Tax forms in the United States

Encyclopedia

Internal Revenue Service

The Internal Revenue Service is the revenue service of the United States federal government. The agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue...

(IRS) of the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

. They are used to report income

Income

Income is the consumption and savings opportunity gained by an entity within a specified time frame, which is generally expressed in monetary terms. However, for households and individuals, "income is the sum of all the wages, salaries, profits, interests payments, rents and other forms of earnings...

, calculate taxes

Taxation in the United States

The United States is a federal republic with autonomous state and local governments. Taxes are imposed in the United States at each of these levels. These include taxes on income, property, sales, imports, payroll, estates and gifts, as well as various fees.Taxes are imposed on net income of...

to be paid to the federal government of the United States

Federal government of the United States

The federal government of the United States is the national government of the constitutional republic of fifty states that is the United States of America. The federal government comprises three distinct branches of government: a legislative, an executive and a judiciary. These branches and...

, and disclose other information as required by the Internal Revenue Code

Internal Revenue Code

The Internal Revenue Code is the domestic portion of Federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code...

(IRC). There are over 800 various forms and schedules. The best-known of these is Form 1040 used by individuals.

990

The Form 990, Return of Organization Exempt From Income Tax, is submitted by tax-exempt and non-profit organizations to provide the Internal Revenue Service with annual financial information. Form 990-PF is available for private foundations. A short version, Form 990-EZ, may be used by organizations with gross receipts of between $25,000 and $500,000 and total assets of less than $2.5 million. (Organizations with gross receipts of under $25,000 in a year are not required to file a form 990). An obscure provision of a 2006 Pension Bill placed a filing mandate on smaller nonprofits (Under $25,000 in annual receipts) or face automatic revocation of their exempt status. In response to over 320,000 organizations failing to meet the mandate, IRS issued one time relief under IR 2010-87 through Oct 15, 2010. Those organizations may file form 990N List of charities at risk of revocation and eligible for relief under IR 2010-87.The Form 990 provides the public with financial information about a given organization, and is often the only source of such information. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. In June 2007, the IRS released a new Form 990 that requires significant disclosures on governance

Governance

Governance is the act of governing. It relates to decisions that define expectations, grant power, or verify performance. It consists of either a separate process or part of management or leadership processes...

and boards of directors. These new disclosures are required for all nonprofit filers for the 2009 tax year, with more significant reporting requirements for nonprofits with over $1 million in revenues or $2.5 million in assets. In addition, certain nonprofits have more comprehensive reporting requirements, such as hospitals and other health care organizations (Schedule H).

The Form 990 disclosures do not require but strongly encourage nonprofit boards to adopt a variety of board policies regarding governance practices. These suggestions go beyond Sarbanes-Oxley requirements for nonprofits to adopt whistleblower

Whistleblower

A whistleblower is a person who tells the public or someone in authority about alleged dishonest or illegal activities occurring in a government department, a public or private organization, or a company...

and document retention policies. The IRS has indicated they will use the Form 990 as an enforcement tool, particularly regarding executive compensation. For example, nonprofits that adopt specific procedures regarding executive compensation are offered "safe harbor" from excessive compensation rules under section 4958 of the Internal Revenue Code and Treasury Regulation section 53.4958-6.

Public Inspection

IRC 6104(d) regulations state that an organization must provide copies of its three most recent Forms 990 to anyone who requests them, whether in person, by mail, fax, or e-mail. Additionally, requests may be made via the IRS using Form 4506-A, and PDF copies can often be found online on sites such as Foundation Center's 990 Finder, Guidestar.org and the National Center for Charitable Statistics.

- New IRS Form 990

- Instructions for Form 990 and Form 990-EZ

- 990 Finder IRS Form 990 lookup tool; provides PDF copies of annual returns.

- Guidestar IRS Form 990's and other information for selection of nonprofits.

- NCCS IRS Form 990 search tool and nonprofit organization profiles.

- Charity NavigatorCharity NavigatorCharity Navigator is an independent, non-profit organization that evaluates American charities. Its stated goal is "to advance a more efficient and responsive philanthropic marketplace by evaluating the financial health of America's largest charities."-About:...

uses IRS Forms 990 to rate charities. - BoardSourceBoardSourceBoardSource, formerly the National Center for Nonprofit Boards, is an American nonprofit organization founded in 1988. Its mission is to build nonprofit boards and encourage board service....

Governance requirements in 990.

5500

The Form 5500, Annual Return/Report of Employee Benefit Plan, was developed jointly by the IRS, United States Department of LaborUnited States Department of Labor

The United States Department of Labor is a Cabinet department of the United States government responsible for occupational safety, wage and hour standards, unemployment insurance benefits, re-employment services, and some economic statistics. Many U.S. states also have such departments. The...

, and Pension Benefit Guaranty Corporation

Pension Benefit Guaranty Corporation

The Pension Benefit Guaranty Corporation is an independent agency of the United States government that was created by the Employee Retirement Income Security Act of 1974 to encourage the continuation and maintenance of voluntary private defined benefit pension plans, provide timely and...

to satisfy filing requirements both under the Internal Revenue Code

Internal Revenue Code

The Internal Revenue Code is the domestic portion of Federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 of the United States Code...

(IRC) and the Employee Retirement Income Security Act

Employee Retirement Income Security Act

The Employee Retirement Income Security Act of 1974 is an American federal statute that establishes minimum standards for pension plans in private industry and provides for extensive rules on the federal income tax effects of transactions associated with employee benefit plans...

(ERISA). The Form 5500 is an important compliance, research, and disclosure tool intended to assure that employee benefit plans are properly managed and to provide participants, beneficiaries, and regulators are provided with sufficient information to protect their rights. Starting in 2009, all Forms 5500 must be filed electronically on the website of the Department of Labor.

1040

The Form 1040, U.S. Individual Income Tax Return, is the starting form for personal (individual) federal income taxIncome tax

An income tax is a tax levied on the income of individuals or businesses . Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate...

returns filed with the IRS. The first Form 1040 was published for use for the tax years 1913, 1914, and 1915. Beginning with the tax year 1916, Form 1040 was converted to an annual form (i.e., updated each tax year with the new year printed on the form). The IRS used to mail tax booklets (Form 1040, instructions, and most common attachments) to all households prior to 2009.

Income tax returns for individual calendar year taxpayers are due by April 15 of the next year. Should April 15 fall on a Saturday, Sunday, or a legal holiday in Washington D.C. or in the state to which the return is required to be filed, the returns are due on the next business day. For example, in 2011, April 16 is a legal holiday, Emancipation Day

Emancipation Day

Emancipation Day is celebrated in many former British colonies in the Caribbean and areas of the United States on various dates in observance of the emancipation of slaves of African origin. It is also observed in other areas in regard to the abolition of serfdom or other forms of...

, in Washington D.C. April 16, 2011, is a Saturday, so the holiday is observed on Friday, April 15, 2011. Because Friday, April 15, 2011 is a legal holiday in Washington D.C., Form 1040 income tax returns filed on Monday, April 18, 2011, will be treated as timely filed on Friday, April 15, 2011.

Form 1040 consists of two full pages not counting attachments. The first page collects information about the taxpayer(s), dependents, income items, and adjustments to income. The second page calculates the allowable deductions and credits, tax due given the income figure, and applies funds already withheld from wages or estimated payments made towards the tax liability. At the top of the first page is the Presidential election campaign fund checkoff

Presidential election campaign fund checkoff

The presidential election campaign fund checkoff appears on US income tax return forms as the question Do you want $3 of your federal tax to go to the Presidential Election Campaign Fund?...

, which allows you to designate that the federal government give $3 of the tax it receives to the Presidential election campaign fund.

Form 1040 has 11 attachments, called "schedules", which may need to be filed depending on the taxpayer. For 2009 and 2010 there is an addition form, Schedule M, due to the "Making Work Pay

Making Work Pay tax credit

The Making Work Pay Tax Credit was a tax credit allowed by the Internal Revenue Service of the United States. It was authorized in the American Recovery and Reinvestment Act of 2009....

" provision of the American Recovery and Reinvestment Act of 2009

American Recovery and Reinvestment Act of 2009

The American Recovery and Reinvestment Act of 2009, abbreviated ARRA and commonly referred to as the Stimulus or The Recovery Act, is an economic stimulus package enacted by the 111th United States Congress in February 2009 and signed into law on February 17, 2009, by President Barack Obama.To...

("the stimulus"):

- Schedule A itemizes allowable deductionsItemized deductionAn itemized deduction is an eligible expense that individual taxpayers in the United States can report on their federal income tax returns in order to decrease their taxable income....

against income; instead of filling out Schedule A, taxpayers may choose to take a standard deductionStandard deductionThe standard deduction, as defined under United States tax law, is a dollar amount that non-itemizers may subtract from their income and is based upon filing status. It is available to US citizens and resident aliens who are individuals, married persons, and heads of household and increases every...

of between $5,700 and $15,800 (for tax year 2010), depending on age, filing status, and whether the taxpayer and/or spouse is blind. - Schedule B enumerates interestInterestInterest is a fee paid by a borrower of assets to the owner as a form of compensation for the use of the assets. It is most commonly the price paid for the use of borrowed money, or money earned by deposited funds....

and/or dividendDividendDividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business , or it can be distributed to...

income, and is required if either interest or dividends received during the tax year exceed $1,500 from all sources or if the filer had certain foreign accounts. - Schedule C lists income and expenses related to self-employment, and is used by sole proprietors.

- Schedule D is used to compute capital gains and losses incurred during the tax year.

- Schedule E is used to report income and expenses arising from the rental of real property, royalties, or from pass-through entities (like trusts, estates, partnerships, or S corporations).

- Schedule EIC is used to document a taxpayer's eligibility for the Earned Income Credit.

- Schedule F is used to report income and expenses related to farming.

- Schedule H is used to report taxes owed due to the employment of household help.

- Schedule J is used when averaging farm income over a period of three years.

- Schedule L is used to figure an increased standard deduction in certain cases.

- Schedule M (2009 and 2010) is used to claim the up to $400 Making Work Pay tax creditMaking Work Pay tax creditThe Making Work Pay Tax Credit was a tax credit allowed by the Internal Revenue Service of the United States. It was authorized in the American Recovery and Reinvestment Act of 2009....

(6.2% earned income credit, up to $400). - Schedule R is used to calculate the Credit for the Elderly or the Disabled.

- Schedule SE is used to calculate the self-employment tax owed on income from self-employment (such as on a Schedule C or Schedule F, or in a partnership).

In most situations, other Internal Revenue Service

Internal Revenue Service

The Internal Revenue Service is the revenue service of the United States federal government. The agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue...

or Social Security Administration

Social Security Administration

The United States Social Security Administration is an independent agency of the United States federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits...

forms such as Form W-2 must be attached to the Form 1040, in addition to the Form 1040 schedules. There are over 100 other, specialized forms that may need to be completed along with Schedules and the Form 1040.

Short forms

Over the years other 'Short Forms' were used for short periods of time. One was an IBM Card on which a few lines could be written which would be transcribed into another card which looked the same but which had holes in it which a computer or 'unit record' machine could read. As with the other forms there was always a place for a signature. This was back in the 1960's.The Form 1040A ("short form"), U.S. individual income tax return, is a shorter version of the Form 1040. Use of Form 1040A is limited to taxpayers with taxable income below $100,000 who take the standard deduction instead of itemizing deductions.

The Form 1040EZ ("easy form"), Income Tax Return for Single and Joint Filers With No Dependents, is the simplest, six-section Federal income tax return, introduced in 1982. Its use is limited to taxpayers with taxable income below $100,000 who take the standard deduction

Standard deduction

The standard deduction, as defined under United States tax law, is a dollar amount that non-itemizers may subtract from their income and is based upon filing status. It is available to US citizens and resident aliens who are individuals, married persons, and heads of household and increases every...

instead of itemizing deductions.

Other

The Form 1040NR, U.S. Nonresident Alien Income Tax Return, and its "easy" version Form 1040NR-EZ, U.S. Income Tax Return for CertainNonresident Aliens With No Dependents, are used by nonresident aliens

Alien (law)

In law, an alien is a person in a country who is not a citizen of that country.-Categorization:Types of "alien" persons are:*An alien who is legally permitted to remain in a country which is foreign to him or her. On specified terms, this kind of alien may be called a legal alien of that country...

who have U.S. source income and therefore have to file a U.S. tax return. Joint returns are not permitted, so that husband and wife must each file a separate return. The Form 1040NR-EZ can be used under conditions similar to those for the 1040EZ form.

The Form 1040X, Amended U.S. Individual Tax Return, is used to make corrections to Form 1040, Form 1040A, and Form 1040EZ tax returns that have been previously filed. Generally for a tax refund

Tax refund

A tax refund or tax rebate is a refund on taxes when the tax liability is less than the taxes paid. Taxpayers can often get a tax refund on their income tax if the tax they owe is less than the sum of the total amount of the withholding taxes and estimated taxes that they paid, plus the...

, this form must be filed within 3 years after the date that the original version was filed, or within 2 years after the date that the tax was paid, whichever is later. Forms 1040X are processed manually and therefore take longer than regular returns. For years prior to 2010, Form 1040X had three columns: for the amounts from the original version, for the net increase or decrease for each line being changed, and for the corrected amounts. For 2010, the form was condensed with a single column for the corrected amounts. Due to confusion amongst taxpayers on how to complete the single-column form, the IRS revised the Form 1040X again for 2011 by returning to the original three-column format.

Self-employed individuals and others who do not have enough income taxes withheld

Tax withholding in the United States

Three key types of withholding tax are imposed at various levels in the United States:*Wage withholding taxes,*Withholding tax on payments to foreign persons, and*Backup withholding on dividends and interest....

, might need to file Form 1040-ES, Estimated Tax for Individuals, each quarter to make estimated installments of annual tax liability (pay-as-you-go tax

Pay-as-you-go tax

Pay as you go is a system for businesses and individuals to pay installments of their expected tax liability on their income from employment, business, or investment for the current income year...

).

Entity returns

- Form 1065, U.S. Return of Partnership Income, is used by partnershipPartnershipA partnership is an arrangement where parties agree to cooperate to advance their mutual interests.Since humans are social beings, partnerships between individuals, businesses, interest-based organizations, schools, governments, and varied combinations thereof, have always been and remain commonplace...

s for tax returns. - Form 1120, U.S. Corporation Income Tax Return, is used by C corporationC corporationC corporation refers to any corporation that, under United States income tax law, is taxed separately from its owners. It is distinguished from an S corporation, which is not taxed separately. Most major companies are treated as C corporations for U.S. income tax purposes.-C corporation vs...

s for tax returns. - Form 1120S, U.S. Income Tax Return for an S Corporation, is used by S corporationS CorporationAn S corporation, for United States federal income tax purposes, is a corporation that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code....

s for tax returns. - Form 1041, U.S. Income Tax Return for Estates and Trusts, is used by estatesEstate (law)An estate is the net worth of a person at any point in time. It is the sum of a person's assets - legal rights, interests and entitlements to property of any kind - less all liabilities at that time. The issue is of special legal significance on a question of bankruptcy and death of the person...

and trustsTrust lawIn common law legal systems, a trust is a relationship whereby property is held by one party for the benefit of another...

for tax returns.

Employment (payroll) taxes

- Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return

- Form 941, Employer’s Quarterly Federal Tax Return

Transfer taxes

- Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, is used to report estate taxesEstate tax in the United StatesThe estate tax in the United States is a tax imposed on the transfer of the "taxable estate" of a deceased person, whether such property is transferred via a will, according to the state laws of intestacy or otherwise made as an incident of the death of the owner, such as a transfer of property...

- Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, is used to report gift taxes

Information returns

Informational returns are prepared by third parties (employers, banks, financial institutions, etc.) and report information to both the IRS and taxpayers to help them complete their own tax returnsTax return (United States)

Tax returns in the United States are reports filed with the Internal Revenue Service or with the state or local tax collection agency containing information used to calculate income tax or other taxes...

. The forms report the amounts only on a calendar year (January 1 through December 31) basis, regardless of the fiscal year used by the payer or payee for other federal tax purposes. Taxpayers are usually not required to attach informational returns to their own federal income tax returns unless the form shows federal income tax withheld. Many businesses and organizations must file thousands of information returns per year.

The issuance or non-issuance of an informational return is not determinative of the tax treatment required of the payee. For example, some income reported on Form 1099 might be nontaxable and some taxable income might not be reported at all. Each payee-taxpayer is legally responsible for reporting the correct amount of total income on his or her own federal income tax return regardless of whether an informational return was filed or received.

1098 series

- The Form 1098, Mortgage Interest Statement, is used to report interest that a taxpayer has paid on his or her mortgageMortgage loanA mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan...

. Such interest might be tax-deductible as an itemized deduction - The Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes, reports charitable contributions of motor vehicles

- The Form 1098-E, Student Loan Interest Statement, reports interests the taxpayer paid on student loanStudent loanA student loan is designed to help students pay for university tuition, books, and living expenses. It may differ from other types of loans in that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in education...

s that might qualify as an adjustment to income - The form 1098-T, Tuition Statement, reports tuition expenses the taxpayer paid for college tuition that might entitle the taxpayer for an adjustment to income or a tax credit

1099 series

Form 1099 series is used to report various types of income other than wages, salaries, and tips (for which Form W-2 is used instead). Examples of reportable transactions are amounts paid to independent contractorIndependent contractor

An independent contractor is a natural person, business, or corporation that provides goods or services to another entity under terms specified in a contract or within a verbal agreement. Unlike an employee, an independent contractor does not work regularly for an employer but works as and when...

for services (in IRS terminology, such payments are nonemployee compensation). The ubiquity of the form has also led to use of the phrase "1099" to refer to the independent contractors themselves. In 2011 the requirement has been extended by the Small Business Jobs Act of 2010

Small Business Jobs Act of 2010

The Small Business Jobs Act of 2010 is a federal law passed by the 111th United States Congress and signed into law by President Barack Obama on September 27, 2010...

to payments made by persons who receive income from rental property.

Each payer must complete a Form 1099 for each covered transaction. Three copies are made: one for the payer, one for the payee, and one for the IRS. Payers who file 250 or more Form 1099 reports must file all of them electronically with the IRS. If the fewer than 250 requirement is met, and paper copies are filed, the IRS also requires the payer to submit a copy of Form 1096, which is a summary of information forms being sent to the IRS. The returns must be filed with the IRS by the end of February immediately following the year for which the income items or other proceeds are paid. Copies of the returns must be sent to payees, however, by the end of January. The law provides various dollar amounts under which no Form 1099 reporting requirement is imposed. For some Form 1099s, for example, no filing is required for payees who receive less than $600 from the payer during the applicable year.

Variants for Form 1099

, several versions of Form 1099 are used, depending on the nature of the income transaction:

- 1099-A: acquisition or Abandonment of Secured Property

- 1099-B: Proceeds from Broker and Barter Exchange Transactions

- 1099-C: Cancellation of Debt

- 1099-CAP: Changes in Corporate Control and Capital Structure

- 1099-DIV: Dividends and Distributions

- 1099-G: Government Payments

- 1099-H: Health Insurance Advance Payments

- 1099-INT: Interest Income

- 1099-LTC: Long Term Care Benefits

- 1099-MISC: Miscellaneous Income

- 1099-OID: Original Issue Discount

- 1099-PATR: Taxable Distributions Received From Cooperatives

- 1099-Q: Payment from Qualified Education Programs

- 1099-R: Distributions from Pensions, Annuities, Retirement Plans, IRAs, or Insurance Contracts

- 1099-S: Proceeds from Real Estate Transactions

- 1099-SA: Distributions From an HSA, Archer MSA, or Medicare Advantage MSA

- 1042-S: Foreign Person's U.S. Source Income

- SSA-1099: Social Security Benefit Statement

- SSA-1042S: Social Security Benefit Statement to Nonresident Aliens

- RRB-1099: Payments by the Railroad Retirement Board

- RRB-1099R: Pension and Annuity Income by the Railroad Retirement Board

- RRB-1042S: Payments by the Railroad Retirement Board to Nonresident Aliens

- W-2G: Certain Gambling Winnings

5498 Series

- Form 5498: IRA Contribution Information

- Form 5498-ESA: Coverdell ESA Contribution Information

- Form 5498-SA: HSA, Archer MSA, or Medicare Advantage MSA Information

W-2

The Form W-2, Wage and Tax Statement, is used to report wages paid to employees and the taxes withheldTax withholding in the United States

Three key types of withholding tax are imposed at various levels in the United States:*Wage withholding taxes,*Withholding tax on payments to foreign persons, and*Backup withholding on dividends and interest....

from them. Employers must complete a Form W-2 for each employee to whom they pay a salary, wage, or other compensation as part of the employment relationship. An employer must mail out the Form W-2 to employees on or before January 31. This deadline gives these taxpayers about 2½ months to prepare their returns before the April 15 income tax due date. The form is also used to report FICA taxes to the Social Security Administration

Social Security Administration

The United States Social Security Administration is an independent agency of the United States federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits...

. The Form W-2, along with Form W-3, generally must be filed by the employer with the Social Security Administration by the end of February. Relevant amounts on Form W-2 are reported by the Social Security Administration to the Internal Revenue Service

Internal Revenue Service

The Internal Revenue Service is the revenue service of the United States federal government. The agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue...

.

W-4

The Form W-4 is used by employers to determine the correct amount of tax withholdingTax withholding in the United States

Three key types of withholding tax are imposed at various levels in the United States:*Wage withholding taxes,*Withholding tax on payments to foreign persons, and*Backup withholding on dividends and interest....

to deduct from employees' wages. The form is not mailed to the IRS, but rather retained by the employer. Tax withholdings depend on employee's personal situation and ideally should be equal the annual tax due on the Form 1040. When filling out a Form W-4, an employee calculates the number of Form W-4 allowances he or she will claim, based on his or her expected tax filing situation for the year. For each Form W-4 allowance taken, the amount of money withheld as federal income tax is reduced. No interest is paid on over-withholding, but penalties might be imposed for under-withholding. Alternatively, or in addition, the employee can send quarterly estimated tax payments directly to the IRS (Form 1040-ES). Quarterly estimates might be required if the employee has additional income (e.g. investments or self-employment income) not subject to withholding or insufficiently withheld.

W-8BEN

The Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding, is used by foreign persons (including corporations) to certify their non-American status. The form establishes that one is a non-resident alien or foreign corporationForeign corporation

A foreign corporation is a term used in the United States for an existing corporation that is registered to do business in a state or other jurisdiction other than where it was originally incorporated...

, to avoid or reduce tax withholding

Tax withholding in the United States

Three key types of withholding tax are imposed at various levels in the United States:*Wage withholding taxes,*Withholding tax on payments to foreign persons, and*Backup withholding on dividends and interest....

from U.S. source income, such as rents from U.S. property, interest on U.S. bank deposits or dividends paid by U.S. corporations. The Form W-8BEN form should be given to the withholding agent such as a property manager, bank or stock broker, and not the IRS. The form is not used for U.S. wages and salaries earned by non-resident aliens (in which case Form W-4 is used), or for U.S. freelance (dependent personal services) income (in which case Form 8233 is used). The form requires the foreign person to provide a U.S. Taxpayer Identification Number unless the U.S. income is dividends or interest from actively traded or similar investments.

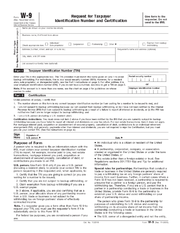

W-9

Social Security number

In the United States, a Social Security number is a nine-digit number issued to U.S. citizens, permanent residents, and temporary residents under section 205 of the Social Security Act, codified as . The number is issued to an individual by the Social Security Administration, an independent...

or Employer Identification Number

Employer identification number

Applicable to the United States, an Employer Identification Number or EIN is the corporate equivalent to a Social Security Number, although it is issued to anyone, including individuals, who has to pay withholding taxes on employees.-Other names:Also known as the Tax Identification Number ,...

). The form is never actually sent to the IRS, but is maintained by the person who files the information return for verification purposes. The information on the Form W-9 and the payment made are usually reported on a Form 1096 or 1099. The second purpose is to help the payee avoid backup withholding. The payor must collect withholding tax

Withholding tax

Withholding tax, also called retention tax, is a government requirement for the payer of an item of income to withhold or deduct tax from the payment, and pay that tax to the government. In most jurisdictions, withholding tax applies to employment income. Many jurisdictions also require...

es on certain reportable payments for the IRS. However, if the payee certifies on the W-9 they are not subject to backup withholding they generally receive the full payment due them from the payor. This is similar to the withholding exemptions certifications found on Form W-4 for employees.

Other forms

- Form 2553, Election by a Small Business Corporation, is used by small businesses to elect to be taxed as a "Subchapter S - Corporation" (S corporationS CorporationAn S corporation, for United States federal income tax purposes, is a corporation that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code....

). - Form 2555, Foreign Earned Income, is filed by taxpayers who have earned income from sources outside the United StatesTaxation in the United StatesThe United States is a federal republic with autonomous state and local governments. Taxes are imposed in the United States at each of these levels. These include taxes on income, property, sales, imports, payroll, estates and gifts, as well as various fees.Taxes are imposed on net income of...

exempt from U.S. income taxIncome taxAn income tax is a tax levied on the income of individuals or businesses . Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate...

. U.S. citizens or resident aliens are taxed on their world-wide income. For those who qualify, however, Form 2555 can be used to exclude foreign earned income up to US$87,600 for 2008, $91,400 for 2009, $91,500 for 2010, and $92,900 for 2011. Also, it can be used to claim a housing exclusion or deductionTax deductionIncome tax systems generally allow a tax deduction, i.e., a reduction of the income subject to tax, for various items, especially expenses incurred to produce income. Often these deductions are subject to limitations or conditions...

. A filer cannot exclude or deduct more than their foreign earned income for the tax year. - Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, is used to request an extension of time to file a federal income tax return for an individual (there is no extension to pay the tax).

- Form 8822, Change of Address, is used to report a change of address to the Internal Revenue ServiceInternal Revenue ServiceThe Internal Revenue Service is the revenue service of the United States federal government. The agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue...

. - Form 8850Form 8850Form 8850 is a United States Internal Revenue Service tax form entitled "Pre-Screening Notice and Certification Request for the Work Opportunity Credit"....

, Pre-Screening Notice and Certification Request for the Work Opportunity Credit, is used in implementation of the federal government's Work Opportunity Tax Credit program. - Form 8889, Health Savings Accounts (HSAs), is used by Health Savings AccountHealth savings accountA health savings account is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan . The funds contributed to an account are not subject to federal income tax at the time of deposit. Unlike a flexible spending account...

HSA holders. HSA administrators are required to send HSA account holders and file forms 1099SA and 5498SA with the IRS each year.

Public disclosure

In the United States, tax records are not publicly available, with the exception the Forms 990 for nonprofits which are generally open for public inspection. Selected tax data is released as economic dataEconomic data

Economic data or economic statistics may refer to data describing an actual economy, past or present. These are typically found in time-series form, that is, covering more than one time period or in cross-sectional data in one time period Economic data or economic statistics may refer to data...

for research. In other countries such as Norway and Finland, tax records are public information. Tax filings in the U.S. were not private when federal income taxation began in 1861, but controversy led to Congress prohibiting any examination of tax records by 1894. Congress allowed public examination of individual and corporate tax payments only in 1923, but the disclosure was eliminated by 1924. In 1934 the measure was briefly considered again. As of 2010, various experts have advocated that the income and tax payments be released for individuals and corporations to shed further light on tax efficiency and spur reform. These experts have suggested only releasing information which can't be used for identity theft to address privacy concerns.