Taxation in medieval England

Encyclopedia

Danegeld

The Danegeld was a tax raised to pay tribute to the Viking raiders to save a land from being ravaged. It was called the geld or gafol in eleventh-century sources; the term Danegeld did not appear until the early twelfth century...

, a land tax first regularly collected in 1012 to pay for mercenaries. After the Norman Conquest of England

Norman conquest of England

The Norman conquest of England began on 28 September 1066 with the invasion of England by William, Duke of Normandy. William became known as William the Conqueror after his victory at the Battle of Hastings on 14 October 1066, defeating King Harold II of England...

in 1066, the geld continued to be collected until 1162, but it was eventually replaced with taxes on personal property and income.

Background

BritanniaBritannia

Britannia is an ancient term for Great Britain, and also a female personification of the island. The name is Latin, and derives from the Greek form Prettanike or Brettaniai, which originally designated a collection of islands with individual names, including Albion or Great Britain. However, by the...

, the southern and central part of the island of Great Britain

Great Britain

Great Britain or Britain is an island situated to the northwest of Continental Europe. It is the ninth largest island in the world, and the largest European island, as well as the largest of the British Isles...

, was a province of the Roman Empire

Roman Empire

The Roman Empire was the post-Republican period of the ancient Roman civilization, characterised by an autocratic form of government and large territorial holdings in Europe and around the Mediterranean....

until the Roman departure from Britain in around 400 AD. The Emperor Honorius

Honorius (emperor)

Honorius , was Western Roman Emperor from 395 to 423. He was the younger son of emperor Theodosius I and his first wife Aelia Flaccilla, and brother of the eastern emperor Arcadius....

told the Britons

Britons (historical)

The Britons were the Celtic people culturally dominating Great Britain from the Iron Age through the Early Middle Ages. They spoke the Insular Celtic language known as British or Brythonic...

in 410 that they were responsible for their own defence, and from then until the landing of Augustine of Canterbury

Augustine of Canterbury

Augustine of Canterbury was a Benedictine monk who became the first Archbishop of Canterbury in the year 597...

in the Kingdom of Kent

Kingdom of Kent

The Kingdom of Kent was a Jutish colony and later independent kingdom in what is now south east England. It was founded at an unknown date in the 5th century by Jutes, members of a Germanic people from continental Europe, some of whom settled in Britain after the withdrawal of the Romans...

in 597 as part of the Gregorian mission

Gregorian mission

The Gregorian mission, sometimes known as the Augustinian mission, was the missionary endeavour sent by Pope Gregory the Great to the Anglo-Saxons in 596 AD. Headed by Augustine of Canterbury, its goal was to convert the Anglo-Saxons to Christianity. By the death of the last missionary in 653, they...

, little is known about Britain's governmental structures or financial systems.

Anglo-Saxon England (597–1066)

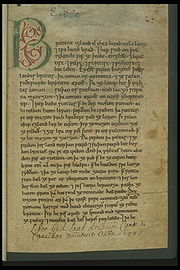

The first unequivocal mention of taxation in Anglo-Saxon England comes from the Law of ÆthelberhtLaw of Æthelberht

The Law of Æthelberht is a set of legal provisions written in Old English, probably dating to the early 7th century. It originates in the kingdom of Kent, and is the first Germanic-language law code...

, the law code of King Æthelberht of Kent, which specifies that fines from judicial cases were to be paid to the king. No other forms of taxes are mentioned in Æthelberht's law code, but other forms of taxation are implied by the grant of an exemption from taxation given by another king, Wihtred of Kent

Wihtred of Kent

Wihtred was king of Kent from about 690 or 691 until his death. He was a son of Ecgberht I and a brother of Eadric. Wihtred acceded to the throne after a confused period in the 680s, which included a brief conquest of Kent by Cædwalla of Wessex and subsequent dynastic conflicts...

, to a church. Other mentions of taxes are contained in the law code of King Ine of Wessex

Ine of Wessex

Ine was King of Wessex from 688 to 726. He was unable to retain the territorial gains of his predecessor, Cædwalla, who had brought much of southern England under his control and expanded West Saxon territory substantially...

. Although other early Anglo-Saxon kings are not mentioned as collecting taxes, the medieval writer Bede

Bede

Bede , also referred to as Saint Bede or the Venerable Bede , was a monk at the Northumbrian monastery of Saint Peter at Monkwearmouth, today part of Sunderland, England, and of its companion monastery, Saint Paul's, in modern Jarrow , both in the Kingdom of Northumbria...

does mention that land in Anglesey and the Isle of Man were divided up in hide

Hide (unit)

The hide was originally an amount of land sufficient to support a household, but later in Anglo-Saxon England became a unit used in assessing land for liability to "geld", or land tax. The geld would be collected at a stated rate per hide...

s, defined in Ine's law as a unit of land that could be used for collecting food and other goods from the king's subjects. A document from the 7th or 8th century, the Tribal Hidage

Tribal Hidage

Image:Tribal Hidage 2.svg|thumb|400px|alt=insert description of map here|The tribes of the Tribal Hidage. Where an appropriate article exists, it can be found by clicking on the name.rect 275 75 375 100 Elmetrect 375 100 450 150 Hatfield Chase...

, shows that much of the Anglo-Saxon lands had been divided into hides by that time. Charters from the time of King Offa of Mercia

Offa of Mercia

Offa was the King of Mercia from 757 until his death in July 796. The son of Thingfrith and a descendant of Eowa, Offa came to the throne after a period of civil war following the assassination of Æthelbald after defeating the other claimant Beornred. In the early years of Offa's reign it is likely...

show that tolls were collected on trade, and it was during Offa's reign that coinage in silver pennies was first introduced into Anglo-Saxon England. Coinage became a royal right, and was probably introduced to make payment of taxes easier.

The Viking expansion

Viking expansion

The Vikings sailed most of the North Atlantic, reaching south to North Africa and east to Russia, Constantinople and the Middle East, as looters, traders, colonists, and mercenaries...

to England necessitated the payment of tribute to the invaders in an attempt to buy off the invasions. Kings in this time levied contributions from their subjects, to pay tributes and to fight the Scandinavian invaders. In addition to these contributions, King Edgar introduced a system where periodically all the coinage was recalled and reminted, with the moneyer

Moneyer

A moneyer is someone who physically creates money. Moneyers have a long tradition, dating back at least to ancient Greece. They became most prominent in the Roman Republic, continuing into the empire.-Roman Republican moneyers:...

s being forced to pay for new die

Die (manufacturing)

A die is a specialized tool used in manufacturing industries to cut or shape material using a press. Like molds, dies are generally customized to the item they are used to create...

s. All profits from these actions went to the king, and were a royal right.

In 1012 saw the introduction of the geld

Danegeld

The Danegeld was a tax raised to pay tribute to the Viking raiders to save a land from being ravaged. It was called the geld or gafol in eleventh-century sources; the term Danegeld did not appear until the early twelfth century...

or heregeld, which was an annual tax first assessed by King Æthelred the Unready to pay for mercenaries to fight the invasion of England by King Sweyn Forkbeard of Denmark. Later, after the conquest of England by Sweyn's son Cnut the Great, the geld was continued. This was a tax based on the ownership of land, and was based on the number of hides owned. The amount due from each hide was variable. It was abolished by King Edward the Confessor

Edward the Confessor

Edward the Confessor also known as St. Edward the Confessor , son of Æthelred the Unready and Emma of Normandy, was one of the last Anglo-Saxon kings of England and is usually regarded as the last king of the House of Wessex, ruling from 1042 to 1066....

in 1051, but was possibly reinstated in 1052.

Norman and Angevin England (1066–1216)

There was no formal division between the household of the king and the government in the Norman periodAnglo-Norman

The Anglo-Normans were mainly the descendants of the Normans who ruled England following the Norman conquest by William the Conqueror in 1066. A small number of Normans were already settled in England prior to the conquest...

, although gradually the household itself began to separate from the government. Thus, income from taxation merged with other income to fund the king and the government without any distinctions such as in the modern world. Under the Norman and Angevin kings

House of Plantagenet

The House of Plantagenet , a branch of the Angevins, was a royal house founded by Geoffrey V of Anjou, father of Henry II of England. Plantagenet kings first ruled the Kingdom of England in the 12th century. Their paternal ancestors originated in the French province of Gâtinais and gained the...

, the government had four main sources of income: (1) income from lands owned directly by the king, or his demesne

Demesne

In the feudal system the demesne was all the land, not necessarily all contiguous to the manor house, which was retained by a lord of the manor for his own use and support, under his own management, as distinguished from land sub-enfeoffed by him to others as sub-tenants...

lands, (2) income that derived from his rights as a feudal overlord, the feudal right

Feudalism

Feudalism was a set of legal and military customs in medieval Europe that flourished between the 9th and 15th centuries, which, broadly defined, was a system for ordering society around relationships derived from the holding of land in exchange for service or labour.Although derived from the...

s such as feudal aid

Feudal aid

Feudal aid, or just plain aid is the legal term for one of the financial duties required of a tenant or vassal to his lord. Variations on the feudal aid were collected in England, France, Germany and Italy during the Middle Ages, although the exact circumstances varied.-Origin:The term originated...

or scutage

Scutage

The form of taxation known as scutage, in the law of England under the feudal system, allowed a knight to "buy out" of the military service due to the Crown as a holder of a knight's fee held under the feudal land tenure of knight-service. Its name derived from shield...

(3) taxation, and (4) income from the fines and other profits of justice. By the time of King Henry I

Henry I of England

Henry I was the fourth son of William I of England. He succeeded his elder brother William II as King of England in 1100 and defeated his eldest brother, Robert Curthose, to become Duke of Normandy in 1106...

, most revenues were paid into the Exchequer

Exchequer

The Exchequer is a government department of the United Kingdom responsible for the management and collection of taxation and other government revenues. The historical Exchequer developed judicial roles...

, the English Treasury, and the first records of the Exchequer date from 1130, in the form of the first surviving Pipe Roll for that year. From the reign of King Henry II

Henry II of England

Henry II ruled as King of England , Count of Anjou, Count of Maine, Duke of Normandy, Duke of Aquitaine, Duke of Gascony, Count of Nantes, Lord of Ireland and, at various times, controlled parts of Wales, Scotland and western France. Henry, the great-grandson of William the Conqueror, was the...

, Pipe Rolls form a mostly continuous record of royal revenues and taxation. However, not all revenue went into the Exchequer, and some occasional taxes and levies were never recorded in the Pipe Rolls.

Taxation itself took a number of forms in this period. The main tax was the geld, still based on the land, and unique in Europe at the time as being the only land tax that was universal on all the king's subjects, not just his immediate feudal tenants and peasants. It was still assessed on the hide, and the usual rate was 2 shillings per hide. In certain circumstances, however, taxation was assessed in terms of services rendered to the crown, such as avera and inward

Avera and Inward

In medieval England, Avera and Inward were feudal obligations assessed against a royal demesne. The terms refer to various services rendered to the crown in lieu of payment in coin. Avera is connected with carrying items by horse, or possibly ploughing or both...

.

Because the geld was assessed on landowners, it only applied to free men who owned land, and thus serfs and slaves were exempt. Other exemptions were granted to favoured subjects or were a right that went with certain governmental offices. The geld was unpopular, and because of the increasing number of exemptions, yielded smaller amounts. During the reign of King Stephen

Stephen of England

Stephen , often referred to as Stephen of Blois , was a grandson of William the Conqueror. He was King of England from 1135 to his death, and also the Count of Boulogne by right of his wife. Stephen's reign was marked by the Anarchy, a civil war with his cousin and rival, the Empress Matilda...

, it is unclear if the geld was collected at all, as no financial records survive. However, when King Henry II

Henry II of England

Henry II ruled as King of England , Count of Anjou, Count of Maine, Duke of Normandy, Duke of Aquitaine, Duke of Gascony, Count of Nantes, Lord of Ireland and, at various times, controlled parts of Wales, Scotland and western France. Henry, the great-grandson of William the Conqueror, was the...

came to the throne, the geld was collected once more. After 1162, however the geld was no longer collected.

In 1194, in part from need to raise the huge sums required for the ransom of King Richard I

Richard I of England

Richard I was King of England from 6 July 1189 until his death. He also ruled as Duke of Normandy, Duke of Aquitaine, Duke of Gascony, Lord of Cyprus, Count of Anjou, Count of Maine, Count of Nantes, and Overlord of Brittany at various times during the same period...

who was captive in Germany, a new land tax was instituted. This was the carucage

Carucage

Carucage was a medieval English land tax introduced by King Richard I in 1194, based on the size—variously calculated—of the estate owned by the taxpayer. It was a replacement for the danegeld, last imposed in 1162, which had become difficult to collect because of an increasing number of exemptions...

, and like the geld it was based on the land. The carucage was imposed six times in all, but it produced smaller sums than other means of raising revenue and was last collected in 1224.

Instead, a new type of tax was imposed starting in 1166, although it was not an annual tax. This was the tax on moveable property and income, and it could be imposed at varying rates. In 1194, as part of the attempts to raise Richard's ransom, a 25% levy on all personal property and income was imposed. In other years, other rates were set, such as the thirteenth imposed in 1207. Likewise, the Saladin tithe

Saladin tithe

The Saladin tithe, or the Aid of 1188, was a tax, or more specifically a tallage, levied in England and to some extent in France in 1188, in response to the capture of Jerusalem by Saladin in 1187.-Background:...

, imposed in 1188 to raise funds for a proposed crusade by King Henry II, was levied at the rate of 10% of all goods and revenues, with some exceptions for a knight's horse and armour and clerical vestments. Also excluded were those who had pledged to go on crusade with the king.

Besides taxes on land and taxes on personal property, this period saw the introduction of taxes on trade. In 1202, King John

John of England

John , also known as John Lackland , was King of England from 6 April 1199 until his death...

imposed a custom duty of a fifteenth of the value of all goods imported or exported. It appears, however, that these duties were discontinued in 1206.

Plantagenet England (1216–1360)

During the reign of King Henry IIIHenry III of England

Henry III was the son and successor of John as King of England, reigning for 56 years from 1216 until his death. His contemporaries knew him as Henry of Winchester. He was the first child king in England since the reign of Æthelred the Unready...

, the king and government sought consent from the nobles of England for taxes the government wished to impose. This led in 1254 to the start of the Parliament of England

Parliament of England

The Parliament of England was the legislature of the Kingdom of England. In 1066, William of Normandy introduced a feudal system, by which he sought the advice of a council of tenants-in-chief and ecclesiastics before making laws...

, when the nobles advised the king to summon knights from each shire

Shire

A shire is a traditional term for a division of land, found in the United Kingdom and in Australia. In parts of Australia, a shire is an administrative unit, but it is not synonymous with "county" there, which is a land registration unit. Individually, or as a suffix in Scotland and in the far...

to help advise and consent to a new tax. In the 1260s, men from the towns were included with the knights, forming the beginnings of the House of Commons of England

House of Commons of England

The House of Commons of England was the lower house of the Parliament of England from its development in the 14th century to the union of England and Scotland in 1707, when it was replaced by the House of Commons of Great Britain...

.

By the middle of the 13th century, the tax on moveable property had become fixed by convention at a fifteenth for those in the country, and a tenth for those living in towns. An innovation in 1334 was the replacement of the individual assessments by a lump sum assessment for each community.

In 1275, King Edward I

Edward I of England

Edward I , also known as Edward Longshanks and the Hammer of the Scots, was King of England from 1272 to 1307. The first son of Henry III, Edward was involved early in the political intrigues of his father's reign, which included an outright rebellion by the English barons...

reestablished a customs duty, by setting a rate of a mark

Mark (money)

Mark was a measure of weight mainly for gold and silver, commonly used throughout western Europe and often equivalent to 8 ounces. Considerable variations, however, occurred throughout the Middle Ages Mark (from a merging of three Teutonic/Germanic languages words, Latinized in 9th century...

on each sack of wool (weighing 364 pounds (165.1 kg)) or 300 wool-fells, and a mark on a last of hides. Edward then added another tax, the maltolt, in 1294, on sacks of wool, which was in addition to the previous customs duty. These taxes were removed in 1296, but in 1303 they were reimposed but only on non-English merchants. Over the next 40 years, the maltolt was the subject of dispute between the king and Parliament, with the final result being that the tax was kept at a lower rate but that Parliament's consent was required to impose it.

Late medieval England (1360–1485)

The revenues from the traditional sources of taxation declined in later medieval England, and a series of experiments in poll taxesPoll tax

A poll tax is a tax of a portioned, fixed amount per individual in accordance with the census . When a corvée is commuted for cash payment, in effect it becomes a poll tax...

began: in 1377 a flat rate tax, in 1379 a graduated tax. By 1381, the unpopularity of these taxes had contributed to the Peasants' Revolt

Peasants' Revolt

The Peasants' Revolt, Wat Tyler's Rebellion, or the Great Rising of 1381 was one of a number of popular revolts in late medieval Europe and is a major event in the history of England. Tyler's Rebellion was not only the most extreme and widespread insurrection in English history but also the...

. Later experiments in income taxes during the 15th century did not manage to raise the sums needed by the government, and other taxes, such as taxes on parishes, were attempted.