FairTax

Encyclopedia

The FairTax is a tax reform

proposal for the federal government of the United States

that would replace all federal taxes

on personal and corporate income with a single broad national consumption tax

on retail sales. The Fair Tax Act (/) would apply a tax once at the point of purchase on all new goods and services for personal consumption. The proposal also calls for a monthly payment to all family

household

s of lawful U.S. residents as an advance rebate, or "prebate", of tax on purchases up to the poverty level. First introduced into the United States Congress

in 1999, a number of congressional committees have heard testimony on the bill

; however, it has not moved from committee and has yet to have any effect on the tax system. In recent years, a tax reform movement has formed behind the FairTax proposal. Increased support was created after talk radio

personality Neal Boortz

and Georgia

Congressman John Linder

published The FairTax Book

in 2005 and additional visibility was gained in the 2008 presidential campaign

.

The sales tax rate, as defined in the legislation for the first year, is 23% of the total payment including the tax ($23 of every $100 spent in total—calculated similar to income taxes). This would be equivalent to a 30% traditional U.S. sales tax

($23 on top of every $77 spent—$100 total). The rate would then be automatically adjusted annually based on federal receipts in the previous fiscal year. With the rebate taken into consideration, the FairTax would be progressive

on consumption

, but would also be regressive

on income

at higher income levels (as consumption falls as a percentage of income). Opponents argue this would accordingly decrease the tax burden

on high income earners

and increase it on the middle class

. Supporters contend that the plan would decrease tax burdens by broadening the tax base, effectively taxing wealth

, and increasing purchasing power

.

The plan's supporters believe that a consumption tax would have a positive effect on savings

and investment

, that it would ease tax compliance

, and that the tax would result in increased economic growth

, incentives for international business

to locate in the U.S., and increased U.S. competitiveness in international trade

. Opponents contend that a consumption tax of this size would be extremely difficult to collect, and would lead to pervasive tax evasion

. They also argue that the proposed sales tax rate would raise less revenue than the current tax system, leading to an increased budget deficit. The plan is expected to increase cost transparency for funding the federal government, and supporters believe it would have positive effects on civil liberties

, the environment

, and advantages with taxing illegal activity

and illegal immigrants

. There are concerns regarding the proposed repeal of the Sixteenth Amendment

, removal of tax deduction

incentives, transition effects on after-tax savings, incentives on credit use, and the loss of tax advantages to state and local bonds.

The Fair Tax Act is designed to replace all federal

The Fair Tax Act is designed to replace all federal

income taxes

(including the alternative minimum tax

, corporate income taxes

, and capital gains taxes

), payroll taxes (including Social Security and Medicare taxes

), gift tax

es, and estate taxes

with a national retail sales tax

. The legislation would remove the Internal Revenue Service

(after three years), and establish an Excise Tax Bureau and a Sales Tax Bureau in the Department of the Treasury

. The states

are granted the primary authority for the collection of sales tax revenues and the remittance of such revenues to the Treasury. The plan was created by Americans For Fair Taxation

, an advocacy group

formed to change the tax system. The group states that, together with economists, it developed the plan and the name "Fair Tax", based on interviews, polls, and focus groups of the general public. Since the term "fair" is subjective, the name of the plan has been criticized as deceptive marketing by some, while being touted as true to its name by others. The FairTax legislation has been introduced in the House by Georgia Republicans

John Linder

(1999–2010) and Rob Woodall

(2011), while being introduced in the Senate by Georgia Republican Saxby Chambliss

.

Linder first introduced the Fair Tax Act on July 14, 1999 to the 106th United States Congress

and has reintroduced a substantially similar bill in each subsequent session of Congress. The bill attracted a total of 56 House and Senate cosponsors in the 108th Congress (/), 61 in the 109th Congress (/), 76 in the 110th Congress (/), 69 in the 111th United States Congress

(/), and 74 in the 112th United States Congress

/). Former Speaker of the House Dennis Hastert

(Republican) has cosponsored the bill but it has not received support from the Democratic leadership, which still controls the Senate. Democratic Representative Collin Peterson

of Minnesota

and Democratic Senator Zell Miller

of Georgia cosponsored and introduced the bill in the 108th Congress, but Peterson is no longer cosponsoring the bill and Miller has left the Senate. In the 109th–111th Congress, Representative Dan Boren

has been the only Democrat to cosponsor the bill. A number of congressional committees have heard testimony on the FairTax, but it has not moved from committee since its introduction in 1999. The legislation was also discussed with President George W. Bush

and his Secretary of the Treasury

Henry M. Paulson.

To become law, the bill will need to be included in a final version of tax legislation from the U.S. House Committee on Ways and Means, pass both the House and the Senate, and finally be signed by the President

. In 2005, President Bush established an advisory panel on tax reform

that examined several national sales tax variants including aspects of the FairTax and noted several concerns. These included uncertainties as to the revenue that would be generated, and difficulties of enforcement and administration, which made this type of tax undesirable to recommend in their final report. The panel did not examine the Fairtax as proposed in the legislation. The FairTax received visibility in the 2008 presidential election

on the issue of taxes and the IRS, with several candidates supporting the bill. A poll in 2009 by Rasmussen Reports

found that 43% of Americans would support a national sales tax replacement, with 38% opposed to the idea; the sales tax was viewed as fairer by 52% of Republicans, 44% of Democrats, and 49% of unaffiliateds. President

Barack Obama

does not support the bill, arguing for more progressive changes to the income and payroll tax systems.

The effective tax rate for any household would be variable due to the fixed monthly tax prebates that are used to "untax" purchases up to the poverty level. The tax would be levied on all U.S. retail sales for personal consumption on new goods and services. Critics argue that the sales tax rate defined in the legislation would not be revenue neutral (that is, it would collect less for the government than the current tax system), and thus would increase the budget deficit, unless government spending were equally reduced.

sales tax on the total transaction value of a purchase; in other words, consumers pay to the government 23 cents of every dollar spent in total (sometimes called tax-inclusive). The equivalent assessed tax rate is 30% if the FairTax is applied to the pre-tax price of a good like traditional U.S. state sales taxes

(sometimes called tax-exclusive). After the first year of implementation, this tax rate would be automatically adjusted annually using a formula specified in the legislation that reflects actual federal receipts in the previous fiscal year.

The tax would be levied once at the final retail sale for personal consumption on new goods and services. A good would be considered "used" and not taxable if a consumer already owns it before the FairTax takes effect or if the FairTax has been paid previously on the good, which may be different than the item being sold previously. Export

s and intermediate business transactions

would not be taxed, nor would savings, investments, or education tuition

expenses as they would be considered an investment (rather than final consumption). Personal services such as health care

, legal services, financial services

, and auto repairs would be subject to the FairTax, as would renting apartments and other real property

. In comparison, the current system taxes income prior to purchasing such personal services. State

sales taxes generally exempt certain goods and services in an effort to reduce the tax burden on low-income families. The FairTax would use a monthly "prebate" system instead of the common state exclusions. The FairTax would apply to Internet purchases and would tax retail international purchases (such as a boat or car) that are imported to the United States (collected by the U.S. Customs and Border Protection

).

Under the FairTax, family

household

s of lawful U.S. residents would be eligible to receive a "Family Consumption Allowance" (FCA) based on family size (regardless of income) that is equal to the estimated total FairTax paid on poverty

level spending according to the poverty guidelines published by the U.S. Department of Health and Human Services. The FCA is a tax rebate (known as a "prebate" as it would be an advance) paid in twelve monthly installments, adjusted for inflation

. The rebate is meant to eliminate the taxation of household necessities and make the plan progressive

. Households would register once a year with their sales tax administering authority, providing the names and social security numbers of each household member. The Social Security Administration

would disburse the monthly rebate payments in the form of a paper check via U.S. Mail, an electronic funds transfer

to a bank account, or a "smartcard" that can be used like a debit card

.

Opponents of the plan criticize this tax rebate due to its costs. Economists at the Beacon Hill Institute

estimated the overall rebate cost to be $489 billion (assuming 100% participation). In addition, economist Bruce Bartlett

has argued that the rebate would create a large opportunity for fraud

, treats children disparately, and would constitute a welfare payment regardless of need.

The President's Advisory Panel for Federal Tax Reform

cited the rebate as one of their chief concerns when analyzing their national sales tax, stating that it would be the largest entitlement program in American history, and contending that it would "make most American families dependent on monthly checks from the federal government". Estimated by the advisory panel at approximately $600 billion, "the Prebate program would cost more than all budgeted spending in 2006 on the Departments of Agriculture, Commerce, Defense, Education, Energy, Homeland Security, Housing and Urban Development, and Interior combined." Proponents point out that income tax deduction

s, tax preferences, loopholes

, credits

, etc. under the current system was estimated at $945 billion by the Joint Committee on Taxation

. They argue this is $456 billion more than the FairTax "entitlement" (tax refund) would spend to cover each person's tax expenses up to the poverty level. In addition, it was estimated for 2005 that the Internal Revenue Service was already sending out $270 billion in refund checks.

).

).

The FairTax statutory rate, unlike most U.S. state-level sales taxes

, is presented on a tax base that includes the amount of FairTax paid. For example, a final after-tax price of $100 includes $23 of taxes. Although no such requirement is included in the text of the legislation, Congressman John Linder has stated that the FairTax would be implemented as an inclusive tax, which would include the tax in the retail price, not added on at checkout—an item on the shelf for five dollars would be five dollars total. The legislation requires the receipt to display the tax as 23% of the total. Linder states the FairTax is presented as a 23% tax rate for easy comparison to income tax rates (the taxes it would be replacing). The plan's opponents call the semantics

deceptive. FactCheck

called the presentation misleading, saying that it hides the real truth of the tax rate. Bruce Bartlett

stated that polls show tax reform support is extremely sensitive to the proposed rate, and called the presentation confusing and deceptive based on the conventional method of calculating sales taxes. Proponents believe it is both inaccurate and misleading to say that an income tax is 23% and the FairTax is 30% as it implies that the sales tax burden is higher.

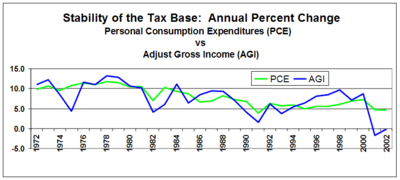

or dynamic scoring

further complicates any estimate of revenue-neutral rates.

A 2006 study published in Tax Notes by the Beacon Hill Institute

at Suffolk University and Dr. Laurence Kotlikoff

estimated the FairTax would be revenue-neutral for the tax year 2007 at a rate of 23.82% (31.27% tax-exclusive). The study states that purchasing power

is transferred to state and local taxpayers from state and local governments. To recapture the lost revenue, state and local governments would have to raise tax rates or otherwise change tax laws in order to continue collecting the same real revenues from their taxpayers. The Argus Group and Arduin, Laffer & Moore Econometrics

each published an analysis that defended the 23% rate. While proponents of the FairTax concede that the above studies did not explicitly account for tax evasion

, they also claim that the studies did not altogether ignore tax evasion under the FairTax. These studies presumably incorporated some degree of tax evasion in their calculations by using National Income and Product Account

based figures, which is argued to understate total household consumption. The studies also did not account for capital gains that may be realized by the U.S. government if consumer prices were allowed to rise, which would reduce the real value of nominal U.S. government debt. Nor did these studies account for any increased economic growth

that many economists researching the plan believe would occur.

In contrast to the above studies, William G. Gale

of the Brookings Institution

published a study in Tax Notes that estimated a rate of 28.2% (39.3% tax-exclusive) for 2007 assuming full taxpayer compliance and an average rate of 31% (44% tax-exclusive) from 2006–2015 (assumes that the Bush tax cuts

expire on schedule and accounts for the replacement of an additional $3 trillion collected through the Alternative Minimum Tax

). The study also concluded that if the tax base were eroded by 10% due to tax evasion, tax avoidance, and/or legislative adjustments, the average rate would be 34% (53% tax-exclusive) for the 10 year period. A dynamic analysis in 2008 by the Baker Institute For Public Policy concluded that a 28% (38.9% tax-exclusive) rate would be revenue neutral for 2006. The President's Advisory Panel for Federal Tax Reform

performed a 2006 analysis to replace the individual and corporate income tax

with a retail sales tax and found the rate to be 25% (34% tax-exclusive) assuming 15% tax evasion, and 33% (49% tax-exclusive) with 30% tax evasion. The rate would need to be substantially higher to replace the additional taxes replaced by the FairTax (payroll, estate, and gift taxes). Several economists criticized the President's Advisory Panel's study as having allegedly altered the terms of the FairTax, using unsound methodology, and/or failing to fully explain their calculations.

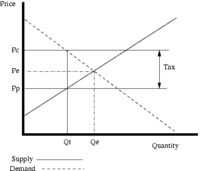

The FairTax's effect on the distribution of taxation or tax incidence

The FairTax's effect on the distribution of taxation or tax incidence

(the effect on the distribution of economic welfare

) is a point of dispute. The plan's supporters argue that the tax would broaden the tax base, that it would be progressive

, and that it would decrease tax burdens and start taxing wealth (reducing the economic gap

). Opponents argue that a national sales tax would be inherently regressive

and would decrease tax burdens paid by high-income individuals. Households at the lower end of the income scale spend almost all their income, while households at the higher end are more likely to devote a portion of income to saving; households at the extreme high end of consumption often finance their purchases out of savings, not income. Income earned and saved would not be taxed until spent under the proposal.

Under the initial rate, a family of four (a couple with two children) earning $25,000 and spending this on taxable goods and services would consume 100% of their income. A higher income family of four making $100,000, spending $75,000 and saving $25,000, would devote 75% of their income for the year on taxable goods and services. Therefore, according to economist William G. Gale

, the percentage of income

taxed is regressive. Since household spending in a given year can exceed household income for that year, the calculated rate as a percentage of income could exceed the stated sales tax rate. When presented with an estimated effective tax rate, the low-income family above would pay a tax rate of 0% on the 100% of consumption. The higher income family would pay a tax rate of 15% on the 75% of consumption (with the other 25% taxed at a later point in time, as savings is tax-deferred). Thus, according to economist Laurence Kotlikoff

, the effective tax rate is progressive on consumption

. A person spending at the poverty level would have an effective tax rate of 0%, whereas someone spending at four times the poverty level would have an effective tax rate on consumption of 17.2%.

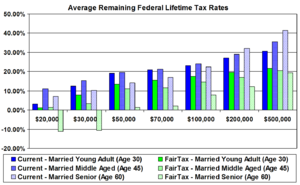

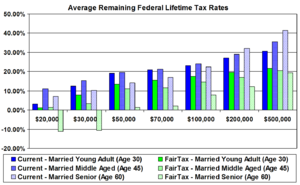

Kotlikoff states that the FairTax could make the tax system much more progressive and generationally equitable, and argues that taxing consumption is effectively the same as taxing wages plus taxing wealth

. Studies by Kotlikoff and Daivd Rapson state that the FairTax would significantly reduce marginal taxes on work and saving, lowering overall average remaining lifetime tax burdens on current and future workers. A study by Kotlikoff and Sabine Jokisch concluded that the long term effects of the FairTax would reward low-income households with 26.3% more purchasing power

, middle-income households with 12.4% more purchasing power, and high-income households with 5% more purchasing power. The Beacon Hill Institute

reported that the FairTax would make the federal tax system more progressive and would benefit the average individual in almost all expenditures deciles. In another study, they state the FairTax would offer the broadest tax base (an increase of over $2 trillion), which allows the FairTax to have a lower tax rate than current tax law.

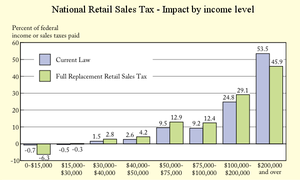

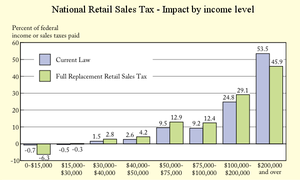

Gale analyzed a national sales tax (though different from the FairTax in several aspects) and reported that the overall tax burden on middle-income Americans would increase while the tax burden on the top 1% would drop. A study by the Beacon Hill Institute reported that the FairTax may have a negative effect on the well-being of mid-income earners for several years after implementation. According to the President's Advisory Panel for Federal Tax Reform

report, which compared the individual and corporate income tax (excluding other taxes the FairTax replaces) to a sales tax with rebate, the percentage of federal taxes paid by those earning from $15,000–$50,000 would rise from 3.6% to 6.7%, while the burden on those earning more than $200,000 would fall from 53.5% to 45.9%. The report states that the top 5% of earners would see their burden decrease from 58.6% to 37.4%. FairTax supporters argue that replacing the regressive payroll tax

(a 15.3% total tax not included in the Tax Panel study; payroll taxes include a 12.4% Social Security

tax on wages up to $97,500 and a 2.9% Medicare

tax, a 15.3% total tax that is often split between employee and employer) greatly changes the tax distribution, and that the FairTax would relieve the tax burden on middle-class workers.

magazine, while many economists and tax experts support the idea of a consumption tax

, many of them view the FairTax proposal as having serious problems with evasion and revenue neutrality. Some economists argue that a consumption tax (the FairTax is one such tax) would have a positive effect on economic growth

, incentives for international business to locate in the U.S., and increased U.S. international competitiveness (border tax adjustment in global trade

). The FairTax would be tax-free on mortgage interest (up to a basic interest rate) and donations, but some law makers have concerns about losing tax incentives on home ownership and charitable contributions. There is also concern about the effect on the income tax industry and the difficulty of repealing the Sixteenth Amendment

(to prevent Congress from re-introducing an income tax).

Americans For Fair Taxation states the FairTax would boost the United States economy and offers a letter signed by eighty economists, including Nobel Laureate Vernon L. Smith

, that have endorsed the plan. The Beacon Hill Institute

estimated that within five years real GDP would increase 10.7% over the current system, domestic investment by 86.3%, capital stock by 9.3%, employment by 9.9%, real wage

s by 10.2%, and consumption by 1.8%. Arduin, Laffer & Moore Econometrics

projected the economy as measured by GDP would be 2.4% higher in the first year and 11.3% higher by the 10th year than it would otherwise be. Economists Laurence Kotlikoff

and Sabine Jokisch reported the incentive to work and save would increase; by 2030, the economy’s capital stock would increase by 43.7% over the current system, output by 9.4%, and real wage

s by 11.5%. Economist John Golob estimates a consumption tax, like the FairTax, would bring long-term interest rates down by 25–35%. An analysis in 2008 by the Baker Institute For Public Policy indicated that the plan would generate significant overall macroeconomic improvement in both the short and long-term, but warned of transitional issues.

FairTax proponents argue that the proposal would provide tax burden visibility and reduce compliance and efficiency costs by 90%, returning a large share of money to the productive economy. The Beacon Hill Institute concluded that the FairTax would save $346.51 billion in administrative costs and would be a much more efficient taxation system. Bill Archer

, former head of the House Ways and Means Committee, asked Princeton University

Econometrics to survey 500 Europe

an and Asia

n companies regarding the effect on their business decisions if the United States enacted the FairTax. 400 of those companies stated they would build their next plant in the United States, and 100 companies said they would move their corporate headquarters to the United States. Supporters argue that the U.S. has the highest combined statutory corporate income tax rate among OECD countries along with being the only country with no border adjustment element in its tax system. Proponents state that because the FairTax eliminates corporate income taxes and is automatically border adjustable, the competitive tax advantage of foreign producers would be eliminated, immediately boosting U.S. competitiveness overseas and at home.

Opponents point to a study commissioned by the National Retail Federation

in 2000 that found a national sales tax bill filed by Billy Tauzin

, the Individual Tax Freedom Act , would bring a three-year decline in the economy, a four-year decline in employment and an eight-year decline in consumer spending. Wall Street Journal columnist James Taranto

states the FairTax is unsuited to take advantage of supply-side effects and would create a powerful disincentive to spend money. John Linder states an estimated $11 trillion is held in foreign accounts (largely for tax purposes), which he states would be repatriated back to U.S. banks if the FairTax were enacted, becoming available to U.S. capital market

s, bringing down interest rates, and otherwise promoting economic growth in the United States. Attorney Allen Buckley

states that a tremendous amount of wealth was already repatriated under law changes in 2004 and 2005. Buckley also argues that if the tax rate was significantly higher, the FairTax would discourage the consumption of new goods and hurt economic growth.

During the transition, many or most of the employees of the IRS (105,978 in 2005) would face loss of employment. The Beacon Hill Institute estimate is that the federal government would be able to cut $8 billion from the IRS budget of $11.01 billion (in 2007), reducing the size of federal tax administration by 73%. In addition, income tax preparers (many seasonal), tax lawyers, tax compliance staff in medium-to-large businesses, and software companies which sell tax preparation software could face significant drops, changes, or loss of employment. The bill would maintain the IRS for three years after implementation before completely decommissioning the agency, providing employees time to find other employment.

During the transition, many or most of the employees of the IRS (105,978 in 2005) would face loss of employment. The Beacon Hill Institute estimate is that the federal government would be able to cut $8 billion from the IRS budget of $11.01 billion (in 2007), reducing the size of federal tax administration by 73%. In addition, income tax preparers (many seasonal), tax lawyers, tax compliance staff in medium-to-large businesses, and software companies which sell tax preparation software could face significant drops, changes, or loss of employment. The bill would maintain the IRS for three years after implementation before completely decommissioning the agency, providing employees time to find other employment.

In the period before the FairTax is implemented, there could be a strong incentive for individuals to buy goods without the sales tax using credit. After the FairTax is in effect, the credit could be paid off using untaxed payroll. If credit incentives do not change, opponents of the FairTax worry it could exacerbate an existing consumer debt problem. Proponents of the FairTax state that this effect could also allow individuals to pay off their existing (pre-FairTax) debt more quickly, and studies suggest lower interest rates after FairTax passage.

Individuals under the current system who accumulated savings from ordinary income (by choosing not to spend their money when the income was earned) paid taxes on that income before it was placed in savings (such as a Roth IRA

or CD

). When individuals spend above the poverty level with money saved under the current system, that spending would be subject to the FairTax. People living through the transition may find both their earnings and their spending taxed. Critics have stated that the FairTax would result in unfair double taxation for savers and suggest it does not address the transition effect on some taxpayers who have accumulated significant savings from after-tax dollars, especially retirees who have finished their careers and switched to spending down their life savings. Supporters of the plan argue that the current system is no different, since compliance costs and "hidden taxes" embedded in the prices of goods and services cause savings to be "taxed" a second time already when spent. The rebates would supplement accrued savings, covering taxes up to the poverty level. The income taxes on capital gains, estates, social security and pension benefits would be eliminated under FairTax. In addition, the FairTax legislation adjusts Social Security

benefits for changes in the price level, so a percentage increase in prices would result in an equal percentage increase to Social Security income. Supporters suggest these changes would offset paying the FairTax under transition conditions.

The FairTax would be tax free on mortgage interest up to the federal borrowing rate

for like-term instruments as determined by the Treasury

, but since savings, education, and other investments would be tax free under the plan, the FairTax could decrease the incentive to spend more on homes. An analysis in 2008 by the Baker Institute For Public Policy concluded that the FairTax would have significant transitional issues for the housing

sector since the investment would no longer be tax-favored

. In a 2007 study, the Beacon Hill Institute concluded that total charitable giving would increase under the FairTax, although increases in giving would not be distributed proportionately amongst the various types of charitable organizations. The FairTax may also affect state and local government debt as the federal income tax system provides tax advantages to municipal bond

s. Proponents believe environmental benefits would result from the FairTax through environmental economics

and the re-use and re-sale of used goods. Former Senator Mike Gravel

states the significant reduction of paperwork for IRS compliance and tax forms

is estimated to save about 300,000 trees each year. Advocates argue the FairTax would provide an incentive for illegal immigrants to legalize

as they would otherwise not receive the rebate. Proponents also believe that the FairTax would have positive effects on civil liberties

that are sometimes charged against the income tax system, such as social inequality

, economic inequality

, financial privacy

, self-incrimination

, unreasonable search and seizure, burden of proof, and due process

.

If the FairTax bill were passed, permanent elimination of income taxation would not be guaranteed; the FairTax bill would repeal much of the existing tax code

, but the Sixteenth Amendment

would remain in place. Preventing new legislation from reintroducing income taxation would require a repeal of the Sixteenth Amendment to the United States Constitution

with a separate provision expressly prohibiting a federal income tax. This is referred to as an "aggressive repeal". Separate income taxes enforced by individual states would be unaffected by the federal repeal. Passing the FairTax would require only a simple majority in each house of the United States Congress along with the signature of the President, whereas enactment of a constitutional amendment

must be approved by two thirds of each house of the Congress, and three-quarters of the individual U.S. states. It is therefore possible that passage of the FairTax bill would simply add another taxation system. If a new income tax bill were passed after the FairTax passage, a hybrid system could develop; albeit, there is nothing preventing a bill for a hybrid system today. To address this issue and preclude that possibility, in the 111th Congress John Linder introduced a contingent sunset provision

in H.R. 25. It would require the repeal of the Sixteenth Amendment within 8 years after the implementation of the FairTax or, failing that, the FairTax would expire. Critics have also argued that a tax on state government consumption could be unconstitutional.

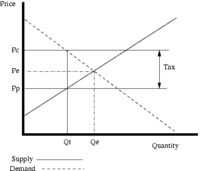

Since the FairTax would not tax used goods, the value would be determined by the supply and demand

in relation to new goods. The price differential/margins between used and new goods would stay consistent, as the cost and value of used goods are in direct relationship to the cost and value of the new goods. Because the U.S. tax system has a hidden effect on prices

, it is expected that moving to the FairTax would decrease production costs from the removal of business taxes and compliance costs, which is predicted to offset a portion of the FairTax effect on prices.

Based on a study conducted by Dale Jorgenson

Based on a study conducted by Dale Jorgenson

, proponents state that production cost of domestic goods and services could decrease by approximately 22% on average after embedded tax costs are removed, leaving the sale nearly the same after taxes. The study concludes that producer prices would drop between 15% and 26% (depending on the type of good/service). Jorgenson's research included all income and payroll taxes in the embedded tax estimation, which assumes employee take-home pay (net income

) remains unchanged from pre-FairTax levels. Price and wage changes after the FairTax would largely depend on the response of the Federal Reserve

monetary authorities. Non-accommodation of the money supply

would suggest retail prices and take home pay stay the same—embedded taxes are replaced by the FairTax. Full accommodation would suggest prices and incomes rise by the exclusive rate (i.e. 30%)—embedded taxes become windfall gain

s. Partial accommodation would suggest a varying degree in-between.

If businesses provided employees with gross pay

(including income tax withholding and the employee share of payroll taxes), Arduin, Laffer & Moore Econometrics

estimated production costs could decrease by a minimum of 11.55% (partial accommodation). This reduction would be from the removal of the remaining embedded costs, including corporate taxes, compliance costs, and the employer share of payroll taxes. This decrease would offset a portion of the FairTax amount reflected in retail prices, which proponents suggest as the most likely scenario. Bruce Bartlett states that it is unlikely that nominal wages would be reduced, which he believes would result in a recession, but that the Federal Reserve would likely increase the money supply to accommodate price increases. David Tuerck states "The monetary authorities would have to consider how the degree of accommodation, varying from none to full, would affect the overall economy and how it would affect the well-being of various groups such as retirees."

Social Security

benefits would be adjusted for any price changes due to FairTax implementation. The Beacon Hill Institute states that it would not matter, apart from transition issues, whether prices fall or rise—the relative tax burden and tax rate remains the same. Decreases in production cost would not fully apply to imported products; so according to proponents, it would provide tax advantages for domestic production and increase U.S. competitiveness in global trade (see Border adjustability). To ease the transition, U.S. retailers will receive a tax credit equal to the FairTax on their inventory to allow for quick cost reduction. Retailers would also receive an administrative fee equal to the greater of $200 or 0.25% of the remitted tax as compensation for compliance costs, which amounts to around $5 billion.

in the United States to be between one and three trillion dollars annually. By imposing a sales tax, supporters argue that black market activity would be taxed when proceeds from such activity are spent on legal consumption. For example, the sale of illegal narcotic

s would remain untaxed (instead of being guilty of income tax evasion, drug dealers would be guilty of failing to submit sales tax), but they would face taxation when they used drug proceeds to buy consumer goods such as food, clothing, and cars. By taxing this previously untaxed money, FairTax supporters argue that non-filers would be paying part of their share of what would otherwise be uncollected income and payroll taxes.

Other economists and analysts have argued that the underground economy would continue to bear the same tax burden as before. They state that replacing the current tax system with a consumption tax would not change the tax revenue generated from the underground economy—while illicit income is not taxed directly, spending of income from illicit activity results in business income and wages that are taxed.

Proponents state the FairTax would reduce the number of tax filers by about 86% (from 100 million to 14 million) and reduce the filing complexity to a simplified state sales tax form. The Economist reported on empirical research that supports the claim that simplified tax systems lead to greater compliance. The Government Accountability Office

Proponents state the FairTax would reduce the number of tax filers by about 86% (from 100 million to 14 million) and reduce the filing complexity to a simplified state sales tax form. The Economist reported on empirical research that supports the claim that simplified tax systems lead to greater compliance. The Government Accountability Office

(GAO), among others, have specifically identified the negative relationship between compliance costs and the number of focal points for collection. Under the FairTax, the federal government would be able to concentrate tax enforcement efforts on a single tax. Retailers would receive an administrative fee equal to the greater of $200 or 0.25% of the remitted tax as compensation for compliance costs. In addition, supporters state that the overwhelming majority of purchases occur in major retail outlets, which are very unlikely to evade the FairTax and risk losing their business licenses. Economic Census figures for 2002 show that 48.5% of merchandise sales are made by just 688 businesses ("Big-Box" retailers

). 85.7% of all retail sales are made by 92,334 businesses, which is 3.6% of American companies. In the service sector, approximately 80% of sales are made by 1.2% of U.S. businesses.

The FairTax is a national tax, but can be administered by the states rather than a federal agency, which may have a bearing on compliance as the states' own agencies could monitor and audit businesses within that state. The 0.25% retained by the states amounts to $5 billion the states would have available for enforcement and administration. For example, California

should receive over $500 million for enforcement and administration, which is more than the $327 million budget for the state's sales and excise taxes. Because the federal money paid to the states would be a percentage of the total revenue collected, John Linder claims the states would have an incentive to maximize collections. Proponents believe that states that choose to conform to the federal tax base would have advantages in enforcement, information sharing

, and clear interstate revenue allocation rules. A study by the Beacon Hill Institute

concluded that, on average, states could more than halve their sales tax rates and that state economies would benefit greatly from adopting a state-level FairTax.

FairTax opponents state that compliance decreases when taxes are not automatically withheld

from citizens, and that massive tax evasion

could result by collecting at just one point in the economic system. Compliance rates can also fall when taxed entities, rather than a third party, self-report their tax liability. For example, ordinary personal income taxes can be automatically withheld and are reported to the government by a third party. Taxes without withholding and with self-reporting, such as the FairTax, can see higher evasion rates. Economist Jane Gravelle of the Congressional Research Service

found studies showing that evasion rates of sales taxes are often above 10%, even when the sales tax rate is in the single digits. Tax publications by the Organisation for Economic Co-operation and Development

(OECD), IMF, and Brookings Institution

have suggested that the upper limit for a sales tax is about 10% before incentives for evasion become too great to control. According to the GAO, 80% of state tax officials opposed a national sales tax as an intrusion on their tax base. Opponents also raise concerns of legal tax avoidance

by spending and consuming outside of the U.S. (imported goods would be subject to collection by the U.S. Customs and Border Protection

).

Economists from the University of Tennessee

concluded that while there would be many desirable macroeconomic effects, adoption of a national retail sales tax would also have serious effects on state and local government finances. Economist Bruce Bartlett stated that if the states did not conform to the FairTax, they would have massive confusion and complication as to what is taxed by the state and what is taxed by the federal government. In addition, sales taxes have long exempted all but a few services because of the enormous difficulty in taxing intangibles—Bartlett suggests that the state may not have sufficient incentive to enforce the tax. University of Michigan

economist Joel Slemrod

argues that states would face significant issues in enforcing the tax. "Even at an average rate of around five percent, state sales taxes are difficult to administer." University of Virginia School of Law professor George Yin states that the FairTax could have evasion issues with export and import transactions. The President's Advisory Panel for Federal Tax Reform

reported that if the federal government were to cease taxing income, states might choose to shift their revenue-raising to income. Absent the Internal Revenue Service

, it would be more difficult for the states to maintain viable income tax systems.

. Under a retail sales tax system, the purchase of intermediate goods and services that are factors of production

are not taxed, since those goods would produce a final retail good that would be taxed. Individuals and businesses may be able to manipulate the tax system by claiming that purchases are for intermediate goods, when in fact they are final purchases that should be taxed. Proponents point out that a business is required to have a registered seller's certificate on file, and must keep complete records of all transactions for six years. Businesses must also record all taxable goods bought for seven years. They are required to report these sales every month (see Personal vs. business purchases). The government could also stipulate that all retail sellers provide buyers with a written receipt, regardless of transaction type (cash, credit, etc.), which would create a paper trail for evasion with risk of having the buyer turn them in (the FairTax authorizes a reward for reporting tax cheats).

While many economists and tax experts support a consumption tax, problems could arise with using a retail sales tax rather than a value added tax

(VAT). A VAT imposes a tax at every intermediate step of production, so the goods reach the final consumer with much of the tax already in the price. The retail seller has little incentive to conceal retail sales, since he has already paid much of the good's tax. Retailers are unlikely to subsidize the consumer's tax evasion by concealing sales. In contrast, a retailer has paid no tax on goods under a sales tax system. This provides an incentive for retailers to conceal sales and engage in "tax arbitrage

" by sharing some of the illicit tax savings with the final consumer. Laurence Kotlikoff

has stated that the government could compel firms to report, via 1099-type forms, their sales to other firms, which would provide the same records that arise under a VAT. In the United States, a general sales tax is imposed in 45 states plus the District of Columbia (accounting for over 97% of both population and economic output), which proponents argue provides a large infrastructure for taxing sales that many countries do not have.

, the business would have to produce invoices for the "business purchases" that they did not pay sales tax on, and would have to be able to show that they were genuine business expenses. Advocates state the significant 86% reduction in collection points would greatly increase the likelihood of business audits, making tax evasion

behavior much more risky. Additionally, the FairTax legislation has several fines and penalties

for non-compliance, and authorizes a mechanism for reporting tax cheats to obtain a reward. To prevent businesses from purchasing everything for their employees, in a family business for example, goods and services bought by the business for the employees that are not strictly for business use would be taxable. Health insurance or medical expenses would be an example where the business would have to pay the FairTax on these purchases. Taxable property and services purchased by a qualified non-profit or religious organization "for business purposes" would not be taxable.

The creation of the FairTax began with a group of businessmen from Houston, Texas, who initially financed what has become the political advocacy group Americans For Fair Taxation

The creation of the FairTax began with a group of businessmen from Houston, Texas, who initially financed what has become the political advocacy group Americans For Fair Taxation

(AFFT), which has grown into a large tax reform movement. This organization, founded in 1994, claims to have spent over $20 million in research, marketing, lobbying, and organizing efforts over a ten year period and is seeking to raise over $100 million more to promote the plan. AFFT includes a staff in Houston and a large group of volunteers who are working to get the FairTax enacted. Bruce Bartlett

has charged that the FairTax was devised by the Church of Scientology

in the early 1990s. Representative John Linder told the Atlanta Journal-Constitution that Bartlett confused the FairTax movement with the Scientology-affiliated Citizens for an Alternative Tax System

, which also seeks to abolish the federal income tax and replace it with a national retail sales tax. Leo Linbeck, AFFT Chairman and CEO, stated "As a founder of Americans For Fair Taxation, I can state categorically, however, that Scientology played no role in the founding, research or crafting of the legislation giving expression to the FairTax."

Much support has been achieved by talk radio personality Neal Boortz

. Boortz's book (co-authored by Georgia Congressman John Linder

) entitled The FairTax Book

, explains the proposal and spent time atop the New York Times Best Seller list

. Boortz stated that he donates his share of the proceeds to charity to promote the book. In addition, Boortz and Linder have organized several FairTax rallies to publicize support for the plan. Other media personalities have also assisted in growing grassroots support including former radio and TV talk show host Larry Elder

, radio host and candidate for the 2012 GOP Presidential Nomination Herman Cain

, Fox News and radio host Sean Hannity

, and ABC News co-anchor John Stossel

. The FairTax received additional visibility as one of the issues in the 2008 presidential election

. At a debate on June 30, 2007, several Republican candidates were asked about their position on the FairTax and many responded that they would sign the bill into law if elected. The most vocal promoters of the FairTax during the 2008 primary elections were Republican candidate Mike Huckabee

and Democratic candidate Mike Gravel

. Since 2008, the tax has been popular at Tea Party protests. The Internet, blogosphere

, and electronic mailing lists have contributed to promoting, organizing, and gaining support for the FairTax. In the 2012 Republican presidential primary, former Governor of New Mexico and businessman Gary Johnson

has been actively campaigning for the FairTax.. Former CEO of Godfather's Pizza

Herman Cain

has been promoting the FairTax as a final step in a multiple-phase tax reform.

Tax reform

Tax reform is the process of changing the way taxes are collected or managed by the government.Tax reformers have different goals. Some seek to reduce the level of taxation of all people by the government. Some seek to make the tax system more progressive or less progressive. Some seek to simplify...

proposal for the federal government of the United States

Federal government of the United States

The federal government of the United States is the national government of the constitutional republic of fifty states that is the United States of America. The federal government comprises three distinct branches of government: a legislative, an executive and a judiciary. These branches and...

that would replace all federal taxes

Income tax in the United States

In the United States, a tax is imposed on income by the Federal, most states, and many local governments. The income tax is determined by applying a tax rate, which may increase as income increases, to taxable income as defined. Individuals and corporations are directly taxable, and estates and...

on personal and corporate income with a single broad national consumption tax

Consumption tax

A consumption tax is a tax on spending on goods and services. The tax base of such a tax is the money spent on consumption. Consumption taxes are usually indirect, such as a sales tax or a value added tax...

on retail sales. The Fair Tax Act (/) would apply a tax once at the point of purchase on all new goods and services for personal consumption. The proposal also calls for a monthly payment to all family

Family

In human context, a family is a group of people affiliated by consanguinity, affinity, or co-residence. In most societies it is the principal institution for the socialization of children...

household

Household

The household is "the basic residential unit in which economic production, consumption, inheritance, child rearing, and shelter are organized and carried out"; [the household] "may or may not be synonymous with family"....

s of lawful U.S. residents as an advance rebate, or "prebate", of tax on purchases up to the poverty level. First introduced into the United States Congress

United States Congress

The United States Congress is the bicameral legislature of the federal government of the United States, consisting of the Senate and the House of Representatives. The Congress meets in the United States Capitol in Washington, D.C....

in 1999, a number of congressional committees have heard testimony on the bill

Bill (proposed law)

A bill is a proposed law under consideration by a legislature. A bill does not become law until it is passed by the legislature and, in most cases, approved by the executive. Once a bill has been enacted into law, it is called an act or a statute....

; however, it has not moved from committee and has yet to have any effect on the tax system. In recent years, a tax reform movement has formed behind the FairTax proposal. Increased support was created after talk radio

Talk radio

Talk radio is a radio format containing discussion about topical issues. Most shows are regularly hosted by a single individual, and often feature interviews with a number of different guests. Talk radio typically includes an element of listener participation, usually by broadcasting live...

personality Neal Boortz

Neal Boortz

Neal A. Boortz, Jr. is an American Libertarian radio host, author, and political commentator. His nationally syndicated talk show, The Neal Boortz Show, airs throughout the United States on Dial Global . It is ranked seventh in overall listeners, with 4.25+ million per week...

and Georgia

Georgia (U.S. state)

Georgia is a state located in the southeastern United States. It was established in 1732, the last of the original Thirteen Colonies. The state is named after King George II of Great Britain. Georgia was the fourth state to ratify the United States Constitution, on January 2, 1788...

Congressman John Linder

John Linder

John Elmer Linder is the former U.S. Representative for , serving from 1993 until 2011. He is a member of the Republican Party.Linder announced that he would retire from Congress at the end of the 111th Congress....

published The FairTax Book

The FairTax Book

The FairTax Book is a non-fiction book by libertarian radio talk show host Neal Boortz and Congressman John Linder, published on August 2, 2005, as a tool to increase public support and understanding for the FairTax plan...

in 2005 and additional visibility was gained in the 2008 presidential campaign

United States presidential election, 2008

The United States presidential election of 2008 was the 56th quadrennial presidential election. It was held on November 4, 2008. Democrat Barack Obama, then the junior United States Senator from Illinois, defeated Republican John McCain, the senior U.S. Senator from Arizona. Obama received 365...

.

The sales tax rate, as defined in the legislation for the first year, is 23% of the total payment including the tax ($23 of every $100 spent in total—calculated similar to income taxes). This would be equivalent to a 30% traditional U.S. sales tax

Sales taxes in the United States

There is no federal sales or use tax in the United States. 45 states and the District of Columbia impose sales and use taxes on the retail sale, lease and rental of many goods, as well as some services. Many cities, counties, transit authorities and special purpose districts impose additional local...

($23 on top of every $77 spent—$100 total). The rate would then be automatically adjusted annually based on federal receipts in the previous fiscal year. With the rebate taken into consideration, the FairTax would be progressive

Progressive tax

A progressive tax is a tax by which the tax rate increases as the taxable base amount increases. "Progressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from low to high, where the average tax rate is less than the marginal tax rate...

on consumption

Consumption (economics)

Consumption is a common concept in economics, and gives rise to derived concepts such as consumer debt. Generally, consumption is defined in part by comparison to production. But the precise definition can vary because different schools of economists define production quite differently...

, but would also be regressive

Regressive tax

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from high to low, where the average tax rate exceeds the...

on income

Income

Income is the consumption and savings opportunity gained by an entity within a specified time frame, which is generally expressed in monetary terms. However, for households and individuals, "income is the sum of all the wages, salaries, profits, interests payments, rents and other forms of earnings...

at higher income levels (as consumption falls as a percentage of income). Opponents argue this would accordingly decrease the tax burden

Tax incidence

In economics, tax incidence is the analysis of the effect of a particular tax on the distribution of economic welfare. Tax incidence is said to "fall" upon the group that, at the end of the day, bears the burden of the tax...

on high income earners

American upper class

See: millionaire for more details-Millionaires:See also: MillionairesHouseholds with net worths of $1 million or more may be identified as members of the upper-most socio-economic demographic, depending on the class model used...

and increase it on the middle class

American middle class

The American middle class is a social class in the United States. While the concept is typically ambiguous in popular opinion and common language use, contemporary social scientists have put forward several, more or less congruent, theories on the American middle class...

. Supporters contend that the plan would decrease tax burdens by broadening the tax base, effectively taxing wealth

Wealth

Wealth is the abundance of valuable resources or material possessions. The word wealth is derived from the old English wela, which is from an Indo-European word stem...

, and increasing purchasing power

Purchasing power

Purchasing power is the number of goods/services that can be purchased with a unit of currency. For example, if you had taken one dollar to a store in the 1950s, you would have been able to buy a greater number of items than you would today, indicating that you would have had a greater purchasing...

.

The plan's supporters believe that a consumption tax would have a positive effect on savings

Saving (money)

Saving is income not spent, or deferred consumption. Methods of saving include putting money aside in a bank or pension plan. Saving also includes reducing expenditures, such as recurring costs...

and investment

Investment

Investment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

, that it would ease tax compliance

Compliance cost

A compliance cost is expenditure of time or money in conforming with government requirements such as legislation or regulation. For example, people or organizations registered for value added tax have the extra burden of having to keep detailed records of all input tax and output tax to facilitate...

, and that the tax would result in increased economic growth

Economic growth

In economics, economic growth is defined as the increasing capacity of the economy to satisfy the wants of goods and services of the members of society. Economic growth is enabled by increases in productivity, which lowers the inputs for a given amount of output. Lowered costs increase demand...

, incentives for international business

International Business

International business is a term used to collectively describe all commercial transactions that take place between two or more regions, countries and nations beyond their political boundary...

to locate in the U.S., and increased U.S. competitiveness in international trade

International trade

International trade is the exchange of capital, goods, and services across international borders or territories. In most countries, such trade represents a significant share of gross domestic product...

. Opponents contend that a consumption tax of this size would be extremely difficult to collect, and would lead to pervasive tax evasion

Tax evasion

Tax evasion is the general term for efforts by individuals, corporations, trusts and other entities to evade taxes by illegal means. Tax evasion usually entails taxpayers deliberately misrepresenting or concealing the true state of their affairs to the tax authorities to reduce their tax liability,...

. They also argue that the proposed sales tax rate would raise less revenue than the current tax system, leading to an increased budget deficit. The plan is expected to increase cost transparency for funding the federal government, and supporters believe it would have positive effects on civil liberties

Civil liberties of the United States

Civil liberties of the United States are certain inalienable rights retained by citizens of the United States under the Constitution of the United States, as interpreted and clarified by the Supreme Court of the United States and lower federal courts...

, the environment

Natural environment

The natural environment encompasses all living and non-living things occurring naturally on Earth or some region thereof. It is an environment that encompasses the interaction of all living species....

, and advantages with taxing illegal activity

Crime

Crime is the breach of rules or laws for which some governing authority can ultimately prescribe a conviction...

and illegal immigrants

Illegal immigration to the United States

An illegal immigrant in the United States is an alien who has entered the United States without government permission or stayed beyond the termination date of a visa....

. There are concerns regarding the proposed repeal of the Sixteenth Amendment

Sixteenth Amendment to the United States Constitution

The Sixteenth Amendment to the United States Constitution allows the Congress to levy an income tax without apportioning it among the states or basing it on Census results...

, removal of tax deduction

Tax deduction

Income tax systems generally allow a tax deduction, i.e., a reduction of the income subject to tax, for various items, especially expenses incurred to produce income. Often these deductions are subject to limitations or conditions...

incentives, transition effects on after-tax savings, incentives on credit use, and the loss of tax advantages to state and local bonds.

Legislative overview and history

Federal government of the United States

The federal government of the United States is the national government of the constitutional republic of fifty states that is the United States of America. The federal government comprises three distinct branches of government: a legislative, an executive and a judiciary. These branches and...

income taxes

Income tax in the United States

In the United States, a tax is imposed on income by the Federal, most states, and many local governments. The income tax is determined by applying a tax rate, which may increase as income increases, to taxable income as defined. Individuals and corporations are directly taxable, and estates and...

(including the alternative minimum tax

Alternative Minimum Tax

The Alternative Minimum Tax is an income tax imposed by the United States federal government on individuals, corporations, estates, and trusts. AMT is imposed at a nearly flat rate on an adjusted amount of taxable income above a certain threshold . This exemption is substantially higher than the...

, corporate income taxes

Corporate tax in the United States

Corporate tax is imposed in the United States at the Federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Federal tax rates on corporate taxable income vary from 15% to 35%. State and local taxes and rules vary by jurisdiction, though many...

, and capital gains taxes

Capital gains tax in the United States

In the United States, individuals and corporations pay income tax on the net total of all their capital gains just as they do on other sorts of income. Capital gains are generally taxed at a preferential rate in comparison to ordinary income...

), payroll taxes (including Social Security and Medicare taxes

Federal Insurance Contributions Act tax

Federal Insurance Contributions Act tax is a United States payroll tax imposed by the federal government on both employees and employers to fund Social Security and Medicare —federal programs that provide benefits for retirees, the disabled, and children of deceased workers...

), gift tax

Gift tax

A gift tax is a tax imposed on the gratuitous transfer of ownership of property. The United States Internal Revenue Service says a gift is "Any transfer to an individual, either directly or indirectly, where full consideration is not received in return."When a taxable gift in the form of cash,...

es, and estate taxes

Estate tax in the United States

The estate tax in the United States is a tax imposed on the transfer of the "taxable estate" of a deceased person, whether such property is transferred via a will, according to the state laws of intestacy or otherwise made as an incident of the death of the owner, such as a transfer of property...

with a national retail sales tax

Sales tax

A sales tax is a tax, usually paid by the consumer at the point of purchase, itemized separately from the base price, for certain goods and services. The tax amount is usually calculated by applying a percentage rate to the taxable price of a sale....

. The legislation would remove the Internal Revenue Service

Internal Revenue Service

The Internal Revenue Service is the revenue service of the United States federal government. The agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue...

(after three years), and establish an Excise Tax Bureau and a Sales Tax Bureau in the Department of the Treasury

United States Department of the Treasury

The Department of the Treasury is an executive department and the treasury of the United States federal government. It was established by an Act of Congress in 1789 to manage government revenue...

. The states

U.S. state

A U.S. state is any one of the 50 federated states of the United States of America that share sovereignty with the federal government. Because of this shared sovereignty, an American is a citizen both of the federal entity and of his or her state of domicile. Four states use the official title of...

are granted the primary authority for the collection of sales tax revenues and the remittance of such revenues to the Treasury. The plan was created by Americans For Fair Taxation

Americans For Fair Taxation

Americans For Fair Taxation , also known as FairTax.org, states it is the United States' largest, single-issue grassroots organization and taxpayers union dedicated to fundamental tax code replacement...

, an advocacy group

Advocacy group

Advocacy groups use various forms of advocacy to influence public opinion and/or policy; they have played and continue to play an important part in the development of political and social systems...

formed to change the tax system. The group states that, together with economists, it developed the plan and the name "Fair Tax", based on interviews, polls, and focus groups of the general public. Since the term "fair" is subjective, the name of the plan has been criticized as deceptive marketing by some, while being touted as true to its name by others. The FairTax legislation has been introduced in the House by Georgia Republicans

Republican Party (United States)

The Republican Party is one of the two major contemporary political parties in the United States, along with the Democratic Party. Founded by anti-slavery expansion activists in 1854, it is often called the GOP . The party's platform generally reflects American conservatism in the U.S...

John Linder

John Linder

John Elmer Linder is the former U.S. Representative for , serving from 1993 until 2011. He is a member of the Republican Party.Linder announced that he would retire from Congress at the end of the 111th Congress....

(1999–2010) and Rob Woodall

Rob Woodall

William Robert Woodall III is the U.S. Representative for . He is a member of the Republican Party. Prior to being elected to congress, he was the Chief of Staff to U.S. Congressman John Linder . He worked for Linder from 1994 to 2010.-Early life, education, and career:Woodall was born in Athens, GA...

(2011), while being introduced in the Senate by Georgia Republican Saxby Chambliss

Saxby Chambliss

Clarence Saxby Chambliss, Jr. is the senior United States Senator from Georgia. A member of the Republican Party, he previously served as a U.S. Representative ....

.

Linder first introduced the Fair Tax Act on July 14, 1999 to the 106th United States Congress

106th United States Congress

The One Hundred Sixth United States Congress was a meeting of the legislative branch of the United States federal government, composed of the United States Senate and the United States House of Representatives. It met in Washington, DC from January 3, 1999 to January 3, 2001, during the last two...

and has reintroduced a substantially similar bill in each subsequent session of Congress. The bill attracted a total of 56 House and Senate cosponsors in the 108th Congress (/), 61 in the 109th Congress (/), 76 in the 110th Congress (/), 69 in the 111th United States Congress

111th United States Congress

The One Hundred Eleventh United States Congress was the meeting of the legislative branch of the United States federal government from January 3, 2009 until January 3, 2011. It began during the last two weeks of the George W. Bush administration, with the remainder spanning the first two years of...

(/), and 74 in the 112th United States Congress

112th United States Congress

The One Hundred Twelfth United States Congress is the current meeting of the legislative branch of the United States federal government, composed of the United States Senate and the United States House of Representatives. It convened in Washington, D.C. on January 3, 2011, and will end on January...

/). Former Speaker of the House Dennis Hastert

Dennis Hastert

John Dennis "Denny" Hastert was the 59th Speaker of the House serving from 1999 to 2007. He represented as a Republican for twenty years, 1987 to 2007.He is the longest-serving Republican Speaker in history...

(Republican) has cosponsored the bill but it has not received support from the Democratic leadership, which still controls the Senate. Democratic Representative Collin Peterson

Collin Peterson

Collin Clark Peterson , is the U.S. Representative for , serving since 1991, and the ranking member of the House Agriculture Committee. He is a member of the Democratic-Farmer-Labor Party and is the dean of the Minnesota congressional delegation.The district, Minnesota's largest and most rural...

of Minnesota

Minnesota

Minnesota is a U.S. state located in the Midwestern United States. The twelfth largest state of the U.S., it is the twenty-first most populous, with 5.3 million residents. Minnesota was carved out of the eastern half of the Minnesota Territory and admitted to the Union as the thirty-second state...

and Democratic Senator Zell Miller

Zell Miller

Zell Bryan Miller is an American politician from the US state of Georgia. A Democrat, Miller served as Lieutenant Governor from 1975 to 1991, 79th Governor of Georgia from 1991 to 1999, and as United States Senator from 2000 to 2005....

of Georgia cosponsored and introduced the bill in the 108th Congress, but Peterson is no longer cosponsoring the bill and Miller has left the Senate. In the 109th–111th Congress, Representative Dan Boren

Dan Boren

Daniel David "Dan" Boren is the U.S. Representative for , serving since 2005. The district includes most of the eastern part of the state outside of Tulsa...

has been the only Democrat to cosponsor the bill. A number of congressional committees have heard testimony on the FairTax, but it has not moved from committee since its introduction in 1999. The legislation was also discussed with President George W. Bush

George W. Bush

George Walker Bush is an American politician who served as the 43rd President of the United States, from 2001 to 2009. Before that, he was the 46th Governor of Texas, having served from 1995 to 2000....

and his Secretary of the Treasury

United States Secretary of the Treasury

The Secretary of the Treasury of the United States is the head of the United States Department of the Treasury, which is concerned with financial and monetary matters, and, until 2003, also with some issues of national security and defense. This position in the Federal Government of the United...

Henry M. Paulson.

To become law, the bill will need to be included in a final version of tax legislation from the U.S. House Committee on Ways and Means, pass both the House and the Senate, and finally be signed by the President

President of the United States

The President of the United States of America is the head of state and head of government of the United States. The president leads the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces....

. In 2005, President Bush established an advisory panel on tax reform

President's Advisory Panel for Federal Tax Reform

On January 7, 2005, President George W. Bush announced the establishment of the President's Advisory Panel for Tax Reform, a bipartisan panel to advise on options to reform the United States income tax code to make it simpler, fairer, and more pro-growth to benefit all Americans.On November 1,...

that examined several national sales tax variants including aspects of the FairTax and noted several concerns. These included uncertainties as to the revenue that would be generated, and difficulties of enforcement and administration, which made this type of tax undesirable to recommend in their final report. The panel did not examine the Fairtax as proposed in the legislation. The FairTax received visibility in the 2008 presidential election

United States presidential election, 2008

The United States presidential election of 2008 was the 56th quadrennial presidential election. It was held on November 4, 2008. Democrat Barack Obama, then the junior United States Senator from Illinois, defeated Republican John McCain, the senior U.S. Senator from Arizona. Obama received 365...

on the issue of taxes and the IRS, with several candidates supporting the bill. A poll in 2009 by Rasmussen Reports

Rasmussen Reports

Rasmussen Reports is an American media company that publishes and distributes information based on public opinion polling. Founded by pollster Scott Rasmussen in 2003, the company updates daily indexes including the President's job approval rating, and provides public opinion data, analysis, and...

found that 43% of Americans would support a national sales tax replacement, with 38% opposed to the idea; the sales tax was viewed as fairer by 52% of Republicans, 44% of Democrats, and 49% of unaffiliateds. President

President of the United States

The President of the United States of America is the head of state and head of government of the United States. The president leads the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces....

Barack Obama

Barack Obama

Barack Hussein Obama II is the 44th and current President of the United States. He is the first African American to hold the office. Obama previously served as a United States Senator from Illinois, from January 2005 until he resigned following his victory in the 2008 presidential election.Born in...

does not support the bill, arguing for more progressive changes to the income and payroll tax systems.

Tax rate

The sales tax rate, as defined in the legislation for the first year, is 23% of the total payment including the tax ($23 of every $100 spent in total—calculated similar to income taxes). This would be equivalent to a 30% traditional U.S. sales tax ($23 on top of every $77 spent—$100 total, or $30 on top of every $100 spent—$130 total). After the first year of implementation, this rate is automatically adjusted annually using a predefined formula reflecting actual federal receipts in the previous fiscal year.The effective tax rate for any household would be variable due to the fixed monthly tax prebates that are used to "untax" purchases up to the poverty level. The tax would be levied on all U.S. retail sales for personal consumption on new goods and services. Critics argue that the sales tax rate defined in the legislation would not be revenue neutral (that is, it would collect less for the government than the current tax system), and thus would increase the budget deficit, unless government spending were equally reduced.

Sales tax rate

During the first year of implementation, the FairTax legislation would apply a 23% federal retailRetailing

Retail consists of the sale of physical goods or merchandise from a fixed location, such as a department store, boutique or kiosk, or by mail, in small or individual lots for direct consumption by the purchaser. Retailing may include subordinated services, such as delivery. Purchasers may be...

sales tax on the total transaction value of a purchase; in other words, consumers pay to the government 23 cents of every dollar spent in total (sometimes called tax-inclusive). The equivalent assessed tax rate is 30% if the FairTax is applied to the pre-tax price of a good like traditional U.S. state sales taxes

Sales taxes in the United States

There is no federal sales or use tax in the United States. 45 states and the District of Columbia impose sales and use taxes on the retail sale, lease and rental of many goods, as well as some services. Many cities, counties, transit authorities and special purpose districts impose additional local...

(sometimes called tax-exclusive). After the first year of implementation, this tax rate would be automatically adjusted annually using a formula specified in the legislation that reflects actual federal receipts in the previous fiscal year.

The tax would be levied once at the final retail sale for personal consumption on new goods and services. A good would be considered "used" and not taxable if a consumer already owns it before the FairTax takes effect or if the FairTax has been paid previously on the good, which may be different than the item being sold previously. Export

Export

The term export is derived from the conceptual meaning as to ship the goods and services out of the port of a country. The seller of such goods and services is referred to as an "exporter" who is based in the country of export whereas the overseas based buyer is referred to as an "importer"...

s and intermediate business transactions

Business-to-business

Business-to-business describes commerce transactions between businesses, such as between a manufacturer and a wholesaler, or between a wholesaler and a retailer...

would not be taxed, nor would savings, investments, or education tuition

Tuition