Money supply

Encyclopedia

In economics

, the money supply or money stock, is the total amount of money

available in an economy

at a specific time. There are several ways to define "money," but standard measures usually include currency

in circulation and demand deposits (depositors' easily accessed assets on the books of financial institutions).

Money supply data are recorded and published, usually by the government or the central bank of the country. Public and private sector analysts have long monitored changes in money supply because of its possible effects on the price level

, inflation

and the business cycle

.

That relation between money and prices is historically associated with the quantity theory of money

. There is strong empirical

evidence of a direct relation between long-term price inflation

and money-supply growth, at least for rapid increases in the amount of money in the economy. That is, a country such as Zimbabwe

which saw rapid increases in its money supply also saw rapid increases in prices (hyperinflation

). This is one reason for the reliance on monetary policy

as a means of controlling inflation.

This causal chain is contentious, however: some heterodox economists

argue that the money supply is endogenous (determined by the workings of the economy, not by the central bank) and that the sources of inflation must be found in the distributional structure of the economy.

In addition those economists seeing the central bank

's control over the money supply as feeble, they also say that there are two weak links between the growth of the money supply and the inflation rate: first, an increase in the money supply, unless trapped in the financial system as excess reserves, can cause a sustained increase in real production instead of inflation in the aftermath of a recession, when many resources are underutilized. Second, if the velocity of money

, i.e., the ratio between nominal GDP and money supply, changes, an increase in the money supply could have either no effect, an exaggerated effect, or an unpredictable effect on the growth of nominal GDP.

is used as a medium of exchange

, in final settlement of a debt

, and as a ready store of value

. Its different functions are associated with different empirical

measures of the money supply. There is no single "correct" measure of the money supply: instead, there are several measures, classified along a spectrum or continuum between narrow and broad monetary aggregates. Narrow measures include only the most liquid assets, the ones most easily used to spend (currency, checkable deposits). Broader measures add less liquid types of assets (certificates of deposit, etc.)

This continuum corresponds to the way that different types of money are more or less controlled by monetary policy. Narrow measures include those more directly affected and controlled by monetary policy, whereas broader measures

are less closely related to monetary-policy actions. It is a matter of perennial debate as to whether narrower or broader versions of the money supply have a more predictable link to nominal GDP.

The different types of money are typically classified as "M"s. The "M"s usually range from M0 (narrowest) to M3 (broadest) but which "M"s are actually used depends on the country's central bank. The typical layout for each of the "M"s is as follows:

The ratio of a pair of these measures, most often M2/M0, is called an (actual, empirical) money multiplier

.

. Whenever a bank gives out a loan in a fractional-reserve banking system, a new sum of money is created. This new type of money is what makes up the non-M0 components in the M1-M3 statistics. In short, there are two types of money in a fractional-reserve banking system:

In the money supply statistics, central bank money is MB while the commercial bank money is divided up into the M1-M3 components. Generally, the types of commercial bank money that tend to be valued at lower amounts are classified in the narrow category of M1 while the types of commercial bank money that tend to exist in larger amounts are categorized in M2 and M3, with M3 having the largest.

In the US, reserves consist of money in Federal Reserve accounts and US currency held by banks (also known as "vault cash"). Currency and money in Fed accounts are interchangeable (both are obligations of the Fed.) Reserves may come from any source, including the federal funds market

, deposits by the public, and borrowing from the Fed itself.

A reserve requirement is a ratio a bank must maintain between deposits and reserves. Reserve requirements do not apply to the amount of money a bank may lend out. The ratio that applies to bank lending is its capital requirement

.

M0

M1

M2

Foreign Exchange

When the Federal Reserve announced in 2005 that they would cease publishing M3 statistics in March 2006, they explained that M3 did not convey any additional information about economic activity compared to M2, and thus, "has not played a role in the monetary policy process for many years." Therefore, the costs to collect M3 data outweighed the benefits the data provided. Some politicians have spoken out against the Federal Reserve's decision to cease publishing M3 statistics and have urged the U.S. Congress to take steps requiring the Federal Reserve to do so. Libertarian congressman Ron Paul

(R-TX) claimed that "M3 is the best description of how quickly the Fed is creating new money and credit. Common sense tells us that a government central bank creating new money out of thin air depreciates the value of each dollar in circulation." Some of the data used to calculate M3 are still collected and published on a regular basis. Current alternate sources of M3 data are available from the private sector.

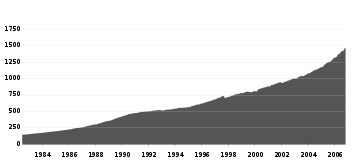

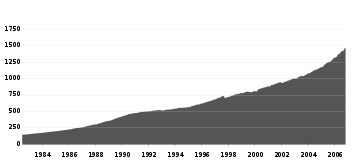

As of November 17, 2011 the Federal Reserve reported that the U.S. dollar monetary base

is $2,150,000,000,000. This is an increase of 28% in 2 years. The monetary base is only one component of money supply, however. M2, the broadest measure of money supply, has increased from approximately $8.48 trillion to $9.61 trillion from November 2009 to October 2011, the latest month-data available. This is a 2-year increase in U.S. M2 of approximately 12.9%.

There are just two official UK measures. M0 is referred to as the "wide monetary base

There are just two official UK measures. M0 is referred to as the "wide monetary base

" or "narrow money" and M4 is referred to as "broad money

" or simply "the money supply".

There are several different definitions of money supply to reflect the differing stores of money. Due to the nature of bank deposits, especially time-restricted savings account deposits, the M4 represents the most illiquid measure of money. M0, by contrast, is the most liquid measure of the money supply.

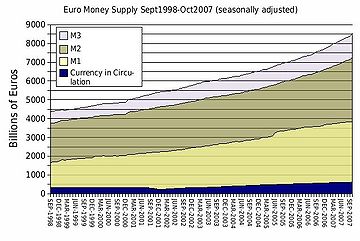

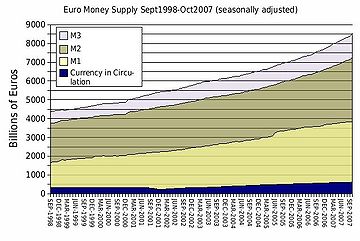

The European Central Bank

The European Central Bank

's definition of euro area monetary aggregates:

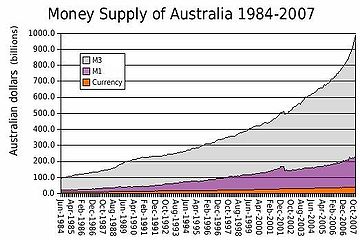

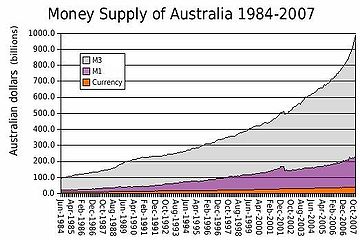

The Reserve Bank of Australia

The Reserve Bank of Australia

defines the monetary aggregates as:

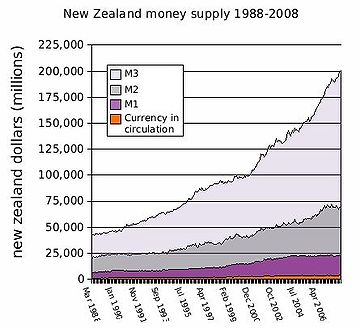

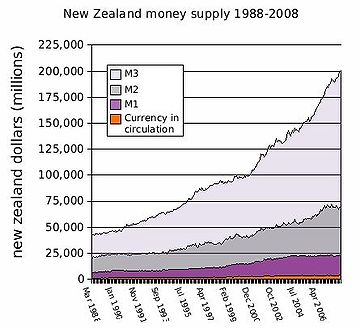

The Reserve Bank of New Zealand

The Reserve Bank of New Zealand

defines the monetary aggregates as:

The Reserve Bank of India

The Reserve Bank of India

defines the monetary aggregates as:

The Bank of Japan

The Bank of Japan

defines the monetary aggregates as:

by the equation of exchange

in an equation proposed by Irving Fisher in 1911

In mathematical terms, this equation is really an identity

which is true by definition rather than describing economic behavior. That is, each term is defined by the values of the other three. Unlike the other terms, the velocity of money has no independent measure and can only be estimated by dividing PQ by M. Adherents of the quantity theory of money assume that the velocity of money is stable and predictable, being determined mostly by financial institutions. If that assumption is valid, then changes in M can be used to predict changes in PQ. If not, then the equation of exchange is useless to macroeconomics.

Most macroeconomists replace the equation of exchange with equations for the demand for money which describe more regular and predictable economic behavior. However, predictability (or the lack thereof) of the velocity of money is equivalent to predictability (or the lack thereof) of the demand for money (since in equilibrium real money demand is simply Q/V). Either way, this unpredictability made policy-makers at the Federal Reserve rely less on the money supply in steering the U.S.economy. Instead, the policy focus has shifted to interest rates such as the fed funds rate.

In practice, macroeconomists almost always use real GDP to measure Q, omitting the role of all transactions except for those involving newly produced goods and services (i.e., consumption goods, investment goods, government-purchased goods, and exports). That is, the only assets counted as part of Q are newly produced investment goods. But the original quantity theory of money did not follow this practice: PQ was the monetary value of all new transactions, whether of real goods and services or of paper assets.

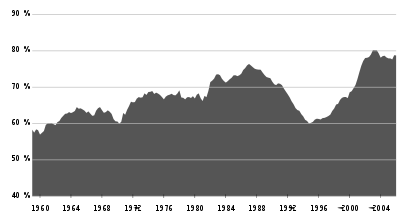

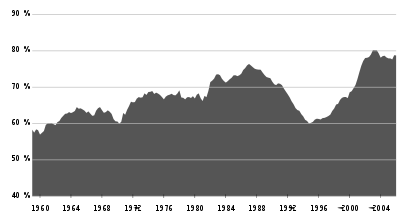

The monetary value of assets, goods, and service sold during the year could be grossly estimated using nominal GDP back in the 1960s. This is not the case anymore because of the dramatic rise of the number of financial transactions relative to that of real transactions up until 2008. That is, the total value of transactions (including purchases of paper assets) rose relative to nominal GDP (which excludes those purchases).

The monetary value of assets, goods, and service sold during the year could be grossly estimated using nominal GDP back in the 1960s. This is not the case anymore because of the dramatic rise of the number of financial transactions relative to that of real transactions up until 2008. That is, the total value of transactions (including purchases of paper assets) rose relative to nominal GDP (which excludes those purchases).

Ignoring the effects of monetary growth on real purchases and velocity, this suggests that the growth of the money supply may cause different kinds of inflation at different times. For example, rises in the U.S. money supplies between the 1970s and the present encouraged first a rise in the inflation rate for newly produced goods and services ("inflation

" as usually defined) in the seventies and then asset-price inflation in later decades: it may have encouraged a stock market boom in the '80s and '90s and then, after 2001, a rise in home prices, i.e., the famous housing bubble. This story, of course, assumes that the amounts of money were the causes of these different types of inflation rather than being endogenous results of the economy's dynamics.

When home prices went down, the Federal Reserve kept its loose monetary policy and lowered interest rates; the attempt to slow price declines in one asset class, e.g. real estate, may well have caused prices in other asset classes to rise, e.g. commodities.

That equation rearranged gives the "basic inflation identity":

Inflation (%ΔP) is equal to the rate of money growth (%ΔM), plus the change in velocity (%ΔV), minus the rate of output growth (%ΔQ). As before, this equation is only useful if %ΔV follows regular behavior. It also loses usefulness if the central bank lacks control over %ΔM.

is "easing", it triggers an increase in money supply by purchasing government securities

on the open market thus increasing available funds for private banks to loan through fractional-reserve banking

(the issue of new money through loans) and thus the amount of bank reserves and the monetary base rise. By purchasing government bonds (especially Treasury Bills), this bids up their prices, so that interest rates fall at the same time that the monetary base increases.

With "easy money," the central bank creates new bank reserves

(in the US known as "federal funds

"), which allow the banks lend more. These loans get spent, and the proceeds get deposited at other banks. Whatever is not required to be held as reserves is then lent out again, and through the "multiplying" effect of the fractional-reserve system, loans and bank deposits go up by many times the initial injection of reserves.

In contrast, when the central bank is "tightening", it slows the process of private bank issue by selling securities on the open market and pulling money (that could be loaned) out of the private banking sector. By increasing the supply of bonds, this lowers their prices and raises interest rates at the same time that the money supply is reduced.

This kind of policy reduces or increases the supply of short term government debt in the hands of banks and the non-bank public, lowering or raising interest rates. In parallel, it increases or reduces the supply of loanable funds (money) and thereby the ability of private banks to issue new money through issuing debt.

The simple connection between monetary policy and monetary aggregates such as M1 and M2 changed in the 1970s as the reserve requirements on deposits started to fall with the emergence of money fund

s, which require no reserves. Then in the early 1990s, reserve requirements were dropped to zeroin what countries? on savings deposits, CD

s, and Eurodollar deposit. At present, reserve requirements apply only to "transactions deposits" – essentially checking accounts. The vast majority of funding sources used by private banks to create loans are not limited by bank reserves. Most commercial and industrial loans are financed by issuing large denomination CD

s. Money market

deposits are largely used to lend to corporations who issue commercial paper

. Consumer loans are also made using savings deposits, which are not subject to reserve requirements. This means that instead of the amount of loans supplied responding passively to monetary policy, we often see it rising and falling with the demand for funds and the willingness of banks to lend.

Some academics argue that the money multiplier is a meaningless concept, because its relevance would require that the money supply be exogenous, i.e. determined by the monetary authorities via open market operations. If central banks usually target the shortest-term interest rate (as their policy instrument) then this leads to the money supply being endogenous

.

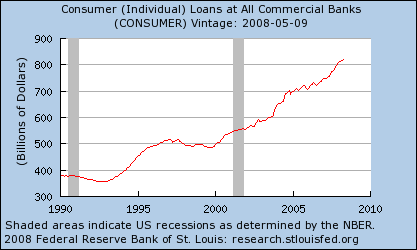

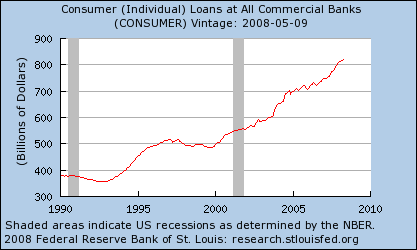

Neither commercial nor consumer loans are any longer limited by bank reserves. Nor are they directly linked proportional to reserves. Between 1995 and 2008, the amount of consumer loans has steadily increased out of proportion to bank reserves. Then, as part of the financial crisis, bank reserves rose dramatically as new loans shrank.

In recent years, some academic economists renowned for their work on the implications of rational expectations

In recent years, some academic economists renowned for their work on the implications of rational expectations

have argued that open market operations are irrelevant. These include Robert Lucas, Jr.

, Thomas Sargent, Neil Wallace

, Finn E. Kydland

, Edward C. Prescott

and Scott Freeman

. The Keynesian side points to a major example of ineffectiveness of open market operations encountered in 2008 in the United States, when short-term interest rates went as low as they could go in nominal terms, so that no more monetary stimulus could occur. This zero bound problem has been called the liquidity trap

or "pushing on a string" (the pusher being the central bank and the string being the real economy).

are to maintain low inflation and a low level of unemployment, although these goals are sometimes in conflict (according to Phillips curve

). A central bank may attempt to do this by artificially influencing the demand for goods by increasing or decreasing the nation's money supply (relative to trend), which lowers or raises interest rates, which stimulates or restrains spending on goods and services.

An important debate among economists in the second half of the twentieth century concerned the central bank's ability to predict how much money should be in circulation, given current employment rates and inflation rates. Economists such as Milton Friedman

believed that the central bank would always get it wrong, leading to wider swings in the economy than if it were just left alone. This is why they advocated a non-interventionist approach—one of targeting a pre-specified path for the money supply independent of current economic conditions— even though in practice this might involve regular intervention with open market operations (or other monetary-policy tools) to keep the money supply on target.

The Chairman of the U.S. Federal Reserve, Ben Bernanke

, has suggested that over the last 10 to 15 years, many modern central banks have become relatively adept at manipulation of the money supply, leading to a smoother business cycle, with recessions tending to be smaller and less frequent than in earlier decades, a phenomenon termed "The Great Moderation

" This theory encountered criticism during the global financial crisis of 2008–2009. Furthermore, it may be that the functions of the central bank may need to encompass more than the shifting up or down of interest rates or bank reserves: these tools, although valuable, may not in fact moderate the volatility of money supply (or its velocity).

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

, the money supply or money stock, is the total amount of money

Money

Money is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally in the past,...

available in an economy

Economy

An economy consists of the economic system of a country or other area; the labor, capital and land resources; and the manufacturing, trade, distribution, and consumption of goods and services of that area...

at a specific time. There are several ways to define "money," but standard measures usually include currency

Currency

In economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

in circulation and demand deposits (depositors' easily accessed assets on the books of financial institutions).

Money supply data are recorded and published, usually by the government or the central bank of the country. Public and private sector analysts have long monitored changes in money supply because of its possible effects on the price level

Price level

A price level is a hypothetical measure of overall prices for some set of goods and services, in a given region during a given interval, normalized relative to some base set...

, inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

and the business cycle

Business cycle

The term business cycle refers to economy-wide fluctuations in production or economic activity over several months or years...

.

That relation between money and prices is historically associated with the quantity theory of money

Quantity theory of money

In monetary economics, the quantity theory of money is the theory that money supply has a direct, proportional relationship with the price level....

. There is strong empirical

Empirical

The word empirical denotes information gained by means of observation or experimentation. Empirical data are data produced by an experiment or observation....

evidence of a direct relation between long-term price inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

and money-supply growth, at least for rapid increases in the amount of money in the economy. That is, a country such as Zimbabwe

Zimbabwe

Zimbabwe is a landlocked country located in the southern part of the African continent, between the Zambezi and Limpopo rivers. It is bordered by South Africa to the south, Botswana to the southwest, Zambia and a tip of Namibia to the northwest and Mozambique to the east. Zimbabwe has three...

which saw rapid increases in its money supply also saw rapid increases in prices (hyperinflation

Hyperinflation

In economics, hyperinflation is inflation that is very high or out of control. While the real values of the specific economic items generally stay the same in terms of relatively stable foreign currencies, in hyperinflationary conditions the general price level within a specific economy increases...

). This is one reason for the reliance on monetary policy

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment...

as a means of controlling inflation.

This causal chain is contentious, however: some heterodox economists

Heterodox economics

"Heterodox economics" refers to approaches or to schools of economic thought that are considered outside of "mainstream economics". Mainstream economists sometimes assert that it has little or no influence on the vast majority of academic economists in the English speaking world. "Mainstream...

argue that the money supply is endogenous (determined by the workings of the economy, not by the central bank) and that the sources of inflation must be found in the distributional structure of the economy.

In addition those economists seeing the central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

's control over the money supply as feeble, they also say that there are two weak links between the growth of the money supply and the inflation rate: first, an increase in the money supply, unless trapped in the financial system as excess reserves, can cause a sustained increase in real production instead of inflation in the aftermath of a recession, when many resources are underutilized. Second, if the velocity of money

Velocity of money

300px|thumb|Similar chart showing the velocity of a broader measure of money that covers M2 plus large institutional deposits, M3. The US no longer publishes official M3 measures, so the chart only runs through 2005....

, i.e., the ratio between nominal GDP and money supply, changes, an increase in the money supply could have either no effect, an exaggerated effect, or an unpredictable effect on the growth of nominal GDP.

Empirical measures

MoneyMoney

Money is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally in the past,...

is used as a medium of exchange

Medium of exchange

A medium of exchange is an intermediary used in trade to avoid the inconveniences of a pure barter system.By contrast, as William Stanley Jevons argued, in a barter system there must be a coincidence of wants before two people can trade – one must want exactly what the other has to offer, when and...

, in final settlement of a debt

Debt

A debt is an obligation owed by one party to a second party, the creditor; usually this refers to assets granted by the creditor to the debtor, but the term can also be used metaphorically to cover moral obligations and other interactions not based on economic value.A debt is created when a...

, and as a ready store of value

Store of value

A recognized form of exchange can be a form of money or currency, a commodity like gold, or financial capital. To act as a store of value, these forms must be able to be saved and retrieved at a later time, and be predictably useful when retrieved....

. Its different functions are associated with different empirical

Empirical

The word empirical denotes information gained by means of observation or experimentation. Empirical data are data produced by an experiment or observation....

measures of the money supply. There is no single "correct" measure of the money supply: instead, there are several measures, classified along a spectrum or continuum between narrow and broad monetary aggregates. Narrow measures include only the most liquid assets, the ones most easily used to spend (currency, checkable deposits). Broader measures add less liquid types of assets (certificates of deposit, etc.)

This continuum corresponds to the way that different types of money are more or less controlled by monetary policy. Narrow measures include those more directly affected and controlled by monetary policy, whereas broader measures

Broad money

In economics, broad money is a measure of the money supply that includes more than just physical money such as currency and coins . It generally includes demand deposits at commercial banks, and any monies held in easily accessible accounts...

are less closely related to monetary-policy actions. It is a matter of perennial debate as to whether narrower or broader versions of the money supply have a more predictable link to nominal GDP.

The different types of money are typically classified as "M"s. The "M"s usually range from M0 (narrowest) to M3 (broadest) but which "M"s are actually used depends on the country's central bank. The typical layout for each of the "M"s is as follows:

| Type of money | M0 | MB | M1 | M2 | M3 | MZM |

|---|---|---|---|---|---|---|

| Notes and coins (currency) in circulation (outside Federal Reserve Banks, and the vaults of depository institutions) | V | V | V | V | V | V |

| Notes and coins (currency) in bank vaults | V | |||||

| Federal Reserve Bank credit (minimum reserves and excess reserves Excess reserves In banking, excess reserves are bank reserves in excess of the reserve requirement set by a central bank. They are reserves of cash more than the required amounts. Holding excess reserves is generally considered costly and uneconomical as no interest is earned on the excess amount... ) |

V | |||||

| traveler's checks of non-bank issuers | V | V | V | V | ||

| demand deposit Demand deposit Demand deposits, bank money or scriptural money are funds held in demand deposit accounts in commercial banks. These account balances are usually considered money and form the greater part of the money supply of a country.-History:... s |

V | V | V | V | ||

| other checkable deposits (OCDs), which consist primarily of negotiable order of withdrawal (NOW) accounts at depository institutions and credit union share draft accounts. | V | V | V | V | ||

| savings deposits | V | V | V | |||

| time deposits less than $100,000 and money-market deposit accounts for individuals | V | V | ||||

| large time deposits, institutional money market funds, short-term repurchase and other larger liquid assets | V | |||||

| all money market funds | V |

- : In some countries, such as the United Kingdom, M0 includes bank reserves, so M0 is referred to as the monetary base, or narrow money.

- MB: is referred to as the monetary baseMonetary baseIn economics, the monetary base is a term relating to the money supply , the amount of money in the economy...

or total currency. This is the base from which other forms of money (like checking deposits, listed below) are created and is traditionally the most liquid measure of the money supply.

- M1: Bank reserves are not included in M1.

- M2: Represents money and "close substitutes" for money. M2 is a broader classification of money than M1. Economists use M2 when looking to quantify the amount of money in circulation and trying to explain different economic monetary conditions. M2 is a key economic indicator used to forecast inflation.

- M3: M2 plus large and long-term deposits. Since 2006, M3 is no longer tracked by the US central bank. However, there are still estimates produced by various private institutions.

- MZM: Money with zero maturity. It measures the supply of financial assets redeemable at par on demand.

The ratio of a pair of these measures, most often M2/M0, is called an (actual, empirical) money multiplier

Money multiplier

In monetary economics, a money multiplier is one of various closely related ratios of commercial bank money to central bank money under a fractional-reserve banking system. Most often, it measures the maximum amount of commercial bank money that can be created by a given unit of central bank money...

.

Fractional-reserve banking

The different forms of money in government money supply statistics arise from the practice of fractional-reserve bankingFractional-reserve banking

Fractional-reserve banking is a form of banking where banks maintain reserves that are only a fraction of the customer's deposits. Funds deposited into a bank are mostly lent out, and a bank keeps only a fraction of the quantity of deposits as reserves...

. Whenever a bank gives out a loan in a fractional-reserve banking system, a new sum of money is created. This new type of money is what makes up the non-M0 components in the M1-M3 statistics. In short, there are two types of money in a fractional-reserve banking system:

-

- central bank money (obligations of a central bank, including currency and central bank depository accounts)

- commercial bank money (obligations of commercial banks, including checking accounts and savings accounts)

In the money supply statistics, central bank money is MB while the commercial bank money is divided up into the M1-M3 components. Generally, the types of commercial bank money that tend to be valued at lower amounts are classified in the narrow category of M1 while the types of commercial bank money that tend to exist in larger amounts are categorized in M2 and M3, with M3 having the largest.

In the US, reserves consist of money in Federal Reserve accounts and US currency held by banks (also known as "vault cash"). Currency and money in Fed accounts are interchangeable (both are obligations of the Fed.) Reserves may come from any source, including the federal funds market

Federal funds

In the United States, federal funds are overnight borrowings by banks to maintain their bank reserves at the Federal Reserve. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clear financial transactions...

, deposits by the public, and borrowing from the Fed itself.

A reserve requirement is a ratio a bank must maintain between deposits and reserves. Reserve requirements do not apply to the amount of money a bank may lend out. The ratio that applies to bank lending is its capital requirement

Capital requirement

Capital requirement refers to -The standardized requirements in place for banks and other depository institutions, which determines how much capital is required to be held for a certain level of assets through regulatory agencies such as the Bank for International Settlements, Federal Deposit...

.

Example

Note: The examples apply when read in sequential order.M0

- Laura has ten US $100 bills, representing $1000 in the M0 supply for the United States. (MB = $1000, M0 = $1000, M1 = $1000, M2 = $1000)

- Laura burns one of her $100 bills. The US M0, and her personal net worth, just decreased by $100. (MB = $900, M0 = $900, M1 = $900, M2 = $900)

M1

- Laura takes the remaining nine bills and deposits them in her checking account (current account) at her bank. (MB = $900, M0 = 0, M1 = $900, M2 = $900)

- The bank then calculates its reserve using the minimum reserve percentage given by the Fed and loans the extra money. If the minimum reserve is 10%, this means $90 will remain in the bank's reserve. The remaining $810 can only be used by the bank as credit, by lending money, but until that happens it will be part of the banks excess reservesExcess reservesIn banking, excess reserves are bank reserves in excess of the reserve requirement set by a central bank. They are reserves of cash more than the required amounts. Holding excess reserves is generally considered costly and uneconomical as no interest is earned on the excess amount...

. - The M1 money supply increased by $810 when the loan is made. M1 money has been created. ( MB = $900 M0 = 0, M1 = $1710, M2 = $1710)

- Laura writes a check for $400, check number 7771. The total M1 money supply didn't change, it includes the $400 check and the $500 left in her account. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710)

- Laura's check number 7771 is accidentally destroyed in the laundry. M1 and her checking account do not change, because the check is never cashed. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710)

- Laura writes check number 7772 for $100 to her friend Alice, and Alice deposits it into her checking account. MB does not change, it still has $900 in it, Alice's $100 and Laura's $800. (MB = $900, M0 = 0, M1 = $1710, M2 = $1710)

- The bank lends Mandy the $810 credit that it has created. Mandy deposits the money in a checking account at another bank. The other bank must keep $81 as a reserve and has $729 available for loans. This creates a promise-to-pay money from a previous promise-to-pay, thus the M1 money supply is now inflated by $729. (MB = $900, M0 = 0, M1 = $2439, M2 = $2439)

- Mandy's bank now lends the money to someone else who deposits it on a checking account on yet another bank, who again stores 10% as reserve and has 90% available for loans. This process repeats itself at the next bank and at the next bank and so on, until the money in the reserves backs up an M1 money supply of $9000, which is 10 times the M0 money. (MB = $900, M0 = 0, M1 = $9000, M2 = $9000)

M2

- Laura writes check number 7774 for $1000 and brings it to the bank to start a Money Market account (these do not have a credit-creating charter), M1 goes down by $1000, but M2 stays the same. This is because M2 includes the Money Market account in addition to all money counted in M1.

Foreign Exchange

- Laura writes check number 7776 for $200 and brings it downtown to a foreign exchange bank teller at Credit Suisse to convert it to British Pounds. On this particular day, the exchange rate is exactly USD 2.00 = GBP 1.00. The bank Credit Suisse takes her $200 check, and gives her two £50 notes (and charges her a dollar for the service fee). Meanwhile, at the Credit Suisse branch office in Hong Kong, a customer named Huang has £100 and wants $200, and the bank does that trade (charging him an extra £.50 for the service fee). US M0 still has the $900, although Huang now has $200 of it. The £50 notes Laura walks off with are part of Britain's M0 money supply that came from Huang.

- The next day, Credit Suisse finds they have an excess of GB Pounds and a shortage of US Dollars, determined by adding up all the branch offices' supplies. They sell some of their GBP on the open FXForeign exchange marketThe foreign exchange market is a global, worldwide decentralized financial market for trading currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends...

market with Deutsche Bank, which has the opposite problem. The exchange rate stays the same.

- The day after, both Credit Suisse and Deutsche Bank find they have too many GBP and not enough USD, along with other traders. Then, To move their inventories, they have to sell GBP at USD 1.999, that is, 1/10 cent less than $2 per pound, and the exchange rate shifts. None of these banks has the power to increase or decrease the British M0 or the American M0; they are independent systems.

United States

The Federal Reserve previously published data on three monetary aggregates, but on 10 November 2005 announced that as of 23 March 2006, it would cease publication of M3. Since the Spring of 2006, the Federal Reserve only publishes data on two of these aggregates. The first, M1, is made up of types of money commonly used for payment, basically currency (M0) and checking account balances. The second, M2, includes M1 plus balances that generally are similar to transaction accounts and that, for the most part, can be converted fairly readily to M1 with little or no loss of principal. The M2 measure is thought to be held primarily by households. As mentioned, the third aggregate, M3 is no longer published. Prior to this discontinuation, M3 had included M2 plus certain accounts that are held by entities other than individuals and are issued by banks and thrift institutions to augment M2-type balances in meeting credit demands; it had also included balances in money market mutual funds held by institutional investors. The aggregates have had different roles in monetary policy as their reliability as guides has changed. The following details their principal components:- M0: The total of all physical currencyCurrencyIn economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

, plus accounts at the central bank that can be exchanged for physical currency. - M1: The total of all physical currencyCurrencyIn economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

part of bank reserves + the amount in demand accountDemand accountA transactional account is a deposit account held at a bank or other financial institution, for the purpose of securely and quickly providing frequent access to funds on demand, through a variety of different channels....

s ("checking" or "current" accounts). - M2: M1 + most savings accountSavings accountSavings accounts are accounts maintained by retail financial institutions that pay interest but cannot be used directly as money . These accounts let customers set aside a portion of their liquid assets while earning a monetary return...

s, money market accounts, retail money market mutual funds, and small denomination time deposits (certificates of deposit of under $100,000). - M3: M2 + all other CDsCertificate of depositA certificate of Deposit is a time deposit, a financial product commonly offered to consumers in the United States by banks, thrift institutions, and credit unions....

(large time deposits, institutional money market mutual fund balances), deposits of eurodollarEurodollarEurodollars are time deposits denominated in U.S. dollars at banks outside the United States, and thus are not under the jurisdiction of the Federal Reserve. Consequently, such deposits are subject to much less regulation than similar deposits within the U.S., allowing for higher margins. The term...

s and repurchase agreementRepurchase agreementA repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is the sale of securities together with an agreement for the seller to buy back the securities at a later date. The repurchase price should be greater than the original sale price, the difference effectively...

s.

When the Federal Reserve announced in 2005 that they would cease publishing M3 statistics in March 2006, they explained that M3 did not convey any additional information about economic activity compared to M2, and thus, "has not played a role in the monetary policy process for many years." Therefore, the costs to collect M3 data outweighed the benefits the data provided. Some politicians have spoken out against the Federal Reserve's decision to cease publishing M3 statistics and have urged the U.S. Congress to take steps requiring the Federal Reserve to do so. Libertarian congressman Ron Paul

Ron Paul

Ronald Ernest "Ron" Paul is an American physician, author and United States Congressman who is seeking to be the Republican Party candidate in the 2012 presidential election. Paul represents Texas's 14th congressional district, which covers an area south and southwest of Houston that includes...

(R-TX) claimed that "M3 is the best description of how quickly the Fed is creating new money and credit. Common sense tells us that a government central bank creating new money out of thin air depreciates the value of each dollar in circulation." Some of the data used to calculate M3 are still collected and published on a regular basis. Current alternate sources of M3 data are available from the private sector.

As of November 17, 2011 the Federal Reserve reported that the U.S. dollar monetary base

Monetary base

In economics, the monetary base is a term relating to the money supply , the amount of money in the economy...

is $2,150,000,000,000. This is an increase of 28% in 2 years. The monetary base is only one component of money supply, however. M2, the broadest measure of money supply, has increased from approximately $8.48 trillion to $9.61 trillion from November 2009 to October 2011, the latest month-data available. This is a 2-year increase in U.S. M2 of approximately 12.9%.

United Kingdom

Monetary base

In economics, the monetary base is a term relating to the money supply , the amount of money in the economy...

" or "narrow money" and M4 is referred to as "broad money

Broad money

In economics, broad money is a measure of the money supply that includes more than just physical money such as currency and coins . It generally includes demand deposits at commercial banks, and any monies held in easily accessible accounts...

" or simply "the money supply".

- M0: Cash outside Bank of EnglandBank of EnglandThe Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694, it is the second oldest central bank in the world...

+ Banks' operational deposits with Bank of England. (No longer published.) - M4: Cash outside banks (i.e. in circulation with the public and non-bank firms) + private-sector retail bank and building society deposits + Private-sector wholesale bank and building society deposits and Certificate of Deposit.

There are several different definitions of money supply to reflect the differing stores of money. Due to the nature of bank deposits, especially time-restricted savings account deposits, the M4 represents the most illiquid measure of money. M0, by contrast, is the most liquid measure of the money supply.

European Union

European Central Bank

The European Central Bank is the institution of the European Union that administers the monetary policy of the 17 EU Eurozone member states. It is thus one of the world's most important central banks. The bank was established by the Treaty of Amsterdam in 1998, and is headquartered in Frankfurt,...

's definition of euro area monetary aggregates:

- M1: Currency in circulation + overnight deposits

- M2: M1 + Deposits with an agreed maturity up to 2 years + Deposits redeemable at a period of notice up to 3 months.

- M3: M2 + Repurchase agreements + Money market fund (MMF) shares/units + Debt securities up to 2 years

Australia

Reserve Bank of Australia

The Reserve Bank of Australia came into being on 14 January 1960 as Australia's central bank and banknote issuing authority, when the Reserve Bank Act 1959 removed the central banking functions from the Commonwealth Bank to it....

defines the monetary aggregates as:

- M1: currency bank + current deposits of the private non-bank sector

- M3: M1 + all other bank deposits of the private non-bank sector

- Broad Money: M3 + borrowings from the private sector by NBFIs, less the latter's holdings of currency and bank deposits

- Money Base: holdings of notes and coins by the private sector plus deposits of banks with the Reserve Bank of Australia (RBA) and other RBA liabilities to the private non-bank sector

New Zealand

Reserve Bank of New Zealand

The Reserve Bank of New Zealand is the central bank of New Zealand and is constituted under the Reserve Bank of New Zealand Act 1989. The Governor of the Reserve Bank is responsible for New Zealand's currency and operating monetary policy. The Bank's current Governor is Dr. Alan Bollard...

defines the monetary aggregates as:

- M1: notes and coins held by the public plus chequeable deposits, minus inter-institutional chequeable deposits, and minus central government deposits

- M2: M1 + all non-M1 call funding (call funding includes overnight money and funding on terms that can of right be broken without break penalties) minus inter-institutional non-M1 call funding

- M3: the broadest monetary aggregate. It represents all New Zealand dollar funding of M3 institutions and any Reserve Bank repos with non-M3 institutions. M3 consists of notes & coin held by the public plus NZ dollar funding minus inter-M3 institutional claims and minus central government deposits

India

Reserve Bank of India

The Reserve Bank of India is the central banking institution of India and controls the monetary policy of the rupee as well as US$300.21 billion of currency reserves. The institution was established on 1 April 1935 during the British Raj in accordance with the provisions of the Reserve Bank of...

defines the monetary aggregates as:

- Reserve Money (M0): Currency in circulation + Bankers’ deposits with the RBI + ‘Other’ deposits with the RBI = Net RBI credit to the Government + RBI credit to the commercial sector + RBI’s claims on banks + RBI’s net foreign assets + Government’s currency liabilities to the public – RBI’s net non-monetary liabilities.

- M1: Currency with the public + Deposit money of the public (Demand deposits with the banking system + ‘Other’ deposits with the RBI).

- M2: M1 + Savings deposits with Post office savings banks.

- M3: M1+ Time deposits with the banking system = Net bank credit to the Government + Bank credit to the commercial sector + Net foreign exchange assets of the banking sector + Government’s currency liabilities to the public – Net non-monetary liabilities of the banking sector (Other than Time Deposits).

- M4: M3 + All deposits with post office savings banks (excluding National Savings Certificates).

Japan

Bank of Japan

is the central bank of Japan. The Bank is often called for short. It has its headquarters in Chuo, Tokyo.-History:Like most modern Japanese institutions, the Bank of Japan was founded after the Meiji Restoration...

defines the monetary aggregates as:

- M1: cash currency in circulation + deposit money

- M2 + CDs: M1 + quasi-money + CDs

- M3 + CDs: (M2 + CDs) + deposits of post offices + other savings and deposits with financial institutions + money trusts

- Broadly defined liquidity: (M3 + CDs) + money market + pecuniary trusts other than money trusts + investment trusts + bank debentures + commercial paper issued by financial institutions + repurchase agreements and securities lending with cash collateral + government bonds + foreign bonds

Monetary exchange equation

Money supply is important because it is linked to inflationInflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

by the equation of exchange

Equation of exchange

In economics, the equation of exchange is the relation:M\cdot V = P\cdot Qwhere, for a given period,M\, is the total nominal amount of money in circulation on average in an economy.V\, is the velocity of money, that is the average frequency with which a unit of money is spent.P\, is the price...

in an equation proposed by Irving Fisher in 1911

- M is the total dollars in the nation’s money supply

- V is the number of times per year each dollar is spent (velocity of money)

- P is the average price of all the goods and services sold during the year

- Q is the quantity of assets, goods and services sold during the year

In mathematical terms, this equation is really an identity

Identity (mathematics)

In mathematics, the term identity has several different important meanings:*An identity is a relation which is tautologically true. This means that whatever the number or value may be, the answer stays the same. For example, algebraically, this occurs if an equation is satisfied for all values of...

which is true by definition rather than describing economic behavior. That is, each term is defined by the values of the other three. Unlike the other terms, the velocity of money has no independent measure and can only be estimated by dividing PQ by M. Adherents of the quantity theory of money assume that the velocity of money is stable and predictable, being determined mostly by financial institutions. If that assumption is valid, then changes in M can be used to predict changes in PQ. If not, then the equation of exchange is useless to macroeconomics.

Most macroeconomists replace the equation of exchange with equations for the demand for money which describe more regular and predictable economic behavior. However, predictability (or the lack thereof) of the velocity of money is equivalent to predictability (or the lack thereof) of the demand for money (since in equilibrium real money demand is simply Q/V). Either way, this unpredictability made policy-makers at the Federal Reserve rely less on the money supply in steering the U.S.economy. Instead, the policy focus has shifted to interest rates such as the fed funds rate.

In practice, macroeconomists almost always use real GDP to measure Q, omitting the role of all transactions except for those involving newly produced goods and services (i.e., consumption goods, investment goods, government-purchased goods, and exports). That is, the only assets counted as part of Q are newly produced investment goods. But the original quantity theory of money did not follow this practice: PQ was the monetary value of all new transactions, whether of real goods and services or of paper assets.

Ignoring the effects of monetary growth on real purchases and velocity, this suggests that the growth of the money supply may cause different kinds of inflation at different times. For example, rises in the U.S. money supplies between the 1970s and the present encouraged first a rise in the inflation rate for newly produced goods and services ("inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

" as usually defined) in the seventies and then asset-price inflation in later decades: it may have encouraged a stock market boom in the '80s and '90s and then, after 2001, a rise in home prices, i.e., the famous housing bubble. This story, of course, assumes that the amounts of money were the causes of these different types of inflation rather than being endogenous results of the economy's dynamics.

When home prices went down, the Federal Reserve kept its loose monetary policy and lowered interest rates; the attempt to slow price declines in one asset class, e.g. real estate, may well have caused prices in other asset classes to rise, e.g. commodities.

Rates of growth

In terms of percentage changes (to a close approximation under small growth rates, the percentage change in a product, say XY, is equal to the sum of the percentage changes %ΔX + %ΔY). So:- %ΔP + %ΔQ = %ΔM + %ΔV

That equation rearranged gives the "basic inflation identity":

- %ΔP = %ΔM + %ΔV – %ΔQ

Inflation (%ΔP) is equal to the rate of money growth (%ΔM), plus the change in velocity (%ΔV), minus the rate of output growth (%ΔQ). As before, this equation is only useful if %ΔV follows regular behavior. It also loses usefulness if the central bank lacks control over %ΔM.

Bank reserves at central bank

When a central bankCentral bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

is "easing", it triggers an increase in money supply by purchasing government securities

Government bond

A government bond is a bond issued by a national government denominated in the country's own currency. Bonds are debt investments whereby an investor loans a certain amount of money, for a certain amount of time, with a certain interest rate, to a company or country...

on the open market thus increasing available funds for private banks to loan through fractional-reserve banking

Fractional-reserve banking

Fractional-reserve banking is a form of banking where banks maintain reserves that are only a fraction of the customer's deposits. Funds deposited into a bank are mostly lent out, and a bank keeps only a fraction of the quantity of deposits as reserves...

(the issue of new money through loans) and thus the amount of bank reserves and the monetary base rise. By purchasing government bonds (especially Treasury Bills), this bids up their prices, so that interest rates fall at the same time that the monetary base increases.

With "easy money," the central bank creates new bank reserves

Bank reserves

Bank reserves are banks' holdings of deposits in accounts with their central bank , plus currency that is physically held in the bank's vault . The central banks of some nations set minimum reserve requirements...

(in the US known as "federal funds

Federal funds

In the United States, federal funds are overnight borrowings by banks to maintain their bank reserves at the Federal Reserve. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clear financial transactions...

"), which allow the banks lend more. These loans get spent, and the proceeds get deposited at other banks. Whatever is not required to be held as reserves is then lent out again, and through the "multiplying" effect of the fractional-reserve system, loans and bank deposits go up by many times the initial injection of reserves.

In contrast, when the central bank is "tightening", it slows the process of private bank issue by selling securities on the open market and pulling money (that could be loaned) out of the private banking sector. By increasing the supply of bonds, this lowers their prices and raises interest rates at the same time that the money supply is reduced.

This kind of policy reduces or increases the supply of short term government debt in the hands of banks and the non-bank public, lowering or raising interest rates. In parallel, it increases or reduces the supply of loanable funds (money) and thereby the ability of private banks to issue new money through issuing debt.

The simple connection between monetary policy and monetary aggregates such as M1 and M2 changed in the 1970s as the reserve requirements on deposits started to fall with the emergence of money fund

Money fund

A money market fund is an open-ended mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds are widely regarded as being as safe as bank deposits yet providing a higher yield...

s, which require no reserves. Then in the early 1990s, reserve requirements were dropped to zeroin what countries? on savings deposits, CD

Certificate of deposit

A certificate of Deposit is a time deposit, a financial product commonly offered to consumers in the United States by banks, thrift institutions, and credit unions....

s, and Eurodollar deposit. At present, reserve requirements apply only to "transactions deposits" – essentially checking accounts. The vast majority of funding sources used by private banks to create loans are not limited by bank reserves. Most commercial and industrial loans are financed by issuing large denomination CD

Certificate of deposit

A certificate of Deposit is a time deposit, a financial product commonly offered to consumers in the United States by banks, thrift institutions, and credit unions....

s. Money market

Money market

The money market is a component of the financial markets for assets involved in short-term borrowing and lending with original maturities of one year or shorter time frames. Trading in the money markets involves Treasury bills, commercial paper, bankers' acceptances, certificates of deposit,...

deposits are largely used to lend to corporations who issue commercial paper

Commercial paper

In the global money market, commercial paper is an unsecured promissory note with a fixed maturity of 1 to 270 days. Commercial Paper is a money-market security issued by large banks and corporations to get money to meet short term debt obligations , and is only backed by an issuing bank or...

. Consumer loans are also made using savings deposits, which are not subject to reserve requirements. This means that instead of the amount of loans supplied responding passively to monetary policy, we often see it rising and falling with the demand for funds and the willingness of banks to lend.

Some academics argue that the money multiplier is a meaningless concept, because its relevance would require that the money supply be exogenous, i.e. determined by the monetary authorities via open market operations. If central banks usually target the shortest-term interest rate (as their policy instrument) then this leads to the money supply being endogenous

Endogeneity (economics)

In an econometric model, a parameter or variable is said to be endogenous when there is a correlation between the parameter or variable and the error term. Endogeneity can arise as a result of measurement error, autoregression with autocorrelated errors, simultaneity, omitted variables, and sample...

.

Neither commercial nor consumer loans are any longer limited by bank reserves. Nor are they directly linked proportional to reserves. Between 1995 and 2008, the amount of consumer loans has steadily increased out of proportion to bank reserves. Then, as part of the financial crisis, bank reserves rose dramatically as new loans shrank.

Rational expectations

Rational expectations is a hypothesis in economics which states that agents' predictions of the future value of economically relevant variables are not systematically wrong in that all errors are random. An alternative formulation is that rational expectations are model-consistent expectations, in...

have argued that open market operations are irrelevant. These include Robert Lucas, Jr.

Robert Lucas, Jr.

Robert Emerson Lucas, Jr. is an American economist at the University of Chicago. He received the Nobel Prize in Economics in 1995 and is consistently indexed among the top 10 economists in the Research Papers in Economics rankings. He is married to economist Nancy Stokey.He received his B.A. in...

, Thomas Sargent, Neil Wallace

Neil Wallace

Neil Wallace is an American economist and professor at Pennsylvania State University. Wallace is considered one of the main proponents of new classical macroeconomics....

, Finn E. Kydland

Finn E. Kydland

Finn Erling Kydland is a Norwegian economist. He is currently the Henley Professor of Economics at the University of California, Santa Barbara. He also holds the Richard P...

, Edward C. Prescott

Edward C. Prescott

Edward Christian Prescott is an American economist. He received the Nobel Memorial Prize in Economics in 2004, sharing the award with Finn E. Kydland, "for their contributions to dynamic macroeconomics: the time consistency of economic policy and the driving forces behind business cycles"...

and Scott Freeman

Scott Freeman

Scott John Freeman was an American economist. He received his undergraduate degree from the University of Wisconsin–Madison and earned his Ph.D. from the University of Minnesota in 1983...

. The Keynesian side points to a major example of ineffectiveness of open market operations encountered in 2008 in the United States, when short-term interest rates went as low as they could go in nominal terms, so that no more monetary stimulus could occur. This zero bound problem has been called the liquidity trap

Liquidity trap

A liquidity trap is a situation described in Keynesian economics in which injections of cash into an economy by a central bank fail to lower interest rates and hence to stimulate economic growth. A liquidity trap is caused when people hoard cash because they expect an adverse event such as...

or "pushing on a string" (the pusher being the central bank and the string being the real economy).

Arguments

The main functions of the central bankCentral bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

are to maintain low inflation and a low level of unemployment, although these goals are sometimes in conflict (according to Phillips curve

Phillips curve

In economics, the Phillips curve is a historical inverse relationship between the rate of unemployment and the rate of inflation in an economy. Stated simply, the lower the unemployment in an economy, the higher the rate of inflation...

). A central bank may attempt to do this by artificially influencing the demand for goods by increasing or decreasing the nation's money supply (relative to trend), which lowers or raises interest rates, which stimulates or restrains spending on goods and services.

An important debate among economists in the second half of the twentieth century concerned the central bank's ability to predict how much money should be in circulation, given current employment rates and inflation rates. Economists such as Milton Friedman

Milton Friedman

Milton Friedman was an American economist, statistician, academic, and author who taught at the University of Chicago for more than three decades...

believed that the central bank would always get it wrong, leading to wider swings in the economy than if it were just left alone. This is why they advocated a non-interventionist approach—one of targeting a pre-specified path for the money supply independent of current economic conditions— even though in practice this might involve regular intervention with open market operations (or other monetary-policy tools) to keep the money supply on target.

The Chairman of the U.S. Federal Reserve, Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

, has suggested that over the last 10 to 15 years, many modern central banks have become relatively adept at manipulation of the money supply, leading to a smoother business cycle, with recessions tending to be smaller and less frequent than in earlier decades, a phenomenon termed "The Great Moderation

The Great Moderation

In economics, the Great Moderation refers to a reduction in the volatility of business cycle fluctuations starting in the mid-1980s, believed to have been caused by institutional and structural changes in developed nations in the later part of the twentieth century...

" This theory encountered criticism during the global financial crisis of 2008–2009. Furthermore, it may be that the functions of the central bank may need to encompass more than the shifting up or down of interest rates or bank reserves: these tools, although valuable, may not in fact moderate the volatility of money supply (or its velocity).

See also

- Bank regulationBank regulationBank regulations are a form of government regulation which subject banks to certain requirements, restrictions and guidelines. This regulatory structure creates transparency between banking institutions and the individuals and corporations with whom they conduct business, among other things...

- Capital requirementCapital requirementCapital requirement refers to -The standardized requirements in place for banks and other depository institutions, which determines how much capital is required to be held for a certain level of assets through regulatory agencies such as the Bank for International Settlements, Federal Deposit...

- Central bankCentral bankA central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

- ChartalismChartalismChartalism is a descriptive economic theory that details the procedures and consequences of using government-issued tokens as the unit of money. The name derives from the Latin charta, in the sense of a token or ticket...

- Core inflationCore inflationCore inflation is a measure of inflation which excludes certain items that face volatile price movements, notably food and energy.The preferred measure by the Federal Reserve of core inflation in the United States is the core Personal consumption expenditures price index...

- Debt levels and flowsDebt levels and flowsDebt is used to finance and pay for entreprises and business around the world. The levels of debt – how much debt is outstanding – and the flows of debt – how much the level of debt changes over time – are basic macroeconomic data, and vary between countries....

- Economics terminology that differs from common usageEconomics terminology that differs from common usageIn any technical subject, words commonly used in everyday life acquire very specific technical meanings, and confusion can arise when someone is uncertain of the intended meaning of a word...

- U.S. Federal Deposit Insurance CorporationFederal Deposit Insurance CorporationThe Federal Deposit Insurance Corporation is a United States government corporation created by the Glass–Steagall Act of 1933. It provides deposit insurance, which guarantees the safety of deposits in member banks, currently up to $250,000 per depositor per bank. , the FDIC insures deposits at...

- Fiat currency

- Financial capitalFinancial capitalFinancial capital can refer to money used by entrepreneurs and businesses to buy what they need to make their products or provide their services or to that sector of the economy based on its operation, i.e. retail, corporate, investment banking, etc....

- FloatFloat (money supply)In economics, float is duplicate money present in the banking system during the time between a deposit being made in the recipient's account and the money being deducted from the sender's account. It makes up the smallest part of the money supply....

- Fractional-reserve bankingFractional-reserve bankingFractional-reserve banking is a form of banking where banks maintain reserves that are only a fraction of the customer's deposits. Funds deposited into a bank are mostly lent out, and a bank keeps only a fraction of the quantity of deposits as reserves...

- FRED (Federal Reserve Economic Data)

- Full reserve banking

- Index of Leading IndicatorsIndex of Leading IndicatorsThe Conference Board Leading Economic Index is an American economic leading indicator intended to forecast future economic activity. It is calculated by The Conference Board, a non-governmental organization, which determines the value of the index from the values of ten key variables. These...

– money supply is a component - InflationInflationIn economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

- MonetarismMonetarismMonetarism is a tendency in economic thought that emphasizes the role of governments in controlling the amount of money in circulation. It is the view within monetary economics that variation in the money supply has major influences on national output in the short run and the price level over...

- Monetary baseMonetary baseIn economics, the monetary base is a term relating to the money supply , the amount of money in the economy...

- Monetary economics

- Money circulationMoney circulationBanknotes have a limited lifetime, after which they are collected for destruction, usually recycling or shredding. A banknote is removed from the money supply by banks or other financial institutions due to everyday wear and tear from its handling...

- Money creationMoney creationIn economics, money creation is the process by which the money supply of a country or a monetary region is increased due to some reason. There are two principal stages of money creation. First, the central bank introduces new money into the economy by purchasing financial assets or lending money...

- Money demandMoney demandThe demand for money is the desired holding of financial assets in the form of money: that is, cash or bank deposits. It can refer to the demand for money narrowly defined as M1 , or for money in the broader sense of M2 or M3....

- Money marketMoney marketThe money market is a component of the financial markets for assets involved in short-term borrowing and lending with original maturities of one year or shorter time frames. Trading in the money markets involves Treasury bills, commercial paper, bankers' acceptances, certificates of deposit,...

- Money with zero maturity (MZM)

- SeigniorageSeigniorageSeigniorage can have the following two meanings:* Seigniorage derived from specie—metal coins, is a tax, added to the total price of a coin , that a customer of the mint had to pay to the mint, and that was sent to the sovereign of the political area.* Seigniorage derived from notes is more...

Data

- Aggregate Reserves Of Depository Institutions And The Monetary Base (H.3)

- U.S. M1,M2 Money Supply Historical Table

- Money Stock Measures (H.6)

- Data on Monetary Aggregates in Australia

- Monetary Statistics on Hong Kong Monetary Authority

- http://www.pbc.gov.cn/english/Monetary Survey on People's Bank of ChinaPeople's Bank of ChinaThe People's Bank of China is the central bank of the People's Republic of China with the power to control monetary policy and regulate financial institutions in mainland China...

]

Articles

- Article in the New Palgrave on Money Supply by Milton FriedmanMilton FriedmanMilton Friedman was an American economist, statistician, academic, and author who taught at the University of Chicago for more than three decades...

- Do all banks hold reserves, and, if so, where do they hold them? (11/2001)

- What effect does a change in the reserve requirement have on the money supply? (08/2001)

- St. Louis Fed: Monetary Aggregates

- Anna J. Schwartz on money supply

- Discontinuance of M3 Publication

- Investopedia: Money Zero Maturity (MZM)

Computer simulations

- Money Supply Process by Fiona Maclachlan, Wolfram Demonstrations ProjectWolfram Demonstrations ProjectThe Wolfram Demonstrations Project is hosted by Wolfram Research, whose stated goal is to bring computational exploration to the widest possible audience. It consists of an organized, open-source collection of small interactive programs called Demonstrations, which are meant to visually and...

.