Mortgage fraud

Encyclopedia

Mortgage fraud is crime in which the intent is to materially misrepresent or omit information on a mortgage loan

application to obtain a loan or to obtain a larger loan than would have been obtained had the lender or borrower known the truth.

In United States federal courts, mortgage fraud is prosecuted as wire fraud

, bank fraud

, mail fraud and money laundering

, with penalties of up to thirty years imprisonment

. As the incidence of mortgage fraud has risen over the past few years, states have also begun to enact their own penalties for mortgage fraud.

Mortgage fraud is not to be confused with predatory mortgage lending

, which occurs when a consumer is misled or deceived by agents of the lender. However, predatory lending practices often co-exist with mortgage fraud.

than was warranted. Because lenders typically charge a higher interest rate for non-owner-occupied properties, which historically have higher delinquency rates, the lender receives insufficient return on capital and is over-exposed to loss relative to what was expected in the transaction. In addition, lenders allow larger loans on owner-occupied homes compared to loans for investment properties. When occupancy fraud occurs, it is likely that taxes on gains are not paid, resulting in additional fraud. It is considered fraud because the borrower has materially misprepresented the risk to the lender to obtain more favorable loan terms.

Income fraud: This occurs when a borrower overstates his/her income

to qualify for a mortgage or for a larger loan amount. This was most often seen with so-called "stated income" mortgage loans (popularly referred to as "liar loans"), where the borrower, or a loan officer acting for a borrower with or without the borrower's knowledge, stated without verification the income needed to qualify for the loan. Because mortgage lenders have begun to tighten underwriting standards and "stated income" loans are less available, income fraud is increasingly seen in traditional full-documentation loans where the borrower forges or alters an employer-issued Form W-2, tax returns and/or bank account records to provide support for the inflated income. It is considered fraud because in most cases the borrower would not have qualified for the loan had the true income been disclosed. The "mortgage meltdown" was caused, in part, when large numbers of borrowers in areas of rapidly increasing home prices lied about their income, acquired homes they could not afford, and then defaulted.

Employment fraud: This occurs when a borrower claims self-employment in a non-existent company or claims a higher position (e.g., manager) in a real company, to provide justification for a fraudulent representation of the borrower's income.

Failure to disclose liabilities: Borrowers may conceal obligations, such as mortgage loans on other properties or newly acquired credit card debt, to reduce the amount of monthly debt declared on the loan application. This omission of liabilities artificially lowers the debt-to-income ratio

, which is a key underwriting criterion used to determine eligibility for most mortgage loans. It is considered fraud because it allows the borrower to qualify for a loan which otherwise would not have been granted, or to qualify for a bigger loan than what would have been granted had the borrower's true debt been disclosed.

Fraud for profit: A complex scheme involving multiple parties, including mortgage lending professionals, in a financially motivated attempt to defraud the lender of large sums of money. Fraud for profit schemes frequently include a straw borrower

whose credit report is used, a dishonest appraiser who intentionally and significantly overstates the value of the subject property, a dishonest settlement agent who might prepare two sets of HUD settlement statements or makes disbursements from loan proceeds which are not disclosed on the settlement statement, and a property owner, all in a coordinated attempt to obtain an inappropriately large loan. The parties involved share the ill-gotten gains and the mortgage eventually goes into default. In other cases, naive "investors" are lured into the scheme with the organizer's promise that the home will be repaired, repairs and/or renovations will be made, tenants will located, rents will be collected, mortgage payments made and profits will be split upon sale of the property, all without the active participation of the straw buyer. Once the loan is closed, the organizer disappears, no repairs are made nor renters found, and the "investor" is liable for paying the mortgage on a property that is not worth what is owed, leaving the "investor" financially ruined. If undetected, a bank may lend hundreds of thousands of dollars against a property that is actually worth far less and in large schemes with multiple transactions, banks may lend millions more than the properties are worth. The Robert Douglas Hartmann case is a notable example of this type of scheme.

Appraisal fraud: Occurs when a home's appraised value is deliberately overstated or understated. When overstated, more money can be obtained by the borrower in the form of a cash-out refinance

, by the seller in a purchase transaction, or by the organizers of a for-profit mortgage fraud scheme. Appraisal fraud also includes cases where the home's value is deliberately understated to get a lower price on a foreclosed home, or in a fraudulent attempt to induce a lender to decrease the amount owed on the mortgage in a loan modification. A dishonest appraiser may be involved in the preparation of the fraudulent appraisal, or an existing and accurate appraisal may be altered by someone with knowledge of graphic editing tools such as Adobe Photoshop

.

Cash-back schemes: Occur where the true price of a property is illegally inflated to provide cash-back to transaction participants, most often the borrowers, who receive a "rebate" which is not disclosed to the lender. As a result the lender lends too much, and the buyer pockets the overage or splits it with other participants, including the seller or the real estate agent. This scheme requires appraisal fraud to deceive the lender. "Get Rich Quick" real-estate gurus' courses frequently rely heavily on this mechanism for profitability.

Shotgunning: Occurs when multiple loans for the same home are obtained simultaneously for a total amount greatly in excess of the actual value of the property. These schemes leave lenders exposed to large losses because the subsequent mortgages are junior to the first mortgage to be recorded and the property value is insufficient for the subsequent lenders to collect against the property in foreclosure. The Matthew Cox

and Robert Douglas Hartmann cases are the most notable example of this type of scheme.

Working the gap: A technique which entails the excessive lien stacking knowingly executed on a specific property within an inordinately narrow timeframe, via the serial recording of multiple Deeds of Trust or Assignments of Note

. When recording a legal document in the United States of America, a time gap exists between when the Deed of Trust is submitted to the Recorder of Deeds

& when it actually shows up in the data. The precision timing technique of "working the gap" between the recording of a deed & its subsequent appearance in the recorder of deeds database is instrumental in propagating the perpetrator's deception. A title search done by any lender immediately prior to the respective loan, promissory note, & deed recording would thus erroneously fail to show the alternate liens concurrently in the queue

. The goal of the perpetrator is the theft of funds from each lender by deceit, with all lenders simultaneously & erroneously believing their respective Deeds of Trust to be senior in position, when in actuality there can be only one. White-collar criminal

s who utilize this technique will frequently claim innocence based on clerical errors, bad record keeping, or other smokescreen excuses in an attempt to obfuscate the true coordination & intent inherent in this version of mortgage fraud. This "gaming

" or exploitation of a structural weakness in the US legal system is a critical precursor to "shotgunning" and considered white-collar crime

when implemented in a systemic fashion.

Identity theft: Occurs when a person assumes the identity of another and uses that identity to obtain a mortgage without the knowledge or consent of the victim. In these schemes, the thieves disappear without making payments on the mortgage. The schemes are usually not discovered until the lender tries to collect from the victim, who may incur substantial costs trying to prove the theft of his/her identity.

Falsification of loan applications without the knowledge of the borrower : The loan applications are falsified with out the knowledge of the borrower when the borrower actually will not qualify for a loan for various reasons. for example parties involved will make a commission out of the transaction. The business happens only if the loan application is falsified. For example borrower applies for a loan stating monthly income of $2000 (but with this income $2000 per month the borrower will not qualify), however the broker or loan officer falsified the income documents and loan application that borrower earns a monthly income of $15,000. The loan gets approved the broker/loan officer etc. gets their commission. But the borrower struggles to repay the loan and defaults the loan eventually.

Mortgage fraud may be perpetrated by one or more participants in a loan transaction, including the borrower; a loan officer who originates the mortgage; a real estate agent, appraiser, a title or escrow representative or attorney; or by multiple parties as in the example of the fraud ring described above. Dishonest and unreputable stakeholders may encourage and assist borrowers in committing fraud because most participants are typically compensated only when a transaction closes.

Mortgage fraud may be perpetrated by one or more participants in a loan transaction, including the borrower; a loan officer who originates the mortgage; a real estate agent, appraiser, a title or escrow representative or attorney; or by multiple parties as in the example of the fraud ring described above. Dishonest and unreputable stakeholders may encourage and assist borrowers in committing fraud because most participants are typically compensated only when a transaction closes.

During 2003 The Money Programme

of the BBC

in the UK uncovered systemic mortgage fraud throughout HBOS

. The Money Programme found that during the investigation brokers advised the undercover researchers to lie on applications for self-certified mortgages from, among others, The Royal Bank of Scotland, The Mortgage Business and Birmingham Midshires Building Society.

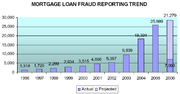

In 2004, the FBI warned that mortgage fraud was becoming so rampant that the resulting "epidemic" of crimes could trigger a massive financial crisis. According to a December 2005 press release from the FBI, "mortgage fraud is one of the fastest growing white collar crimes

in the United States".

The number of FBI agents assigned to mortgage-related crimes increased by 50 percent between 2007 and 2008. In June 2008, The FBI stated that its mortgage fraud caseload has doubled in the past three years to more than 1,400 pending cases. Between 1 March and 18 June 2008, 406 people were arrested for mortgage fraud in an FBI sting across the country. People arrested include buyers, sellers and others across the wide-ranging mortgage industry.

, or FERA, , , public law

in the United States, was enacted. The law takes a number of steps (http://www.govtrack.us/congress/bill.xpd?bill=s111-386&tab=summary) to enhance criminal enforcement of federal fraud

laws, especially regarding financial institution

s, mortgage fraud, and securities fraud

or commodities fraud.

Significant to note, Section 3 of the Act authorized additional funding to detect and prosecute fraud at various federal agencies, specifically:

These authorizations were made for the federal fiscal years beginning October 1, 2009 and 2010, after which point they expire, and are in addition to the previously authorized budgets for these agencies.

Mortgage loan

A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan...

application to obtain a loan or to obtain a larger loan than would have been obtained had the lender or borrower known the truth.

In United States federal courts, mortgage fraud is prosecuted as wire fraud

Wire fraud

Mail and wire fraud is a federal crime in the United States. Together, 18 U.S.C. §§ 1341, 1343, and 1346 reach any fraudulent scheme or artifice to intentionally deprive another of property or honest services with a nexus to mail or wire communication....

, bank fraud

Bank fraud

Bank fraud is the use of fraudulent means to obtain money, assets, or other property owned or held by a financial institution, or to obtain money from depositors by fraudulently representing to be a bank or financial institution. In many instances, bank fraud is a criminal offense...

, mail fraud and money laundering

Money laundering

Money laundering is the process of disguising illegal sources of money so that it looks like it came from legal sources. The methods by which money may be laundered are varied and can range in sophistication. Many regulatory and governmental authorities quote estimates each year for the amount...

, with penalties of up to thirty years imprisonment

Imprisonment

Imprisonment is a legal term.The book Termes de la Ley contains the following definition:This passage was approved by Atkin and Duke LJJ in Meering v Grahame White Aviation Co....

. As the incidence of mortgage fraud has risen over the past few years, states have also begun to enact their own penalties for mortgage fraud.

Mortgage fraud is not to be confused with predatory mortgage lending

Predatory lending

Predatory lending describes unfair, deceptive, or fraudulent practices of some lenders during the loan origination process. While there are no legal definitions in the United States for predatory lending, an audit report on predatory lending from the office of inspector general of the FDIC broadly...

, which occurs when a consumer is misled or deceived by agents of the lender. However, predatory lending practices often co-exist with mortgage fraud.

Types

Occupancy fraud: This occurs where the borrower wishes to obtain a mortgage to acquire an investment property, but states on the loan application that the borrower will occupy the property as the primary residence or as a second home. If undetected, the borrower typically obtains a lower interest rateInterest rate

An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for...

than was warranted. Because lenders typically charge a higher interest rate for non-owner-occupied properties, which historically have higher delinquency rates, the lender receives insufficient return on capital and is over-exposed to loss relative to what was expected in the transaction. In addition, lenders allow larger loans on owner-occupied homes compared to loans for investment properties. When occupancy fraud occurs, it is likely that taxes on gains are not paid, resulting in additional fraud. It is considered fraud because the borrower has materially misprepresented the risk to the lender to obtain more favorable loan terms.

Income fraud: This occurs when a borrower overstates his/her income

Income

Income is the consumption and savings opportunity gained by an entity within a specified time frame, which is generally expressed in monetary terms. However, for households and individuals, "income is the sum of all the wages, salaries, profits, interests payments, rents and other forms of earnings...

to qualify for a mortgage or for a larger loan amount. This was most often seen with so-called "stated income" mortgage loans (popularly referred to as "liar loans"), where the borrower, or a loan officer acting for a borrower with or without the borrower's knowledge, stated without verification the income needed to qualify for the loan. Because mortgage lenders have begun to tighten underwriting standards and "stated income" loans are less available, income fraud is increasingly seen in traditional full-documentation loans where the borrower forges or alters an employer-issued Form W-2, tax returns and/or bank account records to provide support for the inflated income. It is considered fraud because in most cases the borrower would not have qualified for the loan had the true income been disclosed. The "mortgage meltdown" was caused, in part, when large numbers of borrowers in areas of rapidly increasing home prices lied about their income, acquired homes they could not afford, and then defaulted.

Employment fraud: This occurs when a borrower claims self-employment in a non-existent company or claims a higher position (e.g., manager) in a real company, to provide justification for a fraudulent representation of the borrower's income.

Failure to disclose liabilities: Borrowers may conceal obligations, such as mortgage loans on other properties or newly acquired credit card debt, to reduce the amount of monthly debt declared on the loan application. This omission of liabilities artificially lowers the debt-to-income ratio

Debt-to-income ratio

A debt-to-income ratio is the percentage of a consumer's monthly gross income that goes toward paying debts. A debt-to-income ratio (often abbreviated DTI) is the percentage of a consumer's monthly gross income that goes toward paying debts. A debt-to-income ratio (often abbreviated DTI) is the...

, which is a key underwriting criterion used to determine eligibility for most mortgage loans. It is considered fraud because it allows the borrower to qualify for a loan which otherwise would not have been granted, or to qualify for a bigger loan than what would have been granted had the borrower's true debt been disclosed.

Fraud for profit: A complex scheme involving multiple parties, including mortgage lending professionals, in a financially motivated attempt to defraud the lender of large sums of money. Fraud for profit schemes frequently include a straw borrower

Straw borrower

A straw borrower is a United States term for an individual whose name, social security number, and credit history are used to hide the identity of the organizers of a for-profit mortgage fraud scheme....

whose credit report is used, a dishonest appraiser who intentionally and significantly overstates the value of the subject property, a dishonest settlement agent who might prepare two sets of HUD settlement statements or makes disbursements from loan proceeds which are not disclosed on the settlement statement, and a property owner, all in a coordinated attempt to obtain an inappropriately large loan. The parties involved share the ill-gotten gains and the mortgage eventually goes into default. In other cases, naive "investors" are lured into the scheme with the organizer's promise that the home will be repaired, repairs and/or renovations will be made, tenants will located, rents will be collected, mortgage payments made and profits will be split upon sale of the property, all without the active participation of the straw buyer. Once the loan is closed, the organizer disappears, no repairs are made nor renters found, and the "investor" is liable for paying the mortgage on a property that is not worth what is owed, leaving the "investor" financially ruined. If undetected, a bank may lend hundreds of thousands of dollars against a property that is actually worth far less and in large schemes with multiple transactions, banks may lend millions more than the properties are worth. The Robert Douglas Hartmann case is a notable example of this type of scheme.

Appraisal fraud: Occurs when a home's appraised value is deliberately overstated or understated. When overstated, more money can be obtained by the borrower in the form of a cash-out refinance

Refinancing

Refinancing may refer to the replacement of an existing debt obligation with a debt obligation under different terms. The terms and conditions of refinancing may vary widely by country, province, or state, based on several economic factors such as, inherent risk, projected risk, political...

, by the seller in a purchase transaction, or by the organizers of a for-profit mortgage fraud scheme. Appraisal fraud also includes cases where the home's value is deliberately understated to get a lower price on a foreclosed home, or in a fraudulent attempt to induce a lender to decrease the amount owed on the mortgage in a loan modification. A dishonest appraiser may be involved in the preparation of the fraudulent appraisal, or an existing and accurate appraisal may be altered by someone with knowledge of graphic editing tools such as Adobe Photoshop

Adobe Photoshop

Adobe Photoshop is a graphics editing program developed and published by Adobe Systems Incorporated.Adobe's 2003 "Creative Suite" rebranding led to Adobe Photoshop 8's renaming to Adobe Photoshop CS. Thus, Adobe Photoshop CS5 is the 12th major release of Adobe Photoshop...

.

Cash-back schemes: Occur where the true price of a property is illegally inflated to provide cash-back to transaction participants, most often the borrowers, who receive a "rebate" which is not disclosed to the lender. As a result the lender lends too much, and the buyer pockets the overage or splits it with other participants, including the seller or the real estate agent. This scheme requires appraisal fraud to deceive the lender. "Get Rich Quick" real-estate gurus' courses frequently rely heavily on this mechanism for profitability.

Shotgunning: Occurs when multiple loans for the same home are obtained simultaneously for a total amount greatly in excess of the actual value of the property. These schemes leave lenders exposed to large losses because the subsequent mortgages are junior to the first mortgage to be recorded and the property value is insufficient for the subsequent lenders to collect against the property in foreclosure. The Matthew Cox

Matthew Cox

Matthew Bevan Cox , commonly known as Matthew Cox, also sometimes known as Matthew B. Cox and Matt Cox, is an American felon and con man who has been convicted of conspiracy and grand theft...

and Robert Douglas Hartmann cases are the most notable example of this type of scheme.

Working the gap: A technique which entails the excessive lien stacking knowingly executed on a specific property within an inordinately narrow timeframe, via the serial recording of multiple Deeds of Trust or Assignments of Note

Assignment (law)

An assignment is a term used with similar meanings in the law of contracts and in the law of real estate. In both instances, it encompasses the transfer of rights held by one party—the assignor—to another party—the assignee...

. When recording a legal document in the United States of America, a time gap exists between when the Deed of Trust is submitted to the Recorder of Deeds

Recorder of deeds

Recorder of deeds is a government office tasked with maintaining public records and documents, especially records relating to real estate ownership that provide persons other than the owner of a property with real rights over that property.-Background:...

& when it actually shows up in the data. The precision timing technique of "working the gap" between the recording of a deed & its subsequent appearance in the recorder of deeds database is instrumental in propagating the perpetrator's deception. A title search done by any lender immediately prior to the respective loan, promissory note, & deed recording would thus erroneously fail to show the alternate liens concurrently in the queue

Queue

A queue is a particular kind of collection in which the entities in the collection are kept in order and the principal operations on the collection are the addition of entities to the rear terminal position and removal of entities from the front terminal position. This makes the queue a...

. The goal of the perpetrator is the theft of funds from each lender by deceit, with all lenders simultaneously & erroneously believing their respective Deeds of Trust to be senior in position, when in actuality there can be only one. White-collar criminal

White-collar crime

Within the field of criminology, white-collar crime has been defined by Edwin Sutherland as "a crime committed by a person of respectability and high social status in the course of his occupation" . Sutherland was a proponent of Symbolic Interactionism, and believed that criminal behavior was...

s who utilize this technique will frequently claim innocence based on clerical errors, bad record keeping, or other smokescreen excuses in an attempt to obfuscate the true coordination & intent inherent in this version of mortgage fraud. This "gaming

Gaming the system

Gaming the system can be defined as "[using] the rules and procedures meant to protect a system in order, instead, to manipulate the system for [a] desired outcome".According to James Rieley, structures in organizations Gaming the system (or bending the rules, playing the system, abusing the...

" or exploitation of a structural weakness in the US legal system is a critical precursor to "shotgunning" and considered white-collar crime

White-collar crime

Within the field of criminology, white-collar crime has been defined by Edwin Sutherland as "a crime committed by a person of respectability and high social status in the course of his occupation" . Sutherland was a proponent of Symbolic Interactionism, and believed that criminal behavior was...

when implemented in a systemic fashion.

Identity theft: Occurs when a person assumes the identity of another and uses that identity to obtain a mortgage without the knowledge or consent of the victim. In these schemes, the thieves disappear without making payments on the mortgage. The schemes are usually not discovered until the lender tries to collect from the victim, who may incur substantial costs trying to prove the theft of his/her identity.

Falsification of loan applications without the knowledge of the borrower : The loan applications are falsified with out the knowledge of the borrower when the borrower actually will not qualify for a loan for various reasons. for example parties involved will make a commission out of the transaction. The business happens only if the loan application is falsified. For example borrower applies for a loan stating monthly income of $2000 (but with this income $2000 per month the borrower will not qualify), however the broker or loan officer falsified the income documents and loan application that borrower earns a monthly income of $15,000. The loan gets approved the broker/loan officer etc. gets their commission. But the borrower struggles to repay the loan and defaults the loan eventually.

Other background

During 2003 The Money Programme

The Money Programme

The Money Programme is a finance and business affairs television programme on BBC2.It was first broadcast on 5 April 1966 and presented by "commentators" William Davis, Erskine Childers and Joe Roeber. At this time David Attenborough was the controller of BBC2...

of the BBC

BBC

The British Broadcasting Corporation is a British public service broadcaster. Its headquarters is at Broadcasting House in the City of Westminster, London. It is the largest broadcaster in the world, with about 23,000 staff...

in the UK uncovered systemic mortgage fraud throughout HBOS

HBOS

HBOS plc is a banking and insurance company in the United Kingdom, a wholly owned subsidiary of the Lloyds Banking Group having been taken over in January 2009...

. The Money Programme found that during the investigation brokers advised the undercover researchers to lie on applications for self-certified mortgages from, among others, The Royal Bank of Scotland, The Mortgage Business and Birmingham Midshires Building Society.

In 2004, the FBI warned that mortgage fraud was becoming so rampant that the resulting "epidemic" of crimes could trigger a massive financial crisis. According to a December 2005 press release from the FBI, "mortgage fraud is one of the fastest growing white collar crimes

White-collar crime

Within the field of criminology, white-collar crime has been defined by Edwin Sutherland as "a crime committed by a person of respectability and high social status in the course of his occupation" . Sutherland was a proponent of Symbolic Interactionism, and believed that criminal behavior was...

in the United States".

The number of FBI agents assigned to mortgage-related crimes increased by 50 percent between 2007 and 2008. In June 2008, The FBI stated that its mortgage fraud caseload has doubled in the past three years to more than 1,400 pending cases. Between 1 March and 18 June 2008, 406 people were arrested for mortgage fraud in an FBI sting across the country. People arrested include buyers, sellers and others across the wide-ranging mortgage industry.

Fraud Enforcement and Recovery Act of 2009

In May 2009, the Fraud Enforcement and Recovery Act of 2009Fraud Enforcement and Recovery Act of 2009

The Fraud Enforcement and Recovery Act of 2009, or FERA, , is a public law in the United States enacted in 2009. The law enhanced criminal enforcement of federal fraud laws, especially regarding financial institutions, mortgage fraud, and securities fraud or commodities fraud.-Legislative history:U.S...

, or FERA, , , public law

Public law

Public law is a theory of law governing the relationship between individuals and the state. Under this theory, constitutional law, administrative law and criminal law are sub-divisions of public law...

in the United States, was enacted. The law takes a number of steps (http://www.govtrack.us/congress/bill.xpd?bill=s111-386&tab=summary) to enhance criminal enforcement of federal fraud

Fraud

In criminal law, a fraud is an intentional deception made for personal gain or to damage another individual; the related adjective is fraudulent. The specific legal definition varies by legal jurisdiction. Fraud is a crime, and also a civil law violation...

laws, especially regarding financial institution

Financial institution

In financial economics, a financial institution is an institution that provides financial services for its clients or members. Probably the most important financial service provided by financial institutions is acting as financial intermediaries...

s, mortgage fraud, and securities fraud

Securities fraud

Securities fraud, also known as stock fraud and investment fraud, is a practice that induces investors to make purchase or sale decisions on the basis of false information, frequently resulting in losses, in violation of the securities laws....

or commodities fraud.

Significant to note, Section 3 of the Act authorized additional funding to detect and prosecute fraud at various federal agencies, specifically:

- $United States dollarThe United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

165,000,000 to the Department of JusticeUnited States Department of JusticeThe United States Department of Justice , is the United States federal executive department responsible for the enforcement of the law and administration of justice, equivalent to the justice or interior ministries of other countries.The Department is led by the Attorney General, who is nominated...

, - $30,000,000 each to the Postal Inspection ServiceUnited States Postal Inspection ServiceThe United States Postal Inspection Service is the law enforcement arm of the United States Postal Service. Its jurisdiction is defined as "crimes that may adversely affect or fraudulently use the U.S...

and the Office of the Inspector GeneralInspector GeneralAn Inspector General is an investigative official in a civil or military organization. The plural of the term is Inspectors General.-Bangladesh:...

at the United States Department of Housing and Urban DevelopmentUnited States Department of Housing and Urban DevelopmentThe United States Department of Housing and Urban Development, also known as HUD, is a Cabinet department in the Executive branch of the United States federal government...

(HUD/OIG) - $20,000,000 to the Secret ServiceUnited States Secret ServiceThe United States Secret Service is a United States federal law enforcement agency that is part of the United States Department of Homeland Security. The sworn members are divided among the Special Agents and the Uniformed Division. Until March 1, 2003, the Service was part of the United States...

- $21,000,000 to the Securities and Exchange Commission

These authorizations were made for the federal fiscal years beginning October 1, 2009 and 2010, after which point they expire, and are in addition to the previously authorized budgets for these agencies.

See also

- Housing market crisis in the United Kingdom (2008)

- Phillip E. Hill, Sr.Phillip E. Hill, Sr.Phillip E. Hill, Sr. was the ringleader of the largest mortgage fraud scheme ever prosecuted in the State of Georgia. Hill was found guilty of 168 counts of fraud and money laundering on March 14, 2007 in the Northern District of Georgia. On September 21, 2007, U.S. District Judge Thomas W....

- United States housing bubbleUnited States housing bubbleThe United States housing bubble is an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and may not yet have hit bottom as of 2011. On December 30, 2008 the...

- MERSMERSMortgage Electronic Registration Systems, Inc. is a privately held company that operates an electronic registry designed to track servicing rights and ownership of mortgage loans in the United States...

External links

- REPORTING MORTGAGE FRAUD to HUD's Office of Inspector General

- "Mortgage fraud: New and improved Lenders have tightened standards, but scam artists have found new ways to beat the system.", CNNCNNCable News Network is a U.S. cable news channel founded in 1980 by Ted Turner. Upon its launch, CNN was the first channel to provide 24-hour television news coverage, and the first all-news television channel in the United States...

Money. October 17. 2008. - "Stimulus gives rise to consumer scams". Philadelphia Inquirer. March 7, 2009.

- Semi-Annual Reports to Congress and other mortgage fraud information from the Office of Inspector General, U.S. Department of Housing and Urban Development