Merrion v. Jicarilla Apache Tribe

Encyclopedia

Merrion v. Jicarilla Apache Tribe, 455 U.S. 130

(1982), was a case in which the Supreme Court of the United States

holding that an Indian tribe has the authority to impose taxes on non-Indians that are conducting business on the reservation as an inherent power under their tribal sovereignty.

The Jicarilla Apache Tribe

The Jicarilla Apache Tribe

is a Native American (Indian) tribe in northwestern New Mexico

on a reservation of 742315 acre (3,004 km²; 1,159.9 sq mi). The reservation was established by an Executive Order of President

Grover Cleveland

in 1887 and clarified by the Executive Orders of Presidents Theodore Roosevelt

in 1907 and William Howard Taft

in 1912. The tribe adopted a formal constitution under the provisions of the Indian Reorganization Act

, et seq. that provided for the taxation of members of the tribe and non-members of the tribe doing business on the reservation. If the tribe enacted a such tax ordinance on non-members, the ordinance had to be approved by the Secretary of the Interior

.

Beginning in 1953, the tribe entered into agreements with oil companies, including the plaintiffs Merrion and Bayless, to provide oil and gas leases. The leases were approved by the Commissioner of Indian Affairs (now the Bureau of Indian Affairs

, or BIA) in accordance with . As was the usual practice at the time, the oil companies negotiated directly with BIA, who then presented the contracts to the tribal council. While the oil and gas was from reservation land, Merrion paid severance tax

es to the state of New Mexico

under the provisions of , where Congress had authorized such taxation in 1927. The leases provided for royalties to be paid to the tribe, but the BIA was lax in collecting them. In 1973, tribal attorneys wrote to the BIA to demand the collection of royalties, and after a year delay, the BIA would only state that they were "looking into it." In 1976, the BIA approved a tribal ordinance that also provided for a severance tax. This tax was set at 29 cents (U.S.) per barrel of oil

and at 5 cents per million British thermal unit

s (BTU) for natural gas

.

for the District of New Mexico

, along with such major companies as Atlantic Richfield

(now part of BP

), Getty Oil

, Gulf Oil

, and Phillips Petroleum

(now ConocoPhillips

), among others. The case was not filed until 15 days before the severance tax was due. In the hearing on the temporary injunction

on June 17, 1977, Merrion argued that the tribe's severance tax was unconstitutional, violating the both the Commerce clause

and Equal protection clause

, and that it was both taxation without representation and double taxation. In addition, the plaintiffs argued against the entire concept of tribal sovereignty, stating that it had been a "legal fiction for decades." U.S. District Judge H. Vearle Payne granted the temporary injunction and set the hearing on the permanent injunction for August 29, 1977. The oil companies showed up with approximately 40-50 attorneys, compared to 2 or 3 lawyers for the tribe. Both sides made essentially the same arguments as for the temporary injunction. Following the hearing, District court ruled that the tribe's tax violated the Commerce clause of the Constitution

and that only state and local authorities had the ability to tax mineral rights on Indian reservations. The court then issued a permanent injunction

prohibiting the collection of the tax by the tribe.

. The western states of Utah

, New Mexico

, Montana

, North Dakota

and Wyoming

filed amici curiae briefs in support of the oil companies, while the Navajo Nation

, the Arapahoe Nation

, the Shoshone Indian Tribe

, the Assiniboine and Sioux Tribes

, the Three Affiliated Tribes of the Fort Berthold Reservation

, and the National Congress of American Indians

all filed briefs in support of the Jacrilla tribe. The case was heard on May 29, 1979 by a three-judge panel consisting of Chief Judge Oliver Seth

and Circuit Judges William Holloway, Jr.

and Monroe G. McKay

. The arguments were the same as at the district court level, with the oil companies stating that tribal sovereignty did not apply to taxation of non-Indians conducting business on the reservation. In an unusual move, no written decision was issued, and the attorneys were told to reargue the case en banc

. McKay stated that as he recalls, he and Holloway were in disagreement with Seth, who favored a limited view of the tribe's authority to tax the oil companies.

On September 12, 1979, the case was reheard before the entire panel. Following that hearing, in a 5-2 decision, the Tenth Circuit reversed the District Court, holding that the tribe had the inherent power under their tribal sovereignty to impose taxes on the reservation. The court also held that the tax did not violate the Commerce Clause nor place an undue burden on the oil companies.

to hear the case. This appeal came shortly after the Supreme Court had decided Oliphant v. Suquamish Indian Tribe

, , which had stated that an Indian tribe did not have the authority to try a non-Indian for a crime committed on the reservation. The Oliphant case was a major blow against tribal sovereignty, and was a case used by the oil companies in their briefs. The oil companies argued that Oliphant, currently limited to criminal cases, should be expanded to civil matters as well. The attorneys for the tribe argued that this case was no different than Washington v. Confederated Tribes of Colville Indian Reservation, , which stated that tribes had the authority to impose a cigarette tax on both tribal members and non-Indians alike. Amici briefs were filed by Montana, North Dakota, Utah, Wyoming, New Mexico, Washington (state), the Mountain States Legal Foundation

, the Salt River Project Agricultural Improvement and Power District, Shell Oil

, and Westmoreland Resources in support of the oil companies. The Council of Energy Resource Tribes

and the Navajo Nation

filed briefs supporting the tribe.

Arguing for Mellion and Bayless was Jason W. Kellahin, for Amoco

and Marathon Oil

was John R. Cooney (originally a separate case, but which was consolidated with this case), for the tribe was Robert J. Nordhaus, and on behalf of the tribe for the Solicitor General was Louis F. Claiborne. Kellahin argued that tribal sovereignty only extended to members of the tribe, citing both Oliphant and Montana v. United States

, , both cases involving the jurisdiction of a tribal court over non-Indians. Kellahin stated that those cases that allowed a tribe to tax non-Indians were not due to tribal sovereignty, but were connected with the authority of the tribe to regulate who could enter the reservation, in the same manner as a landlord controlled their property. Cooney argued that the tax was a violation of the Commerce Clause, in that Congress

divested the tribes of that authority when they enacted granting the states the right to impose a severance tax on reservation lands. Nordhaus, in arguing for the tribe, pointed out that there was first, no Congressional preemption of the tribal authority to tax, and that second, taxation was an inherent power of tribal sovereignty. Claiborne first distinguished Montana, noting that it dealt with non-Indians on fee land

owned by non-Indians that happened to be within the boundaries of the reservation, something that was completely unrelated to the current case.

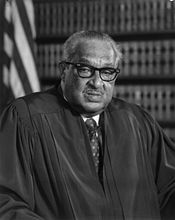

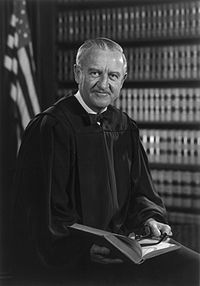

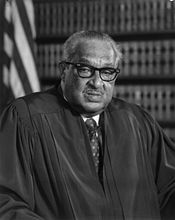

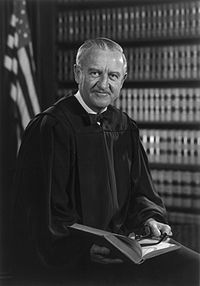

to write the majority opinion

and Justice William J. Brennan, Jr.

asked Justice Thurgood Marshall

to write the minority or dissenting opinion

, based on the initial count of the justices' views. Since Justice Potter Stewart

did not participate in the case, it would take a 5-3 vote to overturn the decision of the Circuit Court. Stevens circulated a memorandum stating that his decision would be to invalidate the tax - Chief Justice Warren Burger and Justice William Rehnquist

immediately stated they would join his opinion. Justice Byron White

stated that he would wait and see what the dissent said, and then indicated he would join the dissent in part. It also appeared that Justice Harry Blackmun

was also going to write a separate dissent, but he also stated that he would wait to see Marshall's opinion. At this point, the tribe had the votes to win on a 4-4 vote, but the Court was close to being adjourned for the summer recess. On July 3, 1981, the Court notified the parties to reargue the case on November 4, 1981.

In the meantime, the Court had changed. Justice Stewart retired, and President

Ronald Reagan

had appointed Sandra Day O'Connor

to replace him. During the re-argument, Kellahin began with the fact the New Mexico was acquired via the Treaty of Guadalupe Hildalgo and that neither Spain

or Mexico

recognized Indian title and claimed that the tax was a veiled attempt to increase royalty payments. Cooney argued that there was no authority in statute for the Secretary of the Interior to approve a tribal tax and that the 1927 statute preempted the tribes authority in favor of the states being empowered to apply a severance tax on reservations. Nordhaus stated that the argument about the Treaty of Guadalupe Hildalgo did not apply, since no branch of the federal government had ever differentiated between these tribes and other tribes. The case was then submitted to the court.

Justice Thurgood Marshall delivered the opinion of the court. Marshall noted that the tribe had a properly formed constitution, approved by the Secretary of the Interior, and that it included that the tribal council may impose taxes on non-members doing business on the reservation. He noted that the tribe had executed oil and gas leases for about 69% of the reservation and that the leases provided for royalties to be paid to the tribe. Marshall further noted that the tribe followed the proper process to enact a severance tax, obtaining the approval of the BIA as part of the process. The first argument of the oil companies that the power to tax only arose from the power of the tribe to exclude persons from the reservation. Marshall disagreed, stating that the power to tax is an inherent attribute of a tribe's sovereignty. Tribal government includes the need to provide for services, not only to the tribe, but to anyone doing business on the reservation. He noted that the oil companies benefited from police protection and other governmental services. Citing Colville, he stated that the tribe's interest in raising "revenues for essential governmental programs . . . is strongest when the revenues are derived from value generated on the reservation by activities involving the Tribes and when the taxpayer is the recipient of tribal services." Marshall noted that Congress was able to remove this power, but had not done so, and had acknowledged in 1879 the power of the Cherokee Nation

Justice Thurgood Marshall delivered the opinion of the court. Marshall noted that the tribe had a properly formed constitution, approved by the Secretary of the Interior, and that it included that the tribal council may impose taxes on non-members doing business on the reservation. He noted that the tribe had executed oil and gas leases for about 69% of the reservation and that the leases provided for royalties to be paid to the tribe. Marshall further noted that the tribe followed the proper process to enact a severance tax, obtaining the approval of the BIA as part of the process. The first argument of the oil companies that the power to tax only arose from the power of the tribe to exclude persons from the reservation. Marshall disagreed, stating that the power to tax is an inherent attribute of a tribe's sovereignty. Tribal government includes the need to provide for services, not only to the tribe, but to anyone doing business on the reservation. He noted that the oil companies benefited from police protection and other governmental services. Citing Colville, he stated that the tribe's interest in raising "revenues for essential governmental programs . . . is strongest when the revenues are derived from value generated on the reservation by activities involving the Tribes and when the taxpayer is the recipient of tribal services." Marshall noted that Congress was able to remove this power, but had not done so, and had acknowledged in 1879 the power of the Cherokee Nation

to tax non-Indians.

Marshall further noted the oil companies' arguments that a lease would prevent a governmental body from later imposing a tax would denigrate tribal sovereignty, and that tribal sovereignty was not limited by contractual arrangements. Only the Federal government has the authority to limit the powers of a tribal government, and a non-Indian's consent is not needed (by contract or otherwise) to exercise its sovereignty, to the contrary, the tribe may set conditions and limits on the non-Indian as a matter of right. "To presume that a sovereign forever waives the right to exercise one of its sovereign powers unless it expressly reserves the right to exercise that power in a commercial agreement turns the concept of sovereignty on its head."

Marshall then addressed the Commerce Clause issues, and the argument of the Solicitor General that the section of the Commerce Clause that dealt directly with Indians applied rather than the argument of the oil companies that the section dealing with interstate commerce applied. First, Marshall noted that the case history of the Indian Commerce Clause was to protect the tribes from state infringement, not to approve of Indian trade without constitutional restraint. He saw of no reason to begin now, especially since he did not find that the tribe's severance tax did not have negative implications on interstate commerce. In a 6-3 decision, Marshall found that the tribe had the right to impose such a tax on non-Indians.

Justice John Paul Stevens, joined by Chief Justice Burger and Justice Rehnquist, dissented from the majority opinion. Stevens noted that over its own members, a tribe has virtually unlimited sovereignty. Over non-Indians, a tribe had no power, but many tribes were granted the authority to exclude non-Indians from their reservations. Stevens also noted that the various statutes that were passed in regards to mineral rights and leases were silent as to the authority of a tribe to impose taxes. Therefore authority must come from one of three sources, federal statutes, treaties, and inherent tribal sovereignty. He noted that in matters involving their own members, the tribe could act in manners that the federal government could not, such as discriminating against females in citizenship cases (citing Santa Clara Pueblo v. Martinez

Justice John Paul Stevens, joined by Chief Justice Burger and Justice Rehnquist, dissented from the majority opinion. Stevens noted that over its own members, a tribe has virtually unlimited sovereignty. Over non-Indians, a tribe had no power, but many tribes were granted the authority to exclude non-Indians from their reservations. Stevens also noted that the various statutes that were passed in regards to mineral rights and leases were silent as to the authority of a tribe to impose taxes. Therefore authority must come from one of three sources, federal statutes, treaties, and inherent tribal sovereignty. He noted that in matters involving their own members, the tribe could act in manners that the federal government could not, such as discriminating against females in citizenship cases (citing Santa Clara Pueblo v. Martinez

). Tribal authority over non-members was always severely limited, in both a civil and criminal context, and he viewed both Oliphant and Montana as controlling in this area also. He viewed the authority to tax as merely an adjunct to the tribe's right to exclude individuals from the reservation. Since the leases were entered into by the tribe voluntarily, the tribe cannot enact later taxes without the consent of the oil companies. Stevens would have reversed the Circuit Court.

articles as of July 2010. Almost all tribes that have mineral deposits now impose a severance tax, based on the Merrion decision and has been used as the basis for subsequent decisions supporting tribal taxing authority. Numerous books also mention the case, whether in regards to tribal sovereignty or taxation.

Case citation

Case citation is the system used in many countries to identify the decisions in past court cases, either in special series of books called reporters or law reports, or in a 'neutral' form which will identify a decision wherever it was reported...

(1982), was a case in which the Supreme Court of the United States

Supreme Court of the United States

The Supreme Court of the United States is the highest court in the United States. It has ultimate appellate jurisdiction over all state and federal courts, and original jurisdiction over a small range of cases...

holding that an Indian tribe has the authority to impose taxes on non-Indians that are conducting business on the reservation as an inherent power under their tribal sovereignty.

History

Jicarilla Apache

Jicarilla Apache refers to the members of the Jicarilla Apache Nation currently living in New Mexico and speaking a Southern Athabaskan language...

is a Native American (Indian) tribe in northwestern New Mexico

New Mexico

New Mexico is a state located in the southwest and western regions of the United States. New Mexico is also usually considered one of the Mountain States. With a population density of 16 per square mile, New Mexico is the sixth-most sparsely inhabited U.S...

on a reservation of 742315 acre (3,004 km²; 1,159.9 sq mi). The reservation was established by an Executive Order of President

President of the United States

The President of the United States of America is the head of state and head of government of the United States. The president leads the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces....

Grover Cleveland

Grover Cleveland

Stephen Grover Cleveland was the 22nd and 24th president of the United States. Cleveland is the only president to serve two non-consecutive terms and therefore is the only individual to be counted twice in the numbering of the presidents...

in 1887 and clarified by the Executive Orders of Presidents Theodore Roosevelt

Theodore Roosevelt

Theodore "Teddy" Roosevelt was the 26th President of the United States . He is noted for his exuberant personality, range of interests and achievements, and his leadership of the Progressive Movement, as well as his "cowboy" persona and robust masculinity...

in 1907 and William Howard Taft

William Howard Taft

William Howard Taft was the 27th President of the United States and later the tenth Chief Justice of the United States...

in 1912. The tribe adopted a formal constitution under the provisions of the Indian Reorganization Act

Indian Reorganization Act

The Indian Reorganization Act of June 18, 1934 the Indian New Deal, was U.S. federal legislation that secured certain rights to Native Americans, including Alaska Natives...

, et seq. that provided for the taxation of members of the tribe and non-members of the tribe doing business on the reservation. If the tribe enacted a such tax ordinance on non-members, the ordinance had to be approved by the Secretary of the Interior

United States Secretary of the Interior

The United States Secretary of the Interior is the head of the United States Department of the Interior.The US Department of the Interior should not be confused with the concept of Ministries of the Interior as used in other countries...

.

Beginning in 1953, the tribe entered into agreements with oil companies, including the plaintiffs Merrion and Bayless, to provide oil and gas leases. The leases were approved by the Commissioner of Indian Affairs (now the Bureau of Indian Affairs

Bureau of Indian Affairs

The Bureau of Indian Affairs is an agency of the federal government of the United States within the US Department of the Interior. It is responsible for the administration and management of of land held in trust by the United States for Native Americans in the United States, Native American...

, or BIA) in accordance with . As was the usual practice at the time, the oil companies negotiated directly with BIA, who then presented the contracts to the tribal council. While the oil and gas was from reservation land, Merrion paid severance tax

Severance tax

Severance taxes are incurred when non-renewable natural resources are separated from a taxing jurisdiction. Industries that typically incur such taxes are oil and gas, coal, mining, and timber industries....

es to the state of New Mexico

New Mexico

New Mexico is a state located in the southwest and western regions of the United States. New Mexico is also usually considered one of the Mountain States. With a population density of 16 per square mile, New Mexico is the sixth-most sparsely inhabited U.S...

under the provisions of , where Congress had authorized such taxation in 1927. The leases provided for royalties to be paid to the tribe, but the BIA was lax in collecting them. In 1973, tribal attorneys wrote to the BIA to demand the collection of royalties, and after a year delay, the BIA would only state that they were "looking into it." In 1976, the BIA approved a tribal ordinance that also provided for a severance tax. This tax was set at 29 cents (U.S.) per barrel of oil

Petroleum

Petroleum or crude oil is a naturally occurring, flammable liquid consisting of a complex mixture of hydrocarbons of various molecular weights and other liquid organic compounds, that are found in geologic formations beneath the Earth's surface. Petroleum is recovered mostly through oil drilling...

and at 5 cents per million British thermal unit

British thermal unit

The British thermal unit is a traditional unit of energy equal to about 1055 joules. It is approximately the amount of energy needed to heat of water, which is exactly one tenth of a UK gallon or about 0.1198 US gallons, from 39°F to 40°F...

s (BTU) for natural gas

Natural gas

Natural gas is a naturally occurring gas mixture consisting primarily of methane, typically with 0–20% higher hydrocarbons . It is found associated with other hydrocarbon fuel, in coal beds, as methane clathrates, and is an important fuel source and a major feedstock for fertilizers.Most natural...

.

District court

Merrion did not want to pay a severance tax to both New Mexico and the tribe, and filed suit in the United States District CourtUnited States district court

The United States district courts are the general trial courts of the United States federal court system. Both civil and criminal cases are filed in the district court, which is a court of law, equity, and admiralty. There is a United States bankruptcy court associated with each United States...

for the District of New Mexico

United States District Court for the District of New Mexico

The United States District Court for the District of New Mexico is the federal district court whose jurisdiction comprises the state of New Mexico...

, along with such major companies as Atlantic Richfield

ARCO

Atlantic Richfield Company is an oil company with operations in the United States as well as in Indonesia, the North Sea, and the South China Sea. It has more than 1,300 gas stations in the western part of the United States. ARCO was originally formed by the merger of East Coast-based Atlantic...

(now part of BP

BP

BP p.l.c. is a global oil and gas company headquartered in London, United Kingdom. It is the third-largest energy company and fourth-largest company in the world measured by revenues and one of the six oil and gas "supermajors"...

), Getty Oil

Getty Oil

Getty Oil is an oil company founded by J. Paul Getty. It was at its height during the 1960s. In 1971, the Getty Realty division was formed to manage the real estate needs of Getty stations. The division was later spun off, but now owns the rights to the Getty brand...

, Gulf Oil

Gulf Oil

Gulf Oil was a major global oil company from the 1900s to the 1980s. The eighth-largest American manufacturing company in 1941 and the ninth-largest in 1979, Gulf Oil was one of the so-called Seven Sisters oil companies...

, and Phillips Petroleum

Phillips Petroleum

Phillips Petroleum Company was founded in 1917 by L.E. Phillips and Frank Phillips, of Bartlesville, Oklahoma. Their younger brother Waite Phillips was the benefactor of Philmont Scout Ranch....

(now ConocoPhillips

ConocoPhillips

ConocoPhillips Company is an American multinational energy corporation with its headquarters located in the Energy Corridor district of Houston, Texas in the United States...

), among others. The case was not filed until 15 days before the severance tax was due. In the hearing on the temporary injunction

Injunction

An injunction is an equitable remedy in the form of a court order that requires a party to do or refrain from doing certain acts. A party that fails to comply with an injunction faces criminal or civil penalties and may have to pay damages or accept sanctions...

on June 17, 1977, Merrion argued that the tribe's severance tax was unconstitutional, violating the both the Commerce clause

Commerce Clause

The Commerce Clause is an enumerated power listed in the United States Constitution . The clause states that the United States Congress shall have power "To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes." Courts and commentators have tended to...

and Equal protection clause

Equal Protection Clause

The Equal Protection Clause, part of the Fourteenth Amendment to the United States Constitution, provides that "no state shall ... deny to any person within its jurisdiction the equal protection of the laws"...

, and that it was both taxation without representation and double taxation. In addition, the plaintiffs argued against the entire concept of tribal sovereignty, stating that it had been a "legal fiction for decades." U.S. District Judge H. Vearle Payne granted the temporary injunction and set the hearing on the permanent injunction for August 29, 1977. The oil companies showed up with approximately 40-50 attorneys, compared to 2 or 3 lawyers for the tribe. Both sides made essentially the same arguments as for the temporary injunction. Following the hearing, District court ruled that the tribe's tax violated the Commerce clause of the Constitution

United States Constitution

The Constitution of the United States is the supreme law of the United States of America. It is the framework for the organization of the United States government and for the relationship of the federal government with the states, citizens, and all people within the United States.The first three...

and that only state and local authorities had the ability to tax mineral rights on Indian reservations. The court then issued a permanent injunction

Injunction

An injunction is an equitable remedy in the form of a court order that requires a party to do or refrain from doing certain acts. A party that fails to comply with an injunction faces criminal or civil penalties and may have to pay damages or accept sanctions...

prohibiting the collection of the tax by the tribe.

Circuit court

The case then went to the Tenth Circuit Court of AppealsUnited States Court of Appeals for the Tenth Circuit

The United States Court of Appeals for the Tenth Circuit is a federal court with appellate jurisdiction over the district courts in the following districts:* District of Colorado* District of Kansas...

. The western states of Utah

Utah

Utah is a state in the Western United States. It was the 45th state to join the Union, on January 4, 1896. Approximately 80% of Utah's 2,763,885 people live along the Wasatch Front, centering on Salt Lake City. This leaves vast expanses of the state nearly uninhabited, making the population the...

, New Mexico

New Mexico

New Mexico is a state located in the southwest and western regions of the United States. New Mexico is also usually considered one of the Mountain States. With a population density of 16 per square mile, New Mexico is the sixth-most sparsely inhabited U.S...

, Montana

Montana

Montana is a state in the Western United States. The western third of Montana contains numerous mountain ranges. Smaller, "island ranges" are found in the central third of the state, for a total of 77 named ranges of the Rocky Mountains. This geographical fact is reflected in the state's name,...

, North Dakota

North Dakota

North Dakota is a state located in the Midwestern region of the United States of America, along the Canadian border. The state is bordered by Canada to the north, Minnesota to the east, South Dakota to the south and Montana to the west. North Dakota is the 19th-largest state by area in the U.S....

and Wyoming

Wyoming

Wyoming is a state in the mountain region of the Western United States. The western two thirds of the state is covered mostly with the mountain ranges and rangelands in the foothills of the Eastern Rocky Mountains, while the eastern third of the state is high elevation prairie known as the High...

filed amici curiae briefs in support of the oil companies, while the Navajo Nation

Navajo Nation

The Navajo Nation is a semi-autonomous Native American-governed territory covering , occupying all of northeastern Arizona, the southeastern portion of Utah, and northwestern New Mexico...

, the Arapahoe Nation

Arapaho

The Arapaho are a tribe of Native Americans historically living on the eastern plains of Colorado and Wyoming. They were close allies of the Cheyenne tribe and loosely aligned with the Sioux. Arapaho is an Algonquian language closely related to Gros Ventre, whose people are seen as an early...

, the Shoshone Indian Tribe

Western Shoshone

Western Shoshone comprises several Shoshone tribes that are indigenous to the Great Basin and have lands identified in the Treaty of Ruby Valley 1863. They resided in Idaho, Nevada, California, and Utah. The tribes are very closely related culturally to the Paiute, Goshute, Bannock, Ute, and...

, the Assiniboine and Sioux Tribes

Fort Peck Indian Reservation

The Fort Peck Indian Reservation is near Fort Peck, Montana. It is the homeland of the Assiniboine and Sioux tribes of Native Americans. It is the ninth-largest Indian reservation in the United States and comprises parts of four counties. In descending order of land area they are Roosevelt, Valley,...

, the Three Affiliated Tribes of the Fort Berthold Reservation

Mandan, Hidatsa, and Arikara Nation

Mandan, Hidatsa, and Arikara Nation, also known as the Three Affiliated Tribes, are a Native American group comprising a union of the Mandan, Hidatsa, and Arikara peoples, whose native lands ranged across the Missouri River basin in the Dakotas...

, and the National Congress of American Indians

National Congress of American Indians

The National Congress of American Indians is a American Indian and Alaska Native indigenous rights organization. It was founded in 1944 in response to termination and assimilation policies that the U.S. government forced upon the tribal governments in contradiction of their treaty rights and...

all filed briefs in support of the Jacrilla tribe. The case was heard on May 29, 1979 by a three-judge panel consisting of Chief Judge Oliver Seth

Oliver Seth

Oliver Seth was a United States federal judge.Born in Albuquerque, New Mexico, Seth received a B.A. from Stanford University in 1937 and an LL.B. from Yale Law School in 1940. He was in private practice in Santa Fe, New Mexico in 1940. He was in the United States Army Major from 1940 to 1946...

and Circuit Judges William Holloway, Jr.

William Judson Holloway, Jr.

William Judson Holloway, Jr. is a United States federal judge.Born in Hugo, Oklahoma, Holloway was in the United States Army during World War II, from 1943 to 1946. He received an A.B. from the University of Oklahoma in 1947 and an LL.B. from Harvard Law School in 1950. He was in private practice...

and Monroe G. McKay

Monroe G. McKay

Monroe G. McKay is a United States federal judge.Born in Huntsville, Utah, McKay was a member of The Church of Jesus Christ of Latter-day Saints . His cousin, David O. McKay, became the president and prophet of the LDS Church in 1951. Around that time, Monroe was serving as a young LDS...

. The arguments were the same as at the district court level, with the oil companies stating that tribal sovereignty did not apply to taxation of non-Indians conducting business on the reservation. In an unusual move, no written decision was issued, and the attorneys were told to reargue the case en banc

En banc

En banc, in banc, in banco or in bank is a French term used to refer to the hearing of a legal case where all judges of a court will hear the case , rather than a panel of them. It is often used for unusually complex cases or cases considered to be of greater importance...

. McKay stated that as he recalls, he and Holloway were in disagreement with Seth, who favored a limited view of the tribe's authority to tax the oil companies.

On September 12, 1979, the case was reheard before the entire panel. Following that hearing, in a 5-2 decision, the Tenth Circuit reversed the District Court, holding that the tribe had the inherent power under their tribal sovereignty to impose taxes on the reservation. The court also held that the tax did not violate the Commerce Clause nor place an undue burden on the oil companies.

Initial arguments

The oil companies immediately appealed and the United States Supreme Court granted certiorariCertiorari

Certiorari is a type of writ seeking judicial review, recognized in U.S., Roman, English, Philippine, and other law. Certiorari is the present passive infinitive of the Latin certiorare...

to hear the case. This appeal came shortly after the Supreme Court had decided Oliphant v. Suquamish Indian Tribe

Oliphant v. Suquamish Indian Tribe

Oliphant v. Suquamish Indian Tribe, 435 U.S. 191 is a United States Supreme Court case regarding the criminal jurisdiction of Tribal courts over non-Indians. The case was decided on March 6, 1978, with a 6-2 majority. The court opinion was written by William Rehnquist; a dissenting opinion was...

, , which had stated that an Indian tribe did not have the authority to try a non-Indian for a crime committed on the reservation. The Oliphant case was a major blow against tribal sovereignty, and was a case used by the oil companies in their briefs. The oil companies argued that Oliphant, currently limited to criminal cases, should be expanded to civil matters as well. The attorneys for the tribe argued that this case was no different than Washington v. Confederated Tribes of Colville Indian Reservation, , which stated that tribes had the authority to impose a cigarette tax on both tribal members and non-Indians alike. Amici briefs were filed by Montana, North Dakota, Utah, Wyoming, New Mexico, Washington (state), the Mountain States Legal Foundation

Mountain States Legal Foundation

Mountain States Legal Foundation is a nonprofit, public-interest law firm dedicated to individual liberty, the right to own and use property, limited and ethical government, and economic freedom...

, the Salt River Project Agricultural Improvement and Power District, Shell Oil

Royal Dutch Shell

Royal Dutch Shell plc , commonly known as Shell, is a global oil and gas company headquartered in The Hague, Netherlands and with its registered office in London, United Kingdom. It is the fifth-largest company in the world according to a composite measure by Forbes magazine and one of the six...

, and Westmoreland Resources in support of the oil companies. The Council of Energy Resource Tribes

Council of Energy Resource Tribes

The Council of Energy Resource Tribes is a consortium of Native American tribes in the United States established to increase tribal control over natural resources...

and the Navajo Nation

Navajo Nation

The Navajo Nation is a semi-autonomous Native American-governed territory covering , occupying all of northeastern Arizona, the southeastern portion of Utah, and northwestern New Mexico...

filed briefs supporting the tribe.

Arguing for Mellion and Bayless was Jason W. Kellahin, for Amoco

Amoco

Amoco Corporation, originally Standard Oil Company , was a global chemical and oil company, founded in 1889 around a refinery located in Whiting, Indiana, United States....

and Marathon Oil

Marathon Oil

Marathon Oil Corporation is a United States-based oil and natural gas exploration and production company. Principal exploration activities are in the United States, Norway, Equatorial Guinea, Angola and Canada. Principal development activities are in the United States, the United Kingdom, Norway,...

was John R. Cooney (originally a separate case, but which was consolidated with this case), for the tribe was Robert J. Nordhaus, and on behalf of the tribe for the Solicitor General was Louis F. Claiborne. Kellahin argued that tribal sovereignty only extended to members of the tribe, citing both Oliphant and Montana v. United States

Montana v. United States

Montana v. United States, 450 U.S. 544 is a Supreme Court case which addressed the Crow Nation’s ability to regulate hunting and fishing on tribal lands by a non-tribal member. The case considered several important issues concerning tribes' treaty rights and sovereign governing authority on Indian...

, , both cases involving the jurisdiction of a tribal court over non-Indians. Kellahin stated that those cases that allowed a tribe to tax non-Indians were not due to tribal sovereignty, but were connected with the authority of the tribe to regulate who could enter the reservation, in the same manner as a landlord controlled their property. Cooney argued that the tax was a violation of the Commerce Clause, in that Congress

United States Congress

The United States Congress is the bicameral legislature of the federal government of the United States, consisting of the Senate and the House of Representatives. The Congress meets in the United States Capitol in Washington, D.C....

divested the tribes of that authority when they enacted granting the states the right to impose a severance tax on reservation lands. Nordhaus, in arguing for the tribe, pointed out that there was first, no Congressional preemption of the tribal authority to tax, and that second, taxation was an inherent power of tribal sovereignty. Claiborne first distinguished Montana, noting that it dealt with non-Indians on fee land

Fee simple

In English law, a fee simple is an estate in land, a form of freehold ownership. It is the most common way that real estate is owned in common law countries, and is ordinarily the most complete ownership interest that can be had in real property short of allodial title, which is often reserved...

owned by non-Indians that happened to be within the boundaries of the reservation, something that was completely unrelated to the current case.

Re-argument

Following the oral argument, the Chief Justice assigned Justice John Paul StevensJohn Paul Stevens

John Paul Stevens served as an Associate Justice of the Supreme Court of the United States from December 19, 1975 until his retirement on June 29, 2010. At the time of his retirement, he was the oldest member of the Court and the third-longest serving justice in the Court's history...

to write the majority opinion

Majority opinion

In law, a majority opinion is a judicial opinion agreed to by more than half of the members of a court. A majority opinion sets forth the decision of the court and an explanation of the rationale behind the court's decision....

and Justice William J. Brennan, Jr.

William J. Brennan, Jr.

William Joseph Brennan, Jr. was an American jurist who served as an Associate Justice of the United States Supreme Court from 1956 to 1990...

asked Justice Thurgood Marshall

Thurgood Marshall

Thurgood Marshall was an Associate Justice of the United States Supreme Court, serving from October 1967 until October 1991...

to write the minority or dissenting opinion

Dissenting opinion

A dissenting opinion is an opinion in a legal case written by one or more judges expressing disagreement with the majority opinion of the court which gives rise to its judgment....

, based on the initial count of the justices' views. Since Justice Potter Stewart

Potter Stewart

Potter Stewart was an Associate Justice of the United States Supreme Court. During his tenure, he made, among other areas, major contributions to criminal justice reform, civil rights, access to the courts, and Fourth Amendment jurisprudence.-Education:Stewart was born in Jackson, Michigan,...

did not participate in the case, it would take a 5-3 vote to overturn the decision of the Circuit Court. Stevens circulated a memorandum stating that his decision would be to invalidate the tax - Chief Justice Warren Burger and Justice William Rehnquist

William Rehnquist

William Hubbs Rehnquist was an American lawyer, jurist, and political figure who served as an Associate Justice on the Supreme Court of the United States and later as the 16th Chief Justice of the United States...

immediately stated they would join his opinion. Justice Byron White

Byron White

Byron Raymond "Whizzer" White won fame both as a football halfback and as an associate justice of the Supreme Court of the United States. Appointed to the court by President John F. Kennedy in 1962, he served until his retirement in 1993...

stated that he would wait and see what the dissent said, and then indicated he would join the dissent in part. It also appeared that Justice Harry Blackmun

Harry Blackmun

Harold Andrew Blackmun was an Associate Justice of the Supreme Court of the United States from 1970 until 1994. He is best known as the author of Roe v. Wade.- Early years and professional career :...

was also going to write a separate dissent, but he also stated that he would wait to see Marshall's opinion. At this point, the tribe had the votes to win on a 4-4 vote, but the Court was close to being adjourned for the summer recess. On July 3, 1981, the Court notified the parties to reargue the case on November 4, 1981.

In the meantime, the Court had changed. Justice Stewart retired, and President

President of the United States

The President of the United States of America is the head of state and head of government of the United States. The president leads the executive branch of the federal government and is the commander-in-chief of the United States Armed Forces....

Ronald Reagan

Ronald Reagan

Ronald Wilson Reagan was the 40th President of the United States , the 33rd Governor of California and, prior to that, a radio, film and television actor....

had appointed Sandra Day O'Connor

Sandra Day O'Connor

Sandra Day O'Connor is an American jurist who was the first female member of the Supreme Court of the United States. She served as an Associate Justice from 1981 until her retirement from the Court in 2006. O'Connor was appointed by President Ronald Reagan in 1981...

to replace him. During the re-argument, Kellahin began with the fact the New Mexico was acquired via the Treaty of Guadalupe Hildalgo and that neither Spain

Spain

Spain , officially the Kingdom of Spain languages]] under the European Charter for Regional or Minority Languages. In each of these, Spain's official name is as follows:;;;;;;), is a country and member state of the European Union located in southwestern Europe on the Iberian Peninsula...

or Mexico

Mexico

The United Mexican States , commonly known as Mexico , is a federal constitutional republic in North America. It is bordered on the north by the United States; on the south and west by the Pacific Ocean; on the southeast by Guatemala, Belize, and the Caribbean Sea; and on the east by the Gulf of...

recognized Indian title and claimed that the tax was a veiled attempt to increase royalty payments. Cooney argued that there was no authority in statute for the Secretary of the Interior to approve a tribal tax and that the 1927 statute preempted the tribes authority in favor of the states being empowered to apply a severance tax on reservations. Nordhaus stated that the argument about the Treaty of Guadalupe Hildalgo did not apply, since no branch of the federal government had ever differentiated between these tribes and other tribes. The case was then submitted to the court.

Majority opinion

Cherokee Nation

The Cherokee Nation is the largest of three Cherokee federally recognized tribes in the United States. It was established in the 20th century, and includes people descended from members of the old Cherokee Nation who relocated voluntarily from the Southeast to Indian Territory and Cherokees who...

to tax non-Indians.

Marshall further noted the oil companies' arguments that a lease would prevent a governmental body from later imposing a tax would denigrate tribal sovereignty, and that tribal sovereignty was not limited by contractual arrangements. Only the Federal government has the authority to limit the powers of a tribal government, and a non-Indian's consent is not needed (by contract or otherwise) to exercise its sovereignty, to the contrary, the tribe may set conditions and limits on the non-Indian as a matter of right. "To presume that a sovereign forever waives the right to exercise one of its sovereign powers unless it expressly reserves the right to exercise that power in a commercial agreement turns the concept of sovereignty on its head."

Marshall then addressed the Commerce Clause issues, and the argument of the Solicitor General that the section of the Commerce Clause that dealt directly with Indians applied rather than the argument of the oil companies that the section dealing with interstate commerce applied. First, Marshall noted that the case history of the Indian Commerce Clause was to protect the tribes from state infringement, not to approve of Indian trade without constitutional restraint. He saw of no reason to begin now, especially since he did not find that the tribe's severance tax did not have negative implications on interstate commerce. In a 6-3 decision, Marshall found that the tribe had the right to impose such a tax on non-Indians.

Dissent

Santa Clara Pueblo v. Martinez

Santa Clara Pueblo v. Martinez, 436 U.S. 49 , involved a request to stop denying tribal membership to those children born to female tribal members who married outside of the tribe. The mother who made the case pleaded that the discrimination against her child was solely based on sex, which...

). Tribal authority over non-members was always severely limited, in both a civil and criminal context, and he viewed both Oliphant and Montana as controlling in this area also. He viewed the authority to tax as merely an adjunct to the tribe's right to exclude individuals from the reservation. Since the leases were entered into by the tribe voluntarily, the tribe cannot enact later taxes without the consent of the oil companies. Stevens would have reversed the Circuit Court.

Subsequent developments

Almost immediately after the decision, the BIA, on directions from Assistant Secretary of the Interior Kenneth Smith, proposed federal regulations that would have severely limited the ability of the tribes to impose severance taxes. Following numerous complaints from the tribes, the BIA abandoned that plan. The Jicarilla tribe has also purchased the Palmer Oil Company, becoming the first Indian tribe to have 100% ownership of an oil production firm. The case is a landmark case in Native American case law, having been cited in approximately 400 law reviewLaw review

A law review is a scholarly journal focusing on legal issues, normally published by an organization of students at a law school or through a bar association...

articles as of July 2010. Almost all tribes that have mineral deposits now impose a severance tax, based on the Merrion decision and has been used as the basis for subsequent decisions supporting tribal taxing authority. Numerous books also mention the case, whether in regards to tribal sovereignty or taxation.

External links

- Merrion v. Jicarilla Apache Tribe, , text of the opinion, courtesy of FindLaw.Com