Real estate bubble

Encyclopedia

A real estate bubble or property bubble (or housing bubble for residential markets) is a type of economic bubble

that occurs periodically in local or global real estate

markets. It is characterized by rapid increases in valuations

of real property

such as housing

until they reach unsustainable levels and then decline.

The questions of whether real estate bubbles can be identified and prevented, and whether they have broader macroeconomic significance are answered differently by schools of economic thought, as detailed below. The financial crisis of 2007–2010 was related to the bursting of real estate bubbles around the world, which had begun during the mid 2000s.

s, whether real estate bubbles can be identified or prevented is contentious. Bubbles are generally not contentious in hindsight, after a peak and crash.

Within mainstream economics

, some argue that real estate bubbles cannot be identified as they occur and cannot or should not be prevented, with government and central bank policy rather cleaning up after the bubble bursts.

Others, such as American economist Robert Shiller

of the Case-Shiller Home Price Index of home prices in 20 metro cities across the United States, indicated in May 31, 2011 that a "Home Price Double Dip Confirmed" and British magazine The Economist

, argue that housing market indicators can be used to identify real estate bubbles. Some argue further that governments and central banks can and should take action to prevent bubbles from forming, or to deflate existing bubbles.

, economic bubbles, and in particular real estate bubbles, are not considered major concerns. Within some schools of heterodox economics

, by contrast, real estate bubbles are considered of critical importance and a fundamental cause of financial crises and ensuing economic crises.

The mainstream economic view is that economic bubbles bring about a temporary boost in wealth and a redistribution of wealth. When prices increase, there is a positive wealth effect

(property owners feel richer and spend more), and when they decline, there is a negative wealth effect (property owners feel poorer and spend less). These effects, it is argued, can be smoothed by counter-cyclical monetary and fiscal policies. The ultimate effect on owners who bought before the bubble formed and did not sell is zero. Those who bought when low and sold high profited, while those who bought high and sold low (after the bubble has burst) or held until the price fell lost money. This redistribution of wealth, it is also argued, is of little macroeconomic significance.

In some schools of heterodox economics, notably Austrian economics and Post-Keynesian economics

, real estate bubbles are seen as an example of credit bubbles (pejoratively, speculative bubbles), because property owners generally use borrowed money to purchase property, in the form of mortgages

. These are then argued to cause financial and hence economic crises. This is first argued empirically – numerous real estate bubbles have been followed by economic slumps, and it is argued that there is a cause-effect relationship between these.

The Post-Keynesian theory of debt deflation

takes a demand-side view, arguing that property owners not only feel richer but borrow to (i) consume against the increased value of their property --- by taking out a home equity line of credit), for instance; or (ii) speculate by buying property with borrowed money in the expectation that it will rise in value. The latter view is associated with Financial Instability Hypothesis of Hyman Minsky

. When the bubble bursts, the value of the property decreases but not the level of debt. The burden of repaying or defaulting on the loan depresses aggregate demand

, it is argued, and constitutes the proximate cause of the subsequent economic slump.

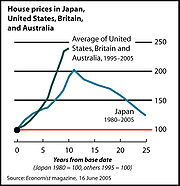

from 1990 on has been very damaging to the Japanese economy,. The crash in 2005 affected Shanghai

, China

's largest city. In comparison to the stock-market bubbles, real estate bubbles take longer to deflate: prices decline slower because the real estate market is less liquid. Commercial real estate generally moves in tandem with the residential properties, since both are affected by many of same factors (e.g., interest rates) and share the "wealth effect

" of booms. Therefore this article focuses on housing bubbles and mentions other sectors only when their situation differs.

, Argentina

, Britain, Netherlands

, Italy

, Australia

, New Zealand, Ireland

, Spain

, Lebanon

, France

, Poland

, South Africa

, Israel

, Greece

, Bulgaria

, Croatia

, Norway

, Singapore

, South Korea

, Sweden

, Baltic states

, India

, Romania

, Russia

, Ukraine

and China

. Then U.S. Federal Reserve Chairman Alan Greenspan

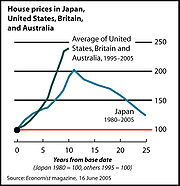

said in mid-2005 that "at a minimum, there's a little 'froth' (in the U.S. housing market) … it's hard not to see that there are a lot of local bubbles." The Economist

magazine, writing at the same time, went further, saying "the worldwide rise in house prices is the biggest bubble in history". Real estate bubbles are invariably followed by severe price decreases (also known as a house price crash) that can result in many owners holding. As of the end of 2010, 11.1 million residential properties, or 23.1% of all U.S. homes, were in negative equity

at Dec. 31, 2010. Commercial property values remain around 35% below their mid-2007 peak in the United Kingdom. As a result, banks have become less willing to hold large amounts of property backed debt, a likely key issue in affecting a recovery worldwide in the near term.

In attempting to identify bubbles before they burst, economists have developed a number of financial ratio

In attempting to identify bubbles before they burst, economists have developed a number of financial ratio

s and economic indicator

s that can be used to evaluate whether homes in a given area are fairly valued. By comparing current levels to previous levels that have proven unsustainable in the past (i.e. led to or at least accompanied crashes), one can make an educated guess as to whether a given real estate market is experiencing a bubble. Indicators describe two interwoven aspects of housing bubble: a valuation component and a debt (or leverage) component. The valuation component measures how expensive houses are relative to what most people can afford, and the debt component measures how indebted households become in buying them for home or profit (and also how much exposure the banks accumulate by lending for them). A basic summary of the progress of housing indicators for U.S. cities is provided by Business Week. See also: real estate economics

and real estate trends

.

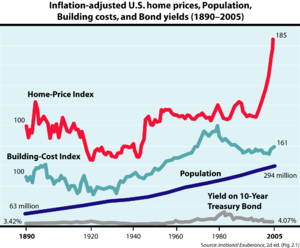

(HPIs).

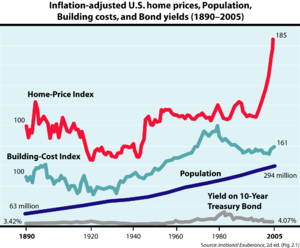

A noted series of HPIs for the United States are the Case–Shiller indices

, devised by American economists Karl Case, Robert J. Shiller, and Allan Weiss

. As measured by the Case–Shiller index, the US experienced a housing bubble peaking in the second quarter of 2006 (2006 Q2).

a bubble state, although this contention was not without controversy. This hypothesis was based on observation of similar patterns in real estate markets of a wide variety of countries. This includes similar patterns of overvaluation and excessive borrowing based on those overvaluations.

The subprime mortgage crisis

, with its accompanying impacts and effects on economies in various nations, has given some credence to the idea that these trends might have some common characteristics.

For individual countries, see:

Economic bubble

An economic bubble is "trade in high volumes at prices that are considerably at variance with intrinsic values"...

that occurs periodically in local or global real estate

Real estate

In general use, esp. North American, 'real estate' is taken to mean "Property consisting of land and the buildings on it, along with its natural resources such as crops, minerals, or water; immovable property of this nature; an interest vested in this; an item of real property; buildings or...

markets. It is characterized by rapid increases in valuations

Real estate appraisal

Real estate appraisal, property valuation or land valuation is the process of valuing real property. The value usually sought is the property's Market Value. Appraisals are needed because compared to, say, corporate stock, real estate transactions occur very infrequently...

of real property

Real property

In English Common Law, real property, real estate, realty, or immovable property is any subset of land that has been legally defined and the improvements to it made by human efforts: any buildings, machinery, wells, dams, ponds, mines, canals, roads, various property rights, and so forth...

such as housing

House

A house is a building or structure that has the ability to be occupied for dwelling by human beings or other creatures. The term house includes many kinds of different dwellings ranging from rudimentary huts of nomadic tribes to free standing individual structures...

until they reach unsustainable levels and then decline.

The questions of whether real estate bubbles can be identified and prevented, and whether they have broader macroeconomic significance are answered differently by schools of economic thought, as detailed below. The financial crisis of 2007–2010 was related to the bursting of real estate bubbles around the world, which had begun during the mid 2000s.

Identification and prevention

As with all types of economic bubbleEconomic bubble

An economic bubble is "trade in high volumes at prices that are considerably at variance with intrinsic values"...

s, whether real estate bubbles can be identified or prevented is contentious. Bubbles are generally not contentious in hindsight, after a peak and crash.

Within mainstream economics

Mainstream economics

Mainstream economics is a loose term used to refer to widely-accepted economics as taught in prominent universities and in contrast to heterodox economics...

, some argue that real estate bubbles cannot be identified as they occur and cannot or should not be prevented, with government and central bank policy rather cleaning up after the bubble bursts.

Others, such as American economist Robert Shiller

Robert Shiller

Robert James "Bob" Shiller is an American economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University and is a Fellow at the Yale International Center for Finance, Yale School of Management...

of the Case-Shiller Home Price Index of home prices in 20 metro cities across the United States, indicated in May 31, 2011 that a "Home Price Double Dip Confirmed" and British magazine The Economist

The Economist

The Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

, argue that housing market indicators can be used to identify real estate bubbles. Some argue further that governments and central banks can and should take action to prevent bubbles from forming, or to deflate existing bubbles.

Macroeconomic significance

Within mainstream economicsMainstream economics

Mainstream economics is a loose term used to refer to widely-accepted economics as taught in prominent universities and in contrast to heterodox economics...

, economic bubbles, and in particular real estate bubbles, are not considered major concerns. Within some schools of heterodox economics

Heterodox economics

"Heterodox economics" refers to approaches or to schools of economic thought that are considered outside of "mainstream economics". Mainstream economists sometimes assert that it has little or no influence on the vast majority of academic economists in the English speaking world. "Mainstream...

, by contrast, real estate bubbles are considered of critical importance and a fundamental cause of financial crises and ensuing economic crises.

The mainstream economic view is that economic bubbles bring about a temporary boost in wealth and a redistribution of wealth. When prices increase, there is a positive wealth effect

Wealth effect

The wealth effect is an economic term, referring to an increase in spending that accompanies an increase in perceived wealth.-Effect on individuals:...

(property owners feel richer and spend more), and when they decline, there is a negative wealth effect (property owners feel poorer and spend less). These effects, it is argued, can be smoothed by counter-cyclical monetary and fiscal policies. The ultimate effect on owners who bought before the bubble formed and did not sell is zero. Those who bought when low and sold high profited, while those who bought high and sold low (after the bubble has burst) or held until the price fell lost money. This redistribution of wealth, it is also argued, is of little macroeconomic significance.

In some schools of heterodox economics, notably Austrian economics and Post-Keynesian economics

Post-Keynesian economics

Post Keynesian economics is a school of economic thought with its origins in The General Theory of John Maynard Keynes, although its subsequent development was influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor and Paul Davidson...

, real estate bubbles are seen as an example of credit bubbles (pejoratively, speculative bubbles), because property owners generally use borrowed money to purchase property, in the form of mortgages

Mortgage loan

A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan...

. These are then argued to cause financial and hence economic crises. This is first argued empirically – numerous real estate bubbles have been followed by economic slumps, and it is argued that there is a cause-effect relationship between these.

The Post-Keynesian theory of debt deflation

Debt deflation

Debt deflation is a theory of economic cycles, which holds that recessions and depressions are due to the overall level of debt shrinking : the credit cycle is the cause of the economic cycle....

takes a demand-side view, arguing that property owners not only feel richer but borrow to (i) consume against the increased value of their property --- by taking out a home equity line of credit), for instance; or (ii) speculate by buying property with borrowed money in the expectation that it will rise in value. The latter view is associated with Financial Instability Hypothesis of Hyman Minsky

Hyman Minsky

Hyman Philip Minsky was an American economist and professor of economics at Washington University in St. Louis. His research attempted to provide an understanding and explanation of the characteristics of financial crises...

. When the bubble bursts, the value of the property decreases but not the level of debt. The burden of repaying or defaulting on the loan depresses aggregate demand

Aggregate demand

In macroeconomics, aggregate demand is the total demand for final goods and services in the economy at a given time and price level. It is the amount of goods and services in the economy that will be purchased at all possible price levels. This is the demand for the gross domestic product of a...

, it is argued, and constitutes the proximate cause of the subsequent economic slump.

1990: Japan

The crash of the Japanese asset price bubbleJapanese asset price bubble

The was an economic bubble in Japan from 1986 to 1991, in which real estate and stock prices were greatly inflated. The bubble's collapse lasted for more than a decade with stock prices initially bottoming in 2003, although they would descend even further amidst the global crisis in 2008. The...

from 1990 on has been very damaging to the Japanese economy,. The crash in 2005 affected Shanghai

Shanghai

Shanghai is the largest city by population in China and the largest city proper in the world. It is one of the four province-level municipalities in the People's Republic of China, with a total population of over 23 million as of 2010...

, China

China

Chinese civilization may refer to:* China for more general discussion of the country.* Chinese culture* Greater China, the transnational community of ethnic Chinese.* History of China* Sinosphere, the area historically affected by Chinese culture...

's largest city. In comparison to the stock-market bubbles, real estate bubbles take longer to deflate: prices decline slower because the real estate market is less liquid. Commercial real estate generally moves in tandem with the residential properties, since both are affected by many of same factors (e.g., interest rates) and share the "wealth effect

Wealth effect

The wealth effect is an economic term, referring to an increase in spending that accompanies an increase in perceived wealth.-Effect on individuals:...

" of booms. Therefore this article focuses on housing bubbles and mentions other sectors only when their situation differs.

2007: many countries

, real estate bubbles had existed in the recent past or were widely believed to still exist in many parts of the world, especially in the United StatesUnited States housing bubble

The United States housing bubble is an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and may not yet have hit bottom as of 2011. On December 30, 2008 the...

, Argentina

Argentina

Argentina , officially the Argentine Republic , is the second largest country in South America by land area, after Brazil. It is constituted as a federation of 23 provinces and an autonomous city, Buenos Aires...

, Britain, Netherlands

Netherlands

The Netherlands is a constituent country of the Kingdom of the Netherlands, located mainly in North-West Europe and with several islands in the Caribbean. Mainland Netherlands borders the North Sea to the north and west, Belgium to the south, and Germany to the east, and shares maritime borders...

, Italy

Italy

Italy , officially the Italian Republic languages]] under the European Charter for Regional or Minority Languages. In each of these, Italy's official name is as follows:;;;;;;;;), is a unitary parliamentary republic in South-Central Europe. To the north it borders France, Switzerland, Austria and...

, Australia

Australia

Australia , officially the Commonwealth of Australia, is a country in the Southern Hemisphere comprising the mainland of the Australian continent, the island of Tasmania, and numerous smaller islands in the Indian and Pacific Oceans. It is the world's sixth-largest country by total area...

, New Zealand, Ireland

Irish property bubble

The property bubble in the Republic of Ireland began in 2000 and peaked in 2006, as with many other western European countries, with a combination of increased speculative construction and rapidly rising prices....

, Spain

Spanish property bubble

The Spanish property bubble refers to the massive growth of real state prices observed, in various stages, from 1985 up to 2008 in Spain. The housing burst can be clearly divided in three periods: 1985-1991, in which the price nearly tripled, 1992-1996, in which the price remained somewhat stable,...

, Lebanon

Lebanese housing bubble

The Lebanese housing bubble is an economic bubble affecting almost all of Lebanon, where property prices have risen exponentially since 2005 , while the GDP has risen only around 52% during the same period....

, France

France

The French Republic , The French Republic , The French Republic , (commonly known as France , is a unitary semi-presidential republic in Western Europe with several overseas territories and islands located on other continents and in the Indian, Pacific, and Atlantic oceans. Metropolitan France...

, Poland

Polish property bubble

Over the span of years 2002-2008 real estate prices in Poland have increased drastically. Between June 2006 and June 2007 alone the average price of a square metre in Warsaw rose from 6,683 PLN to 9,540 PLN .According to a major Polish newspaper, Gazeta Wyborcza, the average monthly salary in...

, South Africa

South Africa

The Republic of South Africa is a country in southern Africa. Located at the southern tip of Africa, it is divided into nine provinces, with of coastline on the Atlantic and Indian oceans...

, Israel

Israel

The State of Israel is a parliamentary republic located in the Middle East, along the eastern shore of the Mediterranean Sea...

, Greece

Greece

Greece , officially the Hellenic Republic , and historically Hellas or the Republic of Greece in English, is a country in southeastern Europe....

, Bulgaria

Bulgaria

Bulgaria , officially the Republic of Bulgaria , is a parliamentary democracy within a unitary constitutional republic in Southeast Europe. The country borders Romania to the north, Serbia and Macedonia to the west, Greece and Turkey to the south, as well as the Black Sea to the east...

, Croatia

Croatia

Croatia , officially the Republic of Croatia , is a unitary democratic parliamentary republic in Europe at the crossroads of the Mitteleuropa, the Balkans, and the Mediterranean. Its capital and largest city is Zagreb. The country is divided into 20 counties and the city of Zagreb. Croatia covers ...

, Norway

Norway

Norway , officially the Kingdom of Norway, is a Nordic unitary constitutional monarchy whose territory comprises the western portion of the Scandinavian Peninsula, Jan Mayen, and the Arctic archipelago of Svalbard and Bouvet Island. Norway has a total area of and a population of about 4.9 million...

, Singapore

Singapore

Singapore , officially the Republic of Singapore, is a Southeast Asian city-state off the southern tip of the Malay Peninsula, north of the equator. An island country made up of 63 islands, it is separated from Malaysia by the Straits of Johor to its north and from Indonesia's Riau Islands by the...

, South Korea

South Korea

The Republic of Korea , , is a sovereign state in East Asia, located on the southern portion of the Korean Peninsula. It is neighbored by the People's Republic of China to the west, Japan to the east, North Korea to the north, and the East China Sea and Republic of China to the south...

, Sweden

Sweden

Sweden , officially the Kingdom of Sweden , is a Nordic country on the Scandinavian Peninsula in Northern Europe. Sweden borders with Norway and Finland and is connected to Denmark by a bridge-tunnel across the Öresund....

, Baltic states

Baltic states

The term Baltic states refers to the Baltic territories which gained independence from the Russian Empire in the wake of World War I: primarily the contiguous trio of Estonia, Latvia, Lithuania ; Finland also fell within the scope of the term after initially gaining independence in the 1920s.The...

, India

India

India , officially the Republic of India , is a country in South Asia. It is the seventh-largest country by geographical area, the second-most populous country with over 1.2 billion people, and the most populous democracy in the world...

, Romania

Romania

Romania is a country located at the crossroads of Central and Southeastern Europe, on the Lower Danube, within and outside the Carpathian arch, bordering on the Black Sea...

, Russia

Russia

Russia or , officially known as both Russia and the Russian Federation , is a country in northern Eurasia. It is a federal semi-presidential republic, comprising 83 federal subjects...

, Ukraine

Ukraine

Ukraine is a country in Eastern Europe. It has an area of 603,628 km², making it the second largest contiguous country on the European continent, after Russia...

and China

China

Chinese civilization may refer to:* China for more general discussion of the country.* Chinese culture* Greater China, the transnational community of ethnic Chinese.* History of China* Sinosphere, the area historically affected by Chinese culture...

. Then U.S. Federal Reserve Chairman Alan Greenspan

Alan Greenspan

Alan Greenspan is an American economist who served as Chairman of the Federal Reserve of the United States from 1987 to 2006. He currently works as a private advisor and provides consulting for firms through his company, Greenspan Associates LLC...

said in mid-2005 that "at a minimum, there's a little 'froth' (in the U.S. housing market) … it's hard not to see that there are a lot of local bubbles." The Economist

The Economist

The Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

magazine, writing at the same time, went further, saying "the worldwide rise in house prices is the biggest bubble in history". Real estate bubbles are invariably followed by severe price decreases (also known as a house price crash) that can result in many owners holding. As of the end of 2010, 11.1 million residential properties, or 23.1% of all U.S. homes, were in negative equity

Negative equity

Negative equity occurs when the value of an asset used to secure a loan is less than the outstanding balance on the loan. In the United States, assets with negative equity are often referred to as being "underwater", and loans and borrowers with negative equity are said to be "upside down".People...

at Dec. 31, 2010. Commercial property values remain around 35% below their mid-2007 peak in the United Kingdom. As a result, banks have become less willing to hold large amounts of property backed debt, a likely key issue in affecting a recovery worldwide in the near term.

Housing market indicators

Financial ratio

A financial ratio is a relative magnitude of two selected numerical values taken from an enterprise's financial statements. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization...

s and economic indicator

Economic indicator

An economic indicator is a statistic about the economy. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles....

s that can be used to evaluate whether homes in a given area are fairly valued. By comparing current levels to previous levels that have proven unsustainable in the past (i.e. led to or at least accompanied crashes), one can make an educated guess as to whether a given real estate market is experiencing a bubble. Indicators describe two interwoven aspects of housing bubble: a valuation component and a debt (or leverage) component. The valuation component measures how expensive houses are relative to what most people can afford, and the debt component measures how indebted households become in buying them for home or profit (and also how much exposure the banks accumulate by lending for them). A basic summary of the progress of housing indicators for U.S. cities is provided by Business Week. See also: real estate economics

Real estate economics

Real estate economics is the application of economic techniques to real estate markets. It tries to describe, explain, and predict patterns of prices, supply, and demand...

and real estate trends

Real estate trends

Real estate trends is a generic term used to describe any consistent pattern or change in the general direction of the real estate industry which, over the course of time, causes a statistically noticeable change...

.

Housing affordability measures

- The price to income ratio is the basic affordability measure for housing in a given area. It is generally the ratio of medianMedianIn probability theory and statistics, a median is described as the numerical value separating the higher half of a sample, a population, or a probability distribution, from the lower half. The median of a finite list of numbers can be found by arranging all the observations from lowest value to...

house prices to median familial disposable incomeDisposable incomeDisposable income is total personal income minus personal current taxes. In national accounts definitions, personal income, minus personal current taxes equals disposable personal income...

s, expressed as a percentage or as years of income. It is sometimes compiled separately for first time buyerFirst time buyerA first-time buyer is a term used in the British and Irish property markets, and in other countries, for a potential house buyer who has not previously owned a property....

s and termed attainability. This ratio, applied to individuals, is a basic component of mortgage lending decisions. According to a back-of-the-envelope calculation by Goldman SachsGoldman SachsThe Goldman Sachs Group, Inc. is an American multinational bulge bracket investment banking and securities firm that engages in global investment banking, securities, investment management, and other financial services primarily with institutional clients...

, a comparison of median home prices to median household income suggests that U.S. housing in 2005 is overvalued by 10%. "However, this estimate is based on an average mortgage rate of about 6%, and we expect rates to rise," the firm's economics team wrote in a recent report. According to Goldman's figures, a one-percentage-point rise in mortgage rates would reduce the fair value of home prices by 8%.

- The deposit to income ratio is the minimum required downpayment for a typical mortgage , expressed in months or years of income. It is especially important for first-time buyers without existing home equityHome equityHome equity is the market value of a homeowner's unencumbered interest in their real property—that is, the difference between the home's fair market value and the outstanding balance of all liens on the property. The property's equity increases as the debtor makes payments against the...

; if the downpayment becomes too high then those buyers may find themselves "priced out" of the market. For example, this ratio was equal to one year of income in the UK.

Another variant is what the United States's National Association of RealtorsNational Association of RealtorsThe National Association of Realtors , whose members are known as Realtors, is North America's largest trade association. representing over 1.2 million members , including NAR's institutes, societies, and councils, involved in all aspects of the residential and commercial real estate industries...

calls the "housing affordability index" in its publications. (The NAR's methodology was criticized by some analysts as it does not account for inflation. Other analysts, however, consider the measure appropriate, because both the income and housing cost data is expressed in terms that include inflation and, all things being equal, the index implicitly includes inflation). In either case, the usefulness of this ratio in identifying a bubble is debatable; while downpayments normally increase with house valuations, bank lending becomes increasingly lax during a bubble and mortgages are offered to borrowers who would not normally qualify for them (see Housing debt measures, below).

- The Affordability Index measures the ratio of the actual monthly cost of the mortgage to take-home income. It is used more in the United Kingdom where nearly all mortgages are variable and pegged to bank lending rates. It offers a much more realistic measure of the ability of households to afford housing than the crude price to income ratio. However it is more difficult to calculate, and hence the price to income ratio is still more commonly used by pundits. In recent years, lending practices have relaxed, allowing greater multiples of income to be borrowed. Some speculate that this practice in the longterm cannot be sustained and may ultimately lead to unaffordable mortgage payments, and repossession for many.

- The Median Multiple measures the ratio of the median house price to the median annual household income. This measure has historically hovered around a value of 3.0 or less, but in recent years has risen dramatically, especially in markets with severe public policy constraints on land and development.

Housing debt measures

- The housing debt to income ratio or debt-service ratio is the ratio of mortgage payments to disposable income. When the ratio gets too high, households become increasingly dependent on rising property values to service their debt. A variant of this indicator measures total home ownership costs, including mortgage payments, utilities and property taxes, as a percentage of a typical household's monthly pre-tax income; for example see RBC Economics' reports for the Canadian markets.

- The housing debt to equity ratio (not to be confused with the corporate debt to equity ratioDebt to equity ratioThe debt-to-equity ratio is a financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company's assets. Closely related to leveraging, the ratio is also known as Risk, Gearing or Leverage...

), also called loan to valueLoan to valueThe loan-to-value ratio expresses the amount of a first mortgage lien as a percentage of the total appraised value of real property. For instance, if a borrower borrows $130,000 to purchase a house worth $150,000, the LTV ratio is $130,000/$150,000 or 87%.Loan to value is one of the key risk...

, is the ratio of the mortgage debt to the value of the underlying property; it measures financial leverage. This ratio increases when the homeowner takes a second mortgageSecond mortgageA second mortgage typically refers to a secured loan that is subordinate to another loan against the same property.In real estate, a property can have multiple loans or liens against it. The loan which is registered with county or city registry first is called the first mortgage or first position...

or home equity loanHome equity loanA home equity loan is a type of loan in which the borrower uses the equity in their home as collateral. These loans are useful to finance major expenses such as home repairs, medical bills or college education...

using the accumulated equity as collateral. A ratio greater higher than 1 implies that owner's equityEquity (finance)In accounting and finance, equity is the residual claim or interest of the most junior class of investors in assets, after all liabilities are paid. If liability exceeds assets, negative equity exists...

is negative.

Housing ownership and rent measures

- The ownership ratio is the proportion of households who own their homes as opposed to rentingRentingRenting is an agreement where a payment is made for the temporary use of a good, service or property owned by another. A gross lease is when the tenant pays a flat rental amount and the landlord pays for all property charges regularly incurred by the ownership from landowners...

. It tends to rise steadily with incomes. Also, governments often enact measures such as tax cutTax cutA tax cut is a reduction in taxes. The immediate effects of a tax cut are a decrease in the real income of the government and an increase in the real income of those whose tax rate has been lowered. Due to the perceived benefit in growing real incomes among tax payers politicians have sought to...

s or subsidized financing to encourage and facilitate home ownership. If a rise in ownership is not supported by a rise in incomes, it can mean either that buyers are taking advantage of low interest rateInterest rateAn interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for...

s (which must eventually rise again as the economy heats up) or that home loans are awarded more liberally, to borrowers with poor credit. Therefore a high ownership ratio combined with an increased rate of subprime lendingSubprime lendingIn finance, subprime lending means making loans to people who may have difficulty maintaining the repayment schedule...

may signal higher debt levels associated with bubbles.

- The price-to-earnings ratio or P/E ratioP/E ratioThe P/E ratio of a stock is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share...

is the common metric used to assess the relative valuation of equities. To compute the P/E ratio for the case of a rented house, divide the pricePrice-Definition:In ordinary usage, price is the quantity of payment or compensation given by one party to another in return for goods or services.In modern economies, prices are generally expressed in units of some form of currency...

of the house by its potential earningsEarnings per shareEarnings per share is the amount of earnings per each outstanding share of a company's stock.In the United States, the Financial Accounting Standards Board requires companies' income statements to report EPS for each of the major categories of the income statement: continuing operations,...

or net incomeNet incomeNet income is the residual income of a firm after adding total revenue and gains and subtracting all expenses and losses for the reporting period. Net income can be distributed among holders of common stock as a dividend or held by the firm as an addition to retained earnings...

, which is the market annual rentRentingRenting is an agreement where a payment is made for the temporary use of a good, service or property owned by another. A gross lease is when the tenant pays a flat rental amount and the landlord pays for all property charges regularly incurred by the ownership from landowners...

of the house minus expenses, which include maintenance and property taxes. This formula is:

-

-

- The house price-to-earnings ratioP/E ratioThe P/E ratio of a stock is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share...

provides a direct comparison to P/E ratios used to analyze other uses of the money tied up in a home. Compare this ratio to the simpler but less accurate price-rent ratio below.

- The price-rent ratio is the average cost of ownership divided by the received rent income (if buying to let) or the estimated rent that would be paid if renting (if buying to reside):

-

-

- The latter is often measured using the "owner's equivalent rent" numbers published by the Bureau of Labor StatisticsBureau of Labor StatisticsThe Bureau of Labor Statistics is a unit of the United States Department of Labor. It is the principal fact-finding agency for the U.S. government in the broad field of labor economics and statistics. The BLS is a governmental statistical agency that collects, processes, analyzes, and...

. It can be viewed as the real estate equivalent of stocks' price-earnings ratio; in other terms it measures how much the buyer is paying for each dollar of received rent income (or dollar saved from rent spending). Rents, just like corporate and personal incomes, are generally tied very closely to supply and demandSupply and demandSupply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

fundamentals; one rarely sees an unsustainable "rent bubble" (or "income bubble" for that matter). Therefore a rapid increase of home prices combined with a flat renting market can signal the onset of a bubble. The U.S. price-rent ratio was 18% higher than its long-run average as of October 2004.

- The gross rental yield, a measure used in the United Kingdom, is the total yearly gross rent divided by the house price and expressed as a percentage:

-

-

- This is the reciprocal of the house price-rent ratio. The net rental yield deducts the landlord's expenses (and sometimes estimated rental voids) from the gross rent before doing the above calculation; this is the reciprocal of the house P/E ratio.

- Because rents are received throughout the year rather than at its end, both the gross and net rental yields calculated by the above are somewhat less than the true rental yields obtained when taking into account the monthly nature of rental payments.

- The occupancy rate (opposite: vacancy rate) is essentially the number of occupied units divided by the total number of units in a given region (in commercial real estate, it is usually expressed in terms of area such as square meters for different grades of buildings). A low occupancy rate means that the market is in a state of oversupply brought about by speculative construction and purchase. In this context, supply-and-demand numbers can be misleading: sales demand exceeds supply, but rent demand does not.

Housing price indices

Measures of house price are also used in identifying housing bubbles; these are known as house price indicesHouse price index

-FHFA/OFHEO:The US Federal Housing Finance Agency publishes the HPI inx, a quarterly broad measure of the movement of single-family house prices....

(HPIs).

A noted series of HPIs for the United States are the Case–Shiller indices

Case–Shiller index

The Standard & Poor's Case–Shiller Home Price Indices are constant-quality house price indices for the United States. There are multiple Case–Shiller home price indices: A national home price index, a 20-city composite index, a 10-city composite index, and twenty individual metro area...

, devised by American economists Karl Case, Robert J. Shiller, and Allan Weiss

Allan Weiss

Allan Neil Weiss has spent his career as an innovator in the areas of asset pricing, asset allocation and risk management. In 1991 he co-founded Case Shiller Weiss, Inc. and served as its CEO from inception to its sale to Fiserv in 2002. CSW is the creator of the Standard & Poor Case-Shiller...

. As measured by the Case–Shiller index, the US experienced a housing bubble peaking in the second quarter of 2006 (2006 Q2).

Real estate bubbles in the 2000s

By 2006, several areas of the world were thought to be ina bubble state, although this contention was not without controversy. This hypothesis was based on observation of similar patterns in real estate markets of a wide variety of countries. This includes similar patterns of overvaluation and excessive borrowing based on those overvaluations.

The subprime mortgage crisis

Subprime mortgage crisis

The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages....

, with its accompanying impacts and effects on economies in various nations, has given some credence to the idea that these trends might have some common characteristics.

For individual countries, see:

- Australian property bubbleAustralian property bubbleThe Australian Property bubble is an observation that real estate prices in Australia are valued at more than they are worth. This is a real estate bubble....

- British property bubble

- Bulgarian property bubbleBulgarian property bubbleThere were rumors and speculations regarding the existence of a property bubble in Bulgaria since at least 2006, however many interested parties tended to discredit such a possibility...

- Canadian property bubble

- Chinese property bubbleChinese property bubbleThe Chinese property bubble is an alleged ongoing real estate bubble in residential and/or commercial real estate in the People's Republic of China...

- Danish property bubbleDanish property bubbleDuring the Danish property bubble of 2001 through 2006, Danish property prices rose faster than at any point in history, in some years increasing by more than 25%...

- Indian property bubbleIndian property bubbleThe origins of Indian Property Market Bubble can be traced to the interest rate reductions made by the NDA coalition government in the years following 2001. Home Loan Rates fell to a historical lows of 7.5% in early 2004. This prepared the basis for the increase in real estate property prices...

- Irish property bubbleIrish property bubbleThe property bubble in the Republic of Ireland began in 2000 and peaked in 2006, as with many other western European countries, with a combination of increased speculative construction and rapidly rising prices....

- Israel's housing bubbleIsrael's housing bubbleThe Israeli housing bubble is an observation that Israeli real estate prices in the late 2000s and 2010 appear to be inflated , and that this may constitute a real estate bubble...

- Japanese asset price bubbleJapanese asset price bubbleThe was an economic bubble in Japan from 1986 to 1991, in which real estate and stock prices were greatly inflated. The bubble's collapse lasted for more than a decade with stock prices initially bottoming in 2003, although they would descend even further amidst the global crisis in 2008. The...

- Lebanese property bubbleLebanese housing bubbleThe Lebanese housing bubble is an economic bubble affecting almost all of Lebanon, where property prices have risen exponentially since 2005 , while the GDP has risen only around 52% during the same period....

- Polish property bubblePolish property bubbleOver the span of years 2002-2008 real estate prices in Poland have increased drastically. Between June 2006 and June 2007 alone the average price of a square metre in Warsaw rose from 6,683 PLN to 9,540 PLN .According to a major Polish newspaper, Gazeta Wyborcza, the average monthly salary in...

- Romanian property bubbleRomanian property bubbleAfter the relative calm of the decade of the 1990s, since 2002 Romania has experienced a dramatic increase in property prices. Between 2002-2007 the median price for an old communist-era apartment rose by a factor of 10 , from around €10,000 to circa €100,000...

- South Korean property bubble

- Spanish property bubbleSpanish property bubbleThe Spanish property bubble refers to the massive growth of real state prices observed, in various stages, from 1985 up to 2008 in Spain. The housing burst can be clearly divided in three periods: 1985-1991, in which the price nearly tripled, 1992-1996, in which the price remained somewhat stable,...

- United States housing bubbleUnited States housing bubbleThe United States housing bubble is an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and may not yet have hit bottom as of 2011. On December 30, 2008 the...

- Greek property bubble

See also

- Real estate pricingReal estate pricingReal estate pricing deals with the valuation of real estate and all the standard methods of determining the price of fixed assets apply....

- Real estate appraisalReal estate appraisalReal estate appraisal, property valuation or land valuation is the process of valuing real property. The value usually sought is the property's Market Value. Appraisals are needed because compared to, say, corporate stock, real estate transactions occur very infrequently...

- Real estate economicsReal estate economicsReal estate economics is the application of economic techniques to real estate markets. It tries to describe, explain, and predict patterns of prices, supply, and demand...

- Deed in lieu of foreclosureDeed in lieu of foreclosureA Deed in lieu of foreclosure is a deed instrument in which a mortgagor conveys all interest in a real property to the mortgagee to satisfy a loan that is in default and avoid foreclosure proceedings....

- Economic bubbleEconomic bubbleAn economic bubble is "trade in high volumes at prices that are considerably at variance with intrinsic values"...

- Foreclosure consultantForeclosure consultantForeclosure consultant means any person who makes any solicitation, representation, or offer to any owner to perform for compensation or who, for compensation, performs any service which the person in any manner represents will in any manner do any of the following:#Stop or postpone the foreclosure...

- :Category:Real estate bubbles of 2000s

- Estate (house)Estate (house)An estate comprises the houses and outbuildings and supporting farmland and woods that surround the gardens and grounds of a very large property, such as a country house or mansion. It is the modern term for a manor, but lacks the latter's now abolished jurisdictional authority...

External links

- Barron's MagazineBarron's MagazineBarron's is an American weekly newspaper covering U.S. financial information, market developments, and relevant statistics. Each issue provides a wrap-up of the previous week's market activity, news reports, and an informative outlook on the week to come....

- John Calverley (2004), Bubbles and how to survive them, N. Brealey. ISBN 1-85788-348-9

- The EconomistThe EconomistThe Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

, December 8, 2005, "Hear that hissing sound?." - The EconomistThe EconomistThe Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

, June 16, 2005, "After the fall." - The EconomistThe EconomistThe Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

, June 16, 2005, "In come the waves." - The EconomistThe EconomistThe Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

, April 20, 2005, "Will the walls come falling down?" - The EconomistThe EconomistThe Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

, May 3d, 2005, "Still want to buy?" - The EconomistThe EconomistThe Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

, May 29, 2003, "House of cards." - The EconomistThe EconomistThe Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

, May 28, 2002, "Going through the roof." - Fred Foldvary (1997). "The Business Cycle: A Georgist-Austrian Synthesis." American Journal of Economics and Sociology 56 (4) (October 1997): 521–41.

- The New York TimesThe New York TimesThe New York Times is an American daily newspaper founded and continuously published in New York City since 1851. The New York Times has won 106 Pulitzer Prizes, the most of any news organization...

, December 25, 2005, Take It From Japan: Bubbles Hurt. - Robert KiyosakiRobert KiyosakiRobert Toru Kiyosaki, born April 8, 1947) is an American investor, businessman, self-help author and motivational speaker. Kiyosaki is best known for his Rich Dad Poor Dad series of motivational books and other material published under the Rich Dad brand. He has written 15 books which have combined...

(2005). All Booms Bust, Rich Dad, Poor DadRich Dad, Poor DadRich Dad Poor Dad is a book by Robert Kiyosaki and Sharon Lechter. It advocates financial independence through investing, real estate, owning businesses, and the use of finance protection tactics.... - Burton G. Malkiel (2003). The Random Walk Guide to Investing: Ten Rules for Financial Success, New York: W. W. Norton and Company, Inc. ISBN 0-393-05854-9.

- Robert J. ShillerRobert ShillerRobert James "Bob" Shiller is an American economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University and is a Fellow at the Yale International Center for Finance, Yale School of Management...

(2005). Irrational Exuberance, 2d ed. Princeton University Press. ISBN 0-691-12335-7. - John R. TalbottJohn R. TalbottJohn R. Talbott is an American finance expert, author, commentator, and political analyst. He is well known for having predicted national and international economic crises in the past decade.-Career:...

(2003). The Coming Crash in the Housing Market, New York: McGraw-Hill, Inc. ISBN 0-07-142220-X. - Andrew TobiasAndrew TobiasAndrew Tobias is an American journalist, author, and columnist. His main body of work is on investment, but he has also written on politics, insurance, and other topics. Since 1999, he has been the treasurer of the Democratic National Committee.-Biography:Tobias graduated from Harvard College in...

(2005). The Only Investment Guide You'll Ever Need (updated ed.), Harcourt Brace and Company. ISBN 0-15-602963-4. - Eric Tyson (2003). Personal Finance for Dummies, 4th ed., Foster City, CA: IDG Books. ISBN 0-7645-2590-5.

- Benjamin Wallace-Wells, "There goes the neighborhood", Washington Monthly, 2004 April.

- Elizabeth WarrenElizabeth WarrenElizabeth Warren is an American bankruptcy expert, policy advocate, Harvard Law School professor, and Democratic Party candidate in the 2012 United States Senate election in Massachusetts. She has written several academic and popular books concerning the American economy and personal finance. She...

and Amelia Warren Tyagi (2003). The Two-Income Trap: Why Middle Class Mothers and Fathers are Going Broke, New York: Basic Books. ISBN 0-465-09082-6. - Dean BakerDean BakerDean Baker is an American macroeconomist and co-founder of the Center for Economic and Policy Research, with Mark Weisbrot. He previously was a senior economist at the Economic Policy Institute and an assistant professor of economics at Bucknell University. He has a Ph.D...

, Financial Bubbles (Stocks and Housing) and How You Can Protect Yourself Against Them, Center for Economic and Policy ResearchCenter for Economic and Policy ResearchThe Center for Economic and Policy Research is a progressive economic policy think-tank based in Washington, DC, founded in 1999. CEPR works on Social Security, the US housing bubble, developing country economies , and gaps in the social policy fabric of the US economy.According to its own...

Economics Seminar Series.http://www.cepr.net/index.php?option=com_content&task=view&id=10&Itemid=36Center for Economic and Policy Research Report by Dean Baker, June 2006, World Economic Outlook, International Monetary Fund, April 2003. - Where should house prices really be and how did they get so high? 2008 Analysis of how the US Real Estate Bubble developed and historical house price to income ratios that show just how big the bubble was and how far house prices are likely to fall., World Economic Outlook, International Monetary Fund, September 2004.

- California’s Real Estate Bubble by Fred E. FoldvaryFred E. FoldvaryFred Emanuel Foldvary is a lecturer in economics at Santa Clara University, California, and a research fellow at The Independent Institute...

, covers the California, U.S., and global bubble from a libertarianLibertarianismLibertarianism, in the strictest sense, is the political philosophy that holds individual liberty as the basic moral principle of society. In the broadest sense, it is any political philosophy which approximates this view...

perspective. - Demographia International Housing Affordability Survey Comparative housing affordability for 100 large markets in the U.S., U.K., Canada, Australia, New Zealand and Ireland., Levy Economics Institute of Bard College, January 2006. Kyero.com, July 2010

- 35 years of house price in Vancouver BC as a rollercoaster currently the least affordable market in North America.

- Rio Real Estate Shielded From Burst

- Housing Bubble Detection, J F Bellod