List of recessions

Encyclopedia

Privately held company

A privately held company or close corporation is a business company owned either by non-governmental organizations or by a relatively small number of shareholders or company members which does not offer or trade its company stock to the general public on the stock market exchanges, but rather the...

nonprofit research organization known as the National Bureau of Economic Research

National Bureau of Economic Research

The National Bureau of Economic Research is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic community." The NBER is well known for providing start and end...

(NBER). The NBER defines a recession as "a significant decline in economic activity spread across the economy

Economy of the United States

The economy of the United States is the world's largest national economy. Its nominal GDP was estimated to be nearly $14.5 trillion in 2010, approximately a quarter of nominal global GDP. The European Union has a larger collective economy, but is not a single nation...

, lasting more than a few months, normally visible in real gross domestic product

Gross domestic product

Gross domestic product refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living....

(GDP), real income, employment, industrial production, and wholesale-retail sales".

There have been as many as 47 recessions in the United States since 1790 (although economists and historians dispute certain 19th-century recessions). These downturns are driven by changes in the government's regulatory, fiscal, trade and monetary policies. Cycles in agriculture

Agriculture in the United States

Agriculture is a major industry in the United States and the country is a net exporter of food. As of the last census of agriculture in 2007, there were 2.2 million farms, covering an area of , an average of per farm.-History:...

, consumption, and business investment, and the health of the banking industry also contribute to these declines. U.S. recessions have increasingly affected economies on a worldwide scale, especially as countries' economies become more intertwined

Globalization

Globalization refers to the increasingly global relationships of culture, people and economic activity. Most often, it refers to economics: the global distribution of the production of goods and services, through reduction of barriers to international trade such as tariffs, export fees, and import...

.

In the 19th century, recessions frequently coincided with financial crises

Financial crisis

The term financial crisis is applied broadly to a variety of situations in which some financial institutions or assets suddenly lose a large part of their value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these...

. Determining the occurrence of pre-20th-century recessions is more difficult due to the dearth of economic statistics

Economic statistics

Economic statistics is a topic in applied statistics that concerns the collection, processing, compilation, dissemination, and analysis of economic data. It is also common to call the data themselves 'economic statistics', but for this usage see economic data. The data of concern to economic ...

, so scholars rely on historical accounts of economic activity, such as contemporary newspapers or business ledgers. Although the NBER does not date recessions before 1857, economists customarily extrapolate dates of U.S. recessions back to 1790 from business annals based on various contemporary descriptions. Their work is aided by historical patterns, in that recessions often follow external shocks to the economic system

Economic system

An economic system is the combination of the various agencies, entities that provide the economic structure that defines the social community. These agencies are joined by lines of trade and exchange along which goods, money etc. are continuously flowing. An example of such a system for a closed...

such as wars and variations in the weather affecting agriculture, as well as banking crises.

Major modern economic statistics, such as unemployment

Unemployment

Unemployment , as defined by the International Labour Organization, occurs when people are without jobs and they have actively sought work within the past four weeks...

and gross domestic product

Gross domestic product

Gross domestic product refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living....

, were not compiled on a regular and standardized basis until after World War II. The average duration of the 11 recessions between 1945 and 2001 is 10 months, compared to 18 months for recessions between 1919 and 1945, and 22 months for recessions from 1854 to 1919. Because of the great changes in the economy over the centuries, it is difficult to compare the severity of modern recessions to early recessions. Recessions after World War II appear to have been less severe than earlier recessions, but the reasons for this are unclear.

Early recessions and crises

Attempts have been made to date recessions in America beginning in 1790. These periods of recession were not identified until the 1920s. To construct the dates, researchers studied business annals during the period and constructed time seriesTime series

In statistics, signal processing, econometrics and mathematical finance, a time series is a sequence of data points, measured typically at successive times spaced at uniform time intervals. Examples of time series are the daily closing value of the Dow Jones index or the annual flow volume of the...

of the data. The earliest recessions for which there is the most certainty are those that coincide with major financial crises.

Beginning in 1834, an index of business activity by the Cleveland Trust Company provides data for comparison between recessions. Beginning in 1854, the National Bureau of Economic Research dates recession peaks and troughs to the month. But for the earliest recessions, there are no standardized indexes, and the data are considered unreliable. As the data get older, their reliability worsens.

In 1791, Congress chartered the First Bank of the United States

First Bank of the United States

The First Bank of the United States is a National Historic Landmark located in Philadelphia, Pennsylvania within Independence National Historical Park.-Banking History:...

to handle the country's financial needs. The bank had some functions of a modern central bank, although it was responsible for only 20% of the young country's currency. In 1811 the bank's charter lapsed, but it was replaced by the Second Bank of the United States

Second Bank of the United States

The Second Bank of the United States was chartered in 1816, five years after the First Bank of the United States lost its own charter. The Second Bank of the United States was initially headquartered in Carpenters' Hall, Philadelphia, the same as the First Bank, and had branches throughout the...

, which lasted from 1816–36.

| Name | Dates | Duration | Time since previous recession | Characteristics |

|---|---|---|---|---|

| Panic of 1797 Panic of 1797 The Panic of 1796–1797 was a series of downturns in Atlantic credit markets that led to broader commercial downturns in both Britain and the United States. In the U.S., problems first emerged when the Bubble of land speculation burst in 1796... |

1796–1799 | ~3 years | ~6 years | Just as a land speculation bubble was bursting, deflation from the Bank of England Bank of England The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694, it is the second oldest central bank in the world... (which was facing insolvency because of the cost of Great Britain's involvement in the French Revolutionary Wars French Revolutionary Wars The French Revolutionary Wars were a series of major conflicts, from 1792 until 1802, fought between the French Revolutionary government and several European states... ) crossed to North America and disrupted commercial Market A market is one of many varieties of systems, institutions, procedures, social relations and infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services in exchange for money from buyers... and real estate Real estate In general use, esp. North American, 'real estate' is taken to mean "Property consisting of land and the buildings on it, along with its natural resources such as crops, minerals, or water; immovable property of this nature; an interest vested in this; an item of real property; buildings or... markets in the United States and the Caribbean Caribbean The Caribbean is a crescent-shaped group of islands more than 2,000 miles long separating the Gulf of Mexico and the Caribbean Sea, to the west and south, from the Atlantic Ocean, to the east and north... , and caused a major financial panic Panic of 1797 The Panic of 1796–1797 was a series of downturns in Atlantic credit markets that led to broader commercial downturns in both Britain and the United States. In the U.S., problems first emerged when the Bubble of land speculation burst in 1796... . Prosperity continued in the south, but economic activity was stagnant in the north for three years. The young United States engaged in the Quasi-War Quasi-War The Quasi-War was an undeclared war fought mostly at sea between the United States and French Republic from 1798 to 1800. In the United States, the conflict was sometimes also referred to as the Franco-American War, the Pirate Wars, or the Half-War.-Background:The Kingdom of France had been a... with France. |

| 1802–1804 recession | 1802–1804 | ~2 years | ~3 years | A boom of war-time activity led to a decline after the Peace of Amiens ended the war between the United Kingdom and France French Revolutionary Wars The French Revolutionary Wars were a series of major conflicts, from 1792 until 1802, fought between the French Revolutionary government and several European states... . Commodity prices fell dramatically. Trade was disrupted by pirates, leading to the First Barbary War First Barbary War The First Barbary War , also known as the Barbary Coast War or the Tripolitan War, was the first of two wars fought between the United States and the North African Berber Muslim states known collectively as the Barbary States... . |

| Depression of 1807 | 1807–1810 | ~3 years | ~3 years | The Embargo Act of 1807 Embargo Act of 1807 The Embargo Act of 1807 and the subsequent Nonintercourse Acts were American laws restricting American ships from engaging in foreign trade between the years of 1807 and 1812. The Acts were diplomatic responses by presidents Thomas Jefferson and James Madison designed to protect American interests... was passed by the United States Congress United States Congress The United States Congress is the bicameral legislature of the federal government of the United States, consisting of the Senate and the House of Representatives. The Congress meets in the United States Capitol in Washington, D.C.... under President Thomas Jefferson Thomas Jefferson Thomas Jefferson was the principal author of the United States Declaration of Independence and the Statute of Virginia for Religious Freedom , the third President of the United States and founder of the University of Virginia... as tensions increased with the United Kingdom. Along with trade restrictions imposed by the British, shipping-related industries were hard hit. The Federalists Federalist Party (United States) The Federalist Party was the first American political party, from the early 1790s to 1816, the era of the First Party System, with remnants lasting into the 1820s. The Federalists controlled the federal government until 1801... fought the embargo and allowed smuggling to take place in New England New England New England is a region in the northeastern corner of the United States consisting of the six states of Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, and Connecticut... . Trade volumes, commodity prices and securities prices all began to fall. Macon's Bill Number 2 Macon's Bill Number 2 Macon's Bill Number 2, which became law in the United States on May 1, 1810, was intended to motivate Britain and France to stop seizing American vessels during the Napoleonic Wars. This bill was a revision of the original bill by Representative Nathaniel Macon, known as Macon's Bill Number 1. The... ended the embargoes in May 1810, and a recovery started. |

| 1812 recession | 1812 | ~6 months | ~18 months | The United States entered a brief recession at the beginning of 1812. The decline was brief primarily because the United States soon increased production to fight the War of 1812 War of 1812 The War of 1812 was a military conflict fought between the forces of the United States of America and those of the British Empire. The Americans declared war in 1812 for several reasons, including trade restrictions because of Britain's ongoing war with France, impressment of American merchant... , which began June 18, 1812. |

| 1815–21 depression | 1815–1821 | ~6 years | ~3 years | Shortly after the war ended on March 23, 1815, the United States entered a period of financial panic as bank notes rapidly depreciated because of inflation following the war. The 1815 panic was followed by several years of mild depression, and then a major financial crisis – the Panic of 1819 Panic of 1819 The Panic of 1819 was the first major financial crisis in the United States, and had occurred during the political calm of the Era of Good Feelings. The new nation previously had faced a depression following the war of independence in the late 1780s and led directly to the establishment of the... , which featured widespread foreclosures, bank failures, unemployment Unemployment Unemployment , as defined by the International Labour Organization, occurs when people are without jobs and they have actively sought work within the past four weeks... , a collapse in real estate prices, and a slump in agriculture Agriculture Agriculture is the cultivation of animals, plants, fungi and other life forms for food, fiber, and other products used to sustain life. Agriculture was the key implement in the rise of sedentary human civilization, whereby farming of domesticated species created food surpluses that nurtured the... and manufacturing Manufacturing Manufacturing is the use of machines, tools and labor to produce goods for use or sale. The term may refer to a range of human activity, from handicraft to high tech, but is most commonly applied to industrial production, in which raw materials are transformed into finished goods on a large scale... . |

| 1822–1823 recession | 1822–1823 | ~1 year | ~1 year | After only a mild recovery following the lengthy 1815–21 depression, commodity prices hit a peak in March 1822 and began to fall. Many businesses failed, unemployment rose and an increase in imports worsened the trade balance. |

| 1825–1826 recession | 1825–1826 | ~1 year | ~2 years | The Panic of 1825 Panic of 1825 The Panic of 1825 was a stock market crash that started in the Bank of England arising in part out of speculative investments in Latin America, including the imaginary country of Poyais... , a stock crash following a bubble of speculative investments in Latin America led to a decline in business activity in the United States and England. The recession coincided with a major panic, the date of which may be more easily determined than general cycle changes associated with other recessions. |

| 1828–1829 recession | 1828–1829 | ~1 year | ~2 years | In 1826, England forbade the United States to trade with English colonies, and in 1827, the United States adopted a counter-prohibition. Trade declined, just as credit became tight for manufacturers in New England. |

| 1833–34 recession | 1833–1834 | ~1 year | ~4 years | The United States' economy declined moderately in 1833–34. News accounts of the time confirm the slowdown. The subsequent expansion was driven by land speculation. |

Free Banking Era to the Great Depression

Andrew Jackson

Andrew Jackson was the seventh President of the United States . Based in frontier Tennessee, Jackson was a politician and army general who defeated the Creek Indians at the Battle of Horseshoe Bend , and the British at the Battle of New Orleans...

fought to end the Second Bank of the United States

Second Bank of the United States

The Second Bank of the United States was chartered in 1816, five years after the First Bank of the United States lost its own charter. The Second Bank of the United States was initially headquartered in Carpenters' Hall, Philadelphia, the same as the First Bank, and had branches throughout the...

. Following the Bank War

Bank War

The Bank War is the name given to the controversy over the Second Bank of the United States and the attempts to destroy it by President Andrew Jackson. At that time, it was the only nationwide bank and, along with its president Nicholas Biddle, exerted tremendous influence over the nation's...

, the Second Bank lost its charter in 1836. From 1837 to 1862, there was no national presence in banking, but still plenty of state and even local regulation, such as laws against branch banking which prevented diversification. In 1863, in response to financing pressures of the Civil War, Congress passed the National Banking Act

National Banking Act

The National Banking Acts of 1863 and 1864 were two United States federal laws that established a system of national charters for banks, and created the United States National Banking System. They encouraged development of a national currency backed by bank holdings of U.S...

, creating nationally chartered banks. There was neither a central bank nor deposit insurance during this era, and thus banking panics were common. Recessions often led to bank panics and financial crises, which in turn worsened the recession.

The dating of recessions during this period is controversial. Modern economic statistics, such as gross domestic product

Gross domestic product

Gross domestic product refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living....

and unemployment, were not gathered during this period. Victor Zarnowitz

Victor Zarnowitz

Victor Zarnowitz was a leading scholar on business cycles, indicators, and forecast evaluation. Dr. Zarnowitz was Senior Fellow and Economic Counselor to The Conference Board...

evaluated a variety of indices to measure the severity of these recessions. From 1834 to 1929, one measure of recessions is the Cleveland Trust Company index, which measured business activity and, beginning in 1882, an index of trade and industrial activity was available, which can be used to compare recessions.

| Name | Dates | Duration | Time since previous recession | Business activity | Trade & industrial activity | Characteristics |

|---|---|---|---|---|---|---|

| 1836–1838 | — | ~2 years | ~2 years | —32.8% | — | A sharp downturn in the American economy Economy of the United States The economy of the United States is the world's largest national economy. Its nominal GDP was estimated to be nearly $14.5 trillion in 2010, approximately a quarter of nominal global GDP. The European Union has a larger collective economy, but is not a single nation... was caused by bank failures and lack of confidence in the paper currency Banknote A banknote is a kind of negotiable instrument, a promissory note made by a bank payable to the bearer on demand, used as money, and in many jurisdictions is legal tender. In addition to coins, banknotes make up the cash or bearer forms of all modern fiat money... . Speculation markets were greatly affected when American banks stopped payment Specie Circular The Specie Circular was an executive order issued by U.S. President Andrew Jackson in 1836 and carried out by President Martin Van Buren. It required payment for government land to be in gold and silver.-History:... in specie Currency In economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply... (gold and silver coinage). Over 600 banks failed in this period. In the South, the cotton market completely collapsed. |

| late 1839–late 1843 | — | ~4 years | ~1 year | -34.3% | — | This was one of the longest and deepest depressions. It was a period of pronounced deflation and massive default on debt. The Cleveland Trust Company Index showed the economy spent 68 months below its trend and only 9 months above it. The Index declined 34.3% during this depression. |

| 1845–late 1846 | — | ~1 year | ~2 years | −5.9% | — | This recession was mild enough that it may have only been a slowdown in the growth cycle. One theory holds that this would have been a recession, except the United States began to gear up for the Mexican–American War Mexican–American War The Mexican–American War, also known as the First American Intervention, the Mexican War, or the U.S.–Mexican War, was an armed conflict between the United States and Mexico from 1846 to 1848 in the wake of the 1845 U.S... , which began April 25, 1846. |

| 1847–48 recession | late 1847–late 1848 | ~1 year | ~1 year | −19.7% | — | The Cleveland Trust Company Index declined 19.7% during 1847 and 1848. It is associated with a financial crisis in Great Britain Panic of 1847 The Panic of 1847 was started as a collapse of British financial markets associated with the end of the 1840s railway industry boom. As a means of stabilizing the British economy the ministry of Robert Peel passed the Bank Charter Act of 1844... . |

| 1853–54 recession | 1853 –Dec 1854 | ~1 year | ~5 years | −18.4% | — | Interest rates rose in this period, contributing to a decrease in railroad investment. Security prices fell during this period. With the exception of falling business investment there is little evidence of contraction in this period. |

| Panic of 1857 Panic of 1857 The Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Indeed, because of the interconnectedness of the world economy by the time of the 1850s, the financial crisis which began in the autumn of 1857 was... |

June 1857–Dec 1858 | 1 year 6 months |

2 years 6 months |

−23.1% | — | Failure of the Ohio Life Insurance and Trust Company Ohio Life Insurance and Trust Company The Ohio Life Insurance and Trust Company was a banking institution based in Cincinnati, Ohio, which existed from 1830 1857. The Panic of 1857, an economic depression, resulted after the company's New York City offices ceased operations due to bad investments, especially in agricultural-related... burst a European speculative bubble in United States' railroads Rail transport in the United States Presently, most rail transport in the United States is based on freight train shipments. The U.S. rail industry has experienced repeated convulsions due to changing U.S. economic needs and the rise of automobile, bus, and air transport.... and caused a loss of confidence in American banks Banking in the United States Banking in the United States is regulated by both the federal and state governments.The U.S. banking sector's short-term liabilities as of October 11, 2008 are 15% of the gross domestic product of the United States or 43% of its national debt, and the average bank leverage ratio is 12 to... . Over 5,000 businesses failed within the first year of the Panic, and unemployment was accompanied by protest meetings in urban areas. This is the earliest recession to which the NBER assigns specific months (rather than years) for the peak and trough. |

| 1860–61 recession | Oct 1860–June 1861 | 8 months | 1 year 10 months |

−14.5% | — | There was a recession before the American Civil War American Civil War The American Civil War was a civil war fought in the United States of America. In response to the election of Abraham Lincoln as President of the United States, 11 southern slave states declared their secession from the United States and formed the Confederate States of America ; the other 25... , which began April 12, 1861. Zarnowitz says the data generally show a contraction occurred in this period, but it was quite mild. A financial panic was narrowly averted in 1860 by the first use of clearing house certificates Clearing house (finance) A clearing house is a financial institution that provides clearing and settlement services for financial and commodities derivatives and securities transactions... between banks. |

| 1865–67 recession | April 1865–Dec 1867 | 2 years 8 months |

3 years 10 months |

−23.8% | — | The American Civil War American Civil War The American Civil War was a civil war fought in the United States of America. In response to the election of Abraham Lincoln as President of the United States, 11 southern slave states declared their secession from the United States and formed the Confederate States of America ; the other 25... ended in April 1865, and the country entered a lengthy period of general deflation that lasted until 1896. The United States occasionally experienced periods of recession during the Reconstruction era. Production increased in the years following the Civil War, but the country still had financial difficulties. The post-war period coincided with a period of some international financial instability Panic of 1866 The Panic of 1866 was an international financial downturn that accompanied the failure of Overend, Gurney and Company in London, and the corso forzoso abandonment of the silver standard in Italy.-References:... . |

| 1869–70 recession | June 1869–Dec 1870 | 1 year 6 months |

1 year 6 months |

−9.7% | — | A few years after the Civil War, a short recession occurred. It was unusual since it came amid a period when railroad investment was greatly accelerating, even producing the First Transcontinental Railroad First Transcontinental Railroad The First Transcontinental Railroad was a railroad line built in the United States of America between 1863 and 1869 by the Central Pacific Railroad of California and the Union Pacific Railroad that connected its statutory Eastern terminus at Council Bluffs, Iowa/Omaha, Nebraska The First... . The railroads built in this period opened up the interior of the country, giving birth to the Farmers' movement Farmers' movement The Farmers Movement was, in American political history, the general name for a movement between 1867 and 1896 remarkable for a radical socio-economic propaganda that came from what was considered the most conservative class of American society... . The recession may be explained partly by ongoing financial difficulties following the war, which discouraged businesses from building up inventories. Several months into the recession, there was a major financial panic Black Friday (1869) Black Friday, September 24, 1869 also known as the Fisk/Gould scandal, was a financial panic in the United States caused by two speculators’ efforts to corner the gold market on the New York Gold Exchange. It was one of several scandals that rocked the presidency of Ulysses S. Grant... . |

| Panic of 1873 Panic of 1873 The Panic of 1873 triggered a severe international economic depression in both Europe and the United States that lasted until 1879, and even longer in some countries. The depression was known as the Great Depression until the 1930s, but is now known as the Long Depression... and the Long Depression Long Depression The Long Depression was a worldwide economic crisis, felt most heavily in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. At the time, the episode was labeled the Great... |

Oct 1873 – Mar 1879 |

5 years 5 months |

2 years 10 months |

−33.6% (−27.3%) | — | Economic problems in Europe prompted the failure of Jay Cooke & Company Jay Cooke Jay Cooke was an American financier. Cooke and his firm Jay Cooke & Company were most notable for their role in financing the Union's war effort during the American Civil War... , the largest bank in the United States, which burst the post-Civil War American Civil War The American Civil War was a civil war fought in the United States of America. In response to the election of Abraham Lincoln as President of the United States, 11 southern slave states declared their secession from the United States and formed the Confederate States of America ; the other 25... speculative bubble Speculation In finance, speculation is a financial action that does not promise safety of the initial investment along with the return on the principal sum... . The Coinage Act of 1873 also contributed by immediately depressing the price of silver, which hurt North American mining interests. The deflation and wage cuts of the era led to labor turmoil, such as the Great Railroad Strike of 1877 Great railroad strike of 1877 The Great Railroad Strike of 1877 began on July 14 in Martinsburg, West Virginia, United States and ended some 45 days later after it was put down by local and state militias, and federal troops.-Economic conditions in the 1870s:... . In 1879, the United States returned to the gold standard with the Specie Payment Resumption Act Specie Payment Resumption Act Late in 1861, the United States federal government suspended specie payments, seeking to raise revenue for the American Civil War effort without exhausting its reserves of gold and silver. Early in 1862, the United States issued legal-tender notes, called greenbacks... . This is the longest period of economic contraction recognized by the NBER. The Long Depression Long Depression The Long Depression was a worldwide economic crisis, felt most heavily in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. At the time, the episode was labeled the Great... is sometimes held to be the entire period from 1873–96. |

| 1882–85 recession | Mar 1882 – May 1885 |

3 years 2 months |

3 years | −32.8% | −24.6% | Like the Long Depression that preceded it, the recession of 1882–85 was more of a price depression than a production depression. From 1879 to 1882, there had been a boom in railroad construction which came to an end, resulting in a decline in both railroad construction and in related industries, particularly iron and steel. A major economic event during the recession was the Panic of 1884 Panic of 1884 The Panic of 1884 was a panic during the Recession of 1882-85. Gold reserves of Europe were depleted and the New York City national banks, with tacit approval of the United States Treasury Department, halted investments in the rest of the United States and called in outstanding loans. A larger... . |

| 1887–88 recession | Mar 1887 – April 1888 |

1 year 1 month |

1 year 10 months |

−14.6% | −8.2% | Investments in railroads and buildings weakened during this period. This slowdown was so mild that it is not always considered a recession. Contemporary accounts apparently indicate it was considered a slight recession. |

| 1890–91 recession | July 1890 – May 1891 |

10 months | 1 year 5 months |

−22.1% | −11.7% | Although shorter than the recession in 1887–88 and still modest, a slowdown in 1890–91 was somewhat more pronounced than the preceding recession. International monetary disturbances are blamed for this recession, such as the Panic of 1890 Panic of 1890 The Panic of 1890 was an acute depression, although less serious than other panics of the era. It was precipitated by the near insolvency of Barings Bank in London. Barings, led by Edward Baring, 1st Baron Revelstoke, faced bankruptcy in November 1890 due mainly to excessive risk-taking on poor... in the United Kingdom. |

| Panic of 1893 Panic of 1893 The Panic of 1893 was a serious economic depression in the United States that began in 1893. Similar to the Panic of 1873, this panic was marked by the collapse of railroad overbuilding and shaky railroad financing which set off a series of bank failures... |

Jan 1893 – June 1894 |

1 year 5 months |

1 year 8 months |

−37.3% | −29.7% | Failure of the United States Reading Railroad and withdrawal of European investment led to a stock market and banking collapse Panic of 1893 The Panic of 1893 was a serious economic depression in the United States that began in 1893. Similar to the Panic of 1873, this panic was marked by the collapse of railroad overbuilding and shaky railroad financing which set off a series of bank failures... . This Panic was also precipitated in part by a run Bank run A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent... on the gold supply. The Treasury had to issue bonds to purchase enough gold. Profits, investment and income all fell, leading to political instability, the height of the U.S. populist movement Populist Party (United States) The People's Party, also known as the "Populists", was a short-lived political party in the United States established in 1891. It was most important in 1892-96, then rapidly faded away... and the Free Silver Free Silver Free Silver was an important United States political policy issue in the late 19th century and early 20th century. Its advocates were in favor of an inflationary monetary policy using the "free coinage of silver" as opposed to the less inflationary Gold Standard; its supporters were called... movement. |

| Panic of 1896 Panic of 1896 The Panic of 1896 was an acute economic depression in the United States that was less serious than other panics of the era precipitated by a drop in silver reserves and market concerns on the effects it would have on the gold standard. Deflation of commodities prices drove the stock market to new... |

Dec 1895 – June 1897 |

1 year 6 months |

1 year 6 months |

−25.2% | −20.8% | The period of 1893–97 is seen as a generally depressed cycle that had a short spurt of growth in the middle, following the Panic of 1893. Production shrank and deflation reigned. |

| 1899–1900 recession | June 1899 – Dec 1900 |

1 year 6 months |

2 years | −15.5% | −8.8% | This was a mild recession in the period of general growth beginning after 1897. Evidence for a recession in this period does not show up in some annual data series. |

| 1902–04 recession | Sep 1902 –Aug 1904 | 1 year 11 months |

1 year 9 months |

−16.2% | −17.1% | Though not severe, this downturn lasted for nearly two years and saw a distinct decline in the national product. Industrial and commercial production both declined, albeit fairly modestly. The recession came about a year after a 1901 stock crash Panic of 1901 The Panic of 1901 was the first stock market crash on the New York Stock Exchange, caused in part by struggles between E. H. Harriman, Jacob Schiff, and J. P. Morgan/James J. Hill for the financial control of the Northern Pacific Railway. The stock cornering was orchestrated by James Stillman and... . |

| Panic of 1907 Panic of 1907 The Panic of 1907, also known as the 1907 Bankers' Panic, was a financial crisis that occurred in the United States when the New York Stock Exchange fell almost 50% from its peak the previous year. Panic occurred, as this was during a time of economic recession, and there were numerous runs on... |

May 1907 – June 1908 |

1 year 1 month |

2 years 9 months |

−29.2% | −31.0% | A run on Knickerbocker Trust Company Knickerbocker Trust Company The Knickerbocker Trust, chartered in 1884 by Frederick G. Eldridge, a friend and classmate of financier J.P. Morgan, figured at one time among the largest banks in the United States and a central player in the Panic of 1907. As a trust company, its main business was serving as trustee for... deposits on October 22, 1907, set events in motion that would lead to a severe monetary contraction. The fallout from the panic led to Congress creating the Federal Reserve System History of the Federal Reserve System This article is about the history of the United States Federal Reserve System from its creation to the present.- Central banking in the United States prior to the Federal Reserve :... . |

| Panic of 1910–1911 | Jan 1910 – Jan 1912 |

2 years | 1 year 7 months |

−14.7% | −10.6% | This was a mild but lengthy recession. The national product grew by less than 1%, and commercial activity and industrial activity declined. The period was also marked by deflation. |

| Recession of 1913–1914 | Jan 1913–Dec 1914 | 1 year 11 months |

1 year | −25.9% | −19.8% | Productions and real income declined during this period and were not offset until the start of World War I World War I World War I , which was predominantly called the World War or the Great War from its occurrence until 1939, and the First World War or World War I thereafter, was a major war centred in Europe that began on 28 July 1914 and lasted until 11 November 1918... increased demand. Incidentally, the Federal Reserve Act Federal Reserve Act The Federal Reserve Act is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes and Federal Reserve Bank Notes as legal tender... was signed during this recession, creating the Federal Reserve System Federal Reserve System The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907... , the culmination of a sequence of events following the Panic of 1907 Panic of 1907 The Panic of 1907, also known as the 1907 Bankers' Panic, was a financial crisis that occurred in the United States when the New York Stock Exchange fell almost 50% from its peak the previous year. Panic occurred, as this was during a time of economic recession, and there were numerous runs on... . |

| Post-World War I recession | Aug 1918 – March 1919 |

7 months | 3 years 8 months |

−24.5% | −14.1% | Severe hyperinflation Hyperinflation In economics, hyperinflation is inflation that is very high or out of control. While the real values of the specific economic items generally stay the same in terms of relatively stable foreign currencies, in hyperinflationary conditions the general price level within a specific economy increases... in Europe took place over production in North America. This was a brief but very sharp recession and was caused by the end of wartime production, along with an influx of labor from returning troops. This, in turn, caused high unemployment. |

| Depression of 1920–21 | Jan 1920 – July 1921 |

1 year 6 months |

10 months | −38.1% | −32.7% | The 1921 recession began a mere 10 months after the post-World War I recession, as the economy continued working through the shift to a peacetime economy. The recession was short, but extremely painful. The year 1920 was the single most deflationary year in American history; production, however, did not fall as much as might be expected from the deflation. GNP may have declined between 2.5 and 7 percent, even as wholesale prices declined by 36.8%. The economy had a strong recovery following the recession. |

| 1923–24 recession | May 1923 – June 1924 |

1 year 2 months |

2 years | −25.4% | −22.7% | From the depression of 1920–21 until the Great Depression, an era dubbed the Roaring Twenties Roaring Twenties The Roaring Twenties is a phrase used to describe the 1920s, principally in North America, but also in London, Berlin and Paris for a period of sustained economic prosperity. The phrase was meant to emphasize the period's social, artistic, and cultural dynamism... , the economy was generally expanding. Industrial production declined in 1923–24, but on the whole this was a mild recession. |

| 1926–27 recession | Oct 1926 – Nov 1927 |

1 year 1 month |

2 years 3 months |

−12.2% | −10.0% | This was an unusual and mild recession, thought to be caused largely because Henry Ford Henry Ford Henry Ford was an American industrialist, the founder of the Ford Motor Company, and sponsor of the development of the assembly line technique of mass production. His introduction of the Model T automobile revolutionized transportation and American industry... closed production in his factories for six months to switch from production of the Model T to the Model A. Charles P. Kindleberger Charles P. Kindleberger Charles Poor "Charlie" Kindleberger was a historical economist and author of over 30 books. His 1978 book Manias, Panics, and Crashes, about speculative stock market bubbles, was reprinted in 2000 after the dot-com bubble. He is well known for hegemonic stability theory.-Life:Kindleberger was born... says the period from 1925 to the start of the Great Depression is best thought of as a boom, and this minor recession just proof that the boom "was not general, uninterrupted or extensive". |

Great Depression onwards

Bureau of Economic Analysis

The Bureau of Economic Analysis is an agency in the United States Department of Commerce that provides important economic statistics including the gross domestic product of the United States. Its stated mission is to "promote a better understanding of the U.S...

, unemployment from the Bureau of Labor Statistics

Bureau of Labor Statistics

The Bureau of Labor Statistics is a unit of the United States Department of Labor. It is the principal fact-finding agency for the U.S. government in the broad field of labor economics and statistics. The BLS is a governmental statistical agency that collects, processes, analyzes, and...

(after 1948). Note that the unemployment rate often reaches a peak associated with a recession after the recession has officially ended.

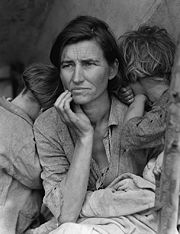

No recession of the post-World War II era has come anywhere near the depth of the Great Depression. In the Great Depression, GDP fell by 27% (the deepest after demobilization is the recession beginning in December 2007, during which GDP has fallen 3.9% as of the second quarter of 2009) and unemployment reached 25% (the highest since was the 10.8% rate reached during the 1981–82 recession).

The National Bureau of Economic Research

National Bureau of Economic Research

The National Bureau of Economic Research is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic community." The NBER is well known for providing start and end...

dates recessions on a monthly basis back to 1854; according to their chronology, from 1854 to 1919, there were 16 cycles. The average recession lasted 22 months, and the average expansion 27. From 1919 to 1945, there were six cycles; recessions lasted an average 18 months and expansions for 35. From 1945 to 2001, and 10 cycles, recessions lasted an average 10 months and expansions an average of 57 months. This has prompted some economists to declare that the business cycle has become less severe. Factors that may have contributed to this moderation include the creation of a central bank and lender of last resort, like the Federal Reserve System

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

in 1913, the establishment of deposit insurance in the form of the Federal Deposit Insurance Corporation

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation is a United States government corporation created by the Glass–Steagall Act of 1933. It provides deposit insurance, which guarantees the safety of deposits in member banks, currently up to $250,000 per depositor per bank. , the FDIC insures deposits at...

in 1933, increased regulation of the banking sector, the adoption of interventionist Keynesian economics

Keynesian economics

Keynesian economics is a school of macroeconomic thought based on the ideas of 20th-century English economist John Maynard Keynes.Keynesian economics argues that private sector decisions sometimes lead to inefficient macroeconomic outcomes and, therefore, advocates active policy responses by the...

, and the increase in automatic stabilizer

Automatic stabilizer

In macroeconomics, automatic stabilizers describes how modern government budget policies, particularly income taxes and welfare spending, act to dampen fluctuations in real GDP....

s in the form of government programs (unemployment insurance, social security, and later Medicare and Medicaid). See Post-World War II economic expansion

Post-World War II economic expansion

The post–World War II economic expansion, also known as the postwar economic boom, the long boom, and the Golden Age of Capitalism, was a period of economic prosperity in the mid 20th century, which occurred mainly in western countries, followed the end of World War II in 1945, and lasted until the...

for further discussion.

| Name | Dates | Duration (months) | Time since previous recession (months) | Peak unemployment | GDP decline (peak to trough) | Characteristics |

|---|---|---|---|---|---|---|

| Great Depression Great Depression The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s... |

Aug 1929 – Mar 1933 |

4 years 7 months |

1 year 9 months |

24.9% (1933) |

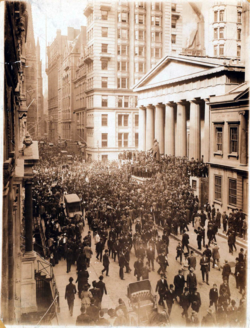

−26.7% | Stock markets crashed Wall Street Crash of 1929 The Wall Street Crash of 1929 , also known as the Great Crash, and the Stock Market Crash of 1929, was the most devastating stock market crash in the history of the United States, taking into consideration the full extent and duration of its fallout... worldwide. A banking collapse took place in the United States. Extensive new tariffs Smoot-Hawley Tariff Act The Tariff Act of 1930, otherwise known as the Smoot–Hawley Tariff was an act, sponsored by United States Senator Reed Smoot and Representative Willis C. Hawley, and signed into law on June 17, 1930, that raised U.S. tariffs on over 20,000 imported goods to record levels.The overall level tariffs... and other factors Causes of the Great Depression The causes of the Great Depression are still a matter of active debate among economists, and is part of the larger debate about economic crises, although the popular belief is that the Great Depression was caused by the crash of the stock market... contributed to an extremely deep depression. The United States did remain in a depression until World War II. In 1936, unemployment fell to 16.9%, but later returned to 19% in 1938 (near 1933 levels). |

| Recession of 1937 Recession of 1937 The Recession of 1937–1938 was a temporary reversal of the pre-war 1933 to 1941 economic recovery from the Great Depression in the United States.-Background:... |

May 1937 – June 1938 |

1 year 1 month |

4 years 2 months |

19.0% (1938) |

−18.2% | The Recession of 1937 Recession of 1937 The Recession of 1937–1938 was a temporary reversal of the pre-war 1933 to 1941 economic recovery from the Great Depression in the United States.-Background:... is only considered minor when compared to the Great Depression, but is otherwise among the worst recessions of the 20th century. Three explanations are offered for the recession: that tight fiscal policy from an attempt to balance the budget after the expansion of the New Deal New Deal The New Deal was a series of economic programs implemented in the United States between 1933 and 1936. They were passed by the U.S. Congress during the first term of President Franklin D. Roosevelt. The programs were Roosevelt's responses to the Great Depression, and focused on what historians call... caused recession, that tight monetary policy from the Federal Reserve caused the recession, or that declining profits for businesses led to a reduction in investment. |

| Recession of 1945 | Feb–Oct 1945 | 8 months | 6 years 8 months |

5.2% (1946) |

−12.7% | The decline in government spending at the end of World War II led to an enormous drop in gross domestic product, making this technically a recession. This was the result of demobilization and the shift from a wartime to peacetime economy. The post-war years were unusual in a number of ways (unemployment was never high) and this era may be considered a "sui generis Sui generis Sui generis is a Latin expression, literally meaning of its own kind/genus or unique in its characteristics. The expression is often used in analytic philosophy to indicate an idea, an entity, or a reality which cannot be included in a wider concept.... end-of-the-war recession". |

| Recession of 1949 Recession of 1949 The Recession of 1949 was a downturn in the United States lasting for 11 months when lots of people had not that much money sometimes. According to the National Bureau of Economic Research, the recession began in November 1948 and lasted until October 1949.... |

Nov 1948 – Oct 1949 |

11 months | 3 years 1 month |

7.9% (Oct 1949) |

−1.7% | The 1948 recession was a brief economic downturn; forecasters of the time expected much worse, perhaps influenced by the poor economy in their recent lifetimes. The recession began shortly after President Truman's "Fair Deal Fair Deal The Fair Deal was the term given to an ambitious set of proposals put forward by United States President Harry S. Truman to the United States Congress in his January 1949 State of the Union address. The term, however, has also been used to describe the domestic reform agenda of the Truman... " economic reforms. The recession also followed a period of monetary tightening. |

| Recession of 1953 Recession of 1953 In the United States the Recession of 1953 began in the second quarter of 1953 and lasted until the first quarter of 1954. The total recession cost roughly $56 billion.-Preceding the Recession:... |

July 1953 – May 1954 |

10 months | 3 years 9 months |

6.1% (Sep 1954) |

−2.6% | After a post-Korean War Korean War The Korean War was a conventional war between South Korea, supported by the United Nations, and North Korea, supported by the People's Republic of China , with military material aid from the Soviet Union... inflationary period, more funds were transferred to national security National security National security is the requirement to maintain the survival of the state through the use of economic, diplomacy, power projection and political power. The concept developed mostly in the United States of America after World War II... . In 1951, the Federal Reserve reasserted its independence 1951 Accord The 1951 Accord, also known simply as the Accord, was an agreement between the U.S. Department of the Treasury and the Federal Reserve that restored independence to the Fed.... from the U.S. Treasury and in 1952, the Federal Reserve changed monetary policy to be more restrictive because of fears of further inflation or of a bubble Economic bubble An economic bubble is "trade in high volumes at prices that are considerably at variance with intrinsic values"... forming. |

| Recession of 1958 Recession of 1958 The Recession of 1958 was a sharp worldwide economic downturn in 1958, and the most significant one during the post-World War II boom between 1945 and 1970.... |

Aug 1957 – April 1958 |

8 months | 3 years 3 months |

7.5% (July 1958) |

−3.7% | Monetary policy was tightened during the two years preceding 1957, followed by an easing of policy at the end of 1957. The budget balance resulted in a change in budget surplus of 0.8% of GDP in 1957 to a budget deficit of 0.6% of GDP in 1958, and then to 2.6% of GDP in 1959. |

| Recession of 1960–61 Recession of 1960–61 The Recession of 1960–1961 was a recession in the United States. According to the National Bureau of Economic Research the recession lasted for 10 months, beginning in April 1960 and ending in February 1961. The recession preceded the second longest economic expansion in U.S... |

Apr 1960 – Feb 1961 |

10 months | 2 years | 7.1% (May 1961) |

−1.6% | Another primarily monetary recession occurred after the Federal Reserve began raising interest rates in 1959. The government switched from deficit (or 2.6% in 1959) to surplus (of 0.1% in 1960). When the economy emerged from this short recession, it began the second-longest period of growth in NBER history. |

| Recession of 1969–70 Recession of 1969–70 The Recession of 1969–1970 was a relatively mild recession in the United States. According to the National Bureau of Economic Research the recession lasted for 11 months, beginning in December 1969 and ending in November 1970. The recession followed the second longest economic expansion in U.S... |

Dec 1969 – Nov 1970 |

11 months | 8 years 10 months |

6.1% (Dec 1970) |

−0.6% | The relatively mild 1969 recession followed a lengthy expansion. At the end of the expansion, inflation was rising, possibly a result of increased deficits. This relatively mild recession coincided with an attempt to start closing the budget deficits of the Vietnam War Vietnam War The Vietnam War was a Cold War-era military conflict that occurred in Vietnam, Laos, and Cambodia from 1 November 1955 to the fall of Saigon on 30 April 1975. This war followed the First Indochina War and was fought between North Vietnam, supported by its communist allies, and the government of... (fiscal tightening) and the Federal Reserve raising interest rates (monetary tightening). |

| 1973–75 recession 1973–75 recession The 1973–75 recession in the United States or 1970s recession was a period of economic stagnation in much of the Western world during the 1970s, putting an end to the general post-World War II economic boom. It differed from many previous recessions as being a stagflation, where high unemployment... |

Nov 1973 – Mar 1975 |

1 year 4 months |

3 years | 9.0% (May 1975) |

−3.2% | A quadrupling of oil prices by OPEC OPEC OPEC is an intergovernmental organization of twelve developing countries made up of Algeria, Angola, Ecuador, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, and Venezuela. OPEC has maintained its headquarters in Vienna since 1965, and hosts regular meetings... coupled with high government spending because of the Vietnam War led to stagflation Stagflation In economics, stagflation is a situation in which the inflation rate is high and the economic growth rate slows down and unemployment remains steadily high... in the United States. The period was also marked by the 1973 oil crisis 1973 oil crisis The 1973 oil crisis started in October 1973, when the members of Organization of Arab Petroleum Exporting Countries or the OAPEC proclaimed an oil embargo. This was "in response to the U.S. decision to re-supply the Israeli military" during the Yom Kippur war. It lasted until March 1974. With the... and the 1973–1974 stock market crash. The period is remarkable for rising unemployment coinciding with rising inflation. |

| 1980 recession Early 1980s recession The early 1980s recession describes the severe global economic recession affecting much of the developed world in the late 1970s and early 1980s. The United States and Japan exited recession relatively early, but high unemployment would continue to affect other OECD nations through at least 1985... |

Jan–July 1980 | 6 months | 4 years 10 months |

7.8% (July 1980) |

−2.2% | The NBER considers a short recession to have occurred in 1980, followed by a short period of growth and then a deep recession. Unemployment remained relatively elevated in between recessions. The recession began as the Federal Reserve, under Paul Volcker Paul Volcker Paul Adolph Volcker, Jr. is an American economist. He was the Chairman of the Federal Reserve under United States Presidents Jimmy Carter and Ronald Reagan from August 1979 to August 1987. He is widely credited with ending the high levels of inflation seen in the United States in the 1970s and... , raised interest rates dramatically to fight the inflation of the 1970s Stagflation In economics, stagflation is a situation in which the inflation rate is high and the economic growth rate slows down and unemployment remains steadily high... . The early '80s are sometimes referred to as a "double-dip" or "W-shaped" recession. |

| Early 1980s recession Early 1980s recession The early 1980s recession describes the severe global economic recession affecting much of the developed world in the late 1970s and early 1980s. The United States and Japan exited recession relatively early, but high unemployment would continue to affect other OECD nations through at least 1985... |

July 1981 – Nov 1982 |

1 year 4 months |

1 year | 10.8% (Nov 1982) |

−2.7% | The Iranian Revolution Iranian Revolution The Iranian Revolution refers to events involving the overthrow of Iran's monarchy under Shah Mohammad Reza Pahlavi and its replacement with an Islamic republic under Ayatollah Ruhollah Khomeini, the leader of the... sharply increased the price of oil around the world in 1979, causing the 1979 energy crisis 1979 energy crisis The 1979 oil crisis in the United States occurred in the wake of the Iranian Revolution. Amid massive protests, the Shah of Iran, Mohammad Reza Pahlavi, fled his country in early 1979 and the Ayatollah Khomeini soon became the new leader of Iran. Protests severely disrupted the Iranian oil... . This was caused by the new regime in power in Iran Iran Iran , officially the Islamic Republic of Iran , is a country in Southern and Western Asia. The name "Iran" has been in use natively since the Sassanian era and came into use internationally in 1935, before which the country was known to the Western world as Persia... , which exported oil at inconsistent intervals and at a lower volume, forcing prices up. Tight monetary policy Monetary policy Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment... in the United States to control inflation led to another recession. The changes were made largely because of inflation carried over from the previous decade because of the 1973 oil crisis 1973 oil crisis The 1973 oil crisis started in October 1973, when the members of Organization of Arab Petroleum Exporting Countries or the OAPEC proclaimed an oil embargo. This was "in response to the U.S. decision to re-supply the Israeli military" during the Yom Kippur war. It lasted until March 1974. With the... and the 1979 energy crisis. |

| Early 1990s recession | July 1990 – Mar 1991 |

8 months | 7 years 8 months |

7.8% (June 1992) |

−1.4% | After the lengthy peacetime expansion of the 1980s, inflation began to increase and the Federal Reserve responded by raising interest rates from 1986 to 1989. This weakened but did not stop growth, but some combination of the subsequent 1990 oil price shock, the debt accumulation of the 1980s, and growing consumer pessimism combined with the weakened economy to produce a brief recession. |

| Early 2000s recession Early 2000s recession The early 2000s recession was a decline in economic activity which occurred mainly in developed countries. The recession affected the European Union mostly during 2000 and 2001 and the United States mostly in 2002 and 2003. The UK, Canada and Australia avoided the recession for the most part, while... |

March 2001–Nov 2001 | 8 months | 10 years | 6.3% (June 2003) |

−0.3% | The 1990s were the longest period of growth in American history. The collapse of the speculative dot-com bubble Dot-com bubble The dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more... , a fall in business outlays and investments, and the September 11th attacks Economic effects arising from the September 11 attacks Major economic effects arose from the September 11 attacks, with initial shock causing global stock markets to drop sharply. The attacks themselves caused approximately $40 billion in insurance losses, making it one of the largest insured events ever.... , brought the decade of growth to an end. Despite these major shocks, the recession was brief and shallow. Without the September 11th attacks, the economy might have avoided recession altogether. |

| Late-2000s recession | Dec 2007-June 2009 | 1 year 6 months |

6 years 1 month |

10.1% (October 2009) U6 17.4% (October 2009) |

−5.1% | The subprime mortgage crisis Subprime mortgage crisis The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages.... led to the collapse of the United States housing bubble United States housing bubble The United States housing bubble is an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and may not yet have hit bottom as of 2011. On December 30, 2008 the... . Falling housing-related assets contributed to a global financial crisis, even as oil and food prices soared. The crisis led to the failure or collapse of many of the United States' largest financial institutions: Bear Stearns Bear Stearns The Bear Stearns Companies, Inc. based in New York City, was a global investment bank and securities trading and brokerage, until its sale to JPMorgan Chase in 2008 during the global financial crisis and recession... , Fannie Mae, Freddie Mac, Lehman Brothers Lehman Brothers Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker... and AIG American International Group American International Group, Inc. or AIG is an American multinational insurance corporation. Its corporate headquarters is located in the American International Building in New York City. The British headquarters office is on Fenchurch Street in London, continental Europe operations are based in... , as well as a crisis in the automobile industry Automotive industry crisis of 2008–2009 The automotive industry crisis of 2008–2010 was a part of a global financial downturn. The crisis affected European and Asian automobile manufacturers, but it was primarily felt in the American automobile manufacturing industry... . The government responded with an unprecedented $700 billion bank bailout and $787 billion fiscal stimulus package American Recovery and Reinvestment Act of 2009 The American Recovery and Reinvestment Act of 2009, abbreviated ARRA and commonly referred to as the Stimulus or The Recovery Act, is an economic stimulus package enacted by the 111th United States Congress in February 2009 and signed into law on February 17, 2009, by President Barack Obama.To... . The National Bureau of Economic Research declared the end of this recession over a year after the end date. |