Marginalism

Encyclopedia

Marginalism refers to the use of marginal concepts

in economic

theory. Marginalism is associated with arguments concerning changes in the quantity used of a good or service, as opposed to some notion of the over-all significance of that class of good or service, or of some total quantity thereof.

The central concept of marginalism proper is that of marginal utility

, but marginalists following the lead of Alfred Marshall

were further heavily dependent upon the concept of marginal physical productivity

in their explanation of cost

; and the neoclassical

tradition that emerged from British

marginalism generally abandoned the concept of utility

and gave marginal rates of substitution

a more fundamental role in analysis.

Marginalism is now an integral part of mainstream economic

theory.

A value that holds true given particular constraints is a marginal value

. A change that would be affected as or by a specific loosening or tightening of those constraints is a marginal change.

Neoclassical economics usually assumes that marginal changes are infinitesimal

s or limit

s. (Though this assumption makes the analysis less robust, it increases tractability.) One is therefore often told that “marginal” is synonymous with “very small”, though in more general analysis this may not be operationally true (and would not in any case be literally true). Frequently, economic analysis concerns the marginal values associated with a change of one unit of a resource, because decisions are often made in terms of units; marginalism seeks to explain unit prices in terms of such marginal values.

Marginalism assumes, for any given agent, economic rationality

and an ordering

of possible states-of-the-world, such that, for any given set of constraints, there is an attainable state which is best in the eyes of that agent. Descriptive

marginalism asserts that choice amongst the specific means by which various anticipated specific states-of-the-world (outcomes) might be affected is governed only by the distinctions amongst those specific outcomes; prescriptive

marginalism asserts that such choice ought to be so governed.

On such assumptions, each increase would be put to the specific, feasible, previously unrealized use of greatest priority, and each decrease would result in abandonment of the use of lowest priority amongst the uses to which the good or service had been put.

. Under the assumption of economic rationality, it is the utility of its least urgent possible use from the best feasible combination of actions in which its use is included.

In 20th century mainstream economics

, the term “utility

” has come to be formally defined as a quantification

capturing preferences by assigning greater quantities to states, goods, services, or applications that are of higher priority. But marginalism and the concept of marginal utility predate the establishment of this convention within economics. The more general conception of utility is that of use or usefulness, and this conception is at the heart of marginalism; the term “marginal utility” arose from translation of the German “Grenznutzen”, which literally means border use, referring directly to the marginal use, and the more general formulations of marginal utility do not treat quantification as an essential feature. On the other hand, none of the early marginalists insisted that utility were not quantified, some indeed treated quantification as an essential feature, and those who did not still used an assumption of quantification for expository purposes. In this context, it is not surprising to find many presentations that fail to recognize a more general approach.

in which usefulness can be quantified, the change in utility of moving from state to state

to state  is

is

Moreover, if and

and  are distinguishable by values of just one variable

are distinguishable by values of just one variable  which is itself quantified, then it becomes possible to speak of the ratio of the marginal utility of the change in

which is itself quantified, then it becomes possible to speak of the ratio of the marginal utility of the change in  to the size of that change:

to the size of that change:

(where “c.p.

” indicates that the only independent variable

to change is ).

).

Mainstream neoclassical economics will typically assume that

is well defined, and use “marginal utility” to refer to a partial derivative

's First Law”) is that, ceteris paribus

, as additional amounts of a good or service are added to available resources, their marginal utilities are decreasing. This “law” is sometimes treated as a tautology

, sometimes as something proven by introspection, or sometimes as a mere instrumental

assumption, adopted only for its perceived predictive efficacy. Actually, it is not quite any of these things, though it may have aspects of each. The “law” does not hold under all circumstances, so it is neither a tautology nor otherwise proveable; but it has a basis in prior observation.

An individual will typically be able to partially order

the potential uses of a good or service. If there is scarcity

, then a rational agent will satisfy wants of highest possible priority, so that no want is avoidably sacrificed to satisfy a want of lower priority. In the absence of complementarity across the uses, this will imply that the priority of use of any additional amount will be lower than the priority of the established uses, as in this famous example:

However, if there is a complementarity across uses, then an amount added can bring things past a desired tipping point

However, if there is a complementarity across uses, then an amount added can bring things past a desired tipping point

, or an amount subtracted cause them to fall short. In such cases, the marginal utility of a good or service might actually be increasing.

Without the presumption that utility is quantified, the diminishing of utility should not be taken to be itself an arithmetic

subtraction

. It is the movement from use of higher to lower priority, and may be no more than a purely ordinal

change.

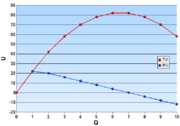

When quantification of utility is assumed, diminishing marginal utility corresponds to a utility function whose slope

is continually or continuously decreasing. In the latter case, if the function is also smooth, then the “law” may be expressed

Neoclassical economics usually supplements or supplants discussion of marginal utility with indifference curve

s, which were originally derived as the level curves of utility functions, or can be produced without presumption of quantification, but are often simply treated as axiomatic. In the absence of complementarity of goods or services, diminishing marginal utility implies convex

ity of indifference curves (though such convexity would also follow from quasiconcavity of the utility function).

When goods and services are discrete

, the least favorable rate at which an agent would trade A for B will usually be different from that at which she would trade B for A:

But, when the goods and services are continuously divisible, in the limiting case

and the marginal rate of substitution is the slope of the indifference curve

(multiplied by ).

).

If, for example, Lisa will not trade a goat for anything less than two sheep, then her

And if she will not trade a sheep for anything less than two goats, then her

But if she would trade one gram of banana for one ounce of ice cream and vice versa, then

When indifference curves (which are essentially graphs of instantaneous rates of substitution) and the convexity of those curves are not taken as given, the “law” of diminishing marginal utility is invoked to explain diminishing marginal rates of substitution — a willingness to accept fewer units of good or service in substitution for

in substitution for  as one's holdings of

as one's holdings of  grow relative to those of

grow relative to those of  . If an individual has a stock or flow of a good or service whose marginal utility is less than would be that of some other good or service for which he or she could trade, then it is in his or her interest to effect that trade. Of course, as one thing is traded-away and another is acquired, the respective marginal gains or losses from further trades are now changed. On the assumption that the marginal utility of one is diminishing, and the other is not increasing, all else being equal, an individual will demand an increasing ratio of that which is acquired to that which is sacrificed. (One important way in which all else might not be equal is when the use of the one good or service complements that of the other. In such cases, exchange ratios might be constant.) If any trader can better his or her own marginal position by offering an exchange more favorable to other traders with desired goods or services, then he or she will do so.

. If an individual has a stock or flow of a good or service whose marginal utility is less than would be that of some other good or service for which he or she could trade, then it is in his or her interest to effect that trade. Of course, as one thing is traded-away and another is acquired, the respective marginal gains or losses from further trades are now changed. On the assumption that the marginal utility of one is diminishing, and the other is not increasing, all else being equal, an individual will demand an increasing ratio of that which is acquired to that which is sacrificed. (One important way in which all else might not be equal is when the use of the one good or service complements that of the other. In such cases, exchange ratios might be constant.) If any trader can better his or her own marginal position by offering an exchange more favorable to other traders with desired goods or services, then he or she will do so.

. In most contexts, however, “marginal cost” will refer to marginal pecuniary

cost — that is to say marginal cost measured by forgone money.

A thorough-going marginalism sees marginal cost as increasing under the “law” of diminishing marginal utility, because applying resources to one application reduces their availability to other applications. Neoclassical economics tends to disregard this argument, but to see marginal costs as increasing in consequence of diminishing returns

.

. In any case buyers are modelled as pursuing typically lower quantities, and sellers offering typically higher quantities, as price is increased, with each being willing to trade until the marginal value of what they would trade-away exceeds that of the thing for which they would trade.

At any given price, a prospective buyer has some marginal rate of substitution of money for the good or service in question. Given the “law” of diminishing marginal utility, or otherwise given convex indifference curves, the rates are such that the willingness to forgo money for the good or service decreases as the buyer would have ever more of the good or service and ever less money. Hence, any given buyer has a demand schedule that generally decreases in response to price (at least until quantity demanded reaches zero). The aggregate quantity demanded by all buyers is, at any given price, just the sum of the quantities demanded by individual buyers, so it too decreases as price increases.

Marginalists in the tradition of Marshall

and neoclassical economists tend to represent the supply curve for any producer as a curve of marginal pecuniary costs objectively determined by physical processes, with an upward slope determined by diminishing returns

.

A more thorough-going marginalism represents the supply curve as a complementary demand curve — where the demand is for money and the purchase is made with a good or service. The shape of that curve is then determined by marginal rates of substitution of money for that good or service.

and of various forms of “imperfect” competition

, which models are usually captured by relatively simple graphs. Other marginalists have sought to present more realistic explanations, but this work has been relatively uninfluential on the mainstream of economic thought.

(though recognized by earlier thinkers). Human beings cannot even survive without water, whereas diamonds were in Smith's day mere ornamentation or engraving bits. Yet water had a very small price, and diamonds a very large price, by any normal measure. Marginalists explained that it is the marginal usefulness of any given quantity that matters, rather than the usefulness of a class or of a totality. For most people, water was sufficiently abundant that the loss or gain of a gallon would withdraw or add only some very minor use if any; whereas diamonds were in much more restricted supply, so that the lost or gained use were much greater.

That is not to say that the price of any good or service is simply a function of the marginal utility that it has for any one individual nor for some ostensibly typical individual. Rather, individuals are willing to trade based upon the respective marginal utilities of the goods that they have or desire (with these marginal utilities being distinct for each potential trader), and prices thus develop constrained by these marginal utilities.

's Politics

, whereïn he writes

(There has been markèd disagreement about the development and role of marginal considerations in Aristotle's' value theory.)

A great variety of economists concluded that there was some sort of inter-relationship between utility and rarity that effected economic decisions, and in turn informed the determination of prices.

Eighteenth-century Italian mercantilist

s, such as Antonio Genovesi

, Giammaria Ortes

, Pietro Verri

, Marchese Cesare di Beccaria

, and Count Giovanni Rinaldo Carli

, held that value was explained in terms of the general utility and of scarcity, though they did not typically work-out a theory of how these interacted. In Della moneta (1751), Abbé Ferdinando Galiani

, a pupil of Genovesi, attempted to explain value as a ratio of two ratios, utility and scarcity, with the latter component ratio being the ratio of quantity to use.

Anne Robert Jacques Turgot, in Réflexions sur la formation et la distribution de richesse (1769), held that value derived from the general utility of the class to which a good belonged, from comparison of present and future wants, and from anticipated difficulties in procurement.

Like the Italian mercantists, Étienne Bonnot, Abbé de Condillac

saw value as determined by utility associated with the class to which the good belong, and by estimated scarcity. In De commerce et le gouvernement (1776), Condillac emphasized that value is not based upon cost but that costs were paid because of value.

This last point was famously restated by the Nineteenth Century proto-marginalist, Richard Whately

, who in Introductory Lectures on Political Economy (1832) wrote (Whately's student Senior

is noted below as an early marginalist.)

, in “Specimen theoriae novae de mensura sortis”. This paper appeared in 1738, but a draft had been written in 1731 or in 1732. In 1728, Gabriel Cramer

produced fundamentally the same theory in a private letter. Each had sought to resolve the St. Petersburg paradox

, and had concluded that the marginal desirability of money decreased as it was accumulated, more specifically such that the desirability of a sum were the natural logarithm

(Bernoulli) or square root

(Cramer) thereof. However, the more general implications of this hypothesis were not explicated, and the work fell into obscurity.

In “A Lecture on the Notion of Value as Distinguished Not Only from Utility, but also from Value in Exchange”, delivered in 1833 and included in Lectures on Population, Value, Poor Laws and Rent (1837), William Forster Lloyd

explicitly offered a general marginal utility theory, but did not offer its derivation nor elaborate its implications. The importance of his statement seems to have been lost on everyone (including Lloyd) until the early 20th century, by which time others had independently developed and popularized the same insight.

In An Outline of the Science of Political Economy (1836), Nassau William Senior

asserted that marginal utilities were the ultimate determinant of demand, yet apparently did not pursue implications, though some interpret his work as indeed doing just that.

In “De la mesure de l’utilité des travaux publics” (1844), Jules Dupuit

applied a conception of marginal utility to the problem of determining bridge tolls.

In 1854, Hermann Heinrich Gossen

published Die Entwicklung der Gesetze des menschlichen Verkehrs und der daraus fließenden Regeln für menschliches Handeln, which presented a marginal utility theory and to a very large extent worked-out its implications for the behavior of a market economy. However, Gossen's work was not well received in the Germany of his time, most copies were destroyed unsold, and he was virtually forgotten until rediscovered after the so-called Marginal Revolution.

in England, Menger

in Austria, and Walras

in Switzerland.

William Stanley Jevons

first proposed the theory in “A General Mathematical Theory of Political Economy” (PDF), a little-noticed paper delivered in 1862 and published in 1863. He later presented the theory in The Theory of Political Economy (1871), which was fairly widely read but not much appreciated. Jevons' conception of utility was that in the hedonic

tradition of Jeremy Bentham

and of John Stuart Mill

, and Jevons explained demand but not supply by reference to marginal utility.

Carl Menger

presented the theory in Grundsätze der Volkswirtschaftslehre (translated as Principles of Economics PDF) in 1871. Menger's presentation is peculiarly notable on two points. First, he took special pains to explain why individuals should be expected to rank possible uses and then to use marginal utility to decide amongst trade-offs. (For this reason, Menger and his followers are sometimes called “the Psychological School”, though they are more frequently known as “the Austrian School

” or as “the Vienna School”.) Second, while his illustrative examples present utility as quantified, his essential assumptions do not. Menger's work found a significant and appreciative audience.

Marie-Esprit-Léon Walras

introduced the theory in Éléments d'économie politique pure, the first part of which was published in 1874. Walras's work found relatively few readers.

(An American, John Bates Clark

, is sometimes also mentioned in this context. But, while Clark independently arrived at a marginal utility theory, he did little to advance it until it was clear that the followers of Jevons, Menger, and Walras were revolutionizing economics. Nonetheless, his contributions thereafter were profound.)

, by William Smart

, and by Alfred Marshall

; in Austria by Eugen von Böhm-Bawerk

and by Friedrich von Wieser

; in Switzerland by Vilfredo Pareto

; and in America by Herbert Joseph Davenport and by Frank A. Fetter

.

There were significant, distinguishing features amongst the approaches of Jevons, Menger, and Walras, but the second generation did not maintain distinctions along national or linguistic lines. The work of von Wieser was heavily influenced by that of Walras. Wicksteed was heavily influenced by Menger. Fetter referred to himself and Davenport as part of “the American Psychological School”, named in imitation of the Austrian “Psychological School”. (And Clark's work from this period onward similarly shows heavy influence by Menger.) William Smart began as a conveyor of Austrian School theory to English-language readers, though he fell increasingly under the influence of Marshall.

Böhm-Bawerk was perhaps the most able expositor of Menger's conception. He was further noted for producing a theory of interest and of profit in equilibrium based upon the interaction of diminishing marginal utility with diminishing marginal product

ivity of time and with time preference

. (This theory was adopted in full and then further developed by Knut Wicksell

and, with modifications including formal disregard for time-preference, by Wicksell's American rival Irving Fisher

.)

Marshall was the second-generation marginalist whose work on marginal utility came most to inform the mainstream of neoclassical economics, especially by way of his Principles of Economics, the first volume of which was published in 1890. Marshall constructed the demand curve with the aid of assumptions that utility was quantified, and that the marginal utility of money was constant (or nearly so). Like Jevons, Marshall did not see an explanation for supply in the theory of marginal utility, so he synthesized an explanation of demand thus explained with supply explained in a more classical

manner, determined by costs which were taken to be objectively determined. (Marshall later actively mischaracterized the criticism that these costs were themselves ultimately determined by marginal utilities.)

. In fact, the first volume of Das Kapital

was not published until July 1867, after the works of Jevons, Menger, and Walras were written or well under way; and Marx

was still a relatively obscure figure when these works were completed. (On the other hand, Hayek

or Bartley

has suggested that Marx may have come across the works of one or more of these figures, and that his inability to formulate a viable critique may account for his failure to complete any further volumes of Kapital.)

Nonetheless, it is not unreasonable to suggest that part of what contributed to the success of the generation who followed the preceptors of the Revolution was their ability to formulate straight-forward responses to Marxist economic theory. The most famous of these was that of Böhm-Bawerk, “Zum Abschluss des Marxschen Systems” (1896), but the first was Wicksteed's “The Marxian Theory of Value. Das Kapital: a criticism” (1884, followed by “The Jevonian criticism of Marx: a rejoinder” in 1885). The most famous early Marxist responses were Rudolf Hilferding

's Böhm-Bawerks Marx-Kritik (1904) and Политической экономии рантье (The Economic Theory of the Leisure Class, 1914) by Никола́й Ива́нович Буха́рин (Nikolai Bukharin)

.

(It might also be noted that some followers of Henry George

similarly consider marginalism and neoclassical economics a reaction to Progress and Poverty

, which was published in 1879.)

presented the indifference curve

, deriving its properties from marginalist theory which assumed utility to be a differentiable function of quantified goods and services. But it came to be seen that indifference curves could be considered as somehow given, without bothering with notions of utility.

In 1915, Евгений Евгениевич Слуцкий (Eugen Slutsky)

derived a theory of consumer choice solely from properties of indifference curves. Because of the World War

, the Bolshevik Revolution

, and his own subsequent loss of interest, Slutsky's work drew almost no notice, but similar work in 1934 by John Richard Hicks

and R. G. D. Allen

derived much the same results and found a significant audience. (Allen subsequently drew attention to Slutksy's earlier accomplishment.)

Although some of the third generation of Austrian School economists had by 1911 rejected the quantification of utility while continuing to think in terms of marginal utility, most economists presumed that utility must be a sort of quantity. Indifference curve analysis seemed to represent a way of dispensing with presumptions of quantification, albeït that a seemingly arbitrary assumption (admitted by Hicks to be a “rabbit out of a hat”) about decreasing marginal rates of substitution would then have to be introduced to have convexity of indifference curves.

For those who accepted that superseded marginal utility analysis had been superseded by indifference curve analysis, the former became at best somewhat analogous to the Bohr model of the atom

— perhaps pedagogically useful, but “old fashioned” and ultimately incorrect.

, rather than the paradox of value

. The marginalists of the revolution, however, had been formally concerned with problems in which there was neither risk

nor uncertainty

. So too with the indifference curve analysis of Slutsky, Hicks, and Allen.

The expected utility hypothesis

of Bernoulli et alii was revived by various 20th century thinkers, perhaps most notably Ramsey

(1926), v. Neumann

and Morgenstern

(1944), and Savage

(1954). Although this hypothesis remains controversial, it brings not merely utility but a quantified conception thereof back into the mainstream of economic thought, and would dispatch the Ockhamistic argument

. (It should perhaps be noted that, in expected utility analysis, the “law” of diminishing marginal utility corresponds to what is called “risk aversion

”.)

Meanwhile, the Austrian School continues to develop its ordinalist notions of marginal utility analysis, formally demonstrating that from them proceed the decreasing marginal rates of substitution of indifference curves.

died before marginalism became the interpretation of economic value accepted by mainstream economics. His theory was based on the labor theory of value

, which distinguishes between exchange value

and use value

. In his Capital he rejected the explanation of long-term market values by supply and demand:

In his early response to marginalism, Nikolai Bukharin

argued that "the subjective evaluation from which price is to be derived really starts from this price", concluding:

Similarly a later Marxist critic, Ernest Mandel

, argued that marginalism was "divorced from reality", ignored the role of production, and that:

Maurice Dobb

argued that prices derived through marginalism depend on the distribution of income. The ability of consumers to express their preferences is dependent on their spending power. As the theory asserts that prices arise in the act of exchange, Dobb argues that it cannot explain how the distribution of income affects prices and consequently cannot explain prices.

Dobb also criticized the motives behind marginal utility theory. Jevons wrote, for example, "so far as is consistent with the inequality of wealth in every community, all commodities are distributed by exchange so as to produce the maximum social benefit." (See Fundamental theorems of welfare economics

.) Dobb contended that this statement indicated that marginalism is intended to insulate market economics from criticism by making prices the natural result of the given income distribution.

, Włodzimierz Brus, and Michal Kalecki

have attempted to integrate the insights of classical political economy

, marginalism, and neoclassical economics

. They believed that Marx lacked a sophisticated theory of prices, and neoclassical economics lacked a theory of the social frameworks of economic activity. Some other Marxists have also argued that on one level there is no conflict between marginalism and Marxism: one could employ a marginalist theory of supply and demand within the context of a “big picture” understanding of the Marxist notion that capitalists exploit labor.

Marginal concepts

In economics, marginal concepts are associated with a specific change in the quantity used of a good or service, as opposed to some notion of the over-all significance of that class of good or service, or of some total quantity thereof.- Marginality :...

in economic

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

theory. Marginalism is associated with arguments concerning changes in the quantity used of a good or service, as opposed to some notion of the over-all significance of that class of good or service, or of some total quantity thereof.

The central concept of marginalism proper is that of marginal utility

Marginal utility

In economics, the marginal utility of a good or service is the utility gained from an increase in the consumption of that good or service...

, but marginalists following the lead of Alfred Marshall

Alfred Marshall

Alfred Marshall was an Englishman and one of the most influential economists of his time. His book, Principles of Economics , was the dominant economic textbook in England for many years...

were further heavily dependent upon the concept of marginal physical productivity

Marginal product

In economics and in particular neoclassical economics, the marginal product or marginal physical product of an input is the extra output that can be produced by using one more unit of the input , assuming that the quantities of no other inputs to production...

in their explanation of cost

Cost

In production, research, retail, and accounting, a cost is the value of money that has been used up to produce something, and hence is not available for use anymore. In business, the cost may be one of acquisition, in which case the amount of money expended to acquire it is counted as cost. In this...

; and the neoclassical

Neoclassical economics

Neoclassical economics is a term variously used for approaches to economics focusing on the determination of prices, outputs, and income distributions in markets through supply and demand, often mediated through a hypothesized maximization of utility by income-constrained individuals and of profits...

tradition that emerged from British

United Kingdom of Great Britain and Ireland

The United Kingdom of Great Britain and Ireland was the formal name of the United Kingdom during the period when what is now the Republic of Ireland formed a part of it....

marginalism generally abandoned the concept of utility

Utility

In economics, utility is a measure of customer satisfaction, referring to the total satisfaction received by a consumer from consuming a good or service....

and gave marginal rates of substitution

Marginal rate of substitution

In economics, the marginal rate of substitution is the rate at which a consumer is ready to give up one good in exchange for another good while maintaining the same level of utility.-Marginal rate of substitution as the slope of indifference curve:...

a more fundamental role in analysis.

Marginalism is now an integral part of mainstream economic

Mainstream economics

Mainstream economics is a loose term used to refer to widely-accepted economics as taught in prominent universities and in contrast to heterodox economics...

theory.

Marginality

Constraints are conceptualized as a border or margin. The location of the margin for any individual corresponds to his or her endowment, broadly conceived to include opportunities. This endowment is determined by many things including physical laws (which constrain how forms of energy and matter may be transformed), accidents of nature (which determine the presence of natural resources), and the outcomes of past decisions made both by others and by the individual.A value that holds true given particular constraints is a marginal value

Marginal value

A marginal value is#a value that holds true given particular constraints,#the change in a value associated with a specific change in some independent variable, whether it be of that variable or of a dependent variable, or...

. A change that would be affected as or by a specific loosening or tightening of those constraints is a marginal change.

Neoclassical economics usually assumes that marginal changes are infinitesimal

Infinitesimal

Infinitesimals have been used to express the idea of objects so small that there is no way to see them or to measure them. The word infinitesimal comes from a 17th century Modern Latin coinage infinitesimus, which originally referred to the "infinite-th" item in a series.In common speech, an...

s or limit

Limit (mathematics)

In mathematics, the concept of a "limit" is used to describe the value that a function or sequence "approaches" as the input or index approaches some value. The concept of limit allows mathematicians to define a new point from a Cauchy sequence of previously defined points within a complete metric...

s. (Though this assumption makes the analysis less robust, it increases tractability.) One is therefore often told that “marginal” is synonymous with “very small”, though in more general analysis this may not be operationally true (and would not in any case be literally true). Frequently, economic analysis concerns the marginal values associated with a change of one unit of a resource, because decisions are often made in terms of units; marginalism seeks to explain unit prices in terms of such marginal values.

Marginal use

The marginal use of a good or service is the specific use to which an agent would put a given increase, or the specific use of the good or service that would be abandoned in response to a given decrease.Marginalism assumes, for any given agent, economic rationality

Rational choice theory

Rational choice theory, also known as choice theory or rational action theory, is a framework for understanding and often formally modeling social and economic behavior. It is the main theoretical paradigm in the currently-dominant school of microeconomics...

and an ordering

Order theory

Order theory is a branch of mathematics which investigates our intuitive notion of order using binary relations. It provides a formal framework for describing statements such as "this is less than that" or "this precedes that". This article introduces the field and gives some basic definitions...

of possible states-of-the-world, such that, for any given set of constraints, there is an attainable state which is best in the eyes of that agent. Descriptive

Positive science

In the humanities and social sciences, the term positive is used in at least two ways.The most common usage refers to analysis or theories which only attempt to describe how things 'are', as opposed to how they 'should' be. Positive means also 'value free'. In this sense, the opposite of positive...

marginalism asserts that choice amongst the specific means by which various anticipated specific states-of-the-world (outcomes) might be affected is governed only by the distinctions amongst those specific outcomes; prescriptive

Normative economics

Normative economics is that part of economics that expresses value judgments about economic fairness or what the economy ought to be like or what goals of public policy ought to be....

marginalism asserts that such choice ought to be so governed.

On such assumptions, each increase would be put to the specific, feasible, previously unrealized use of greatest priority, and each decrease would result in abandonment of the use of lowest priority amongst the uses to which the good or service had been put.

Marginal utility

The marginal utility of a good or service is the utility of its marginal useMarginal use

As defined by the Austrian School of economics the marginal use of a good or service is the specific use to which an agent would put a given increase, or the specific use of the good or service that would be abandoned in response to a given decrease...

. Under the assumption of economic rationality, it is the utility of its least urgent possible use from the best feasible combination of actions in which its use is included.

In 20th century mainstream economics

Mainstream economics

Mainstream economics is a loose term used to refer to widely-accepted economics as taught in prominent universities and in contrast to heterodox economics...

, the term “utility

Utility

In economics, utility is a measure of customer satisfaction, referring to the total satisfaction received by a consumer from consuming a good or service....

” has come to be formally defined as a quantification

Measure (mathematics)

In mathematical analysis, a measure on a set is a systematic way to assign to each suitable subset a number, intuitively interpreted as the size of the subset. In this sense, a measure is a generalization of the concepts of length, area, and volume...

capturing preferences by assigning greater quantities to states, goods, services, or applications that are of higher priority. But marginalism and the concept of marginal utility predate the establishment of this convention within economics. The more general conception of utility is that of use or usefulness, and this conception is at the heart of marginalism; the term “marginal utility” arose from translation of the German “Grenznutzen”, which literally means border use, referring directly to the marginal use, and the more general formulations of marginal utility do not treat quantification as an essential feature. On the other hand, none of the early marginalists insisted that utility were not quantified, some indeed treated quantification as an essential feature, and those who did not still used an assumption of quantification for expository purposes. In this context, it is not surprising to find many presentations that fail to recognize a more general approach.

Quantified marginal utility

Under the special caseSpecial case

In logic, especially as applied in mathematics, concept A is a special case or specialization of concept B precisely if every instance of A is also an instance of B, or equivalently, B is a generalization of A. For example, all circles are ellipses ; therefore the circle is a special case of the...

in which usefulness can be quantified, the change in utility of moving from state

to state

to state  is

is

Moreover, if

and

and  are distinguishable by values of just one variable

are distinguishable by values of just one variable  which is itself quantified, then it becomes possible to speak of the ratio of the marginal utility of the change in

which is itself quantified, then it becomes possible to speak of the ratio of the marginal utility of the change in  to the size of that change:

to the size of that change:

(where “c.p.

Ceteris paribus

or is a Latin phrase, literally translated as "with other things the same," or "all other things being equal or held constant." It is an example of an ablative absolute and is commonly rendered in English as "all other things being equal." A prediction, or a statement about causal or logical...

” indicates that the only independent variable

Dependent and independent variables

The terms "dependent variable" and "independent variable" are used in similar but subtly different ways in mathematics and statistics as part of the standard terminology in those subjects...

to change is

).

).Mainstream neoclassical economics will typically assume that

is well defined, and use “marginal utility” to refer to a partial derivative

Partial derivative

In mathematics, a partial derivative of a function of several variables is its derivative with respect to one of those variables, with the others held constant...

The “law” of diminishing marginal utility

The “law” of diminishing marginal utility (also known as a “GossenHermann Heinrich Gossen

Hermann Heinrich Gossen was a Prussian economist who is often regarded as the first to elaborate a general theory of marginal utility.-Life and work:...

's First Law”) is that, ceteris paribus

Ceteris paribus

or is a Latin phrase, literally translated as "with other things the same," or "all other things being equal or held constant." It is an example of an ablative absolute and is commonly rendered in English as "all other things being equal." A prediction, or a statement about causal or logical...

, as additional amounts of a good or service are added to available resources, their marginal utilities are decreasing. This “law” is sometimes treated as a tautology

Tautology (logic)

In logic, a tautology is a formula which is true in every possible interpretation. Philosopher Ludwig Wittgenstein first applied the term to redundancies of propositional logic in 1921; it had been used earlier to refer to rhetorical tautologies, and continues to be used in that alternate sense...

, sometimes as something proven by introspection, or sometimes as a mere instrumental

Instrumentalism

In the philosophy of science, instrumentalism is the view that a scientific theory is a useful instrument in understanding the world. A concept or theory should be evaluated by how effectively it explains and predicts phenomena, as opposed to how accurately it describes objective...

assumption, adopted only for its perceived predictive efficacy. Actually, it is not quite any of these things, though it may have aspects of each. The “law” does not hold under all circumstances, so it is neither a tautology nor otherwise proveable; but it has a basis in prior observation.

An individual will typically be able to partially order

Partially ordered set

In mathematics, especially order theory, a partially ordered set formalizes and generalizes the intuitive concept of an ordering, sequencing, or arrangement of the elements of a set. A poset consists of a set together with a binary relation that indicates that, for certain pairs of elements in the...

the potential uses of a good or service. If there is scarcity

Scarcity

Scarcity is the fundamental economic problem of having humans who have unlimited wants and needs in a world of limited resources. It states that society has insufficient productive resources to fulfill all human wants and needs. Alternatively, scarcity implies that not all of society's goals can be...

, then a rational agent will satisfy wants of highest possible priority, so that no want is avoidably sacrificed to satisfy a want of lower priority. In the absence of complementarity across the uses, this will imply that the priority of use of any additional amount will be lower than the priority of the established uses, as in this famous example:

- A pioneer farmer had five sacks of grain, with no way of selling them or buying more. He had five possible uses: as basic feed for himself, food to build strength, food for his chickens for dietary variation, an ingredient for making whisky and feed for his parrots to amuse him. Then the farmer lost one sack of grain. Instead of reducing every activity by a fifth, the farmer simply starved the parrots as they were of less utility than the other four uses; in other words they were on the margin. And it is on the margin, and not with a view to the big picture, that we make economic decisions.

Tipping point

In sociology, a tipping point is the event of a previously rare phenomenon becoming rapidly and dramatically more common. The phrase was coined in its sociological use by Morton Grodzins, by analogy with the fact in physics that adding a small amount of weight to a balanced object can cause it to...

, or an amount subtracted cause them to fall short. In such cases, the marginal utility of a good or service might actually be increasing.

Without the presumption that utility is quantified, the diminishing of utility should not be taken to be itself an arithmetic

Elementary arithmetic

Elementary arithmetic is the simplified portion of arithmetic which is considered necessary and appropriate during primary education. It includes the operations of addition, subtraction, multiplication, and division. It is taught in elementary school....

subtraction

Subtraction

In arithmetic, subtraction is one of the four basic binary operations; it is the inverse of addition, meaning that if we start with any number and add any number and then subtract the same number we added, we return to the number we started with...

. It is the movement from use of higher to lower priority, and may be no more than a purely ordinal

Ranking

A ranking is a relationship between a set of items such that, for any two items, the first is either 'ranked higher than', 'ranked lower than' or 'ranked equal to' the second....

change.

When quantification of utility is assumed, diminishing marginal utility corresponds to a utility function whose slope

Slope

In mathematics, the slope or gradient of a line describes its steepness, incline, or grade. A higher slope value indicates a steeper incline....

is continually or continuously decreasing. In the latter case, if the function is also smooth, then the “law” may be expressed

Neoclassical economics usually supplements or supplants discussion of marginal utility with indifference curve

Indifference curve

In microeconomic theory, an indifference curve is a graph showing different bundles of goods between which a consumer is indifferent. That is, at each point on the curve, the consumer has no preference for one bundle over another. One can equivalently refer to each point on the indifference curve...

s, which were originally derived as the level curves of utility functions, or can be produced without presumption of quantification, but are often simply treated as axiomatic. In the absence of complementarity of goods or services, diminishing marginal utility implies convex

Convex function

In mathematics, a real-valued function f defined on an interval is called convex if the graph of the function lies below the line segment joining any two points of the graph. Equivalently, a function is convex if its epigraph is a convex set...

ity of indifference curves (though such convexity would also follow from quasiconcavity of the utility function).

Marginal rate of substitution

The rate of substitution is the least favorable rate at which an agent is willing to exchange units of one good or service for units of another. The marginal rate of substitution (“MRS”) is the rate of substitution at the margin — in other words, given some constraint(s).When goods and services are discrete

Discrete mathematics

Discrete mathematics is the study of mathematical structures that are fundamentally discrete rather than continuous. In contrast to real numbers that have the property of varying "smoothly", the objects studied in discrete mathematics – such as integers, graphs, and statements in logic – do not...

, the least favorable rate at which an agent would trade A for B will usually be different from that at which she would trade B for A:

But, when the goods and services are continuously divisible, in the limiting case

and the marginal rate of substitution is the slope of the indifference curve

Indifference curve

In microeconomic theory, an indifference curve is a graph showing different bundles of goods between which a consumer is indifferent. That is, at each point on the curve, the consumer has no preference for one bundle over another. One can equivalently refer to each point on the indifference curve...

(multiplied by

).

).If, for example, Lisa will not trade a goat for anything less than two sheep, then her

And if she will not trade a sheep for anything less than two goats, then her

But if she would trade one gram of banana for one ounce of ice cream and vice versa, then

When indifference curves (which are essentially graphs of instantaneous rates of substitution) and the convexity of those curves are not taken as given, the “law” of diminishing marginal utility is invoked to explain diminishing marginal rates of substitution — a willingness to accept fewer units of good or service

in substitution for

in substitution for  as one's holdings of

as one's holdings of  grow relative to those of

grow relative to those of  . If an individual has a stock or flow of a good or service whose marginal utility is less than would be that of some other good or service for which he or she could trade, then it is in his or her interest to effect that trade. Of course, as one thing is traded-away and another is acquired, the respective marginal gains or losses from further trades are now changed. On the assumption that the marginal utility of one is diminishing, and the other is not increasing, all else being equal, an individual will demand an increasing ratio of that which is acquired to that which is sacrificed. (One important way in which all else might not be equal is when the use of the one good or service complements that of the other. In such cases, exchange ratios might be constant.) If any trader can better his or her own marginal position by offering an exchange more favorable to other traders with desired goods or services, then he or she will do so.

. If an individual has a stock or flow of a good or service whose marginal utility is less than would be that of some other good or service for which he or she could trade, then it is in his or her interest to effect that trade. Of course, as one thing is traded-away and another is acquired, the respective marginal gains or losses from further trades are now changed. On the assumption that the marginal utility of one is diminishing, and the other is not increasing, all else being equal, an individual will demand an increasing ratio of that which is acquired to that which is sacrificed. (One important way in which all else might not be equal is when the use of the one good or service complements that of the other. In such cases, exchange ratios might be constant.) If any trader can better his or her own marginal position by offering an exchange more favorable to other traders with desired goods or services, then he or she will do so.Marginal cost

At the highest level of generality, a marginal cost is a marginal opportunity costOpportunity cost

Opportunity cost is the cost of any activity measured in terms of the value of the best alternative that is not chosen . It is the sacrifice related to the second best choice available to someone, or group, who has picked among several mutually exclusive choices. The opportunity cost is also the...

. In most contexts, however, “marginal cost” will refer to marginal pecuniary

Money

Money is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally in the past,...

cost — that is to say marginal cost measured by forgone money.

A thorough-going marginalism sees marginal cost as increasing under the “law” of diminishing marginal utility, because applying resources to one application reduces their availability to other applications. Neoclassical economics tends to disregard this argument, but to see marginal costs as increasing in consequence of diminishing returns

Diminishing returns

In economics, diminishing returns is the decrease in the marginal output of a production process as the amount of a single factor of production is increased, while the amounts of all other factors of production stay constant.The law of diminishing returns In economics, diminishing returns (also...

.

Application to price theory

Marginalism and neoclassical economics typically explain price formation broadly through the interaction of curves or schedules of supply and demandSupply and demand

Supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

. In any case buyers are modelled as pursuing typically lower quantities, and sellers offering typically higher quantities, as price is increased, with each being willing to trade until the marginal value of what they would trade-away exceeds that of the thing for which they would trade.

Demand

Demand curves are explained by marginalism in terms of marginal rates of substitution.At any given price, a prospective buyer has some marginal rate of substitution of money for the good or service in question. Given the “law” of diminishing marginal utility, or otherwise given convex indifference curves, the rates are such that the willingness to forgo money for the good or service decreases as the buyer would have ever more of the good or service and ever less money. Hence, any given buyer has a demand schedule that generally decreases in response to price (at least until quantity demanded reaches zero). The aggregate quantity demanded by all buyers is, at any given price, just the sum of the quantities demanded by individual buyers, so it too decreases as price increases.

Supply

Both neoclassical economics and thorough-going marginalism could be said to explain supply curves in terms of marginal cost; however, there are markèd differences in conceptions of that cost.Marginalists in the tradition of Marshall

Alfred Marshall

Alfred Marshall was an Englishman and one of the most influential economists of his time. His book, Principles of Economics , was the dominant economic textbook in England for many years...

and neoclassical economists tend to represent the supply curve for any producer as a curve of marginal pecuniary costs objectively determined by physical processes, with an upward slope determined by diminishing returns

Diminishing returns

In economics, diminishing returns is the decrease in the marginal output of a production process as the amount of a single factor of production is increased, while the amounts of all other factors of production stay constant.The law of diminishing returns In economics, diminishing returns (also...

.

A more thorough-going marginalism represents the supply curve as a complementary demand curve — where the demand is for money and the purchase is made with a good or service. The shape of that curve is then determined by marginal rates of substitution of money for that good or service.

Markets

By confining themselves to limiting cases in which sellers or buyers are both “price takers” — so that demand functions ignore supply functions or vice versa — Marshallian marginalists and neoclassical economists produced tractable models of “pure” or “perfect” competitionPerfect competition

In economic theory, perfect competition describes markets such that no participants are large enough to have the market power to set the price of a homogeneous product. Because the conditions for perfect competition are strict, there are few if any perfectly competitive markets...

and of various forms of “imperfect” competition

Imperfect competition

In economic theory, imperfect competition is the competitive situation in any market where the conditions necessary for perfect competition are not satisfied...

, which models are usually captured by relatively simple graphs. Other marginalists have sought to present more realistic explanations, but this work has been relatively uninfluential on the mainstream of economic thought.

The paradox of water and diamonds

The “law” of diminishing marginal utility is said to explain the “paradox of water and diamonds”, most commonly associated with Adam SmithAdam Smith

Adam Smith was a Scottish social philosopher and a pioneer of political economy. One of the key figures of the Scottish Enlightenment, Smith is the author of The Theory of Moral Sentiments and An Inquiry into the Nature and Causes of the Wealth of Nations...

(though recognized by earlier thinkers). Human beings cannot even survive without water, whereas diamonds were in Smith's day mere ornamentation or engraving bits. Yet water had a very small price, and diamonds a very large price, by any normal measure. Marginalists explained that it is the marginal usefulness of any given quantity that matters, rather than the usefulness of a class or of a totality. For most people, water was sufficiently abundant that the loss or gain of a gallon would withdraw or add only some very minor use if any; whereas diamonds were in much more restricted supply, so that the lost or gained use were much greater.

That is not to say that the price of any good or service is simply a function of the marginal utility that it has for any one individual nor for some ostensibly typical individual. Rather, individuals are willing to trade based upon the respective marginal utilities of the goods that they have or desire (with these marginal utilities being distinct for each potential trader), and prices thus develop constrained by these marginal utilities.

Proto-marginalist approaches

Perhaps the essence of a notion of diminishing marginal utility can be found in AristotleAristotle

Aristotle was a Greek philosopher and polymath, a student of Plato and teacher of Alexander the Great. His writings cover many subjects, including physics, metaphysics, poetry, theater, music, logic, rhetoric, linguistics, politics, government, ethics, biology, and zoology...

's Politics

Politics (Aristotle)

Aristotle's Politics is a work of political philosophy. The end of the Nicomachean Ethics declared that the inquiry into ethics necessarily follows into politics, and the two works are frequently considered to be parts of a larger treatise, or perhaps connected lectures, dealing with the...

, whereïn he writes

(There has been markèd disagreement about the development and role of marginal considerations in Aristotle's' value theory.)

A great variety of economists concluded that there was some sort of inter-relationship between utility and rarity that effected economic decisions, and in turn informed the determination of prices.

Eighteenth-century Italian mercantilist

Mercantilism

Mercantilism is the economic doctrine in which government control of foreign trade is of paramount importance for ensuring the prosperity and security of the state. In particular, it demands a positive balance of trade. Mercantilism dominated Western European economic policy and discourse from...

s, such as Antonio Genovesi

Antonio Genovesi

Antonio Genovesi was an Italian writer on philosophy and political economy.-Biography:Genovesi was born at Castiglione, near Salerno....

, Giammaria Ortes

Giammaria Ortes

Abbé Giovanni Maria Ortes was a Venetian composer, economist, mathematician, Camaldolese monk, and philosopher.- Works :* Della economia nazionale * Sulla religione e sul governo dei popoli...

, Pietro Verri

Pietro Verri

Pietro Verri was an Italian philosopher, economist, historian and writer.-Biography:Born in Milan, then under Austrian rule, to a conservative noble family, he received a strongly religious education, from which he began to rebel when he reached his twenties...

, Marchese Cesare di Beccaria

Cesare, Marquis of Beccaria

Cesare, Marquis of Beccaria-Bonesana was an Italian jurist, philosopher and politician best known for his treatise On Crimes and Punishments , which condemned torture and the death penalty, and was a founding work in the field of penology.-Birth and education:Beccaria was born in Milan on March...

, and Count Giovanni Rinaldo Carli

Giovanni Rinaldo

Giovanni Rinaldo, Count of Carli-Rubbi was an Italian economist and antiquarian.- Biography :Rinaldo was born at Capo d'Istria, then part of the Republic of Venice....

, held that value was explained in terms of the general utility and of scarcity, though they did not typically work-out a theory of how these interacted. In Della moneta (1751), Abbé Ferdinando Galiani

Ferdinando Galiani

Ferdinando Galiani was an Italian economist, a leading Italian figure of the Enlightenment. Friedrich Nietzsche called him the "most fastidious and refined intelligence" of the 18th century....

, a pupil of Genovesi, attempted to explain value as a ratio of two ratios, utility and scarcity, with the latter component ratio being the ratio of quantity to use.

Anne Robert Jacques Turgot, in Réflexions sur la formation et la distribution de richesse (1769), held that value derived from the general utility of the class to which a good belonged, from comparison of present and future wants, and from anticipated difficulties in procurement.

Like the Italian mercantists, Étienne Bonnot, Abbé de Condillac

Étienne Bonnot de Condillac

Étienne Bonnot de Condillac was a French philosopher and epistemologist who studied in such areas as psychology and the philosophy of the mind.-Biography:...

saw value as determined by utility associated with the class to which the good belong, and by estimated scarcity. In De commerce et le gouvernement (1776), Condillac emphasized that value is not based upon cost but that costs were paid because of value.

This last point was famously restated by the Nineteenth Century proto-marginalist, Richard Whately

Richard Whately

Richard Whately was an English rhetorician, logician, economist, and theologian who also served as the Church of Ireland Archbishop of Dublin.-Life and times:...

, who in Introductory Lectures on Political Economy (1832) wrote (Whately's student Senior

Nassau William Senior

Nassau William Senior , English economist, was born at Compton, Berkshire, the eldest son of the Rev. JR Senior, vicar of Durnford, Wiltshire.-Biography:...

is noted below as an early marginalist.)

Marginalists before the Revolution

The first unambiguous published statement of any sort of theory of marginal utility was by Daniel BernoulliDaniel Bernoulli

Daniel Bernoulli was a Dutch-Swiss mathematician and was one of the many prominent mathematicians in the Bernoulli family. He is particularly remembered for his applications of mathematics to mechanics, especially fluid mechanics, and for his pioneering work in probability and statistics...

, in “Specimen theoriae novae de mensura sortis”. This paper appeared in 1738, but a draft had been written in 1731 or in 1732. In 1728, Gabriel Cramer

Gabriel Cramer

Gabriel Cramer was a Swiss mathematician, born in Geneva. He showed promise in mathematics from an early age. At 18 he received his doctorate and at 20 he was co-chair of mathematics.In 1728 he proposed a solution to the St...

produced fundamentally the same theory in a private letter. Each had sought to resolve the St. Petersburg paradox

St. Petersburg paradox

In economics, the St. Petersburg paradox is a paradox related to probability theory and decision theory. It is based on a particular lottery game that leads to a random variable with infinite expected value, i.e., infinite expected payoff, but would nevertheless be considered to be worth only a...

, and had concluded that the marginal desirability of money decreased as it was accumulated, more specifically such that the desirability of a sum were the natural logarithm

Natural logarithm

The natural logarithm is the logarithm to the base e, where e is an irrational and transcendental constant approximately equal to 2.718281828...

(Bernoulli) or square root

Square root

In mathematics, a square root of a number x is a number r such that r2 = x, or, in other words, a number r whose square is x...

(Cramer) thereof. However, the more general implications of this hypothesis were not explicated, and the work fell into obscurity.

In “A Lecture on the Notion of Value as Distinguished Not Only from Utility, but also from Value in Exchange”, delivered in 1833 and included in Lectures on Population, Value, Poor Laws and Rent (1837), William Forster Lloyd

William Forster Lloyd

William Forster Lloyd FRS was a British writer on economics.He was educated at Westminster School and Christ Church, Oxford, graduating BA in 1815 and MA in 1818....

explicitly offered a general marginal utility theory, but did not offer its derivation nor elaborate its implications. The importance of his statement seems to have been lost on everyone (including Lloyd) until the early 20th century, by which time others had independently developed and popularized the same insight.

In An Outline of the Science of Political Economy (1836), Nassau William Senior

Nassau William Senior

Nassau William Senior , English economist, was born at Compton, Berkshire, the eldest son of the Rev. JR Senior, vicar of Durnford, Wiltshire.-Biography:...

asserted that marginal utilities were the ultimate determinant of demand, yet apparently did not pursue implications, though some interpret his work as indeed doing just that.

In “De la mesure de l’utilité des travaux publics” (1844), Jules Dupuit

Jules Dupuit

Jules Dupuit was an Italian-born French civil engineer and economist.He was born in Fossano, Italy then under the rule of Napoleon Bonaparte. At the age of ten he emigrated to France with his family where he studied in Versailles — winning a Physics prize at graduation. He then studied in the...

applied a conception of marginal utility to the problem of determining bridge tolls.

In 1854, Hermann Heinrich Gossen

Hermann Heinrich Gossen

Hermann Heinrich Gossen was a Prussian economist who is often regarded as the first to elaborate a general theory of marginal utility.-Life and work:...

published Die Entwicklung der Gesetze des menschlichen Verkehrs und der daraus fließenden Regeln für menschliches Handeln, which presented a marginal utility theory and to a very large extent worked-out its implications for the behavior of a market economy. However, Gossen's work was not well received in the Germany of his time, most copies were destroyed unsold, and he was virtually forgotten until rediscovered after the so-called Marginal Revolution.

The Marginal Revolution

Marginalism eventually found a foot-hold by way of the work of three economists, JevonsWilliam Stanley Jevons

William Stanley Jevons was a British economist and logician.Irving Fisher described his book The Theory of Political Economy as beginning the mathematical method in economics. It made the case that economics as a science concerned with quantities is necessarily mathematical...

in England, Menger

Carl Menger

Carl Menger was the founder of the Austrian School of economics, famous for contributing to the development of the theory of marginal utility, which contested the cost-of-production theories of value, developed by the classical economists such as Adam Smith and David Ricardo.- Biography :Menger...

in Austria, and Walras

Léon Walras

Marie-Esprit-Léon Walras was a French mathematical economist associated with the creation of the general equilibrium theory.-Life and career:...

in Switzerland.

William Stanley Jevons

William Stanley Jevons

William Stanley Jevons was a British economist and logician.Irving Fisher described his book The Theory of Political Economy as beginning the mathematical method in economics. It made the case that economics as a science concerned with quantities is necessarily mathematical...

first proposed the theory in “A General Mathematical Theory of Political Economy” (PDF), a little-noticed paper delivered in 1862 and published in 1863. He later presented the theory in The Theory of Political Economy (1871), which was fairly widely read but not much appreciated. Jevons' conception of utility was that in the hedonic

Utilitarianism

Utilitarianism is an ethical theory holding that the proper course of action is the one that maximizes the overall "happiness", by whatever means necessary. It is thus a form of consequentialism, meaning that the moral worth of an action is determined only by its resulting outcome, and that one can...

tradition of Jeremy Bentham

Jeremy Bentham

Jeremy Bentham was an English jurist, philosopher, and legal and social reformer. He became a leading theorist in Anglo-American philosophy of law, and a political radical whose ideas influenced the development of welfarism...

and of John Stuart Mill

John Stuart Mill

John Stuart Mill was a British philosopher, economist and civil servant. An influential contributor to social theory, political theory, and political economy, his conception of liberty justified the freedom of the individual in opposition to unlimited state control. He was a proponent of...

, and Jevons explained demand but not supply by reference to marginal utility.

Carl Menger

Carl Menger

Carl Menger was the founder of the Austrian School of economics, famous for contributing to the development of the theory of marginal utility, which contested the cost-of-production theories of value, developed by the classical economists such as Adam Smith and David Ricardo.- Biography :Menger...

presented the theory in Grundsätze der Volkswirtschaftslehre (translated as Principles of Economics PDF) in 1871. Menger's presentation is peculiarly notable on two points. First, he took special pains to explain why individuals should be expected to rank possible uses and then to use marginal utility to decide amongst trade-offs. (For this reason, Menger and his followers are sometimes called “the Psychological School”, though they are more frequently known as “the Austrian School

Austrian School

The Austrian School of economics is a heterodox school of economic thought. It advocates methodological individualism in interpreting economic developments , the theory that money is non-neutral, the theory that the capital structure of economies consists of heterogeneous goods that have...

” or as “the Vienna School”.) Second, while his illustrative examples present utility as quantified, his essential assumptions do not. Menger's work found a significant and appreciative audience.

Marie-Esprit-Léon Walras

Léon Walras

Marie-Esprit-Léon Walras was a French mathematical economist associated with the creation of the general equilibrium theory.-Life and career:...

introduced the theory in Éléments d'économie politique pure, the first part of which was published in 1874. Walras's work found relatively few readers.

(An American, John Bates Clark

John Bates Clark

John Bates Clark was an American neoclassical economist. He was one of the pioneers of the marginalist revolution and opponent to the Institutionalist school of economics, and spent most of his career teaching at Columbia University.-Biography:Clark was born and raised in Providence, Rhode...

, is sometimes also mentioned in this context. But, while Clark independently arrived at a marginal utility theory, he did little to advance it until it was clear that the followers of Jevons, Menger, and Walras were revolutionizing economics. Nonetheless, his contributions thereafter were profound.)

The second generation

Although the Marginal Revolution flowed from the work of Jevons, Menger, and Walras, their work might have failed to enter the mainstream were it not for a second generation of economists. In England, the second generation were exemplified by Philip Henry WicksteedPhilip Wicksteed

Philip Henry Wicksteed is known primarily as an economist. He was also an English Unitarian theologian , classicist, medievalist, and literary critic....

, by William Smart

William Smart

William Smart was a British economist. Originally a conveyor of the thought of the Austrian School, Smart was increasingly won-over to the neoclassicalism of Alfred Marshall....

, and by Alfred Marshall

Alfred Marshall

Alfred Marshall was an Englishman and one of the most influential economists of his time. His book, Principles of Economics , was the dominant economic textbook in England for many years...

; in Austria by Eugen von Böhm-Bawerk

Eugen von Böhm-Bawerk

Eugen Ritter von Böhm-Bawerk was an Austrian economist who made important contributions to the development of the Austrian School of economics.-Biography:...

and by Friedrich von Wieser

Friedrich von Wieser

Friedrich Freiherr von Wieser was an early member of the Austrian School of economics. Born in Vienna, the son of Privy Councillor Leopold von Wieser, a high official in the war ministry he first trained in sociology and law...

; in Switzerland by Vilfredo Pareto

Vilfredo Pareto

Vilfredo Federico Damaso Pareto , born Wilfried Fritz Pareto, was an Italian engineer, sociologist, economist, political scientist and philosopher. He made several important contributions to economics, particularly in the study of income distribution and in the analysis of individuals' choices....

; and in America by Herbert Joseph Davenport and by Frank A. Fetter

Frank Fetter

Frank Albert Fetter was an American economist of the Austrian School. Fetter's treatise, The Principles of Economics, contributed to an increased American interest in the Austrian School, including the theories of Eugen von Böhm-Bawerk, Friedrich von Wieser, Ludwig von Mises and Friedrich...

.

There were significant, distinguishing features amongst the approaches of Jevons, Menger, and Walras, but the second generation did not maintain distinctions along national or linguistic lines. The work of von Wieser was heavily influenced by that of Walras. Wicksteed was heavily influenced by Menger. Fetter referred to himself and Davenport as part of “the American Psychological School”, named in imitation of the Austrian “Psychological School”. (And Clark's work from this period onward similarly shows heavy influence by Menger.) William Smart began as a conveyor of Austrian School theory to English-language readers, though he fell increasingly under the influence of Marshall.

Böhm-Bawerk was perhaps the most able expositor of Menger's conception. He was further noted for producing a theory of interest and of profit in equilibrium based upon the interaction of diminishing marginal utility with diminishing marginal product

Marginal product

In economics and in particular neoclassical economics, the marginal product or marginal physical product of an input is the extra output that can be produced by using one more unit of the input , assuming that the quantities of no other inputs to production...

ivity of time and with time preference

Time preference

In economics, time preference pertains to how large a premium a consumer places on enjoyment nearer in time over more remote enjoyment....

. (This theory was adopted in full and then further developed by Knut Wicksell

Knut Wicksell

Johan Gustaf Knut Wicksell was a leading Swedish economist of the Stockholm school. His economic contributions would influence both the Keynesian and Austrian schools of economic thought....

and, with modifications including formal disregard for time-preference, by Wicksell's American rival Irving Fisher

Irving Fisher

Irving Fisher was an American economist, inventor, and health campaigner, and one of the earliest American neoclassical economists, though his later work on debt deflation often regarded as belonging instead to the Post-Keynesian school.Fisher made important contributions to utility theory and...

.)

Marshall was the second-generation marginalist whose work on marginal utility came most to inform the mainstream of neoclassical economics, especially by way of his Principles of Economics, the first volume of which was published in 1890. Marshall constructed the demand curve with the aid of assumptions that utility was quantified, and that the marginal utility of money was constant (or nearly so). Like Jevons, Marshall did not see an explanation for supply in the theory of marginal utility, so he synthesized an explanation of demand thus explained with supply explained in a more classical

Classical economics

Classical economics is widely regarded as the first modern school of economic thought. Its major developers include Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Malthus and John Stuart Mill....

manner, determined by costs which were taken to be objectively determined. (Marshall later actively mischaracterized the criticism that these costs were themselves ultimately determined by marginal utilities.)

The Marginal Revolution and Marxism

The doctrines of marginalism and the Marginal Revolution are often interpreted as somehow a response to Marxist economicsMarxism

Marxism is an economic and sociopolitical worldview and method of socioeconomic inquiry that centers upon a materialist interpretation of history, a dialectical view of social change, and an analysis and critique of the development of capitalism. Marxism was pioneered in the early to mid 19th...

. In fact, the first volume of Das Kapital

Das Kapital

Das Kapital, Kritik der politischen Ökonomie , by Karl Marx, is a critical analysis of capitalism as political economy, meant to reveal the economic laws of the capitalist mode of production, and how it was the precursor of the socialist mode of production.- Themes :In Capital: Critique of...

was not published until July 1867, after the works of Jevons, Menger, and Walras were written or well under way; and Marx

Karl Marx

Karl Heinrich Marx was a German philosopher, economist, sociologist, historian, journalist, and revolutionary socialist. His ideas played a significant role in the development of social science and the socialist political movement...

was still a relatively obscure figure when these works were completed. (On the other hand, Hayek

Friedrich Hayek

Friedrich August Hayek CH , born in Austria-Hungary as Friedrich August von Hayek, was an economist and philosopher best known for his defense of classical liberalism and free-market capitalism against socialist and collectivist thought...

or Bartley

William Warren Bartley

William Warren Bartley, III, was an American philosopher and Professor of Philosophy at Stanford University.-Life:...