Causes of the United States housing bubble

Encyclopedia

|

|

EWLINE

|

|

EWLINE

|

This article reviews the causes of the United States housing bubble

United States housing bubble

The United States housing bubble is an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and may not yet have hit bottom as of 2011. On December 30, 2008 the...

.

Housing tax policy

In July 1978, Section 121 allowed for a $100,000 one-time exclusion in capital gains for sellers 55 years or older at the time of sale. In 1981, the Section 121 exclusion was increased from $100,000 to $125,000. The Tax Reform Act of 1986Tax Reform Act of 1986

The U.S. Congress passed the Tax Reform Act of 1986 to simplify the income tax code, broaden the tax base and eliminate many tax shelters and other preferences...

eliminated the tax deduction for interest paid on credit cards. As mortgage interest remained deductible, this encouraged the use of home equity through refinancing, second mortgages, and home equity lines of credit (HELOC) by consumers. The Taxpayer Relief Act of 1997

Taxpayer Relief Act of 1997

The Taxpayer Relief Act of 1997 reduced several federal taxes in the United States.Subject to certain phase-in rules, the top capital gains rate fell from 28% to 20%. The 15% bracket was lowered to 10%....

repealed the Section 121 exclusion and section 1034 rollover rules, and replaced them with a $500,000 married/$250,000 single exclusion of capital gains on the sale of a home, available once every two years. This made housing the only investment which escaped capital gains. These tax laws encouraged people to buy expensive, fully mortgaged homes, as well as invest in second homes and investment properties, as opposed to investing in stocks, bonds, or other assets.

Deregulation

Historically, the financial sector was heavily regulated by the Glass–Steagall Act which separated commercialCommercial bank

After the implementation of the Glass–Steagall Act, the U.S. Congress required that banks engage only in banking activities, whereas investment banks were limited to capital market activities. As the two no longer have to be under separate ownership under U.S...

and investment banks. It also set strict limits on Banks' interest rates and loans.

Starting in the 1980s, considerable deregulation took place in banking. Banks were deregulated through:

- The Depository Institutions Deregulation and Monetary Control ActDepository Institutions Deregulation and Monetary Control ActThe Depository Institutions Deregulation and Monetary Control Act, a United States federal financial statute law passed in 1980, gave the Federal Reserve greater control over non-member banks.* It forced all banks to abide by the Fed's rules....

of 1980 (allowing similar banks to merge and set any interest rate).

- The Garn–St. Germain Depository Institutions Act of 1982 (allowing Adjustable-rate mortgages).

- The Gramm–Leach–Bliley Act of 1999 (allowing commercial and investment banks to merge).

This deregulation allowed many risky products to exist (such as Adjustable-rate mortgages) which contributed to the housing bubble and easy credit.

Most blame on deregulation is put on the Gramm–Leach–Bliley Act. Nobel Prize

Nobel Prize

The Nobel Prizes are annual international awards bestowed by Scandinavian committees in recognition of cultural and scientific advances. The will of the Swedish chemist Alfred Nobel, the inventor of dynamite, established the prizes in 1895...

-winning economist Paul Krugman

Paul Krugman

Paul Robin Krugman is an American economist, professor of Economics and International Affairs at the Woodrow Wilson School of Public and International Affairs at Princeton University, Centenary Professor at the London School of Economics, and an op-ed columnist for The New York Times...

has called Senator Phil Gramm

Phil Gramm

William Philip "Phil" Gramm is an American economist and politician, who has served as a Democratic Congressman , a Republican Congressman and a Republican Senator from Texas...

"the father of the financial crisis" due to his sponsorship of the act. Nobel Prize

Nobel Prize

The Nobel Prizes are annual international awards bestowed by Scandinavian committees in recognition of cultural and scientific advances. The will of the Swedish chemist Alfred Nobel, the inventor of dynamite, established the prizes in 1895...

-winning economist

Economist

An economist is a professional in the social science discipline of economics. The individual may also study, develop, and apply theories and concepts from economics and write about economic policy...

Joseph Stiglitz has also argued that GLB helped to create the crisis. An article in The Nation

The Nation

The Nation is the oldest continuously published weekly magazine in the United States. The periodical, devoted to politics and culture, is self-described as "the flagship of the left." Founded on July 6, 1865, It is published by The Nation Company, L.P., at 33 Irving Place, New York City.The Nation...

has made the same argument.

Economists Robert Ekelund

Robert Ekelund

Robert Burton Ekelund, Jr. is an American economist.-Education:Originally from Galveston, Texas, Ekelund attended St. Mary's University in San Antonio, Texas, earning his B.B.A. in economics in 1962 and his M.A. in economics and history the next year...

and Mark Thornton

Mark Thornton

Mark Thornton is an American economist of the Austrian School. Thornton has been described by the Advocates for Self-Government as "one of America's experts on the economics of illegal drugs." Thornton has written extensively on that topic, as well as on the economics of the American Civil War,...

have also criticized the Act as contributing to the crisis. They state that while "in a world regulated by a gold standard

Gold standard

The gold standard is a monetary system in which the standard economic unit of account is a fixed mass of gold. There are distinct kinds of gold standard...

, 100% reserve banking, and no FDIC

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation is a United States government corporation created by the Glass–Steagall Act of 1933. It provides deposit insurance, which guarantees the safety of deposits in member banks, currently up to $250,000 per depositor per bank. , the FDIC insures deposits at...

deposit insurance" the Financial Services Modernization Act would have made "perfect sense" as a legitimate act of deregulation, but under the present fiat monetary system

Debt-based monetary system

Criticisms of fractional-reserve banking have been put forward from a variety of perspectives. Critics have included mainstream economists such as Irving Fisher, Frank Knight and Milton Friedman. Within the economics profession today, most criticisms are from non-mainstream economic theories such...

it "amounts to corporate welfare

Corporate welfare

Corporate welfare is a pejorative term describing a government's bestowal of money grants, tax breaks, or other special favorable treatment on corporations or selected corporations. The term compares corporate subsidies and welfare payments to the poor, and implies that corporations are much less...

for financial institutions and a moral hazard

Moral hazard

In economic theory, moral hazard refers to a situation in which a party makes a decision about how much risk to take, while another party bears the costs if things go badly, and the party insulated from risk behaves differently from how it would if it were fully exposed to the risk.Moral hazard...

that will make taxpayers pay dearly."

Critics have also noted defacto deregulation through a shift in mortgage securitization market share from more highly regulated Government Sponsored Enterprises to less regulated investment banks.

Criticism of mandated loans as the cause of the crisis

Others argue, however, that government-mandated loans were, at best, trivial in the explosion of subprime mortgages.More than 84 percent of the subprime mortgages came from private lending institutions in 2006 and share of subprime loans insured by Fannie Mae and Freddie Mac also decreased as the bubble got bigger (from a high of insuring 48 percent to insuring 24 percent of all subprime loans in 2006). The Community Reinvestment Act

Community Reinvestment Act

The Community Reinvestment Act is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities, including low- and moderate-income neighborhoods...

also only affected one out of the top 25 subprime lenders.

In 2008, Federal Reserve Governor Randall Kroszner

Randall Kroszner

Randall S. Kroszner, Ph.D. is a former member of the Board of Governors of the Federal Reserve System of the United States. He took office on March 1, 2006 to fill an unexpired term, and stepped down on January 21, 2009. Now Kroszner is Norman R...

, said the CRA wasn’t to blame for the subprime mortgage crisis, stating that "first, only a small portion of subprime mortgage originations are related to the CRA. Second, CRA-related loans appear to perform comparably to other types of subprime loans. Taken together… we believe that the available evidence runs counter to the contention that the CRA contributed in any substantive way to the current mortgage crisis,". Only 6% of subprime loans were handed out by CRA-covered lenders to lower income people (the people the CRA is responsible for, CRA-covered banks can technically lend subprime loans to anyone). Others, such as Federal Deposit Insurance Corporation

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation is a United States government corporation created by the Glass–Steagall Act of 1933. It provides deposit insurance, which guarantees the safety of deposits in member banks, currently up to $250,000 per depositor per bank. , the FDIC insures deposits at...

Chairman Sheila Bair, and Ellen Seidman of the New America Foundation

New America Foundation

The New America Foundation is a non-profit public policy institute and think tank with offices in Washington, D.C. and Sacramento, CA. It was founded in 1999 by Ted Halstead, Sherle Schwenninger, Michael Lind and Walter Russell Mead....

also argue that the CRA was not to blame for the crisis.

Mortgage interest rates

The Federal Reserve dramatically lowered interest rates in the wake of the Dot-com bubbleDot-com bubble

The dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more...

which spurred easy credit for banks to make loans. By 2006 the rates had moved up to 5.25% which lowered the demand and increased the monthly payments for adjustable rate mortgages. The resulting foreclosures increased supply, dropping housing prices further.

Mortgages had been bundled together and sold on Wall Street to investors and other countries looking for a higher return than the 1% offered by Federal Reserve. The percentage of risky mortgages was increased while rating companies claimed they were all top-rated. Instead of the limited regions suffering the housing drop, it was felt around the world. The Congressmen who had pushed to create subprime loans now blamed Wall Street and their rating companies for misleading these investors.

Regions affected

Home price appreciation has been non-uniform to such an extent that some economists, including former FedFederal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

Chairman

Chairman of the Federal Reserve

The Chairman of the Board of Governors of the Federal Reserve System is the head of the central banking system of the United States. Known colloquially as "Chairman of the Fed," or in market circles "Fed Chairman" or "Fed Chief"...

Alan Greenspan

Alan Greenspan

Alan Greenspan is an American economist who served as Chairman of the Federal Reserve of the United States from 1987 to 2006. He currently works as a private advisor and provides consulting for firms through his company, Greenspan Associates LLC...

, arguedthe that United States was not experiencing a nationwide housing bubble per se, but a number of local bubbles. However, in 2007 Greenspan admitted that there was in fact a bubble in the US housing market, and that "all the froth bubbles add up to an aggregate bubble." Despite greatly relaxed lending standards and low interest rates, many regions of the country saw very little growth during the "bubble period". Out of 20 largest metropolitan areas tracked by the S&P/Case-Shiller

Robert Shiller

Robert James "Bob" Shiller is an American economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University and is a Fellow at the Yale International Center for Finance, Yale School of Management...

house price index

House price index

-FHFA/OFHEO:The US Federal Housing Finance Agency publishes the HPI inx, a quarterly broad measure of the movement of single-family house prices....

, six (Dallas, Cleveland, Detroit, Denver, Atlanta, and Charlotte) saw less than 10% price growth in inflation-adjusted terms in 2001–2006. During the same period, seven metropolitan areas (Tampa, Miami, San Diego, Los Angeles, Las Vegas, Phoenix, and Washington DC) appreciated by more than 80%.

Somewhat paradoxically, as the housing bubble deflates some metropolitan areas (such as Denver and Atlanta) have been experiencing high foreclosure

Foreclosure

Foreclosure is the legal process by which a mortgage lender , or other lien holder, obtains a termination of a mortgage borrower 's equitable right of redemption, either by court order or by operation of law...

rates, even though they did not see much house appreciation in the first place and therefore did not appear to be contributing to the national bubble. This was also true of some cities in the Rust Belt

Rust Belt

The Rust Belt is a term that gained currency in the 1980s as the informal description of an area straddling the Midwestern and Northeastern United States, in which local economies traditionally garnered an increased manufacturing sector to add jobs and corporate profits...

such as Detroit and Cleveland, where weak local economies had produced little house price appreciation early in the decade but still saw declining values and increased foreclosures in 2007. As of January 2009 California, Michigan, Ohio and Florida were the states with the highest foreclosure rates.

'Mania' for home ownership

Americans' love of their homes is widely known and acknowledged; however, many believe that enthusiasm for home ownership is currently high even by American standards, calling the real estate market "frothy", "speculative madness", and a "mania". Many observers have commented on this phenomenon—as evidenced by the cover of the June 13, 2005 issue of Time Magazine (itself taken as a sign of the bubble's peak)—but as a 2007 article in ForbesForbes

Forbes is an American publishing and media company. Its flagship publication, the Forbes magazine, is published biweekly. Its primary competitors in the national business magazine category are Fortune, which is also published biweekly, and Business Week...

warns, "to realize that America's mania

Mania

Mania, the presence of which is a criterion for certain psychiatric diagnoses, is a state of abnormally elevated or irritable mood, arousal, and/ or energy levels. In a sense, it is the opposite of depression...

for home-buying is out of all proportion to sober reality, one needs to look no further than the current subprime lending mess... As interest

rates—and mortgage payments—have started to climb, many of these new owners are having difficulty making ends meet... Those borrowers are much worse off than before they bought." The boom in housing has also created a boom in the real estate

Real estate

In general use, esp. North American, 'real estate' is taken to mean "Property consisting of land and the buildings on it, along with its natural resources such as crops, minerals, or water; immovable property of this nature; an interest vested in this; an item of real property; buildings or...

profession; for example, California has a record half-million real estate licencees—one for every 52 adults living in the state, up 57% in the last five years.

The overall U.S. homeownership rate increased from 64 percent in 1994 (about where it was since 1980) to a peak in 2004 with an all time high of 69.2 percent. Bush's 2004 campaign slogan "the ownership society

Ownership society

Ownership society is a slogan for a model of society promoted by former United States President George W. Bush. It takes as lead values personal responsibility, economic liberty, and the owning of property...

" indicates the strong preference and societal influence of Americans to own the homes they live in, as opposed to renting. However, in many parts of the United States, rent does not cover mortgage costs; the national median

Median

In probability theory and statistics, a median is described as the numerical value separating the higher half of a sample, a population, or a probability distribution, from the lower half. The median of a finite list of numbers can be found by arranging all the observations from lowest value to...

mortgage payment is $1,687 per month, nearly twice the median rent payment of $868 per month, although this ratio can vary significantly from market to market.

Suspicious Activity Reports pertaining to Mortgage fraud

Mortgage fraud

Mortgage fraud is crime in which the intent is to materially misrepresent or omit information on a mortgage loan application to obtain a loan or to obtain a larger loan than would have been obtained had the lender or borrower known the truth....

increased by 1,411 percent between 1997 and 2005. Both borrowers seeking to obtain homes they could not otherwise afford, and industry insiders seeking monetary gain, were implicated.

Belief that housing is a good investment

Among Americans, home ownership is widely accepted as preferable to renting in many cases, especially when the ownership term is expected to be at least five years. This is partly due to the fact that the fraction of a fixed-rate mortgageMortgage loan

A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan...

used to pay down the principal

Debt

A debt is an obligation owed by one party to a second party, the creditor; usually this refers to assets granted by the creditor to the debtor, but the term can also be used metaphorically to cover moral obligations and other interactions not based on economic value.A debt is created when a...

builds equity for the homeowner over time, while the interest portion of the loan payments qualifies for a tax break, whereas, except for the personal tax deduction often available to renters but not to homeowners, money spent on rent does neither. However, when considered as an investment

Investment

Investment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

, that is, an asset

Asset

In financial accounting, assets are economic resources. Anything tangible or intangible that is capable of being owned or controlled to produce value and that is held to have positive economic value is considered an asset...

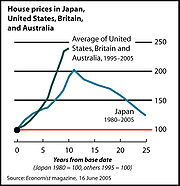

that is expected to grow in value over time, as opposed to the utility of shelter that home ownership provides, housing is not a risk-free investment. The popular notion that, unlike stocks, homes do not fall in value is believed to have contributed to the mania for purchasing homes. Stock prices are reported in real time, which means investors witness the volatility. However, homes are usually valued

yearly or less often, thereby smoothing out perceptions of volatility. This assertion that property prices rise has been true for the United States as a whole since the Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

, and appears to be encouraged by the real estate industry. However, housing prices can move both up and down in local markets, as evidenced by the relatively recent price history in locations such as New York

New York City

New York is the most populous city in the United States and the center of the New York Metropolitan Area, one of the most populous metropolitan areas in the world. New York exerts a significant impact upon global commerce, finance, media, art, fashion, research, technology, education, and...

, Los Angeles

Los Ángeles

Los Ángeles is the capital of the province of Biobío, in the commune of the same name, in Region VIII , in the center-south of Chile. It is located between the Laja and Biobío rivers. The population is 123,445 inhabitants...

, Boston

Boston

Boston is the capital of and largest city in Massachusetts, and is one of the oldest cities in the United States. The largest city in New England, Boston is regarded as the unofficial "Capital of New England" for its economic and cultural impact on the entire New England region. The city proper had...

, Japan

Japan

Japan is an island nation in East Asia. Located in the Pacific Ocean, it lies to the east of the Sea of Japan, China, North Korea, South Korea and Russia, stretching from the Sea of Okhotsk in the north to the East China Sea and Taiwan in the south...

, Seoul

Seoul

Seoul , officially the Seoul Special City, is the capital and largest metropolis of South Korea. A megacity with a population of over 10 million, it is the largest city proper in the OECD developed world...

, Sydney

Sydney

Sydney is the most populous city in Australia and the state capital of New South Wales. Sydney is located on Australia's south-east coast of the Tasman Sea. As of June 2010, the greater metropolitan area had an approximate population of 4.6 million people...

, and Hong Kong

Hong Kong

Hong Kong is one of two Special Administrative Regions of the People's Republic of China , the other being Macau. A city-state situated on China's south coast and enclosed by the Pearl River Delta and South China Sea, it is renowned for its expansive skyline and deep natural harbour...

; large trends of up and down price fluctuations can be seen in many U.S. cities (see graph). Since 2005, the year-over-year median

Median

In probability theory and statistics, a median is described as the numerical value separating the higher half of a sample, a population, or a probability distribution, from the lower half. The median of a finite list of numbers can be found by arranging all the observations from lowest value to...

sale prices (inflation-adjusted) of single family homes in Massachusetts

Massachusetts

The Commonwealth of Massachusetts is a state in the New England region of the northeastern United States of America. It is bordered by Rhode Island and Connecticut to the south, New York to the west, and Vermont and New Hampshire to the north; at its east lies the Atlantic Ocean. As of the 2010...

fell over 10% in 2006. Economist David Lereah

David Lereah

David Lereah is the President of , a real estate advisory and information company located in the Washington, DC area. Reecon Advisors is the owner and publisher of , one of the industry's leading Web sites providing intelligence and information on the residential real estate market. The Web site...

formerly of the NAR

National Association of Realtors

The National Association of Realtors , whose members are known as Realtors, is North America's largest trade association. representing over 1.2 million members , including NAR's institutes, societies, and councils, involved in all aspects of the residential and commercial real estate industries...

said in August 2006 that "he expects home prices to come down 5% nationally, more in some markets, less in others." Commenting in August 2005 on the perceived low risk of housing as an investment vehicle, Alan Greenspan said, "history has not dealt kindly with the aftermath of protracted periods of low risk premiums."

Compounding the popular expectation that home prices do not fall, it is also widely believed that home values will yield average or better-than-average returns as investments. The investment motive for purchasing homes should not be conflated with the necessity of shelter that housing provides; an economic comparison of the relative costs of owning versus renting the equivalent utility of shelter can be made separately (see boxed text). Over the holding periods of decades, inflation-adjusted house prices have increased less than 1% per year. Robert Shiller

Robert Shiller

Robert James "Bob" Shiller is an American economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University and is a Fellow at the Yale International Center for Finance, Yale School of Management...

shows that over long periods, inflation adjusted U.S. home prices increased 0.4% per year from 1890–2004, and 0.7% per year from 1940–2004. Piet Eichholtz also showed comparable results for housing prices on a single street in Amsterdam

Amsterdam

Amsterdam is the largest city and the capital of the Netherlands. The current position of Amsterdam as capital city of the Kingdom of the Netherlands is governed by the constitution of August 24, 1815 and its successors. Amsterdam has a population of 783,364 within city limits, an urban population...

(the site of the fabled tulip mania

Tulip mania

Tulip mania or tulipomania was a period in the Dutch Golden Age during which contract prices for bulbs of the recently introduced tulip reached extraordinarily high levels and then suddenly collapsed...

, and where the housing supply is notably limited) over a 350 year period. Such meager returns are dwarfed by investments in the stock

Stock market

A stock market or equity market is a public entity for the trading of company stock and derivatives at an agreed price; these are securities listed on a stock exchange as well as those only traded privately.The size of the world stock market was estimated at about $36.6 trillion...

and bond

Bond (finance)

In finance, a bond is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest to use and/or to repay the principal at a later date, termed maturity...

markets; although, these investments are not heavily leveraged by fair interest loans. If historic trends hold, it is reasonable to expect home prices to only slightly beat inflation over the long term. Furthermore, one way to assess the quality of any investment is to compute its price-to-earnings (P/E) ratio, which for houses can be defined as the price of the house divided by the potential annual rental income, minus expenses including property taxes, maintenance, insurance, and condominium fees. For many

locations, this computation yields a P/E ratio of about 30–40, which is considered by economists to be high for both the housing and the stock markets; historical price-to-rent ratios are 11–12. For comparison, just before the dot-com crash

Dot-com bubble

The dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more...

the P/E ratio of the S&P 500

S&P 500

The S&P 500 is a free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock...

was 45, while in 2005–2007 around 17. In a 2007 article comparing the cost and risks of renting to buying using a buy vs. rent calculator, the New York Times concluded,

A 2007 Forbes

Forbes

Forbes is an American publishing and media company. Its flagship publication, the Forbes magazine, is published biweekly. Its primary competitors in the national business magazine category are Fortune, which is also published biweekly, and Business Week...

article titled "Don't Buy That House" invokes similar arguments and concludes that for now, "resist the pressure [to buy]. There may be no place like home, but there's no reason you can't rent it."

Promotion in the media

In late 2005 and into 2006, there were an abundance of television programs promoting real estate investment and flipping.In addition to the numerous television shows, book stores in cities throughout the United States could be seen showing large displays of books touting real-estate investment, such as NAR

National Association of Realtors

The National Association of Realtors , whose members are known as Realtors, is North America's largest trade association. representing over 1.2 million members , including NAR's institutes, societies, and councils, involved in all aspects of the residential and commercial real estate industries...

chief economist David Lereah's book Are You Missing the Real Estate Boom?, subtitled Why Home Values and Other Real Estate Investments Will Climb Through The End of The Decade - And How to Profit From Them, published in February 2005. One year later, Lereah retitled his book Why the Real Estate Boom Will Not Bust - And How You Can Profit from It.

However, following Federal Reserve chairman Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

's comments on the "downturn of the housing market" in August 2006, Lereah said in an NBC

NBC

The National Broadcasting Company is an American commercial broadcasting television network and former radio network headquartered in the GE Building in New York City's Rockefeller Center with additional major offices near Los Angeles and in Chicago...

interview that "we've had a boom marketplace: you've got to correct because booms cannot sustain itself forever [sic]." Commenting on the phenomenon of shifting NAR

National Association of Realtors

The National Association of Realtors , whose members are known as Realtors, is North America's largest trade association. representing over 1.2 million members , including NAR's institutes, societies, and councils, involved in all aspects of the residential and commercial real estate industries...

accounts of the national housing market (see David Lereah's comments), the Motley Fool

Motley Fool

The Motley Fool is a multimedia financial-services company that provides financial solutions for investors through various stock, investing, and personal finance products. The Alexandria, Virginia-based private company was founded in July 1993 by co-chairmen and brothers David and Tom Gardner, and...

reported, "There's nothing funnier or more satisfying ... than watching the National Association of Realtors (NAR) change its tune these days. ... the NAR is full of it and will spin the numbers any way it can to keep up the pleasant fiction that all is well."

Upon leaving the NAR in May 2007, Lereah explained to Robert Siegel

Robert Siegel

Robert Siegel is an American radio journalist best known as host of the National Public Radio evening news broadcast All Things Considered.-Career:...

of National Public Radio that using the word "boom" in the title was actually his publisher's idea, and "a poor choice of titles".

Speculative fever

As median

Median

In probability theory and statistics, a median is described as the numerical value separating the higher half of a sample, a population, or a probability distribution, from the lower half. The median of a finite list of numbers can be found by arranging all the observations from lowest value to...

home prices began to rise dramatically in 2000–2001 following the fall in interest rates, speculative purchases of homes also increased. Fortune magazine's article on housing speculation in 2005 said, "America was awash in a stark, raving frenzy that looked every bit as crazy as dot-com stocks." In a 2006 interview in BusinessWeek

BusinessWeek

Bloomberg Businessweek, commonly and formerly known as BusinessWeek, is a weekly business magazine published by Bloomberg L.P. It is currently headquartered in New York City.- History :...

magazine, Yale economist Robert Shiller

Robert Shiller

Robert James "Bob" Shiller is an American economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University and is a Fellow at the Yale International Center for Finance, Yale School of Management...

said of the impact of speculators on long term valuations, "I worry about a big fall because prices today are being supported by a speculative fever

Speculative fever

Speculative Fever is a term used in the housing market which represents the frequent action of buying and selling housing properties. In the case of Speculative fever, the buyer and seller has no intention of ever occupying the house, only purchasing it for the sole reason of selling it off for a...

," and former NAR

National Association of Realtors

The National Association of Realtors , whose members are known as Realtors, is North America's largest trade association. representing over 1.2 million members , including NAR's institutes, societies, and councils, involved in all aspects of the residential and commercial real estate industries...

chief economist David Lereah said in 2005 that "[t]here's a speculative element in home buying now."[broken footnote] Speculation in some local markets has been greater than others, and any correction in valuations is expected to be strongly related to the percentage amount of speculative purchases. In the same BusinessWeek

BusinessWeek

Bloomberg Businessweek, commonly and formerly known as BusinessWeek, is a weekly business magazine published by Bloomberg L.P. It is currently headquartered in New York City.- History :...

interview, Angelo Mozilo, CEO of mortgage lender Countrywide Financial

Countrywide Financial

Bank of America Home Loans is the mortgage unit of Bank of America. Bank of America Home Loans is composed of:*Mortgage Banking, which originates purchases, securitizes, and services mortgages. In 2008, Bank of America purchased the failing Countrywide Financial for $4.1 billion...

, said in March 2006:

The chief economist for the National Association of Home Builders

National Association of Home Builders

The National Association of Home Builders is one of the largest trade associations in the United States. Headquartered in Washington, DC, NAHB's mission is "to enhance the climate for housing and the building industry...

, David Seiders, said that California, Las Vegas, Florida and the Washington, D.C., area "have the largest potential for a price slowdown" because the rising prices in those markets were fed by speculators who bought homes intending to "flip" or sell them for a quick profit.

Dallas Fed president Richard Fisher said in 2006 that the Fed held its target rate at 1 percent "longer than it should have been" and unintentionally prompted speculation in the housing market.

Various real estate investment advisors openly advocated the use of no money down property flipping, which led to the demise of many speculators who followed this strategy such as Casey Serin

Casey Serin

Casey Konstantin Serin is a Uzbek-born American blogger and a former real estate investor. In a newspaper article, USA Today called him the "poster child for everything that went wrong in the real estate boom"....

.

Buying and selling above normal multiples

Home prices, as a multiple of annual rent, have been 15 since World War II. In the bubble, prices reached a multiple of 26. In 2008, prices had fallen to a multiple of 22.In some areas houses were selling at multiples of replacement costs, especially when prices were correctly adjusted for depreciation. Cost per square foot indexes still show wide variability from city to city, therefore it may be that new houses can be built more cheaply in some areas than asking prices for existing homes.

Possible factors of this variation from city to city are housing supply constraints, both regulatory and geographical. Regulatory constraints such as urban growth boundaries serve to reduce the amount of developable land and thus increase prices for new housing construction. Geographic constraints (water bodies, wetlands, and slopes) cannot be ignored either. It is debatable which type of constraint contributes more to price fluctuations. Some argue that the latter, by inherently increasing the value of land in a defined area (because the amount of usable land is less), give homeowners and developers incentive to support regulations to further protect the value of their property. In this case, geographical constraints beget regulatory action. To the contrary, others will argue that geographic constraints are only a secondary factor, pointing to the more discernable effects that urban growth boundaries have on housing prices in such places as Portland, OR. Despite the presence of geographic constraints in the surrounding Portland area, their current urban growth boundary does not encompass those areas. Therefore, one would argue, such geographic constraints are a non issue.

Crash of the dot-com bubble

Dot-com company

A dot-com company, or simply a dot-com , is a company that does most of its business on the Internet, usually through a website that uses the popular top-level domain, ".com" .While the term can refer to present-day companies, it is also used specifically to refer to companies with...

and technology sectors, in 2000 and the subsequent 70% (or so) drop of the NASDAQ

NASDAQ

The NASDAQ Stock Market, also known as the NASDAQ, is an American stock exchange. "NASDAQ" originally stood for "National Association of Securities Dealers Automated Quotations". It is the second-largest stock exchange by market capitalization in the world, after the New York Stock Exchange. As of...

composite index resulted in many people taking their money out of the stock market and purchasing real estate

Real estate

In general use, esp. North American, 'real estate' is taken to mean "Property consisting of land and the buildings on it, along with its natural resources such as crops, minerals, or water; immovable property of this nature; an interest vested in this; an item of real property; buildings or...

, which many believed to be a more reliable investment. Yale

YALE

RapidMiner, formerly YALE , is an environment for machine learning, data mining, text mining, predictive analytics, and business analytics. It is used for research, education, training, rapid prototyping, application development, and industrial applications...

economist Robert Shiller

Robert Shiller

Robert James "Bob" Shiller is an American economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University and is a Fellow at the Yale International Center for Finance, Yale School of Management...

argued further that "irrational exuberance" was displaced from the fallen stock market to housing: "Once stocks fell, real estate became the primary outlet for the speculative frenzy that the stock market had unleashed."

Historically low interest rates

Another important consequence of the dot-com crashDot-com bubble

The dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more...

and the subsequent 2001–2002 recession was that the Federal Reserve cut short-term interest rate

Interest rate

An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for...

s to historically low levels, from about 6.5% to just 1%. Former Federal Reserve Board Chairman Alan Greenspan admitted that the housing bubble was "fundamentally engendered by the decline in real long-term interest rates." In the United States, mortgage rates are typically set in relation to 10-year treasury bond yields, which, in turn, are affected by Federal Funds rates. The Federal Reserve acknowledges the connection between lower interest rates, higher home values, and the increased liquidity the higher home values bring to the overall economy. A Federal Reserve report reads:

For this reason, some have criticized then Fed Chairman Alan Greenspan for "engineering" the housing bubble, saying, e.g., "It was the Federal Reserve-engineered decline in rates that inflated the housing bubble." Between 2000 and 2003, the interest rate on 30-year fixed-rate mortgages fell 2.5 percentage points (from 8% to all-time historical low of about 5.5%). The interest rate on one-year adjustable rate mortgage

Adjustable rate mortgage

A variable-rate mortgage, adjustable-rate mortgage , or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted based on an index which reflects the cost to the lender of borrowing on the credit markets. The loan may be offered at the lender's standard variable...

s (1/1 ARMs) fell 3 percentage points (from about 7% to about 4%). Richard Fisher, president of the Dallas Fed, said in 2006 that the Fed's low interest-rate policies unintentionally prompted speculation in the housing market, and that the subsequent "substantial correction [is] inflicting real costs to millions of homeowners."

Economist and Nobel laureate Joseph Stiglitz blamed the Bush/Greenspan tax cuts designed to benefit the richest Americans but not to lift the economy out of the recession that followed the collapse of the Internet bubble, forcing Greenspan to then cut rates to maintain growth and employment.

A drop in mortgage interest rates reduces the cost of borrowing and should logically result in an increase in prices in a market where most people borrow money to purchase a home (for instance, in the United States), so that average payments remain constant. If one assumes that the housing market is efficient, the expected change in housing prices (relative to interest rates) can be computed mathematically. The calculation in the sidebox shows that a 1 percentage point change in interest rates would theoretically affect home prices by about 10% (given 2005 rates on fixed-rate mortgages). This represents a 10-to-1 multiplier between percentage point changes in interest rates and percentage change in home prices. For interest-only mortgages (at 2005 rates), this yields about a 16% change in principal for a 1% change in interest rates at current rates. Therefore, the 2% drop in long-term interest rates can account for about a 10 × 2% = 20% rise in home prices

if every buyer is using a fixed-rate mortgage (FRM), or about 16 × 3% ≈ 50% if every buyer is using an adjustable rate mortgage (ARM) whose interest rates dropped 3%. Robert Shiller

Robert Shiller

Robert James "Bob" Shiller is an American economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University and is a Fellow at the Yale International Center for Finance, Yale School of Management...

shows that the inflation adjusted U.S. home price increase has been about 45% during this period, an increase in valuations that is approximately consistent with most buyers financing their purchases using ARMs. In areas of the United States believed to have a housing bubble, price increases have far exceeded the 50% that might be explained by the cost of borrowing using ARMs. For example, in San Diego area, average mortgage payments grew 50% between 2001 and 2004. When interest rates rise, a reasonable question is how much house prices will fall, and what effect this will have on those holding negative equity

Negative equity

Negative equity occurs when the value of an asset used to secure a loan is less than the outstanding balance on the loan. In the United States, assets with negative equity are often referred to as being "underwater", and loans and borrowers with negative equity are said to be "upside down".People...

, as well as on the U.S. economy in general. The salient question is whether interest rates are a determining factor in specific markets where there is high

sensitivity to housing affordability. (Thomas Sowell in his book, Housing Boom and Bust, points out that these markets where there is high sensitivity to housing affordability are created by laws that restrict land use and thus its supply. In areas like Houston which has no zoning laws the Fed rate had no effect.)

Return to higher rates

Between 2004 and 2006, the Fed raised interest rates 17 times, increasing them from 1% to 5.25%, before pausing. The Fed paused raising interest rates because of the concern that an accelerating downturn in the housing market could undermine the overall economy, just as the crash of the dot-com bubbleDot-com bubble

The dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more...

in 2000 contributed to the subsequent recession. However, New York University

New York University

New York University is a private, nonsectarian research university based in New York City. NYU's main campus is situated in the Greenwich Village section of Manhattan...

economist Nouriel Roubini

Nouriel Roubini

Nouriel Roubini is an American economist. He claims to have predicted both the collapse of the United States housing market and the worldwide recession which started in 2008. He teaches at New York University's Stern School of Business and is the chairman of Roubini Global Economics, an economic...

asserted that "The Fed should have tightened earlier to avoid a festering of the housing bubble early on."

There was a great debate as to whether or not the Fed would lower rates in late 2007. The majority of economists expected the Fed to maintain the Fed funds rate at 5.25 percent through 2008; however, on September 18, it lowered the rate to 4.75 percent.

Differential relationship between interest rates and affordability. An approximate formula can be obtained that provides the relationship between changes in interest rates and changes in home affordability. The computation proceeds by designating affordability (the monthly mortgage payment) constant, and differentiating the equation for monthly payments with respect to the interest rate Interest rate An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for... r, then solving for the change in Principal. Using the approximation  (K → ∞, and e = 2.718... is the base of the natural logarithm (K → ∞, and e = 2.718... is the base of the natural logarithmNatural logarithm The natural logarithm is the logarithm to the base e, where e is an irrational and transcendental constant approximately equal to 2.718281828... ) for continuously compounded interest, this results in the approximate equation (fixed-rate loans). For interest-only mortgages, the change in principal yielding the same monthly payment is (interest-only loans). This calculation shows that a 1 percentage point change in interest rates would theoretically affect home prices by about 10% (given 2005 rates) on fixed-rate mortgages, and about 16% for interest-only mortgages. Robert Shiller Robert Shiller Robert James "Bob" Shiller is an American economist, academic, and best-selling author. He currently serves as the Arthur M. Okun Professor of Economics at Yale University and is a Fellow at the Yale International Center for Finance, Yale School of Management... does compare interest rates and overall U.S. home prices over the period 1890–2004 and concludes that interest rates do not explain historic trends for the country. |

Expansion of subprime lending

Low interest rates, high home prices, and flippingFlipping

Flipping is a term used primarily in the United States to describe purchasing a revenue-generating asset and quickly reselling it for profit...

(or reselling homes to make a profit), effectively created an almost risk-free environment for lenders because risky or defaulted loans could be paid back by flipping homes.

Private lenders pushed subprime mortgages to capitalize on this, aided by greater market power for mortgage originators and less market power for mortgage originators. Subprime mortgages amounted to $35 billion (5% of total originations) in 1994, 9% in 1996, $160 billion (13%) in 1999, and $600 billion (20%) in 2006.

Risky products

The recent use of subprime mortgagesSubprime lending

In finance, subprime lending means making loans to people who may have difficulty maintaining the repayment schedule...

, adjustable rate mortgage

Adjustable rate mortgage

A variable-rate mortgage, adjustable-rate mortgage , or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted based on an index which reflects the cost to the lender of borrowing on the credit markets. The loan may be offered at the lender's standard variable...

s, interest-only mortgages

Interest-only loan

An interest-only loan is a loan in which, for a set term, the borrower pays only the interest on the principal balance, with the principal balance unchanged...

, and stated income loan

Stated income loan

A stated income loan is a mortgage where the lender does not verify the borrower's income by looking at their pay stubs, W-2 forms, income tax returns, or other records. Instead, borrowers are simply asked to state their income, and taken at their word. These loans are sometimes called liar loans...

s (a subset of "Alt-A" loans, where the borrower did not have to provide documentation to substantiate the income stated on the application; these loans were also called "no doc" (no documentation) loans and, somewhat pejoratively, as "liar loans") to finance home purchases described above have raised concerns about the quality of these loans should interest rates rise again or the borrower is unable to pay the mortgage. In many areas, particularly in those with most appreciation, non-standard loans went from almost unheard of to prevalent. For example, 80% of all mortgages initiated in San Diego region in 2004 were adjustable-rate, and 47% were interest only.

In 1995, Fannie Mae and Freddie Mac began receiving affordable housing credit for buying Alt-A securities Academic opinion is divided on how much this contributed to GSE purchases of nonprime MBS and to growth of nonprime mortgage origination.

Some borrowers got around downpayment requirements by using seller-funded downpayment assistance programs (DPA), in which a seller gives money to a charitable organizations that then give the money to them. From 2000 through 2006, more than 650,000 buyers got their down payments through nonprofits.

According to a Government Accountability Office

Government Accountability Office

The Government Accountability Office is the audit, evaluation, and investigative arm of the United States Congress. It is located in the legislative branch of the United States government.-History:...

study, there are higher default and foreclosure rates for these mortgages. The study also showed that sellers inflated home prices to recoup their contributions to the nonprofits. On May 4, 2006 the IRS ruled that such plans are no longer eligible for non-profit status due to the circular nature of the cash flow, in which the seller pays the charity a "fee" after closing. On October 31, 2007 the Department of

Housing and Urban Development adopted new regulations banning so-called "seller-funded" downpayment programs. Most must cease providing grants on FHA loans immediately; one can operate until March 31, 2008.

Some believe that mortgage standards became lax because of a moral hazard

Moral hazard

In economic theory, moral hazard refers to a situation in which a party makes a decision about how much risk to take, while another party bears the costs if things go badly, and the party insulated from risk behaves differently from how it would if it were fully exposed to the risk.Moral hazard...

, where each link in the mortgage chain collected profits while believing it was passing on risk.

Mortgage denial rates for conventional home purchase loans, reported under the Home Mortgage Disclosure Act, have dropped noticeably, from 29 percent in 1998, to 14 percent in 2002 and 2003. Others have suggested that traditional gatekeepers such as mortgage securitizers and credit rating agencies lost their ability to maintain high standards because of competitive pressures.

In March 2007, the United States' subprime

Subprime lending

In finance, subprime lending means making loans to people who may have difficulty maintaining the repayment schedule...

mortgage industry collapsed

Subprime mortgage crisis

The U.S. subprime mortgage crisis was one of the first indicators of the late-2000s financial crisis, characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting decline of securities backed by said mortgages....

due to higher-than-expected home foreclosure

Foreclosure

Foreclosure is the legal process by which a mortgage lender , or other lien holder, obtains a termination of a mortgage borrower 's equitable right of redemption, either by court order or by operation of law...

rates, with more than 25 subprime lenders declaring bankruptcy, announcing significant losses, or putting themselves up for sale. Harper's Magazine

Harper's Magazine

Harper's Magazine is a monthly magazine of literature, politics, culture, finance, and the arts, with a generally left-wing perspective. It is the second-oldest continuously published monthly magazine in the U.S. . The current editor is Ellen Rosenbush, who replaced Roger Hodge in January 2010...

warned of the danger of rising interest rates for recent homebuyers holding such mortgages, as well as the U.S. economy

Economy of the United States

The economy of the United States is the world's largest national economy. Its nominal GDP was estimated to be nearly $14.5 trillion in 2010, approximately a quarter of nominal global GDP. The European Union has a larger collective economy, but is not a single nation...

as a whole: "The problem [is] that prices are falling even as the buyers' total mortgage remains the same or even increases. ... Rising debt-service payments will further divert income from new consumer spending. Taken together, these factors will further shrink the “real” economy, drive down

those already declining real wages, and push our debt-ridden economy into Japan-style stagnation or worse." Factors that could contribute to rising rates are the U.S. national debt, inflationary pressure caused by such factors as increased fuel and housing costs, and changes in foreign investments in the U.S. economy. The Fed raised rates 17 times, increasing them from 1% to 5.25%, between 2004 and 2006. BusinessWeek

BusinessWeek

Bloomberg Businessweek, commonly and formerly known as BusinessWeek, is a weekly business magazine published by Bloomberg L.P. It is currently headquartered in New York City.- History :...

magazine called the option ARM "the riskiest and most complicated home loan product ever created" and warned that over one million borrowers took out $466 billion in option ARMs in 2004 through the second quarter of 2006, citing concerns that these financial products could hurt individual borrowers the most and "worsen the [housing] bust." To address the problems arising from "liar loans", the Internal Revenue Service

Internal Revenue Service

The Internal Revenue Service is the revenue service of the United States federal government. The agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue...

updated an income verification tool used by lenders to make confirmation of borrower's claimed income to be faster and easier. In April 2007, financial problems similar to the subprime mortgages began to appear with Alt-A loans made to homeowners who were thought to be less risky; the delinquency rate for Alt-A mortgages rose in 2007. The manager of the world's largest bond fund PIMCO, warned in June 2007 that the subprime mortgage crisis was not an isolated event and will eventually take a toll on the economy and whose ultimate impact will be on the impaired prices of homes.

See also

- Savings and Loan crisisSavings and Loan crisisThe savings and loan crisis of the 1980s and 1990s was the failure of about 747 out of the 3,234 savings and loan associations in the United States...

- Resolution Trust CorporationResolution Trust CorporationThe Resolution Trust Corporation was a United States Government-owned asset management company run by Lewis William Seidman and charged with liquidating assets, primarily real estate-related assets such as mortgage loans, that had been assets of savings and loan associations declared insolvent by...

- dot-com bubbleDot-com bubbleThe dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more...

- SecuritizationSecuritizationSecuritization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or Collateralized mortgage obligation , to...

, property tax rate

, property tax rate  (assumed to be ½–2% of P), and yearly maintenance cost rate

(assumed to be ½–2% of P), and yearly maintenance cost rate  (assumed to be ½–1% of P), the monthly cost of home ownership is approximately

(assumed to be ½–1% of P), the monthly cost of home ownership is approximately