Causes of the Great Depression

Encyclopedia

The causes of the Great Depression are still a matter of active debate among economist

s, and is part of the larger debate about economic crises, although the popular belief is that the Great Depression was caused by the crash of the stock market. The specific economic events that took place during the Great Depression

have been studied thoroughly: a deflation in asset and commodity

prices, dramatic drops in demand and credit, and disruption of trade, ultimately resulting in widespread unemployment and hence poverty. However, historians lack consensus in describing the causal relationship between various events and the role of government economic policy

in causing or ameliorating the Depression.

Current theories may be broadly classified into two main areas:

First, there is orthodox classical economics

: monetarist

, Austrian Economics and neoclassical economic theory

, which focus on the macroeconomic effects of money supply

, how central bank

ing decisions led to a surplus or shortage of money, ergo an economic bubble

or deflation, or on the impact of gold standards, which backed many currencies at the onset of the Great Depression, and was universally abandoned as a likely contributor. This was seen as impacting production

and consumption

. A fourth point of view, not widely held, is the effect of population dynamics upon demand.

Second, there are structural theories, most importantly Keynesian

, but also including those of institutional economics

, that point to underconsumption

and overinvestment, malfeasance

by bankers and industrialists, or incompetence by government officials. The only consensus viewpoint is that there was a large-scale lack of confidence. Unfortunately, once panic and deflation set in, many people believed they could make more money by keeping clear of the markets as prices got lower and lower and a given amount of money bought ever more goods.

in 1936 argued that there are many reasons why the self-correcting mechanisms that some economists claimed should work during a downturn may not work in practice. In his The General Theory of Employment, Interest and Money, Keynes introduced concepts that were intended to help explain the Great Depression. One argument for a non-interventionist policy during a recession

was that if consumption fell due to savings, the savings would cause the rate of interest to fall. According to the classical economists, lower interest rates would lead to increased investment spending and demand would remain constant. However, Keynes states that there are good reasons why investment does not necessarily increase in response to a fall in the interest rate. Businesses make investments based on expectations of profit. Therefore, if a fall in consumption appears to be long-term, businesses analyzing trends will lower expectations of future sales. Therefore, the last thing they are interested in doing is investing in increasing future production, even if lower interest rates make capital inexpensive. In that case, according to Keynesians and contrary to Say's law

, the economy can be thrown into a general slump. According to Keynes, this self-reinforcing dynamic is what occurred to an extreme degree during the Depression, where bankruptcies

were common and investment, which requires a degree of optimism, was very unlikely to occur.

and Anna Schwartz

laid out their case for a different explanation of the Great Depression. After the Depression, the primary explanations of it tended to ignore the importance of money. However, in the monetarist view, the Depression was “in fact a tragic testimonial to the importance of monetary forces.” In their view, the failure of the Federal Reserve

to deal with the Depression was not a sign that monetary policy was impotent, but that the Federal Reserve exercised the wrong policies. They did not claim the Fed caused the depression, only that it failed to use policies that might have stopped a recession from turning into a depression.

Monetarist explanations had been rejected in Samuelson's 1948 Economics

, writing "Today few economists regard Federal Reserve monetary policy as a panacea for controlling the business cycle. Purely monetary factors are considered to be as much symptoms as causes, albeit symptoms with aggravating effects that should not be completely neglected." According to Keynesian economist, Paul Krugman, the work of Friedman and Schwartz became dominant among mainstream economists by the 1980s but should be reconsidered in light of Japan's Lost Decade

of the 1990s. The role of monetary policy in financial crises is in active debate regarding the financial crisis of 2007–2010; see causes of the financial crisis of 2007–2009

.

Ben Bernanke

, the current Chairman of the Federal Reserve, agreed with Friedman in blaming the Federal Reserve for its role in the Great Depression, and stated on Nov. 8, 2002:

Starting in 1873, when the US and Europe had generally adopted a government-mandated gold standard, the US had dealt with what appeared to be a cycle of boom and bust, the failure half often seeming to be set off by bank panics, the most significant occurring in 1873, 1893, 1901, 1907, and 1920. Before the 1913 establishment of the Federal Reserve

, the banking system had dealt with these crises in the U.S. (such as in the Panic of 1907

) by suspending the convertibility of deposits into currency. Starting in 1893, there was a growing effort by financial institutions and business men to intervene, providing liquidity to banks suffering runs. In 1907, an ad-hoc coalition assembled by J. P. Morgan

succeeded in doing just this, cutting off the panic and appearing to prevent the depression that usually followed. A call by some for a government version of this solution resulted in the establishment of the Federal Reserve.

But in 1928-32, the Federal Reserve did not act to provide liquidity to banks suffering runs. In fact, it did the opposite, preceding the whole crisis by its own sudden contraction of the money supply: During the Roaring Twenties, the Fed had set as its primary goal "price stability", in part because the governor of the New York Fed, Benjamin Strong, was a disciple of Irving Fisher

, a tremendously popular economist who popularized stable prices as a monetary goal. It had kept the number of dollars at such an amount that prices of goods in society appeared stable. In 1928, Strong died, and with his death this policy ended, to be replaced with a Real bills doctrine

, requiring that all currency or securities have material goods backing them. This policy forced a contraction of 30% of the US money supply

When this money shortage caused runs on banks, the Fed maintained its True Bills policy, refusing to lend money to the banks in the way that had cut short the 1907 panic, instead allowing each to suffer a catastrophic run and fail entirely.

Friedman said that if a policy similar to 1907 had been followed during the banking panic at the end of 1930, perhaps this would have stopped the vicious circle of the forced liquidation of assets at depressed prices. Consequently, the banking panics of 1931, 1932, and 1933 might not have happened, just as suspension of convertibility in 1893 and 1907 had quickly ended the liquidity crises at the time.”

Essentially, the Great Depression, in the monetarist view, was caused by the fall of the money supply. Friedman and Schwartz write: "From the cyclical peak in August 1929 to a cyclical trough in March 1933, the stock of money fell by over a third." The result was what Friedman calls the "Great Contraction" — a period of falling income, prices, and employment caused by the choking effects of a restricted money supply.

Chain Reactions in Economics (Friedman and Schwartz, 1963: P.419: the banking crisis in USA: “It happens that a liquidity crisis in a unit fractional reserve banking system is precisely the kind of event that trigger- and often has triggered- a chain reaction. And economic collapse often has the character of a cumulative process. Let it go beyond a certain point, and it will tend for a time to gain strength from its own development as its effects spread and return to intensify the process of collapse”. Thus chain reactions may result in vicious circles

.

The mechanism suggested by Friedman and Schwartz was that people wanted to hold more money than the Federal Reserve was supplying. As a result people hoarded money by consuming less. This caused a contraction in employment and production since prices were not flexible enough to immediately fall. The Fed's failure was in not realizing what was happening and not taking corrective action.

theorists who wrote about the Depression include F.A. Hayek

and Murray Rothbard

.

Hayek objected to the price stability policy of the Roaring Twenties, but referred to the Fed's sudden contraction of money and failure to offer banks liquidity as "silly":

Hayek did oppose Keynes' arguments regarding what caused the Great Depression, which he blamed on government spending and other stimulus, saying in a 1932 letter to Keynes:

Rothbard, on the other hand, advocated the Fed's hands-off approach, and wrote "America's Great Depression

" in 1963. In his view, the Great Depression was the inevitable outcome of the easy credit policies of the Federal Reserve during the 1920s. Since its enactment in 1913, the Federal Reserve had served as the central bank

of the U.S. The Federal reserve effectively regulated the amount of credit private banks could issue by providing overnight loans and strict reserve requirements. According to Rothbard, government intervention delayed the market’s adjustment and made the road to complete recovery more difficult.

Rothbard criticizes Milton Friedman

's assertion that the central bank failed to sufficiently increase the supply of money, saying that the Federal Reserve's purchased $1.1 billion of government securities from February to July 1932, which raised its total holding to $1.8 billion, was already too much intervention, which Rothbard claimed to be inflation. Total bank reserves only rose by $212 million, but Rothbard argues that this was because the American populace lost faith in the banking system and began hoarding more cash, a factor very much beyond the control of the Central Bank. The potential for a run on the banks caused local bankers to be more conservative in lending out their reserves, and, Rothbard argues, was the cause of the Federal Reserve's inability to inflate.

This illustrates a fundamental difference between Rothbard and not only Friedman, but even other Austrians like Ludwig von Mises

, who note that consumers and banks holding money represents an increase in demand, and that inflation only occurs when the money's supply outpaces its demand:

According to Mises, the increased holding of money meant that the Fed was not inflating the money supply by $1.8 billion, but only by $212 million.

Total debt to GDP levels in the U.S. reached a high of just under 300% by the time of the Depression. This level of debt was not exceeded again until near the end of the 20th century.

Total debt to GDP levels in the U.S. reached a high of just under 300% by the time of the Depression. This level of debt was not exceeded again until near the end of the 20th century.

Jerome (1934) gives an unattributed quote about finance conditions that allowed the great industrial expansion of the post WW I period:

Furthermore, Jerome says that the volume of new capital issues increased at a 7.7% compounded annual rate from 1922-29 at a time when the Standard Statistics Co.'s index of 60 high grade bonds yielded from 4.98% in 1923 to 4.47% in 1927.

There was also a real estate and housing bubble in the 1920s, especially in Florida, which burst in 1925. Alvin Hansen

stated that housing construction during the 1920s decade exceeded population growth by 25%. See also:Florida land boom of the 1920s

Irving Fisher

argued that the predominant factor leading to the Great Depression was over-indebtedness and deflation. Fisher tied loose credit to over-indebtedness, which fueled speculation and asset bubbles. He then outlined nine factors interacting with one another under conditions of debt and deflation to create the mechanics of boom to bust. The chain of events proceeded as follows:

During the Crash of 1929 preceding the Great Depression, margin requirements were only 10%. Brokerage firms, in other words, would lend $9 for every $1 an investor had deposited. When the market fell, brokers called in these loans, which could not be paid back. Banks began to fail as debtors defaulted on debt and depositors attempted to withdraw their deposits en masse, triggering multiple bank run

s. Government guarantees and Federal Reserve banking regulations to prevent such panics were ineffective or not used. Bank failures led to the loss of billions of dollars in assets. Outstanding debts became heavier, because prices and incomes fell by 20–50% but the debts remained at the same dollar amount. After the panic of 1929, and during the first 10 months of 1930, 744 US banks failed. (In all, 9,000 banks failed during the 1930s). By April 1933, around $7 billion in deposits had been frozen in failed banks or those left unlicensed after the March Bank Holiday

.

Bank failures snowballed as desperate bankers called in loans, which the borrowers did not have time or money to repay. With future profits looking poor, capital investment

and construction slowed or completely ceased. In the face of bad loans and worsening future prospects, the surviving banks became even more conservative in their lending. Banks built up their capital reserves and made fewer loans, which intensified deflationary pressures. A vicious cycle

developed and the downward spiral accelerated.

The liquidation of debt could not keep up with the fall of prices it caused. The mass effect of the stampede to liquidate increased the value of each dollar owed, relative to the value of declining asset holdings. The very effort of individuals to lessen their burden of debt effectively increased it. Paradoxically, the more the debtors paid, the more they owed. This self-aggravating process turned a 1930 recession into a 1933 great depression.

Macroeconomists including Ben Bernanke

, the current chairman of the U.S. Federal Reserve Bank, have revived the debt-deflation view of the Great Depression originated by Fisher.

of the last quarter of the 19th century. There may have also been a continuation of the correction to the sharp inflation caused by WW I.

Oil prices reached their all time low in the early 1930s as production began from the East Texas Oil Field

, the largest field ever found in the lower 48 states. With the oil market oversupplied prices locally fell to below ten cents per barrel.

, popularized a theory that influenced many policy makers, including Herbert Hoover, Henry A. Wallace

, Paul Douglas

, and Marriner Eccles. It held that the economy produced more than it consumed, because the consumers did not have enough income. Thus the unequal distribution of wealth throughout the 1920s caused the Great Depression.

According to this view, wages increased at a rate lower than productivity increases. Most of the benefit of the increased productivity went into profits, which went into the stock market bubble

rather than into consumer purchases. Say's law

no longer operated in this model (an idea picked up by Keynes).

As long as corporations had continued to expand their capital facilities (their factories, warehouses, heavy equipment, and other investments), the economy had flourished. Under pressure from the Coolidge

administration and from business, the Federal Reserve Board kept the discount rate low, encouraging high (and excessive) investment. By the end of the 1920s, however, capital investments had created more plant space than could be profitably used, and factories were producing more than consumers could purchase.

According to this view, the root cause of the Great Depression was a global overinvestment in heavy industry capacity compared to wages and earnings from independent businesses, such as farms. The solution was the government must pump money into consumers' pockets. That is, it must redistribute purchasing power, maintain the industrial base, but reinflate prices and wages to force as much of the inflationary increase in purchasing power into consumer spending. The economy was overbuilt, and new factories were not needed. Foster and Catchings recommended federal and state governments start large construction projects, a program followed by Hoover and Roosevelt.

Economic historians (especially Friedman and Schwartz) emphasize the importance of numerous bank failures. The failures were mostly in rural America. Structural weaknesses in the rural economy made local banks highly vulnerable. Farmers, already deeply in debt, saw farm prices plummet in the late 1920s and their implicit real interest rates on loans skyrocket; their land was already over-mortgaged (as a result of the 1919 bubble in land prices), and crop prices were too low to allow them to pay off what they owed. Small banks, especially those tied to the agricultural economy, were in constant crisis in the 1920s with their customers defaulting on loans because of the sudden rise in real interest rates; there was a steady stream of failures among these smaller banks throughout the decade.

Economic historians (especially Friedman and Schwartz) emphasize the importance of numerous bank failures. The failures were mostly in rural America. Structural weaknesses in the rural economy made local banks highly vulnerable. Farmers, already deeply in debt, saw farm prices plummet in the late 1920s and their implicit real interest rates on loans skyrocket; their land was already over-mortgaged (as a result of the 1919 bubble in land prices), and crop prices were too low to allow them to pay off what they owed. Small banks, especially those tied to the agricultural economy, were in constant crisis in the 1920s with their customers defaulting on loans because of the sudden rise in real interest rates; there was a steady stream of failures among these smaller banks throughout the decade.

The city banks also suffered from structural weaknesses that made them vulnerable to a shock. Some of the nation's largest banks were failing to maintain adequate reserves and were investing heavily in the stock market or making risky loans. Loans to Germany

and Latin America

by New York City

banks were especially risky. In other words, the banking system was not well prepared to absorb the shock of a major recession.

Economists have argued that a liquidity trap

might have contributed to bank failures.

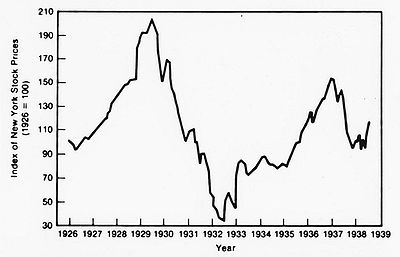

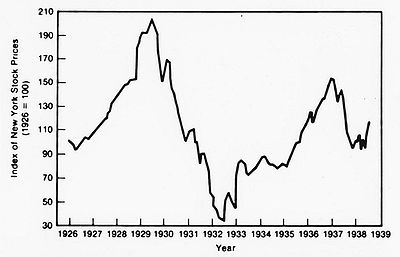

Economists and historians debate how much responsibility to assign the Wall Street Crash of 1929. The timing was right; the magnitude of the shock to expectations of future prosperity was high. Most analysts believe the market in 1928-29 was a "bubble" with prices far higher than justified by fundamentals. Economists agree that somehow it shared some blame, but how much no one has estimated. Milton Friedman concluded, "I don't doubt for a moment that the collapse of the stock market in 1929 played a role in the initial recession". The debate has three sides: one group says the crash caused the depression by drastically lowering expectations about the future and by removing large sums of investment capital; a second group says the economy was slipping since summer 1929 and the crash ratified it; the third group says that in either scenario the crash could not have caused more than a recession. There was a brief recovery in the market into April 1930, but prices then started falling steadily again from there, not reaching a final bottom until July 1932. This was the largest long-term U.S. market decline by any measure. To move from a recession in 1930 to a deep depression in 1931-32, entirely different factors had to be in play.

had to pay France

, Germany began a credit-fueled period of growth in order to export and sell enough abroad to gain gold to pay back reparations. The U.S., as the world's gold sink, loaned money to Germany to industrialize, which was then the basis for Germany paying back France, and France paying back loans to the U.K. and U.S. This arrangement was codified in the Dawes Plan

.

This had numerous economic consequences. However, what is of particular relevance is that following the war, most nations returned to the gold standard at the pre-war gold price, in part, because those who had loaned in nominal amounts hoped to recover the same value in gold that they had lent, and in part because the prevailing opinion at the time was that deflation was not a danger, while inflation, particularly the inflation in the Weimar Republic

, was an unbearable danger. Monetary policy was in effect put into a deflationary setting that would over the next decade slowly grind away at the health of many European economies. While the British Banking Act of 1925 created currency controls and exchange restrictions, it set the new price of the Pound Sterling

at parity with the pre-war price. At the time, this was criticized by John Maynard Keynes

and others, who argued that in so doing, they were forcing a revaluation of wages without any tendency to equilibrium. Keynes' criticism of Winston Churchill

's form of the return to the gold standard implicitly compared it to the consequences of the Versailles Treaty.

Deflation's impact is particularly hard on sectors of the economy that are in debt or that regularly use loans to finance activity, such as agriculture. Deflation erodes the price of commodities while increasing the real value of debt, which all came to the stock market crash of 1929.

More recent research, by economists such as Peter Temin

, Ben Bernanke

and Barry Eichengreen

, has focused on the constraints policy makers were under at the time of the Depression. In this view, the constraints of the inter-war gold standard

magnified the initial economic shock and was a significant obstacle to any actions that would ameliorate the growing Depression. According to them, the initial destabilizing shock may have originated with the Wall Street Crash of 1929

in the U.S., but it was the gold standard system that transmitted the problem to the rest of the world.

According to their conclusions, during a time of crisis, policy makers may have wanted to loosen monetary and fiscal policy, but such action would threaten the countries’ ability to maintain its obligation to exchange gold at its contractual rate. The gold standard required countries to maintain high interest rates to attract international investors who bought foreign assets with gold. Therefore, governments had their hands tied as the economies collapsed, unless they abandoned their currency’s link to gold. By fixing the exchange rate of all countries on the gold standard, it ensured that the market for foreign exchange can only equilibrate through interest rates. As the Depression worsened, many countries started to abandon the gold standard, and those that abandoned it earlier suffered less from deflation and tended to recover more quickly.

Richard Timberlake

, economist of the free banking

school and protege of Milton Friedman, specifically addressed this stance in his paper, Gold Standards and the Real Bills Doctrine in U.S. Monetary Policy, wherein he argued that the Federal Reserve actually had plenty of lee-way under the gold standard, as had been demonstrated by the price stability policy of New York Fed governor Benjamin Strong, between 1923 and 1928. But when Strong died in late 1928, the faction that took over dominance of the Fed advocated a real bills doctrine, where all money had to be represented by physical goods. This policy, forcing a 30% deflation of the dollar that inevitably damaged the US economy, is stated by Timberlake as being arbitrary and avoidable, the existing gold standard having been capable of continuing without it:

]

Steven Horwitz

, economist of the free banking

branch of Austrian economics, blamed Hoover's spending, itself, for putting the "Great" in the depression:

David Weinberger

contrasted this approach with the cutting of spending, taxes, and deficits (also seen in the chart at right) under Coolidge, which had dramatically stimulated the economy out of the depression that Wilson's massive Federal government had caused. It's noteworthy that Hoover, as commerce secretary under Coolidge, had urged for increases in spending and regulation under Coolidge, much of the kind he later implemented, himself, in 1929.

This massive growth under Hoover is apparent even if adjusting for the declining revenue of Hoover's economic downturn, as noted by Randall G. Holcombe

, who found that Federal spending as a percentage of GDP still increased, in fact did so more than under FDR.

, in Herbert Hoover's Depression and elsewhere Murray Rothbard outlined a laundry list of new Federal regulations imposed by Hoover, in industrial, agricultural, and labor fields, which he described as combining with the Federal Reserve's interventionism to bring about the Great Depression:

had insisted (to the consternation of Woodrow Wilson) on demanding reparation payments from Germany and Austria–Hungary. Reparations, they believed, would provide them with a way to pay off their own debts. However, Germany and Austria-Hungary were themselves in deep economic trouble after the war; they were no more able to pay the reparations than the Allies were able to pay their debts.

The debtor nations put strong pressure on the U.S. in the 1920s to forgive the debts, or at least reduce them. The American government refused. Instead, U.S. banks began making large loans to the nations of Europe. Thus, debts (and reparations) were being paid only by augmenting old debts and piling up new ones. In the late 1920s, and particularly after the American economy began to weaken after 1929, the European nations found it much more difficult to borrow money from the U.S. At the same time, high U.S. tariff

s were making it much more difficult for them to sell their goods in U.S. markets. Without any source of revenue from foreign exchange to repay their loans, they began to default.

Beginning late in the 1920s, European demand for U.S. goods began to decline. That was partly because European industry and agriculture were becoming more productive, and partly because some European nations (most notably Weimar Germany) were suffering serious financial crises and could not afford to buy goods overseas. However, the central issue causing the destabilization of the European economy in the late 1920s was the international debt structure that had emerged in the aftermath of World War I.

The Smoot–Hawley Tariff Act was especially harmful to agriculture because it caused farmers to default on their loans. This event may have worsened or even caused the ensuing bank runs in the Midwest

and West

that caused the collapse of the banking system.

Prior to the Great Depression, a petition signed by over 1,000 economists was presented to the U.S. government warning that the Smoot-Hawley Tariff Act would bring disastrous economic repercussions; however, this did not stop the act from being signed into law.

The high tariff walls critically impeded the payment of war debts. As a result of high U.S. tariffs, only a sort of cycle kept the reparations and war-debt payments going. During the 1920s, the former allies paid the war-debt installments to the U.S. chiefly with funds obtained from German reparations payments, and Germany was able to make those payments only because of large private loans from the U.S. and Britain. Similarly, U.S. investments abroad provided the dollars, which alone made it possible for foreign nations to buy U.S. exports.

In the scramble for liquidity that followed the 1929 stock market crash, funds flowed back from Europe to America, and Europe's fragile economies crumbled.

By 1931, the world was reeling from the worst depression of recent memory, and the entire structure of reparations and war debts collapsed.

, such as the Smoot–Hawley Tariff Act, is often indicted as a cause of the Great Depression, with countries enacting protectionist policies yielding a beggar-thy-neighbor result. Others argue that protectionism was not a cause but a reaction to the depression, with protectionism policies being adopted by countries holding to the gold standard

rather than having floating exchange rate

s: countries on the gold standard could not cut interest rates or act as lender of last resort because they would run out of gold, while countries off the gold standard could cut interest rates and print fiat money

. In this interpretation, protectionism served to change the terms of trade

for countries whose monetary policy

was constrained by the gold standard.

, followed by the Immigration Act of 1924

. The 1924 Act was aimed at further restricting the Southern and Eastern Europeans, especially Jews, Italians, and Slavs, who had begun to enter the country in large numbers beginning in the 1890s, but it had the effect of reducing overall immigration.

Clarence L. Barber, an economist at the University of Manitoba

, explored declines in population growth as a contributing, and possibly a key, underlying factor. He explored how the deaths of young men in World War I resulted in fewer households being formed thereafter. Certainly, the 1918 flu contributed greatly. And increased secularism in the "Roaring Twenties

" may have also diverted couples from forming families, and bearing and raising children, gradually affecting demand for housing and other goods. Barber also cites studies indicating falling demand for loans from banks preceded the decline in availability of funds for loans. This would explain, at least in part, underconsumption.

More evidence for this explanation comes from Phillip Longman

, author of “The Empty Cradle”, in a documentary, “Demographic Winter”, where he stated, “In previous eras in which we had manpower shortages, we resorted to things like slavery, and indentured servitude. And gradually, as the world population took off, beginning in the 18th century, we freed more and more categories of people from slavery and from debt peonage". This statement implies that economic prosperity was in part, if not largely, the result of a boom in population growth.

, mass production

and motorized transportation and farm machinery, and because of the rapid growth in productivity there was a lot of excess production capacity, with numerous closings of manufacturing plants and falling prices. As a consequence, the work week fell slightly in the decade prior to the depression.

The depression led to additional large numbers of plant closings.

Mechanization in Industry Jerome (1934), whose publication was sponsored by the National Bureau of Economic Research,

noted that whether mechanization tends to increase output or displace labor depends on the elasticity of demand for the product. Also, reduced costs of production were not always passed on to consumers. It was further noted agriculture was adversely affected by the decrease in need for animal feed as horses and mules were displaced by inanimate sources of power following WW I. Mechanization in Industry also said the term "technological unemployment" was being used to describe the labor situation during the depression.

Sometime after the peak of the business cycle in 1923 an excess number of workers were displaced by productivity improvements compared to new jobs created, causing unemployment to rise slowly after 1925.

The dramatic rise in productivity of major industries in the U. S. and the effects of productivity on output, wages and the work week are discussed by a Brookings Institution sponsored book.

Economist

An economist is a professional in the social science discipline of economics. The individual may also study, develop, and apply theories and concepts from economics and write about economic policy...

s, and is part of the larger debate about economic crises, although the popular belief is that the Great Depression was caused by the crash of the stock market. The specific economic events that took place during the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

have been studied thoroughly: a deflation in asset and commodity

Commodity

In economics, a commodity is the generic term for any marketable item produced to satisfy wants or needs. Economic commodities comprise goods and services....

prices, dramatic drops in demand and credit, and disruption of trade, ultimately resulting in widespread unemployment and hence poverty. However, historians lack consensus in describing the causal relationship between various events and the role of government economic policy

Economic policy

Economic policy refers to the actions that governments take in the economic field. It covers the systems for setting interest rates and government budget as well as the labor market, national ownership, and many other areas of government interventions into the economy.Such policies are often...

in causing or ameliorating the Depression.

Current theories may be broadly classified into two main areas:

First, there is orthodox classical economics

Classical economics

Classical economics is widely regarded as the first modern school of economic thought. Its major developers include Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Malthus and John Stuart Mill....

: monetarist

Monetarism

Monetarism is a tendency in economic thought that emphasizes the role of governments in controlling the amount of money in circulation. It is the view within monetary economics that variation in the money supply has major influences on national output in the short run and the price level over...

, Austrian Economics and neoclassical economic theory

Neoclassical economics

Neoclassical economics is a term variously used for approaches to economics focusing on the determination of prices, outputs, and income distributions in markets through supply and demand, often mediated through a hypothesized maximization of utility by income-constrained individuals and of profits...

, which focus on the macroeconomic effects of money supply

Money supply

In economics, the money supply or money stock, is the total amount of money available in an economy at a specific time. There are several ways to define "money," but standard measures usually include currency in circulation and demand deposits .Money supply data are recorded and published, usually...

, how central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

ing decisions led to a surplus or shortage of money, ergo an economic bubble

Economic bubble

An economic bubble is "trade in high volumes at prices that are considerably at variance with intrinsic values"...

or deflation, or on the impact of gold standards, which backed many currencies at the onset of the Great Depression, and was universally abandoned as a likely contributor. This was seen as impacting production

Mass production

Mass production is the production of large amounts of standardized products, including and especially on assembly lines...

and consumption

Consumption (economics)

Consumption is a common concept in economics, and gives rise to derived concepts such as consumer debt. Generally, consumption is defined in part by comparison to production. But the precise definition can vary because different schools of economists define production quite differently...

. A fourth point of view, not widely held, is the effect of population dynamics upon demand.

Second, there are structural theories, most importantly Keynesian

Keynesian economics

Keynesian economics is a school of macroeconomic thought based on the ideas of 20th-century English economist John Maynard Keynes.Keynesian economics argues that private sector decisions sometimes lead to inefficient macroeconomic outcomes and, therefore, advocates active policy responses by the...

, but also including those of institutional economics

Institutional economics

Institutional economics focuses on understanding the role of the evolutionary process and the role of institutions in shaping economic behaviour. Its original focus lay in Thorstein Veblen's instinct-oriented dichotomy between technology on the one side and the "ceremonial" sphere of society on the...

, that point to underconsumption

Underconsumption

In underconsumption theory in economics, recessions and stagnation arise due to inadequate consumer demand relative to the amount produced. The theory has been replaced since the 1930s by Keynesian economics and the theory of aggregate demand, both of which were influenced by...

and overinvestment, malfeasance

Malfeasance

The expressions misfeasance and nonfeasance, and occasionally malfeasance, are used in English law with reference to the discharge of public obligations existing by common law, custom or statute.-Definition and relevant rules of law:...

by bankers and industrialists, or incompetence by government officials. The only consensus viewpoint is that there was a large-scale lack of confidence. Unfortunately, once panic and deflation set in, many people believed they could make more money by keeping clear of the markets as prices got lower and lower and a given amount of money bought ever more goods.

Keynesian

British economist John Maynard KeynesJohn Maynard Keynes

John Maynard Keynes, Baron Keynes of Tilton, CB FBA , was a British economist whose ideas have profoundly affected the theory and practice of modern macroeconomics, as well as the economic policies of governments...

in 1936 argued that there are many reasons why the self-correcting mechanisms that some economists claimed should work during a downturn may not work in practice. In his The General Theory of Employment, Interest and Money, Keynes introduced concepts that were intended to help explain the Great Depression. One argument for a non-interventionist policy during a recession

Recession

In economics, a recession is a business cycle contraction, a general slowdown in economic activity. During recessions, many macroeconomic indicators vary in a similar way...

was that if consumption fell due to savings, the savings would cause the rate of interest to fall. According to the classical economists, lower interest rates would lead to increased investment spending and demand would remain constant. However, Keynes states that there are good reasons why investment does not necessarily increase in response to a fall in the interest rate. Businesses make investments based on expectations of profit. Therefore, if a fall in consumption appears to be long-term, businesses analyzing trends will lower expectations of future sales. Therefore, the last thing they are interested in doing is investing in increasing future production, even if lower interest rates make capital inexpensive. In that case, according to Keynesians and contrary to Say's law

Say's law

Say's law, or the law of market, is an economic principle of classical economics named after the French businessman and economist Jean-Baptiste Say , who stated that "products are paid for with products" and "a glut can take place only when there are too many means of production applied to one kind...

, the economy can be thrown into a general slump. According to Keynes, this self-reinforcing dynamic is what occurred to an extreme degree during the Depression, where bankruptcies

Bankruptcy

Bankruptcy is a legal status of an insolvent person or an organisation, that is, one that cannot repay the debts owed to creditors. In most jurisdictions bankruptcy is imposed by a court order, often initiated by the debtor....

were common and investment, which requires a degree of optimism, was very unlikely to occur.

Monetarist

In their 1963 book "A Monetary History of the United States, 1867-1960", Milton FriedmanMilton Friedman

Milton Friedman was an American economist, statistician, academic, and author who taught at the University of Chicago for more than three decades...

and Anna Schwartz

Anna Schwartz

Anna Jacobson Schwartz is an economist at the National Bureau of Economic Research in New York City, and according to Paul Krugman "one of the world's greatest monetary scholars"...

laid out their case for a different explanation of the Great Depression. After the Depression, the primary explanations of it tended to ignore the importance of money. However, in the monetarist view, the Depression was “in fact a tragic testimonial to the importance of monetary forces.” In their view, the failure of the Federal Reserve

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

to deal with the Depression was not a sign that monetary policy was impotent, but that the Federal Reserve exercised the wrong policies. They did not claim the Fed caused the depression, only that it failed to use policies that might have stopped a recession from turning into a depression.

Monetarist explanations had been rejected in Samuelson's 1948 Economics

Economics (textbook)

Economics is an influential introductory textbook by American economists Paul Samuelson and William Nordhaus. It was first published in 1948, and has appeared in nineteen different editions, the most recent in 2010. It was the best selling economics textbook for many decades and still remains...

, writing "Today few economists regard Federal Reserve monetary policy as a panacea for controlling the business cycle. Purely monetary factors are considered to be as much symptoms as causes, albeit symptoms with aggravating effects that should not be completely neglected." According to Keynesian economist, Paul Krugman, the work of Friedman and Schwartz became dominant among mainstream economists by the 1980s but should be reconsidered in light of Japan's Lost Decade

Lost Decade (Japan)

The is the time after the Japanese asset price bubble's collapse within the Japanese economy, which occurred gradually rather than catastrophically...

of the 1990s. The role of monetary policy in financial crises is in active debate regarding the financial crisis of 2007–2010; see causes of the financial crisis of 2007–2009

Causes of the financial crisis of 2007–2009

Many factors directly and indirectly caused the ongoing Financial crisis of 2007–10 , with experts placing different weights upon particular causes. The complexity and interdependence of many of the causes, as well as competing political, economic and organizational interests, have resulted in a...

.

Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

, the current Chairman of the Federal Reserve, agreed with Friedman in blaming the Federal Reserve for its role in the Great Depression, and stated on Nov. 8, 2002:

"Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again."

Starting in 1873, when the US and Europe had generally adopted a government-mandated gold standard, the US had dealt with what appeared to be a cycle of boom and bust, the failure half often seeming to be set off by bank panics, the most significant occurring in 1873, 1893, 1901, 1907, and 1920. Before the 1913 establishment of the Federal Reserve

Federal Reserve Act

The Federal Reserve Act is an Act of Congress that created and set up the Federal Reserve System, the central banking system of the United States of America, and granted it the legal authority to issue Federal Reserve Notes and Federal Reserve Bank Notes as legal tender...

, the banking system had dealt with these crises in the U.S. (such as in the Panic of 1907

Panic of 1907

The Panic of 1907, also known as the 1907 Bankers' Panic, was a financial crisis that occurred in the United States when the New York Stock Exchange fell almost 50% from its peak the previous year. Panic occurred, as this was during a time of economic recession, and there were numerous runs on...

) by suspending the convertibility of deposits into currency. Starting in 1893, there was a growing effort by financial institutions and business men to intervene, providing liquidity to banks suffering runs. In 1907, an ad-hoc coalition assembled by J. P. Morgan

J. P. Morgan

John Pierpont Morgan was an American financier, banker and art collector who dominated corporate finance and industrial consolidation during his time. In 1892 Morgan arranged the merger of Edison General Electric and Thomson-Houston Electric Company to form General Electric...

succeeded in doing just this, cutting off the panic and appearing to prevent the depression that usually followed. A call by some for a government version of this solution resulted in the establishment of the Federal Reserve.

But in 1928-32, the Federal Reserve did not act to provide liquidity to banks suffering runs. In fact, it did the opposite, preceding the whole crisis by its own sudden contraction of the money supply: During the Roaring Twenties, the Fed had set as its primary goal "price stability", in part because the governor of the New York Fed, Benjamin Strong, was a disciple of Irving Fisher

Irving Fisher

Irving Fisher was an American economist, inventor, and health campaigner, and one of the earliest American neoclassical economists, though his later work on debt deflation often regarded as belonging instead to the Post-Keynesian school.Fisher made important contributions to utility theory and...

, a tremendously popular economist who popularized stable prices as a monetary goal. It had kept the number of dollars at such an amount that prices of goods in society appeared stable. In 1928, Strong died, and with his death this policy ended, to be replaced with a Real bills doctrine

Real bills doctrine

The real bills doctrine holds that issuing money in exchange for real bills is not inflationary. It is best known as "the decried doctrine of the old Bank Directors of 1810: that so long as a bank issues its notes only in the discount of good bills, at not more than sixty days’ date, it cannot go...

, requiring that all currency or securities have material goods backing them. This policy forced a contraction of 30% of the US money supply

When this money shortage caused runs on banks, the Fed maintained its True Bills policy, refusing to lend money to the banks in the way that had cut short the 1907 panic, instead allowing each to suffer a catastrophic run and fail entirely.

Friedman said that if a policy similar to 1907 had been followed during the banking panic at the end of 1930, perhaps this would have stopped the vicious circle of the forced liquidation of assets at depressed prices. Consequently, the banking panics of 1931, 1932, and 1933 might not have happened, just as suspension of convertibility in 1893 and 1907 had quickly ended the liquidity crises at the time.”

Essentially, the Great Depression, in the monetarist view, was caused by the fall of the money supply. Friedman and Schwartz write: "From the cyclical peak in August 1929 to a cyclical trough in March 1933, the stock of money fell by over a third." The result was what Friedman calls the "Great Contraction" — a period of falling income, prices, and employment caused by the choking effects of a restricted money supply.

Chain Reactions in Economics (Friedman and Schwartz, 1963: P.419: the banking crisis in USA: “It happens that a liquidity crisis in a unit fractional reserve banking system is precisely the kind of event that trigger- and often has triggered- a chain reaction. And economic collapse often has the character of a cumulative process. Let it go beyond a certain point, and it will tend for a time to gain strength from its own development as its effects spread and return to intensify the process of collapse”. Thus chain reactions may result in vicious circles

Virtuous circle and vicious circle

A virtuous circle and a vicious circle are economic terms. They refer to a complex of events that reinforces itself through a feedback loop. A virtuous circle has favorable results, while a vicious circle has detrimental results...

.

The mechanism suggested by Friedman and Schwartz was that people wanted to hold more money than the Federal Reserve was supplying. As a result people hoarded money by consuming less. This caused a contraction in employment and production since prices were not flexible enough to immediately fall. The Fed's failure was in not realizing what was happening and not taking corrective action.

Austrian

AustrianAustrian School

The Austrian School of economics is a heterodox school of economic thought. It advocates methodological individualism in interpreting economic developments , the theory that money is non-neutral, the theory that the capital structure of economies consists of heterogeneous goods that have...

theorists who wrote about the Depression include F.A. Hayek

Friedrich Hayek

Friedrich August Hayek CH , born in Austria-Hungary as Friedrich August von Hayek, was an economist and philosopher best known for his defense of classical liberalism and free-market capitalism against socialist and collectivist thought...

and Murray Rothbard

Murray Rothbard

Murray Newton Rothbard was an American author and economist of the Austrian School who helped define capitalist libertarianism and popularized a form of free-market anarchism he termed "anarcho-capitalism." Rothbard wrote over twenty books and is considered a centrally important figure in the...

.

Hayek objected to the price stability policy of the Roaring Twenties, but referred to the Fed's sudden contraction of money and failure to offer banks liquidity as "silly":

- The moment there is any sign that the total income stream may actually shrink, I should certainly not only try everything in my power to prevent it from dwindling, but I should announce beforehand that I would do so in the event the problem arose.

- Friedrich von Hayek, American Enterprise Institute (1975)

- I agree with Milton Friedman that once the Crash had occurred, the Federal Reserve System pursued a silly deflationary policy. I am not only against inflation but I am also against deflation. So, once again, a badly programmed monetary policy prolonged the depression.

- Interview with Diego Pizano (1979)

Hayek did oppose Keynes' arguments regarding what caused the Great Depression, which he blamed on government spending and other stimulus, saying in a 1932 letter to Keynes:

- We are of the opinion that many of the troubles of the world at the present time are due to imprudent borrowing and spending on the part of the public authorities. We do not desire to see a renewal of such practices. At best they mortgage the Budgets of the future, and they tend to drive up the rate of interest — a process which is surely particularly undesirable at this juncture, when the revival of the supply of capital to private industry is an admitted urgent necessity. The depression has abundantly shown that the existence of public debt on a large scale imposes frictions and obstacles to readjustment very much greater than the frictions and obstacles imposed by the existence of private debt. Hence we cannot agree with the signatories of the letter that this is a time for new municipal swimming baths, etc., merely because people “feel they want” such amenities.

- Hayek's open letter to Keynes, published in The TimesThe TimesThe Times is a British daily national newspaper, first published in London in 1785 under the title The Daily Universal Register . The Times and its sister paper The Sunday Times are published by Times Newspapers Limited, a subsidiary since 1981 of News International...

(1932)

- Hayek's open letter to Keynes, published in The Times

Rothbard, on the other hand, advocated the Fed's hands-off approach, and wrote "America's Great Depression

America's Great Depression

America's Great Depression is a 1963 treatise on the 1930s Great Depression and its root causes, written by Austrian School economist and author Murray Rothbard. The fifth edition was released in 2000.-Brief summary:...

" in 1963. In his view, the Great Depression was the inevitable outcome of the easy credit policies of the Federal Reserve during the 1920s. Since its enactment in 1913, the Federal Reserve had served as the central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

of the U.S. The Federal reserve effectively regulated the amount of credit private banks could issue by providing overnight loans and strict reserve requirements. According to Rothbard, government intervention delayed the market’s adjustment and made the road to complete recovery more difficult.

Rothbard criticizes Milton Friedman

Milton Friedman

Milton Friedman was an American economist, statistician, academic, and author who taught at the University of Chicago for more than three decades...

's assertion that the central bank failed to sufficiently increase the supply of money, saying that the Federal Reserve's purchased $1.1 billion of government securities from February to July 1932, which raised its total holding to $1.8 billion, was already too much intervention, which Rothbard claimed to be inflation. Total bank reserves only rose by $212 million, but Rothbard argues that this was because the American populace lost faith in the banking system and began hoarding more cash, a factor very much beyond the control of the Central Bank. The potential for a run on the banks caused local bankers to be more conservative in lending out their reserves, and, Rothbard argues, was the cause of the Federal Reserve's inability to inflate.

This illustrates a fundamental difference between Rothbard and not only Friedman, but even other Austrians like Ludwig von Mises

Ludwig von Mises

Ludwig Heinrich Edler von Mises was an Austrian economist, philosopher, and classical liberal who had a significant influence on the modern Libertarian movement and the "Austrian School" of economic thought.-Biography:-Early life:...

, who note that consumers and banks holding money represents an increase in demand, and that inflation only occurs when the money's supply outpaces its demand:

- In theoretical investigation there is only one meaning that can rationally be attached to the expression Inflation: an increase in the quantity of money (in the broader sense of the term, so as to include fiduciary media as well), that is not offset by a corresponding increase in the need for money (again in the broader sense of the term), so that a fall in the objective exchange-value of money must occur.

According to Mises, the increased holding of money meant that the Fed was not inflating the money supply by $1.8 billion, but only by $212 million.

Debt deflation

Jerome (1934) gives an unattributed quote about finance conditions that allowed the great industrial expansion of the post WW I period:

"Probably never before in this country had such a volume of funds been available at such low rates for such a long period."

Furthermore, Jerome says that the volume of new capital issues increased at a 7.7% compounded annual rate from 1922-29 at a time when the Standard Statistics Co.'s index of 60 high grade bonds yielded from 4.98% in 1923 to 4.47% in 1927.

There was also a real estate and housing bubble in the 1920s, especially in Florida, which burst in 1925. Alvin Hansen

Alvin Hansen

Alvin Harvey Hansen , often referred to as "the American Keynes," was a professor of economics at Harvard, a widely read author on current economic issues, and an influential advisor to the government who helped create the Council of Economic Advisors and the Social security system...

stated that housing construction during the 1920s decade exceeded population growth by 25%. See also:Florida land boom of the 1920s

Florida land boom of the 1920s

The Florida land boom of the 1920s was Florida's first real estate bubble, which burst in 1925, leaving behind entire new cities and the remains of failed development projects such as Aladdin City in south Miami-Dade County and Isola di Lolando in north Biscayne Bay...

Irving Fisher

Irving Fisher

Irving Fisher was an American economist, inventor, and health campaigner, and one of the earliest American neoclassical economists, though his later work on debt deflation often regarded as belonging instead to the Post-Keynesian school.Fisher made important contributions to utility theory and...

argued that the predominant factor leading to the Great Depression was over-indebtedness and deflation. Fisher tied loose credit to over-indebtedness, which fueled speculation and asset bubbles. He then outlined nine factors interacting with one another under conditions of debt and deflation to create the mechanics of boom to bust. The chain of events proceeded as follows:

- Debt liquidation and distress selling

- Contraction of the money supply as bank loans are paid off

- A fall in the level of asset prices

- A still greater fall in the net worths of business, precipitating bankruptcies

- A fall in profits

- A reduction in output, in trade and in employment.

- Pessimism and loss of confidence

- Hoarding of money

- A fall in nominal interest rates and a rise in deflation adjusted interest rates.

During the Crash of 1929 preceding the Great Depression, margin requirements were only 10%. Brokerage firms, in other words, would lend $9 for every $1 an investor had deposited. When the market fell, brokers called in these loans, which could not be paid back. Banks began to fail as debtors defaulted on debt and depositors attempted to withdraw their deposits en masse, triggering multiple bank run

Bank run

A bank run occurs when a large number of bank customers withdraw their deposits because they believe the bank is, or might become, insolvent...

s. Government guarantees and Federal Reserve banking regulations to prevent such panics were ineffective or not used. Bank failures led to the loss of billions of dollars in assets. Outstanding debts became heavier, because prices and incomes fell by 20–50% but the debts remained at the same dollar amount. After the panic of 1929, and during the first 10 months of 1930, 744 US banks failed. (In all, 9,000 banks failed during the 1930s). By April 1933, around $7 billion in deposits had been frozen in failed banks or those left unlicensed after the March Bank Holiday

Emergency Banking Act

The Emergency Banking Act was an act of the United States Congress spearheaded by President Franklin D. Roosevelt during the Great Depression. It was passed on March 9, 1933...

.

Bank failures snowballed as desperate bankers called in loans, which the borrowers did not have time or money to repay. With future profits looking poor, capital investment

Investment

Investment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

and construction slowed or completely ceased. In the face of bad loans and worsening future prospects, the surviving banks became even more conservative in their lending. Banks built up their capital reserves and made fewer loans, which intensified deflationary pressures. A vicious cycle

Virtuous circle and vicious circle

A virtuous circle and a vicious circle are economic terms. They refer to a complex of events that reinforces itself through a feedback loop. A virtuous circle has favorable results, while a vicious circle has detrimental results...

developed and the downward spiral accelerated.

The liquidation of debt could not keep up with the fall of prices it caused. The mass effect of the stampede to liquidate increased the value of each dollar owed, relative to the value of declining asset holdings. The very effort of individuals to lessen their burden of debt effectively increased it. Paradoxically, the more the debtors paid, the more they owed. This self-aggravating process turned a 1930 recession into a 1933 great depression.

Macroeconomists including Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

, the current chairman of the U.S. Federal Reserve Bank, have revived the debt-deflation view of the Great Depression originated by Fisher.

Non-debt deflation

In addition to the debt deflation there was a component of productivity deflation that had been occurring since the The Great DeflationThe Great Deflation

The Great Deflation or the Great Sag refers to the period from 1870 until 1890 in which world prices of goods, materials and labor decreased, although at a low rate of less than 2% annually...

of the last quarter of the 19th century. There may have also been a continuation of the correction to the sharp inflation caused by WW I.

Oil prices reached their all time low in the early 1930s as production began from the East Texas Oil Field

East Texas oil field

The East Texas Oil Field is a large oil and gas field in east Texas. Covering and parts of five counties, and having 30,340 historic and active oil wells, it is the largest oil field in the United States outside of Alaska, both in extent and in total volume of oil recovered since its discovery in...

, the largest field ever found in the lower 48 states. With the oil market oversupplied prices locally fell to below ten cents per barrel.

Disparities in wealth and income

Two economists of the 1920s, Waddill Catchings and William Trufant FosterWilliam Trufant Foster

William Trufant Foster , was an American educator and economist, whose theories were especially influential in the 1920s. He was the first president of Reed College.- Career :...

, popularized a theory that influenced many policy makers, including Herbert Hoover, Henry A. Wallace

Henry A. Wallace

Henry Agard Wallace was the 33rd Vice President of the United States , the Secretary of Agriculture , and the Secretary of Commerce . In the 1948 presidential election, Wallace was the nominee of the Progressive Party.-Early life:Henry A...

, Paul Douglas

Paul Douglas

Paul Howard Douglas was an liberal American politician and University of Chicago economist. A war hero, he was elected as a Democratic U.S. Senator from Illinois from in the 1948 landslide, serving until his defeat in 1966...

, and Marriner Eccles. It held that the economy produced more than it consumed, because the consumers did not have enough income. Thus the unequal distribution of wealth throughout the 1920s caused the Great Depression.

According to this view, wages increased at a rate lower than productivity increases. Most of the benefit of the increased productivity went into profits, which went into the stock market bubble

Stock market bubble

A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation....

rather than into consumer purchases. Say's law

Say's law

Say's law, or the law of market, is an economic principle of classical economics named after the French businessman and economist Jean-Baptiste Say , who stated that "products are paid for with products" and "a glut can take place only when there are too many means of production applied to one kind...

no longer operated in this model (an idea picked up by Keynes).

As long as corporations had continued to expand their capital facilities (their factories, warehouses, heavy equipment, and other investments), the economy had flourished. Under pressure from the Coolidge

Calvin Coolidge

John Calvin Coolidge, Jr. was the 30th President of the United States . A Republican lawyer from Vermont, Coolidge worked his way up the ladder of Massachusetts state politics, eventually becoming governor of that state...

administration and from business, the Federal Reserve Board kept the discount rate low, encouraging high (and excessive) investment. By the end of the 1920s, however, capital investments had created more plant space than could be profitably used, and factories were producing more than consumers could purchase.

According to this view, the root cause of the Great Depression was a global overinvestment in heavy industry capacity compared to wages and earnings from independent businesses, such as farms. The solution was the government must pump money into consumers' pockets. That is, it must redistribute purchasing power, maintain the industrial base, but reinflate prices and wages to force as much of the inflationary increase in purchasing power into consumer spending. The economy was overbuilt, and new factories were not needed. Foster and Catchings recommended federal and state governments start large construction projects, a program followed by Hoover and Roosevelt.

Financial institution structures

The city banks also suffered from structural weaknesses that made them vulnerable to a shock. Some of the nation's largest banks were failing to maintain adequate reserves and were investing heavily in the stock market or making risky loans. Loans to Germany

Germany

Germany , officially the Federal Republic of Germany , is a federal parliamentary republic in Europe. The country consists of 16 states while the capital and largest city is Berlin. Germany covers an area of 357,021 km2 and has a largely temperate seasonal climate...

and Latin America

Latin America

Latin America is a region of the Americas where Romance languages – particularly Spanish and Portuguese, and variably French – are primarily spoken. Latin America has an area of approximately 21,069,500 km² , almost 3.9% of the Earth's surface or 14.1% of its land surface area...

by New York City

New York City

New York is the most populous city in the United States and the center of the New York Metropolitan Area, one of the most populous metropolitan areas in the world. New York exerts a significant impact upon global commerce, finance, media, art, fashion, research, technology, education, and...

banks were especially risky. In other words, the banking system was not well prepared to absorb the shock of a major recession.

Economists have argued that a liquidity trap

Liquidity trap

A liquidity trap is a situation described in Keynesian economics in which injections of cash into an economy by a central bank fail to lower interest rates and hence to stimulate economic growth. A liquidity trap is caused when people hoard cash because they expect an adverse event such as...

might have contributed to bank failures.

Economists and historians debate how much responsibility to assign the Wall Street Crash of 1929. The timing was right; the magnitude of the shock to expectations of future prosperity was high. Most analysts believe the market in 1928-29 was a "bubble" with prices far higher than justified by fundamentals. Economists agree that somehow it shared some blame, but how much no one has estimated. Milton Friedman concluded, "I don't doubt for a moment that the collapse of the stock market in 1929 played a role in the initial recession". The debate has three sides: one group says the crash caused the depression by drastically lowering expectations about the future and by removing large sums of investment capital; a second group says the economy was slipping since summer 1929 and the crash ratified it; the third group says that in either scenario the crash could not have caused more than a recession. There was a brief recovery in the market into April 1930, but prices then started falling steadily again from there, not reaching a final bottom until July 1932. This was the largest long-term U.S. market decline by any measure. To move from a recession in 1930 to a deep depression in 1931-32, entirely different factors had to be in play.

Gold standard

The Gold Standard theory of the Depression attributes it to postwar deflationary policies. During World War I, many European nations abandoned the gold standard, forced by the enormous costs of the war. This resulted in inflation, because it was not matched with rationing and other forms of forced savings. The view is that the quantity of money determined inflation, and therefore, the cure to inflation was to reduce the amount of circulating media. Because of the huge reparations that GermanyGermany

Germany , officially the Federal Republic of Germany , is a federal parliamentary republic in Europe. The country consists of 16 states while the capital and largest city is Berlin. Germany covers an area of 357,021 km2 and has a largely temperate seasonal climate...

had to pay France

France

The French Republic , The French Republic , The French Republic , (commonly known as France , is a unitary semi-presidential republic in Western Europe with several overseas territories and islands located on other continents and in the Indian, Pacific, and Atlantic oceans. Metropolitan France...

, Germany began a credit-fueled period of growth in order to export and sell enough abroad to gain gold to pay back reparations. The U.S., as the world's gold sink, loaned money to Germany to industrialize, which was then the basis for Germany paying back France, and France paying back loans to the U.K. and U.S. This arrangement was codified in the Dawes Plan

Dawes Plan

The Dawes Plan was an attempt in 1924, following World War I for the Triple Entente to collect war reparations debt from Germany...

.

This had numerous economic consequences. However, what is of particular relevance is that following the war, most nations returned to the gold standard at the pre-war gold price, in part, because those who had loaned in nominal amounts hoped to recover the same value in gold that they had lent, and in part because the prevailing opinion at the time was that deflation was not a danger, while inflation, particularly the inflation in the Weimar Republic

Inflation in the Weimar Republic

The hyperinflation in the Weimar Republic was a three year period of hyperinflation in Germany between June 1921 and July 1924.- Analysis :...

, was an unbearable danger. Monetary policy was in effect put into a deflationary setting that would over the next decade slowly grind away at the health of many European economies. While the British Banking Act of 1925 created currency controls and exchange restrictions, it set the new price of the Pound Sterling

Pound sterling

The pound sterling , commonly called the pound, is the official currency of the United Kingdom, its Crown Dependencies and the British Overseas Territories of South Georgia and the South Sandwich Islands, British Antarctic Territory and Tristan da Cunha. It is subdivided into 100 pence...

at parity with the pre-war price. At the time, this was criticized by John Maynard Keynes

John Maynard Keynes

John Maynard Keynes, Baron Keynes of Tilton, CB FBA , was a British economist whose ideas have profoundly affected the theory and practice of modern macroeconomics, as well as the economic policies of governments...

and others, who argued that in so doing, they were forcing a revaluation of wages without any tendency to equilibrium. Keynes' criticism of Winston Churchill

Winston Churchill

Sir Winston Leonard Spencer-Churchill, was a predominantly Conservative British politician and statesman known for his leadership of the United Kingdom during the Second World War. He is widely regarded as one of the greatest wartime leaders of the century and served as Prime Minister twice...

's form of the return to the gold standard implicitly compared it to the consequences of the Versailles Treaty.

Deflation's impact is particularly hard on sectors of the economy that are in debt or that regularly use loans to finance activity, such as agriculture. Deflation erodes the price of commodities while increasing the real value of debt, which all came to the stock market crash of 1929.

More recent research, by economists such as Peter Temin

Peter Temin

Dr. Peter Temin is a widely cited economist and economic historian, currently Gray Professor Emeritus of Economics, MIT and former head of the Economics Department....

, Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

and Barry Eichengreen

Barry Eichengreen

Barry Eichengreen is an American economist who holds the title of George C. Pardee and Helen N. Pardee Professor of Economics and Political Science at the University of California, Berkeley, where he has taught since 1987...

, has focused on the constraints policy makers were under at the time of the Depression. In this view, the constraints of the inter-war gold standard

Gold standard

The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

magnified the initial economic shock and was a significant obstacle to any actions that would ameliorate the growing Depression. According to them, the initial destabilizing shock may have originated with the Wall Street Crash of 1929

Wall Street Crash of 1929

The Wall Street Crash of 1929 , also known as the Great Crash, and the Stock Market Crash of 1929, was the most devastating stock market crash in the history of the United States, taking into consideration the full extent and duration of its fallout...

in the U.S., but it was the gold standard system that transmitted the problem to the rest of the world.

According to their conclusions, during a time of crisis, policy makers may have wanted to loosen monetary and fiscal policy, but such action would threaten the countries’ ability to maintain its obligation to exchange gold at its contractual rate. The gold standard required countries to maintain high interest rates to attract international investors who bought foreign assets with gold. Therefore, governments had their hands tied as the economies collapsed, unless they abandoned their currency’s link to gold. By fixing the exchange rate of all countries on the gold standard, it ensured that the market for foreign exchange can only equilibrate through interest rates. As the Depression worsened, many countries started to abandon the gold standard, and those that abandoned it earlier suffered less from deflation and tended to recover more quickly.

Richard Timberlake

Richard Timberlake

Richard Timberlake, born 1922, is an economist who was Professor Emeritus of Economics at the University of Georgia for much of his career. He also has become a leading advocate of free banking, the belief that money should be issued by private companies, not by a government monopoly.-History:Born...

, economist of the free banking

Free banking

Free banking refers to a monetary arrangement in which banks are subject to no special regulations beyond those applicable to most enterprises, and in which they also are free to issue their own paper currency...

school and protege of Milton Friedman, specifically addressed this stance in his paper, Gold Standards and the Real Bills Doctrine in U.S. Monetary Policy, wherein he argued that the Federal Reserve actually had plenty of lee-way under the gold standard, as had been demonstrated by the price stability policy of New York Fed governor Benjamin Strong, between 1923 and 1928. But when Strong died in late 1928, the faction that took over dominance of the Fed advocated a real bills doctrine, where all money had to be represented by physical goods. This policy, forcing a 30% deflation of the dollar that inevitably damaged the US economy, is stated by Timberlake as being arbitrary and avoidable, the existing gold standard having been capable of continuing without it: