Dot-com bubble

Overview

Economic bubble

An economic bubble is "trade in high volumes at prices that are considerably at variance with intrinsic values"...

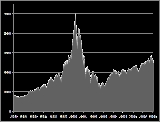

covering roughly 1995–2000 (with a climax on March 10, 2000, with the NASDAQ

Nasdaq Composite

The Nasdaq Composite is a stock market index of the common stocks and similar securities listed on the NASDAQ stock market, meaning that it has over 3,000 components. It is highly followed in the U.S. as an indicator of the performance of stocks of technology companies and growth companies. ...

peaking at 5132.52 in intraday trading before closing at 5048.62) during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more recent Internet sector

Quaternary sector of industry

The quaternary sector of the economy is a way to describe a knowledge-based part of the economy which typically includes services such as information generation and sharing, information technology, consultation, education, research and development, financial planning, and other knowledge-based...

and related fields. While the latter part was a boom and bust

Boom and bust

A credit boom-bust cycle is an episode characterized by a sustained increase in several economics indicators followed by a sharp and rapid contraction. Commonly the boom is driven by a rapid expansion of credit to the private sector accompanied with rising prices of commodities and stock market index...

cycle, the Internet boom is sometimes meant to refer to the steady commercial growth of the Internet with the advent of the world wide web

World Wide Web

The World Wide Web is a system of interlinked hypertext documents accessed via the Internet...

, as exemplified by the first release of the Mosaic web browser

Mosaic (web browser)

Mosaic is the web browser credited with popularizing the World Wide Web. It was also a client for earlier protocols such as FTP, NNTP, and gopher. Its clean, easily understood user interface, reliability, Windows port and simple installation all contributed to making it the application that opened...

in 1993, and continuing through the 1990s.

During the mid-to-late 1990s, Cisco Systems

Cisco Systems

Cisco Systems, Inc. is an American multinational corporation headquartered in San Jose, California, United States, that designs and sells consumer electronics, networking, voice, and communications technology and services. Cisco has more than 70,000 employees and annual revenue of US$...

, Dell

Dell

Dell, Inc. is an American multinational information technology corporation based in 1 Dell Way, Round Rock, Texas, United States, that develops, sells and supports computers and related products and services. Bearing the name of its founder, Michael Dell, the company is one of the largest...

, Intel, and Microsoft

Microsoft

Microsoft Corporation is an American public multinational corporation headquartered in Redmond, Washington, USA that develops, manufactures, licenses, and supports a wide range of products and services predominantly related to computing through its various product divisions...

were known as "the Four Horsemen of the NASDAQ" because of their dominant market capitalizations.