Laffer curve

Encyclopedia

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

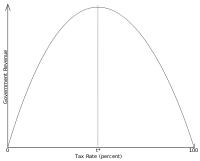

, the Laffer curve is a theoretical representation of the relationship between government revenue raised by tax

Tax

To tax is to impose a financial charge or other levy upon a taxpayer by a state or the functional equivalent of a state such that failure to pay is punishable by law. Taxes are also imposed by many subnational entities...

ation and all possible rates of taxation. It is used to illustrate the concept of taxable income elasticity (that taxable income

Taxable income

Taxable income refers to the base upon which an income tax system imposes tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. The amounts included as income, expenses, and other deductions vary by country or system. Many systems provide that...

will change in response to changes in the rate of taxation). The curve is constructed by thought experiment

Thought experiment

A thought experiment or Gedankenexperiment considers some hypothesis, theory, or principle for the purpose of thinking through its consequences...

. First, the amount of tax revenue raised at the extreme tax rates of 0% and 100% is considered. It is clear that a 0% tax rate raises no revenue, but the Laffer curve hypothesis is that a 100% tax rate will also generate no revenue because at such a rate there is no longer any incentive for a rational taxpayer to earn any income, thus the revenue raised will be 100% of nothing. If both a 0% rate and 100% rate of taxation generate no revenue, it follows from the extreme value theorem

Extreme value theorem

In calculus, the extreme value theorem states that if a real-valued function f is continuous in the closed and bounded interval [a,b], then f must attain its maximum and minimum value, each at least once...

that there must exist at least one rate in between where tax revenue would be a maximum. The Laffer curve is typically represented as a graph which starts at 0% tax, zero revenue, rises to a maximum rate of revenue raised at an intermediate rate of taxation and then falls again to zero revenue at a 100% tax rate.

One potential result of the Laffer curve is that increasing tax rates beyond a certain point will become counterproductive for raising further tax revenue. A hypothetical Laffer curve for any given economy can only be estimated and such estimates are sometimes controversial. The New Palgrave Dictionary of Economics

The New Palgrave Dictionary of Economics

The New Palgrave Dictionary of Economics , 2nd Edition, is an eight-volume reference work, edited by Steven N. Durlauf and Lawrence E. Blume. It contains 5.8 million words and spans 7,680 pages with 1,872 articles. Included are 1057 new articles and, from earlier, 80 essays that are designated as...

reports that estimates of revenue-maximizing tax rates have varied widely, with a mid-range of around 70%.

The Laffer curve is associated with supply-side economics

Supply-side economics

Supply-side economics is a school of macroeconomic thought that argues that economic growth can be most effectively created by lowering barriers for people to produce goods and services, such as lowering income tax and capital gains tax rates, and by allowing greater flexibility by reducing...

, where its use in debates over rates of taxation has also been controversial. The Laffer curve was popularized by Jude Wanniski

Jude Wanniski

Jude Thaddeus Wanniski was an American journalist, conservative commentator, and political economist.- Early life and education :...

in the 1970s, with Wanniski naming the curve after the work of Arthur Laffer

Arthur Laffer

Arthur Betz Laffer is an American economist who first gained prominence during the Reagan administration as a member of Reagan's Economic Policy Advisory Board . Laffer is best known for the Laffer curve, an illustration of the theory that there exists some tax rate between 0% and 100% that will...

. Laffer later pointed out that the concept was not original, noting similar ideas in the writings of both 14th century North African polymath

Polymath

A polymath is a person whose expertise spans a significant number of different subject areas. In less formal terms, a polymath may simply be someone who is very knowledgeable...

Ibn Khaldun

Ibn Khaldun

Ibn Khaldūn or Ibn Khaldoun was an Arab Tunisian historiographer and historian who is often viewed as one of the forerunners of modern historiography, sociology and economics...

(who discussed the idea in his 1377 Muqaddimah

Muqaddimah

The Muqaddimah , also known as the Muqaddimah of Ibn Khaldun or the Prolegomena , is a book written by the Maghrebian Muslim historian Ibn Khaldun in 1377 which records an early view of universal history...

) and John Maynard Keynes

John Maynard Keynes

John Maynard Keynes, Baron Keynes of Tilton, CB FBA , was a British economist whose ideas have profoundly affected the theory and practice of modern macroeconomics, as well as the economic policies of governments...

. Numerous other historical precedents also exist.

Origin of the term "Laffer Curve"

The term "Laffer curve" was reportedly coined by Jude WanniskiJude Wanniski

Jude Thaddeus Wanniski was an American journalist, conservative commentator, and political economist.- Early life and education :...

(a writer for The Wall Street Journal

The Wall Street Journal

The Wall Street Journal is an American English-language international daily newspaper. It is published in New York City by Dow Jones & Company, a division of News Corporation, along with the Asian and European editions of the Journal....

) after a 1974 afternoon meeting between Laffer, Wanniski, Dick Cheney

Dick Cheney

Richard Bruce "Dick" Cheney served as the 46th Vice President of the United States , under George W. Bush....

, Donald Rumsfeld

Donald Rumsfeld

Donald Henry Rumsfeld is an American politician and businessman. Rumsfeld served as the 13th Secretary of Defense from 1975 to 1977 under President Gerald Ford, and as the 21st Secretary of Defense from 2001 to 2006 under President George W. Bush. He is both the youngest and the oldest person to...

, and his deputy press secretary Grace-Marie Arnett. In this meeting, Laffer, arguing against President Gerald Ford

Gerald Ford

Gerald Rudolph "Jerry" Ford, Jr. was the 38th President of the United States, serving from 1974 to 1977, and the 40th Vice President of the United States serving from 1973 to 1974...

's tax increase, reportedly sketched the curve on a napkin to illustrate the concept. Cheney did not buy the idea immediately, but it caught the imaginations of those present. Laffer professes no recollection of this napkin, but writes: "I used the so-called Laffer Curve all the time in my classes and with anyone else who would listen to me."

Laffer himself does not claim to have invented the concept, attributing it to 14th century Muslim scholar Ibn Khaldun

Ibn Khaldun

Ibn Khaldūn or Ibn Khaldoun was an Arab Tunisian historiographer and historian who is often viewed as one of the forerunners of modern historiography, sociology and economics...

and, more recently, to John Maynard Keynes

John Maynard Keynes

John Maynard Keynes, Baron Keynes of Tilton, CB FBA , was a British economist whose ideas have profoundly affected the theory and practice of modern macroeconomics, as well as the economic policies of governments...

.

Other historical precedents

There are historical precedents other than those cited directly by Laffer. For example, in 1924, Secretary of Treasury Andrew Mellon wrote: "It seems difficult for some to understand that high rates of taxation do not necessarily mean large revenue to the Government, and that more revenue may often be obtained by lower rates." Exercising his understanding that "73% of nothing is nothing", he pushed for the reduction of the top income tax bracket from 73% to an eventual 24% (as well as tax breaks for lower brackets). Personal income-tax receipts rose from US$719 million in 1921 to over $1 billion in 1929, an average increase of 4.2% per year over an 8-year period, which supporters attribute to the rate cut.Amongst others, David Hume

David Hume

David Hume was a Scottish philosopher, historian, economist, and essayist, known especially for his philosophical empiricism and skepticism. He was one of the most important figures in the history of Western philosophy and the Scottish Enlightenment...

expressed similar arguments in his essay Of Taxes in 1756, as did fellow Scottish economist Adam Smith

Adam Smith

Adam Smith was a Scottish social philosopher and a pioneer of political economy. One of the key figures of the Scottish Enlightenment, Smith is the author of The Theory of Moral Sentiments and An Inquiry into the Nature and Causes of the Wealth of Nations...

, twenty years later.

The Democratic party made a similar argument in the 1880s

1880s

The 1880s was the decade that spanned from January 1, 1880 to December 31, 1889. They occurred at the core period of the Second Industrial Revolution. Most Western countries experienced a large economic boom, due to the mass production of railroads and other more convenient methods of travel...

when high revenue from import tariffs raised during the Civil War (1861–1865) led to federal budget surpluses. The Republican party, which was then based in the protectionist industrial Northeast, argued that cutting rates would lower revenues. But the Democratic party, then rooted in the agricultural South, argued tariff reductions would increase revenues by increasing the number of taxable imports. A 1997 analysis concluded that the tariff rate used was lower than the revenue maximizing rate.

An argument along similar lines has also been advocated by Ali ibn Abi Talib, the first Shi'a Imam and fourth Caliph of the Islamic empire; in his letter to the Governor of Egypt, Malik al-Ashtar. He writes:

Theoretical justification

Laffer explains the model in terms of two interacting effects of taxation: an "arithmetic effect" and an "economic effect". The "arithmetic effect" assumes that tax revenue raised is the tax rate multiplied by the revenue available for taxation (or tax base). At a 0% tax rate, the model assumes that no tax revenue is raised. The "economic effect" assumes that the tax rate will have an impact on the tax base itself. At the extreme of a 100% tax rate, the government theoretically collects zero revenue because taxpayers change their behavior in response to the tax rate: either they have no incentive to work or they find a way to avoid paying taxes. Thus, the "economic effect" of a 100% tax rate is to decrease the tax base to zero. If this is the case, then somewhere between 0% and 100% lies a tax rate that will maximize revenue. Graphical representations of the curve sometimes appear to put the rate at around 50%, but the optimal rate could theoretically be any percentage greater than 0% and less than 100%. Similarly, the curve is often presented as a parabolic shape, but there is no reason that this is necessarily the case.Jude Wanniski noted that all economic activity would be unlikely to cease at 100% taxation, but would switch to barter from the exchange of money. He also noted that there can be special circumstances where economic activity can continue for a period at a near 100% taxation rate (for example, in war time).

Various efforts have been made to quantify the relationship between tax revenue and tax rates (for example, in the United States by the Congressional Budget Office

Congressional Budget Office

The Congressional Budget Office is a federal agency within the legislative branch of the United States government that provides economic data to Congress....

). While the interaction between tax rates and tax revenue is generally accepted, the precise nature of this interaction is debated. In practice, the shape of a hypothetical Laffer curve for a given economy can only be estimated. The relationship between tax rate and tax revenue is likely to vary from one economy to another and depends on the elasticity of supply for labor and various other factors. Even in the same economy, the characteristics of the curve could vary over time. Complexities such as possible differences in the incentive to work for different income groups and progressive tax

Progressive tax

A progressive tax is a tax by which the tax rate increases as the taxable base amount increases. "Progressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from low to high, where the average tax rate is less than the marginal tax rate...

ation complicate the task of estimation. The structure of the curve may also be changed by policy decisions. For example, if tax loopholes and off-shore tax shelters are made more readily available by legislation, the point at which revenue begins to decrease with increased taxation is likely to become lower.

Laffer presented the curve as a pedagogical device to show that, in some circumstances, a reduction in tax rates will actually increase government revenue and not need to be offset by decreased government spending or increased borrowing. For a reduction in tax rates to increase revenue, the current tax rate would need to be higher than the revenue maximizing rate. In 2007, Laffer said that the curve should not be the sole basis for raising or lowering taxes.

Criticisms

Laffer assumes that the government would collect no income tax at a 100% tax rate because there would be no incentive to earn income. Research has shown that it is possible for a Laffer curve to continuously slope upwards all the way to 100%. Additionally, the Laffer curve depends on the assumption that tax revenue is used to provide a public good that is separable in utility and separate from labor supply, which may not be true in practice. The Laffer curve is also too simplistic in that it assumes a single tax rate, a single labor supply. Actual systems of public finance are more complex. There is serious doubt about the relevance considering a single marginal tax rate.Quantification and empirical data

Research on revenue maximising tax rate

Economist Paul Pecorino presented a model in 1995 that predicted the peak of the Laffer curve occurred at tax rates around 65%. A 1996 study by Y. Hsing of the United States economy between 1959 and 1991 placed the revenue-maximizing tax rate (the point at which another marginal tax rateMarginal tax rate

In a tax system and in economics, the tax rate describes the burden ratio at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, effective, effective average, and effective marginal...

increase would decrease tax revenue) between 32.67% and 35.21%. A 1981 paper published in the Journal of Political Economy

Journal of Political Economy

The Journal of Political Economy is an academic journal run by economists at the University of Chicago and published every two months by the University of Chicago Press. The journal publishes articles in both theoretical economics and empirical economics...

presented a model integrating empirical data that indicated that the point of maximum tax revenue in Sweden in the 1970s would have been 70%. A recent paper by Trabandt and Uhlig of the NBER presented a model that predicted that the US and most European economies are on the left of the Laffer curve (in other words, that raising taxes would raise further revenue). The New Palgrave Dictionary of Economics

The New Palgrave Dictionary of Economics

The New Palgrave Dictionary of Economics , 2nd Edition, is an eight-volume reference work, edited by Steven N. Durlauf and Lawrence E. Blume. It contains 5.8 million words and spans 7,680 pages with 1,872 articles. Included are 1057 new articles and, from earlier, 80 essays that are designated as...

reports that for academic studies, the mid-range for the revenue maximizing rate is around 70%.

However, a study by Teather and Young of the conservative Adam Smith Institute

Adam Smith Institute

The Adam Smith Institute, abbreviated to ASI, is a think tank based in the United Kingdom, named after one of the founders of modern economics, Adam Smith. It espouses free market and classical liberal views, in particular by creating radical policy options in the light of public choice theory,...

using evidence from the Republic of Ireland

Republic of Ireland

Ireland , described as the Republic of Ireland , is a sovereign state in Europe occupying approximately five-sixths of the island of the same name. Its capital is Dublin. Ireland, which had a population of 4.58 million in 2011, is a constitutional republic governed as a parliamentary democracy,...

has suggested that the optimal rate for capital gains tax, as opposed to income tax, may be around 20%, but this is at least partly due to savvy taxpayers holding onto assets in anticipation of tax rates being lowered in the future. A 2007 study by the conservative think tank, the American Enterprise Institute, found that the revenue maximizing rate for corporate taxes in OECD countries was about 26%, down from about 34% in the 1980s.

2005 US CBO estimates on tax cuts

In 2005, the Congressional Budget OfficeCongressional Budget Office

The Congressional Budget Office is a federal agency within the legislative branch of the United States government that provides economic data to Congress....

(CBO) released a paper called "Analyzing the Economic and Budgetary Effects of a 10 Percent Cut in Income Tax Rates". This paper considered the impact of a stylized reduction of 10% in the then existing marginal rate of federal income tax

Income tax in the United States

In the United States, a tax is imposed on income by the Federal, most states, and many local governments. The income tax is determined by applying a tax rate, which may increase as income increases, to taxable income as defined. Individuals and corporations are directly taxable, and estates and...

in the US (for example, if those facing a 25% marginal federal income tax rate had it lowered to 22.5%). Unlike earlier research, the CBO paper estimates the budgetary impact of possible macroeconomic effects of tax policies, that is, it attempts to account for how reductions in individual income tax rates might affect the overall future growth of the economy, and therefore influence future government tax revenues; and ultimately, impact deficits or surpluses.

The paper's author forecasts the effects using various assumptions (e.g., people's foresight, the mobility of capital, and the ways in which the federal government might make up for a lower percentage revenue). In the paper's most generous estimated growth scenario, only 28% of the projected lower tax revenue would be recouped over a 10-year period after a 10% across-the-board reduction in all individual income tax rates. The paper points out that these projected shortfalls in revenue would have to be made up by federal borrowing: the paper estimates that the federal government would pay an extra $200 billion in interest over the decade covered by the paper's analysis.

Other empirical data

Laffer has presented the examples of Russia and the Baltic states, which instituted a flat taxFlat tax

A flat tax is a tax system with a constant marginal tax rate. Typically the term flat tax is applied in the context of an individual or corporate income that will be taxed at one marginal rate...

with rates lower than 35% and whose economies started growing soon after implementation, in support of the Laffer curve. He has similarly referred to the economic outcome of the Kemp-Roth tax act, the Kennedy tax cuts, the 1920s tax cuts, and the changes in US capital gains tax

Capital gains tax

A capital gains tax is a tax charged on capital gains, the profit realized on the sale of a non-inventory asset that was purchased at a lower price. The most common capital gains are realized from the sale of stocks, bonds, precious metals and property...

structure in 1997. Others have cited Hauser's Law

Hauser's Law

Hauser's law is the proposition that, in the United States, federal tax revenues since World War II have always been approximately equal to 19.5% of GDP, regardless of wide fluctuations in the marginal tax rate.- Historic tax revenues :...

, an empirical observation that US federal revenues, as a percentage of GDP, have remained stable at approximately 19.5% over the period 1950 to 2007 despite significant changes in margin tax rates over the same period, as supporting evidence. However, since the Laffer curve is based on the theory that decreased tax rates result in greater tax revenue through increased economic activity, any study normalized to GDP is not really saying anything about the Laffer curve.

The Adam Smith Institute

Adam Smith Institute

The Adam Smith Institute, abbreviated to ASI, is a think tank based in the United Kingdom, named after one of the founders of modern economics, Adam Smith. It espouses free market and classical liberal views, in particular by creating radical policy options in the light of public choice theory,...

stated in a 2010 report that "The 1997 Budget in Ireland halved the rate of taxation of realized capital gains from 40% to 20%. The then Minister for Finance, Charlie McCreevy, was heavily criticized on the grounds that this change would reduce revenues. He countered by predicting that revenues would rise substantially as a result of the lower tax rate. Revenues rose considerably, almost trebling in fact, and greatly exceeded official predictions." The effects of the credit bubble in the Republic of Ireland

Republic of Ireland

Ireland , described as the Republic of Ireland , is a sovereign state in Europe occupying approximately five-sixths of the island of the same name. Its capital is Dublin. Ireland, which had a population of 4.58 million in 2011, is a constitutional republic governed as a parliamentary democracy,...

have not been included in this research, although since the bubble burst the taxes collected have proven far from adequate to continue operating the Irish state or economy.

Optimal taxation

One of the uses of the Laffer curve is in determining the rate of taxation which will raise the maximum revenue (in other words, "optimizing" revenue collection). However, the revenue maximizing rate should not be confused with the optimal tax rate, which Economists use to describe a tax which raises a given amount of revenue with the least distortions to the economy. Taxation causes deadweight lossDeadweight loss

In economics, a deadweight loss is a loss of economic efficiency that can occur when equilibrium for a good or service is not Pareto optimal...

to an economy, and the impact of this needs to be considered in conjunction with the amount of revenue raised.

Relationship with supply-side economics

Supply-side economics is a school of macroeconomic thought that argues that overall economic well-being is maximized by lowering the barriers to producing goods and services (the "Supply Side" of the economy). By lowering such barriers, consumers are thought to benefit from a greater supply of goods and services at lower prices. Typical supply-side policy would advocate generally lower income tax and capital gains tax rates (to increase the supply of labor and capital), smaller government and a lower regulatory burden on enterprises (to lower costs). Although tax policy is often mentioned in relation to supply-side economics, supply-side economists are concerned with all impediments to the supply of goods and services and not just taxation.Both Wanniski and Laffer were prominent supply-side advocates, and as such the concepts of the Laffer curve and supply-side economics are often conflated. Further, supply-side advocates have at times argued for lower taxes on the basis of supply-side benefits while citing the Laffer curve as a reason that such cuts would also raise revenue. However, the objective of supply-side theory is to maximize the supply of goods and services, and to achieve this one should, in theory, always lower taxes. In contrast, the Laffer curve would suggest that a tax cut would raise tax revenues only if current tax rates were in the right-hand region of the curve.

Reaganomics

The Laffer curve and supply-side economicsSupply-side economics

Supply-side economics is a school of macroeconomic thought that argues that economic growth can be most effectively created by lowering barriers for people to produce goods and services, such as lowering income tax and capital gains tax rates, and by allowing greater flexibility by reducing...

inspired Reaganomics

Reaganomics

Reaganomics refers to the economic policies promoted by the U.S. President Ronald Reagan during the 1980s, also known as supply-side economics and called trickle-down economics, particularly by critics...

and the Kemp-Roth Tax Cut

Kemp-Roth Tax Cut

The Economic Recovery Tax Act of 1981 , also known as the ERTA or "Kemp-Roth Tax Cut," was a federal law enacted in the United States in 1981...

of 1981. Supply-side advocates of tax cuts claimed that lower tax rates would generate more tax revenue because the United States government's marginal income tax rates

Marginal tax rate

In a tax system and in economics, the tax rate describes the burden ratio at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, effective, effective average, and effective marginal...

prior to the legislation were on the right-hand side of the curve. As a successful actor, Reagan himself had been subject to marginal tax rates as high as 90% during World War II

World War II

World War II, or the Second World War , was a global conflict lasting from 1939 to 1945, involving most of the world's nations—including all of the great powers—eventually forming two opposing military alliances: the Allies and the Axis...

. During the Reagan presidency, the top marginal rate of tax in the US fell from 70% to 31%, while revenue continued to increase during his tenure. According to the CBO historical tables, income taxes as a percentage of GDP declined from 9.4% in 1981 to a range of 7.8% to 8.4% through 1989.

David Stockman

David Stockman

David Alan Stockman is a former U.S. politician and businessman, serving as a Republican U.S. Representative from the state of Michigan and as the Director of the Office of Management and Budget ....

, Ronald Reagan

Ronald Reagan

Ronald Wilson Reagan was the 40th President of the United States , the 33rd Governor of California and, prior to that, a radio, film and television actor....

's budget director during his first administration and one of the early proponents of supply-side economics, was concerned that the administration did not pay enough attention to cutting government spending. He maintained that the Laffer curve was not to be taken literally — at least not in the economic environment of the 1980s United States. In The Triumph of Politics, he writes: "[T]he whole California gang had taken [the Laffer curve] literally (and primitively). The way they talked, they seemed to expect that once the supply-side tax cut was in effect, additional revenue would start to fall, manna-like, from the heavens. Since January, I had been explaining that there is no literal Laffer curve." Stockman also said that "Laffer wasn't wrong, he just didn't go far enough" (in paying attention to government spending).

Some have criticized elements of Reaganomics on the basis of equity. For example, economist John Kenneth Galbraith

John Kenneth Galbraith

John Kenneth "Ken" Galbraith , OC was a Canadian-American economist. He was a Keynesian and an institutionalist, a leading proponent of 20th-century American liberalism...

believed that the Reagan administration

Reagan Administration

The United States presidency of Ronald Reagan, also known as the Reagan administration, was a Republican administration headed by Ronald Reagan from January 20, 1981, to January 20, 1989....

actively used the Laffer curve "to lower taxes on the affluent." Some critics point out that tax revenues almost always rise every year and during Reagan's two terms increases in tax revenue were more shallow than increases in tax revenue during presidencies where taxes top marginal tax rates were higher. Critics also point out that since the Reagan tax cuts, income has not significantly increased for the rest of the population

Income inequality in the United States

Income inequality in the United States of America refers to the extent to which income is distributed in an uneven manner in the US. Data from the United States Department of Commerce, CBO, and Internal Revenue Service indicate that income inequality among households has been increasing...

.

Bush tax cuts

Economist Paul Krugman contended that supply-side adherents did not fully believe that the United States income tax rate was on the "backwards-sloping" side of the curve and yet they still advocated lowering taxes to encourage investment of personal savings.Outside the United States

Between 1979 and 2002, more than 40 other countries, including the United KingdomUnited Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

, Belgium

Belgium

Belgium , officially the Kingdom of Belgium, is a federal state in Western Europe. It is a founding member of the European Union and hosts the EU's headquarters, and those of several other major international organisations such as NATO.Belgium is also a member of, or affiliated to, many...

, Denmark

Denmark

Denmark is a Scandinavian country in Northern Europe. The countries of Denmark and Greenland, as well as the Faroe Islands, constitute the Kingdom of Denmark . It is the southernmost of the Nordic countries, southwest of Sweden and south of Norway, and bordered to the south by Germany. Denmark...

, Finland

Finland

Finland , officially the Republic of Finland, is a Nordic country situated in the Fennoscandian region of Northern Europe. It is bordered by Sweden in the west, Norway in the north and Russia in the east, while Estonia lies to its south across the Gulf of Finland.Around 5.4 million people reside...

, France

France

The French Republic , The French Republic , The French Republic , (commonly known as France , is a unitary semi-presidential republic in Western Europe with several overseas territories and islands located on other continents and in the Indian, Pacific, and Atlantic oceans. Metropolitan France...

, Germany

Germany

Germany , officially the Federal Republic of Germany , is a federal parliamentary republic in Europe. The country consists of 16 states while the capital and largest city is Berlin. Germany covers an area of 357,021 km2 and has a largely temperate seasonal climate...

, Norway

Norway

Norway , officially the Kingdom of Norway, is a Nordic unitary constitutional monarchy whose territory comprises the western portion of the Scandinavian Peninsula, Jan Mayen, and the Arctic archipelago of Svalbard and Bouvet Island. Norway has a total area of and a population of about 4.9 million...

, and Sweden

Sweden

Sweden , officially the Kingdom of Sweden , is a Nordic country on the Scandinavian Peninsula in Northern Europe. Sweden borders with Norway and Finland and is connected to Denmark by a bridge-tunnel across the Öresund....

cut their top rates of personal income tax. In an article about this, Alan Reynolds, a senior fellow with the Cato Institute

Cato Institute

The Cato Institute is a libertarian think tank headquartered in Washington, D.C. It was founded in 1977 by Edward H. Crane, who remains president and CEO, and Charles Koch, chairman of the board and chief executive officer of the conglomerate Koch Industries, Inc., the largest privately held...

, wrote, "Why did so many other countries so dramatically reduce marginal tax rates? Perhaps they were influenced by new economic analysis and evidence from... supply-side economics. But the sheer force of example may well have been more persuasive. Political authorities saw that other national governments fared better by having tax collectors claim a medium share of a rapidly growing economy (a low marginal tax) rather than trying to extract a large share of a stagnant economy (a high average tax)."

Another explanation might be that a higher tax rate also increases the risk of tax evasion

Tax evasion

Tax evasion is the general term for efforts by individuals, corporations, trusts and other entities to evade taxes by illegal means. Tax evasion usually entails taxpayers deliberately misrepresenting or concealing the true state of their affairs to the tax authorities to reduce their tax liability,...

towards tax haven

Tax haven

A tax haven is a state or a country or territory where certain taxes are levied at a low rate or not at all while offering due process, good governance and a low corruption rate....

s, which leads governments to lose revenue.

See also

- Arthur LafferArthur LafferArthur Betz Laffer is an American economist who first gained prominence during the Reagan administration as a member of Reagan's Economic Policy Advisory Board . Laffer is best known for the Laffer curve, an illustration of the theory that there exists some tax rate between 0% and 100% that will...

- Deadweight lossDeadweight lossIn economics, a deadweight loss is a loss of economic efficiency that can occur when equilibrium for a good or service is not Pareto optimal...

- Hauser's lawHauser's LawHauser's law is the proposition that, in the United States, federal tax revenues since World War II have always been approximately equal to 19.5% of GDP, regardless of wide fluctuations in the marginal tax rate.- Historic tax revenues :...

- Jude WanniskiJude WanniskiJude Thaddeus Wanniski was an American journalist, conservative commentator, and political economist.- Early life and education :...

- List of economics topics

- MacroeconomicsMacroeconomicsMacroeconomics is a branch of economics dealing with the performance, structure, behavior, and decision-making of the whole economy. This includes a national, regional, or global economy...

- Optimal taxOptimal taxOptimal tax theory is the study of how best to design a tax to minimize distortion and inefficiency subject to increasing set revenues through distortionary taxation. A neutral tax is a theoretical tax which avoids distortion and inefficiency completely....

- ReaganomicsReaganomicsReaganomics refers to the economic policies promoted by the U.S. President Ronald Reagan during the 1980s, also known as supply-side economics and called trickle-down economics, particularly by critics...

- Supply-side economicsSupply-side economicsSupply-side economics is a school of macroeconomic thought that argues that economic growth can be most effectively created by lowering barriers for people to produce goods and services, such as lowering income tax and capital gains tax rates, and by allowing greater flexibility by reducing...

- Trickle-down economicsTrickle-down economics"Trickle-down economics" and "the trickle-down theory" are terms used in United States politics to refer to the idea that tax breaks or other economic benefits provided by government to businesses and the wealthy will benefit poorer members of society by improving the economy as a whole...