Alternative Minimum Tax

Encyclopedia

The Alternative Minimum Tax (AMT) is an income tax

imposed by the United States federal government

on individuals, corporations

, estates

, and trusts

. AMT is imposed at a nearly flat rate on an adjusted amount of taxable income above a certain threshold (exemption). This exemption is substantially higher than the exemption from regular income tax. Regular taxable income is adjusted for certain items computed differently for AMT, such as depreciation and medical expenses. No deduction is allowed for state income taxes or miscellaneous itemized deductions in computing AMT income. Taxpayers with incomes above the exemption whose regular Federal income tax is below the amount of AMT must pay the higher AMT amount.

A predecessor Minimum Tax, enacted in 1969, imposed an additional tax on certain tax benefits for certain taxpayers. The present AMT was enacted in 1982 and limits tax benefits from a variety of deductions. The thresholds at which AMT begins to apply are not automatically adjusted for inflation, as are regular tax thresholds, but Congress has made frequent legislative adjustments.

as modified for AMT. As with regular Federal income tax, rates and exemptions vary by filing status. The lower rate and the exemption are phased out above certain income levels at 25% of AMT income. A lower rate applies (through 2012) on capital gains (and qualifying dividends). These amounts for 2009 and 2010 are reflected in the following table:

In addition, corporations with average annual gross receipts less than $7,500,000 for the prior three years are exempt from AMT, but only so long as they continue to meet this test. Further, a corporation is exempt from AMT during its first year as a corporation. Affiliated corporations are treated as if they were a single corporation for all three exemptions ($40,000, $7.5 million, and first year).

To the extent AMT exceeds regular Federal income tax, a future credit is provided which can offset future regular tax to the extent AMT does not apply in a future year. However, this credit is limited: see further details in the "AMT credit against regular tax" section.

Regular tax used as a basis for computing AMT is found on the following lines of tax return forms: individual Form 1040 Line 44, or corporate Form 1120 Schedule J line 2 less foreign tax credit.

Under the AMT, no deduction is allowed for personal exemptions, nor is the standard deduction. State, local, and foreign taxes are not deductible. However, most other itemized deduction

s apply at least in part. Significant other adjustments to income and deductions apply.

Individuals must file IRS Form 6251 and corporations must file Form 4626 if they have any net AMT due. The form is also filed to claim the credit for prior year AMT.

Other individual adjustments in computing AMT include:

Many AMT adjustments apply to businesses operated by individuals or corporations. The adjustments tend to have the effect of deferring certain deductions or recognizing income sooner. These adjustments include:

Certain other adjustments apply. Corporations are also subject to an adjustment (up or down) for adjusted current earnings. In addition, a partner or shareholder's share of AMT income and adjustments flow through to the partner or shareholder from the partnership

or S corporation

.

AMT is reduced by a foreign tax credit

, limited based on AMT income rather than regular taxable income. Certain specified business tax credits are allowed.

and went into effect in 1970. Treasury Secretary Joseph Barr prompted the enactment action with an announcement that 155 high-income households had not paid a dime of federal income taxes. The households had taken advantage of so many tax benefits and deductions that reduced their tax liabilities to zero. Congress responded by creating an add-on tax on high-income households, equal to 10% of the sum of tax preferences in excess of $30,000 plus the taxpayer’s regular tax liability.

The explanation of the 1969 Act prepared by Congress's Staff of the Joint Committee on Internal Revenue Taxation described the reason for the AMT as follows:

The AMT has undergone several changes since 1969. The most significant of those, according to the Joint Committee on Taxation, occurred under the Reagan

era Tax Equity and Fiscal Responsibility Act of 1982

. The law changed the AMT from an add-on tax to its current form: a parallel tax system. The current structure of the AMT reflects changes that were made by the 1982 law. Congress made other notable, but less significant, changes to the law in 1978, 1982, 1986, 1990, and 1993.

However both participation and revenues from the AMT temporarily plummeted after the 1986 changes. Further significant changes occurred as a result of the Omnibus Budget Reconciliation Acts of 1990 and 1993, which raised the AMT rate to 24%, and to 26%/28% respectively, from the prior level of 21%. Now, some taxpayers who do not have very high incomes or participate in numerous special tax benefits and/or activities will pay the AMT.

However both participation and revenues from the AMT temporarily plummeted after the 1986 changes. Further significant changes occurred as a result of the Omnibus Budget Reconciliation Acts of 1990 and 1993, which raised the AMT rate to 24%, and to 26%/28% respectively, from the prior level of 21%. Now, some taxpayers who do not have very high incomes or participate in numerous special tax benefits and/or activities will pay the AMT.

For years, Congress has passed one-year patches aimed at minimizing the impact of the tax. For the 2007 tax year, a patch was passed on 12/20/2007, but only after the IRS had already designed its forms for 2007. The IRS had to reprogram its forms to accommodate the law change.

While the AMT is not automatically indexed for inflation, the exemption has been increased by Congress several times. In addition, the rate was increased for individuals effective 1991 and 1993, and the tax was limited for capital gains and qualifying dividends in 2003. These are reflected in the following table:

The tax rate for corporations has remained 20% and the exemption amount has remained $40,000 since the 1986 changes.

AMT is imposed if the tentative minimum tax exceeds the regular tax. Tentative minimum tax is the AMT rate of tax times alternative minimum taxable income less the AMT foreign tax credit. Regular tax is the regular income tax reduced only by the foreign and possessions tax credits. In any year in which regular tax exceeds tentative minimum tax, a credit (AMT Credit) is allowed against regular tax to the extent the taxpayer has paid AMT in any prior year. This credit may not reduce regular tax below the tentative minimum tax.

Alternative minimum taxable income is regular taxable income, plus or minus certain adjustments, plus tax preference items, less the allowable exemption (as phased out).

The rate of AMT varies by type of taxpayer. Through 2012, individuals, estates, and trusts are subject to the same rate of tax on long term capital gains for regular tax and AMT.

Small corporations are exempt from AMT. A small corporation is one with average gross receipts for the prior three years of $7.5 million or less. Once a corporation ceases to be a small corporation for AMT, it is never again a small corporation. This limit is applied to all members of an affiliated group as if they were a single corporation.

.

In addition, corporate taxpayers may be required to make adjustments to depreciation deductions in computing the adjusted current earnings (ACE) adjustment. Such adjustments only apply to assets acquired before 1989.

Adjustments are also required for the following:

Medical expenses are deductible for AMT only to the extent they exceed 10% of adjusted gross income (as compared to 7.5% for regular tax).

Interest expense deductions for individuals may be adjusted. Generally, interest paid on debt used to acquire, construct, or improve the individual's principal or second residence is unaffected. This includes interest resulting from refinancing such debt. In addition, investment interest expense is deductible for AMT only to the extent of adjusted net investment income. Other non-business interest is generally not deductible for AMT.

An adjustment is also made for qualified incentive stock options and stock received under employee stock purchase plans. In both cases, the employee must recognize income for AMT purposes on the bargain or compensation element, the employer is granted a deduction for this, and the employee has basis in the shares received.

Circulation and research expenses must be capitalized and amortized.

Farm losses are limited for AMT purposes. Passive activity losses are recomputed for AMT purposes based on income and deductions as recomputed for AMT. Certain adjustments apply with respect to farm and passive activity loss rules for insolvent taxpayers.

Taxpayers may elect an optional 10-year write-off of certain tax preference items in lieu of the preference add-back.

Note that in prior years there were certain other tax preference items relating to provisions now repealed.

The AMT foreign tax credit limitation is redetermined based on AMTI rather than regular taxable income. Thus, all adjustments and tax preference items above must be applied in computing the AMT foreign tax credit limitation.

In the tax year 2000, many taxpayers in Silicon Valley

were caught unprepared by the AMT due to the sudden decline in technology stock prices. Under AMT rules, for incentive stock options

at the time of exercise, the "bargain element" (the difference between the strike price and fair market value) is treated as an AMT adjustment, e.g. it needs to be added to the AMT calculation even though no ordinary income tax is due at the time of exercise. In contrast, under the regular tax rules capital gains tax

es are not paid until the actual shares of stock are sold. For example, if someone exercised a 10,000 share Nortel

stock option at $7 when the stock price was at $87, the bargain element

was $80 per share or $800,000. Without selling the stock, the stock price dropped to $7. Although the real gain is $0, the $800,000 bargain element still becomes an AMT adjustment, and the taxpayer owes around $200,000 in AMT.

The AMT was designed to prevent people from using loophole

s in the tax law

to avoid tax. However, the inclusion of unrealized gain on incentive stock options imposes difficulties for people who cannot come up with cash to pay tax on gains that they have not realized yet. As a result, Congress has taken action to modify the AMT regarding incentive stock options. In 2000 and 2001, people exercised incentive stock options and held onto the shares, hoping to pay long-term capital gains taxes instead of short-term capital gains taxes. Many of these people were forced to pay the AMT on this income, and by the end of the year, the stock was no longer worth the amount of AMT tax owed, forcing some individuals into bankruptcy

. In the Nortel example given above, the individual would receive a credit for the AMT paid when the individual did eventually sell the Nortel shares. However, given the way AMT carryover

amounts are recalculated each year, the eventual credit received is in many cases less than originally paid.

In the Nortel example above, the taxpayer could have avoided problems by selling sufficient stock to cover the AMT liability immediately upon exercising the stock options. However, AMT also applies to stock options in pre-IPO or privately-held companies: in such cases the IRS may regard the stock as having significant value even though there may be no market in which to sell the stock, or the employee may be legally forbidden from selling the stock. In such a case, it may be effectively impossible for the employee to exercise the option unless he or she has enough cash with which to pay the AMT.

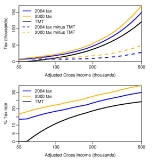

The primary reason for AMT growth is the fact that the AMT exemption, unlike regular income tax items, is not indexed to inflation. This means that income thresholds do not keep pace with the cost of living. As a result, the tax affects an increasing number of households each year, as workers’ incomes adjust to inflation and surpass AMT eligibility levels. While not indexed for inflation, Congress has often passed short term increases in exemption amounts. The Tax Policy Center (a research group) estimated that if the AMT had been indexed to inflation in 1985, and if the Bush tax cuts

had not gone into effect, only 300,000 taxpayers—instead of their projected 27 million—would be subject to the tax in 2010. President Barack Obama included indexing the AMT to inflation in his FY2011 budget proposal, which did not pass. AMT raised $26 Billion of $1,031 Billion total individual income tax in 2008.

Another important reason for the recent expansion of the AMT is the effect of the 2001–2006 Bush tax cuts

. The tax cuts decreased marginal tax rates for all income tax brackets without making corresponding changes to AMT rates. The lower tax liabilities triggered AMT eligibility for many households, eliminating the incentive effect of the tax cuts and subjecting more households to the tax. Economists often refer to this as the “take-back effect” of the Bush tax cuts.

As the AMT has expanded, the inequalities created by the structure of the tax have become more apparent. Taxpayers are not allowed to deduct state and local taxes in calculating their AMT liability; as a result, taxpayers who live in states with high income tax rates are up to 7 times more likely to pay the AMT than those who live in states with lower income tax taxes. Similarly, taxpayers are not allowed to deduct personal exemptions in calculating their AMT liability; as a result, taxpayers with large families—and specifically families with 3 or more children—are more likely to pay the AMT than smaller families.

One perceived flaw in the AMT is that it hasn't been changed at the same rate as regular income taxes. The tax cut

passed in 2001 lowered regular tax rates, but did not lower AMT tax rates. As a result, certain middle-class people are affected by the AMT, even though that was not the original intent of the law. People with large deductions, particularly mortgage interest and state income tax deductions, are affected the most. The AMT also has the potential to tax families with large numbers of dependents (usually children), although in recent years, Congress

has acted to keep deductions for dependents, especially children, from triggering the AMT.

Because the AMT is not indexed to inflation and because of recent tax cuts, an increasing number of middle-income taxpayers have been finding themselves subject to this tax. The lack of indexing produces bracket creep. The recent tax cuts in the regular tax have the effect of causing many taxpayers to pay some AMT, reducing or eliminating the benefit from the reduction in regular rates. (In all such cases, however, the overall tax payable will not increase.)

In 2006, the IRS's National Taxpayer Advocate's report highlighted the AMT as the single most serious problem with the tax code. The Advocate noted that the AMT punishes taxpayers for having children or living in a high-tax state and that the complexity of the AMT leads to most taxpayers who owe AMT not realizing it until preparing their returns or being notified by the IRS. A brief issued by the Congressional Budget Office

(CBO) (No. 4, April 15, 2004), concludes:

However, CBO's rules state that it must use current law in its analysis, and at the time the above text was written, the AMT threshold was set to expire in 2006 and be reset to far lower values.

Critics of the AMT argue that various features are flaws, though others defend some of these features:

.

A further criticism is that the AMT does not even affect its intended target. Congress introduced the AMT after it was discovered that 21 millionaire

s did not pay any US income tax in 1969 as a result of various deductions taken on their income tax return

. Since the marginal rate of persons with one million dollars of income is 35% and the AMT uses a 26% or 28% rate on all income

, it is unlikely that millionaires would get tripped by the AMT as their effective tax rates are already higher. Those that do pay by the AMT are typically people making approximately $200k-$500k.

Determining whether one is subject to the AMT can be difficult. According to the IRS's taxpayer advocate, determining whether someone owes the AMT can require reading 9 pages of instructions, and completing a 16 line worksheet and a 55 line form.

The complexity of the AMT paired with the historic last minute, annual patches create a huge uncertainty for taxpayers. For the last ten years, Congress has passed one-year patches to mitigate negative effects, but they are typically passed close to the end of the year. This makes it difficult for taxpayers to determine their tax liability ahead of time. In addition, because the AMT is not indexed for inflation, the cost of annual patches rises every year.

The median

household income in the United States was $44,389 in 2005, and households making over $75,000 per year made up the top quartile

of household incomes. Because those are the households generally required to compute the AMT (though only a fraction currently have to pay), some argue that the AMT still hits only the wealthy or the upper middle class. However, some counties, such as Fairfax County, Virginia

($102,460), and some cities, such as San Jose, California

($76,354), have local median incomes that are considerably higher than the national median, and approach or exceed the typical AMT threshold. The cost-of-living index

is generally higher in such areas, which leads to families who are "middle class" in that area having to pay the AMT, while in poorer locales with lower costs of living, only the "locally wealthy" pay the AMT. In other words, many who pay the AMT have incomes that would place them among the wealthy when considering the United States as a whole, but who think of themselves as "middle class" because of the cost of living in their locale.

As early as the first Tax Reform study in 1984, arguments were made for eliminating the deduction for state and local taxes:

Proponents of eliminating the state and local tax deduction lost out in the 1986 Tax Reform, but they won a concession by eliminating these deductions in the AMT computation. That, coupled with the non-indexation of the AMT, created a slow-motion repeal of the deduction for state and local income taxes.

The AMT's partial disallowance of the foreign tax credit disadvantages even low-paid American citizens and green card holders who work abroad or who are otherwise paid in foreign currency. Particularly as the dollar falls around the world, those working abroad see their incomes (when reported to the IRS in terms of US dollars) sky-rocket even if their actual incomes fall from year to year and even if their foreign tax liabilities increase. They are in effect being taxed solely on changes in exchange rates, from which they do not benefit because their household expenses are all in foreign currency.

A more relevant question is therefore "How do I minimize Tentative Minimum Tax (TMT)?" The simple answer is to have fewer AMT preferences. The biggest of these are normally state income taxes and local real estate taxes. In any given year, if a taxpayer's TMT is substantially greater than his or her regular tax, the taxpayer may want to push the last real estate tax payment or state estimated taxes into the upcoming year. Conversely, if the TMT is much lower than the regular tax, prepayment of state and local taxes may help avoid AMT liability in the following year.

The standard deduction is an AMT tax preference. It is zeroed out when computing TMT. If an AMT liability appears when the standard deduction is claimed, it may decrease or disappear when itemizing deductions, even though the itemized deductions are less than the standard deduction. Even if the AMT liability decreases, the total tax liability might either increase or decrease when changing from the standard deduction to itemized deductions. There is no simple rule to follow when the AMT is involved. The computation must be done both ways to be sure.

Another way to avoid AMT liability is to stay out of the $150,000 to $415,000 income range.

For example, a taxpayer might be better off realizing a $1 million capital gain all in one year rather than dividing it into two or three years.

For taxpayers who owe AMT, charitable deductions and home mortgage interest (but not "hard money" refinancing interest) are especially valuable. They reduce tax liability by the full TMT effective marginal rate of 32.5% or 35% (for those in the AMT exemption phase-out range) plus the full state income tax marginal rate. This may be quite a bit better than under the regular tax.

and Brookings Institution

, have proposed a revenue-neutral, highly progressive replacement for the AMT. They suggest an "option [that] would repeal the AMT and replace it with an add-on tax of four percent of adjusted gross income above $100,000 for singles and $200,000 for couples. The thresholds would be indexed for inflation after 2007." This plan, the authors contend, would share the original goal of the AMT—that is, to ensure a certain level of taxation for high earners.

Other groups advocate repealing the AMT rather than attempting to reform it. One such group, the Cato Institute

, notes that:

The National Taxpayers Union

also supports repeal. "It is wholly unfair for policymakers to promote certain social and fiscal ideas through exemptions, credits, and deductions, only to take these incentives away when a taxpayer takes advantage of them too well."

The Tax Foundation

says that the AMT could be effectively repealed simply by correcting the deficiencies in the regular tax code. Economist Patrick Fleenor argues that "it is usually the unjustifiable limitations on taxable income…that cause the AMT backstop to kick in. If income were taxed comprehensively by the regular tax code, there would be no way of legally avoiding taxation, and not one taxpayer would have to file the AMT form even if the law were still on the books."

Some have proposed abolishing the regular tax and modifying and indexing the AMT. A proposal to the 2005 President's Advisory Panel on Federal Tax Reform advocated increasing the AMT exemption to $100,000 ($50,000 for singles) and indexing it thereafter, applying a flat 25% rate, and allowing appropriate exemptions for income-producing activities, in addition to repeal of the regular tax.

Income tax

An income tax is a tax levied on the income of individuals or businesses . Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate...

imposed by the United States federal government

Federal government of the United States

The federal government of the United States is the national government of the constitutional republic of fifty states that is the United States of America. The federal government comprises three distinct branches of government: a legislative, an executive and a judiciary. These branches and...

on individuals, corporations

Corporation

A corporation is created under the laws of a state as a separate legal entity that has privileges and liabilities that are distinct from those of its members. There are many different forms of corporations, most of which are used to conduct business. Early corporations were established by charter...

, estates

Estate (law)

An estate is the net worth of a person at any point in time. It is the sum of a person's assets - legal rights, interests and entitlements to property of any kind - less all liabilities at that time. The issue is of special legal significance on a question of bankruptcy and death of the person...

, and trusts

Trust law

In common law legal systems, a trust is a relationship whereby property is held by one party for the benefit of another...

. AMT is imposed at a nearly flat rate on an adjusted amount of taxable income above a certain threshold (exemption). This exemption is substantially higher than the exemption from regular income tax. Regular taxable income is adjusted for certain items computed differently for AMT, such as depreciation and medical expenses. No deduction is allowed for state income taxes or miscellaneous itemized deductions in computing AMT income. Taxpayers with incomes above the exemption whose regular Federal income tax is below the amount of AMT must pay the higher AMT amount.

A predecessor Minimum Tax, enacted in 1969, imposed an additional tax on certain tax benefits for certain taxpayers. The present AMT was enacted in 1982 and limits tax benefits from a variety of deductions. The thresholds at which AMT begins to apply are not automatically adjusted for inflation, as are regular tax thresholds, but Congress has made frequent legislative adjustments.

AMT basics

Each year a taxpayer must pay the greater of an Alternative Minimum Tax (AMT) or regular tax. The AMT is a nearly flat tax on taxable incomeTaxable income

Taxable income refers to the base upon which an income tax system imposes tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. The amounts included as income, expenses, and other deductions vary by country or system. Many systems provide that...

as modified for AMT. As with regular Federal income tax, rates and exemptions vary by filing status. The lower rate and the exemption are phased out above certain income levels at 25% of AMT income. A lower rate applies (through 2012) on capital gains (and qualifying dividends). These amounts for 2009 and 2010 are reflected in the following table:

| Status | Single | Married Joint | Married Separate | Trust | Corporation |

| Tax Rate: Low | 26% | 26% | 26% | 26% | 20% |

| Tax Rate: High | 28% | 28% | 28% | 28% | 20% |

| High Rate Starts | $175,000 | $175,000 | $87,500 | $87,500 | n/a |

| Exemption 2009 | $46,700 | $70,950 | $35,475 | $22,500 | $40,000 |

| Exemption 2010 | $47,450 | $72,450 | $36,225 | $22,500 | $40,000 |

| Exemption phase-out starts at | $112,500 | $150,000 | $75,000 | $75,000 | $150,000 |

| Zero 2009 exemption at | $299,300 | $433,800 | $216,900 | $165,000 | $310,000 |

| Zero 2010 exemption at | $302,300 | $439,800 | $219,900 | $165,000 | $310,000 |

| Capital gain rate | 25% | 25% | 25% | 25% | 20% |

In addition, corporations with average annual gross receipts less than $7,500,000 for the prior three years are exempt from AMT, but only so long as they continue to meet this test. Further, a corporation is exempt from AMT during its first year as a corporation. Affiliated corporations are treated as if they were a single corporation for all three exemptions ($40,000, $7.5 million, and first year).

To the extent AMT exceeds regular Federal income tax, a future credit is provided which can offset future regular tax to the extent AMT does not apply in a future year. However, this credit is limited: see further details in the "AMT credit against regular tax" section.

Regular tax used as a basis for computing AMT is found on the following lines of tax return forms: individual Form 1040 Line 44, or corporate Form 1120 Schedule J line 2 less foreign tax credit.

Under the AMT, no deduction is allowed for personal exemptions, nor is the standard deduction. State, local, and foreign taxes are not deductible. However, most other itemized deduction

Itemized deduction

An itemized deduction is an eligible expense that individual taxpayers in the United States can report on their federal income tax returns in order to decrease their taxable income....

s apply at least in part. Significant other adjustments to income and deductions apply.

Individuals must file IRS Form 6251 and corporations must file Form 4626 if they have any net AMT due. The form is also filed to claim the credit for prior year AMT.

Other individual adjustments in computing AMT include:

- Miscellaneous itemized deductions are not allowed. These include all items subject to the 2% "floor", such as employee business expenses, tax preparation fees, etc.

- The home mortgage interest deduction is limited to interest on purchase money mortgages for a first and second residence.

- Medical expenses may be deducted only if they exceed 10% of Adjusted Gross Income, as compared to 7.5% for regular tax.

- Inclusion of the bargain element of an Incentive Stock Option when exercised, regardless of whether the stock can immediately be sold.

Many AMT adjustments apply to businesses operated by individuals or corporations. The adjustments tend to have the effect of deferring certain deductions or recognizing income sooner. These adjustments include:

- Depreciation deductions must be computed using the straight line method and longer lives than may be used for regular tax. (See MACRSMACRSThe Modified Accelerated Cost Recovery System is the current tax depreciation system in the United States. Under this system, the capitalized cost of tangible property is recovered over a specified life by annual deductions for depreciation. The lives are specified broadly in the Internal...

) - Deductions for certain "preferences" are limited. These include deductions related to:

- circulation costs,

- mining costs,

- research and experimentation costs,

- intangible drilling costs, and

- certain amortization.

- Certain income must be recognized earlier, including:

- long term contracts and

- installment sales.

Certain other adjustments apply. Corporations are also subject to an adjustment (up or down) for adjusted current earnings. In addition, a partner or shareholder's share of AMT income and adjustments flow through to the partner or shareholder from the partnership

Partnership

A partnership is an arrangement where parties agree to cooperate to advance their mutual interests.Since humans are social beings, partnerships between individuals, businesses, interest-based organizations, schools, governments, and varied combinations thereof, have always been and remain commonplace...

or S corporation

S Corporation

An S corporation, for United States federal income tax purposes, is a corporation that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code....

.

AMT is reduced by a foreign tax credit

Foreign tax credit

Income tax systems that tax residents on worldwide income generally offer a foreign tax credit to mitigate the potential for double taxation. The credit may also be granted in those systems taxing residents on income that may have been taxed in another jurisdiction...

, limited based on AMT income rather than regular taxable income. Certain specified business tax credits are allowed.

History

A predecessor Minimum Tax was enacted by the Tax Reform Act of 1969Tax Reform Act of 1969

The United States Tax Reform Act of 1969 was a federal tax law signed by president Richard Nixon in 1969. The largest impact of the act was the creation of the Alternative Minimum Tax, which was intended to tax high income earners otherwise exempt from income taxes through various exemptions and...

and went into effect in 1970. Treasury Secretary Joseph Barr prompted the enactment action with an announcement that 155 high-income households had not paid a dime of federal income taxes. The households had taken advantage of so many tax benefits and deductions that reduced their tax liabilities to zero. Congress responded by creating an add-on tax on high-income households, equal to 10% of the sum of tax preferences in excess of $30,000 plus the taxpayer’s regular tax liability.

The explanation of the 1969 Act prepared by Congress's Staff of the Joint Committee on Internal Revenue Taxation described the reason for the AMT as follows:

"The prior treatment imposed no limit on the amount of income which an individual or corporation could exclude from tax as the result of various tax preferences. As a result, there were large variations in the tax burdens placed on individuals or corporations with similar economic incomes, depending upon the size of their preference income. In general, those individual or corporate taxpayers who received the bulk of their income from personal services or manufacturing were taxed at relatively higher tax rates than others. On the other hand, individuals or corporations which received the bulk of their income from such sources as capital gains or were in a position to benefit from net lease arrangements, from accelerated depreciation on real estate, from percentage depletion, or from other tax-preferred activities tended to pay relatively low rates of tax. In fact, many individuals with high incomes who could benefit from these provisions paid lower effective rates of tax than many individuals with modest incomes. In extreme cases, individuals enjoyed large economic incomes without paying any tax at all. This was true for example in the case of 154 returns in 1966 with adjusted gross incomes of $200,000 a year (apart from those with income exclusions which do not show on the returns filed). Similarly, a number of large corporations paid either no tax at all or taxes which represented very low effective rates."

The AMT has undergone several changes since 1969. The most significant of those, according to the Joint Committee on Taxation, occurred under the Reagan

Ronald Reagan

Ronald Wilson Reagan was the 40th President of the United States , the 33rd Governor of California and, prior to that, a radio, film and television actor....

era Tax Equity and Fiscal Responsibility Act of 1982

Tax Equity and Fiscal Responsibility Act of 1982

The Tax Equity and Fiscal Responsibility Act of 1982 , also known as TEFRA, was a United States federal law that rescinded some of the effects of the Kemp-Roth Act passed the year before. As a result of ongoing recession, a short-term fall in tax revenue generated concern over the budget deficit...

. The law changed the AMT from an add-on tax to its current form: a parallel tax system. The current structure of the AMT reflects changes that were made by the 1982 law. Congress made other notable, but less significant, changes to the law in 1978, 1982, 1986, 1990, and 1993.

For years, Congress has passed one-year patches aimed at minimizing the impact of the tax. For the 2007 tax year, a patch was passed on 12/20/2007, but only after the IRS had already designed its forms for 2007. The IRS had to reprogram its forms to accommodate the law change.

While the AMT is not automatically indexed for inflation, the exemption has been increased by Congress several times. In addition, the rate was increased for individuals effective 1991 and 1993, and the tax was limited for capital gains and qualifying dividends in 2003. These are reflected in the following table:

| 1986-1990 | 1991-1992 | 1993-2000 | 2001-2002 | 2003-2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Individual Tax rate | 21% | 24% | 26/28% | 26/28% | 26/28% | 26/28% | 26/28% | 26/28% | 26/28% | 26/28% | 26/28% | 26/28% |

| Married Filing Jointly | 40,000 | 40,000 | 45,000 | 49,000 | 58,000 | 62,550 | 66,250 | 69,950 | 70,950 | 72,450 | 74,450 | 45,000 |

| Single or Head of Household | 30,000 | 30,000 | 33,750 | 35,750 | 40,250 | 42,500 | 44,350 | 46,200 | 46,700 | 47,450 | 48,450 | 33,750 |

The tax rate for corporations has remained 20% and the exemption amount has remained $40,000 since the 1986 changes.

AMT Details

Alternative minimum tax (AMT) is imposed on an alternative, more comprehensive measure of income than regular federal income tax. Conceptually, it is imposed instead of, rather than in addition to, regular tax.AMT is imposed if the tentative minimum tax exceeds the regular tax. Tentative minimum tax is the AMT rate of tax times alternative minimum taxable income less the AMT foreign tax credit. Regular tax is the regular income tax reduced only by the foreign and possessions tax credits. In any year in which regular tax exceeds tentative minimum tax, a credit (AMT Credit) is allowed against regular tax to the extent the taxpayer has paid AMT in any prior year. This credit may not reduce regular tax below the tentative minimum tax.

Alternative minimum taxable income is regular taxable income, plus or minus certain adjustments, plus tax preference items, less the allowable exemption (as phased out).

Taxpayers and rates

Individuals, regular C corporations, estates, and trusts are subject to AMT. Partnerships and S corporations are not taxable themselves, but the items related to computing AMT are "passed through" to their members. Foreign persons are subject to AMT only on their income effectively connected with a U.S. trade or business.The rate of AMT varies by type of taxpayer. Through 2012, individuals, estates, and trusts are subject to the same rate of tax on long term capital gains for regular tax and AMT.

Exemptions

The deduction for personal exemptions is not allowed. Instead, all taxpayers are granted an exemption that is phased out at higher income levels. See above for amounts of this exemption and phase out points. Due to the phase-out of exemptions, the actual marginal tax rate (1.25*26% = 32.5%) is higher for the income above the phase out point. The Married Filing Separately (MFS) phase-out does not stop when the exemption reaches zero, either in 2009 or 2010. This is because the MFS exemption is half of the joint exemption, but the phase-out is the full amount, so for MFS filers the phase-out amount can be up to twice the exemption amount, resulting in a 'negative exemption'. For example, using 2009 figures, a filer with $358,800 of income not only gets zero exemption, but is also taxed on an additional $35,475 that they never actually earned (see "Line 29 — Alternative Minimum Taxable Income" in 2009 Instructions for Form 6251 or "Line 28 — Alternative Minimum Taxable Income" in 2010 Instructions for Form 6251). This prevents a married couple with dissimilar incomes from benefiting by filing separate returns so that the lower earner gets the benefit of some exemption amount that would be phased out if they filed jointly. When filing separately, each spouse in effect not only has their own exemption phased out, but is also taxed on a second exemption too, on the presumption that the other spouse could be claiming that on their own separate MFS return.Small corporations are exempt from AMT. A small corporation is one with average gross receipts for the prior three years of $7.5 million or less. Once a corporation ceases to be a small corporation for AMT, it is never again a small corporation. This limit is applied to all members of an affiliated group as if they were a single corporation.

Depreciation and other adjustments

All taxpayers claiming deductions for depreciation must adjust those deductions in computing AMT income to the amount of deduction allowed for AMT. For AMT purposes, depreciation is computed on most assets under the straight line method using the class life of the asset. When a taxpayer is required to recognize gain or loss on disposal of a depreciable asset (or pollution control facility), the gain or loss must be adjusted to reflect the AMT depreciation amount rather than regular depreciation amounts. This adjustment also applies to additional amounts deducted in the year of acquisition of the assets. For more details on these calculations, see MACRSMACRS

The Modified Accelerated Cost Recovery System is the current tax depreciation system in the United States. Under this system, the capitalized cost of tangible property is recovered over a specified life by annual deductions for depreciation. The lives are specified broadly in the Internal...

.

In addition, corporate taxpayers may be required to make adjustments to depreciation deductions in computing the adjusted current earnings (ACE) adjustment. Such adjustments only apply to assets acquired before 1989.

Adjustments are also required for the following:

- Long term contracts: taxpayers must use the percentage of completion method for AMT.

- Mine exploration and development costs must be capitalized and amortized over 10 years, rather than expensed.

- Certain accelerated deductions related to pollution controls facilities are not allowed.

- The credit allowed for alcohol and biodiesel fuels is included in income.

Adjustments for individuals

Individuals are not allowed certain deductions in computing AMT that are allowed for regular tax. No deduction is allowed for personal exemptions or for the standard deduction. The phase out of itemized deductions does not apply. No deduction is allowed for state, local, or foreign income or property taxes. A recovery of such taxes is excluded from AMTI. No deduction is allowed for most miscellaneous itemized deductions.Medical expenses are deductible for AMT only to the extent they exceed 10% of adjusted gross income (as compared to 7.5% for regular tax).

Interest expense deductions for individuals may be adjusted. Generally, interest paid on debt used to acquire, construct, or improve the individual's principal or second residence is unaffected. This includes interest resulting from refinancing such debt. In addition, investment interest expense is deductible for AMT only to the extent of adjusted net investment income. Other non-business interest is generally not deductible for AMT.

An adjustment is also made for qualified incentive stock options and stock received under employee stock purchase plans. In both cases, the employee must recognize income for AMT purposes on the bargain or compensation element, the employer is granted a deduction for this, and the employee has basis in the shares received.

Circulation and research expenses must be capitalized and amortized.

Adjusted current earnings for corporations

Corporations are required to make an adjustment based on adjusted current earnings (ACE). The adjustment increases or decreases AMTI for 75% of the difference between ACE and AMTI. ACE is AMTI further adjusted for certain items. These include further depreciation adjustments for most assets, adjustments to more closely reflect earnings and profits, cost rather than percentage depletion, LIFO, charitable contributions, and certain other items.Losses

The deduction for net operating losses is adjusted to be based on losses for AMTI.Farm losses are limited for AMT purposes. Passive activity losses are recomputed for AMT purposes based on income and deductions as recomputed for AMT. Certain adjustments apply with respect to farm and passive activity loss rules for insolvent taxpayers.

Tax preferences

All taxpayers must add back tax preference deductions in computing AMTI. Tax preferences include the following amounts of deduction:- percentage depletion in excess of basis,

- the deduction for intangible drilling costs in excess of the amount that would have been allowed if the costs were capitalized and amortized, with adjustments,

- otherwise tax exempt interest on bonds used to finance certain private activities, including mutual fund dividends from such interest,

- certain depreciation on pre-1987 assets,

- 7% of excluded gain on certain small business stock.

Taxpayers may elect an optional 10-year write-off of certain tax preference items in lieu of the preference add-back.

Note that in prior years there were certain other tax preference items relating to provisions now repealed.

Credits

Credits are allowed against AMT for foreign taxes and certain specified business credits.The AMT foreign tax credit limitation is redetermined based on AMTI rather than regular taxable income. Thus, all adjustments and tax preference items above must be applied in computing the AMT foreign tax credit limitation.

AMT credit against regular tax

After a taxpayer has paid AMT, a credit is allowed against regular tax in future years for the amount of AMT. The credit for individuals is generally limited to the amount of AMT generated by deferral items (e.g. exercise of incentive stock options), as opposed to exclusion items (e.g. state and local taxes). This credit is limited so that regular tax is not reduced below AMT for the year. Taxpayers may use a simplified method under which the AMT foreign tax credit limit is computed proportionately to the regular tax foreign tax credit limit. Form 8801 is used to claim this credit.Stock options

The Alternative Minimum Tax may apply to individuals exercising stock options.In the tax year 2000, many taxpayers in Silicon Valley

Silicon Valley

Silicon Valley is a term which refers to the southern part of the San Francisco Bay Area in Northern California in the United States. The region is home to many of the world's largest technology corporations...

were caught unprepared by the AMT due to the sudden decline in technology stock prices. Under AMT rules, for incentive stock options

Incentive stock options

Incentive stock options , are a type of employee stock option that can be granted only to employees and confer a U.S. tax benefit. ISOs are also sometimes referred to as incentive share options or Qualified Stock Options by IRS ....

at the time of exercise, the "bargain element" (the difference between the strike price and fair market value) is treated as an AMT adjustment, e.g. it needs to be added to the AMT calculation even though no ordinary income tax is due at the time of exercise. In contrast, under the regular tax rules capital gains tax

Capital gains tax

A capital gains tax is a tax charged on capital gains, the profit realized on the sale of a non-inventory asset that was purchased at a lower price. The most common capital gains are realized from the sale of stocks, bonds, precious metals and property...

es are not paid until the actual shares of stock are sold. For example, if someone exercised a 10,000 share Nortel

Nortel

Nortel Networks Corporation, formerly known as Northern Telecom Limited and sometimes known simply as Nortel, was a multinational telecommunications equipment manufacturer headquartered in Mississauga, Ontario, Canada...

stock option at $7 when the stock price was at $87, the bargain element

Bargain element

The bargain element phrase is generally used in describing the difference between one price or cost and it's fair market value. For example in the case of stock options, an employee stock option is granted at a specific price, known as the exercise price...

was $80 per share or $800,000. Without selling the stock, the stock price dropped to $7. Although the real gain is $0, the $800,000 bargain element still becomes an AMT adjustment, and the taxpayer owes around $200,000 in AMT.

The AMT was designed to prevent people from using loophole

Loophole

A loophole is a weakness that allows a system to be circumvented.Loophole may also refer to:*Arrowslit, a slit in a castle wall*Loophole , a short science fiction story by Arthur C...

s in the tax law

Tax law

Tax law is the codified system of laws that describes government levies on economic transactions, commonly called taxes.-Major issues:Primary taxation issues facing the governments world over include;* taxes on income and wealth...

to avoid tax. However, the inclusion of unrealized gain on incentive stock options imposes difficulties for people who cannot come up with cash to pay tax on gains that they have not realized yet. As a result, Congress has taken action to modify the AMT regarding incentive stock options. In 2000 and 2001, people exercised incentive stock options and held onto the shares, hoping to pay long-term capital gains taxes instead of short-term capital gains taxes. Many of these people were forced to pay the AMT on this income, and by the end of the year, the stock was no longer worth the amount of AMT tax owed, forcing some individuals into bankruptcy

Bankruptcy

Bankruptcy is a legal status of an insolvent person or an organisation, that is, one that cannot repay the debts owed to creditors. In most jurisdictions bankruptcy is imposed by a court order, often initiated by the debtor....

. In the Nortel example given above, the individual would receive a credit for the AMT paid when the individual did eventually sell the Nortel shares. However, given the way AMT carryover

Carryover

Carryover may refer to:* Carryover basis, in taxation* Carry over cooking* Carryover with steam, in power generation...

amounts are recalculated each year, the eventual credit received is in many cases less than originally paid.

In the Nortel example above, the taxpayer could have avoided problems by selling sufficient stock to cover the AMT liability immediately upon exercising the stock options. However, AMT also applies to stock options in pre-IPO or privately-held companies: in such cases the IRS may regard the stock as having significant value even though there may be no market in which to sell the stock, or the employee may be legally forbidden from selling the stock. In such a case, it may be effectively impossible for the employee to exercise the option unless he or she has enough cash with which to pay the AMT.

Growth of the AMT

Although the AMT was originally enacted to target 155 high-income households, it now affects millions of middle-income families each year. The number of households that pay the tax has increased significantly in the last decade: In 1997, for example, 605,000 taxpayers paid the AMT; by 2008, the number of affected taxpayers jumped to 3.9 million, or about 4% of individual taxpayers. A total of 27% of households that paid the AMT in 2008 had adjusted gross income of $200,000 or less.The primary reason for AMT growth is the fact that the AMT exemption, unlike regular income tax items, is not indexed to inflation. This means that income thresholds do not keep pace with the cost of living. As a result, the tax affects an increasing number of households each year, as workers’ incomes adjust to inflation and surpass AMT eligibility levels. While not indexed for inflation, Congress has often passed short term increases in exemption amounts. The Tax Policy Center (a research group) estimated that if the AMT had been indexed to inflation in 1985, and if the Bush tax cuts

Bush tax cuts

The Bush tax cuts refers to changes to the United States tax code passed during the presidency of George W. Bush and extended during the presidency of Barack Obama that generally lowered tax rates and revised the code specifying taxation in the United States...

had not gone into effect, only 300,000 taxpayers—instead of their projected 27 million—would be subject to the tax in 2010. President Barack Obama included indexing the AMT to inflation in his FY2011 budget proposal, which did not pass. AMT raised $26 Billion of $1,031 Billion total individual income tax in 2008.

Another important reason for the recent expansion of the AMT is the effect of the 2001–2006 Bush tax cuts

Bush tax cuts

The Bush tax cuts refers to changes to the United States tax code passed during the presidency of George W. Bush and extended during the presidency of Barack Obama that generally lowered tax rates and revised the code specifying taxation in the United States...

. The tax cuts decreased marginal tax rates for all income tax brackets without making corresponding changes to AMT rates. The lower tax liabilities triggered AMT eligibility for many households, eliminating the incentive effect of the tax cuts and subjecting more households to the tax. Economists often refer to this as the “take-back effect” of the Bush tax cuts.

As the AMT has expanded, the inequalities created by the structure of the tax have become more apparent. Taxpayers are not allowed to deduct state and local taxes in calculating their AMT liability; as a result, taxpayers who live in states with high income tax rates are up to 7 times more likely to pay the AMT than those who live in states with lower income tax taxes. Similarly, taxpayers are not allowed to deduct personal exemptions in calculating their AMT liability; as a result, taxpayers with large families—and specifically families with 3 or more children—are more likely to pay the AMT than smaller families.

Opinions about AMT

In recent years, the AMT has been under increased attention.One perceived flaw in the AMT is that it hasn't been changed at the same rate as regular income taxes. The tax cut

Tax cut

A tax cut is a reduction in taxes. The immediate effects of a tax cut are a decrease in the real income of the government and an increase in the real income of those whose tax rate has been lowered. Due to the perceived benefit in growing real incomes among tax payers politicians have sought to...

passed in 2001 lowered regular tax rates, but did not lower AMT tax rates. As a result, certain middle-class people are affected by the AMT, even though that was not the original intent of the law. People with large deductions, particularly mortgage interest and state income tax deductions, are affected the most. The AMT also has the potential to tax families with large numbers of dependents (usually children), although in recent years, Congress

United States Congress

The United States Congress is the bicameral legislature of the federal government of the United States, consisting of the Senate and the House of Representatives. The Congress meets in the United States Capitol in Washington, D.C....

has acted to keep deductions for dependents, especially children, from triggering the AMT.

Because the AMT is not indexed to inflation and because of recent tax cuts, an increasing number of middle-income taxpayers have been finding themselves subject to this tax. The lack of indexing produces bracket creep. The recent tax cuts in the regular tax have the effect of causing many taxpayers to pay some AMT, reducing or eliminating the benefit from the reduction in regular rates. (In all such cases, however, the overall tax payable will not increase.)

In 2006, the IRS's National Taxpayer Advocate's report highlighted the AMT as the single most serious problem with the tax code. The Advocate noted that the AMT punishes taxpayers for having children or living in a high-tax state and that the complexity of the AMT leads to most taxpayers who owe AMT not realizing it until preparing their returns or being notified by the IRS. A brief issued by the Congressional Budget Office

Congressional Budget Office

The Congressional Budget Office is a federal agency within the legislative branch of the United States government that provides economic data to Congress....

(CBO) (No. 4, April 15, 2004), concludes:

- "Over the coming decade, a growing number of taxpayers will become liable for the AMT. In 2010, if nothing is changed, one in five taxpayers will have AMT liability and nearly every married taxpayer with income between $100,000 and $500,000 will owe the alternative tax. Rather than affecting only high-income taxpayers who would otherwise pay no tax, the AMT has extended its reach to many upper-middle-income households. As an increasing number of taxpayers incur the AMT, pressures to reduce or eliminate the tax are likely to grow."

However, CBO's rules state that it must use current law in its analysis, and at the time the above text was written, the AMT threshold was set to expire in 2006 and be reset to far lower values.

Critics of the AMT argue that various features are flaws, though others defend some of these features:

- The AMT exemption and AMT exemption phaseout threshold are not indexed for inflationInflationIn economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

so that over time, the real values decline and the fraction of taxpayers subject to the AMT rises. This is known as fiscal dragFiscal dragFiscal drag happens when the government's net fiscal position fails to cover the net savings desires of the private economy, also called the private economy's spending gap...

or bracket creep. - The AMT eliminates state and local tax deductionTax deductionIncome tax systems generally allow a tax deduction, i.e., a reduction of the income subject to tax, for various items, especially expenses incurred to produce income. Often these deductions are subject to limitations or conditions...

s. (Arguments have been produced for and against deducting such taxes. For example, an argument against a deduction is that if taxes are viewed as a payment for government services, they should not be treated differently from other consumption.) - The AMT disallows a portion of the foreign tax creditForeign tax creditIncome tax systems that tax residents on worldwide income generally offer a foreign tax credit to mitigate the potential for double taxation. The credit may also be granted in those systems taxing residents on income that may have been taxed in another jurisdiction...

, creating some degree of double taxation for the more than 8 million American citizens living abroad. Some modest income families owe AMT solely because of currency fluctuations. - Businesses and individuals have to do twice the amount of tax planning when considering whether to sell an asset or start a business. They must first consider whether a particular path of action will increase their regular income tax and then also must calculate if alternative tax will increase.

- Taxes are often owed in the year that an exercise of ISO stock options occurs, even if no stock is sold (which, for private or pre-IPO companies, may be because it is impossible to sell the stock). Although many taxpayers believe that in such a case no actual income exists, the bargain element of the exercise is considered income under the AMT system. In extreme cases, if the stock is private or the value drops, it may be impossible to realize the money the AMT demands.

A further shift, involving many definitional changes and extensive reorganization, occurred with the Tax Reform Act of 1986

"In 1986, when President Ronald Reagan and both parties on Capitol Hill agreed to a major change in the tax system, the law was subtly changed to aim at a wholly different set of deductions, the ones that everyone gets, like the personal exemption, state and local taxes, the standard deduction, certain expenses like union dues and even some medical costs for the seriously ill. At the same time it removed and revised some of the exotic investment deductions. A law for untaxed rich investors was refocused on families who own their homes in high tax states."

Tax Reform Act of 1986

The U.S. Congress passed the Tax Reform Act of 1986 to simplify the income tax code, broaden the tax base and eliminate many tax shelters and other preferences...

.

A further criticism is that the AMT does not even affect its intended target. Congress introduced the AMT after it was discovered that 21 millionaire

Millionaire

A millionaire is an individual whose net worth or wealth is equal to or exceeds one million units of currency. It can also be a person who owns one million units of currency in a bank account or savings account...

s did not pay any US income tax in 1969 as a result of various deductions taken on their income tax return

Tax return

A tax return is a tax form that can be filed with a government body to declare liability for taxation in various countries:* Tax return * Tax return * Tax return * Tax return...

. Since the marginal rate of persons with one million dollars of income is 35% and the AMT uses a 26% or 28% rate on all income

Income

Income is the consumption and savings opportunity gained by an entity within a specified time frame, which is generally expressed in monetary terms. However, for households and individuals, "income is the sum of all the wages, salaries, profits, interests payments, rents and other forms of earnings...

, it is unlikely that millionaires would get tripped by the AMT as their effective tax rates are already higher. Those that do pay by the AMT are typically people making approximately $200k-$500k.

Determining whether one is subject to the AMT can be difficult. According to the IRS's taxpayer advocate, determining whether someone owes the AMT can require reading 9 pages of instructions, and completing a 16 line worksheet and a 55 line form.

Complexity

The AMT is a tax of roughly 28% on adjusted gross income over $175,000 plus 26% of amounts less than $175,000 minus an exemption depending on filing status after adding back in most deductions. However, taxpayers must also perform all of the paperwork for a regular tax return and then all of the paperwork for Form 6251. Furthermore, affected taxpayers may have to calculate AMT versions of all carryforwards since the AMT carryforwards may be different than regular tax carryforwards. Once a taxpayer qualifies for AMT, he or she may have to calculate AMT versions of carryforward losses and AMT carryforward credits until they are used up in future years. The definitions of taxable income, deductible expenses, and exemptions differ on Form 6251 from those on Form 1040.The complexity of the AMT paired with the historic last minute, annual patches create a huge uncertainty for taxpayers. For the last ten years, Congress has passed one-year patches to mitigate negative effects, but they are typically passed close to the end of the year. This makes it difficult for taxpayers to determine their tax liability ahead of time. In addition, because the AMT is not indexed for inflation, the cost of annual patches rises every year.

Taxpayer incomes

The AMT's lack of indexation is widely conceded across the political spectrum as a flaw. In 2005, the Urban-Brookings Tax Policy Center and the US Treasury Department estimated that around 15% of households with incomes between $75,000 and $100,000 must pay the AMT, up from only 2-3% in 2000, with the percentage increasing at high incomes. That percentage is set to increase quickly over the coming years if no change is made such as indexing for inflation. Currently, households with incomes below $75,000 are subject to the AMT only very rarely (and thus most tax advisors do not recommend computing AMT for such households). That is set to change in only a few years, however, if the AMT remains unindexed.The median

Median

In probability theory and statistics, a median is described as the numerical value separating the higher half of a sample, a population, or a probability distribution, from the lower half. The median of a finite list of numbers can be found by arranging all the observations from lowest value to...

household income in the United States was $44,389 in 2005, and households making over $75,000 per year made up the top quartile

Quartile

In descriptive statistics, the quartiles of a set of values are the three points that divide the data set into four equal groups, each representing a fourth of the population being sampled...

of household incomes. Because those are the households generally required to compute the AMT (though only a fraction currently have to pay), some argue that the AMT still hits only the wealthy or the upper middle class. However, some counties, such as Fairfax County, Virginia

Fairfax County, Virginia

Fairfax County is a county in Virginia, in the United States. Per the 2010 Census, the population of the county is 1,081,726, making it the most populous jurisdiction in the Commonwealth of Virginia, with 13.5% of Virginia's population...

($102,460), and some cities, such as San Jose, California

San Jose, California

San Jose is the third-largest city in California, the tenth-largest in the U.S., and the county seat of Santa Clara County which is located at the southern end of San Francisco Bay...

($76,354), have local median incomes that are considerably higher than the national median, and approach or exceed the typical AMT threshold. The cost-of-living index

Cost-of-living index

Cost of living is the cost of maintaining a certain standard of living. Changes in the cost of living over time are often operationalized in a cost of living index. Cost of living calculations are also used to compare the cost of maintaining a certain standard of living in different geographic areas...

is generally higher in such areas, which leads to families who are "middle class" in that area having to pay the AMT, while in poorer locales with lower costs of living, only the "locally wealthy" pay the AMT. In other words, many who pay the AMT have incomes that would place them among the wealthy when considering the United States as a whole, but who think of themselves as "middle class" because of the cost of living in their locale.

As early as the first Tax Reform study in 1984, arguments were made for eliminating the deduction for state and local taxes:

"The current deduction for State and local taxes in effect provides a Federal subsidy for the public services provided by State and local governments, such as public education, road construction and repair, and sanitary services. When taxpayers acquire similar services by private purchase (for example, when taxpayers pay for water or sewer services), no deduction is allowed for the expenditure. Allowing a deduction for State and local taxes simply permits taxpayers to finance personal consumption expenditures with pre-tax dollars."

Proponents of eliminating the state and local tax deduction lost out in the 1986 Tax Reform, but they won a concession by eliminating these deductions in the AMT computation. That, coupled with the non-indexation of the AMT, created a slow-motion repeal of the deduction for state and local income taxes.

The AMT's partial disallowance of the foreign tax credit disadvantages even low-paid American citizens and green card holders who work abroad or who are otherwise paid in foreign currency. Particularly as the dollar falls around the world, those working abroad see their incomes (when reported to the IRS in terms of US dollars) sky-rocket even if their actual incomes fall from year to year and even if their foreign tax liabilities increase. They are in effect being taxed solely on changes in exchange rates, from which they do not benefit because their household expenses are all in foreign currency.

Avoiding AMT

For many taxpayers, the common question is, "How do I avoid AMT"? The first step in answering this question is to recognize that AMT is not a simple add-on tax that is calculated independently of other taxes on the return. Some strategies that reduce or eliminate AMT do so by increasing the regular tax, and so do not reduce the taxpayer's overall tax liability.A more relevant question is therefore "How do I minimize Tentative Minimum Tax (TMT)?" The simple answer is to have fewer AMT preferences. The biggest of these are normally state income taxes and local real estate taxes. In any given year, if a taxpayer's TMT is substantially greater than his or her regular tax, the taxpayer may want to push the last real estate tax payment or state estimated taxes into the upcoming year. Conversely, if the TMT is much lower than the regular tax, prepayment of state and local taxes may help avoid AMT liability in the following year.

The standard deduction is an AMT tax preference. It is zeroed out when computing TMT. If an AMT liability appears when the standard deduction is claimed, it may decrease or disappear when itemizing deductions, even though the itemized deductions are less than the standard deduction. Even if the AMT liability decreases, the total tax liability might either increase or decrease when changing from the standard deduction to itemized deductions. There is no simple rule to follow when the AMT is involved. The computation must be done both ways to be sure.

Another way to avoid AMT liability is to stay out of the $150,000 to $415,000 income range.

For example, a taxpayer might be better off realizing a $1 million capital gain all in one year rather than dividing it into two or three years.

For taxpayers who owe AMT, charitable deductions and home mortgage interest (but not "hard money" refinancing interest) are especially valuable. They reduce tax liability by the full TMT effective marginal rate of 32.5% or 35% (for those in the AMT exemption phase-out range) plus the full state income tax marginal rate. This may be quite a bit better than under the regular tax.

Arguments against repealing the AMT

While many parties agree that the AMT needs to be changed, some argue against its outright repeal.- More than half of the AMT is paid by those having current annual income between $150,000 and $200,000.

- The AMT could be amended so as to have little or no effect on those with lower incomes.

- The reduction in tax revenues from repeal is relatively large. The loss is expected to be between $800 billion and $1.5 trillion in federal revenues over 10 years. According to the Washington Post, "By 2008, it would cost the Treasury considerably less to repeal the ordinary income tax system than the alternative minimum tax, according to the Tax Policy Center, jointly run by the Brookings InstitutionBrookings InstitutionThe Brookings Institution is a nonprofit public policy organization based in Washington, D.C., in the United States. One of Washington's oldest think tanks, Brookings conducts research and education in the social sciences, primarily in economics, metropolitan policy, governance, foreign policy, and...

and Urban InstituteUrban InstituteThe Urban Institute is a Washington, D.C.-based think tank that carries out nonpartisan economic and social policy research, collects data, evaluates social programs, educates the public on key domestic issues, and provides advice and technical assistance to developing governments abroad...

." In 2007, an analysis in the New York Times claimed that; (1) Annual cost of repealing the AMT, and maintaining the regular income tax, would be $70 billion, while (2) Annual cost of making everyone pay the AMT, and repealing the regular income tax, would be the lesser amount of $63 billion.

AMT reform

Policy analysts are divided over the best way to address the criticisms of the AMT. Len Burman and Greg Leiserson of The Tax Policy Center, a joint program of the Urban InstituteUrban Institute

The Urban Institute is a Washington, D.C.-based think tank that carries out nonpartisan economic and social policy research, collects data, evaluates social programs, educates the public on key domestic issues, and provides advice and technical assistance to developing governments abroad...

and Brookings Institution

Brookings Institution

The Brookings Institution is a nonprofit public policy organization based in Washington, D.C., in the United States. One of Washington's oldest think tanks, Brookings conducts research and education in the social sciences, primarily in economics, metropolitan policy, governance, foreign policy, and...

, have proposed a revenue-neutral, highly progressive replacement for the AMT. They suggest an "option [that] would repeal the AMT and replace it with an add-on tax of four percent of adjusted gross income above $100,000 for singles and $200,000 for couples. The thresholds would be indexed for inflation after 2007." This plan, the authors contend, would share the original goal of the AMT—that is, to ensure a certain level of taxation for high earners.

Other groups advocate repealing the AMT rather than attempting to reform it. One such group, the Cato Institute

Cato Institute

The Cato Institute is a libertarian think tank headquartered in Washington, D.C. It was founded in 1977 by Edward H. Crane, who remains president and CEO, and Charles Koch, chairman of the board and chief executive officer of the conglomerate Koch Industries, Inc., the largest privately held...

, notes that:

- Many tax loopholes the AMT was designed to address have since been closed;

- The AMT is needlessly complex and burdensome to taxpayers;

- A full repeal would leave Federal revenues as a fraction of GDP at about 18%, its average value in recent decades.

The National Taxpayers Union

National Taxpayers Union

National Taxpayers Union is a taxpayers advocacy organization and taxpayers union in the United States, founded in 1969 by James Dale Davidson. NTU advertises that it is the largest and oldest grassroots taxpayer organization in the nation, with 362,000 members nationwide. It is closely...

also supports repeal. "It is wholly unfair for policymakers to promote certain social and fiscal ideas through exemptions, credits, and deductions, only to take these incentives away when a taxpayer takes advantage of them too well."

The Tax Foundation

Tax Foundation

The Tax Foundation is a Washington, D.C.-based think tank founded in 1937 that collects data and publishes research studies on tax policies at the federal and state levels. The organization is broken into three primary areas of research which are the Center for Federal Fiscal Policy, The and the...

says that the AMT could be effectively repealed simply by correcting the deficiencies in the regular tax code. Economist Patrick Fleenor argues that "it is usually the unjustifiable limitations on taxable income…that cause the AMT backstop to kick in. If income were taxed comprehensively by the regular tax code, there would be no way of legally avoiding taxation, and not one taxpayer would have to file the AMT form even if the law were still on the books."

Some have proposed abolishing the regular tax and modifying and indexing the AMT. A proposal to the 2005 President's Advisory Panel on Federal Tax Reform advocated increasing the AMT exemption to $100,000 ($50,000 for singles) and indexing it thereafter, applying a flat 25% rate, and allowing appropriate exemptions for income-producing activities, in addition to repeal of the regular tax.

Further reading

Standard tax texts- Willis, Eugene, Hoffman, William H. Jr., et al, South-Western Federal Taxation, published annually (cited as Willis & Hoffman). 2009 edition included ISBN 978-0-324-66060-0 (student) and ISBN 978-0-324-66208-5 (instructor).

- Pratt, James W., Kulsrud, William N., et al, Federal Taxation, updated periodically (cited as Pratt & Kulsrud). 2010 edition ISBN 978-1424069866.

Software

- IRS: AMT Assistant for Individuals (online software)