Causes of the financial crisis of 2007–2009

Encyclopedia

Many factors directly and indirectly caused the ongoing Financial crisis of 2007–10 (which started with the US subprime mortgage crisis

), with experts placing different weights upon particular causes. The complexity and interdependence of many of the causes, as well as competing political, economic and organizational interests, have resulted in a variety of narratives describing the crisis. One category of causes created a vulnerable or fragile financial system, including complex financial securities, a dependence on short-term funding markets, and international trade imbalances. Other causes increased the stress on this fragile system, such as high corporate and consumer debt levels. Still others represent shocks to that system, such as the ongoing foreclosure crisis and the failures of key financial institutions. Regulatory and market-based controls did not effectively protect this system or measure the buildup of risk. Some causes relate to particular markets, such as the stock market or housing market, while others relate to the global economy more broadly.

The U.S. Financial Crisis Inquiry Commission

reported its findings in January 2011. It concluded that "the crisis was avoidable and was caused by: Widespread failures in financial regulation, including the Federal Reserve’s failure to stem the tide of toxic mortgages; Dramatic breakdowns in corporate governance including too many financial firms acting recklessly and taking on too much risk; An explosive mix of excessive borrowing and risk by households and Wall Street that put the financial system on a collision course with crisis; Key policy makers ill prepared for the crisis, lacking a full understanding of the financial system they oversaw; and systemic breaches in accountability and ethics at all levels.“

s secured by the price appreciation.

By September 2008, average U.S. housing prices had declined by over 20% from their mid-2006 peak. Easy credit, and a belief that house prices would continue to appreciate, had encouraged many subprime borrowers to obtain adjustable-rate mortgages. These mortgages enticed borrowers with a below market interest rate for some predetermined period, followed by market interest rates for the remainder of the mortgage's term. Borrowers who could not make the higher payments once the initial grace period ended would try to refinance their mortgages. Refinancing became more difficult, once house prices began to decline in many parts of the USA. Borrowers who found themselves unable to escape higher monthly payments by refinancing began to default. During 2007, lenders had begun foreclosure proceedings on nearly 1.3 million properties, a 79% increase over 2006. This increased to 2.3 million in 2008, an 81% increase vs. 2007. As of August 2008, 9.2% of all mortgages outstanding were either delinquent or in foreclosure.

The Economist

described the issue this way: "No part of the financial crisis has received so much attention, with so little to show for it, as the tidal wave of home foreclosures sweeping over America. Government programmes have been ineffectual, and private efforts not much better." Up to 9 million homes may enter foreclosure over the 2009-2011 period, versus one million in a typical year. At roughly U.S. $50,000 per foreclosure according to a 2006 study by the Chicago Federal Reserve Bank, 9 million foreclosures represents $450 billion in losses.

In addition to easy credit conditions, there is evidence that both government and competitive pressures contributed to an increase in the amount of subprime lending during the years preceding the crisis. Major U.S. investment banks and government sponsored enterprises like Fannie Mae played an important role in the expansion of higher-risk lending.

In addition to easy credit conditions, there is evidence that both government and competitive pressures contributed to an increase in the amount of subprime lending during the years preceding the crisis. Major U.S. investment banks and government sponsored enterprises like Fannie Mae played an important role in the expansion of higher-risk lending.

The term subprime refers to the credit quality of particular borrowers, who have weakened credit histories and a greater risk of loan default than prime borrowers. The value of U.S. subprime mortgages was estimated at $1.3 trillion as of March 2007, with over 7.5 million first-lien

subprime mortgages outstanding.

Subprime mortgages remained below 10% of all mortgage originations until 2004, when they spiked to nearly 20% and remained there through the 2005-2006 peak of the United States housing bubble

. A proximate event to this increase was the April 2004 decision by the U.S. Securities and Exchange Commission (SEC) to relax the net capital rule

, which encouraged the largest five investment banks to dramatically increase their financial leverage and aggressively expand their issuance of mortgage-backed securities. Subprime mortgage payment delinquency rates remained in the 10-15% range from 1998 to 2006, then began to increase rapidly, rising to 25% by early 2008.

Mortgage underwriting standards declined gradually during the boom period, particularly form 2004 to 2007. The use of automated loan approvals allowed loans to be made without appropriate review and documentation. In 2007, 40% of all subprime loans resulted from automated underwriting. The chairman of the Mortgage Bankers Association claimed that mortgage brokers, while profiting from the home loan boom, did not do enough to examine whether borrowers could repay. Mortgage fraud

by lenders and borrowers increased enormously.

A study by analysts at the Federal Reserve Bank of Cleveland found that the average difference between subprime and prime mortgage interest rates (the "subprime markup") declined significantly between 2001 and 2007. The quality of loans originated also worsened gradually during that period. The combination of declining risk premia and credit standards is common to boom and bust credit cycle

s. The authors also concluded that the decline in underwriting standards did not directly trigger the crisis, because the gradual changes in standards did not statistically account for the large difference in default rates for subprime mortgages issued between 2001-2005 (which had a 10% default rate within one year of origination) and 2006-2007 (which had a 20% rate). In other words, standards gradually declined but defaults suddenly jumped. Further, the authors argued that the trend in worsening loan quality was harder to detect with rising housing prices, as more refinancing options were available, keeping the default rate lower.

warned of an "epidemic" in mortgage fraud, an important credit risk of nonprime mortgage lending, which, they said, could lead to "a problem that could have as much impact as the S&L crisis".

refers to the cash paid to the lender for the home and represents the initial homeowners equity or financial interest in the home. A low down payment means that a home represents a highly leveraged investment for the homeowner, with little equity relative to debt. In such circumstances, only small declines in the value of the home result in negative equity

, a situation in which the value of the home is less than the mortgage amount owed. In 2005, the median down payment for first-time home buyers was 2%, with 43% of those buyers making no down payment whatsoever. By comparison, China has down payment requirements that exceed 20%, with higher amounts for non-primary residences.

Economist Nouriel Roubini

wrote in Forbes in July 2009: "Home prices have already fallen from their peak by about 30%. Based on my analysis, they are going to fall by at least 40% from their peak, and more likely 45%, before they bottom out. They are still falling at an annualized rate of over 18%. That fall of at least 40%-45% percent of home prices from their peak is going to imply that about half of all households that have a mortgage—about 25 million of the 51 million that have mortgages—are going to be underwater with negative equity

and will have a significant incentive to walk away from their homes."

Economist Stan Leibowitz argued in the Wall Street Journal that the extent of equity in the home was the key factor in foreclosure, rather than the type of loan, credit worthiness of the borrower, or ability to pay. Although only 12% of homes had negative equity (meaning the property was worth less than the mortgage obligation), they comprised 47% of foreclosures during the second half of 2008. Homeowners with negative equity have less financial incentive to stay in the home.

The L.A. Times reported the results of a study that found homeowners with high credit scores at the time of entering the mortgage are 50% more likely to "strategically default

" -- abruptly and intentionally pull the plug and abandon the mortgage—compared with lower-scoring borrowers. Such strategic defaults were heavily concentrated in markets with the highest price declines. An estimated 588,000 strategic defaults occurred nationwide during 2008, more than double the total in 2007. They represented 18% of all serious delinquencies that extended for more than 60 days in the fourth quarter of 2008.

, which the credit consumer might not notice until long after the loan transaction had been consummated.

Countrywide, sued by California Attorney General Jerry Brown

for "Unfair Business Practices" and "False Advertising" was making high cost mortgages "to homeowners with weak credit, adjustable rate mortgages (ARMs) that allowed homeowners to make interest-only payments.". When housing prices decreased, homeowners in ARMs then had little incentive to pay their monthly payments, since their home equity had disappeared. This caused Countrywide's financial condition to deteriorate, ultimately resulting in a decision by the Office of Thrift Supervision to seize the lender.

Countrywide, according to Republican Lawmakers, had involved itself in making low-cost loans to politicians, for purposes of gaining political favors.

Former employees from Ameriquest

, which was United States's leading wholesale lender, described a system in which they were pushed to falsify mortgage documents and then sell the mortgages to Wall Street banks eager to make fast profits. There is growing evidence that such mortgage fraud

s may be a cause of the crisis.

argued that a "culture of irresponsibility" was an important cause of the crisis. He criticized executive compensation that "rewarded recklessness rather than responsibility" and Americans who bought homes "without accepting the responsibilities." He continued that there "was far too much debt and not nearly enough capital in the system. And a growing economy bred complacency."

A key theme of the crisis is that many large financial institutions did not have a sufficient financial cushion to absorb the losses they sustained or to support the commitments made to others. Using technical terms, these firms were highly leveraged

(i.e., they maintained a high ratio of debt to equity) or had insufficient capital

to post as collateral

for their borrowing. A key to a stable financial system is that firms have the financial capacity to support their commitments. Michael Lewis

and David Einhorn argued: "The most critical role for regulation is to make sure that the sellers of risk have the capital to support their bets."

's chief economist at the time, stated that the 2006 decline in investment buying was expected: "Speculators left the market in 2006, which caused investment sales to fall much faster than the primary market."

Housing prices nearly doubled between 2000 and 2006, a vastly different trend from the historical appreciation at roughly the rate of inflation. While homes had not traditionally been treated as investments subject to speculation, this behavior changed during the housing boom. Media widely reported condominiums being purchased while under construction, then being "flipped" (sold) for a profit without the seller ever having lived in them. Some mortgage companies identified risks inherent in this activity as early as 2005, after identifying investors assuming highly leveraged positions in multiple properties.

Nicole Gelinas of the Manhattan Institute

described the negative consequences of not adjusting tax and mortgage policies to the shifting treatment of a home from conservative inflation hedge to speculative investment. Economist Robert Shiller

argued that speculative bubbles are fueled by "contagious optimism, seemingly impervious to facts, that often takes hold when prices are rising. Bubbles are primarily social phenomena; until we understand and address the psychology that fuels them, they're going to keep forming."

described how speculative borrowing contributed to rising debt and an eventual collapse of asset values.

Economist Paul McCulley

described how Minsky's hypothesis translates to the current crisis, using Minsky's words: "...from time to time, capitalist economies exhibit inflations and debt deflations which seem to have the potential to spin out of control. In such processes, the economic system's reactions to a movement of the economy amplify the movement--inflation feeds upon inflation and debt-deflation feeds upon debt deflation." In other words, people are momentum investors by nature, not value investors. People naturally take actions that expand the apex and nadir of cycles. One implication for policymakers and regulators is the implementation of counter-cyclical policies, such as contingent capital requirements for banks that increase during boom periods and are reduced during busts.

The former CEO of Citigroup

The former CEO of Citigroup

Charles O. Prince said in November 2007: "As long as the music is playing, you've got to get up and dance." This metaphor summarized how financial institutions took advantage of easy credit conditions, by borrowing and investing large sums of money, a practice called leveraged lending. Debt taken on by financial institutions increased from 63.8% of U.S. gross domestic product

in 1997 to 113.8% in 2007.

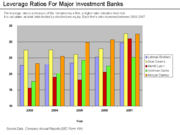

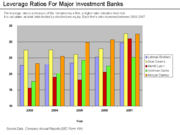

A 2004 SEC decision related to the net capital rule

allowed USA investment banks to issue substantially more debt, which was then used to help fund the housing bubble through purchases of mortgage-backed securities. From 2004-07, the top five U.S. investment banks each significantly increased their financial leverage (see diagram), which increased their vulnerability to a financial shock. These five institutions reported over $4.1 trillion in debt for fiscal year 2007, about 30% of USA nominal GDP for 2007. Lehman Brothers

was liquidated, Bear Stearns

and Merrill Lynch

were sold at fire-sale prices, and Goldman Sachs

and Morgan Stanley

became commercial banks, subjecting themselves to more stringent regulation. With the exception of Lehman, these companies required or received government support.

Fannie Mae and Freddie Mac, two U.S. Government sponsored enterprises, owned or guaranteed nearly $5 trillion in mortgage obligations at the time they were placed into conservatorship

by the U.S. government in September 2008.

These seven entities were highly leveraged and had $9 trillion in debt or guarantee obligations, an enormous concentration of risk, yet were not subject to the same regulation as depository banks.

In a May 2008 speech, Ben Bernanke

quoted Walter Bagehot

: "A good banker will have accumulated in ordinary times the reserve he is to make use of in extraordinary times." However, this advice was not heeded by these institutions, which had used the boom times to increase their leverage ratio instead.

In laissez-faire

capitalism, financial institutions would be risk-averse because failure would result in liquidation

. But the Federal Reserve's 1984 rescue of Continental Illinois and the 1998 rescue of the Long-Term Capital Management

hedge fund

, among others, showed that institutions which failed to exercise due diligence

could reasonably expect to be protected from the consequences of their mistakes. The belief that they could not be allowed to fail

created a moral hazard

which was a contributing factor to the late-2000s recession.

cited the following causes related to features of the modern financial markets:

The term financial innovation

The term financial innovation

refers to the ongoing development of financial products designed to achieve particular client objectives, such as offsetting a particular risk exposure (such as the default of a borrower) or to assist with obtaining financing. Examples pertinent to this crisis included: the adjustable-rate mortgage; the bundling of subprime mortgages into mortgage-backed securities (MBS) or collateralized debt obligations (CDO) for sale to investors, a type of securitization

; and a form of credit insurance called credit default swaps(CDS). The usage of these products expanded dramatically in the years leading up to the crisis. These products vary in complexity and the ease with which they can be valued on the books of financial institutions.

The CDO in particular enabled financial institutions to obtain investor funds to finance subprime and other lending, extending or increasing the housing bubble and generating large fees. Approximately $1.6 trillion in CDO's were originated between 2003-2007. A CDO essentially places cash payments from multiple mortgages or other debt obligations into a single pool, from which the cash is allocated to specific securities in a priority sequence. Those securities obtaining cash first received investment-grade ratings from rating agencies. Lower priority securities received cash thereafter, with lower credit ratings but theoretically a higher rate of return on the amount invested. A sample of 735 CDO deals originated between 1999 and 2007 showed that subprime and other less-than-prime mortgages represented an increasing percentage of CDO assets, rising from 5% in 2000 to 36% in 2007.

For a variety of reasons, market participants did not accurately measure the risk inherent with this innovation or understand its impact on the overall stability of the financial system. For example, the pricing model for CDOs clearly did not reflect the level of risk they introduced into the system. The average recovery rate for "high quality" CDOs has been approximately 32 cents on the dollar, while the recovery rate for mezzanine CDO's has been approximately five cents for every dollar. These massive, practically unthinkable, losses have dramatically impacted the balance sheets of banks across the globe, leaving them with very little capital to continue operations.

Others have pointed out that there were not enough of these loans made to cause a crisis of this magnitude. In an article in Portfolio Magazine, Michael Lewis

spoke with one trader who noted that "There weren’t enough Americans with [bad] credit taking out [bad loans] to satisfy investors’ appetite for the end product." Essentially, investment banks and hedge funds used financial innovation

to synthesize more loans using derivatives

. "They were creating [loans] out of whole cloth. One hundred times over! That’s why the losses are so much greater than the loans."

Princeton professor Harold James wrote that one of the byproducts of this innovation was that MBS and other financial assets were "repackaged so thoroughly and resold so often that it became impossible to clearly connect the thing being traded to its underlying value." He called this a "...profound flaw at the core of the U.S. financial system..."

Another example relates to AIG

, which insured obligations of various financial institutions through the usage of credit default swaps. The basic CDS transaction involved AIG receiving a premium in exchange for a promise to pay money to party A in the event party B defaulted. However, AIG did not have the financial strength to support its many CDS commitments as the crisis progressed and was taken over by the government in September 2008. U.S. taxpayers provided over $180 billion in government support to AIG during 2008 and early 2009, through which the money flowed to various counterparties to CDS transactions, including many large global financial institutions.

Author Michael Lewis

wrote that CDS enabled speculators to stack bets on the same mortgage bonds and CDO's. This is analogous to allowing many persons to buy insurance on the same house. Speculators that bought CDS insurance were betting that significant defaults would occur, while the sellers (such as AIG

) bet they would not. In addition, Chicago Public Radio and the Huffington Post reported in April 2010 that market participants, including a hedge fund called Magnetar Capital

, encouraged the creation of CDO's containing low quality mortgages, so they could bet against them using CDS. NPR reported that Magnetar encouraged investors to purchase CDO's while simultaneously betting against them, without disclosing the latter bet.

Credit rating agencies are now under scrutiny for having given investment-grade ratings to MBS

Credit rating agencies are now under scrutiny for having given investment-grade ratings to MBS

s based on risky subprime mortgage loans. These high ratings enabled these MBS to be sold to investors, thereby financing the housing boom. These ratings were believed justified because of risk reducing practices, such as credit default insurance and equity investors willing to bear the first losses. However, there are also indications that some involved in rating subprime-related securities knew at the time that the rating process was faulty.

An estimated $3.2 trillion in loans were made to homeowners with bad credit and undocumented incomes (e.g., subprime or Alt-A

mortgages) between 2002 and 2007. Economist Joseph Stiglitz stated: "I view the rating agencies as one of the key culprits...They were the party that performed the alchemy that converted the securities from F-rated to A-rated. The banks could not have done what they did without the complicity of the rating agencies." Without the AAA ratings, demand for these securities would have been considerably less. Bank writedowns and losses on these investments totaled $523 billion as of September 2008.

The ratings of these securities was a lucrative business for the rating agencies, accounting for just under half of Moody's

total ratings revenue in 2007. Through 2007, ratings companies enjoyed record revenue, profits and share prices. The rating companies earned as much as three times more for grading these complex products than corporate bonds, their traditional business. Rating agencies also competed with each other to rate particular MBS and CDO securities issued by investment banks, which critics argued contributed to lower rating standards. Interviews with rating agency senior managers indicate the competitive pressure to rate the CDO's favorably was strong within the firms. This rating business was their "golden goose" (which laid the proverbial golden egg or wealth) in the words of one manager. Author Upton Sinclair

(1878–1968) famously stated: "It is difficult to get a man to understand something when his job depends on not understanding it." From 2000-2006, structured finance (which includes CDO's) accounted for 40% of the revenues of the credit rating agencies. During that time, one major rating agency had its stock increase six-fold and its earnings grew by 900%.

Critics allege that the rating agencies suffered from conflicts of interest, as they were paid by investment banks and other firms that organize and sell structured securities to investors. On 11 June 2008, the SEC proposed rules designed to mitigate perceived conflicts of interest between rating agencies and issuers of structured securities. On 3 December 2008, the SEC approved measures to strengthen oversight of credit rating agencies, following a ten-month investigation that found "significant weaknesses in ratings practices," including conflicts of interest.

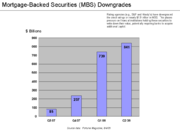

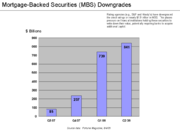

Between Q3 2007 and Q2 2008, rating agencies lowered the credit ratings on $1.9 trillion in mortgage backed securities. Financial institutions felt they had to lower the value of their MBS and acquire additional capital so as to maintain capital ratios. If this involved the sale of new shares of stock, the value of the existing shares was reduced. Thus ratings downgrades lowered the stock prices of many financial firms.

's Gaussian copula formula assumed that the price of CDS was correlated with and could predict the correct price of mortgage backed securities. Because it was highly tractable, it rapidly came to be used by a huge percentage of CDO and CDS investors, issuers, and rating agencies. According to one wired.com article: "Then the model fell apart. Cracks started appearing early on, when financial markets began behaving in ways that users of Li's formula hadn't expected. The cracks became full-fledged canyons in 2008—when ruptures in the financial system's foundation swallowed up trillions of dollars and put the survival of the global banking system in serious peril... Li's Gaussian copula formula will go down in history as instrumental in causing the unfathomable losses that brought the world financial system to its knees."

As financial assets became more complex, less transparent, and harder and harder to value, investors were reassured by the fact that both the international bond rating agencies and bank regulators, who came to rely on them, accepted as valid some complex mathematical models which theoretically showed the risks were much smaller than they actually proved to be in practice. George Soros

commented that "The super-boom got out of hand when the new products became so complicated that the authorities could no longer calculate the risks and started relying on the risk management methods of the banks themselves. Similarly, the rating agencies relied on the information provided by the originators of synthetic products. It was a shocking abdication of responsibility."

. They were then able to lend anew, earning additional fees. Author Robin Blackburn

explained how they worked: Off balance sheet financing also made firms look less leveraged and enabled them to borrow at cheaper rates.

Banks had established automatic lines of credit to these SIV and conduits. When the cash flow into the SIV's began to decline as subprime defaults mounted, banks were contractually obligated to provide cash to these structures and their investors. This "conduit-related balance sheet pressure" placed strain on the banks' ability to lend, both raising interbank lending rates and reducing the availability of funds.

In the years leading up to the crisis, the top four U.S. depository banks moved an estimated $5.2 trillion in assets and liabilities off-balance sheet into these SIV's and conduits. This enabled them to essentially bypass existing regulations regarding minimum capital ratios, thereby increasing leverage and profits during the boom but increasing losses during the crisis. Accounting guidance was changed in 2009 that will require them to put some of these assets back onto their books, which will significantly reduce their capital ratios. One news agency estimated this amount to be between $500 billion and $1 trillion. This effect was considered as part of the stress tests performed by the government during 2009.

During March 2010, the bankruptcy court examiner released a report on Lehman Brothers

, which had failed spectacularly in September 2008. The report indicated that up to $50 billion was moved off-balance sheet in a questionable manner by management during 2008, with the effect of making its debt level (leverage ratio) appear smaller. Analysis by the Federal Reserve Bank of New York indicated big banks mask their risk levels just prior to reporting data quarterly to the public.

wrote in June 2009: "...an enormous part of what banks did in the early part of this decade – the off-balance-sheet vehicles, the derivatives and the 'shadow banking system' itself – was to find a way round regulation."

wrote that the financial sector became increasingly concentrated in the years leading up to the crisis, which made the stability of the financial system more reliant on just a few firms, which were also highly leveraged:

By contrast, some scholars have argued that fragmentation in the mortgage securitization market led to increased risk taking and a deterioration in underwriting standards.

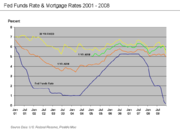

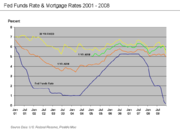

From 2000 to 2003, the Federal Reserve lowered the federal funds rate

From 2000 to 2003, the Federal Reserve lowered the federal funds rate

target from 6.5% to 1.0%. This was done to soften the effects of the collapse of the dot-com bubble

and of the September 2001 terrorist attacks, and to combat the perceived risk of deflation.

The Fed then raised the Fed funds rate significantly between July 2004 and July 2006. This contributed to an increase in 1-year and 5-year adjustable-rate mortgage (ARM) rates, making ARM interest rate resets more expensive for homeowners. This may have also contributed to the deflating of the housing bubble, as asset prices generally move inversely to interest rates and it became riskier to speculate in housing.

This globalization can be measured in growing trade deficits in developed countries such as the U.S. and Europe. In 2005, Ben Bernanke

addressed the implications of the USA's high and rising current account

deficit, resulting from USA imports exceeding its exports. Between 1996 and 2004, the USA current account deficit increased by $650 billion, from 1.5% to 5.8% of GDP. Financing these deficits required the USA to borrow large sums from abroad, much of it from countries running trade surpluses, mainly the emerging economies in Asia and oil-exporting nations. The balance of payments

identity

requires that a country (such as the USA) running a current account

deficit also have a capital account

(investment) surplus of the same amount. Hence large and growing amounts of foreign funds (capital) flowed into the USA to finance its imports. This created demand for various types of financial assets, raising the prices of those assets while lowering interest rates. Foreign investors had these funds to lend, either because they had very high personal savings rates (as high as 40% in China), or because of high oil prices. Bernanke referred to this as a "saving glut." A "flood" of funds (capital

or liquidity) reached the USA financial markets. Foreign governments supplied funds by purchasing USA Treasury bonds and thus avoided much of the direct impact of the crisis. USA households, on the other hand, used funds borrowed from foreigners to finance consumption or to bid up the prices of housing and financial assets. Financial institutions invested foreign funds in mortgage-backed securities. USA housing and financial assets dramatically declined in value after the housing bubble burst.

has argued that "inordinately mercantilist

currency policies" were a significant cause of the U.S. trade deficit, indirectly driving a flood of money into the U.S. as described above. In his view, China maintained an artificially weak currency to make Chinese goods relatively cheaper for foreign countries to purchase, thereby keeping its vast workforce occupied and encouraging exports to the U.S. One byproduct was a large accumulation of U.S. dollars by the Chinese government, which were then invested in U.S. government securities and those of Fannie Mae and Freddie Mac, providing additional funds for lending that contributed to the housing bubble.

Economist Paul Krugman

also wrote similar comments during October 2009, further arguing that China's currency should have appreciated relative to the U.S. dollar beginning around 2001. Various U.S. officials have also indicated concerns with Chinese exchange rate policies, which have not allowed its currency to appreciate significantly relative to the dollar despite large trade surpluses. In January 2009, Timothy Geithner wrote: "Obama -- backed by the conclusions of a broad range of economists -- believes that China is manipulating its currency...the question is how and when to broach the subject in order to do more good than harm."

and in long economic waves based on technological revolutions. Daniel Šmihula

believes that this crisis and stagnation are a result of the end of the long economic cycle originally initiated by the Information and telecommunications technological revolution in 1985-2000.

The market has been already saturated by new “technical wonders” (e.g. everybody has his own mobile phone) and – what is more important - in the developed countries the economy reached limits of productivity

in conditions of existing technologies. A new economic revival can come only with a new technological revolution (a hypothetical Post-informational technological revolution). Šmihula expects that it will happen in about 2014-15.

winning program, NPR correspondents argued that a "Giant Pool of Money" (represented by $70 trillion in worldwide fixed income investments) sought higher yields than those offered by U.S. Treasury bonds early in the decade, which were low due to low interest rates and trade deficits discussed above. Further, this pool of money had roughly doubled in size from 2000 to 2007, yet the supply of relatively safe, income generating investments had not grown as fast. Investment banks on Wall Street answered this demand with the mortgage-backed security

(MBS) and collateralized debt obligation

(CDO), which were assigned safe ratings by the credit rating agencies. In effect, Wall Street connected this pool of money to the mortgage market in the U.S., with enormous fees accruing to those throughout the mortgage supply chain, from the mortgage broker selling the loans, to small banks that funded the brokers, to the giant investment banks behind them. By approximately 2003, the supply of mortgages originated at traditional lending standards had been exhausted. However, continued strong demand for MBS and CDO began to drive down lending standards, as long as mortgages could still be sold along the supply chain. Eventually, this speculative bubble proved unsustainable.

. These entities became critical to the credit markets underpinning the financial system, but were not subject to the same regulatory controls. Further, these entities were vulnerable because they borrowed short-term in liquid markets to purchase long-term, illiquid and risky assets. This meant that disruptions in credit markets would make them subject to rapid deleveraging, selling their long-term assets at depressed prices. He described the significance of these entities: "In early 2007, asset-backed commercial paper conduits, in structured investment vehicles, in auction-rate preferred securities, tender option bonds and variable rate demand notes, had a combined asset size of roughly $2.2 trillion. Assets financed overnight in triparty repo grew to $2.5 trillion. Assets held in hedge funds grew to roughly $1.8 trillion. The combined balance sheets of the then five major investment banks totaled $4 trillion. In comparison, the total assets of the top five bank holding companies in the United States at that point were just over $6 trillion, and total assets of the entire banking system were about $10 trillion." He stated that the "combined effect of these factors was a financial system vulnerable to self-reinforcing asset price and credit cycles."

described the run on the shadow banking system as the "core of what happened" to cause the crisis. "As the shadow banking system expanded to rival or even surpass conventional banking in importance, politicians and government officials should have realized that they were re-creating the kind of financial vulnerability that made the Great Depression possible—and they should have responded by extending regulations and the financial safety net to cover these new institutions. Influential figures should have proclaimed a simple rule: anything that does what a bank does, anything that has to be rescued in crises the way banks are, should be regulated like a bank." He referred to this lack of controls as "malign neglect." Some researchers have suggested that competition between GSEs and the shadow banking system led to a deterioration in underwriting standards.

For example, investment bank Bear Stearns

was required to replenish much of its funding in overnight markets, making the firm vulnerable to credit market disruptions. When concerns arose regarding its financial strength, its ability to secure funds in these short-term markets was compromised, leading to the equivalent of a bank run. Over four days, its available cash declined from $18 billion to $3 billion as investors pulled funding from the firm. It collapsed and was sold at a fire-sale price to bank JP Morgan Chase March 16, 2008.

American homeowners, consumers, and corporations owed roughly $25 trillion during 2008. American banks retained about $8 trillion of that total directly as traditional mortgage loans. Bondholders and other traditional lenders provided another $7 trillion. The remaining $10 trillion came from the securitization markets, meaning the parallel banking system. The securitization markets started to close down in the spring of 2007 and nearly shut-down in the fall of 2008. More than a third of the private credit markets thus became unavailable as a source of funds. In February 2009, Ben Bernanke

stated that securitization markets remained effectively shut, with the exception of conforming mortgages, which could be sold to Fannie Mae and Freddie Mac.

The Economist

reported in March 2010: "Bear Stearns and Lehman Brothers were non-banks that were crippled by a silent run among panicky overnight "repo

" lenders, many of them money market funds uncertain about the quality of securitized collateral they were holding. Mass redemptions from these funds after Lehman's failure froze short-term funding for big firms."

was passed from mortgage originators to investors using various types of financial innovation

. This became known as the "originate to distribute" model, as opposed to the traditional model where the bank originating the mortgage retained the credit risk. In effect, the mortgage originators were left with nothing which was at risk, giving rise to moral hazard

in which behavior and consequence were separated.

Economist Mark Zandi

described moral hazard

as a root cause of the subprime mortgage crisis

. He wrote: "...the risks inherent in mortgage lending became so widely dispersed that no one was forced to worry about the quality of any single loan. As shaky mortgages were combined, diluting any problems into a larger pool, the incentive for responsibility was undermined." He also wrote: "Finance companies weren't subject to the same regulatory oversight as banks. Taxpayers weren't on the hook if they went belly up [pre-crisis], only their shareholders and other creditors were. Finance companies thus had little to discourage them from growing as aggressively as possible, even if that meant lowering or winking at traditional lending standards."

The New York State Comptroller's Office has said that in 2006, Wall Street executives took home bonuses totaling $23.9 billion. "Wall Street traders were thinking of the bonus at the end of the year, not the long-term health of their firm. The whole system—from mortgage brokers to Wall Street risk managers—seemed tilted toward taking short-term risks while ignoring long-term obligations. The most damning evidence is that most of the people at the top of the banks didn't really understand how those [investments] worked."

Investment banker incentive compensation was focused on fees generated from assembling financial products, rather than the performance of those products and profits generated over time. Their bonuses were heavily skewed towards cash rather than stock and not subject to "claw-back" (recovery of the bonus from the employee by the firm) in the event the MBS or CDO created did not perform. In addition, the increased risk (in the form of financial leverage) taken by the major investment banks was not adequately factored into the compensation of senior executives.

Bank CEO Jamie Dimon

argued: "Rewards have to track real, sustained, risk-adjusted performance. Golden parachutes, special contracts, and unreasonable perks must disappear. There must be a relentless focus on risk management that starts at the top of the organization and permeates down to the entire firm. This should be business-as-usual, but at too many places, it wasn't."

, such as the increasing importance of the shadow banking system

, derivatives

and off-balance sheet financing. In other cases, laws were changed or enforcement weakened in parts of the financial system. Several critics have argued that the most critical role for regulation is to make sure that financial institutions have the ability or capital to deliver on their commitments. Critics have also noted de facto deregulation through a shift in market share toward the least regulated portions of the mortgage market.

Key examples of regulatory failures include:

Author Roger Lowenstein

summarized some of the regulatory problems that caused the crisis in November 2009: "1) Mortgage regulation was too lax and in some cases nonexistent; 2) Capital requirements for banks were too low; 3) Trading in derivatives such as credit default swaps posed giant, unseen risks; 4) Credit ratings on structured securities such as collateralized-debt obligations were deeply flawed; 5) Bankers were moved to take on risk by excessive pay packages; 6) The government’s response to the crash also created, or exacerbated, moral hazard. Markets now expect that big banks won’t be allowed to fail, weakening the incentives of investors to discipline big banks and keep them from piling up too many risky assets again."

have been argued as contributing to this crisis:

Banks in the U.S. lobby politicians extensively. A November 2009 report from economists of the International Monetary Fund

(IMF) writing independently of that organization indicated that:

The study concluded that: "the prevention of future crises might require weakening political influence of the financial industry or closer monitoring of lobbying activities to understand better the incentives behind it."

The Boston Globe reported during that during January–June 2009, the largest four U.S. banks spent these amounts ($ millions) on lobbying, despite receiving taxpayer bailouts: Citigroup $3.1; JP Morgan Chase $3.1; Bank of America $1.5; and Wells Fargo $1.4.

The New York Times reported in April 2010: "An analysis by Public Citizen found that at least 70 former members of Congress were lobbying for Wall Street and the financial services sector last year, including two former Senate majority leaders (Trent Lott and Bob Dole), two former House majority leaders (Richard A. Gephardt and Dick Armey) and a former House speaker (J. Dennis Hastert). In addition to the lawmakers, data from the Center for Responsive Politics counted 56 former Congressional aides on the Senate or House banking committees who went on to use their expertise to lobby for the financial sector."

The Financial Crisis Inquiry Commission

reported in January 2011 that "...from 1998 to 2008, the financial sector expended $2.7 billion in reported federal lobbying expenses; individuals and political action committees in the sector made more than $1 billion in campaign contributions."

magazine claims that economists mostly failed to predict the worst international economic crisis since the Great Depression

of 1930s. The Wharton School of the University of Pennsylvania

online business journal examines why economists failed to predict a major global financial crisis. An article in the New York Times informs that economist Nouriel Roubini

warned of such crisis as early as September 2006, and the article goes on to state that the profession of economics is bad at predicting recessions. According to The Guardian

, Roubini was ridiculed for predicting a collapse of the housing market and worldwide recession, while The New York Times labelled him "Dr. Doom". However, there are examples of other experts who gave indications of a financial crisis.

concluded that the crisis was: (1) caused by excess monetary expansion; (2) prolonged by an inability to evaluate counter-party risk due to opaque financial statements; and (3) worsened by the unpredictable nature of government's response to the crisis.

, where lenders that had provided the funds using the MBS as collateral had contractual rights to get their money back. The combination of losses and margin calls resulted in further forced sales of MBS and emergency efforts to obtain cash (liquidity). Markdowns may also reduce the value of bank regulatory capital, requiring additional capital raising and creating uncertainty regarding the health of the bank. In other words, writing down the assets presented both liquidity and solvency challenges. Advocates argued that the rule enabled the most accurate estimate of the financial health of the banks.

explanation, is that the financial crisis is merely a symptom of another, deeper crisis, which is a systemic crisis of capitalism

itself. According to Samir Amin

, an Egyptian economist, the constant decrease in GDP

growth

rates in Western countries

since the early 1970s created a growing surplus of capital which did not have sufficient profitable investment outlets in the real economy

. The alternative was to place this surplus into the financial market, which became more profitable than productive capital

investment

, especially with subsequent deregulation. According to Samir Amin, this phenomenon has led to recurrent financial bubbles

(such as the internet bubble) and is the deep cause of the financial crisis of 2007-2009.

John Bellamy Foster

, a political economy analyst and editor of the Monthly Review

, believes that the decrease in GDP

growth

rates since the early 1970s is due to increasing market saturation

.

John C. Bogle wrote during 2005 that a series of unresolved challenges face capitalism that have contributed to past financial crises and have not been sufficiently addressed: "Corporate America went astray largely because the power of managers went virtually unchecked by our gatekeepers for far too long...They failed to 'keep an eye on these geniuses' to whom they had entrusted the responsibility of the management of America's great corporations." He cites particular issues, including:

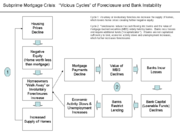

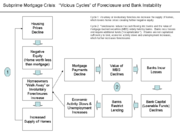

One of the unique features of this crisis is the linkage of global investors and financial institutions to the price of U.S. housing, through financial innovations such as MBS, CDO, and CDS described above. As borrowers stop paying their mortgages (due to the inability to refinance, negative equity, or loss of employment), foreclosures and the supply of homes for sale increases. This places downward pressure on housing prices, which further lowers homeowners' equity. The decline in mortgage payments also reduces the value of mortgage-backed securities, which erodes the net worth and financial health of banks. This reduces the amount of lending that banks can support, which slows down business investment. When consumers do not spend, business earnings are impacted, which increases unemployment. This vicious cycle or self-reinforcing loop is at the heart of the crisis.

One of the unique features of this crisis is the linkage of global investors and financial institutions to the price of U.S. housing, through financial innovations such as MBS, CDO, and CDS described above. As borrowers stop paying their mortgages (due to the inability to refinance, negative equity, or loss of employment), foreclosures and the supply of homes for sale increases. This places downward pressure on housing prices, which further lowers homeowners' equity. The decline in mortgage payments also reduces the value of mortgage-backed securities, which erodes the net worth and financial health of banks. This reduces the amount of lending that banks can support, which slows down business investment. When consumers do not spend, business earnings are impacted, which increases unemployment. This vicious cycle or self-reinforcing loop is at the heart of the crisis.

Thomas Friedman

summarized some of this interaction in November 2008:

Former Fed Chair Paul Volcker

summarized several other assumptions:

Subprime mortgage crisis

The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages....

), with experts placing different weights upon particular causes. The complexity and interdependence of many of the causes, as well as competing political, economic and organizational interests, have resulted in a variety of narratives describing the crisis. One category of causes created a vulnerable or fragile financial system, including complex financial securities, a dependence on short-term funding markets, and international trade imbalances. Other causes increased the stress on this fragile system, such as high corporate and consumer debt levels. Still others represent shocks to that system, such as the ongoing foreclosure crisis and the failures of key financial institutions. Regulatory and market-based controls did not effectively protect this system or measure the buildup of risk. Some causes relate to particular markets, such as the stock market or housing market, while others relate to the global economy more broadly.

The U.S. Financial Crisis Inquiry Commission

Financial Crisis Inquiry Commission

The Commission reported its findings in January 2011. It concluded that "the crisis was avoidable and was caused by: Widespread failures in financial regulation, including the Federal Reserve’s failure to stem the...

reported its findings in January 2011. It concluded that "the crisis was avoidable and was caused by: Widespread failures in financial regulation, including the Federal Reserve’s failure to stem the tide of toxic mortgages; Dramatic breakdowns in corporate governance including too many financial firms acting recklessly and taking on too much risk; An explosive mix of excessive borrowing and risk by households and Wall Street that put the financial system on a collision course with crisis; Key policy makers ill prepared for the crisis, lacking a full understanding of the financial system they oversaw; and systemic breaches in accountability and ethics at all levels.“

The U.S. housing bubble and foreclosures

Between 1997 and 2006, the price of the typical American house increased by 124%. During the two decades ending in 2001, the national median home price ranged from 2.9 to 3.1 times median household income. This ratio rose to 4.0 in 2004, and 4.6 in 2006. This housing bubble resulted in quite a few homeowners refinancing their homes at lower interest rates, or financing consumer spending by taking out second mortgageSecond mortgage

A second mortgage typically refers to a secured loan that is subordinate to another loan against the same property.In real estate, a property can have multiple loans or liens against it. The loan which is registered with county or city registry first is called the first mortgage or first position...

s secured by the price appreciation.

By September 2008, average U.S. housing prices had declined by over 20% from their mid-2006 peak. Easy credit, and a belief that house prices would continue to appreciate, had encouraged many subprime borrowers to obtain adjustable-rate mortgages. These mortgages enticed borrowers with a below market interest rate for some predetermined period, followed by market interest rates for the remainder of the mortgage's term. Borrowers who could not make the higher payments once the initial grace period ended would try to refinance their mortgages. Refinancing became more difficult, once house prices began to decline in many parts of the USA. Borrowers who found themselves unable to escape higher monthly payments by refinancing began to default. During 2007, lenders had begun foreclosure proceedings on nearly 1.3 million properties, a 79% increase over 2006. This increased to 2.3 million in 2008, an 81% increase vs. 2007. As of August 2008, 9.2% of all mortgages outstanding were either delinquent or in foreclosure.

The Economist

The Economist

The Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

described the issue this way: "No part of the financial crisis has received so much attention, with so little to show for it, as the tidal wave of home foreclosures sweeping over America. Government programmes have been ineffectual, and private efforts not much better." Up to 9 million homes may enter foreclosure over the 2009-2011 period, versus one million in a typical year. At roughly U.S. $50,000 per foreclosure according to a 2006 study by the Chicago Federal Reserve Bank, 9 million foreclosures represents $450 billion in losses.

Sub-prime lending

The term subprime refers to the credit quality of particular borrowers, who have weakened credit histories and a greater risk of loan default than prime borrowers. The value of U.S. subprime mortgages was estimated at $1.3 trillion as of March 2007, with over 7.5 million first-lien

Lien

In law, a lien is a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation...

subprime mortgages outstanding.

Subprime mortgages remained below 10% of all mortgage originations until 2004, when they spiked to nearly 20% and remained there through the 2005-2006 peak of the United States housing bubble

United States housing bubble

The United States housing bubble is an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and may not yet have hit bottom as of 2011. On December 30, 2008 the...

. A proximate event to this increase was the April 2004 decision by the U.S. Securities and Exchange Commission (SEC) to relax the net capital rule

Net capital rule

The uniform net capital rule is a rule created by the U.S. Securities and Exchange Commission in 1975 to regulate directly the ability of broker-dealers to meet their financial obligations to customers and other creditors...

, which encouraged the largest five investment banks to dramatically increase their financial leverage and aggressively expand their issuance of mortgage-backed securities. Subprime mortgage payment delinquency rates remained in the 10-15% range from 1998 to 2006, then began to increase rapidly, rising to 25% by early 2008.

Mortgage underwriting

In addition to considering higher-risk borrowers, lenders offered increasingly risky loan options and borrowing incentives.Mortgage underwriting standards declined gradually during the boom period, particularly form 2004 to 2007. The use of automated loan approvals allowed loans to be made without appropriate review and documentation. In 2007, 40% of all subprime loans resulted from automated underwriting. The chairman of the Mortgage Bankers Association claimed that mortgage brokers, while profiting from the home loan boom, did not do enough to examine whether borrowers could repay. Mortgage fraud

Mortgage fraud

Mortgage fraud is crime in which the intent is to materially misrepresent or omit information on a mortgage loan application to obtain a loan or to obtain a larger loan than would have been obtained had the lender or borrower known the truth....

by lenders and borrowers increased enormously.

A study by analysts at the Federal Reserve Bank of Cleveland found that the average difference between subprime and prime mortgage interest rates (the "subprime markup") declined significantly between 2001 and 2007. The quality of loans originated also worsened gradually during that period. The combination of declining risk premia and credit standards is common to boom and bust credit cycle

Credit cycle

The credit cycle is the expansion and contraction of access to credit over the course of the business cycle. Some economists, including Barry Eichengreen, Hyman Minsky, and other Post-Keynesian economists, and some members of the Austrian school, regard credit cycles as the fundamental process...

s. The authors also concluded that the decline in underwriting standards did not directly trigger the crisis, because the gradual changes in standards did not statistically account for the large difference in default rates for subprime mortgages issued between 2001-2005 (which had a 10% default rate within one year of origination) and 2006-2007 (which had a 20% rate). In other words, standards gradually declined but defaults suddenly jumped. Further, the authors argued that the trend in worsening loan quality was harder to detect with rising housing prices, as more refinancing options were available, keeping the default rate lower.

Mortgage fraud

In 2004, the Federal Bureau of InvestigationFederal Bureau of Investigation

The Federal Bureau of Investigation is an agency of the United States Department of Justice that serves as both a federal criminal investigative body and an internal intelligence agency . The FBI has investigative jurisdiction over violations of more than 200 categories of federal crime...

warned of an "epidemic" in mortgage fraud, an important credit risk of nonprime mortgage lending, which, they said, could lead to "a problem that could have as much impact as the S&L crisis".

Down payments and negative equity

A down paymentDown payment

Down payment is a payment used in the context of the purchase of expensive items such as a car and a house, whereby the payment is the initial upfront portion of the total amount due and it is usually given in cash at the time of finalizing the transaction.A loan is then required to make the full...

refers to the cash paid to the lender for the home and represents the initial homeowners equity or financial interest in the home. A low down payment means that a home represents a highly leveraged investment for the homeowner, with little equity relative to debt. In such circumstances, only small declines in the value of the home result in negative equity

Negative equity

Negative equity occurs when the value of an asset used to secure a loan is less than the outstanding balance on the loan. In the United States, assets with negative equity are often referred to as being "underwater", and loans and borrowers with negative equity are said to be "upside down".People...

, a situation in which the value of the home is less than the mortgage amount owed. In 2005, the median down payment for first-time home buyers was 2%, with 43% of those buyers making no down payment whatsoever. By comparison, China has down payment requirements that exceed 20%, with higher amounts for non-primary residences.

Economist Nouriel Roubini

Nouriel Roubini

Nouriel Roubini is an American economist. He claims to have predicted both the collapse of the United States housing market and the worldwide recession which started in 2008. He teaches at New York University's Stern School of Business and is the chairman of Roubini Global Economics, an economic...

wrote in Forbes in July 2009: "Home prices have already fallen from their peak by about 30%. Based on my analysis, they are going to fall by at least 40% from their peak, and more likely 45%, before they bottom out. They are still falling at an annualized rate of over 18%. That fall of at least 40%-45% percent of home prices from their peak is going to imply that about half of all households that have a mortgage—about 25 million of the 51 million that have mortgages—are going to be underwater with negative equity

Negative equity

Negative equity occurs when the value of an asset used to secure a loan is less than the outstanding balance on the loan. In the United States, assets with negative equity are often referred to as being "underwater", and loans and borrowers with negative equity are said to be "upside down".People...

and will have a significant incentive to walk away from their homes."

Economist Stan Leibowitz argued in the Wall Street Journal that the extent of equity in the home was the key factor in foreclosure, rather than the type of loan, credit worthiness of the borrower, or ability to pay. Although only 12% of homes had negative equity (meaning the property was worth less than the mortgage obligation), they comprised 47% of foreclosures during the second half of 2008. Homeowners with negative equity have less financial incentive to stay in the home.

The L.A. Times reported the results of a study that found homeowners with high credit scores at the time of entering the mortgage are 50% more likely to "strategically default

Strategic default

A strategic default is the decision by a borrower to stop making payments on a debt despite having the financial ability to make the payments....

" -- abruptly and intentionally pull the plug and abandon the mortgage—compared with lower-scoring borrowers. Such strategic defaults were heavily concentrated in markets with the highest price declines. An estimated 588,000 strategic defaults occurred nationwide during 2008, more than double the total in 2007. They represented 18% of all serious delinquencies that extended for more than 60 days in the fourth quarter of 2008.

Predatory lending

Predatory lending refers to the practice of unscrupulous lenders, to enter into "unsafe" or "unsound" secured loans for inappropriate purposes. A classic bait-and-switch method was used by Countrywide, advertising low interest rates for home refinancing. Such loans were written into mind-numbingly detailed contracts, and swapped for more expensive loan products on the day of closing. Whereas the advertisement might state that 1% or 1.5% interest would be charged, the consumer would be put into an adjustable rate mortgage (ARM) in which the interest charged would be greater than the amount of interest paid. This created negative amortizationNegative amortization

In finance, negative amortization, also known as NegAm, deferred interest or graduated payment mortgage, occurs whenever the loan payment for any period is less than the interest charged over that period so that the outstanding balance of the loan increases...

, which the credit consumer might not notice until long after the loan transaction had been consummated.

Countrywide, sued by California Attorney General Jerry Brown

Jerry Brown

Edmund Gerald "Jerry" Brown, Jr. is an American politician. Brown served as the 34th Governor of California , and is currently serving as the 39th California Governor...

for "Unfair Business Practices" and "False Advertising" was making high cost mortgages "to homeowners with weak credit, adjustable rate mortgages (ARMs) that allowed homeowners to make interest-only payments.". When housing prices decreased, homeowners in ARMs then had little incentive to pay their monthly payments, since their home equity had disappeared. This caused Countrywide's financial condition to deteriorate, ultimately resulting in a decision by the Office of Thrift Supervision to seize the lender.

Countrywide, according to Republican Lawmakers, had involved itself in making low-cost loans to politicians, for purposes of gaining political favors.

Former employees from Ameriquest

Ameriquest

ACC Capital Holdings was a national mortgage lender based in Orange, California. The company is the largest privately held retail mortgage lender in the United States and the largest subprime lender by volume...

, which was United States's leading wholesale lender, described a system in which they were pushed to falsify mortgage documents and then sell the mortgages to Wall Street banks eager to make fast profits. There is growing evidence that such mortgage fraud

Mortgage fraud

Mortgage fraud is crime in which the intent is to materially misrepresent or omit information on a mortgage loan application to obtain a loan or to obtain a larger loan than would have been obtained had the lender or borrower known the truth....

s may be a cause of the crisis.

Risk-taking behavior

In a June 2009 speech, U.S. President Barack ObamaBarack Obama

Barack Hussein Obama II is the 44th and current President of the United States. He is the first African American to hold the office. Obama previously served as a United States Senator from Illinois, from January 2005 until he resigned following his victory in the 2008 presidential election.Born in...

argued that a "culture of irresponsibility" was an important cause of the crisis. He criticized executive compensation that "rewarded recklessness rather than responsibility" and Americans who bought homes "without accepting the responsibilities." He continued that there "was far too much debt and not nearly enough capital in the system. And a growing economy bred complacency."

A key theme of the crisis is that many large financial institutions did not have a sufficient financial cushion to absorb the losses they sustained or to support the commitments made to others. Using technical terms, these firms were highly leveraged

Leverage (finance)

In finance, leverage is a general term for any technique to multiply gains and losses. Common ways to attain leverage are borrowing money, buying fixed assets and using derivatives. Important examples are:* A public corporation may leverage its equity by borrowing money...

(i.e., they maintained a high ratio of debt to equity) or had insufficient capital

Financial capital

Financial capital can refer to money used by entrepreneurs and businesses to buy what they need to make their products or provide their services or to that sector of the economy based on its operation, i.e. retail, corporate, investment banking, etc....

to post as collateral

Collateral (finance)

In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan.The collateral serves as protection for a lender against a borrower's default - that is, any borrower failing to pay the principal and interest under the terms of a loan obligation...

for their borrowing. A key to a stable financial system is that firms have the financial capacity to support their commitments. Michael Lewis

Michael Lewis (author)

Michael Lewis is an American non-fiction author and financial journalist. His bestselling books include The Big Short: Inside the Doomsday Machine, Liar's Poker, The New New Thing, Moneyball: The Art of Winning an Unfair Game, The Blind Side: Evolution of a Game, Panic and Home Game: An...

and David Einhorn argued: "The most critical role for regulation is to make sure that the sellers of risk have the capital to support their bets."

Consumer and household borrowing

U.S. households and financial institutions became increasingly indebted or overleveraged during the years preceding the crisis. This increased their vulnerability to the collapse of the housing bubble and worsened the ensuing economic downturn.- USA household debt as a percentage of annual disposable personal income was 127% at the end of 2007, versus 77% in 1990.

- U.S. home mortgage debt relative to gross domestic productGross domestic productGross domestic product refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living....

(GDP) increased from an average of 46% during the 1990s to 73% during 2008, reaching $10.5 trillion. - In 1981, U.S. private debt was 123% of GDP; by the third quarter of 2008, it was 290%.

Home equity extraction

This refers to homeowners borrowing and spending against the value of their homes, typically via a home equity loan or when selling the home. Free cash used by consumers from home equity extraction doubled from $627 billion in 2001 to $1,428 billion in 2005 as the housing bubble built, a total of nearly $5 trillion dollars over the period, contributing to economic growth worldwide. U.S. home mortgage debt relative to GDP increased from an average of 46% during the 1990s to 73% during 2008, reaching $10.5 trillion.Housing speculation

Speculative borrowing in residential real estate has been cited as a contributing factor to the subprime mortgage crisis. During 2006, 22% of homes purchased (1.65 million units) were for investment purposes, with an additional 14% (1.07 million units) purchased as vacation homes. During 2005, these figures were 28% and 12%, respectively. In other words, a record level of nearly 40% of homes purchases were not intended as primary residences. David Lereah, NARNational Association of Realtors

The National Association of Realtors , whose members are known as Realtors, is North America's largest trade association. representing over 1.2 million members , including NAR's institutes, societies, and councils, involved in all aspects of the residential and commercial real estate industries...

's chief economist at the time, stated that the 2006 decline in investment buying was expected: "Speculators left the market in 2006, which caused investment sales to fall much faster than the primary market."

Housing prices nearly doubled between 2000 and 2006, a vastly different trend from the historical appreciation at roughly the rate of inflation. While homes had not traditionally been treated as investments subject to speculation, this behavior changed during the housing boom. Media widely reported condominiums being purchased while under construction, then being "flipped" (sold) for a profit without the seller ever having lived in them. Some mortgage companies identified risks inherent in this activity as early as 2005, after identifying investors assuming highly leveraged positions in multiple properties.

Nicole Gelinas of the Manhattan Institute

Manhattan Institute

The Manhattan Institute for Policy Research is a conservative, market-oriented think tank established in New York City in 1978 by Antony Fisher and William J...

described the negative consequences of not adjusting tax and mortgage policies to the shifting treatment of a home from conservative inflation hedge to speculative investment. Economist Robert Shiller

Robert Shiller

Robert James "Bob" Shiller is an American economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University and is a Fellow at the Yale International Center for Finance, Yale School of Management...

argued that speculative bubbles are fueled by "contagious optimism, seemingly impervious to facts, that often takes hold when prices are rising. Bubbles are primarily social phenomena; until we understand and address the psychology that fuels them, they're going to keep forming."

Pro-cyclical human nature

Keynesian economist Hyman MinskyHyman Minsky

Hyman Philip Minsky was an American economist and professor of economics at Washington University in St. Louis. His research attempted to provide an understanding and explanation of the characteristics of financial crises...

described how speculative borrowing contributed to rising debt and an eventual collapse of asset values.

Economist Paul McCulley

Paul McCulley

Paul Allen McCulley is a former managing director at PIMCO. He coined the terms Minsky moment and Shadow banking system which became famous during the Financial crisis of 2007-2009....

described how Minsky's hypothesis translates to the current crisis, using Minsky's words: "...from time to time, capitalist economies exhibit inflations and debt deflations which seem to have the potential to spin out of control. In such processes, the economic system's reactions to a movement of the economy amplify the movement--inflation feeds upon inflation and debt-deflation feeds upon debt deflation." In other words, people are momentum investors by nature, not value investors. People naturally take actions that expand the apex and nadir of cycles. One implication for policymakers and regulators is the implementation of counter-cyclical policies, such as contingent capital requirements for banks that increase during boom periods and are reduced during busts.

Corporate risk-taking and leverage

Citigroup

Citigroup Inc. or Citi is an American multinational financial services corporation headquartered in Manhattan, New York City, New York, United States. Citigroup was formed from one of the world's largest mergers in history by combining the banking giant Citicorp and financial conglomerate...

Charles O. Prince said in November 2007: "As long as the music is playing, you've got to get up and dance." This metaphor summarized how financial institutions took advantage of easy credit conditions, by borrowing and investing large sums of money, a practice called leveraged lending. Debt taken on by financial institutions increased from 63.8% of U.S. gross domestic product

Gross domestic product

Gross domestic product refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living....

in 1997 to 113.8% in 2007.

A 2004 SEC decision related to the net capital rule

Net capital rule

The uniform net capital rule is a rule created by the U.S. Securities and Exchange Commission in 1975 to regulate directly the ability of broker-dealers to meet their financial obligations to customers and other creditors...

allowed USA investment banks to issue substantially more debt, which was then used to help fund the housing bubble through purchases of mortgage-backed securities. From 2004-07, the top five U.S. investment banks each significantly increased their financial leverage (see diagram), which increased their vulnerability to a financial shock. These five institutions reported over $4.1 trillion in debt for fiscal year 2007, about 30% of USA nominal GDP for 2007. Lehman Brothers

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

was liquidated, Bear Stearns

Bear Stearns

The Bear Stearns Companies, Inc. based in New York City, was a global investment bank and securities trading and brokerage, until its sale to JPMorgan Chase in 2008 during the global financial crisis and recession...

and Merrill Lynch

Merrill Lynch

Merrill Lynch is the wealth management division of Bank of America. With over 15,000 financial advisors and $2.2 trillion in client assets it is the world's largest brokerage. Formerly known as Merrill Lynch & Co., Inc., prior to 2009 the firm was publicly owned and traded on the New York...

were sold at fire-sale prices, and Goldman Sachs

Goldman Sachs

The Goldman Sachs Group, Inc. is an American multinational bulge bracket investment banking and securities firm that engages in global investment banking, securities, investment management, and other financial services primarily with institutional clients...

and Morgan Stanley

Morgan Stanley

Morgan Stanley is a global financial services firm headquartered in New York City serving a diversified group of corporations, governments, financial institutions, and individuals. Morgan Stanley also operates in 36 countries around the world, with over 600 offices and a workforce of over 60,000....

became commercial banks, subjecting themselves to more stringent regulation. With the exception of Lehman, these companies required or received government support.

Fannie Mae and Freddie Mac, two U.S. Government sponsored enterprises, owned or guaranteed nearly $5 trillion in mortgage obligations at the time they were placed into conservatorship

Conservatorship

Conservatorship is a legal concept in the United States of America, where an entity or organization is subjected to the legal control of an external entity or organization, known as a conservator. Conservatorship is established either by court order or via a statutory or regulatory authority...

by the U.S. government in September 2008.

These seven entities were highly leveraged and had $9 trillion in debt or guarantee obligations, an enormous concentration of risk, yet were not subject to the same regulation as depository banks.

In a May 2008 speech, Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

quoted Walter Bagehot

Walter Bagehot

Walter Bagehot was an English businessman, essayist, and journalist who wrote extensively about literature, government, and economic affairs.-Early years:...

: "A good banker will have accumulated in ordinary times the reserve he is to make use of in extraordinary times." However, this advice was not heeded by these institutions, which had used the boom times to increase their leverage ratio instead.

In laissez-faire

Laissez-faire

In economics, laissez-faire describes an environment in which transactions between private parties are free from state intervention, including restrictive regulations, taxes, tariffs and enforced monopolies....