Kondratiev wave

Encyclopedia

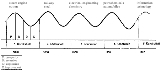

Kondratiev waves are described as sinusoidal-like cycles in the modern capitalist world economy

. Averaging fifty and ranging from approximately forty to sixty years in length, the cycles consist of alternating periods between high sectoral growth

and periods of relatively slow growth. Unlike the short-term business cycle

, the long wave of this theory is not accepted by current mainstream economics

.

(also written Kondratieff) was the first to bring these observations to international attention in his book The Major Economic Cycles (1925) alongside other works written in the same decade. Two Dutch economists, Jacob van Gelderen

and Samuel de Wolff, had previously argued for the existence of 50 to 60 year cycles in 1913. However, the work of de Wolff and van Gelderen has only recently been translated from Dutch

to reach a wider audience.

Kondratiev was a Russia

n economist

, but his economic conclusions were disliked by the Soviet

leadership and upon their release he was quickly dismissed from his post as director of the Institute for the Study of Business Activity in the Soviet Union in 1928. His conclusions were seen as a criticism of Joseph Stalin

's intentions for the Soviet economy: as a result he was sentenced to the Soviet Gulag

and later received the death penalty in 1938.

Later, in Business Cycles (1939), Joseph Schumpeter

suggested naming the cycles "Kondratieff waves", in honor of the economist who first noticed them. In the 1950s, French economist François Simiand

proposed naming the ascendant period of the cycle "Phase A" and the downward period "Phase B". Some market commentators divide the Kondratiev wave into four 'seasons', namely, the Kondratiev Spring (improvement or plateau) and Summer (acceleration or prosperity) of the ascendant period and the Kondratiev Fall (recession or plateau) and Winter (acceleration or depression) of the downward period.

The saturation of major markets or infrastructures (canals, railroads) creates a stagnation in the economy. However, stagnation does not necessarily mean that markets are mature. Markets were temporarily oversupplied during the high growth period from the 1870s-90s, during which time there was also a lot of creative destruction

in industries like iron, which was displaced by steel, and labor, which was displaced by machinery, but re-employed because of growth. The stagnation phase is characterized by a lack of good investment opportunities that leads to low interest rates and lowered credit standards which creates a speculative boom

and high debt levels, followed by a crash and financial crisis. Past speculative excesses included canals, railroads, farm land, real estate and the broader stock market. Carlota Perez

describes the roles of financial capital and production capital in the cycle. Perez also says excess financial speculation is likely to occur in the "frenzy" stage of a new technology, such as the 1998-2000 computer, internet, dotcom-mania and bust.

The last two long cycles can be better seen in international production data than in individual national economies. The pre-1870 cycles can only be seen in Western economies.

The long cycle supposedly affects all sectors of an economy, and concerns mainly output rather than prices (although Kondratieff had made observations focusing more on price

s, inflation

and interest rates). According to Kondratiev, the ascendant phase is characterized by an increase in prices and low interest rates, while the other phase consists of a decrease in prices and high interest rates.

Deflation sometimes occurred during the cycle's downturns under the gold standard; however, there is no strong historical correlation between depressions and deflation. Rising productivity and reduced transportation cost created structural deflation during the accelerating productivity growth era of the last third of the 19th century. There was mild inflation from the cycle upswing around 1895 until establishment of the Federal Reserve in 1913. Inflation rose sharply during World War I

, but deflation returned again after World War I and during the 1930s depression. Most nations abandoned the gold standard in the 1930s. Today there is no reason to expect general, non-asset deflation under a fiat currency system with low productivity growth, especially with depleting natural resources like oil causing real prices to rise.

Over time the number of innovations in each wave increased and the diffusion of innovations overlapped, thus complicating dating the waves. Also, it is hard to tell much about which industries are growing, stagnating or declining by looking at the aggregate economic statistics, [at least until better statistics were collected following the 1930s].

With lack of major technological driving forces and high debt levels, as in developed economies today, we should expect stagnation. Also, changes to the patterns of now rapid growth in some developing economies could perhaps be forecast using logistic analysis (see IIASA Research section below) of their major sectors.

and land speculation. Some argue that war and capitalist crisis theories are cycle effects and not causes of the cycle. See: Cycle impact on social mood and vice versa

Since the inception of the theories, various studies have expanded the range of possible cycles, finding longer or shorter cycles in the data. The Marxist scholar Ernest Mandel

revived interest in long wave theory with his 1964 essay predicting the end of the long boom after five years and in his Alfred Marshall

lectures in 1979. However, in Mandel's theory, there are no long "cycles", only distinct epochs of faster and slower growth spanning 20–25 years.

sectors. Kondratiev's ideas were taken up by Joseph Schumpeter

in the 1930s. The theory hypothesized the existence of very long-run macroeconomic and price cycles, originally estimated to last 50–54 years.

In recent decades there has been considerable in historical economics and the history of technology, and numerous investigations of the relationship between technological innovation and economic cycles. Some of the works involving long cycle research and technology include Mensch (1979), Tylecote (1991), The International Institute for Applied Systems Analysis (IIASA) (Marchetti, Ayres), Freeman and Louçã (2001) and Carlota Perez. See table below. See also IIASA under Other Reserarhcrs section and Fruther reading.

Perez (2002) places the phases on a logistic

or S curve, with the following labels: beginning of a technological era as irruption, the ascent as frenzy, the rapid build out as synergy and the completion as maturity.

As discussed by Reinhart and Rogoff (2009), excessive debt, public and private, internal and external, has repeatedly led to financial crises in almost all countries throughout the last two centuries. These crises typically end in default and restructuring, although sometimes the default is through currency debasement (inflation). The high levels of debt normally take years to work off, and create a prolonged slump as businesses and consumers rebuild their balance sheets.

The link between depressions and debt was investigated by Irving Fisher

during the Great Depression in Booms and Depressions. Building on Fisher's work, Hyman Minsky

developed his financial instability hypothesis. A recent presentation by Steve Keen

expands on financial instability and provides a good analysis of the relationship between debt and the long economic cycle.

In the U.S. since the beginning of the 20th century there were parts of two long term cycles of total debt relative to GDP. The first cycle had debt rising until the 1929 crash, after which the total debt-to-GDP spiked to about 260% during the Great Depression. The debt/GDP declined following the depression high and reached a low of less than 140% in the 1950s. The ratio began a sharp rise from 160% in the early 1980s to over 360% during the 2008-9 financial crisis. Most European countries have high total debt levels and Japan has a high government debt ratio.

Economist Melchior Palyi (1892–1970) popularized the concept of marginal productivity of debt, which it came to be called after his death. Financial newsletter writer Alan M. Newman has periodically updated a debt/GDP graph and has also shown the declining marginal productivity of debt to increase GDP. In the 1960s it took $1.53 of debt to produce $1 of GDP; by 2000 it took $6 of debt to produce $1 of GDP. The declining marginal productivity of debt is a result of debt based money expansion flowing into land, including housing and commercial real estate, and financial markets in the second half of the 20th century instead of non-real estate production capital, which is saturated. Real estate also became heavily saturated, but a speculative bubble mitigated the effect.

Because real estate is the collateral a large amount of private debt, Georgism

, a philosophy that advocats government ownership of part of the economic rent

value of land, views land price cycles as part of the credit cycle. Henry George

wrote about land speculative bubbles being the cause of depressions, which many George followers believe. The rise in the value of U. S. real estate during the recent bubble was overwhelming in the land value rather than the value of structures.

See: Georgism

See also: Japanese asset price bubble

has written extensively on demographics and economic cycles. Tylecote (1991) devoted a chapter to demographics and the long cycle.

A slowing of U.S. population growth rate was given as one of the causes of the Great Depression by Alvin Hansen

.

Causes included a decline in the fertility rate, reduced immigration during the war, the 1918 influenza pandemic and the war deaths. In 1921, the Congress passed the Emergency Quota Act

, followed by the Immigration Act of 1924

, both of which led to a long term reduction in immigration the U.S. See also: Causes of the Great Depression#Population dynamics

Alvin Hansen expressed his concern about declining population growth prolonging the Great Depression at the time the U.S. birth rate was beginning its long term surge that would turn into the baby boom.

A sharp slowdown in the birth rate in Japan occurred in the two decades preceding the collapse of the Japanese asset price bubble

, which started in 1989 and resulted in the lost decade

. See: Demographics of Japan

An important trend since the industrial revolution is the unprecedented increase in life expectancy due primarily to more children living to adulthood. The fertility rate also declined. As a result the dependency ratio

has undergone changes not fully reflected in the number itself because children no longer work and people live long past their productive years.

.

Additionally, there are several versions of the technological cycles, and they are best interpreted using diffusion curves of leading industries. For example, railways only started around 1830, with steady growth for the next 35 years. It was after Bessemer steel was introduced that railroads had their highest growth rates; however, this period is usually labeled the "age of steel".

The technological cycles can be labeled as follows:

A typical, somewhat updated sequence of technological Kondratiev Waves in the U.S. and some other leading Western economies can be seen in the table below:

The above table has a focus on technologies, but as Perez (2004) and Schumpeter (1939) point out, capital, both financial and production, has an important role in the cycle. The above table should be compared to the list of recessions, depressions and economic bubbles: See:

According to the credit cycle

theory, the economic cycle that began in around 1939 is just ending. Although productivity slowed in the 1970s, the structure of the economy changed, with peak per capita oil and steel use in 1973 and with the sharp upturn in debt that began in the 1980s, creating the FIRE (finance, insurance and real estate) economy. Additional support for this cycle timing is that although there were severe recessions in the 1970s and early 1980s, they were nothing like the Great Depression.

Productivity

was an important factor in the two "great depressions", the 1870s Long Depression

and the 1930s Great Depression

. There were exceptional periods of high productivity growth that preceded both major depressions and caused great unemployment after the 1929 downturn. Also, both depressions were associated with overcapacity and market saturation. The whole period from 1870 to 1896 was in and out of recession or depression, despite being one of the greatest periods of industrial growth. The post WW 2 period up to the mid 1960s was an exception in that there was high productivity growth without a business depression or high unemployment.

, these researchers were able to provide new insight into market penetration, saturation and forecasting the diffusion of various innovations, infrastructures and energy source substitutions. A concise version of Kondratiev cycles can be found in Robert Ayres (1989) in which he gives a historical overview of the relationships of the most significant technologies. Cesare Marchetti published on Kondretiev waves and on diffusion of innovations. Arnulf Grübler’s book (1990) gives a detailed account of the diffusion of infrastructures including canals, railroads, highways and airlines, with findings that the principle infrastructures have midpoints spaced in time corresponding to 55 year K wavelengths, with railroads and highways taking almost a century to complete. Grübler devotes a chapter to the long economic wave.

Korotayev

et al. recently employed spectral analysis

and claimed that it confirmed the presence of Kondratiev waves in the world GDP dynamics at an acceptable level of statistical significance. Korotayev et al. also detected shorter business cycles, dating the Kuznets to about 17 years and calling it the third harmonic of the Kondratiev, meaning that there are three Kuznets cycles per Kondratiev.

The historian Eric Hobsbawm

wrote of the theory: "That good predictions have proved possible on the basis of Kondratiev Long Waves—this is not very common in economics—has convinced many historians and even some economists that there is something in them, even if we don't know what."

More recently the physicist and systems scientist Tessaleno Devezas

advanced a causal model for the long wave phenomenon based on a generation-learning model and a nonlinear dynamic behaviour of information systems. In both works a complete theory is presented containing not only the explanation for the existence of K-Waves, but also and for the first time an explanation for the timing of a K-Wave (≈60 years = two generations).

A specific modification of the theory

of Kondratiev cycles was developed by Daniel Šmihula

.

For the modern era and the capitalist economy he defined six long economic waves

(cycles) and each of them was initiated by a specific technological revolution:

Unlike original Kondratiev's and Schumpeter's views, in Smihula's conception each new "wave" due to acceleration of scientific and technological progress) is shorter than a previous one. The main stress is put on technological progress and new technologies as decisive factors of any long-time economic development. Each of these waves has its innovation phase (there occur innovations in a form applicable in practical life and also their first real application) which is described as a technological revolution and an application phase in which the number of revolutionary innovation

s falls and attention focuses on exploiting and extending existing innovations. (As soon as an innovation or a "chain of innovations" becomes available, it becomes more efficient to invest in its adoption, extension and use than in creating new innovations.)

Each wave (each cycle) of technological innovations can be characterized by the area in which the most revolutionary changes took place ("leading sectors").

Every wave of innovations lasts approximately until the profits from the new innovation or sector fall to the level of other, older, more traditional sectors. It is a situation when the new technology, which originally increased a capacity to utilize new sources from nature, reached its limits and it is not possible to overcome this limit without an application of another new technology

.

For the end of an application phase of any wave there are typical an economic crisis and stagnation

. The economic crisis in 2007–2010 is a result of the coming end of the "wave of the Information and telecommunications technological revolution". Some authors have started to predict what the sixth wave might be, such as James Bradfield Moody

and Bianca Nogrady who forecast that it will be driven by resource efficiency and clean technology

.

Kondratiev wave research has generally neglected to distinguish between innovations that created new goods or services and those that increased productivity.

, capital accumulation

, and innovation

that are present in this first period of the cycle create upheavals and displacements in society. The economic changes result in redefining work and the role of participants in society. In the next phase, the "Summer" stagflation, there is a mood of affluence from the previous growth stage that change the attitude towards work in society, creating inefficiencies. After this stage comes the season of deflationary growth, or the plateau period. The popular mood changes during this period as well. It shifts toward stability, normalcy, and isolationism

after the policies and economics during unpopular excesses of war. Finally, the "Winter" stage, that of severe depression, includes the integration of previous social shifts and changes into the social fabric of society, supported by the shifts in innovation and technology.

Some scholars, particularly Immanuel Wallerstein

, argue that cycles of global war are tied to capitalist long waves and major, highly-destructive wars, which tend to begin just prior to an output upswing. Others, like Ernesto Screpanti

, developed a theory based on a correlation between long economic cycles and recurrent waves of social conflict.

Elliott Wave analyst Robert Prechter

is perhaps the person best known today for his views on the how the economic cycle is affected by the social mood, for which he used the term socionomics.

David Ames Wells

(1891) noted that as workers were lifted out of miserable levels of poverty by the end of the 19th century and exposed to a wider world view and new consumer products, they created more labor and social unrest. Instead of capitalism enslaving workers and holding them at subsistence levels as some economists predicted, the opposite happened-by the 1890s businesses were operating with little profit, as Marx predicted; however, the workers enjoyed much higher real wages.

Investment adviser Ian Gordon has advocated a 4 season Kondratiev social mood influenced model in which spring is moderate growth from a stock market

and inflationary bottom, summer is characterized by accelerating growth and high inflation, autumn is characterized by declining inflation and asset bubble

s, and winter involves the collapse of the asset bubbles.

was the high point for the development of economically important technologies. The time lag for the diffusion of these technologies would result in U.S. peak productivity growth at some time in the period between 1928 and 1950.

Unlike the First Industrial Revolution, the technologies of the Second were solidly based in science. During Smil's “Age of Synergy” for the first time there was a scientific understanding of chemistry, thermodynamics

and the unification of light, electricity and magnetism through Maxwell's electromagnetic theory

. Electricity generation, electric motors and lights, radio, the steam turbine, the chemical industry, Haber-Bosch

ammonia synthesis, internal combustion and inexpensive steel making processes were notable major technologies developed during this era.

Interchangeable parts

, or precision manufacturing, took several decades to perfect in the small firearms industry before finally diffusing through the manufacturing economy in the late 19th century. Scientific management

, promoted by Frederick Winslow Taylor

, began to be implemented. Ford Motor Co. developed a revolutionary new manufacturing concept of mass production

based on electric powered machine tool

s and special purpose machines, systematically arranged in the order of the work flow. The movements of workers was kept to a minimum by using motorized conveyors on assembly line

s. Toward the end of the period agriculture was mechanized with internal combustion.

The building of railroads accelerated after the introduction of inexpensive steel rails, which lasted considerably longer than the 10 year life of wrought iron rails. Railroads lowered the cost of shipping to 0.875 cents/ton-mile from 24.5 cents/ton-mile by wagon. Cheap transportation made large scale manufacturing possible, giving economies of scale.

The development of control theory

was necessary for process control

, a common form of automation in continuous process industries such as refineries and paper mills. Control theory is used in a wide variety of servomechanisms which are used in such applications as steering ships and stabilizing airplanes.

The rapid economic advances at the time David A. Wells

(1891) wrote were the result of industry for the first time in history being based on scientific principles, which resulted in great increases in the efficiency of the use of labor and energy. This caused great upheavals in commerce and industry, with many laborers being displaced by machines and many factories, ships and other forms of fixed capital becoming obsolete in a very short time span.

The Long Depression

of 1873-9 was mostly a profit depression and unlike the Great Depression of the 1930s. Economist Murray Rothbard

expressed doubts about whether there was a Long Depression

because of the large increases in U.S. industrial production, GNP and real product per capita. See:Long depression#Interpretations

The dates 1867 to 1914 are what Vaclav Smil called "The Age of Synergy" and are a technological period during which the "great innovations" were developed and is not an economic cycle. Only a few major innovations occurred in the post WW 2 era, some of which are: the diffusion of earlier technologies, namely internal combustion powered agricultural machinery, railroad diesel locomotives and diesel powered ships. Other past World War II innovations were new technologies such as computers, semiconductors, the fiber optic network and the Internet, cellular telephones, combustion turbines (jet engines) and the Green Revolution

.

It has been noted by several researchers and economists that the significance of innovations has decreased over time and the recent innovations such as computers, the Internet and hand held communication devices do not compare with the great innovations of the past such as railroads, electrification and automobiles.

The fact that computers failed to significantly boost productivity is known as the productivity paradox

.

There was high productivity growth from the end of the 19th century with a peak some time between 1928 and about 1950 with slowdown beginning in the 1970s. Productivity allowed the work week to be reduced from 60 to 50 hours in the late 19th century, and then to 40 hours in the mid 1930s. Thus the 1930s depression may be viewed partly as a structural adjustment to high productivity in the preceding decades.

By the end of the Second Industrial Revolution almost all physical work was performed by machines. Also, the efficiency of processes such as electricity generation, steel and chemical production are approaching thermodynamic limits.

Mainly as a result of slowing productivity growth, but also because of global wage arbitrage (globalization) and resource depletion, real wages for workers in the U.S. have stagnated since the early 1970s.

Another important contribution to this wage stagnation is the increasing portion of GDP going to the richest socioeconomic classes in most nations. Globalization causes mostly less-wealthy workers' wages to stagnate.

There was a marked slowdown in U. S. GDP growth after 1910. The slowdown was partly related to a decline in investment in structures and partly due to reduced immigration. Perhaps the decline in residential structure investment could be related to demographics or construction productivity. Possible reasons for the decline in commercial structures are: construction productivity, cheap steel, more efficient use of factory space because of electrification and mass production and less warehousing because of motorized transportation. Hounshell (1984) calculated that the Ford Motor Co. foundry of 1914 poured ten times more iron in an area half the size of the Singer Manufacturing Co.'s foundry (ca. 1880) despite Ford's being half the area.

Sustained U.S. economic growth never returned to the 4% plus rate of the first decade of the 20th century.

The peak share of manufacturing in the U.S. economy occurred during WW II. It has since declined as a percentage from the low 30s to about 16%.

, i.e. the main heterodox stream in economics. Among economists who accept it, there has been no universal agreement about the start and the end years of particular waves. This points to another criticism of the theory: that it amounts to seeing patterns in a mass of statistics that aren't really there.

Moreover, there is a lack of agreement over the cause of this phenomenon. How much this matters is disputed: some scientific patterns have in the past been identified before an explanation could be advanced. (The best known example is that of the precursors to the periodic table

, which were in fact rejected by many scientists precisely on the grounds of lack of explanation.)

Some believe that not enough is attributed to actual human error

s that have created some of the economic situations of history, and too much to the inevitability of the characteristics of the phases of the waves. They claim that many of the situations were entirely avoidable, not the consequences of an unstoppable wave pattern. Others doubt the legitimacy of Kondratiev's waves because they believe that every wave is a structural cycle that has unique characteristics and cannot be repeated. There is also controversy over Kondratiev's research—many believe that the conclusions and results of his research are biased because he highlighted and used only certain events to reach his conclusions and left out other important data and events that could have affected his outcomes.

A problem with analyzing Kondratiev waves is that there is little data before 1870 and then it is only for a few countries in Europe and the U.S. Also, the early data consisted mostly of prices, trade statistics and limited information on industrial production. Pre 20th century depressions were periods of depressed prices and profits and not necessarily associated with high unemployment or falling industrial production. Falling prices typically increased real purchasing power and the standard of living was maintained or actually rose. With the end of the gold standard prices were no longer depressed with economic contractions and such periods were called recessions. To date the only true depression with very high unemployment for a number of years was the Great Depression of the early 1930s.

World economy

The world economy, or global economy, generally refers to the economy, which is based on economies of all of the world's countries, national economies. Also global economy can be seen as the economy of global society and national economies – as economies of local societies, making the global one....

. Averaging fifty and ranging from approximately forty to sixty years in length, the cycles consist of alternating periods between high sectoral growth

Economic growth

In economics, economic growth is defined as the increasing capacity of the economy to satisfy the wants of goods and services of the members of society. Economic growth is enabled by increases in productivity, which lowers the inputs for a given amount of output. Lowered costs increase demand...

and periods of relatively slow growth. Unlike the short-term business cycle

Business cycle

The term business cycle refers to economy-wide fluctuations in production or economic activity over several months or years...

, the long wave of this theory is not accepted by current mainstream economics

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

.

History of discovery

The Russian economist Nikolai KondratievNikolai Kondratiev

Nikolai Dmitriyevich Kondratiev , Russian: Николай Дмитриевич Кондратьев , was a Russian economist, who was a proponent of the New Economic Policy in the Soviet Union....

(also written Kondratieff) was the first to bring these observations to international attention in his book The Major Economic Cycles (1925) alongside other works written in the same decade. Two Dutch economists, Jacob van Gelderen

Jacob van Gelderen

Jacob van Gelderen was a Dutch economist. Alongside Samuel de Wolff, he proposed the existence of 50- to 60-year long economic super cycles, now known as Kondratiev waves.-External links:*...

and Samuel de Wolff, had previously argued for the existence of 50 to 60 year cycles in 1913. However, the work of de Wolff and van Gelderen has only recently been translated from Dutch

Dutch language

Dutch is a West Germanic language and the native language of the majority of the population of the Netherlands, Belgium, and Suriname, the three member states of the Dutch Language Union. Most speakers live in the European Union, where it is a first language for about 23 million and a second...

to reach a wider audience.

Kondratiev was a Russia

Russia

Russia or , officially known as both Russia and the Russian Federation , is a country in northern Eurasia. It is a federal semi-presidential republic, comprising 83 federal subjects...

n economist

Economist

An economist is a professional in the social science discipline of economics. The individual may also study, develop, and apply theories and concepts from economics and write about economic policy...

, but his economic conclusions were disliked by the Soviet

Soviet Union

The Soviet Union , officially the Union of Soviet Socialist Republics , was a constitutionally socialist state that existed in Eurasia between 1922 and 1991....

leadership and upon their release he was quickly dismissed from his post as director of the Institute for the Study of Business Activity in the Soviet Union in 1928. His conclusions were seen as a criticism of Joseph Stalin

Joseph Stalin

Joseph Vissarionovich Stalin was the Premier of the Soviet Union from 6 May 1941 to 5 March 1953. He was among the Bolshevik revolutionaries who brought about the October Revolution and had held the position of first General Secretary of the Communist Party of the Soviet Union's Central Committee...

's intentions for the Soviet economy: as a result he was sentenced to the Soviet Gulag

Gulag

The Gulag was the government agency that administered the main Soviet forced labor camp systems. While the camps housed a wide range of convicts, from petty criminals to political prisoners, large numbers were convicted by simplified procedures, such as NKVD troikas and other instruments of...

and later received the death penalty in 1938.

Later, in Business Cycles (1939), Joseph Schumpeter

Joseph Schumpeter

Joseph Alois Schumpeter was an Austrian-Hungarian-American economist and political scientist. He popularized the term "creative destruction" in economics.-Life:...

suggested naming the cycles "Kondratieff waves", in honor of the economist who first noticed them. In the 1950s, French economist François Simiand

François Simiand

François Simiand was a French sociologist and economist best known as a participant in the Année Sociologique. As a member of the French Historical School of economics, Simiand predicated a rigorous factual and statistical basis for theoretical models and policies...

proposed naming the ascendant period of the cycle "Phase A" and the downward period "Phase B". Some market commentators divide the Kondratiev wave into four 'seasons', namely, the Kondratiev Spring (improvement or plateau) and Summer (acceleration or prosperity) of the ascendant period and the Kondratiev Fall (recession or plateau) and Winter (acceleration or depression) of the downward period.

Characteristics of the cycle

Kondratiev identified three phases in the cycle: expansion, stagnation, recession. More common today is the division into four periods with a turning point (collapse) between the first and second phases. Writing in the 1920s, Kondratiev proposed to apply the theory to the 19th century:- 1790–1849 with a turning point in 1815.

- 1850–1896 with a turning point in 1873.

- Kondratiev supposed that, in 1896, a new cycle had started.

The saturation of major markets or infrastructures (canals, railroads) creates a stagnation in the economy. However, stagnation does not necessarily mean that markets are mature. Markets were temporarily oversupplied during the high growth period from the 1870s-90s, during which time there was also a lot of creative destruction

Creative destruction

Creative destruction is a term originally derived from Marxist economic theory which refers to the linked processes of the accumulation and annihilation of wealth under capitalism. These processes were first described in The Communist Manifesto and were expanded in Marx's Grundrisse and "Volume...

in industries like iron, which was displaced by steel, and labor, which was displaced by machinery, but re-employed because of growth. The stagnation phase is characterized by a lack of good investment opportunities that leads to low interest rates and lowered credit standards which creates a speculative boom

Economic bubble

An economic bubble is "trade in high volumes at prices that are considerably at variance with intrinsic values"...

and high debt levels, followed by a crash and financial crisis. Past speculative excesses included canals, railroads, farm land, real estate and the broader stock market. Carlota Perez

Carlota Perez

Carlota Perez is a Venezuelan scholar and expert on technology and socio-economic development most famous for her concept of Techno-Economic Paradigm Shifts and her theory of great surges, a further development of the Kondratieff waves.-Career:...

describes the roles of financial capital and production capital in the cycle. Perez also says excess financial speculation is likely to occur in the "frenzy" stage of a new technology, such as the 1998-2000 computer, internet, dotcom-mania and bust.

The last two long cycles can be better seen in international production data than in individual national economies. The pre-1870 cycles can only be seen in Western economies.

The long cycle supposedly affects all sectors of an economy, and concerns mainly output rather than prices (although Kondratieff had made observations focusing more on price

Price

-Definition:In ordinary usage, price is the quantity of payment or compensation given by one party to another in return for goods or services.In modern economies, prices are generally expressed in units of some form of currency...

s, inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

and interest rates). According to Kondratiev, the ascendant phase is characterized by an increase in prices and low interest rates, while the other phase consists of a decrease in prices and high interest rates.

Deflation sometimes occurred during the cycle's downturns under the gold standard; however, there is no strong historical correlation between depressions and deflation. Rising productivity and reduced transportation cost created structural deflation during the accelerating productivity growth era of the last third of the 19th century. There was mild inflation from the cycle upswing around 1895 until establishment of the Federal Reserve in 1913. Inflation rose sharply during World War I

World War I

World War I , which was predominantly called the World War or the Great War from its occurrence until 1939, and the First World War or World War I thereafter, was a major war centred in Europe that began on 28 July 1914 and lasted until 11 November 1918...

, but deflation returned again after World War I and during the 1930s depression. Most nations abandoned the gold standard in the 1930s. Today there is no reason to expect general, non-asset deflation under a fiat currency system with low productivity growth, especially with depleting natural resources like oil causing real prices to rise.

Over time the number of innovations in each wave increased and the diffusion of innovations overlapped, thus complicating dating the waves. Also, it is hard to tell much about which industries are growing, stagnating or declining by looking at the aggregate economic statistics, [at least until better statistics were collected following the 1930s].

With lack of major technological driving forces and high debt levels, as in developed economies today, we should expect stagnation. Also, changes to the patterns of now rapid growth in some developing economies could perhaps be forecast using logistic analysis (see IIASA Research section below) of their major sectors.

Tentative explanations of the cycle

Early on, several schools of thought emerged as to why capitalist economies have these long waves. These schools of thought centered on innovations, capital investment, war capitalist crisisCrisis theory

Crisis theory is generally associated with Marxian economics. In this context crisis refers to what is called, even currently and outside Marxian theory in many European countries a "conjuncture" or especially sharp bust cycle of the regular boom and bust pattern of what Marxists term "chaotic"...

and land speculation. Some argue that war and capitalist crisis theories are cycle effects and not causes of the cycle. See: Cycle impact on social mood and vice versa

Since the inception of the theories, various studies have expanded the range of possible cycles, finding longer or shorter cycles in the data. The Marxist scholar Ernest Mandel

Ernest Mandel

Ernest Ezra Mandel, also known by various pseudonyms such as Ernest Germain, Pierre Gousset, Henri Vallin, Walter , was a revolutionary Marxist theorist.-Life:...

revived interest in long wave theory with his 1964 essay predicting the end of the long boom after five years and in his Alfred Marshall

Alfred Marshall

Alfred Marshall was an Englishman and one of the most influential economists of his time. His book, Principles of Economics , was the dominant economic textbook in England for many years...

lectures in 1979. However, in Mandel's theory, there are no long "cycles", only distinct epochs of faster and slower growth spanning 20–25 years.

Technological innovation theory

According to the innovation theory, these waves arise from the bunching of basic innovations that launch technological revolutions that in turn create leading industrial or commercialCommerce

While business refers to the value-creating activities of an organization for profit, commerce means the whole system of an economy that constitutes an environment for business. The system includes legal, economic, political, social, cultural, and technological systems that are in operation in any...

sectors. Kondratiev's ideas were taken up by Joseph Schumpeter

Joseph Schumpeter

Joseph Alois Schumpeter was an Austrian-Hungarian-American economist and political scientist. He popularized the term "creative destruction" in economics.-Life:...

in the 1930s. The theory hypothesized the existence of very long-run macroeconomic and price cycles, originally estimated to last 50–54 years.

In recent decades there has been considerable in historical economics and the history of technology, and numerous investigations of the relationship between technological innovation and economic cycles. Some of the works involving long cycle research and technology include Mensch (1979), Tylecote (1991), The International Institute for Applied Systems Analysis (IIASA) (Marchetti, Ayres), Freeman and Louçã (2001) and Carlota Perez. See table below. See also IIASA under Other Reserarhcrs section and Fruther reading.

Perez (2002) places the phases on a logistic

Logistic function

A logistic function or logistic curve is a common sigmoid curve, given its name in 1844 or 1845 by Pierre François Verhulst who studied it in relation to population growth. It can model the "S-shaped" curve of growth of some population P...

or S curve, with the following labels: beginning of a technological era as irruption, the ascent as frenzy, the rapid build out as synergy and the completion as maturity.

Credit cycle theory

Excessive debt is known to ultimately have negative consequences for the economy, although monetary policy, such as low interest rates, is used to increase borrowing and stimulate growth.As discussed by Reinhart and Rogoff (2009), excessive debt, public and private, internal and external, has repeatedly led to financial crises in almost all countries throughout the last two centuries. These crises typically end in default and restructuring, although sometimes the default is through currency debasement (inflation). The high levels of debt normally take years to work off, and create a prolonged slump as businesses and consumers rebuild their balance sheets.

The link between depressions and debt was investigated by Irving Fisher

Irving Fisher

Irving Fisher was an American economist, inventor, and health campaigner, and one of the earliest American neoclassical economists, though his later work on debt deflation often regarded as belonging instead to the Post-Keynesian school.Fisher made important contributions to utility theory and...

during the Great Depression in Booms and Depressions. Building on Fisher's work, Hyman Minsky

Hyman Minsky

Hyman Philip Minsky was an American economist and professor of economics at Washington University in St. Louis. His research attempted to provide an understanding and explanation of the characteristics of financial crises...

developed his financial instability hypothesis. A recent presentation by Steve Keen

Steve Keen

Steve Keen is a Professor in economics and finance at the University of Western Sydney. He classes himself as a post-Keynesian, criticizing both modern neoclassical economics and Marxian economics as inconsistent, unscientific and empirically unsupported...

expands on financial instability and provides a good analysis of the relationship between debt and the long economic cycle.

In the U.S. since the beginning of the 20th century there were parts of two long term cycles of total debt relative to GDP. The first cycle had debt rising until the 1929 crash, after which the total debt-to-GDP spiked to about 260% during the Great Depression. The debt/GDP declined following the depression high and reached a low of less than 140% in the 1950s. The ratio began a sharp rise from 160% in the early 1980s to over 360% during the 2008-9 financial crisis. Most European countries have high total debt levels and Japan has a high government debt ratio.

Economist Melchior Palyi (1892–1970) popularized the concept of marginal productivity of debt, which it came to be called after his death. Financial newsletter writer Alan M. Newman has periodically updated a debt/GDP graph and has also shown the declining marginal productivity of debt to increase GDP. In the 1960s it took $1.53 of debt to produce $1 of GDP; by 2000 it took $6 of debt to produce $1 of GDP. The declining marginal productivity of debt is a result of debt based money expansion flowing into land, including housing and commercial real estate, and financial markets in the second half of the 20th century instead of non-real estate production capital, which is saturated. Real estate also became heavily saturated, but a speculative bubble mitigated the effect.

Because real estate is the collateral a large amount of private debt, Georgism

Georgism

Georgism is an economic philosophy and ideology that holds that people own what they create, but that things found in nature, most importantly land, belong equally to all...

, a philosophy that advocats government ownership of part of the economic rent

Economic rent

Economic rent is typically defined by economists as payment for goods and services beyond the amount needed to bring the required factors of production into a production process and sustain supply. A recipient of economic rent is a rentier....

value of land, views land price cycles as part of the credit cycle. Henry George

Henry George

Henry George was an American writer, politician and political economist, who was the most influential proponent of the land value tax, also known as the "single tax" on land...

wrote about land speculative bubbles being the cause of depressions, which many George followers believe. The rise in the value of U. S. real estate during the recent bubble was overwhelming in the land value rather than the value of structures.

See: Georgism

Georgism

Georgism is an economic philosophy and ideology that holds that people own what they create, but that things found in nature, most importantly land, belong equally to all...

See also: Japanese asset price bubble

Japanese asset price bubble

The was an economic bubble in Japan from 1986 to 1991, in which real estate and stock prices were greatly inflated. The bubble's collapse lasted for more than a decade with stock prices initially bottoming in 2003, although they would descend even further amidst the global crisis in 2008. The...

Demographic theory

Because people have fairly typical spending patterns through their life cycle, such as schooling, marriage, first car purchase, first home purchase, upgrade home purchase, maximum earnings period, maximum retirement savings and retirement, demographic anomalies such as baby booms and busts exert a rather predictable influence on the economy over a long time period. Harry DentHarry Dent

Harry S. Dent, Jr. is an American financial newsletter writer. His latest book, The Great Depression Ahead, appeared on the New York Times Bestseller List.-Biography:...

has written extensively on demographics and economic cycles. Tylecote (1991) devoted a chapter to demographics and the long cycle.

A slowing of U.S. population growth rate was given as one of the causes of the Great Depression by Alvin Hansen

Alvin Hansen

Alvin Harvey Hansen , often referred to as "the American Keynes," was a professor of economics at Harvard, a widely read author on current economic issues, and an influential advisor to the government who helped create the Council of Economic Advisors and the Social security system...

.

Causes included a decline in the fertility rate, reduced immigration during the war, the 1918 influenza pandemic and the war deaths. In 1921, the Congress passed the Emergency Quota Act

Emergency Quota Act

The Emergency Quota Act, also known as the Emergency Immigration Act of 1921, the Immigration Restriction Act of 1921, the Per Centum Law, and the Johnson Quota Act restricted immigration into the United States...

, followed by the Immigration Act of 1924

Immigration Act of 1924

The Immigration Act of 1924, or Johnson–Reed Act, including the National Origins Act, and Asian Exclusion Act , was a United States federal law that limited the annual number of immigrants who could be admitted from any country to 2% of the number of people from that country who were already...

, both of which led to a long term reduction in immigration the U.S. See also: Causes of the Great Depression#Population dynamics

Alvin Hansen expressed his concern about declining population growth prolonging the Great Depression at the time the U.S. birth rate was beginning its long term surge that would turn into the baby boom.

A sharp slowdown in the birth rate in Japan occurred in the two decades preceding the collapse of the Japanese asset price bubble

Japanese asset price bubble

The was an economic bubble in Japan from 1986 to 1991, in which real estate and stock prices were greatly inflated. The bubble's collapse lasted for more than a decade with stock prices initially bottoming in 2003, although they would descend even further amidst the global crisis in 2008. The...

, which started in 1989 and resulted in the lost decade

Lost Decade (Japan)

The is the time after the Japanese asset price bubble's collapse within the Japanese economy, which occurred gradually rather than catastrophically...

. See: Demographics of Japan

Demographics of Japan

The demographic features of the population of Japan include population density, ethnicity, education level, health of the populace, economic status, religious affiliations and other aspects of the population....

An important trend since the industrial revolution is the unprecedented increase in life expectancy due primarily to more children living to adulthood. The fertility rate also declined. As a result the dependency ratio

Dependency ratio

In economics and geography the dependency ratio is an age-population ratio of those typically not in the labor force and those typically in the labor force...

has undergone changes not fully reflected in the number itself because children no longer work and people live long past their productive years.

Modern modifications of Kondratiev theory

There are several modern timing versions of the cycle although most are based on either of two causes: one on technology and the other on the credit cycleCredit cycle

The credit cycle is the expansion and contraction of access to credit over the course of the business cycle. Some economists, including Barry Eichengreen, Hyman Minsky, and other Post-Keynesian economists, and some members of the Austrian school, regard credit cycles as the fundamental process...

.

Additionally, there are several versions of the technological cycles, and they are best interpreted using diffusion curves of leading industries. For example, railways only started around 1830, with steady growth for the next 35 years. It was after Bessemer steel was introduced that railroads had their highest growth rates; however, this period is usually labeled the "age of steel".

The technological cycles can be labeled as follows:

- The Industrial Revolution—1771

- The Age of Steam and Railways—1829

- The Age of Steel and Heavy Engineering—1875

- The Age of Oil, Electricity, the Automobile and Mass Production—1908

- The Age of Information and Telecommunications—1971

A typical, somewhat updated sequence of technological Kondratiev Waves in the U.S. and some other leading Western economies can be seen in the table below:

| Period | Date (Prosperity to prosperity) | Innovation | Saturation point |

|---|---|---|---|

| First Industrial Revolution (Mechanical Age) | Circa 1787–1842 | Cotton-based technology: spinning weaving; atmospheric stationary steam engines replaced by high pressure engines, cast and wrought iron, iron displaces wood in machinery, canals. Development of machine tools | Cotton textiles: British market saturated ca. 1800. By 1840, 71% of British cotton textiles were exported |

| Railroad and Steam Engine Era | Circa 1842–1897 | Age of steam railways and steam shipping, first inexpensive steel Steel Steel is an alloy that consists mostly of iron and has a carbon content between 0.2% and 2.1% by weight, depending on the grade. Carbon is the most common alloying material for iron, but various other alloying elements are used, such as manganese, chromium, vanadium, and tungsten... , telegraph, animal powered combine harvesters, etc. Final development of and diffusion of machine tool Machine tool A machine tool is a machine, typically powered other than by human muscle , used to make manufactured parts in various ways that include cutting or certain other kinds of deformation... s and interchangeable parts Interchangeable parts Interchangeable parts are parts that are, for practical purposes, identical. They are made to specifications that ensure that they are so nearly identical that they will fit into any device of the same type. One such part can freely replace another, without any custom fitting... . Emergence of petroleum and chemical industries and heavy industries after 1870. Beginning of public water and sewer systems. |

Canals: Late 1840s 1870: Steam exceeds water power and animal power. 1890s: Railroads. Track mileage continued to grow but much is later abandoned. |

| Age of steel, electricity and internal combustion | 1897–1939 | Steel, electric motors, electrification of factories and households, electric utilities, aluminum, chemicals and petrochemicals, internal combustion engine, automobiles, highway system, Fordist mass production, telephony, beginning of motorized agricultural mechanization, radio. Electric street railways help create streetcar suburbs. Build out of urban public water supply and sewage systems. | 1917: Railroads nationalized United States Railroad Administration The United States Railroad Administration was the name of the nationalized railroad system of the United States between 1917 and 1920. It was possibly the largest American experiment with nationalization, and was undertaken against a background of war emergency.- Background :On April 6, 1917, the... . Post World War I short depression. Railroads and electric street railways decline after 1920. Horses, mules and agricultural commodities: 1919. After 1923 industrial output rises as workforce slowly declines. Depression of 1930s: Overcapacity in manufacturing, real estate. Work week reduced from 50 to 40 hours in mid-1930s. Total debt reaches 260% of GDP during early 1930s. |

| War and Post-war Boom: Suburbia | 1939–1982? | Oil displaces coal. Suburban growth and infrastructure. Greatest period of agricultural productivity growth 1940s-1970s. Consumer goods, semiconductors, business computers, plastics, synthetic fibers, fertilizers, television and electronics, green revolution Green Revolution Green Revolution refers to a series of research, development, and technology transfer initiatives, occurring between the 1940s and the late 1970s, that increased agriculture production around the world, beginning most markedly in the late 1960s.... , military-industrial complex, diffusion of commercial aviation and air conditioning, beginning nuclear utilities. |

1940s-50s: Diesel locomotives replace steam. 1971: Peak U.S. oil production 1973: Peak steel consumption in U.S. Pennsylvania steel cities and industrial midwest turn into "rust belt". 1973: Slow economic and productivity growth noted. 1980s: Highway system near saturation |

| Post Industrial Era: Information Technology and care of elderly | 1982? – ?? | Fiber optics and Internet, personal computers, wireless technology, on line commerce, biotechnology, Reagan's "Star Wars" military projects. Energy conservation. Beginning of industrial robots. In the U.S. health care becomes a major sector of the economy (16%) and financial sector increases to 7.5% of economy. | 1984: Peak U.S. employment in computer manufacturing. Long term decline in U.S. capacity utilization Capacity utilization Capacity utilization is a concept in economics and managerial accounting which refers to the extent to which an enterprise or a nation actually uses its installed productive capacity... 1990s: Automobiles, land line telephones, chemicals, plastics, appliances, paper, other basic materials, commercial aviation. 2001:Computers, fiber optics 2000s: Crop yields approach limits of photosynthesis. 2008: Developed world on verge of depression. Widespread overcapacity except some nonferrous metals and oil. Large housing and commercial real estate surplus. GDP no longer responds to increases in debt. Total debt exceeds 360% of GDP by late 2009. |

The above table has a focus on technologies, but as Perez (2004) and Schumpeter (1939) point out, capital, both financial and production, has an important role in the cycle. The above table should be compared to the list of recessions, depressions and economic bubbles: See:

- List of recessions in the United States

- List of recessions in the United Kingdom

- Examples of bubbles and purported bubbles

According to the credit cycle

Credit cycle

The credit cycle is the expansion and contraction of access to credit over the course of the business cycle. Some economists, including Barry Eichengreen, Hyman Minsky, and other Post-Keynesian economists, and some members of the Austrian school, regard credit cycles as the fundamental process...

theory, the economic cycle that began in around 1939 is just ending. Although productivity slowed in the 1970s, the structure of the economy changed, with peak per capita oil and steel use in 1973 and with the sharp upturn in debt that began in the 1980s, creating the FIRE (finance, insurance and real estate) economy. Additional support for this cycle timing is that although there were severe recessions in the 1970s and early 1980s, they were nothing like the Great Depression.

Productivity

Productivity improving technologies (historical)

Productivity improving technologies date back to antiquity, with rather slow progress until the late Middle Ages. Technological progress was aided by literacy and the diffusion of knowledge that accelerated after the spinning wheel spread to Western Europe in the 13th century...

was an important factor in the two "great depressions", the 1870s Long Depression

Long Depression

The Long Depression was a worldwide economic crisis, felt most heavily in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. At the time, the episode was labeled the Great...

and the 1930s Great Depression

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

. There were exceptional periods of high productivity growth that preceded both major depressions and caused great unemployment after the 1929 downturn. Also, both depressions were associated with overcapacity and market saturation. The whole period from 1870 to 1896 was in and out of recession or depression, despite being one of the greatest periods of industrial growth. The post WW 2 period up to the mid 1960s was an exception in that there was high productivity growth without a business depression or high unemployment.

Other researchers

Several papers on the relationship between technology and the economy were written by researchers at the International Institute for Applied Systems Analysis (IIASA). The pertinent papers deal with energy substitution and the role of work in the economy as well as with the long economic cycle. The authors were engineers, physicists or economists, or other technical people often working with economists, and give a much better interpretation than most previous works. Using the logistic functionLogistic function

A logistic function or logistic curve is a common sigmoid curve, given its name in 1844 or 1845 by Pierre François Verhulst who studied it in relation to population growth. It can model the "S-shaped" curve of growth of some population P...

, these researchers were able to provide new insight into market penetration, saturation and forecasting the diffusion of various innovations, infrastructures and energy source substitutions. A concise version of Kondratiev cycles can be found in Robert Ayres (1989) in which he gives a historical overview of the relationships of the most significant technologies. Cesare Marchetti published on Kondretiev waves and on diffusion of innovations. Arnulf Grübler’s book (1990) gives a detailed account of the diffusion of infrastructures including canals, railroads, highways and airlines, with findings that the principle infrastructures have midpoints spaced in time corresponding to 55 year K wavelengths, with railroads and highways taking almost a century to complete. Grübler devotes a chapter to the long economic wave.

Korotayev

Andrey Korotayev

Andrey Korotayev is an anthropologist, economic historian, and sociologist, with major contributions to world-systems theory, cross-cultural studies, Near Eastern history, and mathematical modeling of social and economic macrodynamics.Education and career=Born in Moscow, Andrey Korotayev attended...

et al. recently employed spectral analysis

Spectral analysis

Spectral analysis or Spectrum analysis may refer to:* Spectrum analysis in chemistry and physics, a method of analyzing the chemical properties of matter from bands in their visible spectrum...

and claimed that it confirmed the presence of Kondratiev waves in the world GDP dynamics at an acceptable level of statistical significance. Korotayev et al. also detected shorter business cycles, dating the Kuznets to about 17 years and calling it the third harmonic of the Kondratiev, meaning that there are three Kuznets cycles per Kondratiev.

The historian Eric Hobsbawm

Eric Hobsbawm

Eric John Ernest Hobsbawm , CH, FBA, is a British Marxist historian, public intellectual, and author...

wrote of the theory: "That good predictions have proved possible on the basis of Kondratiev Long Waves—this is not very common in economics—has convinced many historians and even some economists that there is something in them, even if we don't know what."

More recently the physicist and systems scientist Tessaleno Devezas

Tessaleno Devezas

Tessaleno Campos Devezas is a physicist, systems theorist, and materials scientist known by his contributions to the long waves theory in socioeconomic development, technological evolution, as well as world system analysis.-Awards:In March 2002 Devezas was honored with the “Elsevier Best Paper...

advanced a causal model for the long wave phenomenon based on a generation-learning model and a nonlinear dynamic behaviour of information systems. In both works a complete theory is presented containing not only the explanation for the existence of K-Waves, but also and for the first time an explanation for the timing of a K-Wave (≈60 years = two generations).

A specific modification of the theory

Theory

The English word theory was derived from a technical term in Ancient Greek philosophy. The word theoria, , meant "a looking at, viewing, beholding", and referring to contemplation or speculation, as opposed to action...

of Kondratiev cycles was developed by Daniel Šmihula

Daniel Šmihula

JUDr. MUDr. Daniel Šmihula PhD. Dr.iur. is a Slovak lawyer, political scientist, journalist and writer.- Life :...

.

For the modern era and the capitalist economy he defined six long economic waves

Waves of Economic Development

Economic development research has currently identified five phases, or "waves" of economic development practice. The differences between these waves are shaped by historical factors, the economic climate during historical periods, and leaders' response to these forces, which over time have created...

(cycles) and each of them was initiated by a specific technological revolution:

- 1. (1600–1780) The wave of the Financial-agricultural revolution

- 2. (1780–1880) The wave of the Industrial revolution

- 3. (1880–1940) The wave of the Technical revolution

- 4. (1940–1985) The wave of the Scientific-technical revolution

- 5. (1985–2015) The wave of the Information and telecommunications revolution

- 6. (2015-2035?) The hypothetical wave of the post-informational technological revolution

Unlike original Kondratiev's and Schumpeter's views, in Smihula's conception each new "wave" due to acceleration of scientific and technological progress) is shorter than a previous one. The main stress is put on technological progress and new technologies as decisive factors of any long-time economic development. Each of these waves has its innovation phase (there occur innovations in a form applicable in practical life and also their first real application) which is described as a technological revolution and an application phase in which the number of revolutionary innovation

Innovation

Innovation is the creation of better or more effective products, processes, technologies, or ideas that are accepted by markets, governments, and society...

s falls and attention focuses on exploiting and extending existing innovations. (As soon as an innovation or a "chain of innovations" becomes available, it becomes more efficient to invest in its adoption, extension and use than in creating new innovations.)

Each wave (each cycle) of technological innovations can be characterized by the area in which the most revolutionary changes took place ("leading sectors").

Every wave of innovations lasts approximately until the profits from the new innovation or sector fall to the level of other, older, more traditional sectors. It is a situation when the new technology, which originally increased a capacity to utilize new sources from nature, reached its limits and it is not possible to overcome this limit without an application of another new technology

Technology

Technology is the making, usage, and knowledge of tools, machines, techniques, crafts, systems or methods of organization in order to solve a problem or perform a specific function. It can also refer to the collection of such tools, machinery, and procedures. The word technology comes ;...

.

For the end of an application phase of any wave there are typical an economic crisis and stagnation

Stagnation

Stagnation may refer to one of the following*Economic stagnation, slow or no economic growth*Era of Stagnation, a period of economic stagnation in Soviet Union*Stagnation in fluid dynamics, see "Stagnation point"*Water stagnation*Air stagnation...

. The economic crisis in 2007–2010 is a result of the coming end of the "wave of the Information and telecommunications technological revolution". Some authors have started to predict what the sixth wave might be, such as James Bradfield Moody

James Bradfield Moody

James Bradfield Moody is Executive Director, Development at the Commonwealth Scientific and Industrial Research Organisation. He is also a panel member of the ABC Television show “The New Inventors” and co-author of The Sixth Wave with Bianca Nogrady.From 2004 to 2009 he held various roles at...

and Bianca Nogrady who forecast that it will be driven by resource efficiency and clean technology

Clean technology

Clean technology includes recycling, renewable energy , information technology, green transportation, electric motors, green chemistry, lighting, Greywater, and many other appliances that are now more energy efficient. It is a means to create electricity and fuels, with a smaller environmental...

.

Kondratiev wave research has generally neglected to distinguish between innovations that created new goods or services and those that increased productivity.

Cycle impact on social mood and vice versa

The phases of Kondratiev's waves also carry with them social shifts and changes in the public mood. The first stage of expansion and growth, the "Spring" stage, encompasses a social shift in which the wealthWealth

Wealth is the abundance of valuable resources or material possessions. The word wealth is derived from the old English wela, which is from an Indo-European word stem...

, capital accumulation

Capital accumulation

The accumulation of capital refers to the gathering or amassing of objects of value; the increase in wealth through concentration; or the creation of wealth. Capital is money or a financial asset invested for the purpose of making more money...

, and innovation

Innovation

Innovation is the creation of better or more effective products, processes, technologies, or ideas that are accepted by markets, governments, and society...

that are present in this first period of the cycle create upheavals and displacements in society. The economic changes result in redefining work and the role of participants in society. In the next phase, the "Summer" stagflation, there is a mood of affluence from the previous growth stage that change the attitude towards work in society, creating inefficiencies. After this stage comes the season of deflationary growth, or the plateau period. The popular mood changes during this period as well. It shifts toward stability, normalcy, and isolationism

Protectionism

Protectionism is the economic policy of restraining trade between states through methods such as tariffs on imported goods, restrictive quotas, and a variety of other government regulations designed to allow "fair competition" between imports and goods and services produced domestically.This...

after the policies and economics during unpopular excesses of war. Finally, the "Winter" stage, that of severe depression, includes the integration of previous social shifts and changes into the social fabric of society, supported by the shifts in innovation and technology.

Some scholars, particularly Immanuel Wallerstein

Immanuel Wallerstein

Immanuel Maurice Wallerstein is a US sociologist, historical social scientist, and world-systems analyst...

, argue that cycles of global war are tied to capitalist long waves and major, highly-destructive wars, which tend to begin just prior to an output upswing. Others, like Ernesto Screpanti

Ernesto Screpanti

Ernesto Screpanti is a professor of Political Economy at the University of Siena. He worked on the “rethinking Marxism” research programme, in the attempt to update Marxist analysis by bring it in line with the reality of contemporary capitalism, on the one hand, and to liberate Marxism from any...

, developed a theory based on a correlation between long economic cycles and recurrent waves of social conflict.

Elliott Wave analyst Robert Prechter

Robert Prechter

Robert R. Prechter, Jr. is an American author and stock market analyst, known for his financial forecasts using the Elliott wave principle. Prechter is an author and co-author of 14 books, and editor of 2 books , his book Conquer the Crash is a New York Times bestseller...

is perhaps the person best known today for his views on the how the economic cycle is affected by the social mood, for which he used the term socionomics.

David Ames Wells

David Ames Wells

David Ames Wells was an American engineer, textbook author, economist and advocate of low tariffs.-Biography:...

(1891) noted that as workers were lifted out of miserable levels of poverty by the end of the 19th century and exposed to a wider world view and new consumer products, they created more labor and social unrest. Instead of capitalism enslaving workers and holding them at subsistence levels as some economists predicted, the opposite happened-by the 1890s businesses were operating with little profit, as Marx predicted; however, the workers enjoyed much higher real wages.

Investment adviser Ian Gordon has advocated a 4 season Kondratiev social mood influenced model in which spring is moderate growth from a stock market

Stock market

A stock market or equity market is a public entity for the trading of company stock and derivatives at an agreed price; these are securities listed on a stock exchange as well as those only traded privately.The size of the world stock market was estimated at about $36.6 trillion...

and inflationary bottom, summer is characterized by accelerating growth and high inflation, autumn is characterized by declining inflation and asset bubble

Economic bubble

An economic bubble is "trade in high volumes at prices that are considerably at variance with intrinsic values"...

s, and winter involves the collapse of the asset bubbles.

World long cycle peak

The highest world GDP growth rates in the last two cycles occurred from the 1950s to 1960s. The peak world growth plateau was just over 5% annual GDP.Western world peak technological progress: 1870 to 1914

There is considerable evidence that the period called the Second Industrial RevolutionSecond Industrial Revolution

The Second Industrial Revolution, also known as the Technological Revolution, was a phase of the larger Industrial Revolution corresponding to the latter half of the 19th century until World War I...

was the high point for the development of economically important technologies. The time lag for the diffusion of these technologies would result in U.S. peak productivity growth at some time in the period between 1928 and 1950.

Unlike the First Industrial Revolution, the technologies of the Second were solidly based in science. During Smil's “Age of Synergy” for the first time there was a scientific understanding of chemistry, thermodynamics

Thermodynamics

Thermodynamics is a physical science that studies the effects on material bodies, and on radiation in regions of space, of transfer of heat and of work done on or by the bodies or radiation...

and the unification of light, electricity and magnetism through Maxwell's electromagnetic theory

Maxwell's equations

Maxwell's equations are a set of partial differential equations that, together with the Lorentz force law, form the foundation of classical electrodynamics, classical optics, and electric circuits. These fields in turn underlie modern electrical and communications technologies.Maxwell's equations...

. Electricity generation, electric motors and lights, radio, the steam turbine, the chemical industry, Haber-Bosch

Haber

Haber means in old German "oat", in modern German it is "Hafer":"Haferflocken"="Oatflakes".Haber can refer to:* The Haber process, the method of synthesizing ammonia from hydrogen and nitrogen....

ammonia synthesis, internal combustion and inexpensive steel making processes were notable major technologies developed during this era.

Interchangeable parts

Interchangeable parts

Interchangeable parts are parts that are, for practical purposes, identical. They are made to specifications that ensure that they are so nearly identical that they will fit into any device of the same type. One such part can freely replace another, without any custom fitting...

, or precision manufacturing, took several decades to perfect in the small firearms industry before finally diffusing through the manufacturing economy in the late 19th century. Scientific management

Scientific management

Scientific management, also called Taylorism, was a theory of management that analyzed and synthesized workflows. Its main objective was improving economic efficiency, especially labor productivity. It was one of the earliest attempts to apply science to the engineering of processes and to management...

, promoted by Frederick Winslow Taylor

Frederick Winslow Taylor

Frederick Winslow Taylor was an American mechanical engineer who sought to improve industrial efficiency. He is regarded as the father of scientific management and was one of the first management consultants...

, began to be implemented. Ford Motor Co. developed a revolutionary new manufacturing concept of mass production

Mass production

Mass production is the production of large amounts of standardized products, including and especially on assembly lines...

based on electric powered machine tool

Machine tool

A machine tool is a machine, typically powered other than by human muscle , used to make manufactured parts in various ways that include cutting or certain other kinds of deformation...

s and special purpose machines, systematically arranged in the order of the work flow. The movements of workers was kept to a minimum by using motorized conveyors on assembly line

Assembly line

An assembly line is a manufacturing process in which parts are added to a product in a sequential manner using optimally planned logistics to create a finished product much faster than with handcrafting-type methods...

s. Toward the end of the period agriculture was mechanized with internal combustion.

The building of railroads accelerated after the introduction of inexpensive steel rails, which lasted considerably longer than the 10 year life of wrought iron rails. Railroads lowered the cost of shipping to 0.875 cents/ton-mile from 24.5 cents/ton-mile by wagon. Cheap transportation made large scale manufacturing possible, giving economies of scale.

The development of control theory

Control theory

Control theory is an interdisciplinary branch of engineering and mathematics that deals with the behavior of dynamical systems. The desired output of a system is called the reference...

was necessary for process control

Process control