2003 to 2008 world oil market chronology

Encyclopedia

Barrel (unit)

A barrel is one of several units of volume, with dry barrels, fluid barrels , oil barrel, etc...

of crude oil on NYMEX

New York Mercantile Exchange

The New York Mercantile Exchange is the world's largest physical commodity futures exchange. It is located at One North End Avenue in the World Financial Center in the Battery Park City section of Manhattan, New York City...

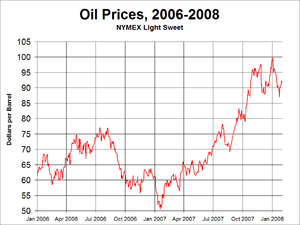

was generally under $25/barrel. Then, during 2004, the price rose above $40, and then $50. A series of events led the price to exceed $60 by August 11, 2005, and then briefly exceed $75 in the middle of 2006. Prices then dropped back to $60/barrel by the early part of 2007 before rising steeply again to $92/barrel by October 2007, and $99.29/barrel for December futures in New York

New York City

New York is the most populous city in the United States and the center of the New York Metropolitan Area, one of the most populous metropolitan areas in the world. New York exerts a significant impact upon global commerce, finance, media, art, fashion, research, technology, education, and...

on November 21, 2007. Throughout the first half of 2008, oil regularly reached record high prices. On February 29, 2008, oil prices peaked at $103.05 per barrel, and reached $110.20 on March 12, 2008, the sixth record in seven trading days. Prices on June 27, 2008, touched $141.71/barrel, for August delivery in the New York Mercantile Exchange (after the recent $140.56/barrel), amid Libya

Libya

Libya is an African country in the Maghreb region of North Africa bordered by the Mediterranean Sea to the north, Egypt to the east, Sudan to the southeast, Chad and Niger to the south, and Algeria and Tunisia to the west....

's threat to cut output, and OPEC

OPEC

OPEC is an intergovernmental organization of twelve developing countries made up of Algeria, Angola, Ecuador, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, and Venezuela. OPEC has maintained its headquarters in Vienna since 1965, and hosts regular meetings...

's president predicted prices may reach $170 by the Northern

Northern Hemisphere

The Northern Hemisphere is the half of a planet that is north of its equator—the word hemisphere literally means “half sphere”. It is also that half of the celestial sphere north of the celestial equator...

summer. The most recent price per barrel maximum of $147.02 was reached on July 11, 2008. After falling below $100 in the late summer of 2008, prices rose again in late September. On September 22, oil rose over $25 to $130 before settling again to $120.92, marking a record one-day gain of $16.37. Electronic crude oil trading was temporarily halted by NYMEX when the daily price rise limit of $10 was reached, but the limit was reset seconds later and trading resumed.

By October 16, prices had fallen again to below $70, and on November 6 oil closed below $60.

As the price of producing petroleum did not rise significantly, the price increases have coincided with a period of record profits for the oil industry. Between 2004 and 2007, the profits of the six supermajor

Supermajor

Supermajor is a name commonly used to describe the world's five largest publicly owned oil and gas companies.-Composition:Trading under various names around the world, the supermajors are considered to be:* BP p.l.c...

s - ExxonMobil

ExxonMobil

Exxon Mobil Corporation or ExxonMobil, is an American multinational oil and gas corporation. It is a direct descendant of John D. Rockefeller's Standard Oil company, and was formed on November 30, 1999, by the merger of Exxon and Mobil. Its headquarters are in Irving, Texas...

, Total

Total S.A.

Total S.A. is a French multinational oil company and one of the six "Supermajor" oil companies in the world.Its businesses cover the entire oil and gas chain, from crude oil and natural gas exploration and production to power generation, transportation, refining, petroleum product marketing, and...

, Shell

Royal Dutch Shell

Royal Dutch Shell plc , commonly known as Shell, is a global oil and gas company headquartered in The Hague, Netherlands and with its registered office in London, United Kingdom. It is the fifth-largest company in the world according to a composite measure by Forbes magazine and one of the six...

, BP

BP

BP p.l.c. is a global oil and gas company headquartered in London, United Kingdom. It is the third-largest energy company and fourth-largest company in the world measured by revenues and one of the six oil and gas "supermajors"...

, Chevron

Chevron Corporation

Chevron Corporation is an American multinational energy corporation headquartered in San Ramon, California, United States and active in more than 180 countries. It is engaged in every aspect of the oil, gas, and geothermal energy industries, including exploration and production; refining,...

, and ConocoPhillips

ConocoPhillips

ConocoPhillips Company is an American multinational energy corporation with its headquarters located in the Energy Corridor district of Houston, Texas in the United States...

- totaled $494.8 billion.

2003

United StatesUnited States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

crude oil prices averaged $31 a barrel in 2003 due to political instability within various oil producing nations.

It rose 19% from the average in 2002. The 2003 invasion of Iraq

2003 invasion of Iraq

The 2003 invasion of Iraq , was the start of the conflict known as the Iraq War, or Operation Iraqi Freedom, in which a combined force of troops from the United States, the United Kingdom, Australia and Poland invaded Iraq and toppled the regime of Saddam Hussein in 21 days of major combat operations...

marked a significant event for oil markets because Iraq

Iraq

Iraq ; officially the Republic of Iraq is a country in Western Asia spanning most of the northwestern end of the Zagros mountain range, the eastern part of the Syrian Desert and the northern part of the Arabian Desert....

contains a large amount of global oil reserves

Oil reserves

The total estimated amount of oil in an oil reservoir, including both producible and non-producible oil, is called oil in place. However, because of reservoir characteristics and limitations in petroleum extraction technologies, only a fraction of this oil can be brought to the surface, and it is...

. The conflict coincided with an increase in global demand for petroleum, but it also reduced Iraq's current oil production and has been blamed for increasing oil prices. However, oil company CEO Matthew Simmons

Matthew Simmons

Matthew Roy Simmons was founder and chairman emeritus of Simmons & Company International, and was a prominent advocate of peak oil. Simmons was motivated by the 1973 energy crisis to create an investment banking firm catering to oil companies. In his previous capacity, he served as energy...

emphasizes the peaking and decline

Peak oil

Peak oil is the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline. This concept is based on the observed production rates of individual oil wells, projected reserves and the combined production rate of a field...

of oil-exporting in Mexico

Mexico

The United Mexican States , commonly known as Mexico , is a federal constitutional republic in North America. It is bordered on the north by the United States; on the south and west by the Pacific Ocean; on the southeast by Guatemala, Belize, and the Caribbean Sea; and on the east by the Gulf of...

, Indonesia

Indonesia

Indonesia , officially the Republic of Indonesia , is a country in Southeast Asia and Oceania. Indonesia is an archipelago comprising approximately 13,000 islands. It has 33 provinces with over 238 million people, and is the world's fourth most populous country. Indonesia is a republic, with an...

and the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

is the reason for the price gouging

Price gouging

Price gouging is a pejorative term referring to a situation in which a seller prices goods or commodities much higher than is considered reasonable or fair. In precise, legal usage, it is the name of a crime that applies in some of the United States during civil emergencies...

. According to Simmons, isolated events, such as the Iraq war, affect short-term prices but do not determine a long-term trend. Simmons cites the use of enhanced oil recovery

Enhanced oil recovery

Enhanced Oil Recovery is a generic term for techniques for increasing the amount of crude oil that can be extracted from an oil field...

techniques in large fields such as Mexico's Cantarell

Cantarell Field

Cantarell Field or Cantarell Complex is an aging supergiant oil field in Mexico. It was discovered in 1976 by a fisherman, Rudesindo Cantarell. It was placed on nitrogen injection in 2000, and production peaked at in 2003. In terms of cumulative production to date, it is by far the largest oil...

, which maintained production for a few years until it eventually declined. Pumping oil out of Iraq may reduce petroleum prices in the short term, but will be unable to perpetually lower the price. From Simmons' point of view, the invasion of Iraq is associated with the start of long-term increase in oil prices, but it may mitigate the decline

Mitigation of peak oil

The mitigation of peak oil is the attempt to delay the date and minimize the social and economic impact of peak oil by reducing the world's consumption and reliance on petroleum. By reducing petroleum consumption, mitigation efforts seek to favorably change the shape of the Hubbert curve, which is...

in oil production by retaining a partial amount of Iraq's oil reserves. As a direct consequence, the oil production capacity was diminished to 2 Moilbbl per day.

2004 to 2008: rising costs of oil

Petroleum

Petroleum or crude oil is a naturally occurring, flammable liquid consisting of a complex mixture of hydrocarbons of various molecular weights and other liquid organic compounds, that are found in geologic formations beneath the Earth's surface. Petroleum is recovered mostly through oil drilling...

prices rose to new highs in March 2005. The price on NYMEX

New York Mercantile Exchange

The New York Mercantile Exchange is the world's largest physical commodity futures exchange. It is located at One North End Avenue in the World Financial Center in the Battery Park City section of Manhattan, New York City...

has been above the $

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

50 per barrel since March 5, 2005. In June 2005, crude oil prices broke the psychological barrier of $60 per barrel. After the destruction of Hurricane Katrina

Hurricane Katrina

Hurricane Katrina of the 2005 Atlantic hurricane season was a powerful Atlantic hurricane. It is the costliest natural disaster, as well as one of the five deadliest hurricanes, in the history of the United States. Among recorded Atlantic hurricanes, it was the sixth strongest overall...

in the United States, gasoline prices reached a record high during the first week of September 2005. The average retail price was, on average, $

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

3.04 per U.S. gallon. The average retail price of a liter of petrol

Gasoline

Gasoline , or petrol , is a toxic, translucent, petroleum-derived liquid that is primarily used as a fuel in internal combustion engines. It consists mostly of organic compounds obtained by the fractional distillation of petroleum, enhanced with a variety of additives. Some gasolines also contain...

in the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

was 86.4p on October 19, 2006, or $6.13 per gallon. Oil production in Iraq continued to decline as result of the nation's ongoing conflict causing a decrease in production to 1 Moilbbl/d.

In mid 2006, crude oil was traded for over USD 79 per barrel (bbl), setting an all-time record. The run-up is attributed to a 1.9 increase in gasoline consumption, geopolitical tensions resulting from North Korea

North Korea

The Democratic People’s Republic of Korea , , is a country in East Asia, occupying the northern half of the Korean Peninsula. Its capital and largest city is Pyongyang. The Korean Demilitarized Zone serves as the buffer zone between North Korea and South Korea...

's missile launch. The ongoing Iraq war, as well as Israel and Lebanon going to war are also causative factors.

The higher price of oil substantially cut growth of world oil demand in 2006, including a reduction in oil demand of the OECD

Organisation for Economic Co-operation and Development

The Organisation for Economic Co-operation and Development is an international economic organisation of 34 countries founded in 1961 to stimulate economic progress and world trade...

. After news of North Korea's successful nuclear test on October 9, 2006, oil prices rose past $60 a barrel, but fell back the next day.

On October 19, 2007, U.S. light crude

Light crude oil

Light crude oil is liquid petroleum that has a low density and flows freely at room temperature. It has a low viscosity, low specific gravity and high API gravity due to the presence of a high proportion of light hydrocarbon fractions. It generally has a low wax content...

rose to $90.02 per barrel due to a combination of ongoing tensions in eastern Turkey

Turkey

Turkey , known officially as the Republic of Turkey , is a Eurasian country located in Western Asia and in East Thrace in Southeastern Europe...

and the reducing strength of the U.S. dollar

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

. Prices fell briefly on the expectation of increased U.S. crude oil stocks, however they quickly rose to a peak of $92.22 on October 26, 2007.

On January 2, 2008, U.S. light crude

Light crude oil

Light crude oil is liquid petroleum that has a low density and flows freely at room temperature. It has a low viscosity, low specific gravity and high API gravity due to the presence of a high proportion of light hydrocarbon fractions. It generally has a low wax content...

surpassed $100 per barrel before falling to $99.69 due to tensions on New Years Day in Nigeria

Nigeria

Nigeria , officially the Federal Republic of Nigeria, is a federal constitutional republic comprising 36 states and its Federal Capital Territory, Abuja. The country is located in West Africa and shares land borders with the Republic of Benin in the west, Chad and Cameroon in the east, and Niger in...

, and on suspicion that U.S. crude stocks will have dropped for the seventh consecutive week. A BBC

BBC

The British Broadcasting Corporation is a British public service broadcaster. Its headquarters is at Broadcasting House in the City of Westminster, London. It is the largest broadcaster in the world, with about 23,000 staff...

report from the following day stated a single trader bid up the price; Stephen Schork, a former floor trader on the New York Mercantile Exchange

New York Mercantile Exchange

The New York Mercantile Exchange is the world's largest physical commodity futures exchange. It is located at One North End Avenue in the World Financial Center in the Battery Park City section of Manhattan, New York City...

and the editor of an oil market newsletter, said one floor trader

Floor trader

A floor trader is a member of a stock or commodities exchange who trades on the floor of that exchange for his or her own account. The floor trader must abide by trading rules similar to those of the exchange specialists who trade on behalf of others. The term should not be confused with floor broker...

bought 1000 barrels (159 m³), the smallest amount permitted, and immediately sold it for $99.40 at a $600 loss. Oil fell back later in the week to $97.91 at the close of trading on Friday, January 4, in part due to a weak jobs report that showed unemployment had risen.

On March 5, 2008, OPEC

OPEC

OPEC is an intergovernmental organization of twelve developing countries made up of Algeria, Angola, Ecuador, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, and Venezuela. OPEC has maintained its headquarters in Vienna since 1965, and hosts regular meetings...

accused the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

of economic "mismanagement" that was pushing oil prices to record highs, rebuffing calls to boost output and laying blame at the George W. Bush administration. Oil prices surged above $110 to a new inflation-adjusted record on March 12, 2008 before settling at $109.92. On April 18, 2008 the price of oil broke $117 per barrel after a Nigerian militant group claimed an attack on an oil pipeline. Oil prices rose to a new high of $119.90 a barrel on April 22, 2008, before dipping and then rising $3 on April 25, 2008 to $119.10 on the New York Mercantile Exchange after a news report that a ship contracted by the U.S. Military Sealift Command fired at an Iranian boat.

On June 6, prices rose $11 in 24 hours, the largest gain in history due to the possibility of an Israeli attack on Iran. The combination of two major oil suppliers reducing supply generated fears of a repeat of the 1973 oil crisis

1973 oil crisis

The 1973 oil crisis started in October 1973, when the members of Organization of Arab Petroleum Exporting Countries or the OAPEC proclaimed an oil embargo. This was "in response to the U.S. decision to re-supply the Israeli military" during the Yom Kippur war. It lasted until March 1974. With the...

. The mid-July decision of Saudi Arabia to increase oil output caused little significant influence on prices. According to the oil minister of the Islamic Republic of Iran, Gholam-Hossein Nozari, the world markets were saturated and a Saudi promise of increased production would not lower prices. Several Asian refineries were refusing Saudi petroleum in late June because they were over priced grade.

On July 3, "the Brent North Sea

Brent Crude

Brent Crude is the biggest of the many major classifications of crude oil consisting of Brent Crude, Brent Sweet Light Crude, Oseberg, Ekofisk, and Forties . Brent Crude is sourced from the North Sea. The Brent Crude oil marker is also known as Brent Blend, London Brent and Brent petroleum...

crude contract for August delivery rose to $US145.01 a barrel" in Asian trade. London Brent crude reached a record of $145.75 a barrel, and Brent crude for August delivery peaked to a record $145.11 a barrel on London's ICE Futures Europe exchange, and to $144.44 a barrel on the NYMExchange. By midday in Europe, crude rose to $145.85 a barrel on the NYME while Brent crude futures rose to a trading record of $146.69 a barrel on the ICE Futures exchange.

2008: oil prices peak and then decline

Chairman of the Federal Reserve

The Chairman of the Board of Governors of the Federal Reserve System is the head of the central banking system of the United States. Known colloquially as "Chairman of the Fed," or in market circles "Fed Chairman" or "Fed Chief"...

, Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

, indicated significant demand destruction

Demand destruction

Demand destruction is an economic term used to describe a permanent downward shift in the demand curve in the direction of lower demand of a commodity such as energy products, induced by a prolonged period of high prices or constrained supply....

within the US because of high prices. Bernanke's statement precipitated an $8 drop, the biggest since the first US-Iraq war

Gulf War

The Persian Gulf War , commonly referred to as simply the Gulf War, was a war waged by a U.N.-authorized coalition force from 34 nations led by the United States, against Iraq in response to Iraq's invasion and annexation of Kuwait.The war is also known under other names, such as the First Gulf...

. By the end of the week, crude oil fell 11% to $128, also affected by easing of tensions between the US and Iran. By August 13, prices had fallen to $113 a barrel. By the middle of September, oil price fell below $100 for the first time in over six months, falling below $92 in the aftermath of the Lehman Brothers

Lehman Brothers

Lehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

bankruptcy.

A stronger US dollar and a likely decline in European demand were suggested to be among the causes of the decline. By October 24, the price of crude dropped to $64.15, and closed at $60.77 on November 6.

2009

In January 2009, oil prices rose temporarily because of tensions in the Gaza Strip2008–2009 Israel–Gaza conflict

The Gaza War, known as Operation Cast Lead in Israel and as the Gaza Massacre in the Arab world, was a three-week bombing and invasion of the Gaza Strip by Israel, and hundreds of rocket attacks on south of Israel which...

. From mid January to February 13, oil fell to near $35 a barrel.

2010

On May 21, 2010, the price of oil had dropped in two weeks from $88 to $70 mainly due to concerns over how European countries would reduce budget deficits; if the European economy slowed down, this would mean less demand for crude oil. Also, if the European economic crisis2010 European sovereign debt crisis

From late 2009, fears of a sovereign debt crisis developed among investors concerning some European states, intensifying in early 2010 and thereafter.....

caused the American economy to have problems, demand for oil would be reduced further. Other factors included the strong dollar

Dollar

The dollar is the name of the official currency of many countries, including Australia, Belize, Canada, Ecuador, El Salvador, Hong Kong, New Zealand, Singapore, Taiwan, and the United States.-Etymology:...

and high inventories. According to the U.S. Energy Information Administration, gas prices nationwide averaged $2.91 on May 10, dropping to $2.79 two weeks later. The Deepwater Horizon oil spill

Deepwater Horizon oil spill

The Deepwater Horizon oil spill is an oil spill in the Gulf of Mexico which flowed unabated for three months in 2010, and continues to leak fresh oil. It is the largest accidental marine oil spill in the history of the petroleum industry...

was not a factor in gas prices since the well had not produced.

Prices rose back to $90/barrel in December 2010. The national average for a gallon of 87 octane regular unleaded averaged $3.00/gallon on December 23, sparking fear of a second recession if prices reached $100/barrel and $4.00/gallon gasoline, as forecasted for spring 2011. The price increases in December were based on global demand and the Arctic blasts affecting North America

North America

North America is a continent wholly within the Northern Hemisphere and almost wholly within the Western Hemisphere. It is also considered a northern subcontinent of the Americas...

and Europe

Winter of 2010–2011 in Europe

The winter of 2010-2011 in Europe began with an unusually cold November caused by a cold weather cycle that started in southern Scandinavia and subsequently moved south and west over both Belgium and the Netherlands on 25 November and into the west of Scotland and north east England on 26 November...

.

2011

Political turmoilArab Spring

The Arab Spring , otherwise known as the Arab Awakening, is a revolutionary wave of demonstrations and protests occurring in the Arab world that began on Saturday, 18 December 2010...

in Egypt, Libya, Yemen, and Bahrain drove oil prices to $95/barrel in late February 2011. A few days prior, oil prices on the NYMEX closed at $86. Oil prices topped at $103 on February 24 where oil production is curtailed to the political upheaval in Libya

2011 Libyan civil war

The 2011 Libyan civil war was an armed conflict in the North African state of Libya, fought between forces loyal to Colonel Muammar Gaddafi and those seeking to oust his government. The war was preceded by protests in Benghazi beginning on 15 February 2011, which led to clashes with security...

.

Oil supplies remained high, and Saudi Arabia assured an increase in production to counteract shutdowns. Still, the Mideast and North African crisis led to a rise in oil prices to the highest level in two years, with gasoline prices following. Though most Libyan oil went to Europe, all oil prices reacted. The average price of gasoline in the United States increased 6 cents to $3.17. On March 1, 2011, a significant drop in Libyan production and fears of more instability in other countries pushed the price of oil over $100 a barrel in New York trading, while the average price of gas reached $3.37. Despite Saudi promises, the sour type oil the country exported could not replace the more desirable sweet Libyan oil

Sweet crude oil

Sweet crude oil is a type of petroleum. Petroleum is considered "sweet" if it contains less than 0.5% sulfur, compared to a higher level of sulfur in sour crude oil. Sweet crude oil contains small amounts of hydrogen sulfide and carbon dioxide. High quality, low sulfur crude oil is commonly used...

. On March 7, 2011, the average price of gas having reached $3.57, individuals were making changes in their driving.

The weakened U.S. Dollar resulted in a spike to $112/barrel with the national average of $3.74/gallon - with expectations of damaging the U.S. economy suggestive of a long-term recession. As of April 26, the national average was $3.87 - with a fear of $4/gallon as the nationwide average prior to the summer driving season.

The national average rose on May 5, 2011 for the 44th straight day, reaching $3.98. However, that same day, West Texas Intermediate crude fell below $100 a barrel, the lowest since March 16. This came after crude oil for June delivery reached $114.83 on May 2, the highest since September 2008, before closing at $97.18 on May 6, a day after dropping 9 percent, the most dramatic single-day drop in over two years. Gas prices fell slightly on May 6, and experts predicted $3.50 a gallon by summer.

In mid-June, West Texas Intermediate crude for July delivery fell nearly $2 to $93.01, the lowest price since February. The dollar was up and the euro

Euro

The euro is the official currency of the eurozone: 17 of the 27 member states of the European Union. It is also the currency used by the Institutions of the European Union. The eurozone consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg,...

and other currencies down, and the European economic crisis made investors concerned. London Brent crude

Brent Crude

Brent Crude is the biggest of the many major classifications of crude oil consisting of Brent Crude, Brent Sweet Light Crude, Oseberg, Ekofisk, and Forties . Brent Crude is sourced from the North Sea. The Brent Crude oil marker is also known as Brent Blend, London Brent and Brent petroleum...

fell 81 cents to $113.21. On June 15 the Energy Information Association said oil consumption was down 3.5 percent from a year earlier, but wholesale gasoline demand was up for the first time in several weeks. The price of gas on June 17 was $3.67.5 a gallon, 25.1 cents lower than a month earlier but 96.8 cents above a year earlier. On June 24, the price of gas was $3.62.8 and expected to go much lower due to the opening of the Strategic Petroleum Reserve

Strategic Petroleum Reserve

The Strategic Petroleum Reserve is an emergency fuel storage of oil maintained by the United States Department of Energy.- United States :The US SPR is the largest emergency supply in the world with the current capacity to hold up to ....

. U.S. oil prices fell below $90 before rising again, and Brent crude fell two percent. However, on June 29, West Texas intermediate crude had risen to $94.96, almost $5 above the lowest point reached after the previous week's action. One reason was the falling dollar, as Greece appeared less likely to default on its debt; concern over the Greek debt crisis had caused falling oil prices. After another week, oil for August delivery had risen from $90.61 to $98.67 and gas prices were up five cents. Increased worldwide demand was one reason. Brent Crude remained high at $118.38 partly due to supply problems in Europe, including lower North Sea

North Sea

In the southwest, beyond the Straits of Dover, the North Sea becomes the English Channel connecting to the Atlantic Ocean. In the east, it connects to the Baltic Sea via the Skagerrak and Kattegat, narrow straits that separate Denmark from Norway and Sweden respectively...

production and the continuing war in Libya.

On August 4, the price of oil dropped 6 percent to its lowest level in 6 months. On August 5, the price had dropped $8.82 in a week to $86.88 per barrel on the New York Mercantile Exchange. The same pessimistic economic news that caused stock prices to fall also decreased expected energy demand, and experts predicted a gas price drop of 35 cents per gallon from the average of $3.70. On August 8, oil fell over 6 percent, in its largest drop since May, to $81, its lowest price of the year. On September 24, oil reached $79.85, down 9 percent for the week, due to concerns about another recession and the overall world economy. The average price of gas was $3.51, with predictions of $3.25 by November, but it was below $3 in some markets.

During October, the price of oil rose 22 percent, the fastest pace since February, as worries over the U.S. economy decreased, leading to predictions of $4 by early 2012. As of November 8, the price reached $96.80. Gas prices were not following the increase, due to lower demand resulting from the economy, the normal decrease in travel, lower oil prices in other countries, and production of winter blends which cost less. The average rose slightly to $3.41 but predictions of $3.25 have been made.