Global financial crisis in September 2008

Encyclopedia

Prelude

The subprime mortgage crisisSubprime mortgage crisis

The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages....

reached a critical stage during the first week of September 2008, characterized by severely contracted liquidity

Market liquidity

In business, economics or investment, market liquidity is an asset's ability to be sold without causing a significant movement in the price and with minimum loss of value...

in the global credit markets and insolvency threats to investment banks and other institutions.

US Government takeover of home mortgage lenders

The United States director of the Federal Housing Finance AgencyFederal Housing Finance Agency

The Federal Housing Finance Agency is an independent federal agency created as the successor regulatory agency resulting from the statutory merger of the Federal Housing Finance Board , the Office of Federal Housing Enterprise Oversight , and the U.S...

(FHFA), James B. Lockhart III

James B. Lockhart III

James B. Lockhart III assumed the position of Vice Chairman of WL Ross & Co. LLC in September 2009. WL Ross manages $9 billion of private equity investments, a hedge fund and a Mortgage Recovery Fund. It is a subsidiary of Invesco, a Fortune 500 investment management firm...

, on September 7, 2008 announced his decision to place two United States government-sponsored enterprises

Government-owned corporation

A government-owned corporation, state-owned company, state-owned entity, state enterprise, publicly owned corporation, government business enterprise, or parastatal is a legal entity created by a government to undertake commercial activities on behalf of an owner government...

(GSEs), Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation), into conservatorship

Conservatorship

Conservatorship is a legal concept in the United States of America, where an entity or organization is subjected to the legal control of an external entity or organization, known as a conservator. Conservatorship is established either by court order or via a statutory or regulatory authority...

run by FHFA. United States Treasury Secretary Henry Paulson

Henry Paulson

Henry Merritt "Hank" Paulson, Jr. is an American banker who served as the 74th United States Secretary of the Treasury. He previously served as the Chairman and Chief Executive Officer of Goldman Sachs.-Early life and family:...

, at the same press conference stated that placing the two GSEs into conservatorship was a decision he fully supported, and said that he advised "that conservatorship was the only form in which I would commit taxpayer money to the GSEs." He further said that "I attribute the need for today's action primarily to the inherent conflict and flawed business model embedded in the GSE structure, and to the ongoing housing correction

United States housing market correction

A United States housing market correction is a market correction or "bubble bursting" of a United States housing bubble; the most recent began following a national home price peak first identified in July 2006. Because realty trades in illiquid markets relative to financial assets such as common...

." The same day, Federal Reserve Bank

Federal Reserve Bank

The twelve Federal Reserve Banks form a major part of the Federal Reserve System, the central banking system of the United States. The twelve federal reserve banks together divide the nation into twelve Federal Reserve Districts, the twelve banking districts created by the Federal Reserve Act of...

Chairman Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

stated in support: "I strongly endorse both the decision by FHFA Director Lockhart to place Fannie Mae and Freddie Mac into conservatorship and the actions taken by Treasury Secretary Paulson to ensure the financial soundness of those two companies."

Developing global financial crisis

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

on September 14, 2008, the financial crisis entered an acute phase marked by failures of prominent American and Europe

Europe

Europe is, by convention, one of the world's seven continents. Comprising the westernmost peninsula of Eurasia, Europe is generally 'divided' from Asia to its east by the watershed divides of the Ural and Caucasus Mountains, the Ural River, the Caspian and Black Seas, and the waterways connecting...

an banks and efforts by the American and European governments to rescue distressed financial institutions, in the United States by passage of the Emergency Economic Stabilization Act of 2008

Emergency Economic Stabilization Act of 2008

The Emergency Economic Stabilization Act of 2008 The Emergency Economic Stabilization Act of 2008 The Emergency Economic Stabilization Act of 2008 (Division A of , commonly referred to as a bailout of the U.S. financial system, is a law enacted in response to the subprime mortgage crisis...

and in European countries by infusion of capital into major banks. Afterwards, Iceland

Iceland

Iceland , described as the Republic of Iceland, is a Nordic and European island country in the North Atlantic Ocean, on the Mid-Atlantic Ridge. Iceland also refers to the main island of the country, which contains almost all the population and almost all the land area. The country has a population...

almost claimed to go bankrupt as the country's three largest banks, and in effect financial system, collapsed. Many financial institutions in Europe also faced the liquidity problem that they needed to raise their capital adequacy ratio. As the crisis developed, stock markets fell worldwide, and global financial regulators attempted to coordinate efforts to contain the crisis. The US government composed a $700 billion plan to purchase unperforming collateral

Collateral (finance)

In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan.The collateral serves as protection for a lender against a borrower's default - that is, any borrower failing to pay the principal and interest under the terms of a loan obligation...

s and assets. However, the plan failed to pass because some members of the US Congress rejected the idea of using taxpayers' money to bail out Wall Street

Wall Street

Wall Street refers to the financial district of New York City, named after and centered on the eight-block-long street running from Broadway to South Street on the East River in Lower Manhattan. Over time, the term has become a metonym for the financial markets of the United States as a whole, or...

investment bankers. After the stock market plunged, Congress amended the $700 billion bail out plan and passed the legislation. The market sentiment continued to deteriorate, however, and the global financial system almost collapsed. While the market turned extremely pessimistic, the British government launched a 500 billion pound bail out plan aimed at injecting capital into the financial system. The British government nationalized most of the financial institutions in trouble. Many European governments followed suit, as well as the US government. Stock markets appeared to have stabilized as October ended. In addition, the falling prices due to reduced demand for oil

Oil

An oil is any substance that is liquid at ambient temperatures and does not mix with water but may mix with other oils and organic solvents. This general definition includes vegetable oils, volatile essential oils, petrochemical oils, and synthetic oils....

, coupled with projections of a global recession, brought the 2000s energy crisis to temporary resolution. In the Eastern Europe

Eastern Europe

Eastern Europe is the eastern part of Europe. The term has widely disparate geopolitical, geographical, cultural and socioeconomic readings, which makes it highly context-dependent and even volatile, and there are "almost as many definitions of Eastern Europe as there are scholars of the region"...

an economies of Poland

Poland

Poland , officially the Republic of Poland , is a country in Central Europe bordered by Germany to the west; the Czech Republic and Slovakia to the south; Ukraine, Belarus and Lithuania to the east; and the Baltic Sea and Kaliningrad Oblast, a Russian exclave, to the north...

, Hungary

Hungary

Hungary , officially the Republic of Hungary , is a landlocked country in Central Europe. It is situated in the Carpathian Basin and is bordered by Slovakia to the north, Ukraine and Romania to the east, Serbia and Croatia to the south, Slovenia to the southwest and Austria to the west. The...

, Romania

Romania

Romania is a country located at the crossroads of Central and Southeastern Europe, on the Lower Danube, within and outside the Carpathian arch, bordering on the Black Sea...

, and Ukraine

Ukraine

Ukraine is a country in Eastern Europe. It has an area of 603,628 km², making it the second largest contiguous country on the European continent, after Russia...

the economic crisis was characterized by difficulties with loans made in hard currencies such as the Swiss franc

Swiss franc

The franc is the currency and legal tender of Switzerland and Liechtenstein; it is also legal tender in the Italian exclave Campione d'Italia. Although not formally legal tender in the German exclave Büsingen , it is in wide daily use there...

. As local currencies in those countries lost value, making payment on such loans became progressively more difficult.

As the financial panic developed during September and October 2008, there was a "flight-to-quality

Flight-to-quality

A flight-to-quality is a financial market phenomenon occurring when investors sell what they perceive to be higher-risk investments and purchase safer investments, such as US Treasuries or gold...

" as investors sought safety in U.S. Treasury bonds, gold

Gold

Gold is a chemical element with the symbol Au and an atomic number of 79. Gold is a dense, soft, shiny, malleable and ductile metal. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Chemically, gold is a...

, and currencies such as the US dollar (still widely perceived as the world’s reserve currency) and the Yen (mainly through unwinding of carry trades). This currency crisis threatened to disrupt international trade and produced strong pressure on all world currencies. The International Monetary Fund

International Monetary Fund

The International Monetary Fund is an organization of 187 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world...

had limited resources relative to the needs of the many nations with currency under pressure or near collapse.

A further shift towards assets that are perceived as tangible, sustainable, like gold

Gold as an investment

Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a hedge or harbor against economic, political, or social fiat currency crises...

or land

Land banking

Land banking is the practice of purchasing raw land with the intent to hold on to it until such a time as it is profitable to sell it on to others for more than was initially paid...

(as opposed to “paper assets”) was anticipated. However, as events progressed during early 2009, it was U.S. Treasury bonds which were the main refuge chosen. This inflow of money into the United States translated into an outflow from other countries restricting their ability to raise money for local rescue efforts.

Major US financial firms' crisis

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

would file for bankruptcy after the Federal Reserve Bank declined to participate in creating a financial support facility for Lehman Brothers. The significance of the Lehman Brothers bankruptcy is disputed with some assigning it a pivotal role in the unfolding of subsequent events. The principals involved, Ben Bernanke and Henry Paulson, dispute this view, citing a volume of toxic assets at Lehman which made a rescue impossible. Immediately following the bankruptcy, JPMorgan Chase provided the broker dealer unit of Lehman Brothers

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

with $138 billion to "settle securities transactions with customers of Lehman and its clearance parties" according to a statement made in a New York City Bankruptcy court filing.

The same day, the sale of Merrill Lynch

Merrill Lynch

Merrill Lynch is the wealth management division of Bank of America. With over 15,000 financial advisors and $2.2 trillion in client assets it is the world's largest brokerage. Formerly known as Merrill Lynch & Co., Inc., prior to 2009 the firm was publicly owned and traded on the New York...

to Bank of America

Bank of America

Bank of America Corporation, an American multinational banking and financial services corporation, is the second largest bank holding company in the United States by assets, and the fourth largest bank in the U.S. by market capitalization. The bank is headquartered in Charlotte, North Carolina...

was announced. The beginning of the week was marked by extreme instability in global stock markets, with dramatic drops in market values on Monday, September 15, and Wednesday, September 17. On September 16, the large insurer American International Group

American International Group

American International Group, Inc. or AIG is an American multinational insurance corporation. Its corporate headquarters is located in the American International Building in New York City. The British headquarters office is on Fenchurch Street in London, continental Europe operations are based in...

(AIG), a significant participant in the credit default swap

Credit default swap

A credit default swap is similar to a traditional insurance policy, in as much as it obliges the seller of the CDS to compensate the buyer in the event of loan default...

s markets, suffered a liquidity crisis

Liquidity crisis

In financial economics, liquidity is a catch-all term that may refer to several different yet closely related concepts. Among other things, it may refer to Asset Market liquidity In financial economics, liquidity is a catch-all term that may refer to several different yet closely related...

following the downgrade of its credit rating. The Federal Reserve, at AIG

AIG

AIG is American International Group, a major American insurance corporation.AIG may also refer to:* And-inverter graph, a concept in computer theory* Answers in Genesis, a creationist organization in the U.S.* Arta Industrial Group in Iran...

's request, and after AIG had shown that it could not find lenders willing to save it from insolvency, created a credit facility for up to US$85 billion in exchange for a 79.9% equity interest, and the right to suspend dividends to previously issued common and preferred stock.

Money market funds insurance and short sales prohibitions

On September 16, the Reserve Primary FundReserve Primary Fund

The Reserve Primary Fund was a large money market mutual fund.On September 16, 2008, during the Global financial crisis of September-October, 2008, it lowered its share price below $1 because of exposure to Lehman Brothers debt securities. This resulted in demands from investors to return their...

, a large money market mutual fund

Money fund

A money market fund is an open-ended mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds are widely regarded as being as safe as bank deposits yet providing a higher yield...

, lowered its share price below $1 because of exposure to Lehman debt securities. This resulted in demands from investors to return their funds as the financial crisis mounted. By the morning of September 18, money market sell orders from institutional investors totalled $0.5 trillion, out of a total market capitalization of $4 trillion, but a $105 billion liquidity injection from the Federal Reserve averted an immediate collapse. On September 19 the U.S. Treasury offered temporary insurance (akin to Federal Deposit Insurance Corporation

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation is a United States government corporation created by the Glass–Steagall Act of 1933. It provides deposit insurance, which guarantees the safety of deposits in member banks, currently up to $250,000 per depositor per bank. , the FDIC insures deposits at...

insurance of bank accounts) to money market funds. Toward the end of the week, short selling of financial stocks was suspended by the Financial Services Authority

Financial Services Authority

The Financial Services Authority is a quasi-judicial body responsible for the regulation of the financial services industry in the United Kingdom. Its board is appointed by the Treasury and the organisation is structured as a company limited by guarantee and owned by the UK government. Its main...

in the United Kingdom and by the Securities and Exchange Commission in the United States. Similar measures were taken by authorities in other countries. Some restoration of market confidence occurred with the publicity surrounding efforts of the Treasury and the Securities Exchange Commission

US Troubled Asset Relief Program

On September 19, 2008 a plan intended to ameliorate the difficulties caused by the subprime mortgage crisisSubprime mortgage crisis

The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages....

was proposed by the Secretary of the Treasury, Henry Paulson

Henry Paulson

Henry Merritt "Hank" Paulson, Jr. is an American banker who served as the 74th United States Secretary of the Treasury. He previously served as the Chairman and Chief Executive Officer of Goldman Sachs.-Early life and family:...

. He proposed a Troubled Assets Relief Program

Troubled Assets Relief Program

The Troubled Asset Relief Program is a program of the United States government to purchase assets and equity from financial institutions to strengthen its financial sector that was signed into law by U.S. President George W. Bush on October 3, 2008...

(TARP), later incorporated into the Emergency Economic Stabilization Act

Emergency Economic Stabilization Act of 2008

The Emergency Economic Stabilization Act of 2008 The Emergency Economic Stabilization Act of 2008 The Emergency Economic Stabilization Act of 2008 (Division A of , commonly referred to as a bailout of the U.S. financial system, is a law enacted in response to the subprime mortgage crisis...

, which would permit the United States government to purchase illiquid

Market liquidity

In business, economics or investment, market liquidity is an asset's ability to be sold without causing a significant movement in the price and with minimum loss of value...

assets, informally termed toxic assets, from financial institutions. The value of the securities is extremely difficult to determine."Plan’s Mystery: What’s All This Stuff Worth?" article by Vikas Bajaj in The New York Times

The New York Times

The New York Times is an American daily newspaper founded and continuously published in New York City since 1851. The New York Times has won 106 Pulitzer Prizes, the most of any news organization...

September 24, 2008

Consultations between the Secretary of the Treasury, the Chairman of the Federal Reserve

Chairman of the Federal Reserve

The Chairman of the Board of Governors of the Federal Reserve System is the head of the central banking system of the United States. Known colloquially as "Chairman of the Fed," or in market circles "Fed Chairman" or "Fed Chief"...

, and the Chairman of the U.S. Securities and Exchange Commission, Congressional leaders and the President of the United States

George W. Bush

George Walker Bush is an American politician who served as the 43rd President of the United States, from 2001 to 2009. Before that, he was the 46th Governor of Texas, having served from 1995 to 2000....

moved forward plans to advance a comprehensive solution to the problems created by illiquid mortgage-backed securities. Of this time the President later said: "... I was told by [my] chief economic advisors that the situation we were facing could be worse than the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

."

At the close of the week the Secretary of the Treasury and President Bush announced a proposal for the federal government to buy up to US$700 billion of illiquid mortgage backed securities with the intent to increase the liquidity of the secondary mortgage market

Secondary mortgage market

The secondary mortgage market is the market for the sale of securities or bonds collateralized by the value of mortgage loans. The mortgage lender, commercial banks, or specialized firm will group together many loans and sell grouped loans as securities called collateralized mortgage obligations ....

s and reduce potential losses encountered by financial institutions owning the securities. The draft proposal of the plan was received favorably by investors in the stock market. Details of the bailout remained to be acted upon by Congress.

Week of September 21

On Sunday, September 21, the two remaining US investment banks, Goldman SachsGoldman Sachs

The Goldman Sachs Group, Inc. is an American multinational bulge bracket investment banking and securities firm that engages in global investment banking, securities, investment management, and other financial services primarily with institutional clients...

and Morgan Stanley

Morgan Stanley

Morgan Stanley is a global financial services firm headquartered in New York City serving a diversified group of corporations, governments, financial institutions, and individuals. Morgan Stanley also operates in 36 countries around the world, with over 600 offices and a workforce of over 60,000....

, with the approval of the Federal Reserve, converted to bank holding companies, a status subject to more regulation, but with readier access to capital. On September 21, Treasury Secretary Henry Paulson

Henry Paulson

Henry Merritt "Hank" Paulson, Jr. is an American banker who served as the 74th United States Secretary of the Treasury. He previously served as the Chairman and Chief Executive Officer of Goldman Sachs.-Early life and family:...

announced that the original proposal, which would have excluded foreign banks, had been widened to include foreign financial institutions with a presence in the US. The US administration was pressuring other countries to set up similar bailout plans.

On Monday and Tuesday during the week of September 22, appearances were made by the US Secretary of the Treasury and the Chairman of the Board of Governors of the Federal Reserve before Congressional committees and on Wednesday a prime-time presidential address was delivered by the President of the United States on television. Behind the scenes, negotiations were held refining the proposal which had grown to 42 pages from its original 3 and was reported to include both an oversight structure and limitations on executive salaries, with other provisions under consideration.

On September 25, agreement was reported by congressional leaders on the basics of the package; however, general and vocal opposition to the proposal was voiced by the public. On Thursday afternoon at a White House meeting attended by congressional leaders and the presidential candidates, John McCain and Barack Obama, it became clear that there was no congressional consensus, with Republican representatives and the ranking member of the Senate Banking Committee, Richard C. Shelby, strongly opposing the proposal. The alternative advanced by conservative House Republicans was to create a system of mortgage insurance funded by fees on those holding mortgages; as the working week ended, negotiations continued on the plan, which had grown to 102 pages and included mortgage insurance as an option. On Thursday evening Washington Mutual

Washington Mutual

Washington Mutual, Inc. , abbreviated to WaMu, was a savings bank holding company and the former owner of Washington Mutual Bank, which was the United States' largest savings and loan association until its collapse in 2008....

, the nation's largest savings and loan, was seized by the Federal Deposit Insurance Corporation

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation is a United States government corporation created by the Glass–Steagall Act of 1933. It provides deposit insurance, which guarantees the safety of deposits in member banks, currently up to $250,000 per depositor per bank. , the FDIC insures deposits at...

and most of its assets transferred to JPMorgan Chase. Wachovia

Wachovia

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo in 2008, Wachovia was the fourth-largest bank holding company in the United States based on total assets...

, one of the largest US banks, was reported to be in negotiations with Citigroup

Citigroup

Citigroup Inc. or Citi is an American multinational financial services corporation headquartered in Manhattan, New York City, New York, United States. Citigroup was formed from one of the world's largest mergers in history by combining the banking giant Citicorp and financial conglomerate...

and other financial institutions.

Week of September 28

Early on Sunday morning an announcement was made by the United States Secretary of the Treasury and congressional leaders that agreement had been reached on all major issues: the total amount of $700 billion remained with provision for the option of creating a scheme of mortgage insurance.It was reported on Sunday, September 28, that a rescue plan had been crafted for the British mortgage lender Bradford & Bingley

Bradford & Bingley

Bradford & Bingley plc is a British bank with headquarters in the West Yorkshire town of Bingley. In 2008, partly due to the credit crunch, the bank was nationalised and in effect split into two parts; the mortgage book remained with the now publicly owned Bradford & Bingley plc, and the deposits...

. Grupo Santander

Grupo Santander

The Santander Group is a banking group centered on Banco Santander, S.A., the largest bank in the Eurozone and one of the largest banks in the world in terms of market capitalisation. According to Forbes Magazine Global 2000, it is the 13th largest public company in the world...

, the largest bank in Spain, was slated to take over the offices and savings accounts while the mortgage and loans business would be nationalized.

Fortis

Fortis (finance)

Fortis N.V./S.A. was a company active in insurance, banking and investment management. In 2007 it was the 20th largest business in the world by revenue but after encountering severe problems in the financial crisis of 2008, most of the company was sold in parts, with only insurance activities...

, a huge Benelux

Benelux

The Benelux is an economic union in Western Europe comprising three neighbouring countries, Belgium, the Netherlands, and Luxembourg. These countries are located in northwestern Europe between France and Germany...

banking and finance company was partially nationalized on September 28, 2008, with Belgium

Belgium

Belgium , officially the Kingdom of Belgium, is a federal state in Western Europe. It is a founding member of the European Union and hosts the EU's headquarters, and those of several other major international organisations such as NATO.Belgium is also a member of, or affiliated to, many...

, the Netherlands

Netherlands

The Netherlands is a constituent country of the Kingdom of the Netherlands, located mainly in North-West Europe and with several islands in the Caribbean. Mainland Netherlands borders the North Sea to the north and west, Belgium to the south, and Germany to the east, and shares maritime borders...

and Luxembourg

Luxembourg

Luxembourg , officially the Grand Duchy of Luxembourg , is a landlocked country in western Europe, bordered by Belgium, France, and Germany. It has two principal regions: the Oesling in the North as part of the Ardennes massif, and the Gutland in the south...

investing a total of €11.2 billion (US$16.3 billion) in the bank. Belgium will purchase 49% of Fortis's Belgian division, with the Netherlands doing the same for the Dutch division. Luxembourg has agreed to a loan convertible into a 49% share of Fortis's Luxembourg division.

It was reported on Monday morning, September 29, that Wachovia

Wachovia

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo in 2008, Wachovia was the fourth-largest bank holding company in the United States based on total assets...

, the 4th largest bank in the United States, would be acquired by Citigroup

Citigroup

Citigroup Inc. or Citi is an American multinational financial services corporation headquartered in Manhattan, New York City, New York, United States. Citigroup was formed from one of the world's largest mergers in history by combining the banking giant Citicorp and financial conglomerate...

.

On Monday the German finance minister announced a rescue of Hypo Real Estate

Hypo Real Estate

The Hypo Real Estate Holding AG is a holding company based in Munich, Germany which comprises a number of real estate financing banks. The company's activities span three sectors of the real estate market: commercial property, infrastructure and public finance, and capital markets and asset...

, a Munich

Munich

Munich The city's motto is "" . Before 2006, it was "Weltstadt mit Herz" . Its native name, , is derived from the Old High German Munichen, meaning "by the monks' place". The city's name derives from the monks of the Benedictine order who founded the city; hence the monk depicted on the city's coat...

-based holding company comprising a number of real estate financing banks, but the deal collapsed on Saturday, October 4.

The same day the government of Iceland nationalized Glitnir

Glitnir (bank)

Glitnir was an international Icelandic bank. It was created by the state-directed merger of the country's three privately held banks - Alþýðubanki , Verzlunarbanki and Iðnaðarbanki - and one failing publicly held bank - Útvegsbanki - to form Íslandsbanki in 1990...

, Iceland’s

Iceland

Iceland , described as the Republic of Iceland, is a Nordic and European island country in the North Atlantic Ocean, on the Mid-Atlantic Ridge. Iceland also refers to the main island of the country, which contains almost all the population and almost all the land area. The country has a population...

third largest lender.

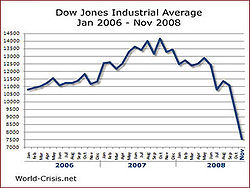

Stocks fell dramatically Monday in Europe and the US despite infusion of funds into the market for short term credit. In the US the Dow dropped 777 points (6.98%), the largest one-day point-drop in history (but only the 17th largest percentage drop).

The U.S. bailout plan, now named the Emergency Economic Stabilization Act of 2008

Emergency Economic Stabilization Act of 2008

The Emergency Economic Stabilization Act of 2008 The Emergency Economic Stabilization Act of 2008 The Emergency Economic Stabilization Act of 2008 (Division A of , commonly referred to as a bailout of the U.S. financial system, is a law enacted in response to the subprime mortgage crisis...

and expanded to 110 pages was slated for consideration in the House of Representatives on Monday, September 29 as HR 3997 and in the Senate later in the week. The plan failed after the vote being held open for 40 minutes in the House of Representatives, 205 for the plan, 228 against. Meanwhile the Federal Reserve

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

announced it will inject $630 billion into the global financial system to increase the liquidity of dollars worldwide as US stock markets suffered steep declines, the Dow losing 300 points in a matter of minutes, ending down 777.68, the Nasdaq losing 199.61, falling below the 2000 point mark, and the S.&P. 500 off 8.77% for the day. By the end of the day, the Dow suffered the largest drop in the history of the index. The S&P 500 Banking Index fell 14% on September 29 with drops in the stock value of a number of US banks generally considered sound, including Bank of New York Mellon, State Street and Northern Trust

Northern Trust

Northern Trust Corporation is an international financial services company headquartered in Chicago, Illinois, USA. It provides investment management, asset and fund administration, fiduciary and banking services through a network of 85 offices in 18 U.S. states and 12 international offices in North...

; three Ohio banks, National City

National City Corp.

National City Corporation was a regional bank holding company based in Cleveland, Ohio, USA, founded in 1845; it was once one of the ten largest banks in America in terms of deposits, mortgages and home equity lines of credit. Subsidiary National City Mortgage is credited for doing the first...

, Fifth Third

Fifth Third Bank

Fifth Third Bank is a U.S. regional banking corporation, headquartered in Cincinnati, Ohio and is the principal subsidiary of holding company Fifth Third Bancorp ....

, and KeyBank were down dramatically.

On Tuesday, September 30, stocks rebounded but credit markets remained tight with the London Interbank Offered Rate

London Interbank Offered Rate

The LIBOR rate is the average interest rate that leading banks in London charge when lending to other banks. It is an acronym for London Interbank Offered Rate Banks borrow money for one day, one month, two months, six months, one year etc. and they pay interest to their lenders based on...

(overnight dollar Libor) rising 4.7% to 6.88%. 9 billion USD was made available by the French, Belgian and Luxembourg governments to the French-Belgian bank Dexia

Dexia

Dexia N.V./S.A., also referred to as the Dexia Group, is a Belgian-French financial institution active in public finance, providing retail and commercial banking services to individuals and SMEs, asset management, and insurance...

.

After Irish banks came under pressure on Monday, September 29, the Irish government undertook a two year "guarantee arrangement to safeguard all deposits (retail, commercial, institutional and inter-bank), covered bonds, senior debt and dated subordinated debt (lower tier II)" of 6 Irish banks: Allied Irish Banks

Allied Irish Banks

Allied Irish Banks p.l.c. is a major commercial bank based in Ireland.AIB is one of the so called "big four" commercial banks in the state. The bank has one of the largest branch networks in Ireland; only Bank of Ireland fully rivals it. AIB offers a full range of personal and corporate banking...

, Bank of Ireland

Bank of Ireland

The Bank of Ireland is a commercial bank operation in Ireland, which is one of the 'Big Four' in both parts of the island.Historically the premier banking organisation in Ireland, the Bank occupies a unique position in Irish banking history...

, Anglo Irish Bank

Anglo Irish Bank

Anglo Irish Bank was a bank based in Ireland with its headquarters in Dublin from 1964 to 2011. It went into wind-down mode after nationalisation in 2009....

, Irish Life and Permanent

Irish Life and Permanent

Irish Life and Permanent, Plc or IL&P is a provider of personal financial services in Ireland. IL&P enjoys limited liability....

, Irish Nationwide

Irish Nationwide

Irish Nationwide Building Society was a financial institution in Ireland from 1873 to 2011. One of the country's oldest financial institutions, it was originally called the Irish Industrial Building Society; it changed its name in 1975 when it had just five staff...

and the EBS Building Society

EBS Building Society

EBS Limited was a financial institution in Ireland and was the country's largest building society. EBS has more than 400,000 members and distributes its products through a branch and franchised agency network. It handles direct business by telephone and the Internet...

; the potential liability involved is about 400 billion dollars.

Key risk indicators in September

Emergency Economic Stabilization Act of 2008

The Emergency Economic Stabilization Act of 2008 The Emergency Economic Stabilization Act of 2008 The Emergency Economic Stabilization Act of 2008 (Division A of , commonly referred to as a bailout of the U.S. financial system, is a law enacted in response to the subprime mortgage crisis...

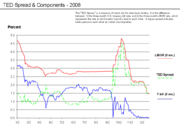

. The “TED spread

TED spread

The TED spread is the difference between the interest rates on interbank loans and on short-term U.S. government debt . TED is an acronym formed from T-Bill and ED, the ticker symbol for the Eurodollar futures contract....

” is a measure of credit risk for inter-bank lending. It is the difference between: 1) the risk-free three-month U.S. treasury bill rate; and 2) the three-month London InterBank Offered Rate (LIBOR), which represents the rate at which banks typically lend to each other. A higher spread indicates banks perceive each other as riskier counterparties. The t-bill is considered "risk-free" because the full faith and credit of the U.S. government is behind it; theoretically, the government could just print money so that the principal is fully repaid at maturity. The TED spread reached record levels in late September 2008. The diagram indicates that the Treasury yield movement was a more significant driver than the changes in LIBOR. A three month t-bill yield so close to zero means that people are willing to forgo interest just to keep their money (principal) safe for three months – a very high level of risk aversion and indicative of tight lending conditions. Driving this change were investors shifting funds from money market funds (generally considered nearly risk free but paying a slightly higher rate of return than t-bills) and other investment types to t-bills. These issues are consistent with the September 2008 aspects of the subprime mortgage crisis

Subprime mortgage crisis

The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages....

which prompted the Emergency Economic Stabilization Act of 2008 signed into law by the U.S. President on October 2, 2008.

In addition, an increase in LIBOR means that financial instruments with variable interest terms are increasingly expensive. For example, car loans and credit card interest

Credit card interest

Credit card interest is the principal way in which credit card issuers generate revenue. A card issuer is a bank or credit union that gives a consumer a card or account number that can be used with various payees to make payments and borrow money from the bank simultaneously...

rates are often tied to LIBOR; some estimate as much as $150 trillion in loans and derivatives

Derivative (finance)

A derivative instrument is a contract between two parties that specifies conditions—in particular, dates and the resulting values of the underlying variables—under which payments, or payoffs, are to be made between the parties.Under U.S...

are tied to LIBOR. Furthermore, the basis swap between one-month LIBOR and three-month LIBOR increased from 30 basis points in the beginning of September to a high of over 100 basis points. Financial institutions with liability exposure to 1 month LIBOR but funding from 3 month LIBOR faced increased funding costs. Overall, higher interest rates place additional downward pressure on consumption, increasing the risk of recession.

Further reading

- Stewart, James B.James B. StewartJames Bennett Stewart is an American lawyer, journalist, and author.-Life and career:Stewart was born in Quincy, Illinois. A graduate of DePauw University and Harvard Law School, James B. Stewart is a member of the Bar of New York and Bloomberg Professor of Business and Economic Journalism at the...

, "Eight Days: the battle to save the American financial system", The New YorkerThe New YorkerThe New Yorker is an American magazine of reportage, commentary, criticism, essays, fiction, satire, cartoons and poetry published by Condé Nast...

magazine, September 21, 2009.