Naked short selling

Encyclopedia

Securities lending

In finance, securities lending or stock lending refers to the lending of securities by one party to another. The terms of the loan will be governed by a "Securities Lending Agreement", which requires that the borrower provides the lender with collateral, in the form of cash, government securities,...

or ensuring that the security can be borrowed, as is conventionally done in a short sale. When the seller does not obtain the shares within the required time frame, the result is known as a "fail to deliver". The transaction generally remains open until the shares are acquired by the seller, or the seller's broker settles the trade. Short selling is used to anticipate a price fall, but exposes the seller to the risk of a price rise. Abusive naked short selling has been illegal in the United States since 2008, as well as some other jurisdictions, as a method of driving down share prices. Failing to deliver shares is legal under certain circumstances, and naked short selling is not per se illegal. In the United States, naked short selling is covered by various SEC regulations which prohibit the practice. Critics, including Overstock.com

Overstock.com

Overstock.com , also known by its shortcut, O.co, is an online retailer headquartered in Cottonwood Heights, Utah, near Salt Lake City. Founded in 1997 by Robert Brazell, under the name D2: Discounts Direct, it was a pioneering online seller of surplus merchandise which, upon its failure in 1999,...

's Patrick M. Byrne

Patrick M. Byrne

Patrick M. Byrne is the president, CEO, and chairman of the board of directors of Internet retailer Overstock.com. In 1999, Byrne took control of the company, then called D2: Discounts Direct, and changed its name to Overstock...

, have advocated for stricter regulations against naked short selling.

In 2005, "Regulation SHO" was enacted, requiring that broker-dealers have grounds to believe that shares will be available for a given stock transaction, and requiring that delivery take place within a limited time period.

As part of its response to the crisis in the North American markets in 2008, the SEC issued a temporary order restricting short-selling in the shares of 19 financial firms deemed systemically important, by reinforcing the penalties for failing to deliver the shares in time.

Effective September 18, 2008, amid claims that aggressive short selling had played a role in the failure of financial giant Lehman Brothers

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

, the SEC extended and expanded the rules to remove exceptions and to cover all companies, including market maker

Market maker

A market maker is a company, or an individual, that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. From a market microstructure theory standpoint, market makers are net sellers of an option to be...

s.

Some commentators have contended that despite regulations, naked shorting is widespread and that the SEC regulations are poorly enforced. Its critics have contended that the practice is susceptible to abuse, can be damaging to targeted companies struggling to raise capital, and has led to numerous bankruptcies. However, other commentators have said that the naked shorting issue is a "devil theory", not a bona fide market issue and a waste of regulatory resources.

Normal shorting

Short selling is a form of speculationSpeculation

In finance, speculation is a financial action that does not promise safety of the initial investment along with the return on the principal sum...

that allows a trader

Trader (finance)

A trader is someone in finance who buys and sells financial instruments such as stocks, bonds, commodities and derivatives. A broker who simply fills buy or sell orders is not a trader, as they are merely executing instructions given to them. According to the Wall Street Journal in 2004, a managing...

to take a "negative position

Position (finance)

In financial trading, a position is a binding commitment to buy or sell a given amount of financial instruments, such as securities, currencies or commodities, for a given price....

" in a stock of a company. Such a trader first "borrows

Securities lending

In finance, securities lending or stock lending refers to the lending of securities by one party to another. The terms of the loan will be governed by a "Securities Lending Agreement", which requires that the borrower provides the lender with collateral, in the form of cash, government securities,...

" shares of that stock from their owner (the lender), typically via a bank

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

or a prime broker under the condition that he will return it on demand. Next, the trader sells the borrowed shares and delivers them to the buyer who becomes their new owner. The buyer is typically unaware that the shares have been sold short: his transaction with the trader proceeds just as if the trader owned rather than borrowed the shares. Some time later, the trader closes his short position by purchasing the same number of shares in the market and returning them to the lender.

The trader's profit is the difference between the sale price and the purchase price of the shares. In contrast to "going long" where sale succeeds the purchase, short sale precedes the purchase. Because the seller/borrower is generally required to make a cash deposit equivalent to the sale proceeds, it offers the lender some security.

Naked shorts in the United States

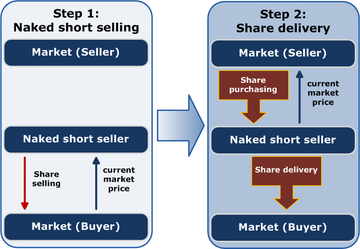

Naked short selling is a case of short selling without first arranging a borrow. If the stock is in short supply, finding shares to borrow can be difficult. The seller may also decide not to borrow the shares, in some cases because lenders are not available, or because of the costs of lending. When shares are not borrowed within the clearing time period and the short-seller does not tender shares to the buyer, the trade is considered to have "failed to deliver." Nevertheless, the trade will continue to sit open or the buyer may be credited the shares by the DTCC until the short-seller either closes out the position or borrows the shares.It is difficult to measure how often naked short selling occurs. Fails to deliver are not necessarily indicative of naked shorting, and can result from both "long" transactions (stock purchases) and short sales. Naked shorting can be invisible in a liquid market, as long as the short sale is eventually delivered to the buyer. However, if the covers are impossible to find, the trades fail. Fail reports are published regularly by the SEC, and a sudden rise in the number of fails-to-deliver will alert the SEC to the possibility of naked short selling. In some recent cases, it was claimed that the daily activity was larger than all of the available shares, which would normally be unlikely.

Extent of naked shorting

The reasons for naked shorting, and the extent of it, have been disputed for several years before the SEC's 2008 action to prohibit the practice. What is generally recognized is that naked shorting tends to happen when shares are difficult to borrow. Studies have shown that naked short selling also increases with the cost of borrowing.In recent years, a number of companies have been accused of using naked shorts in aggressive efforts to drive down share prices, sometimes with no intention of ever delivering the shares. These claims focus on the fact that, at least in theory, the practice allows an unlimited number of shares to be sold short. A Los Angeles Times editorial in July 2008 said that naked short selling "enables speculators to drive down a company's stock by offering an overwhelming number of shares for sale." The SEC has stated that naked shorting is sometimes falsely asserted as a reason for a share price decline, when, often, "the price decrease is a result of the company's poor financial situation rather than the reasons provided by the insiders or promoters."

Before 2008, regulators had generally downplayed the extent of naked shorting in the US. At a North American Securities Administrators Association

North American Securities Administrators Association

The North American Securities Administrators Association , founded in Kansas in 1919, is the oldest international investor protection organization. NASAA is an association of state securities administrators who are charged with the responsibility to protect consumers who purchase securities or...

(NASAA) conference on naked short selling in November 2005, an official of the New York Stock Exchange

New York Stock Exchange

The New York Stock Exchange is a stock exchange located at 11 Wall Street in Lower Manhattan, New York City, USA. It is by far the world's largest stock exchange by market capitalization of its listed companies at 13.39 trillion as of Dec 2010...

stated that NYSE had not found evidence of widespread naked short selling. In 2006, an official of the SEC said that "While there may be instances of abusive short selling, 99% of all trades in dollar value settle on time without incident." Of all those that do not, 85% are resolved within 10 business days and 90% within 20. That means that about 1% of shares that change hands daily, or about $1 billion per day, are subject to delivery failures, although the SEC has stated that "fails-to-deliver can occur for a number of reasons on both long and short sales," and accordingly that they do not necessarily indicate naked short selling.

In 2008, SEC chairman Christopher Cox said that the SEC "has zero tolerance for abusive naked short-selling" while implementing new regulations to prohibit the practice, culminating in the September 2008 action following the failures of Bear Sterns and Lehman Brothers

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

amidst speculation that naked short selling had played a contributory role. Cox said that "the rule would be designed to ensure transparency in short-selling in general, beyond the practice of naked short-selling."

Claimed effects of naked shorting

As with the prevalence of naked shorting, the effects are contested. The SEC has stated that the practice can be beneficial in enhancing liquidity in difficult-to-borrow shares, while others have suggested that it adds efficiency to the securities lending market. Critics of the practice argue that it is often used for market manipulationMarket manipulation

Market manipulation describes a deliberate attempt to interfere with the free and fair operation of the market and create artificial, false or misleading appearances with respect to the price of, or market for, a security, commodity or currency...

, that it can damage companies and even that it threatens the broader markets.

One complaint about naked shorting from targeted companies is that the practice dilutes a company's shares for as long as unsettled short sales sit open on the books. This has been alleged to create "phantom" or "counterfeit" shares, sometimes going from trade to trade without connection to any physical shares, and artificially depressing the share price. However, the SEC has disclaimed the existence of counterfeit shares and stated that naked short selling would not increase a company's outstanding shares. Short seller David Rocker

David Rocker

David A. Rocker is the founder of the hedge fund Rocker Partners, LP , and former columnist for TheStreet.com...

contended that failure to deliver securities "can be done for manipulative purposes to create the impression that the stock is a tight borrow," although he said that this should be seen as a failure to deliver "longs" rather than "shorts."

Robert J. Shapiro

Robert J. Shapiro

Robert J. Shapiro is co-founder and chairman of , a United States private finance consultancy that has built a reputation on a range of economic policy issues, including climate change, intellectual property, and finance. He is known for warning of the dangers of naked short selling...

, former undersecretary of commerce for economic affairs, and a consultant to a law firm suing over naked shorting, has claimed that naked short selling has cost investors $100 billion and driven 1,000 companies into the ground.

Richard Fuld, the former CEO of the financial firm Lehman Brothers, during hearings on the bankruptcy filing by Lehman Brothers and bailout of AIG before the House Committee on Oversight and Government Reform alleged that a host of factors including a crisis of confidence and naked short selling attacks followed by false rumors contributed to the collapse of both Bear Stearns and Lehman Brothers. Fuld had been obsessed with short sellers and had even demoted those Lehman executives that dealt with them; he claimed that the short sellers and the rumour mongers had brought down Lehman, although he hadn't evidence of it. Upon the examination of the issue of whether "naked short selling" was in any way a cause of the collapse of Bear Stearns or Lehman, securities experts reached the conclusion that the alleged "naked short sales" occurred after the collapse and therefore played no role in it. House committee Chairman Henry Waxman said the committee received thousands of pages of internal documents from Lehman and these documents portray a company in which there was “no accountability for failure". In July 2008, U.S. Securities and Exchange Commission chairman Christopher Cox said there was no "unbridled naked short selling in financial issues."

Securities Exchange Act of 1934

The Securities Exchange Act of 1934Securities Exchange Act of 1934

The Securities Exchange Act of 1934 , , codified at et seq., is a law governing the secondary trading of securities in the United States of America. It was a sweeping piece of legislation...

stipulates a settlement period up to three business days before a stock needs to be delivered, generally referred to as "T+3 delivery."

Regulation SHO

The SEC enacted Regulation SHO in January 2005 to target abusive naked short selling by reducing failure to deliver securities, and by limiting the time in which a broker can permit failures to deliver. In addressing the first, it stated that a broker or dealer may not accept a short sale order without having first borrowed or identified the stock being sold. The rule had the following exemptions:- Broker or dealer accepting a short sale order from another registered broker or dealer

- Bona-fide market makingMarket makerA market maker is a company, or an individual, that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. From a market microstructure theory standpoint, market makers are net sellers of an option to be...

- Broker-dealer effecting a sale on behalf of a customer that is deemed to own the security pursuant to Rule 200 through no fault of the customer or the broker-dealer.

To reduce the duration for which fails to deliver are permitted to sit open, the regulation requires broker-dealers to close-out open fail-to-deliver positions in threshold securities that have persisted for 13 consecutive settlement days. The SEC, in describing Regulation SHO, stated that failures to deliver shares that persist for an extended period of time "may result in large delivery obligations where stock settlement occurs."

Regulation SHO also created the "Threshold Security List," which reported any stock where more than 0.5% of a company's total outstanding shares failed delivery for five consecutive days. A number of companies have appeared on the list, including Krispy Kreme

Krispy Kreme

Krispy Kreme is the name of an international chain of doughnut stores that was founded by Vernon Rudolph in 1937 in Winston-Salem, North Carolina. The parent company of Krispy Kreme is Krispy Kreme Doughnuts, Inc...

, Martha Stewart Omnimedia and Delta Air Lines

Delta Air Lines

Delta Air Lines, Inc. is a major airline based in the United States and headquartered in Atlanta, Georgia. The airline operates an extensive domestic and international network serving all continents except Antarctica. Delta and its subsidiaries operate over 4,000 flights every day...

. The Motley Fool

Motley Fool

The Motley Fool is a multimedia financial-services company that provides financial solutions for investors through various stock, investing, and personal finance products. The Alexandria, Virginia-based private company was founded in July 1993 by co-chairmen and brothers David and Tom Gardner, and...

, an investment website, observes that "when a stock appears on this list, it is like a red flag waving, stating 'something is wrong here!'" However, the SEC clarified that appearance on the threshold list "does not necessarily mean that there has been abusive naked short selling or any impermissible trading in the stock."

In July 2006, the SEC proposed to amend Regulation SHO, to further reduce failures to deliver securities. SEC Chairman Christopher Cox referred to "the serious problem of abusive naked short sales, which can be used as a tool to drive down a company's stock price." and that the SEC is "concerned about the persistent failures to deliver in the market for some securities that may be due to loopholes in Regulation SHO.

Developments, 2007 to the present

In June 2007, the SEC voted to remove the grandfather provision that allowed fails-to-deliver that existed before Reg SHO to be exempt from Reg SHO. SEC Chairman Christopher Cox called naked short selling "a fraud that the commission is bound to prevent and to punish." The SEC also said it was considering removing an exemption from the rule for options market makerMarket maker

A market maker is a company, or an individual, that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. From a market microstructure theory standpoint, market makers are net sellers of an option to be...

s. Removal of the grandfather provision and naked shorting restrictions generally have been endorsed by the U.S. Chamber of Commerce.

In March 2008, SEC Chairman Christopher Cox gave a speech entitled the "'Naked' Short Selling Anti-Fraud Rule," in which he announced new SEC efforts to combat naked short selling. Under the proposal, the SEC would create an antifraud rule targeting those who knowingly deceive brokers about having located securities before engaging in short sales, and who fail to deliver the securities by the delivery date. Cox said the proposal would address concerns about short-selling abuses, particularly in the market for small-cap stocks. Even with the regulation in place, the SEC received hundreds of complaints in 2007 about alleged abuses involving short sales. The SEC estimated that about 1% of shares that changed hands daily, about $1 billion, were subject to delivery failures. SEC Commissioners Paul Atkins and Kathleen Casey expressed support for the crackdown.

In mid-July 2008, the SEC announced emergency actions to limit the naked short selling of government sponsored enterprises (GSEs), such as Fannie Mae and Freddie Mac, in an effort to limit market volatility of financial stocks. But even with respect to those stocks the SEC soon thereafter announced there would be an exception with regard to market makers. SEC Chairman Cox noted that the emergency order was "not a response to unbridled naked short selling in financial issues", saying that "that has not occurred". Cox said, "rather it is intended as a preventative step to help restore market confidence at a time when it is sorely needed." Analysts warned of the potential for the creation of price bubbles.

The emergency actions rule expired August 12, 2008. However, at September 17, 2008, the SEC issued new, more extensive rules against naked shorting, making "it crystal clear that the SEC has zero tolerance for abusive naked short selling". Among the new rules is that market makers are no longer given an exception. As a result, options market makers will be treated in the same way as all other market participants, and effectively will be banned from naked short selling.

On November 4, 2008, voters in South Dakota considered a ballot initiative, "The South Dakota Small Investor Protection Act", to end naked short selling in that state. The Securities Industry and Financial Markets Association of Washington and New York said they would take legal action if the measure passed. The voters defeated the initiative.

In July 2009, the SEC, under what the Wall Street Journal described as "intense political pressure," made permanent an interim rule that obliges brokerages to promptly buy or borrow securities when executing a short sale. The SEC said that since the fall of 2008, abusive naked short selling had been reduced by 50%, and the number of threshold list securities (equity securities with too many "fails to deliver") declined from 582 in July 2008 to 63 in March 2009.

In January 2010, Mary Schapiro, chairperson of the SEC, testified before the U.S. Financial Crisis Inquiry Commission, fails to deliver in equity securities has declined 63.4 percent, while persistent and large fails have declined 80.5 percent.

Regulations outside of the United States

Several international exchanges have either partially or fully restricted the practice of naked short selling of shares. They include Australia's Australian Securities ExchangeAustralian Securities Exchange

The Australian Securities Exchange was created by the merger of the Australian Stock Exchange and the Sydney Futures Exchange in July 2006. It is the primary stock exchange group in Australia....

, India's Securities and Exchange Board

Securities and Exchange Board of India

The Securities and Exchange Board of India is the regulator for the securities market in India.-History:It was formed officially by the Government of India in 1992 with SEBI Act 1992 being passed by the Indian Parliament...

, the Netherlands's Euronext Amsterdam, Japan's Tokyo Stock Exchange

Tokyo Stock Exchange

The , called or TSE for short, is located in Tokyo, Japan and is the third largest stock exchange in the world by aggregate market capitalization of its listed companies...

, and Switzerland's SWX Swiss Exchange

SWX Swiss Exchange

SIX Swiss Exchange , based in Zurich, is Switzerland's principal stock exchange . SIX Swiss Exchange also trades other securities such as Swiss government bonds and derivatives such as stock options.The main stock market index for the SIX Swiss Exchange is the SMI, the Swiss Market Index...

. Also Spain's securities regulator CNMV

Comisión Nacional del Mercado de Valores

The Comisión Nacional del Mercado de Valores is the Spanish government agency responsible for regulating the financial securities markets in Spain...

.

In March 2007, the Securities and Exchange Board of India (SEBI), which disallowed short sales altogether in 2001 as a result of the Ketan Parekh

Ketan Parekh

Ketan Parekh is a former stock broker from Mumbai, India, who was convicted in 2008, for involvement in the Indian stock market manipulation scam in late 1999-2001...

affair, reintroduced short selling under regulations similar to those developed in the United States. In conjunction with this rule change, SEBI outlawed all naked short selling.

Japan's naked shorting ban started on November 4, 2008, and was originally scheduled to run until July 2009, but was extended through October of that year. Japan's Finance

Ministry of Finance (Japan)

The ' is one of cabinet-level ministries of the Japanese government. The ministry was once named Ōkura-shō . The Ministry is headed by the Minister of Finance , who is a member of the Cabinet and is typically chosen from members of the Diet by the Prime Minister.The Ministry's origin was back in...

Minister

Minister of Finance (Japan)

The is the member of the Cabinet of Japan in charge of the Ministry of Finance. This position was formerly cited as being Japan's most powerful and one of the world's, because Japan had historically held the largest foreign exchange reserves...

, Shōichi Nakagawa

Shoichi Nakagawa

was a Japanese conservative politician in the Liberal Democratic Party , who served as Minister of Finance from September 24, 2008 to February 17, 2009. He previously held the posts of Minister of Economy, Trade and Industry and Ministry of Agriculture, Forestry and Fisheries in the cabinet of...

stated, "We decided (to move up the short-selling ban) as we thought it could be dangerous for the Tokyo stock market if we do not take action immediately." Nakagawa added that Japan's Financial Services Agency

Financial Services Agency

The is a Japanese government organization responsible for overseeing banking, securities and exchange, and insurance in order to ensure the stability of the financial system of Japan. The agency operates with a commissioner and reports to the Minister of Finance. It oversees the Securities and...

would be teaming with the Securities and Exchange Surveillance Commission

Securities and Exchange Surveillance Commission

The is a Japanese commission which comes under the authority of the Financial Services Agency. It is responsible for “ensuring fair transactions in both securities and financial futures markets.”...

and Tokyo Stock Exchange to investigate past violations of Japanese regulations on stock short-selling. The ban was subsequently extended through October 2010.

The Singapore Exchange

Singapore Exchange

Singapore Exchange Limited is an investment holding company located in Singapore and providing different services related to securities and derivatives trading and others. SGX is a member of the World Federation of Exchanges and the Asian and Oceanian Stock Exchanges FederationSingapore Exchange...

started to penalize naked short sales with an interim measure in September, 2008. These initial penalties started at $100 per day. In November, they announced plans to increase the fines for failing to complete trades. The new penalties would penalize traders who fail to cover their positions, starting at $1,000 per day. There would also be fines for brokerages who fail to use the exchange's buying-in market to cover their positions, starting at $5,000 per day. The Singapore exchange had stated that the failure to deliver shares inherent in naked short sales threatened market orderliness.

On May 18, 2010, the German Minister of Finance announced that naked short sales of euro-denominated government bonds, credit default swaps based on those bonds, and shares in Germany's ten leading financial institutions will be prohibited. This ban went into effect that night and was set to expire on March 31, 2011. On May 28, German financial market regulator BaFin announced that this ban would be permanent. The ban is effective July 27, 2010. The International Monetary Fund issued a report in August 2010 saying that the measure succeeded only in impeding the markets. It said the ban "did relatively little to support the targeted institutions’ underlying stock prices, while liquidity dropped and volatility rose substantially." The IMF said there was no strong evidence that stock prices fell because of shorting.

In August 2011, France, Italy, Spain, Belgium and South Korea temporally banned all short selling in their financial stocks, while Germany pushed for an eurozone-wide ban on naked short selling.

Regulatory enforcement actions

In 2005, the SEC notified RefcoRefco

Refco was a New York-based financial services company, primarily known as a broker of commodities and futures contracts. It was founded in 1969 as "Ray E. Friedman and Co." Prior to its collapse in October, 2005, the firm had over $4 billion in approximately 200,000 customer accounts, and it was...

of intent to file an enforcement action against the securities unit of Refco for securities trading violations concerning the shorting of Sedona stock. The SEC sought information related to two former Refco brokers who handled the account of a client, Amro International, which shorted Sedona's stock. No charges had been filed by 2007.

In December 2006, the SEC sued Gryphon Partners, a hedge fund

Hedge fund

A hedge fund is a private pool of capital actively managed by an investment adviser. Hedge funds are only open for investment to a limited number of accredited or qualified investors who meet criteria set by regulators. These investors can be institutions, such as pension funds, university...

, for insider trading

Insider trading

Insider trading is the trading of a corporation's stock or other securities by individuals with potential access to non-public information about the company...

and naked short-selling involving PIPEs in the unregistered stock of 35 companies. PIPEs are "private investments in public equities," used by companies to raise cash. The naked shorting took place in Canada, where it was legal at the time. Gryphon denied the charges.

In March 2007, Goldman Sachs

Goldman Sachs

The Goldman Sachs Group, Inc. is an American multinational bulge bracket investment banking and securities firm that engages in global investment banking, securities, investment management, and other financial services primarily with institutional clients...

was fined $2 million by the SEC for allowing customers to illegally sell shares short prior to secondary public offerings. Naked short-selling was allegedly used by the Goldman clients. The SEC charged Goldman with failing to ensure those clients had ownership of the shares. SEC Chairman Cox said "That is an important case and it reflects our interest in this area."

In July 2007, Piper Jaffray

Piper Jaffray

Piper Jaffray & Co. , often shortened to just Piper Jaffray or PiperJaffray, is a U.S. middle-market investment banking firm based in Minneapolis, Minnesota, and sells financial advice, investment products, and transaction execution within targeted sectors of the financial services marketplace...

was fined $150,000 by the New York Stock Exchange

New York Stock Exchange

The New York Stock Exchange is a stock exchange located at 11 Wall Street in Lower Manhattan, New York City, USA. It is by far the world's largest stock exchange by market capitalization of its listed companies at 13.39 trillion as of Dec 2010...

(NYSE). Piper violated securities trading rules from January through May 2005, selling shares without borrowing them, and also failing to "cover short sales in a timely manner", according to the NYSE. At the time of this fine, the NYSE had levied over $1.9 million in fines for naked short sales over seven regulatory actions.

Also in July 2007, the American Stock Exchange

American Stock Exchange

NYSE Amex Equities, formerly known as the American Stock Exchange is an American stock exchange situated in New York. AMEX was a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange. On January 17, 2008, NYSE Euronext announced it would acquire the...

fined two options market makers for violations of Regulation SHO. SBA Trading was sanctioned for $5 million, and ALA Trading was fined $3 million, which included disgorgement of profits. Both firms and their principals were suspended from association with the exchange for five years. The exchange said the firms used an exemption to Reg. SHO for options market makers to "impermissibly engage in naked short selling."

In October 2007, the SEC settled charges against New York hedge fund adviser Sandell Asset Management Corp. and three executives of the firm for, among other things, shorting stock without locating shares to borrow. Fines totalling $8 million were imposed, and the firm neither admitted nor denied the charges.

In October 2008 Lehman Brothers Inc. was fined $250,000 by the Financial Industry Regulatory Authority

Financial Industry Regulatory Authority

In the United States, the Financial Industry Regulatory Authority, Inc., or FINRA, is a private corporation that acts as a self-regulatory organization . FINRA is the successor to the National Association of Securities Dealers, Inc. ...

(FINRA) for failing to properly document the ownership of short sales as they occurred, and for failing to annotate an affirmative declaration that shares would be available by the settlement date.

In April 2010 Goldman Sachs paid $450,000 to settle SEC's allegations that it had failed to deliver "approximatedly" 86 short sells between early December 2008 and mid-January 2009, and that it had failed to institute adequate controls to prevent the failures. The company neither admitted nor denied any wrongdoing.

Litigation and DTCC

The Depository Trust and Clearing Corporation (DTCC) has been criticized for its approach to naked short selling. DTCC has been sued with regard to its alleged participation in naked short selling, and the issue of DTCC's possible involvement has been taken up by Senator Robert BennettRobert Foster Bennett

Robert Foster "Bob" Bennett is a former United States Senator from Utah and a member of the Republican Party. In 2006, Bennett was tapped to serve on the Senate Republican Leadership Team as Counsel to the Minority Leader, United States Senator Mitch McConnell...

and discussed by the NASAA and in articles in the Wall Street Journal and Euromoney.

There is no dispute that illegal naked shorting happens, what is in dispute is how much it happens, and to what extent is DTCC to blame. Some companies with falling stocks blame DTCC as the keeper of the system where it happens, and say DTCC turns a blind eye to the problem. Referring to trades that remain unsettled, DTCC's chief spokesman Stuart Goldstein said, "We're not saying there is no problem, but to suggest the sky is falling might be a bit overdone." In July 2007, Senator Bennett suggested on the U.S. Senate floor that the allegations involving DTCC and naked short selling are "serious enough" that there should be a hearing on them with DTCC officials by the Senate Banking Committee, and that banking committee chairman Christopher Dodd has expressed a willingness to hold such a hearing.

Critics also contend DTCC has been too secretive with information about where naked shorting is taking place. Ten suits concerning naked short-selling filed against the DTCC were withdrawn or dismissed by May 2005.

A suit by Electronic Trading Group, naming major Wall Street brokerages, was filed in April 2006 and dismissed in December 2007.

Two separate lawsuits, filed in 2006 and 2007 by NovaStar Financial, Inc.

NovaStar Financial, Inc.

For information about the Belgian band, see Novastar.Novastar Financial, Inc. originated and serviced "nonconforming" residential loans to borrowers who generally did not qualify for conventional mortgages....

shareholders and Overstock.com

Overstock.com

Overstock.com , also known by its shortcut, O.co, is an online retailer headquartered in Cottonwood Heights, Utah, near Salt Lake City. Founded in 1997 by Robert Brazell, under the name D2: Discounts Direct, it was a pioneering online seller of surplus merchandise which, upon its failure in 1999,...

, named as defendants ten Wall Street prime brokers. They claimed a scheme to manipulate the companies' stock by allowing naked short selling. A motion to dismiss the Overstock suit was denied in July 2007.

A suit against DTCC by Pet Quarters Inc. was dismissed by a federal court in Arkansas, and upheld by the Eighth Circuit Court of Appeals in March 2009. Pet Quarters alleged the Depository Trust & Clearing Corp.'s stock-borrow program resulted in the creation of nonexistent or phantom stock and contributed to the illegal short selling of the company's shares. The court ruled: "In short, all the damages that Pet Quarters claims to have suffered stem from activities performed or statements made by the defendants in conformity with the program's Commission approved rules. We conclude that the district court did not err in dismissing the complaint on the basis of preemption." Pet Quarters' complaint was almost identical to suits against DTCC brought by Whistler Investments Inc. and Nanopierce Technologies Inc. The suits also challenged DTCC's stock-borrow program, and were dismissed.

Studies

A study of trading in initial public offerings by two SEC staff economists, published in April 2007, found that excessive numbers of fails to deliver were not correlated with naked short selling. The authors of the study said that while the findings in the paper specifically concern IPO trading, "The results presented in this paper also inform a public debate surrounding the role of short selling and fails to deliver in price formation."In contrast, a study by Leslie Boni in 2004 found correlation between "strategic delivery failures" and the cost of borrowing shares. The paper, which looked at a "unique dataset of the

entire cross-section of U.S. equities," credited the initial recognition of strategic delivery fails to Richard Evans, Chris Geczy, David Musto and Adam Reed, and found its review to provide evidence consistent with their hypothesis that "market makers strategically fail to deliver shares when borrowing costs are high." A recent study by Autore, Boulton, and Braga-Alves examines stock returns around delivery failures between 2005 and 2008 and finds evidence consistent with a positive link between delivery failures and borrowing costs.

An April 2007 study conducted for Canadian market regulators by Market Regulation Services Inc. found that fails to deliver securities were not a significant problem on the Canadian market, that "less than 6% of fails resulting from the sale of a security involved short sales" and that "fails involving short sales are projected to account for only 0.07% of total short sales.

A Government Accountability Office study, released in June 2009, found that recent SEC rules had apparently reduced abusive short selling, but that the SEC needed to give clearer guidance to the brokerage industry.

The Financial Crisis Inquiry Commission

Financial Crisis Inquiry Commission

The Commission reported its findings in January 2011. It concluded that "the crisis was avoidable and was caused by: Widespread failures in financial regulation, including the Federal Reserve’s failure to stem the...

, appointed by Congress to investigate the 2008 financial crisis, makes no reference to naked shorting, or short-selling of financial stocks, in its conclusions.

Media coverage

Some journalists have expressed concern about naked short selling, while others contend that naked short selling is not harmful and that its prevalence has been exaggerated by corporate officials seeking to blame external forces for internal problems with their companies. Others have discussed naked short selling as a confusing or bizarre form of trading.In June 2007, executives of Universal Express

Universal Express

Universal Express claimed to be a transportation and logistics service company and was registered in Nevada and headquartered in Boca Raton, Florida. However, investigation by the SEC clearly revealed that the primary business of USXP was the production of and distribution of billions of illegal,...

, which had claimed naked shorting of its stock, were sanctioned by a federal court judge for violation of securities laws. Referring to a court ruling against CEO Richard Altomare, New York Times columnist Floyd Norris

Floyd Norris

Floyd Norris born September 6, 1947 Los Angeles) is chief financial correspondent of The New York Times and The International Herald Tribune.He writes a regular column on the stock market for the Times, plus a blog.-Biography:...

said: "In Altomare's view, the issues that bothered the judge are irrelevant. Long and short of it, this is a naked short hallmark case in the making. Or it is proof that it can take a long time for the SEC to stop a fraud." Universal Express claimed that 6,000 small companies had been put out of business by naked shorting, which the company said "the SEC has ignored and condoned."

Reviewing the SEC's July 2008 emergency order, Barron's

Barron's Magazine

Barron's is an American weekly newspaper covering U.S. financial information, market developments, and relevant statistics. Each issue provides a wrap-up of the previous week's market activity, news reports, and an informative outlook on the week to come....

said in an editorial: "Rather than fixing any of the real problems with the agency and its mission, Cox and his fellow commissioners waved a newspaper and swatted the imaginary fly of naked short-selling. It made a big noise, but there's no dead bug." Holman Jenkins of the Wall Street Journal said the order was "an exercise in symbolic confidence-building" and that naked shorting involved technical concerns except for subscribers to a "devil theory". The Economist

The Economist

The Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

said the SEC had "picked the wrong target", mentioning a study by Arturo Bris of the Swiss International Institute for Management Development

International Institute for Management Development

IMD - International Institute for Management Development is a non profit business school located in Lausanne, Switzerland.- History & Mission :...

who found that trading in the 19 financial stocks became less efficient. The Washington Post expressed approval of the SEC's decision to address a "frenetic shadow world of postponed promises, borrowed time, obscured paperwork and nail-biting price-watching, usually compressed into a few high-tension days swirling around the decline of a company." The Los Angeles Times called the practice of naked short selling "hard to defend," and stated that it was past time the SEC became active in addressing market manipulation.

The Wall Street Journal said in an editorial in July 2008 that "the Beltway is shooting the messenger by questioning the price-setting mechanisms for barrels of oil and shares of stock." But it said the emergency order to bar naked short selling "won't do much harm," and said "Critics might say it's a solution to a nonproblem, but the SEC doesn't claim to be solving a problem. The Commission's move is intended to prevent even the possibility that an unscrupulous short seller could drive down the shares of a financial firm with a flood of sell orders that aren't backed by an actual ability to deliver the shares to buyers."

In an article in March 2009 Bloomberg News Service said that the Lehman Brothers bankruptcy may have been prevented by curbs on naked shorting. "..as many as 32.8 million shares in the company were sold and not delivered to buyers on time as of Sept. 11, according to data compiled by the Securities and Exchange Commission.."

In May 2009, the New York Times's chief financial correspondent Floyd Norris

Floyd Norris

Floyd Norris born September 6, 1947 Los Angeles) is chief financial correspondent of The New York Times and The International Herald Tribune.He writes a regular column on the stock market for the Times, plus a blog.-Biography:...

reported that naked shorting is "almost gone." He said that delivery failures, where they occur, are quickly corrected.

In an article published in October 2009, Rolling Stone

Rolling Stone

Rolling Stone is a US-based magazine devoted to music, liberal politics, and popular culture that is published every two weeks. Rolling Stone was founded in San Francisco in 1967 by Jann Wenner and music critic Ralph J...

writer Matt Taibbi

Matt Taibbi

Matthew C. "Matt" Taibbi is an American author and journalist reporting on politics, media, finance, and sports for Rolling Stone and Men's Journal, often in a polemical style. He has also edited and written for The eXile, the New York Press, and The Beast.- Early years :Taibbi grew up in the...

contended that Bear Stearns

Bear Stearns

The Bear Stearns Companies, Inc. based in New York City, was a global investment bank and securities trading and brokerage, until its sale to JPMorgan Chase in 2008 during the global financial crisis and recession...

and Lehman Brothers

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

were flooded with "counterfeit stock" that helped kill both companies. Taibbi said that the two firms got a "push" into extinction from "a flat-out counterfeiting scheme called naked short-selling". During a May 2010 discussion on the inclusion of 'counterfeiting' in the charges filed against Icelandic bankers, the host Max Keiser

Max Keiser

Timothy Maxwell "Max" Keiser is an American broadcaster, film-maker, and former equities broker. Keiser is the host of On the Edge, a program of news and analysis hosted by Iran's Press TV. He also hosts Keiser Report, a financial program broadcast on RT - formerly Russia Today...

speculated that the charge might refer to naked short selling because "naked short-selling is the same as counterfeiting, in that it is selling something that doesn't exist."

External links

- Short Selling FAQ: Securities and Exchange Commission

- Naked Short Selling FAQ: Depository Trust and Clearing Corp.

- AMEX's daily and monthly Regulation SHO threshold security list

- NYSE's Regulation SHO threshold security list

- NASDAQ's Regulation SHO threshold security list

- SEC stock delivery failures charted.

- In pursuit of the Naked Short in New York University Journal of Law and Business