Debit card

Encyclopedia

A debit card is a plastic card that provides the cardholder electronic access to his or her bank account

/s at a financial institution. Some cards have a stored value with which a payment is made, while most relay a message to the cardholder's bank to withdraw funds from a designated account in favor of the payee's designated bank account. The card can be used as an alternative payment method to cash

when making purchases. In some cases, the cards are designed exclusively for use on the Internet, and so there is no physical card.

In many countries the use of debit cards has become so widespread that their volume of use has overtaken or entirely replaced the check

and, in some instances, cash transactions. Like credit card

s, debit cards are used widely for telephone and Internet purchases.

However, unlike credit cards, the funds paid using a debit card are transferred immediately from the bearer's bank account, instead of having the bearer pay back the money at a later date.

Debit cards usually also allow for instant withdrawal of cash, acting as the ATM card

for withdrawing cash and as a check guarantee card. Merchants may also offer cashback

facilities to customers, where a customer can withdraw cash along with their purchase.

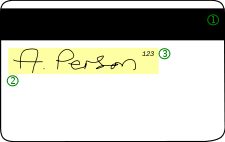

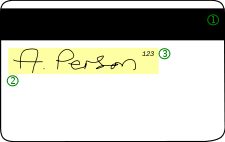

There are currently three ways that debit card transactions are processed: online debit (also known as PIN debit), offline debit (also known as signature debit) and the Electronic Purse Card System. One physical card can include the functions of an online debit card, an offline debit card and an electronic purse card.

There are currently three ways that debit card transactions are processed: online debit (also known as PIN debit), offline debit (also known as signature debit) and the Electronic Purse Card System. One physical card can include the functions of an online debit card, an offline debit card and an electronic purse card.

Although many debit cards are of the Visa

or MasterCard

brand, there are many other types of debit card, each accepted only within a particular country or region, for example Switch

(now: Maestro) and Solo

in the United Kingdom

, Interac

in Canada

, Carte Bleue

in France

, Laser

in Ireland

, "EC electronic cash" (formerly Eurocheque

) in Germany

, UnionPay in China

and EFTPOS

cards in Australia and New Zealand. The need for cross-border compatibility and the advent of the euro

recently led to many of these card networks (such as Switzerland

's "EC direkt", Austria

's "Bankomatkasse" and Switch

in the United Kingdom

) being re-branded with the internationally recognised Maestro

logo, which is part of the MasterCard

brand. Some debit cards are dual branded with the logo of the (former) national card as well as Maestro

(for example, EC cards in Germany, Laser cards in Ireland, Switch and Solo in the UK, Pinpas cards in the Netherlands, Bancontact cards in Belgium, etc.). The use of a debit card system allows operators to package their product more effectively while monitoring customer spending. An example of one of these systems is ECS by Embed International

.

(PIN) authentication

system and some online cards require such authentication for every transaction, essentially becoming enhanced automatic teller machine (ATM) cards

. One difficulty in using online debit cards is the necessity of an electronic authorization device at the point of sale

(POS) and sometimes also a separate PINpad

to enter the PIN, although this is becoming commonplace for all card transactions in many countries. Overall, the online debit card is generally viewed as superior to the offline debit card because of its more secure authentication system and live status, which alleviates problems with processing lag

on transactions that may only issue online debit cards. Some on-line debit systems are using the normal authentication processes of Internet banking to provide real-time on-line debit transactions. The most notable of these are Ideal and POLl.

s of major credit cards (for example, Visa

or MasterCard

) or major debit cards (for example, Maestro

in the United Kingdom

and other countries, but not the United States

) and are used at the point of sale

like a credit card (with payer's signature). This type of debit card may be subject to a daily limit, and/or a maximum limit equal to the current/checking account balance from which it draws funds. Transactions conducted with offline debit cards require 2–3 days to be reflected on users’ account balances.

In some countries and with some banks and merchant service organizations, a "credit" or offline debit transaction is without cost to the purchaser beyond the face value of the transaction, while a fee may be charged for a "debit" or online debit transaction (although it is often absorbed by the retailer). Other differences are that online debit purchasers may opt to withdraw cash in addition to the amount of the debit purchase (if the merchant supports that functionality); also, from the merchant's standpoint, the merchant pays lower fees on online debit transaction as compared to "credit" (offline) debit transaction.

), Austria (Quick Wertkarte

), the Netherlands (Chipknip), Belgium (Proton

), Switzerland (CASH) and France (Mon€o

, which is usually carried by a debit card). In Austria and Germany, all current bank cards now include electronic purses.

people, an umbrella term used to describe diverse groups of individuals who do not use banks or credit unions for their financial transactions.

The advantages of prepaid debit cards include being safer than carry cash, worldwide functionality due to Visa and MasterCard

merchant acceptance, not having to worry about paying a credit card bill or going into debt, the ability for anyone over the age of 18 to apply and be accepted without regard to credit quality and the ability to direct deposit paychecks and government benefits onto the card for free.

Some of the first companies to enter this market were MiCash, RushCard and Netspend who gained high market share as a result of being first to market. However, in the past few years there have been several new providers that carry a number of other benefits, such as money remittance service, card-to-card transfers and the ability to apply without a social security number. An example of two of these providers are Goyow, a company based in New York who has grown substantially in the past 2 years as a result of their unique features and low fees. The other one is TransCash, a company based in California that came up with the only dual Visa

prepaid debit card product with the 2 cards inside the pack. The unique feature of the product is the fact that it comes with 2 separate accounts and not a shared balance.

Advantages of debit cards

Disadvantages of debit cards

In some countries, like India and Sweden, the consumer protection is the same regardless of the network used. Some banks set minimum and maximum purchase sizes, mostly for online-only cards. However, this has nothing to do with the card networks, but rather with the bank's judgement of the person's age and credit records. Any fees that the customers have to pay to the bank are the same regardless of whether the transaction is conducted as a credit or as a debit transaction, so there is no advantage for the customers to choose one transaction mode over another. Shops may add surcharges to the price of the goods or services in accordance with laws allowing them to do so. Banks consider the purchases as having been made at the moment when the card was swiped, regardless of when the purchase settlement was made. Regardless of which transaction type was used, the purchase may result in an overdraft because the money is considered to have left the account at the moment of the card swiping.

d workers to send money home to their families holding an affiliated debit card.

on the customer's account; funds are not actually withdrawn until the transaction is reconciled and hard-posted to the customer's account, usually a few days later. However, the previous sentence applies to all kinds of transaction types, at least when using a card issued by a European bank. This is in contrast to a typical credit card transaction; though it can also have a lag time of a few days before the transaction is posted to the account, it can be many days to a month or more before the consumer makes repayment with actual money.

Because of this, in the case of a benign or malicious error by the merchant or bank, a debit transaction may cause more serious problems (for example, money not accessible; overdrawn account) than in the case of a credit card transaction (for example, credit not accessible; over credit limit

). This is especially true in the United States

, where check fraud is a crime in every state, but exceeding your credit limit is not.

offers the customer to use an online-only Maestro card if the customer enters a Dutch address of residence, but not if the same customer enters a Swedish address of residence.

Internet purchases use neither a PIN code nor a signature for identification. Transactions may be conducted in either credit or debit mode (which is sometimes, but not always, indicated on the receipt), and this has nothing to do with whether the transaction was conducted on online or offline mode, since both credit and debit transactions may be conducted in both modes.

, banking industry spokesperson and lobbyist, contended that "current technology makes real-time notification of overdrafts cost-prohibitive." The article contended that "financial institutions don't want to change the status quo because they make good and easy money off their own customers' mistakes and irresponsibility."

On the other hand, prevention to keep consumers from debt has been a great relief to many consumers who are irresponsible and lack the necessary budgeting skills. Instead of taking away from others blindfolded, prepaid debit cards will disallow consumers from not spending what they do not have and encourage better habits with money management. To a great extent, prevention from such fees is helpful, trustworthy, and provides great relief to many that do not have to worry about any financial loss.

on the sale, making the transaction uneconomic for the retailer.

are called different names depending on the issuing bank: Commonwealth Bank of Australia: Keycard; Westpac Banking Corporation

: Handycard; National Australia Bank

: FlexiCard; ANZ Bank

: Access card; Bendigo Bank

: Cashcard.

EFTPOS is very popular in Australia and has been operating there since the 1980s. EFTPOS-enabled cards are accepted at almost all swipe terminals able to accept credit card

s, regardless of the bank that issued the card, including Maestro

cards issued by foreign banks, with most businesses accepting them, with 450,000 point of sale terminals.

EFTPOS cards can also be used to deposit and withdraw cash over the counter at Australia Post

outlets participating in giroPost, just as if the transaction was conducted at a bank branch, even if the bank branch is closed. Electronic transactions in Australia are generally processed via the Telstra Argent and Optus Transact Plus network - which has recently superseded the old Transcend network in the last few years. Most early keycards were only usable for EFTPOS and at ATM or bank branches, whilst the new debit card system works in the same ways a credit card, except it will only use funds in the specified bank account. This means that, among other advantages, the new system is suitable for electronic purchases without a delay of 2 to 4 days for bank-to-bank money transfers.

Australia operates both electronic credit card transaction authorization and traditional EFTPOS debit card authorization systems, the difference between the two being that EFTPOS transactions are authorized by a personal identification number (PIN) while credit card transactions are usually authorized by the printing and signing of a receipt, however in recent years card holders have been encouraged to enter their pin for added security on credit card purchases, negating the need to sign the receipt. If the user fails to enter the correct pin 3 times, the consequences range from the card being locked out for a minimum 24 hour period, a phone call or trip to the branch to reactivate with a new PIN, the card being cut up by the merchant, or in the case of an ATM, being kept inside the machine, both of which require a new card to be ordered.

Generally credit card transaction costs are borne by the merchant with no fee applied to the end user while EFTPOS transactions cost the consumer an applicable withdrawal fee charged by their bank.

The introduction of Visa and MasterCard

debit cards along with regulation in the settlement fees charged by the operators of both EFTPOS and credit cards by the Reserve Bank has seen a continuation in the increasing ubiquity of credit card use among Australians and a general decline in the profile of EFTPOS. However, the regulation of settlement fees also removed the ability of banks, who typically provide merchant services to retailers on behalf of Visa, MasterCard or Bankcard, from stopping those retailers charging extra fees to take payment by credit card instead of cash or EFTPOS. Though only a few operators with strong market power have done so, the passing on of fees charged for credit card transactions may result in an increased use of EFTPOS.

has a nation-wide EFTPOS system, called Interac Direct Payment

. Since being introduced in 1994, IDP has become the most popular payment method in the country. Previously, debit cards have been in use for ABM usage since the late 1970s, with Credit Unions in Saskatchewan and Alberta, Canada introducing the first card-based, networked ATMs beginning in June, 1977. Debit Cards, which could be used anywhere a credit card was accepted, were first introduced in Canada by Saskatchewan Credit Unions in 1982. In the early 1990s, pilot projects were conducted among Canada's six largest banks to gauge security, accuracy and feasibility of the Interac system. Slowly in the later half of the 1990s, it was estimated that approximately 50% of retailers offered Interac as a source of payment. Retailers, many small transaction retailers like coffee shops, resisted offering IDP to promote faster service. In 2009, 99% of retailers offer IDP as an alternative payment form.

In Canada, the debit card is sometimes referred to as a "bank card". It is a client card issued by a bank that provides access to funds and other bank account transactions, such as transferring funds, checking balances, paying bills, etc., as well as point of purchase transactions connected on the Interac

network. Since its national launch in 1994, Interac Direct Payment has become so widespread that, as of 2001, more transactions in Canada were completed using debit cards than cash. This popularity may be partially attributable to two main factors: the convenience of not having to carry cash, and the availability of automated bank machines (ABMs) and Direct Payment merchants on the network.

Debit cards may be considered similar to stored-value card

s in that they represent a finite amount of money owed by the card issuer to the holder. They are different in that stored-value cards are generally anonymous and are only usable at the issuer, while debit cards are generally associated with an individual's bank account and can be used anywhere on the Interac

network.

In Canada, the bank cards can be used at POS and ABMs. Interac Online has also been introduced in recent years allowing clients of most major Canadian banks to use their debit cards for online payment with certain merchants as well. Certain financial institutions also allow their clients to use their debit cards in the United States on the NYCE network.

(FCAC), which investigates consumer complaints.

According to the FCAC website, revisions to the Code that came into effect in 2005 put the onus on the financial institution to prove that a consumer was responsible for a disputed transaction, and also place a limit on the number of days that an account can be frozen during the financial institution's investigation of a transaction.

has an EFTPOS system called Redcompra (Purchase Network) which is currently used in at least 23,000 establishments throughout the country. Goods may be purchased using this system at most supermarkets, retail stores, pubs and restaurants in major urban centers.

has a system called Redeban-Multicolor and Credibanco Visa which are currently used in at least 23,000 establishments throughout the country. Goods may be purchased using this system at most supermarkets, retail stores, pubs and restaurants in major urban centers. Colombian debit cards are Maestro (pin), Visa Electron (pin), Visa Debit (as Credit) and MasterCard-Debit (as Credit).

was introduced on 1 September 1983, and despite the initial transactions being paper-based, the Dankort quickly won widespread acceptance in Denmark

. By 1985 the first EFTPOS

terminals were introduced, and 1985 was also the year when the number of Dankort transactions first exceeded 1 million.

It is not uncommon that Dankort is the only card accepted at smaller stores, thus making it harder for tourists to travel without cash.

Miscellaneous facts & numbers

Banks in France charge annual fees for debit cards (despite card payments being very cost efficient for the banks), yet they do not charge personal customers for checkbooks or processing checks (despite checks being very costly for the banks). This imbalance most probably dates from the unilateral introduction in France of Chip and PIN

debit cards in the early 1990s, when the cost of this technology was much higher than it is now. Credit cards of the type found in the United Kingdom and United States

are unusual in France and the closest equivalent is the deferred debit card, which operates like a normal debit card, except that all purchase transactions are postponed until the end of the month, thereby giving the customer between 1 and 31 days of interest-free credit. The annual fee for a deferred debit card is around €10 more than for one with immediate debit. Most France debit cards are branded with the Carte Bleue

logo, which assures acceptance throughout France. Most card holders choose to pay around €5 more in their annual fee to additionally have a Visa

or a MasterCard logo on their Carte Bleue

, so that the card is accepted internationally. A Carte Bleue

without a Visa

or a MasterCard logo is often known as a "Carte Bleue

Nationale" and a Carte Bleue

with a Visa

or a MasterCard logo is known as a "Carte Bleue

Internationale", or more frequently, simply called a "Visa" or "MasterCard". Many smaller merchants in France refuse to accept debit cards for transactions under a certain amount because of the minimum fee charged by merchants' banks per transaction (this minimum amount varies from €5 to €15.25, or in some rare cases even more). But more and more merchants accept debit cards for small amounts, due to the massive daily use of debit card nowadays. Merchants in France do not differentiate between debit and credit cards, and so both have equal acceptance. It is legal in France to set a minimum amount to transactions but the merchants must display it clearly.

for years. Facilities already existed before EFTPOS became popular with the Eurocheque

card, an authorization system initially developed for paper checks

where, in addition to signing the actual check, customers also needed to show the card alongside the check as a security measure. Those cards could also be used at ATMs and for card-based electronic funds transfer

(called Girocard

) with PIN entry. These are now the only functions of such cards: the Eurocheque system (along with the brand) was abandoned in 2002 during the transition from the Deutsche Mark to the euro

. As of 2005, most stores and petrol outlets have EFTPOS facilities. Processing fees are paid by the businesses, which leads to some business owners refusing debit card payments for sales totalling less than a certain amount, usually 5 or 10 euro.

To avoid the processing fees, many businesses resorted to using direct debit

, which is then called electronic direct debit . The point-of-sale terminal reads the bank sort code and account number from the card but instead of handling the transaction through the Girocard network it simply prints a form, which the customer signs to authorise the debit note. However, this method also avoids any verification or payment guarantee provided by the network. Further, customers can return debit notes by notifying their bank without giving a reason. This means that the beneficiary bears the risk of fraud and illiquidity. Some business mitigate the risk by consulting a proprietary blacklist

or by switching to Girocard for higher transaction amounts.

Around 2000, an Electronic Purse Card was introduced, dubbed Geldkarte

("money card"). It makes use of the smart card

chip on the front of the standard issue debit card. This chip can be charged with up to 200 euro, and is advertised as a means of making medium to very small payments, even down to several euros or cent payments. The key factor here is that no processing fees are deducted by banks. It did not gain the popularity its inventors had hoped for. However, this could change as this chip is now used as means of age verification at cigarette vending machines, which has been mandatory since January 2007. Furthermore, some payment discounts are being offered (e.g. a 10% reduction for public transport fares) when paying with "Geldkarte". The "Geldkarte" payment lacks all security measures, since it does not require the user to enter a PIN or sign a sales slip: the loss of a "Geldkarte" is similar to the loss of a wallet or purse - anyone who finds it can then use their find to pay for their own purchases.

is EPS

. Bank customers can use their ATM card to make an instant EPS payment, much like a debit card. Most banks in Hong Kong provide ATM cards with EPS capability.

Only one bank at this time offers a Visa card as a debit card in Hong Kong. Hang Seng's Bank's Enjoy card is the only one. It is linked to a person's or company's savings or checking account and funds can be moved upon request or on a regularly scheduled basis to cover the charges that are incurred, whether in person or on-line. Overdraft privileges are not permitted at this time. The reason for the limited use is the virtual monopoly of the EPS Corporation which us co-owned by 21 major banks. Unfortunately, EPS is not useable on-line or overseas as a debit card (with limited exceptions, i.e. PLUS network POS transactions).

debit cards are far more common and popular than credit cards. Many Hungarians even refer to their debit card ("betéti kártya") mistakenly using the word for credit card ("hitelkártya").

as the merchant is charged for each transaction. The debit card therefore is mostly used for ATM

transactions. Most of the banks issue VISA debit cards, while some banks (like SBI

and Citibank India

) issue Maestro

cards. The debit card transactions are routed through the VISA or MasterCard

networks rather than directly via the issuing bank.

The National Payments Corporation of India

(NPCI) is introducing a payment network and debit card dubbed 'India card'. The Reserve Bank of India

is expecting this system will gradually replace the overseas run networks from Visa and MaterCard for Indian ATM, debit and credit card services.

The National Payments Corporation of India

(NPCI) has formally decided the name and logo of this new international payment gateway. The new name is being called RuPay

.

and Rasheed Bank

, together with the Iraqi Electronic Payment System (IEPS) have established a company called International Smart Card, which have developed a national credit card called 'Qi Card

'. The card is issued since 2008. According to the company's website: 'after less than two years of the initial launch of the Qi card solution, we have hit 1.6 million cardholder with the potential to issue 2 million cards by the end of 2010, issuing about 100,000 card monthly is a testament to the huge success of the Qi card solution. Parallel to this will be the expansion into retail stores through a network of points of sales of about 30,000 units by 2015'

people usually use their , originally intended only for use with cash machines, as debit cards. The debit functionality of these cards is usually referred to as , and only cash cards from certain banks can be used. A cash card has the same size as a VISA/MasterCard. As identification, the user will have to enter his or her four-digit PIN when paying. J-Debit was started in Japan on March 6, 2000.

Suruga Bank began service of Japan's first Visa Debit

in 2006. Ebank will start service of Visa Debit by the end of 2007.

using EFTPOS

is known as pinnen (pinning), a term derived from the use of a Personal Identification Number

. PINs are also used for ATM

transactions, and the term is used interchangeably by many people, although it was introduced as a marketing brand for EFTPOS. The system was launched in 1987, and in 2010 there were 258,585 terminals throughout the country, including mobile terminals used by delivery services and on markets. All banks offer a debit card suitable for EFTPOS with current accounts.

PIN transactions are usually free to the customer, but the retailer is charged per-transaction and monthly fees. Equens, an association with all major banks as its members, runs the system, and until August 2005 also charged for it. Responding to allegations of monopoly abuse, it has handed over contractual responsibilities to its member banks, who now offer competing contracts. Interpay, a legal predecessor of Equens, was fined €47 million in 2004, but the fine was later dropped, and a related fine for banks was lowered from €17 million to €14 million. Per-transaction fees are between 5-10 eurocents, depending on volume.

Credit cards use in the Netherlands is very low, and most credit cards cannot be used with EFTPOS, or charge very high fees to the customer. Debit cards can often, though not always, be used in the entire EU for EFTPOS. Most debit cards are Maestro

cards.

Electronic Purse Cards (called Chipknip) were introduced in 1996, but have never become very popular.

(electronic fund transfer at point of sale

) in New Zealand is highly popular. In 2006, 70 percent of all retail transactions were made by eftpos, with an average of 306 EFTPOS transaction being made per person. At the same time, there were 125,000 EFTPOS terminals in operation (one for every 30 people), and 5.1 million EFTPOS cards in circulation (1.27 per capita).

The system involves the merchant swiping (or inserting) the customer's card and entering the purchase amount. Point of sale systems with integrated EFTPOS often sent the purchase total to the terminal and the customer swipes their own card. The customer then selects the account they wish to use: Current/Cheque (CHQ), Savings (SAV), or Credit Card (CRD), before entering in their PIN. After a short processing time in which the terminal contacts the EFTPOS network and the bank, the transaction is accepted (or declined) and a receipt is printed. The EFTPOS system is used for credit cards as well, with a customer selecting Credit Card and entering their PIN, or for older credit cards without loaded PIN, pressing OK and signing their receipt with identification through matching signatures. Larger businesses connect to the EFTPOS network by dedicated phone lines or more recently internet protocol

connections. Most smaller businesses however have their EFTPOS terminals communicate through their regular voice line, often resulting in shouts for people to get off the phone or "Declined Transmission Error" transactions when the merchant forgets someone is on the phone.

Virtually all retail outlets have EFTPOS facilities, so much that retailers without EFTPOS have to advertise so. In addition, an increasing number of mobile operator, such as taxis, stall holders and pizza deliverers have mobile EFTPOS systems. The system is made up of two primary networks: EFTPOS NZ, which is owned by ANZ National Bank and Paymark Limited (formerly Electronic Transaction Services Limited), which is owned by ANZ National Bank, ASB Bank

, Westpac

and the Bank of New Zealand

. The two networks are intertwined and highly sophisticated and secure, able to handle huge volumes of transactions during busy periods such as the lead-up to Christmas. Network failures are rare, but when they occur they cause massive disruption, resulting in major delays and loss of income for businesses. Most businesses have to resort to manual "zip-zap" swipe machines in such case. Newer POS-based terminals have the ability to "capture" transactions in the event of a communications break-down - instead of entering a PIN, the customer signs their receipt and the transaction is accepted on a matching signature, and the transaction is stored until the network is restored. A notable example of this occurs on the Cook Strait

ferries, where in the middle of Cook Strait there is no mobile phone reception to connect to the EFTPOS network.

EFTPOS is used for transactions large and small, from 10c up to thousands of dollars (or the daily limit of the EFTPOS card). Depending on the user's bank, a fee may be charged for use of EFTPOS. Most youth accounts do not attract fees for electronic transactions, meaning the use of EFTPOS by the younger generations has become ubiquitous (and subsequently cash use becoming rare). Typically merchants don't pay fees for transactions, most only having to pay for the equipment rental.

ATM cards and EFTPOS cards were once separate, but today EFTPOS and ATM cards are combined into a single EFTPOS-ATM card. The cards are issued by banks to customers, and often come in multiple designs, with some banks allowing customers to place a picture of their choice on their EFTPOS card. One of the disadvantages of New Zealand's well-established EFTPOS system is that it is incompatible with overseas systems and non-face-to-face purchases. In response to this, many banks have adopted international debit card systems such as Maestro

and Visa Debit

in addition to the New Zealand EFTPOS system.

, all three national ATM network consortia offer proprietary PIN debit. This was first offered by Express Payment System

in 1987, followed by Megalink

with Paylink in 1993 then BancNet

with the Point-of-Sale in 1994.

Express Payment System

or EPS was the pioneer provider, having launched the service in 1987 on behalf of the Bank of the Philippine Islands

. The EPS service has subsequently been extended in late 2005 to include the other Expressnet members: Banco de Oro and Land Bank of the Philippines

. They currently operate 10,000 terminals for their cardholders.

Megalink

launched Paylink EFTPOS system in 1993. Terminal services are provided by Equitable Card Network on behalf of the consortium. Service is available in 2,000 terminals, mostly in Metro Manila

.

BancNet

introduced their Point of sale

System in 1994 as the first consortium-operated EFTPOS service in the country. The service is available in over 1,400 locations throughout the Philippines, including second and third-class municipalities. In 2005, BancNet signed a Memorandum of Agreement to serve as the local gateway for China UnionPay

, the sole ATM switch in the People's Republic of China

. This will allow the estimated 1.0 billion Chinese ATM cardholders to use the BancNet ATMs and the EFTPOS in all participating merchants.

Visa debit cards are issued by Union Bank of the Philippines

(e-Wallet & eon), Chinatrust, Equicom Savings Bank

(Key Card & Cash Card), Banco De Oro, HSBC

, HSBC Savings Bank & Sterling Bank of Asia (VISA ShopNPay prepaid and debit cards). Union Bank of the Philippines cards, Equicom Savings Bank & Sterling Bank of Asia EMV cards which can also be used for internet purchases. Sterling Bank of Asia has released its first line of prepaid and debit Visa cards with EMV

chip.

MasterCard

debit cards are issued by Banco de Oro, Security Bank

(Cashlink & Cash Card) & Smart Communications

(Smart Money) tied up with Banco De Oro. MasterCard Electronic cards are issued by BPI (Express Cash) and Security Bank

(CashLink Plus). All VISA and MasterCard based debit cards in the Philippines are non-embossed and are marked either for "Electronic Use Only" (VISA/MasterCard) or "Valid only where MasterCard Electronic is Accepted" (MasterCard Electronic).

, local debit cards, such as PolCard, have become largely substituted with international ones, such as Visa, MasterCard, or the unembossed Visa Electron or Maestro. Most banks in Poland block Internet and MOTO transactions with unembossed cards, requiring the customer to buy an embossed card or a card for Internet/MOTO transactions only. The number of banks which do not block MOTO transactions on unembossed cards has recently started to increase.

, debit cards are accepted almost everywhere: ATMs, stores, and so on. The most commonly accepted are Visa and MasterCard, or the unembossed Visa Electron or Maestro. Regarding Internet payments debit cards can't be used for transfers, due to its unsafeness, so banks recommend the use of 'MBnet', a pre-registered safe system that creates a virtual card with a pre-selected credit limit. All the card system is regulated by SIBS, the institution created by Portuguese banks to manage all the regulations and communication processes proply. SIBS' shareholders are all the 27 banks operating in Portugal.

technology.

Nearly every transaction, regardless of brand or system, is processed as an immediate debit transaction. Non-debit transactions within these systems have spending limits that are strictly limited when compared with typical Visa or MasterCard accounts.

, all debit card transactions are routed trough Saudi Payments Network (SPAN), the only electronic payment system in the Kingdom and all banks are required by the Saudi Arabian Monetary Agency

(SAMA) to issue cards fully compatible with the network. It connects all point of sale (POS) terminals throughout the country to a central payment switch which in turn re-routes the financial transactions to the card issuer, local bank, VISA, AMEX or MasterCard.

As well as its use for debit cards, the network is also used for ATM and credit card transactions.

(NETS), founded by Singapore’s leading banks and shareholders namely DBS, Keppel Bank, OCBC and its associates, OUB, IBS, POSB, Tat Lee Bank and UOB in 1985 as a result of a need for a centralised e-Payment operator.

However,due to the banking restructuring and mergers, the local banks became UOB, OCBC, DBS-POSB as the shareholders of NETS with Standard Chartered Bank to offer NETS to their customers. However, DBS and POSB customers can use their network atms on their own and not be shared with UOB, OCBC or SCB (StanChart). The mega failure of 5 July 2010 of POSB-DBS ATM Networks (about 97,000 machines) made the government to rethink the shared ATM system again as it affected the NETS system too.

In 2010, in line with the mandatory EMV system, Local Singapore Banks starts to reissue their Debit Visa/Mastercard branded debit cards with the EMV Chip compliant ones compared to the magnetic stripe system in place. Banks involved includes the NETS Members of POSB-DBS, UOB-OCBC-SCB along with the SharedATM alliance (NON-NETS) of HSBC, Citibank, State Bank of India, and Maybank. Standard Chartered Bank (SCB) is also a SharedATM alliance member. Non branded cards of POSB and Maybank local ATM Cards are kept without a chip but has a Plus or Maestro sign so that they can use it only to draw cash locally or overseas.

Maybank Debit Mastercard are also available to use in Malaysia just as a normal ATM or Dedit MEPS card.

Singapore also uses the e-purse systems of NETS CASHCARD and the CEPAS wave system by EZ-Link

and NETS.

debit cards (an integrated EFTPOS

system) are an established part of the retail market and are widely accepted both by bricks and mortar stores and by internet stores. The term EFTPOS

is not widely used by the public; debit card is the generic term used. Cards commonly in circulation include Maestro

(previously Switch

), Debit MasterCard

, Visa Debit

(previously Visa Delta) and Visa Electron

. Banks do not charge customers for EFTPOS

transactions in the UK, but some retailers make small charges, particularly where the transaction amount in question is small. The UK has converted all debit cards in circulation to Chip and PIN

(except for Chip and Signature cards issued to people with certain disabilities), based on the EMV

standard, to increase transaction security; however, PINs are not required for internet transactions.

In the United Kingdom, banks started to issue debit cards in the mid 1980s in a bid to reduce the number of cheques being used at the point of sale, which are costly for the banks to process; the first bank to do so was Barclays with the Barclays Connect card. As in most countries, fees paid by merchants in the United Kingdom

to accept credit cards are a percentage of the transaction amount, which funds card holders' interest-free credit periods as well as incentive schemes such as points, airmiles or cashback. Debit cards do not usually have these characteristics, and so the fee for merchants to accept debit cards is a low fixed amount, regardless of transaction amount. For very small amounts, this means it is cheaper for a merchant to accept a credit card than a debit card. Although merchants won the right through The Credit Cards (Price Discrimination) Order 1990 to charge customers different prices according to the payment method, few merchants in the UK charge less for payment by debit card than by credit card, the most notable exceptions being budget airlines, travel agents and IKEA

. Debit cards in the UK lack the advantages offered to holders of UK-issued credit cards, such as free incentives (points, airmiles, cashback etc.), interest-free credit and protection against defaulting merchants under Section 75 of the Consumer Credit Act 1974. Almost all establishments in the United Kingdom that accept credit cards also accept debit cards (although not always Solo

and Visa Electron

), but a minority of merchants, for cost reasons, accept debit cards and not credit cards.

, EFTPOS is universally referred to simply as debit. The same interbank network

s that operate the ATM

network also operate the POS network. Most interbank network

s, such as Pulse

, NYCE

, MAC, Tyme

, SHAZAM

, STAR

, and so on, are regional and do not overlap, however, most ATM/POS networks have agreements to accept each other's cards. This means that cards issued by one network will typically work anywhere they accept ATM/POS cards for payment. For example, a NYCE card will work at a Pulse POS terminal or ATM, and vice versa. Many debit cards in the United States are issued with a Visa, MasterCard or American Express

logo allowing use of their signature-based networks.

The liability of a U.S. debit card user in case of loss or theft is up to $50 USD if the loss or theft is reported to the issuing bank in two business days after the customer notices the loss.

The fees charged to merchants on offline debit purchases—and the lack of fees charged merchants for processing online debit purchases and paper checks—have prompted some major merchants in the U.S. to file lawsuit

s against debit-card transaction processors such as Visa and MasterCard. In 2003, Visa and MasterCard agreed to settle the largest of these lawsuits and agreed to settlement

s of billions of dollars.

Some consumers prefer "credit" transactions because of the lack of a fee charged to the consumer/purchaser; also, a few debit cards in the U.S. offer rewards for using "credit" (for example, S&T Bank's "Preferred Debit Rewards Card" ). However, since "credit" costs more for merchants, many terminals at PIN-accepting merchant locations now make the "credit" function more difficult to access. For example, if you swipe a debit card at Wal-Mart

in the U.S., you are immediately presented with the PIN screen for online debit; to use offline debit you must press "cancel" to exit the PIN screen, then press "credit" on the next screen.

2009-07-08: Minimum and Maximum Charges for Visa in USA

The Merchants Agreement for Visa states (page 9, or 14/141 in PDF):

Always honor valid Visa cards in your acceptance category, regardless of the dollar amount of the purchase. Imposing minimum or maximum purchase amounts in order to accept a Visa card transaction is a violation of the Visa rules.

As a result of the Dodd-Frank Act, U.S. merchants can now set a minimum purchase amount on credit cards (but not debit cards), not to exceed $10.

only allows medical expenses. It is used by some banks for withdrawals from their FSAs

, MSA

s, and HSA

s as well. They have Visa or MasterCard

logos, but cannot be used as "debit cards", only as "credit cards"", and they are not accepted by all merchants that accept debit and credit cards, but only by those that accept FSA debit card

s. Merchant codes and product codes are used at the point of sale (required by law by certain merchants by certain dates in the USA) to restrict sales if they do not qualify. Because of the extra checking and documenting that goes on, later, the statement can be used to substantiate

these purchases for tax deductions. In the occasional instance that a qualifying purchase is rejected, another form of payment must be used (a check or payment from another account and a claim for reimbursement later). In the more likely case that non-qualifying items are accepted, the consumer is technically still responsible, and the discrepancy could be revealed during an audit.

A small but growing segment of the debit card business in the U.S. involves access to tax-favored spending accounts such as flexible spending account

s (FSA), health reimbursement accounts

(HRA), and health savings account

s (HSA). Most of these debit cards are for medical expenses, though a few are also issued for dependent care and transportation expenses.

Traditionally, FSAs (the oldest of these accounts) were accessed only through claims for reimbursement after incurring, and often paying, an out-of-pocket expense; this often happens after the funds have already been deducted from the employee's paycheck. (FSAs are usually funded by payroll deduction.) The only method permitted by the Internal Revenue Service

(IRS) to avoid this "double-dipping" for medical FSAs and HRAs is through accurate and auditable reporting on the tax return. Statements on the debit card that say "for medical uses only" are invalid for several reasons: (1) The merchant and issuing banks have no way of quickly determining whether the entire purchase qualifies for the customer's type of tax benefit; (2) the customer also has no quick way of knowing; often has mixed purchases by necessity or convenience; and can easily make mistakes; (3) extra contractual clauses between the customer and issuing bank would cross-over into the payment processing standards, creating additional confusion (for example if a customer was penalized for accidentally purchasing a non-qualifying item, it would undercut the potential savings advantages of the account). Therefore, using the card exclusively for qualifying purchases may be convenient for the customer, but it has nothing to do with how the card can actually be used. If the bank rejects a transaction, for instance, because it is not at a recognized drug store, then it would be causing harm and confusion to the cardholder. In the United States, not all medical service or supply stores are capable of providing the correct information so an FSA debit card issuer can honor every transaction-if rejected or documentation is not deemed enough to satisfy regulations, cardholders may have to send in forms manually.

Bank account

A Bank account is a financial account recording the financial transactions between the customer and the bank and the resulting financial position of the customer with the bank .-Account types:...

/s at a financial institution. Some cards have a stored value with which a payment is made, while most relay a message to the cardholder's bank to withdraw funds from a designated account in favor of the payee's designated bank account. The card can be used as an alternative payment method to cash

Cash

In common language cash refers to money in the physical form of currency, such as banknotes and coins.In bookkeeping and finance, cash refers to current assets comprising currency or currency equivalents that can be accessed immediately or near-immediately...

when making purchases. In some cases, the cards are designed exclusively for use on the Internet, and so there is no physical card.

In many countries the use of debit cards has become so widespread that their volume of use has overtaken or entirely replaced the check

Cheque

A cheque is a document/instrument See the negotiable cow—itself a fictional story—for discussions of cheques written on unusual surfaces. that orders a payment of money from a bank account...

and, in some instances, cash transactions. Like credit card

Credit card

A credit card is a small plastic card issued to users as a system of payment. It allows its holder to buy goods and services based on the holder's promise to pay for these goods and services...

s, debit cards are used widely for telephone and Internet purchases.

However, unlike credit cards, the funds paid using a debit card are transferred immediately from the bearer's bank account, instead of having the bearer pay back the money at a later date.

Debit cards usually also allow for instant withdrawal of cash, acting as the ATM card

ATM card

An ATM card is a card issued by a bank, credit union or building society that can be used at an ATM for deposits, withdrawals, account information, and other types of transactions, often through interbank networks.Some ATM cards can also be used:* at a branch, as identification for in-person...

for withdrawing cash and as a check guarantee card. Merchants may also offer cashback

Debit card cashback

Debit card cashback is a service offered to retail customers whereby an amount is added to the total purchase price of a transaction paid by debit card and the customer receives that amount in cash along with the purchase. For example, a customer purchasing $18.99 worth of goods might ask for...

facilities to customers, where a customer can withdraw cash along with their purchase.

Types of debit card systems

Although many debit cards are of the Visa

VISA (credit card)

Visa Inc. is an American multinational financial services corporation headquartered on 595 Market Street, Financial District in San Francisco, California, United States, although much of the company's staff is based in Foster City, California. It facilitates electronic funds transfers throughout...

or MasterCard

MasterCard

Mastercard Incorporated or MasterCard Worldwide is an American multinational financial services corporation with its headquarters in the MasterCard International Global Headquarters, Purchase, Harrison, New York, United States...

brand, there are many other types of debit card, each accepted only within a particular country or region, for example Switch

Switch (debit card)

Switch is a debit card in the United Kingdom. It is a sister to the Solo debit card.Switch was launched in 1988 by Midland Bank, National Westminster Bank and the Royal Bank of Scotland as a multifunction cheque guarantee and cash card. The brand was merged with Maestro, an international debit card...

(now: Maestro) and Solo

Solo (debit card)

Solo is a debit card in the United Kingdom. It is a sister to the UK Maestro debit card. Solo was launched on 1 July 1997 by the Switch Card Scheme for use on deposit accounts, as well as by customers who did not qualify for a Maestro card on current accounts.Solo was formerly issued as a...

in the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

, Interac

Interac

Interac Association is a Canadian organization linking enterprises that have proprietary networks so that they may communicate with each other for the purpose of exchanging electronic financial transactions. The Association was founded in 1984 as a cooperative venture between five financial...

in Canada

Canada

Canada is a North American country consisting of ten provinces and three territories. Located in the northern part of the continent, it extends from the Atlantic Ocean in the east to the Pacific Ocean in the west, and northward into the Arctic Ocean...

, Carte Bleue

Carte Bleue

Carte Bleue is a major debit card payment system operating in France. Unlike Visa Electron or Maestro debit cards, Carte Bleue allows transactions without requiring authorization from the cardholder's bank. In many situations, the card works like a credit card but without fees for the cardholder...

in France

France

The French Republic , The French Republic , The French Republic , (commonly known as France , is a unitary semi-presidential republic in Western Europe with several overseas territories and islands located on other continents and in the Indian, Pacific, and Atlantic oceans. Metropolitan France...

, Laser

Laser (debit card)

Laser Card is a debit card scheme in Ireland. The Laser Scheme is maintained and operated by , a not-for-profit body owned by four leading financial institutions in Ireland and overseen since 2008 by the Oversight Unit of the Central Bank. The scheme was launched in 1996 and in 2010 there were...

in Ireland

Republic of Ireland

Ireland , described as the Republic of Ireland , is a sovereign state in Europe occupying approximately five-sixths of the island of the same name. Its capital is Dublin. Ireland, which had a population of 4.58 million in 2011, is a constitutional republic governed as a parliamentary democracy,...

, "EC electronic cash" (formerly Eurocheque

Eurocheque

The Eurocheque was a type of cheque used in Europe that was accepted across national borders and which could be written in a variety of currencies....

) in Germany

Germany

Germany , officially the Federal Republic of Germany , is a federal parliamentary republic in Europe. The country consists of 16 states while the capital and largest city is Berlin. Germany covers an area of 357,021 km2 and has a largely temperate seasonal climate...

, UnionPay in China

China

Chinese civilization may refer to:* China for more general discussion of the country.* Chinese culture* Greater China, the transnational community of ethnic Chinese.* History of China* Sinosphere, the area historically affected by Chinese culture...

and EFTPOS

EFTPOS

EFTPOS is the general term used for debit card based systems used for processing transactions through terminals at points of sale. In Australia and New Zealand it is also the brand name of the specific system used for such payments...

cards in Australia and New Zealand. The need for cross-border compatibility and the advent of the euro

Euro

The euro is the official currency of the eurozone: 17 of the 27 member states of the European Union. It is also the currency used by the Institutions of the European Union. The eurozone consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg,...

recently led to many of these card networks (such as Switzerland

Switzerland

Switzerland name of one of the Swiss cantons. ; ; ; or ), in its full name the Swiss Confederation , is a federal republic consisting of 26 cantons, with Bern as the seat of the federal authorities. The country is situated in Western Europe,Or Central Europe depending on the definition....

's "EC direkt", Austria

Austria

Austria , officially the Republic of Austria , is a landlocked country of roughly 8.4 million people in Central Europe. It is bordered by the Czech Republic and Germany to the north, Slovakia and Hungary to the east, Slovenia and Italy to the south, and Switzerland and Liechtenstein to the...

's "Bankomatkasse" and Switch

Switch (debit card)

Switch is a debit card in the United Kingdom. It is a sister to the Solo debit card.Switch was launched in 1988 by Midland Bank, National Westminster Bank and the Royal Bank of Scotland as a multifunction cheque guarantee and cash card. The brand was merged with Maestro, an international debit card...

in the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

) being re-branded with the internationally recognised Maestro

Maestro (debit card)

Maestro is a multi-national debit card service owned by MasterCard, and was founded in 1990. Maestro cards are obtained from associate banks and can be linked to the card holder's current account, or they can be prepaid cards...

logo, which is part of the MasterCard

MasterCard

Mastercard Incorporated or MasterCard Worldwide is an American multinational financial services corporation with its headquarters in the MasterCard International Global Headquarters, Purchase, Harrison, New York, United States...

brand. Some debit cards are dual branded with the logo of the (former) national card as well as Maestro

Maestro (debit card)

Maestro is a multi-national debit card service owned by MasterCard, and was founded in 1990. Maestro cards are obtained from associate banks and can be linked to the card holder's current account, or they can be prepaid cards...

(for example, EC cards in Germany, Laser cards in Ireland, Switch and Solo in the UK, Pinpas cards in the Netherlands, Bancontact cards in Belgium, etc.). The use of a debit card system allows operators to package their product more effectively while monitoring customer spending. An example of one of these systems is ECS by Embed International

Embed International

Embed International is a supplier and manufacturer of debit card systems and managementapplications for the amusement, leisure and entertainment industries.Embed systems are now used throughout the world at over 1000 operating locations...

.

Online Debit System

Online debit cards require electronic authorization of every transaction and the debits are reflected in the user’s account immediately. The transaction may be additionally secured with the personal identification numberPersonal identification number

A personal identification number is a secret numeric password shared between a user and a system that can be used to authenticate the user to the system. Typically, the user is required to provide a non-confidential user identifier or token and a confidential PIN to gain access to the system...

(PIN) authentication

Authentication

Authentication is the act of confirming the truth of an attribute of a datum or entity...

system and some online cards require such authentication for every transaction, essentially becoming enhanced automatic teller machine (ATM) cards

ATM card

An ATM card is a card issued by a bank, credit union or building society that can be used at an ATM for deposits, withdrawals, account information, and other types of transactions, often through interbank networks.Some ATM cards can also be used:* at a branch, as identification for in-person...

. One difficulty in using online debit cards is the necessity of an electronic authorization device at the point of sale

Point of sale

Point of sale or checkout is the location where a transaction occurs...

(POS) and sometimes also a separate PINpad

PINpad

A PIN pad is an electronic device used in a debit or smart card-based transaction to input and encrypt the cardholder's PIN. PIN pads are normally used with integrated point of sale devices in which an electronic cash register is responsible for taking the sale amount and initiating/handling the...

to enter the PIN, although this is becoming commonplace for all card transactions in many countries. Overall, the online debit card is generally viewed as superior to the offline debit card because of its more secure authentication system and live status, which alleviates problems with processing lag

Lag

Lag is a common word meaning to fail to keep up or to fall behind. In real-time applications, the term is used when the application fails to respond in a timely fashion to inputs...

on transactions that may only issue online debit cards. Some on-line debit systems are using the normal authentication processes of Internet banking to provide real-time on-line debit transactions. The most notable of these are Ideal and POLl.

Offline Debit System

Offline debit cards have the logoLogo

A logo is a graphic mark or emblem commonly used by commercial enterprises, organizations and even individuals to aid and promote instant public recognition...

s of major credit cards (for example, Visa

VISA (credit card)

Visa Inc. is an American multinational financial services corporation headquartered on 595 Market Street, Financial District in San Francisco, California, United States, although much of the company's staff is based in Foster City, California. It facilitates electronic funds transfers throughout...

or MasterCard

MasterCard

Mastercard Incorporated or MasterCard Worldwide is an American multinational financial services corporation with its headquarters in the MasterCard International Global Headquarters, Purchase, Harrison, New York, United States...

) or major debit cards (for example, Maestro

Maestro (debit card)

Maestro is a multi-national debit card service owned by MasterCard, and was founded in 1990. Maestro cards are obtained from associate banks and can be linked to the card holder's current account, or they can be prepaid cards...

in the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

and other countries, but not the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

) and are used at the point of sale

Point of sale

Point of sale or checkout is the location where a transaction occurs...

like a credit card (with payer's signature). This type of debit card may be subject to a daily limit, and/or a maximum limit equal to the current/checking account balance from which it draws funds. Transactions conducted with offline debit cards require 2–3 days to be reflected on users’ account balances.

In some countries and with some banks and merchant service organizations, a "credit" or offline debit transaction is without cost to the purchaser beyond the face value of the transaction, while a fee may be charged for a "debit" or online debit transaction (although it is often absorbed by the retailer). Other differences are that online debit purchasers may opt to withdraw cash in addition to the amount of the debit purchase (if the merchant supports that functionality); also, from the merchant's standpoint, the merchant pays lower fees on online debit transaction as compared to "credit" (offline) debit transaction.

Electronic Purse Card System

Smart-card-based electronic purse systems (in which value is stored on the card chip, not in an externally recorded account, so that machines accepting the card need no network connectivity) are in use throughout Europe since the mid-1990s, most notably in Germany (GeldkarteGeldkarte

Geldkarte is a Stored-value card or electronic cash system used in Germany. It operates as an offline smart card for small payment at things like vending machines and to pay for public transport or parking tickets. The card is pre-paid and funds are loaded onto the card using ATMs or dedicated...

), Austria (Quick Wertkarte

Quick Wertkarte

Quick is an electronic purse system available on Austrian bank cards to allow small purchases to be made without cash. The history of the Quick system goes back to 1994....

), the Netherlands (Chipknip), Belgium (Proton

Proton (bank card)

Proton is an electronic purse application for debit cards in Belgium. The system was introduced in February 1995 with the goal to replace cash primarily for small transactions around the 15 EUR...

), Switzerland (CASH) and France (Mon€o

Mon€o

Moneo, sometimes branded as mon€o, is an electronic purse system available on French bank cards to allow small purchases to be made without cash....

, which is usually carried by a debit card). In Austria and Germany, all current bank cards now include electronic purses.

Prepaid debit cards

Prepaid debit cards, also called reloadable debit cards, appeal to a variety of users. The primary market for prepaid cards are unbankedUnbanked

The unbanked are citizens of a country who do not have their own bank account. Along with the underbanked, they may rely on alternative financial services for their financial needs, where these are available.-The unbanked in the United States:...

people, an umbrella term used to describe diverse groups of individuals who do not use banks or credit unions for their financial transactions.

The advantages of prepaid debit cards include being safer than carry cash, worldwide functionality due to Visa and MasterCard

MasterCard

Mastercard Incorporated or MasterCard Worldwide is an American multinational financial services corporation with its headquarters in the MasterCard International Global Headquarters, Purchase, Harrison, New York, United States...

merchant acceptance, not having to worry about paying a credit card bill or going into debt, the ability for anyone over the age of 18 to apply and be accepted without regard to credit quality and the ability to direct deposit paychecks and government benefits onto the card for free.

Some of the first companies to enter this market were MiCash, RushCard and Netspend who gained high market share as a result of being first to market. However, in the past few years there have been several new providers that carry a number of other benefits, such as money remittance service, card-to-card transfers and the ability to apply without a social security number. An example of two of these providers are Goyow, a company based in New York who has grown substantially in the past 2 years as a result of their unique features and low fees. The other one is TransCash, a company based in California that came up with the only dual Visa

Visa

Visa or VISA may refer to:* Visa , a document issued by a country's government allowing the holder to enter or to leave that country...

prepaid debit card product with the 2 cards inside the pack. The unique feature of the product is the fact that it comes with 2 separate accounts and not a shared balance.

Advantages and disadvantages

The widespread use of debit and check cards have revealed numerous advantages and disadvantages to the consumer and retailer alike.Advantages of debit cards

- A consumer who is not credit worthy and may find it difficult or impossible to obtain a credit card can more easily obtain a debit card, allowing him/her to make plastic transactions. For example, legislation often prevents minors from taking out debt, which includes the use of a credit card, but not online debit card transactions.

- For most transactions, a check card can be used to avoid check writing altogether. Check cards debit funds from the user's account on the spot, thereby finalizing the transaction at the time of purchase, and bypassing the requirement to pay a credit card bill at a later date, or to write an insecure check containing the account holder's personal information.

- Like credit cards, debit cards are accepted by merchants with less identification and scrutiny than personal checks, thereby making transactions quicker and less intrusive. Unlike personal checks, merchants generally do not believe that a payment via a debit card may be later dishonored.

- Unlike a credit card, which charges higher fees and interest rates when a cash advance is obtained, a debit card may be used to obtain cash from an ATM or a PIN-based transaction at no extra charge, other than a foreign ATM fee.

Disadvantages of debit cards

- Use of a debit card is not usually limited to the existing funds in the account to which it is linked, most banks allow a certain threshold over the available bank balance which can cause overdraftOverdraftAn overdraft occurs when money is withdrawn from a bank account and the available balance goes below zero. In this situation the account is said to be "overdrawn". If there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft...

fees if the user's transaction does not reflect available balance. This disadvantage has lessened in the United States with the requirement that an issuer obtain opt-in permission in advance to allow an overdraft on a debit card. Lacking this opt-in, overdrafts are not permitted for electronic transactions. - Many banks are now charging over-limit fees or non-sufficient funds fees based upon pre-authorizations, and even attempted but refused transactions by the merchant (some of which may be unknown until later discovery by account holder).

- Many merchants mistakenly believe that amounts owed can be "taken" from a customer's account after a debit card (or number) has been presented, without agreement as to date, payee name, amount and currency, thus causing penalty fees for overdrafts, over-the-limit, amounts not available causing further rejections or overdrafts, and rejected transactions by some banks.

- In some countries debit cards offer lower levels of security protection than credit cards. Theft of the users PIN using skimming devices can be accomplished much easier with a PIN input than with a signature-based credit transaction. However, theft of users' PIN codes using skimming devices can be equally easily accomplished with a debit transaction PIN input, as with a credit transaction PIN input, and theft using a signature-based credit transaction is equally easy as theft using a signature-based debit transaction.

- In many places, laws protect the consumer from fraud much less than with a credit card. While the holder of a credit card is legally responsible for only a minimal amount of a fraudulent transaction made with a credit card, which is often waived by the bank, the consumer may be held liable for hundreds of dollars, or even the entire value of fraudulent debit transactions. The consumer also has a shorter time (usually just two days) to report such fraud to the bank in order to be eligible for such a waiver with a debit card, whereas with a credit card, this time may be up to 60 days. A thief who obtains or clones a debit card along with its PIN may be able to clean out the consumer's bank account, and the consumer will have no recourse.

Federally Imposed Maximum Liability for Unauthorized Card Use (United States) Reported Maximum Card Holder Liability Credit Card Debit Card Before Use $0 $0 Within 2 business days $50 $50 After 2 but before 60 business days $50 $500 After 60 business days Unlimited Unlimited

- In the UKUnited KingdomThe United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

and IrelandRepublic of IrelandIreland , described as the Republic of Ireland , is a sovereign state in Europe occupying approximately five-sixths of the island of the same name. Its capital is Dublin. Ireland, which had a population of 4.58 million in 2011, is a constitutional republic governed as a parliamentary democracy,...

, among other countries, a consumer who purchases goods or services with a credit card can pursue the credit card issuer if the goods or services are not delivered or are unmerchantable. While they must generally exhaust the process provided by the retailer first, this is not necessary if the retailer has gone out of business. This protection is not provided by legislation when using a debit card but may be offered to a limited extent as a benefit provided by the card network, for example, Visa debit cards. - When a transaction is made using a credit card, the bank's money is being spent, and therefore, the bank has a vested interest in claiming its money where there is fraud or a dispute. The bank may fight to void the charges of a consumer who is dissatisfied with a purchase, or who has otherwise been treated unfairly by the merchant. But when a debit purchase is made, the consumer has spent his/her own money, and the bank has little if any motivation to collect the funds.

- In some countries, and for certain types of purchases, such as gasolineGasolineGasoline , or petrol , is a toxic, translucent, petroleum-derived liquid that is primarily used as a fuel in internal combustion engines. It consists mostly of organic compounds obtained by the fractional distillation of petroleum, enhanced with a variety of additives. Some gasolines also contain...

(via a pay at the pumpPay at the pumpPay at the pump is a system used at some filling stations where customers can pay for their fuel by inserting a credit or debit card into a slot on the pump, bypassing the requirement to make the transaction with the station attendant or to walk away from one's vehicle.The system was introduced in...

system), lodgingLodgingLodging is a type of residential accommodation. People who travel and stay away from home for more than a day need lodging for sleep, rest, safety, shelter from cold temperatures or rain, storage of luggage and access to common household functions.Lodgings may be self catering in which case no...

, or car rentalCar rentalA car rental or car hire agency is a company that rents automobiles for short periods of time for a fee...

, the bank may place a hold on funds much greater than the actual purchase for a fixed period of time. However, this isn't the case in other countries, such as Sweden. Until the hold is released, any other transactions presented to the account, including checks, may be dishonoured, or may be paid at the expense of an overdraftOverdraftAn overdraft occurs when money is withdrawn from a bank account and the available balance goes below zero. In this situation the account is said to be "overdrawn". If there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft...

fee if the account lacks any additional funds to pay those items. - While debit cards bearing the logo of a major credit card are accepted for virtually all transactions where an equivalent credit card is taken, a major exception in some countries is at car rental facilities. In some countries, such as Canada & Australia, car rental agencies require an actual credit card to be used, or at the very least, will verify the creditworthiness of the renter using a debit card. In Canada and additional unspecified countries, car rental companies will deny a rental to anyone who does not fit the requirements, and such a credit check may actually hurt one's credit scoreCredit scoreA credit score is a numerical expression based on a statistical analysis of a person's credit files, to represent the creditworthiness of that person...

, as long as there is such a thing as a credit score in the country of purchase and/or the country of residence of the customer.

Consumer protection

Consumer protections vary, depending on the network used. Visa and MasterCard, for instance, prohibit minimum and maximum purchase sizes, surcharges, and arbitrary security procedures on the part of merchants. Merchants are usually charged higher transaction fees for credit transactions, since debit network transactions are less likely to be fraudulent. This may lead them to "steer" customers to debit transactions. Consumers disputing charges may find it easier to do so with a credit card, since the money will not immediately leave their control. Fraudulent charges on a debit card can also cause problems with a checking account because the money is withdrawn immediately and may thus result in an overdraft or bounced checks. In some cases debit card-issuing banks will promptly refund any disputed charges until the matter can be settled, and in some jurisdictions the consumer liability for unauthorized charges is the same for both debit and credit cards.In some countries, like India and Sweden, the consumer protection is the same regardless of the network used. Some banks set minimum and maximum purchase sizes, mostly for online-only cards. However, this has nothing to do with the card networks, but rather with the bank's judgement of the person's age and credit records. Any fees that the customers have to pay to the bank are the same regardless of whether the transaction is conducted as a credit or as a debit transaction, so there is no advantage for the customers to choose one transaction mode over another. Shops may add surcharges to the price of the goods or services in accordance with laws allowing them to do so. Banks consider the purchases as having been made at the moment when the card was swiped, regardless of when the purchase settlement was made. Regardless of which transaction type was used, the purchase may result in an overdraft because the money is considered to have left the account at the moment of the card swiping.

Financial access

Debit cards and secured credit cards are popular among college students who have not yet established a credit history. Debit cards may also be used by expatriateExpatriate

An expatriate is a person temporarily or permanently residing in a country and culture other than that of the person's upbringing...

d workers to send money home to their families holding an affiliated debit card.

Issues with deferred posting of offline debit

To the consumer, a debit transaction is perceived as occurring in real-time; i.e. the money is withdrawn from their account immediately following the authorization request from the merchant, which in many countries, is the case when making an online debit purchase. However, when a purchase is made using the "credit" (offline debit) option, the transaction merely places an authorization holdAuthorization hold

Authorization hold is the practice within the banking industry of authorizing electronic transactions done with a debit card or credit card and holding this balance as unavailable either until the merchant clears the transaction , or the hold "falls off." In the case of debit cards,...

on the customer's account; funds are not actually withdrawn until the transaction is reconciled and hard-posted to the customer's account, usually a few days later. However, the previous sentence applies to all kinds of transaction types, at least when using a card issued by a European bank. This is in contrast to a typical credit card transaction; though it can also have a lag time of a few days before the transaction is posted to the account, it can be many days to a month or more before the consumer makes repayment with actual money.

Because of this, in the case of a benign or malicious error by the merchant or bank, a debit transaction may cause more serious problems (for example, money not accessible; overdrawn account) than in the case of a credit card transaction (for example, credit not accessible; over credit limit

Credit limit

A credit limit is the maximum amount of credit that a financial institution or other lender will extend to a debtor for a particular line of credit...

). This is especially true in the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

, where check fraud is a crime in every state, but exceeding your credit limit is not.

Internet purchases

Debit cards may also be used on the Internet. Internet transactions may be conducted in either online or offline mode, although shops accepting online-only cards are rare in some countries (such as Sweden), while they are common in other countries (such as the Netherlands). For a comparison, PayPalPayPal

PayPal is an American-based global e-commerce business allowing payments and money transfers to be made through the Internet. Online money transfers serve as electronic alternatives to paying with traditional paper methods, such as checks and money orders....

offers the customer to use an online-only Maestro card if the customer enters a Dutch address of residence, but not if the same customer enters a Swedish address of residence.