985-1991, in which the price nearly tripled, 1992-1996, in which the price remained somewhat stable,...

, France

France

The French Republic , The French Republic , The French Republic , (commonly known as France , is a unitary semi-presidential republic in Western Europe with several overseas territories and islands located on other continents and in the Indian, Pacific, and Atlantic oceans. Metropolitan France...

, Poland

Polish property bubble

Over the span of years 2002-2008 real estate prices in Poland have increased drastically. Between June 2006 and June 2007 alone the average price of a square metre in Warsaw rose from 6,683 PLN to 9,540 PLN .According to a major Polish newspaper, Gazeta Wyborcza, the average monthly salary in...

, South Africa

South Africa

The Republic of South Africa is a country in southern Africa. Located at the southern tip of Africa, it is divided into nine provinces, with of coastline on the Atlantic and Indian oceans...

, Israel

Israel

The State of Israel is a parliamentary republic located in the Middle East, along the eastern shore of the Mediterranean Sea...

, Greece

Greece

Greece , officially the Hellenic Republic , and historically Hellas or the Republic of Greece in English, is a country in southeastern Europe....

, Bulgaria

Bulgaria

Bulgaria , officially the Republic of Bulgaria , is a parliamentary democracy within a unitary constitutional republic in Southeast Europe. The country borders Romania to the north, Serbia and Macedonia to the west, Greece and Turkey to the south, as well as the Black Sea to the east...

, Croatia

Croatia

Croatia , officially the Republic of Croatia , is a unitary democratic parliamentary republic in Europe at the crossroads of the Mitteleuropa, the Balkans, and the Mediterranean. Its capital and largest city is Zagreb. The country is divided into 20 counties and the city of Zagreb. Croatia covers ...

, Norway

Norway

Norway , officially the Kingdom of Norway, is a Nordic unitary constitutional monarchy whose territory comprises the western portion of the Scandinavian Peninsula, Jan Mayen, and the Arctic archipelago of Svalbard and Bouvet Island. Norway has a total area of and a population of about 4.9 million...

, Singapore

Singapore

Singapore , officially the Republic of Singapore, is a Southeast Asian city-state off the southern tip of the Malay Peninsula, north of the equator. An island country made up of 63 islands, it is separated from Malaysia by the Straits of Johor to its north and from Indonesia's Riau Islands by the...

, South Korea

South Korea

The Republic of Korea , , is a sovereign state in East Asia, located on the southern portion of the Korean Peninsula. It is neighbored by the People's Republic of China to the west, Japan to the east, North Korea to the north, and the East China Sea and Republic of China to the south...

, Sweden

Sweden

Sweden , officially the Kingdom of Sweden , is a Nordic country on the Scandinavian Peninsula in Northern Europe. Sweden borders with Norway and Finland and is connected to Denmark by a bridge-tunnel across the Öresund....

, Finland

Finland

Finland , officially the Republic of Finland, is a Nordic country situated in the Fennoscandian region of Northern Europe. It is bordered by Sweden in the west, Norway in the north and Russia in the east, while Estonia lies to its south across the Gulf of Finland.Around 5.4 million people reside...

, Argentina

Argentina

Argentina , officially the Argentine Republic , is the second largest country in South America by land area, after Brazil. It is constituted as a federation of 23 provinces and an autonomous city, Buenos Aires...

, Baltic states

Baltic states

The term Baltic states refers to the Baltic territories which gained independence from the Russian Empire in the wake of World War I: primarily the contiguous trio of Estonia, Latvia, Lithuania ; Finland also fell within the scope of the term after initially gaining independence in the 1920s.The...

, India

India

India , officially the Republic of India , is a country in South Asia. It is the seventh-largest country by geographical area, the second-most populous country with over 1.2 billion people, and the most populous democracy in the world...

, Romania

Romania

Romania is a country located at the crossroads of Central and Southeastern Europe, on the Lower Danube, within and outside the Carpathian arch, bordering on the Black Sea...

, Russia

Russia

Russia or , officially known as both Russia and the Russian Federation , is a country in northern Eurasia. It is a federal semi-presidential republic, comprising 83 federal subjects...

, Ukraine

Ukraine

Ukraine is a country in Eastern Europe. It has an area of 603,628 km², making it the second largest contiguous country on the European continent, after Russia...

and China

China

Chinese civilization may refer to:* China for more general discussion of the country.* Chinese culture* Greater China, the transnational community of ethnic Chinese.* History of China* Sinosphere, the area historically affected by Chinese culture...

. U.S. Federal Reserve Chairman Alan Greenspan

Alan Greenspan

Alan Greenspan is an American economist who served as Chairman of the Federal Reserve of the United States from 1987 to 2006. He currently works as a private advisor and provides consulting for firms through his company, Greenspan Associates LLC...

said in mid-2005 that "at a minimum, there's a little 'froth' (in the U.S. housing market) ... it's hard not to see that there are a lot of local bubbles". The Economist

The Economist

The Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

magazine, writing at the same time, went further, saying "the worldwide rise in house prices is the biggest bubble in history". Real estate bubbles are (by definition of the word "bubble") followed by a price decrease (also known as a housing price crash) that can result in many owners holding negative equity

Negative equity

Negative equity occurs when the value of an asset used to secure a loan is less than the outstanding balance on the loan. In the United States, assets with negative equity are often referred to as being "underwater", and loans and borrowers with negative equity are said to be "upside down".People...

(a mortgage

Mortgage loan

A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan...

debt higher than the current value of the property).

Inflation

In February 2008, Reuters reported that global inflation was at historic levels, and that domestic inflation was at 10–20 year highs for many nations. "Excess money supply around the globe, monetary easing by the Fed to tame financial crisis, growth surge supported by easy monetary policy in Asia, speculation in commodities, agricultural failure, rising cost of imports from China and rising demand of food and commodities in the fast growing emerging markets," have been named as possible reasons for the inflation.In mid-2007, International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

(IMF) data indicated that inflation was highest in the oil-exporting countries, largely due to the unsterilized growth of foreign exchange reserves

Foreign exchange reserves

Foreign-exchange reserves in a strict sense are 'only' the foreign currency deposits and bonds held by central banks and monetary authorities. However, the term in popular usage commonly includes foreign exchange and gold, Special Drawing Rights and International Monetary Fund reserve positions...

, the term "unsterilized" referring to a lack of monetary policy operations that could offset such a foreign exchange intervention in order to maintain a country's monetary policy target. However, inflation was also growing in countries classified by the IMF as "non-oil-exporting LDCs" (Least Developed Countries

Least Developed Countries

Least developed country is the name given to a country which, according to the United Nations, exhibits the lowest indicators of socioeconomic development, with the lowest Human Development Index ratings of all countries in the world...

) and "Developing Asia", on account of the rise in oil and food prices.

Inflation was also increasing in the developed countries

Developed country

A developed country is a country that has a high level of development according to some criteria. Which criteria, and which countries are classified as being developed, is a contentious issue...

, but remained low compared to the developing world.

Causes

Debate over origins

The central debate about the origin has been focused on the respective parts played by the public monetary policy (in the US notably) and by private financial institutions practices. In the U.S., mortgage funding was unusually decentralized, opaque, and competitive, and it is believed that competition between lenders for revenue and market share contributed to declining underwriting standards and risky lending.On October 15, 2008, Anthony Faiola, Ellen Nakashima, and Jill Drew wrote a lengthy article in The Washington Post

The Washington Post

The Washington Post is Washington, D.C.'s largest newspaper and its oldest still-existing paper, founded in 1877. Located in the capital of the United States, The Post has a particular emphasis on national politics. D.C., Maryland, and Virginia editions are printed for daily circulation...

titled, "What Went Wrong". In their investigation, the authors claim that former Federal Reserve Board Chairman Alan Greenspan

Alan Greenspan

Alan Greenspan is an American economist who served as Chairman of the Federal Reserve of the United States from 1987 to 2006. He currently works as a private advisor and provides consulting for firms through his company, Greenspan Associates LLC...

, Treasury Secretary Robert Rubin, and SEC Chairman Arthur Levitt vehemently opposed any regulation of financial instruments

Financial instruments

A financial instrument is a tradable asset of any kind, either cash; evidence of an ownership interest in an entity; or a contractual right to receive, or deliver, cash or another financial instrument....

known as derivatives

Derivative (finance)

A derivative instrument is a contract between two parties that specifies conditions—in particular, dates and the resulting values of the underlying variables—under which payments, or payoffs, are to be made between the parties.Under U.S...

. They further claim that Greenspan actively sought to undermine the office of the Commodity Futures Trading Commission

Commodity Futures Trading Commission

The U.S. Commodity Futures Trading Commission is an independent agency of the United States government that regulates futures and option markets....

, specifically under the leadership of Brooksley E. Born, when the Commission sought to initiate regulation of derivatives. Ultimately, it was the collapse of a specific kind of derivative, the mortgage-backed security

Mortgage-backed security

A mortgage-backed security is an asset-backed security that represents a claim on the cash flows from mortgage loans through a process known as securitization.-Securitization:...

, that triggered the economic crisis of 2008.

While Greenspan's role as Chairman of the Federal Reserve

Chairman of the Federal Reserve

The Chairman of the Board of Governors of the Federal Reserve System is the head of the central banking system of the United States. Known colloquially as "Chairman of the Fed," or in market circles "Fed Chairman" or "Fed Chief"...

has been widely discussed (the main point of controversy remains the lowering of Federal funds rate

Federal funds rate

In the United States, the federal funds rate is the interest rate at which depository institutions actively trade balances held at the Federal Reserve, called federal funds, with each other, usually overnight, on an uncollateralized basis. Institutions with surplus balances in their accounts lend...

at only 1% for more than a year which, according to the Austrian School

Austrian School

The Austrian School of economics is a heterodox school of economic thought. It advocates methodological individualism in interpreting economic developments , the theory that money is non-neutral, the theory that the capital structure of economies consists of heterogeneous goods that have...

of economics, allowed huge amounts of "easy" credit-based money to be injected into the financial system and thus create an unsustainable economic boom) there is also the argument that Greenspan's actions in the years 2002–2004 were actually motivated by the need to take the U.S. economy out of the early 2000s recession

Early 2000s recession

The early 2000s recession was a decline in economic activity which occurred mainly in developed countries. The recession affected the European Union mostly during 2000 and 2001 and the United States mostly in 2002 and 2003. The UK, Canada and Australia avoided the recession for the most part, while...

caused by the bursting of the dot-com bubble

Dot-com bubble

The dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more...

— although by doing so he did not help avert the crisis, but only postpone it.