Poll tax

Encyclopedia

A poll tax is a tax

of a portioned, fixed amount per individual in accordance with the census (as opposed to a percentage of income). When a corvée

is commuted for cash payment, in effect it becomes a poll tax (and vice versa, if a poll tax obligation can be worked off). Head taxes were important sources of revenue for many governments from ancient times until the 19th century. There have been several famous (and infamous) cases of head taxes in history, notably a tax formerly required for voting

in parts of the United States that was often designed to disenfranchise

poor people, including African American

s, Native Americans

, and white people of non-English descent (e.g., the Irish). In the United Kingdom, poll taxes were levied by the governments of John of Gaunt in the 14th C., Charles II

in the 17th and Margaret Thatcher

in the 20th century.

The word poll is an English word that once meant "head" - and still does, in some specialised contexts - hence the name poll tax

for a per-person tax. In the United States, however, the term has come to be used almost exclusively for a fixed tax

applied to voting. Since "going to the polls" is a common idiom for voting (deriving from the fact that early voting involved head-counts), a new folk etymology has supplanted common knowledge of the phrase's true origins in America.

, payable by every man above the age of twenty ("rich shall not give more, and the poor shall not give less"), designated for the upkeep of the Temple of Jerusalem. Priests, women, slaves and minors were exempted, although they can offer it voluntarily. Payment by Samaritans or Gentiles was rejected. It was collected yearly during the month of Adar

, both at the Temple and at special collection bureaus in the provinces.

(publican

i), but from the time of Emperor Augustus

, the collection were gradually transferred to magistrates and the senates of provincial cities. The Roman census

was conducted periodically in the provinces to draw up and update the poll tax register.

The Roman poll tax fell principally on Roman subjects in the provinces, but not on Roman citizens. Towns in the provinces who possessed the Jus Italicum (enjoying the "privileges of Italy") were exempted from the poll tax. The 212 edict of Emperor Caracalla

which formally conferred Roman citizenship on all residents of Roman provinces, did not however exempt them from the poll tax.

The Roman poll tax was deeply resented - Tertullian

bewailed the poll tax as a "badge of slavery" - and it provoked numerous revolts in the provinces. Perhaps most famous is the Zealot revolt in Judaea of 66 CE. After the destruction of the temple in 70 CE, the Emperor imposed an extra poll tax on Jews throughout the empire, the fiscus judaicus

, of two denari

each.

The Italian revolt of the 720s, organized and led by Pope Gregory II

, was originally provoked by the attempt of the Constantinople Emperor Leo III the Isaurian

to introduce a poll tax in the Italian provinces

of the Byzantine Empire

in 722, and set in motion the permanent separation of Italy from the Byzantine empire. When King Aistulf

of the Lombards

availed himself of the Italian dissent and invaded the Exarchate of Ravenna

in 751, one of his first acts was to institute a crushing poll tax of one gold solidus

per head on every Roman citizen. Seeking relief from this burden, Pope Stephen II

appealed to the Pepin the Short of the Franks

for assistance, that led to the establishment of the Papal States

in 756.

is a poll tax imposed under Islamic law

on non-Muslims - specifically, the dhimmi ("People of the Book", i.e. Jews and Christians). The tax is levied on free-born abled-bodied men of military age. The poor are exempt, as well as those who were not independent or wealthy who were slaves, women, children, the old, the sick, monks, or hermits.

There are several legal rationales for the jizya (and its equivalent land tax, the kharaj

). The common argument is that jizya was a fee in exchange for the dhimma (permission to practice one's faith, enjoy communal autonomy, and to be entitled to Muslim protection from outside aggression). Some scholars emphasize that its higher rate is also a sign of submission and acceptance of Muslim rule, and some argue humiliation for failing to embrace Islam. Other rationales assume such rights were every person's birthright (Muslim or non-Muslim), and the imposition of jizya on non-Muslims similar to the imposition of zakat

(one of the Five Pillars of Islam, an obligatory wealth tax paid on certain assets which are not used productively for a period of a year) on Muslims. The rates of jizya are higher (often quite higher) than zakat.

Although jizya is designated as a poll tax, its assessment and collection is often qualified by income. For instance, Amr ibn al-As, after conquering Egypt, set up a census to measure the population for the jizya, and thus the total expected jizya revenue for the whole province, but organized the actual collection by partitioning the population into wealth classes, so that the rich paid more and the poor less jizya of that total sum. Elsewhere, it is reported customary to partition into three classes, e.g. 48 dirhams for the rich, 24 for middle class and 12 for the poor.

The differing tax rates between zakat and jizya gave an incentive for populations to convert to Islam, to benefit from the lower tax rates. However, this was not always respected by the governing authorities, who were reluctant to lose the cash revenues. In the late 7th and early 8th C., during the Umayyad Caliphate, conversions were often ignored and jizya continued being collected on Muslim converts, particularly if they were non-Arabs (e.g. Berber

s, Persians

), raising tensions throughout the caliphate. In 718, the Umayyad caliph Umar II

strictly forbade collection of jizya from Muslim converts. However, after his death, difficulties in the caliphal treasury prompted governors to side-step the prohibitions and surreptitiously re-introduce jizya-collection on converts by other guises. The zeal of the Umayyad tax-collectors led to the eruption of two notable revolts in the 740s - the Berber Revolt

in North Africa and Spain and the Abbasid Revolt in Persia - demanding the equality of all Muslims, regardless of ethnicity, and adherence to the tax rates prescribed by Islamic law.

In 1855, the Ottoman Empire

abolished the jizya tax, as part of reforms to equalize the status of Muslims and non-Muslims. It was replaced, however, by a military-exemption tax on non-Muslims, the Bedel-i Askeri, which is perhaps the same thing.

of the assessed value of their movable goods. That percentage varied from year to year and place to place, and which goods could be taxed differed between urban

and rural

locations. Churchmen were exempt, as were the poor, workers in the Royal Mint

, inhabitants of the Cinque Ports

, tin

workers in Cornwall

and Devon

, and those who lived in the Palatinate counties

of Cheshire

and Durham

.

(4d) to the Crown. By 1379 that had been graded by social class, with the lower age limit changed to 16, and to 15 two years later. The levy in 1381 was particularly unpopular, as each person aged over 15 was required to pay the amount of one shilling

, which was then a large amount. This played a role in provoking the Peasants' Revolt in 1381, due in part to attempts to restore feudal conditions in rural areas.

in 1641 to finance the raising of the army against the Scottish and Irish uprisings. With the Restoration of Charles II

in 1660, the Convention Parliament of 1660 instituted a poll tax to finance the disbanding of the New Model Army

(pay arrears, etc.) (12 Charles II c.9). The poll tax was assessed according to "rank", e.g. dukes paid £100, earls £60, knights £20, esquires £10. Eldest sons paid 2/3rds of their father's rank, widows paid a third of their late husband's rank. The members of the livery companies paid according to company's rank (e.g. masters of first-tier guilds like the Mercers paid £10, whereas masters of fifth-tier guilds, like the Clerks, paid 5 shillings). Professionals also paid differing rates, e.g. physicians (£10), judges (£20), advocates (£5), attorneys (£3), and so on. Anyone with property (land, etc.) paid 40 shillings per £100 earned, anyone over the age of 16 and unmarried paid 12-pence and everyone else over 16 paid 6-pence.

The poll tax was imposed again by William and Mary

in 1689 (1 Will. & Mar. c.13), reassessed in 1690 adjusting rank for fortune, and then again in 1691 back to rank irrespective of fortune. The poll tax was imposed again in 1692, and one final time in 1698 (the last poll tax until the 20th C.). A poll tax was imposed on Scotland between 1694 and 1699.

As the greater weight of the 17th C. poll taxes fell primarily upon the wealthy and powerful, it was not too unpopular. There were grumblings within the taxed ranks about lack of differentiation by income within ranks. Ultimately, it was the inefficiency of their collection - what they brought in routinely fell far short of expected revenues - that prompted the government to abandon the poll tax after 1698.

Far more controversial was the hearth tax introduced in 1662 (13 & 14 Charles II c.10), which imposed a hefty two shillings on every hearth in a family dwelling (which was easier to count than persons). Heavier, more permanent and more regressive than the poll tax proper, the intrusive entry of tax inspectors into private homes to count hearths was a very sore point, and it was promptly repealed with the Glorious Revolution

in 1689. It was replaced with a "window tax" in 1695 (inspectors could count windows from outside of homes).

The Community Charge was a poll tax to fund local government in the United Kingdom

, instituted in 1989 by the government of Margaret Thatcher

. It replaced the rates

that were based on the notional rental value of a house. The abolition of rates was in the manifesto of Thatcher's Conservative Party

in the 1979 general election

, and the replacement was proposed in the Green Paper of 1986, Paying for Local Government based on ideas developed by Dr Madsen Pirie

and Douglas Mason

of the Adam Smith Institute

. It was a fixed tax

per adult resident, but there was a reduction for those with lower household income. Each person was to pay for the services provided in their community. This proposal was contained in the Conservative

Manifesto

for the 1987 General Election

. The new tax replaced the rates in Scotland from the start of the 1989/90 financial year, and in England and Wales from the start of the 1990/91 financial year.

The system was deeply unpopular. It seemed to shift the tax burden from rich to poor, as it was based on the number of people living in a house rather than its estimated price. Many tax rates set by local councils proved to be much higher than earlier predictions, leading to resentment even among people who had supported it. The tax in different boroughs differed dramatically because local taxes paid by businesses varied and grants by central government to local authorities sometimes varied capriciously.

Mass protests were called by the All-Britain Anti-Poll Tax Federation, with which the vast majority of local Anti Poll Tax Unions (APTUs) were affiliated. In Scotland the APTUs called for mass non-payment and these calls rapidly gathered widespread support which spread to England and Wales, even though non-payment meant that people could be prosecuted. In some areas, 30% of former ratepayers defaulted. While owner-occupier

s were easy to tax, those who regularly changed accommodation were almost impossible to pursue if they chose not to pay. The cost of collecting the tax rose steeply while the returns from it fell. Enforcement measures became increasingly draconian, and unrest grew and culminated in a number of Poll Tax Riots

. The most serious was in a protest at Trafalgar Square

, London, on 31 March 1990, of more than 200,000 protesters. A Labour MP, Terry Fields

, was jailed for 60 days for refusing to pay his poll tax.

This unrest was instrumental in toppling Margaret Thatcher in 1990. Her replacement, John Major

, replaced the Community Charge with the Council Tax

, similar to the rating system that preceded the Poll Tax. The main differences were that it was levied on capital value rather than notional rental value of a property, and that it had a 25% discount for single-occupancy dwellings.

in 1695 as a temporary measure to finance the War of the League of Augsburg, and thus repealed in 1699. It was resumed during the War of Spanish Succession and in 1704 set on a permanent basis, remaining until the end of the Ancien regime.

Like the English poll tax, the French capitation tax was assessed on rank – for taxation persons, French society was divided in twenty-two "classes", with the Dauphin (a class by himself) paying 2,000 livre

s, princes of the blood paying 1500 livres, and so on down to the lowest class, composed of day laborers and servants, who paid 1 livre each. The bulk of the common population was covered by four classes, paying 40, 30, 10 and 3 livres respectively. Unlike most other direct French taxes, nobles and clergy were not exempted from capitation taxes. It did, however, exempt the mendicant orders and the poor who contributed less than 40 sous.

At the time of its design, the capitation tax was probably the most equitable tax in France. This was soon gnawed away. The French clergy managed to temporarily escape capitation assessment by promising to pay a total sum of 4 million livres per annum in 1695, and then obtained permanent exemption in 1709 with a lump sum payment of 24 million livres. The Pays d'états

(Brittany, Burgundy, etc.) and many towns also escaped assessment by promising annual fixed payments. The nobles did not escape assessment, but they obtained the right to appoint their own capitation tax assessors, which allowed them to escape most of the burden (in one calculation, they escaped ⅞ of it). So it not long before it was only the routiers (peasants) who paid the capitation tax.

Compounding the burden, the assessment on the capitation did not remain stable. The pays de taille personelle (basically, Pays d'élection

, the bulk of France and Aquitaine) secured the ability to assess the capitation tax proportionally to the taille - which effectively meant adjusting the burden heavily against the lower classes. According to the estimates of Jacques Necker

in 1788, the capitation tax was so riddled in practice, that the privileged classes (nobles and clergy and towns) were largely exempt, while the lower classes were heavily crushed: the lowest peasant class, originally assessed to pay 3 livres, were now paying 24, the second lowest, assessed at 10 livres, were now paying 60 and the third-lowest assessed at 30 were paying 180. The total collection from the capitation, according to Necker in 1788, was 41 million livres, well short of the 54 million estimate, and it was projected that the revenues could have doubled if the exemptions were revoked and the original 1695 assessment properly restored.

The old capitation tax was repealed with the French Revolution

and replaced, in November 23, 1790, with a new poll tax as part of the contribution personnelle mobilière, which lasted well into the late 19th Century. It was fixed for every individual at "three days's labor" (assessed locally, but by statute, no less than 1 franc 50 centimes and no more than 4 francs 50 centimes, depending on the area). A dwelling tax (impôt sur les portes et fenêtres, similar to the English window-tax) was imposed in 1791.

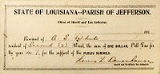

and the adoption of income tax

as a significant source of government funding. The second meaning of poll tax, namely a tax to be paid as a prerequisite to voting, is more widely known in the United States today. The term was widely used in the South after the turn of the 20th century in combination with other measures to bar blacks and poor whites from voter registration and voting.

Recent debate has arisen about whether requiring citizens to purchase a state identification card acts as a poll tax and bars poor voters from voting. To reduce cost, some state offer free identification cards for those who can demonstrate the need. However, significant additional costs can be incurred when acquiring a "free" ID. In addition to travel cost or potential lost wages, a certified copy of a birth certificate costs from $10 to $45 depending on the state, a passport costs $85 and certified naturalization papers cost $19.95. Further, about 12 percent of voting-age Americans currently lack a driver's license.

, reads "[n]o capitation, or other direct, tax shall be laid, unless in proportion to the census or enumeration herein before directed to be taken." Capitation here means a tax of a uniform, fixed amount per taxpayer. Direct tax

means a tax levied directly by the United States federal government

on taxpayers, as opposed to a tax on events or transactions. The United States government levied direct taxes from time to time during the 18th and early 19th centuries. It levied direct taxes on the owners of houses, land, slaves, and estates in the late 1790s but cancelled the taxes in 1802.

An income tax is neither a poll tax nor a capitation, as the amount of tax will vary from person to person, depending on each person's income. Until a United States Supreme Court decision in 1895, all income taxes were deemed to be excises (i.e. indirect taxes). The Revenue Act of 1861

established the first income tax

in the United States, to pay for the cost of the American Civil War

. This income tax was abolished after the war, in 1872. Another income tax statute in 1894 was overturned in Pollock v. Farmers' Loan & Trust Co.

in 1895, where the Supreme Court held that income taxes on income from property, such as rent income, interest income, and dividend income (but not income taxes on income from wages, employment, etc.) were to be treated as direct taxes. Because the statute in question had not apportioned income taxes on income from property by population, the statute was ruled unconstitutional. Finally, ratification

of the Sixteenth Amendment to the United States Constitution

in 1913 made possible modern income taxes, by removing the requirement of apportionment with respect to income taxes.

stipulated that all Chinese entering Canada would be subjected to a head tax of $50. The act was mostly to discourage the lower class Chinese from entering, since Canada still welcomed the rich Chinese merchants who could afford the head tax. After the Government of Canada realized that the $50 fee did not effectively eliminate Chinese from entering Canada, the government passed the Chinese Immigration Act of 1900 and 1903, increasing the tax to $100 and $500, respectively. In 1923, the government passed Chinese Immigration Act, 1923

which prohibited all Chinese from immigrating to Canada.

On 22 June 2006, the Prime Minister of Canada

Stephen Harper

delivered a message of redress for a head tax once applied to Chinese immigrants. Survivors or their spouses will receive $20,000 CAD compensation.

offered New Zealand's Chinese community an official apology for the poll tax on 12 February 2002.

Tax

To tax is to impose a financial charge or other levy upon a taxpayer by a state or the functional equivalent of a state such that failure to pay is punishable by law. Taxes are also imposed by many subnational entities...

of a portioned, fixed amount per individual in accordance with the census (as opposed to a percentage of income). When a corvée

Corvée

Corvée is unfree labour, often unpaid, that is required of people of lower social standing and imposed on them by the state or a superior . The corvée was the earliest and most widespread form of taxation, which can be traced back to the beginning of civilization...

is commuted for cash payment, in effect it becomes a poll tax (and vice versa, if a poll tax obligation can be worked off). Head taxes were important sources of revenue for many governments from ancient times until the 19th century. There have been several famous (and infamous) cases of head taxes in history, notably a tax formerly required for voting

Suffrage

Suffrage, political franchise, or simply the franchise, distinct from mere voting rights, is the civil right to vote gained through the democratic process...

in parts of the United States that was often designed to disenfranchise

Disfranchisement

Disfranchisement is the revocation of the right of suffrage of a person or group of people, or rendering a person's vote less effective, or ineffective...

poor people, including African American

African American

African Americans are citizens or residents of the United States who have at least partial ancestry from any of the native populations of Sub-Saharan Africa and are the direct descendants of enslaved Africans within the boundaries of the present United States...

s, Native Americans

Native Americans in the United States

Native Americans in the United States are the indigenous peoples in North America within the boundaries of the present-day continental United States, parts of Alaska, and the island state of Hawaii. They are composed of numerous, distinct tribes, states, and ethnic groups, many of which survive as...

, and white people of non-English descent (e.g., the Irish). In the United Kingdom, poll taxes were levied by the governments of John of Gaunt in the 14th C., Charles II

Charles II of England

Charles II was monarch of the three kingdoms of England, Scotland, and Ireland.Charles II's father, King Charles I, was executed at Whitehall on 30 January 1649, at the climax of the English Civil War...

in the 17th and Margaret Thatcher

Margaret Thatcher

Margaret Hilda Thatcher, Baroness Thatcher, was Prime Minister of the United Kingdom from 1979 to 1990...

in the 20th century.

The word poll is an English word that once meant "head" - and still does, in some specialised contexts - hence the name poll tax

Poll tax

A poll tax is a tax of a portioned, fixed amount per individual in accordance with the census . When a corvée is commuted for cash payment, in effect it becomes a poll tax...

for a per-person tax. In the United States, however, the term has come to be used almost exclusively for a fixed tax

Fixed tax

A fixed tax is a lump sum tax that is not measured as a percentage of the tax base . Fixed taxes like a poll tax or sin tax are often considered regressive, but could have progressive effects if applied to luxury goods and services.Since citizens share common roads, military protection, policing,...

applied to voting. Since "going to the polls" is a common idiom for voting (deriving from the fact that early voting involved head-counts), a new folk etymology has supplanted common knowledge of the phrase's true origins in America.

Mosaic law

As prescribed in Exodus (30: 11-16), Jewish law imposed a poll tax of half-shekelShekel

Shekel , is any of several ancient units of weight or of currency. The first usage is from Mesopotamia around 3000 BC. Initially, it may have referred to a weight of barley...

, payable by every man above the age of twenty ("rich shall not give more, and the poor shall not give less"), designated for the upkeep of the Temple of Jerusalem. Priests, women, slaves and minors were exempted, although they can offer it voluntarily. Payment by Samaritans or Gentiles was rejected. It was collected yearly during the month of Adar

Adar

Adar is the sixth month of the civil year and the twelfth month of the ecclesiastical year on the Hebrew calendar. It is a winter month of 29 days...

, both at the Temple and at special collection bureaus in the provinces.

Roman Empire

The ancient Romans imposed a tributum capitis (poll tax) as one of the principal direct taxes on the peoples of the Roman provinces (Digest 50, tit.15). In the Republican period, poll taxes were principally collected by private tax farmersTax farming

Farming is a technique of financial management, namely the process of commuting , by its assignment by legal contract to a third party, a future uncertain revenue stream into fixed and certain periodic rents, in consideration for which commutation a discount in value received is suffered...

(publican

Publican

In antiquity, publicans were public contractors, in which role they often supplied the Roman legions and military, managed the collection of port duties, and oversaw public building projects...

i), but from the time of Emperor Augustus

Augustus

Augustus ;23 September 63 BC – 19 August AD 14) is considered the first emperor of the Roman Empire, which he ruled alone from 27 BC until his death in 14 AD.The dates of his rule are contemporary dates; Augustus lived under two calendars, the Roman Republican until 45 BC, and the Julian...

, the collection were gradually transferred to magistrates and the senates of provincial cities. The Roman census

Census

A census is the procedure of systematically acquiring and recording information about the members of a given population. It is a regularly occurring and official count of a particular population. The term is used mostly in connection with national population and housing censuses; other common...

was conducted periodically in the provinces to draw up and update the poll tax register.

The Roman poll tax fell principally on Roman subjects in the provinces, but not on Roman citizens. Towns in the provinces who possessed the Jus Italicum (enjoying the "privileges of Italy") were exempted from the poll tax. The 212 edict of Emperor Caracalla

Caracalla

Caracalla , was Roman emperor from 198 to 217. The eldest son of Septimius Severus, he ruled jointly with his younger brother Geta until he murdered the latter in 211...

which formally conferred Roman citizenship on all residents of Roman provinces, did not however exempt them from the poll tax.

The Roman poll tax was deeply resented - Tertullian

Tertullian

Quintus Septimius Florens Tertullianus, anglicised as Tertullian , was a prolific early Christian author from Carthage in the Roman province of Africa. He is the first Christian author to produce an extensive corpus of Latin Christian literature. He also was a notable early Christian apologist and...

bewailed the poll tax as a "badge of slavery" - and it provoked numerous revolts in the provinces. Perhaps most famous is the Zealot revolt in Judaea of 66 CE. After the destruction of the temple in 70 CE, the Emperor imposed an extra poll tax on Jews throughout the empire, the fiscus judaicus

Fiscus Judaicus

The Fiscus Iudaicus or Fiscus Judaicus was a tax collecting agency instituted to collect the tax imposed on Jews in the Roman Empire after the destruction of the Temple of Jerusalem in 70 CE in favor of the temple of Jupiter Capitolinus in Rome.-Imposition:The tax was initially imposed by Roman...

, of two denari

Denarius

In the Roman currency system, the denarius was a small silver coin first minted in 211 BC. It was the most common coin produced for circulation but was slowly debased until its replacement by the antoninianus...

each.

The Italian revolt of the 720s, organized and led by Pope Gregory II

Pope Gregory II

Pope Saint Gregory II was pope from May 19, 715 to his death on February 11, 731, succeeding Pope Constantine. Having, it is said, bought off the Lombards for thirty pounds of gold, Charles Martel having refused his call for aid, he used the tranquillity thus obtained for vigorous missionary...

, was originally provoked by the attempt of the Constantinople Emperor Leo III the Isaurian

Leo III the Isaurian

Leo III the Isaurian or the Syrian , was Byzantine emperor from 717 until his death in 741...

to introduce a poll tax in the Italian provinces

Exarchate of Ravenna

The Exarchate of Ravenna or of Italy was a centre of Byzantine power in Italy, from the end of the 6th century to 751, when the last exarch was put to death by the Lombards.-Introduction:...

of the Byzantine Empire

Byzantine Empire

The Byzantine Empire was the Eastern Roman Empire during the periods of Late Antiquity and the Middle Ages, centred on the capital of Constantinople. Known simply as the Roman Empire or Romania to its inhabitants and neighbours, the Empire was the direct continuation of the Ancient Roman State...

in 722, and set in motion the permanent separation of Italy from the Byzantine empire. When King Aistulf

Aistulf

Aistulf was the Duke of Friuli from 744, King of Lombards from 749, and Duke of Spoleto from 751. His father was the Duke Pemmo.After his brother Ratchis became king, Aistulf succeeded him in Friuli. He succeeded him later as king when Ratchis abdicated to a monastery...

of the Lombards

Lombards

The Lombards , also referred to as Longobards, were a Germanic tribe of Scandinavian origin, who from 568 to 774 ruled a Kingdom in Italy...

availed himself of the Italian dissent and invaded the Exarchate of Ravenna

Exarchate of Ravenna

The Exarchate of Ravenna or of Italy was a centre of Byzantine power in Italy, from the end of the 6th century to 751, when the last exarch was put to death by the Lombards.-Introduction:...

in 751, one of his first acts was to institute a crushing poll tax of one gold solidus

Solidus (coin)

The solidus was originally a gold coin issued by the Romans, and a weight measure for gold more generally, corresponding to 4.5 grams.-Roman and Byzantine coinage:...

per head on every Roman citizen. Seeking relief from this burden, Pope Stephen II

Pope Stephen II

Pope Stephen II was Pope from 752 to 757, succeeding Pope Zachary following the death of Pope-elect Stephen. Stephen II marks the historical delineation between the Byzantine Papacy and the Frankish Papacy.-Allegiance to Constantinople:...

appealed to the Pepin the Short of the Franks

Franks

The Franks were a confederation of Germanic tribes first attested in the third century AD as living north and east of the Lower Rhine River. From the third to fifth centuries some Franks raided Roman territory while other Franks joined the Roman troops in Gaul. Only the Salian Franks formed a...

for assistance, that led to the establishment of the Papal States

Papal States

The Papal State, State of the Church, or Pontifical States were among the major historical states of Italy from roughly the 6th century until the Italian peninsula was unified in 1861 by the Kingdom of Piedmont-Sardinia .The Papal States comprised territories under...

in 756.

Islamic law

JizyaJizya

Under Islamic law, jizya or jizyah is a per capita tax levied on a section of an Islamic state's non-Muslim citizens, who meet certain criteria...

is a poll tax imposed under Islamic law

Sharia

Sharia law, is the moral code and religious law of Islam. Sharia is derived from two primary sources of Islamic law: the precepts set forth in the Quran, and the example set by the Islamic prophet Muhammad in the Sunnah. Fiqh jurisprudence interprets and extends the application of sharia to...

on non-Muslims - specifically, the dhimmi ("People of the Book", i.e. Jews and Christians). The tax is levied on free-born abled-bodied men of military age. The poor are exempt, as well as those who were not independent or wealthy who were slaves, women, children, the old, the sick, monks, or hermits.

There are several legal rationales for the jizya (and its equivalent land tax, the kharaj

Kharaj

In Islamic law, kharaj is a tax on agricultural land.Initially, after the first Muslim conquests in the 7th century, kharaj usually denoted a lump-sum duty levied upon the conquered provinces and collected by the officials of the former Byzantine and Sassanid empires or, more broadly, any kind of...

). The common argument is that jizya was a fee in exchange for the dhimma (permission to practice one's faith, enjoy communal autonomy, and to be entitled to Muslim protection from outside aggression). Some scholars emphasize that its higher rate is also a sign of submission and acceptance of Muslim rule, and some argue humiliation for failing to embrace Islam. Other rationales assume such rights were every person's birthright (Muslim or non-Muslim), and the imposition of jizya on non-Muslims similar to the imposition of zakat

Zakat

Zakāt , one of the Five Pillars of Islam, is the giving of a fixed portion of one's wealth to charity, generally to the poor and needy.-History:Zakat, a practice initiated by Muhammed himself, has played an important role throughout Islamic history...

(one of the Five Pillars of Islam, an obligatory wealth tax paid on certain assets which are not used productively for a period of a year) on Muslims. The rates of jizya are higher (often quite higher) than zakat.

Although jizya is designated as a poll tax, its assessment and collection is often qualified by income. For instance, Amr ibn al-As, after conquering Egypt, set up a census to measure the population for the jizya, and thus the total expected jizya revenue for the whole province, but organized the actual collection by partitioning the population into wealth classes, so that the rich paid more and the poor less jizya of that total sum. Elsewhere, it is reported customary to partition into three classes, e.g. 48 dirhams for the rich, 24 for middle class and 12 for the poor.

The differing tax rates between zakat and jizya gave an incentive for populations to convert to Islam, to benefit from the lower tax rates. However, this was not always respected by the governing authorities, who were reluctant to lose the cash revenues. In the late 7th and early 8th C., during the Umayyad Caliphate, conversions were often ignored and jizya continued being collected on Muslim converts, particularly if they were non-Arabs (e.g. Berber

Berber people

Berbers are the indigenous peoples of North Africa west of the Nile Valley. They are continuously distributed from the Atlantic to the Siwa oasis, in Egypt, and from the Mediterranean to the Niger River. Historically they spoke the Berber language or varieties of it, which together form a branch...

s, Persians

Persian people

The Persian people are part of the Iranian peoples who speak the modern Persian language and closely akin Iranian dialects and languages. The origin of the ethnic Iranian/Persian peoples are traced to the Ancient Iranian peoples, who were part of the ancient Indo-Iranians and themselves part of...

), raising tensions throughout the caliphate. In 718, the Umayyad caliph Umar II

Umar II

Umar ibn Abd al-Aziz was an Umayyad caliph who ruled from 717 to 720. He was also a cousin of the former caliph, being the son of Abd al-Malik's younger brother, Abd al-Aziz. He was also a great-grandson of the companion of the Prophet Muhammad, Umar bin Al-Khattab.-Lineage:Umar was born around...

strictly forbade collection of jizya from Muslim converts. However, after his death, difficulties in the caliphal treasury prompted governors to side-step the prohibitions and surreptitiously re-introduce jizya-collection on converts by other guises. The zeal of the Umayyad tax-collectors led to the eruption of two notable revolts in the 740s - the Berber Revolt

Berber Revolt

The Great Berber Revolt of 739/740-743 AD took place during the reign of the Umayyad Caliph Hisham ibn Abd al-Malik and marked the first successful secession from the Arab caliphate...

in North Africa and Spain and the Abbasid Revolt in Persia - demanding the equality of all Muslims, regardless of ethnicity, and adherence to the tax rates prescribed by Islamic law.

In 1855, the Ottoman Empire

Ottoman Empire

The Ottoman EmpireIt was usually referred to as the "Ottoman Empire", the "Turkish Empire", the "Ottoman Caliphate" or more commonly "Turkey" by its contemporaries...

abolished the jizya tax, as part of reforms to equalize the status of Muslims and non-Muslims. It was replaced, however, by a military-exemption tax on non-Muslims, the Bedel-i Askeri, which is perhaps the same thing.

United Kingdom

The poll tax was essentially a lay subsidy (a tax on the movable property of most of the population) to help fund war. It had first been levied in 1275 and continued, under different names, until the 17th century. People were taxed a percentagePercentage

In mathematics, a percentage is a way of expressing a number as a fraction of 100 . It is often denoted using the percent sign, “%”, or the abbreviation “pct”. For example, 45% is equal to 45/100, or 0.45.Percentages are used to express how large/small one quantity is, relative to another quantity...

of the assessed value of their movable goods. That percentage varied from year to year and place to place, and which goods could be taxed differed between urban

Urban area

An urban area is characterized by higher population density and vast human features in comparison to areas surrounding it. Urban areas may be cities, towns or conurbations, but the term is not commonly extended to rural settlements such as villages and hamlets.Urban areas are created and further...

and rural

Rural

Rural areas or the country or countryside are areas that are not urbanized, though when large areas are described, country towns and smaller cities will be included. They have a low population density, and typically much of the land is devoted to agriculture...

locations. Churchmen were exempt, as were the poor, workers in the Royal Mint

Royal Mint

The Royal Mint is the body permitted to manufacture, or mint, coins in the United Kingdom. The Mint originated over 1,100 years ago, but since 2009 it operates as Royal Mint Ltd, a company which has an exclusive contract with HM Treasury to supply all coinage for the UK...

, inhabitants of the Cinque Ports

Cinque Ports

The Confederation of Cinque Ports is a historic series of coastal towns in Kent and Sussex. It was originally formed for military and trade purposes, but is now entirely ceremonial. It lies at the eastern end of the English Channel, where the crossing to the continent is narrowest...

, tin

Tin

Tin is a chemical element with the symbol Sn and atomic number 50. It is a main group metal in group 14 of the periodic table. Tin shows chemical similarity to both neighboring group 14 elements, germanium and lead and has two possible oxidation states, +2 and the slightly more stable +4...

workers in Cornwall

Cornwall

Cornwall is a unitary authority and ceremonial county of England, within the United Kingdom. It is bordered to the north and west by the Celtic Sea, to the south by the English Channel, and to the east by the county of Devon, over the River Tamar. Cornwall has a population of , and covers an area of...

and Devon

Devon

Devon is a large county in southwestern England. The county is sometimes referred to as Devonshire, although the term is rarely used inside the county itself as the county has never been officially "shired", it often indicates a traditional or historical context.The county shares borders with...

, and those who lived in the Palatinate counties

County palatine

A county palatine or palatinate is an area ruled by an hereditary nobleman possessing special authority and autonomy from the rest of a kingdom or empire. The name derives from the Latin adjective palatinus, "relating to the palace", from the noun palatium, "palace"...

of Cheshire

Cheshire

Cheshire is a ceremonial county in North West England. Cheshire's county town is the city of Chester, although its largest town is Warrington. Other major towns include Widnes, Congleton, Crewe, Ellesmere Port, Runcorn, Macclesfield, Winsford, Northwich, and Wilmslow...

and Durham

Durham

Durham is a city in north east England. It is within the County Durham local government district, and is the county town of the larger ceremonial county...

.

14th century

The Hilary Parliament, held between January and March 1377, levied a poll tax in 1377 to finance the war against France at the request of John of Gaunt who, as King Edward III was mortally sick, was the de facto head of government at the time. This tax covered almost 60% of the population, far more than lay subsidies had earlier. It was levied three times, in 1377, 1379 and 1381. Each time the basis was slightly different. In 1377, every lay person over the age of 14 years who was not a beggar had to pay a groatGroat

Groat or Fuppence is the traditional name of an English silver coin worth four English pence, and also a Scottish coin originally worth fourpence, with later issues being valued at eightpence and one shilling.-Name:...

(4d) to the Crown. By 1379 that had been graded by social class, with the lower age limit changed to 16, and to 15 two years later. The levy in 1381 was particularly unpopular, as each person aged over 15 was required to pay the amount of one shilling

Shilling

The shilling is a unit of currency used in some current and former British Commonwealth countries. The word shilling comes from scilling, an accounting term that dates back to Anglo-Saxon times where it was deemed to be the value of a cow in Kent or a sheep elsewhere. The word is thought to derive...

, which was then a large amount. This played a role in provoking the Peasants' Revolt in 1381, due in part to attempts to restore feudal conditions in rural areas.

17th Century

The poll tax was resurrected during the 17th C., usually related to a military emergency. It was imposed by Charles ICharles I of England

Charles I was King of England, King of Scotland, and King of Ireland from 27 March 1625 until his execution in 1649. Charles engaged in a struggle for power with the Parliament of England, attempting to obtain royal revenue whilst Parliament sought to curb his Royal prerogative which Charles...

in 1641 to finance the raising of the army against the Scottish and Irish uprisings. With the Restoration of Charles II

Charles II of England

Charles II was monarch of the three kingdoms of England, Scotland, and Ireland.Charles II's father, King Charles I, was executed at Whitehall on 30 January 1649, at the climax of the English Civil War...

in 1660, the Convention Parliament of 1660 instituted a poll tax to finance the disbanding of the New Model Army

New Model Army

The New Model Army of England was formed in 1645 by the Parliamentarians in the English Civil War, and was disbanded in 1660 after the Restoration...

(pay arrears, etc.) (12 Charles II c.9). The poll tax was assessed according to "rank", e.g. dukes paid £100, earls £60, knights £20, esquires £10. Eldest sons paid 2/3rds of their father's rank, widows paid a third of their late husband's rank. The members of the livery companies paid according to company's rank (e.g. masters of first-tier guilds like the Mercers paid £10, whereas masters of fifth-tier guilds, like the Clerks, paid 5 shillings). Professionals also paid differing rates, e.g. physicians (£10), judges (£20), advocates (£5), attorneys (£3), and so on. Anyone with property (land, etc.) paid 40 shillings per £100 earned, anyone over the age of 16 and unmarried paid 12-pence and everyone else over 16 paid 6-pence.

The poll tax was imposed again by William and Mary

William and Mary

The phrase William and Mary usually refers to the coregency over the Kingdoms of England, Scotland and Ireland, of King William III & II and Queen Mary II...

in 1689 (1 Will. & Mar. c.13), reassessed in 1690 adjusting rank for fortune, and then again in 1691 back to rank irrespective of fortune. The poll tax was imposed again in 1692, and one final time in 1698 (the last poll tax until the 20th C.). A poll tax was imposed on Scotland between 1694 and 1699.

As the greater weight of the 17th C. poll taxes fell primarily upon the wealthy and powerful, it was not too unpopular. There were grumblings within the taxed ranks about lack of differentiation by income within ranks. Ultimately, it was the inefficiency of their collection - what they brought in routinely fell far short of expected revenues - that prompted the government to abandon the poll tax after 1698.

Far more controversial was the hearth tax introduced in 1662 (13 & 14 Charles II c.10), which imposed a hefty two shillings on every hearth in a family dwelling (which was easier to count than persons). Heavier, more permanent and more regressive than the poll tax proper, the intrusive entry of tax inspectors into private homes to count hearths was a very sore point, and it was promptly repealed with the Glorious Revolution

Glorious Revolution

The Glorious Revolution, also called the Revolution of 1688, is the overthrow of King James II of England by a union of English Parliamentarians with the Dutch stadtholder William III of Orange-Nassau...

in 1689. It was replaced with a "window tax" in 1695 (inspectors could count windows from outside of homes).

20th century: community charge

The Community Charge was a poll tax to fund local government in the United Kingdom

Local government in the United Kingdom

The pattern of local government in England is complex, with the distribution of functions varying according to the local arrangements. Legislation concerning local government in England is decided by the Parliament and Government of the United Kingdom, because England does not have a devolved...

, instituted in 1989 by the government of Margaret Thatcher

Margaret Thatcher

Margaret Hilda Thatcher, Baroness Thatcher, was Prime Minister of the United Kingdom from 1979 to 1990...

. It replaced the rates

Rates (tax)

Rates are a type of property tax system in the United Kingdom, and in places with systems deriving from the British one, the proceeds of which are used to fund local government...

that were based on the notional rental value of a house. The abolition of rates was in the manifesto of Thatcher's Conservative Party

Conservative Party (UK)

The Conservative Party, formally the Conservative and Unionist Party, is a centre-right political party in the United Kingdom that adheres to the philosophies of conservatism and British unionism. It is the largest political party in the UK, and is currently the largest single party in the House...

in the 1979 general election

United Kingdom general election, 1979

The United Kingdom general election of 1979 was held on 3 May 1979 to elect 635 members to the British House of Commons. The Conservative Party, led by Margaret Thatcher ousted the incumbent Labour government of James Callaghan with a parliamentary majority of 43 seats...

, and the replacement was proposed in the Green Paper of 1986, Paying for Local Government based on ideas developed by Dr Madsen Pirie

Madsen Pirie

Dr Duncan Madsen Pirie, PhD is a British researcher, author, and educator. He is the founder and current President of the Adam Smith Institute, a UK think tank which has been in operation since 1978.-Early life and education:...

and Douglas Mason

Douglas Mason

Douglas Calder Mason was a British policymaker, writer and antiquarian bookseller. He came to be known as the "father of the poll tax".-Biography:...

of the Adam Smith Institute

Adam Smith Institute

The Adam Smith Institute, abbreviated to ASI, is a think tank based in the United Kingdom, named after one of the founders of modern economics, Adam Smith. It espouses free market and classical liberal views, in particular by creating radical policy options in the light of public choice theory,...

. It was a fixed tax

Fixed tax

A fixed tax is a lump sum tax that is not measured as a percentage of the tax base . Fixed taxes like a poll tax or sin tax are often considered regressive, but could have progressive effects if applied to luxury goods and services.Since citizens share common roads, military protection, policing,...

per adult resident, but there was a reduction for those with lower household income. Each person was to pay for the services provided in their community. This proposal was contained in the Conservative

Conservative Party (UK)

The Conservative Party, formally the Conservative and Unionist Party, is a centre-right political party in the United Kingdom that adheres to the philosophies of conservatism and British unionism. It is the largest political party in the UK, and is currently the largest single party in the House...

Manifesto

Manifesto

A manifesto is a public declaration of principles and intentions, often political in nature. Manifestos relating to religious belief are generally referred to as creeds. Manifestos may also be life stance-related.-Etymology:...

for the 1987 General Election

United Kingdom general election, 1987

The United Kingdom general election of 1987 was held on 11 June 1987, to elect 650 members to the British House of Commons. The election was the third consecutive election victory for the Conservative Party under the leadership of Margaret Thatcher, who became the first Prime Minister since the 2nd...

. The new tax replaced the rates in Scotland from the start of the 1989/90 financial year, and in England and Wales from the start of the 1990/91 financial year.

The system was deeply unpopular. It seemed to shift the tax burden from rich to poor, as it was based on the number of people living in a house rather than its estimated price. Many tax rates set by local councils proved to be much higher than earlier predictions, leading to resentment even among people who had supported it. The tax in different boroughs differed dramatically because local taxes paid by businesses varied and grants by central government to local authorities sometimes varied capriciously.

Mass protests were called by the All-Britain Anti-Poll Tax Federation, with which the vast majority of local Anti Poll Tax Unions (APTUs) were affiliated. In Scotland the APTUs called for mass non-payment and these calls rapidly gathered widespread support which spread to England and Wales, even though non-payment meant that people could be prosecuted. In some areas, 30% of former ratepayers defaulted. While owner-occupier

Owner-occupier

An owner-occupier is a person who lives in and owns the same home. It is a type of housing tenure. The home of the owner-occupier may be, for example, a house, apartment, condominium, or a housing cooperative...

s were easy to tax, those who regularly changed accommodation were almost impossible to pursue if they chose not to pay. The cost of collecting the tax rose steeply while the returns from it fell. Enforcement measures became increasingly draconian, and unrest grew and culminated in a number of Poll Tax Riots

Poll Tax Riots

The UK Poll Tax Riots were a series of mass disturbances, or riots, in British towns and cities during protests against the Community Charge , introduced by the Conservative government led by Prime Minister Margaret Thatcher...

. The most serious was in a protest at Trafalgar Square

Trafalgar Square

Trafalgar Square is a public space and tourist attraction in central London, England, United Kingdom. At its centre is Nelson's Column, which is guarded by four lion statues at its base. There are a number of statues and sculptures in the square, with one plinth displaying changing pieces of...

, London, on 31 March 1990, of more than 200,000 protesters. A Labour MP, Terry Fields

Terry Fields

Terence Fields was a British trades unionist and Labour Member of Parliament for Liverpool Broadgreen. He was a supporter of the Militant tendency.-Early life:...

, was jailed for 60 days for refusing to pay his poll tax.

This unrest was instrumental in toppling Margaret Thatcher in 1990. Her replacement, John Major

John Major

Sir John Major, is a British Conservative politician, who served as Prime Minister of the United Kingdom and Leader of the Conservative Party from 1990–1997...

, replaced the Community Charge with the Council Tax

Council tax

Council Tax is the system of local taxation used in England, Scotland and Wales to part fund the services provided by local government in each country. It was introduced in 1993 by the Local Government Finance Act 1992, as a successor to the unpopular Community Charge...

, similar to the rating system that preceded the Poll Tax. The main differences were that it was levied on capital value rather than notional rental value of a property, and that it had a 25% discount for single-occupancy dwellings.

Capitation

In France, a poll tax, the capitation, was first imposed by King Louis XIVLouis XIV of France

Louis XIV , known as Louis the Great or the Sun King , was a Bourbon monarch who ruled as King of France and Navarre. His reign, from 1643 to his death in 1715, began at the age of four and lasted seventy-two years, three months, and eighteen days...

in 1695 as a temporary measure to finance the War of the League of Augsburg, and thus repealed in 1699. It was resumed during the War of Spanish Succession and in 1704 set on a permanent basis, remaining until the end of the Ancien regime.

Like the English poll tax, the French capitation tax was assessed on rank – for taxation persons, French society was divided in twenty-two "classes", with the Dauphin (a class by himself) paying 2,000 livre

French livre

The livre was the currency of France until 1795. Several different livres existed, some concurrently. The livre was the name of both units of account and coins.-Etymology:...

s, princes of the blood paying 1500 livres, and so on down to the lowest class, composed of day laborers and servants, who paid 1 livre each. The bulk of the common population was covered by four classes, paying 40, 30, 10 and 3 livres respectively. Unlike most other direct French taxes, nobles and clergy were not exempted from capitation taxes. It did, however, exempt the mendicant orders and the poor who contributed less than 40 sous.

At the time of its design, the capitation tax was probably the most equitable tax in France. This was soon gnawed away. The French clergy managed to temporarily escape capitation assessment by promising to pay a total sum of 4 million livres per annum in 1695, and then obtained permanent exemption in 1709 with a lump sum payment of 24 million livres. The Pays d'états

Pays d'états

Under the Ancien Régime, a pays d'états was a type of province which had held onto its estates provincial or representative assembly of the three orders, whose main role was to negotiate the raising of taxes with the royal commissaires or intendants, its division by diocese and parish, and...

(Brittany, Burgundy, etc.) and many towns also escaped assessment by promising annual fixed payments. The nobles did not escape assessment, but they obtained the right to appoint their own capitation tax assessors, which allowed them to escape most of the burden (in one calculation, they escaped ⅞ of it). So it not long before it was only the routiers (peasants) who paid the capitation tax.

Compounding the burden, the assessment on the capitation did not remain stable. The pays de taille personelle (basically, Pays d'élection

Pays d'élection

A pays d'élection was a généralité, in fiscal and financial matters, in France under the Ancien Régime. The representative of the royal government, the intendant, split up the impôts in such an area at a local level with the aid of the élus A pays d'élection was a généralité, in fiscal and...

, the bulk of France and Aquitaine) secured the ability to assess the capitation tax proportionally to the taille - which effectively meant adjusting the burden heavily against the lower classes. According to the estimates of Jacques Necker

Jacques Necker

Jacques Necker was a French statesman of Swiss birth and finance minister of Louis XVI, a post he held in the lead-up to the French Revolution in 1789.-Early life:...

in 1788, the capitation tax was so riddled in practice, that the privileged classes (nobles and clergy and towns) were largely exempt, while the lower classes were heavily crushed: the lowest peasant class, originally assessed to pay 3 livres, were now paying 24, the second lowest, assessed at 10 livres, were now paying 60 and the third-lowest assessed at 30 were paying 180. The total collection from the capitation, according to Necker in 1788, was 41 million livres, well short of the 54 million estimate, and it was projected that the revenues could have doubled if the exemptions were revoked and the original 1695 assessment properly restored.

The old capitation tax was repealed with the French Revolution

French Revolution

The French Revolution , sometimes distinguished as the 'Great French Revolution' , was a period of radical social and political upheaval in France and Europe. The absolute monarchy that had ruled France for centuries collapsed in three years...

and replaced, in November 23, 1790, with a new poll tax as part of the contribution personnelle mobilière, which lasted well into the late 19th Century. It was fixed for every individual at "three days's labor" (assessed locally, but by statute, no less than 1 franc 50 centimes and no more than 4 francs 50 centimes, depending on the area). A dwelling tax (impôt sur les portes et fenêtres, similar to the English window-tax) was imposed in 1791.

United States

A poll tax (in the sense of capitation) plays a significant role in the history of taxation in the United StatesTaxation in the United States

The United States is a federal republic with autonomous state and local governments. Taxes are imposed in the United States at each of these levels. These include taxes on income, property, sales, imports, payroll, estates and gifts, as well as various fees.Taxes are imposed on net income of...

and the adoption of income tax

Income tax

An income tax is a tax levied on the income of individuals or businesses . Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate...

as a significant source of government funding. The second meaning of poll tax, namely a tax to be paid as a prerequisite to voting, is more widely known in the United States today. The term was widely used in the South after the turn of the 20th century in combination with other measures to bar blacks and poor whites from voter registration and voting.

Recent debate has arisen about whether requiring citizens to purchase a state identification card acts as a poll tax and bars poor voters from voting. To reduce cost, some state offer free identification cards for those who can demonstrate the need. However, significant additional costs can be incurred when acquiring a "free" ID. In addition to travel cost or potential lost wages, a certified copy of a birth certificate costs from $10 to $45 depending on the state, a passport costs $85 and certified naturalization papers cost $19.95. Further, about 12 percent of voting-age Americans currently lack a driver's license.

Capitation and federal taxation

The capitation clause of Article I of the United States ConstitutionUnited States Constitution

The Constitution of the United States is the supreme law of the United States of America. It is the framework for the organization of the United States government and for the relationship of the federal government with the states, citizens, and all people within the United States.The first three...

, reads "[n]o capitation, or other direct, tax shall be laid, unless in proportion to the census or enumeration herein before directed to be taken." Capitation here means a tax of a uniform, fixed amount per taxpayer. Direct tax

Direct tax

The term direct tax generally means a tax paid directly to the government by the persons on whom it is imposed.-General meaning:In the general sense, a direct tax is one paid directly to the government by the persons on whom it is imposed...

means a tax levied directly by the United States federal government

Federal government of the United States

The federal government of the United States is the national government of the constitutional republic of fifty states that is the United States of America. The federal government comprises three distinct branches of government: a legislative, an executive and a judiciary. These branches and...

on taxpayers, as opposed to a tax on events or transactions. The United States government levied direct taxes from time to time during the 18th and early 19th centuries. It levied direct taxes on the owners of houses, land, slaves, and estates in the late 1790s but cancelled the taxes in 1802.

An income tax is neither a poll tax nor a capitation, as the amount of tax will vary from person to person, depending on each person's income. Until a United States Supreme Court decision in 1895, all income taxes were deemed to be excises (i.e. indirect taxes). The Revenue Act of 1861

Revenue Act of 1861

The Revenue Act of 1861, formally cited as , included the first U.S. Federal income tax statute . The Act, motivated by the need to fund the Civil War , imposed an income tax to be "levied, collected, and paid, upon the annual income of every person residing in the United States, whether such...

established the first income tax

Income tax

An income tax is a tax levied on the income of individuals or businesses . Various income tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional, or regressive. When the tax is levied on the income of companies, it is often called a corporate...

in the United States, to pay for the cost of the American Civil War

American Civil War

The American Civil War was a civil war fought in the United States of America. In response to the election of Abraham Lincoln as President of the United States, 11 southern slave states declared their secession from the United States and formed the Confederate States of America ; the other 25...

. This income tax was abolished after the war, in 1872. Another income tax statute in 1894 was overturned in Pollock v. Farmers' Loan & Trust Co.

Pollock v. Farmers' Loan & Trust Co.

Pollock v. Farmers' Loan & Trust Company, , aff'd on reh'g, , with a ruling of 5–4, was a landmark case in which the Supreme Court of the United States ruled that the unapportioned income taxes on interest, dividends and rents imposed by the Income Tax Act of 1894 were, in effect, direct taxes, and...

in 1895, where the Supreme Court held that income taxes on income from property, such as rent income, interest income, and dividend income (but not income taxes on income from wages, employment, etc.) were to be treated as direct taxes. Because the statute in question had not apportioned income taxes on income from property by population, the statute was ruled unconstitutional. Finally, ratification

Ratification

Ratification is a principal's approval of an act of its agent where the agent lacked authority to legally bind the principal. The term applies to private contract law, international treaties, and constitutionals in federations such as the United States and Canada.- Private law :In contract law, the...

of the Sixteenth Amendment to the United States Constitution

Sixteenth Amendment to the United States Constitution

The Sixteenth Amendment to the United States Constitution allows the Congress to levy an income tax without apportioning it among the states or basing it on Census results...

in 1913 made possible modern income taxes, by removing the requirement of apportionment with respect to income taxes.

1885 head tax

The Chinese Immigration Act of 1885Chinese Immigration Act of 1885

The Chinese Immigration Act of 1885 placed a head tax on all Chinese immigrants coming to Canada, forcing them to pay a fifty dollar fee to enter the country. In 1900, the fee was raised to one hundred dollars...

stipulated that all Chinese entering Canada would be subjected to a head tax of $50. The act was mostly to discourage the lower class Chinese from entering, since Canada still welcomed the rich Chinese merchants who could afford the head tax. After the Government of Canada realized that the $50 fee did not effectively eliminate Chinese from entering Canada, the government passed the Chinese Immigration Act of 1900 and 1903, increasing the tax to $100 and $500, respectively. In 1923, the government passed Chinese Immigration Act, 1923

Chinese Immigration Act, 1923

The Chinese Immigration Act, 1923, known in the Chinese Canadian community as the Chinese Exclusion Act, was an act passed by the Parliament of Canada, banning most forms of Chinese immigration to Canada...

which prohibited all Chinese from immigrating to Canada.

On 22 June 2006, the Prime Minister of Canada

Prime Minister of Canada

The Prime Minister of Canada is the primary minister of the Crown, chairman of the Cabinet, and thus head of government for Canada, charged with advising the Canadian monarch or viceroy on the exercise of the executive powers vested in them by the constitution...

Stephen Harper

Stephen Harper

Stephen Joseph Harper is the 22nd and current Prime Minister of Canada and leader of the Conservative Party. Harper became prime minister when his party formed a minority government after the 2006 federal election...

delivered a message of redress for a head tax once applied to Chinese immigrants. Survivors or their spouses will receive $20,000 CAD compensation.

New Zealand

The numbers of the Chinese immigration went from 20,000 a year to 8 people after the government-imposed "head tax". New Zealand imposed a poll tax on Chinese immigrants during the 19th and early 20th centuries. The poll tax was effectively lifted in the 1930s following the invasion of China by Japan, and was finally repealed in 1944. Prime Minister Helen ClarkHelen Clark

Helen Elizabeth Clark, ONZ is a New Zealand political figure who was the 37th Prime Minister of New Zealand for three consecutive terms from 1999 to 2008...

offered New Zealand's Chinese community an official apology for the poll tax on 12 February 2002.

See also

- Hut taxHut taxThe hut tax was a type of taxation introduced by British colonialists in Africa on a per hut or household basis. It was variously payable in money, labour, grain or stock and benefited the colonial authorities in four related ways: it raised money; it supported the currency ; it broadened the cash...

- Fixed taxFixed taxA fixed tax is a lump sum tax that is not measured as a percentage of the tax base . Fixed taxes like a poll tax or sin tax are often considered regressive, but could have progressive effects if applied to luxury goods and services.Since citizens share common roads, military protection, policing,...

- Poll tax (United States)

- Disfranchisement after the Civil War

- CorvéeCorvéeCorvée is unfree labour, often unpaid, that is required of people of lower social standing and imposed on them by the state or a superior . The corvée was the earliest and most widespread form of taxation, which can be traced back to the beginning of civilization...

External links

- Middle Ages Poll Tax

- Pictures by Paul Ross, who witnessed the riots

- The battle that brought down Thatcher - a perspective by the Trotskyist Militant tendencyMilitant TendencyThe Militant tendency was an entrist group within the British Labour Party based around the Militant newspaper that was first published in 1964...