Stock trader

Encyclopedia

Individual

An individual is a person or any specific object or thing in a collection. Individuality is the state or quality of being an individual; a person separate from other persons and possessing his or her own needs, goals, and desires. Being self expressive...

or firm who buys and sells

Trade

Trade is the transfer of ownership of goods and services from one person or entity to another. Trade is sometimes loosely called commerce or financial transaction or barter. A network that allows trade is called a market. The original form of trade was barter, the direct exchange of goods and...

stock

Stock

The capital stock of a business entity represents the original capital paid into or invested in the business by its founders. It serves as a security for the creditors of a business since it cannot be withdrawn to the detriment of the creditors...

s in the financial markets. Many stock traders will trade bonds

Bond (finance)

In finance, a bond is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest to use and/or to repay the principal at a later date, termed maturity...

(and possibly other financial asset

Financial asset

A financial asset is an intangible asset that derives value because of a contractual claim. Examples include bank deposits, bonds, and stocks. Financial assets are usually more liquid than tangible assets, such as land or real estate, and are traded on financial markets....

s) as well. Trading stocks is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators

Financial regulation

Financial regulation is a form of regulation or supervision, which subjects financial institutions to certain requirements, restrictions and guidelines, aiming to maintain the integrity of the financial system...

are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants

Financial market participants

There are two basic financial market participant categories, Investor vs. Speculator and Institutional vs. Retail. Action in financial markets by central banks is usually regarded as intervention rather than participation.-Supply Side vs...

. In addition, the financial markets are usually subjected to speculation

Speculation

In finance, speculation is a financial action that does not promise safety of the initial investment along with the return on the principal sum...

.

Stock traders and stock investors

Individuals or firms trading equity (stockStock

The capital stock of a business entity represents the original capital paid into or invested in the business by its founders. It serves as a security for the creditors of a business since it cannot be withdrawn to the detriment of the creditors...

) on the stock market

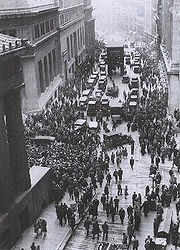

Stock market

A stock market or equity market is a public entity for the trading of company stock and derivatives at an agreed price; these are securities listed on a stock exchange as well as those only traded privately.The size of the world stock market was estimated at about $36.6 trillion...

s as their principal capacity are called stock trader

Trader (finance)

A trader is someone in finance who buys and sells financial instruments such as stocks, bonds, commodities and derivatives. A broker who simply fills buy or sell orders is not a trader, as they are merely executing instructions given to them. According to the Wall Street Journal in 2004, a managing...

s. Stock traders usually try to profit from short-term price volatility with trades lasting anywhere from several seconds to several weeks.

The stock trader is usually a professional

Professional

A professional is a person who is paid to undertake a specialised set of tasks and to complete them for a fee. The traditional professions were doctors, lawyers, clergymen, and commissioned military officers. Today, the term is applied to estate agents, surveyors , environmental scientists,...

. Persons can call themselves full or part-time stock traders/investors while maintaining other professions. When a stock trader/investor has clients, and acts as a money manager or adviser with the intention of adding value to their clients finances, he is also called a financial advisor or manager. In this case, the financial manager could be an independent professional or a large bank corporation employee. This may include managers dealing with investment funds, hedge fund

Hedge fund

A hedge fund is a private pool of capital actively managed by an investment adviser. Hedge funds are only open for investment to a limited number of accredited or qualified investors who meet criteria set by regulators. These investors can be institutions, such as pension funds, university...

s, mutual funds, and pension fund

Pension fund

A pension fund is any plan, fund, or scheme which provides retirement income.Pension funds are important shareholders of listed and private companies. They are especially important to the stock market where large institutional investors dominate. The largest 300 pension funds collectively hold...

s, or other professionals in equity investment, fund management, and wealth management

Wealth management

Wealth management is an investment advisory discipline that incorporates financial planning, investment portfolio management and a number of aggregated financial services...

. These wealthy and powerful organized investors, are sometimes referred to as institutional investors. Several different types of stock trading exist including day trading

Day trading

Day trading refers to the practice of buying and selling financial instruments within the same trading day such that all positions are usually closed before the market close for the trading day...

, trend following

Trend following

Trend following is an investment strategy that tries to take advantage of long-term moves that seem to play out in various markets. The strategy aims to work on the market trend mechanism and take benefit from both sides of the market, enjoying the profits from the ups and downs of the stock or...

, market making

Market maker

A market maker is a company, or an individual, that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. From a market microstructure theory standpoint, market makers are net sellers of an option to be...

, scalping (trading)

Scalping (trading)

Scalping, when used in reference to trading in securities, commodities and foreign exchange, may refer to# a fraudulent form of market manipulation# a legitimate method of arbitrage of small price gaps created by the bid-ask spread....

, momentum trading, trading the news

Trading the news

Trading the news is a technique to trade equities, currencies and other financial instruments on the financial markets. Trading news releases can be a significant tool for financial investors. Economic news reports often spur strong short-term moves in the markets, which may create trading...

, and arbitrage

Arbitrage

In economics and finance, arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices...

.

On the other hand, stock investors are firms or individuals who purchase stocks with the intention of holding them for an extended period of time, usually several months to years. They rely primarily on fundamental analysis

Fundamental analysis

Fundamental analysis of a business involves analyzing its financial statements and health, its management and competitive advantages, and its competitors and markets. When applied to futures and forex, it focuses on the overall state of the economy, interest rates, production, earnings, and...

for their investment decisions and fully recognize stock shares as part-ownership in the company. Many investors believe in the buy and hold

Buy and hold

Buy and hold is a long-term investment strategy based on the view that in the long run financial markets give a good rate of return despite periods of volatility or decline. This viewpoint also holds that short-term market timing, i.e...

strategy, which as the name suggests, implies that investors will buy stock ownership in a corporation and hold onto those stocks for the very long term, generally measured in years. This strategy was made popular in the equity bull market of the 1980s and 90s where buy-and-hold investors rode out short-term market declines and continued to hold as the market returned to its previous highs and beyond. However, during the 2001-2003 equity bear market, the buy-and-hold strategy lost some followers as broader market indexes like the NASDAQ

NASDAQ

The NASDAQ Stock Market, also known as the NASDAQ, is an American stock exchange. "NASDAQ" originally stood for "National Association of Securities Dealers Automated Quotations". It is the second-largest stock exchange by market capitalization in the world, after the New York Stock Exchange. As of...

saw their values decline by over 60%.

Stock trading as a profession/career

Stock traders advise shareholderShareholder

A shareholder or stockholder is an individual or institution that legally owns one or more shares of stock in a public or private corporation. Shareholders own the stock, but not the corporation itself ....

s and help manage portfolio

Portfolio (finance)

Portfolio is a financial term denoting a collection of investments held by an investment company, hedge fund, financial institution or individual.-Definition:The term portfolio refers to any collection of financial assets such as stocks, bonds and cash...

s. Traders engage in buying and selling bonds, stocks, futures and shares in hedge funds. A stock trader also conducts extensive research and observation of how financial markets perform. This is accomplished through economic and microeconomic study; consequently, more advanced stock traders will delve into macroeconomics

Macroeconomics

Macroeconomics is a branch of economics dealing with the performance, structure, behavior, and decision-making of the whole economy. This includes a national, regional, or global economy...

and industry specific technical analysis to track asset or corporate performance. Other duties of a stock trader include comparison of financial analysis

Financial analysis

Financial analysis refers to an assessment of the viability, stability and profitability of a business, sub-business or project....

to current and future regulation of his or her occupation.

Professional stock traders who work for a financial company, are required to complete an internship of up to four months before becoming established in their career field. In the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

, for example, internship is followed up by taking and passing a Financial Industry Regulatory Authority

Financial Industry Regulatory Authority

In the United States, the Financial Industry Regulatory Authority, Inc., or FINRA, is a private corporation that acts as a self-regulatory organization . FINRA is the successor to the National Association of Securities Dealers, Inc. ...

-administered Series 63 or 65 exam. Stock traders who pass demonstrate familiarity with U.S. Securities and Exchange Commission (SEC) compliant practices and regulation. Stock traders with experience usually obtain a four-year degree in a financial, accounting or economics field after licensure. Supervisory positions as a trader may usually require an MBA for advanced stock market analysis.

The U.S. Bureau of Labor Statistics (BLS) reported that growth for stock and commodities traders was forecast to be greater than 21% between 2006 and 2016. In that period, stock traders would benefit from trends driven by pension

Pension

In general, a pension is an arrangement to provide people with an income when they are no longer earning a regular income from employment. Pensions should not be confused with severance pay; the former is paid in regular installments, while the latter is paid in one lump sum.The terms retirement...

s of baby boomer

Baby boomer

A baby boomer is a person who was born during the demographic Post-World War II baby boom and who grew up during the period between 1946 and 1964. The term "baby boomer" is sometimes used in a cultural context. Therefore, it is impossible to achieve broad consensus of a precise definition, even...

s and their decreased reliance on Social Security

Social Security

Social security is a social program providing protection against conditions like poverty, old age, and disability.It may also refer to:* Social Security , the system of welfare payments in Australia* Social Security...

. U.S. Treasury bond

Bond

Bond, bonds, bonded, and bonding may refer to:* Peace-bonding, something which makes a weapon unusable as a weapon- Fiduciary :* Bond , in finance, a type of debt security...

s would also be traded on a more fluctuating basis. Stock traders just entering the field suffer since few entry-level positions exist. While entry into this career field is very competitive, increased ownership of stocks and mutual funds drive substantial career growth of traders. Banks were also offering more opportunities for people of average means to invest and trade stocks. The BLS reported that stock traders had median annual incomes of $68,500. Experienced traders of stocks and mutual funds have the potential to earn more than $145,600 annually.

Risks and other costs

Stock broker

A stock broker or stockbroker is a regulated professional broker who buys and sells shares and other securities through market makers or Agency Only Firms on behalf of investors...

, a professional who arranges transactions between a buyer and a seller, and gets a guaranteed commission for every deal executed, a professional trader may have a steep learning curve

Learning curve

A learning curve is a graphical representation of the changing rate of learning for a given activity or tool. Typically, the increase in retention of information is sharpest after the initial attempts, and then gradually evens out, meaning that less and less new information is retained after each...

and his/her ultra-competitive performance based career may be cut short, specially during generalized stock market crash

Stock market crash

A stock market crash is a sudden dramatic decline of stock prices across a significant cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic as much as by underlying economic factors...

es. Stock market trading operations have a considerably high level of risk, uncertainty

Uncertainty

Uncertainty is a term used in subtly different ways in a number of fields, including physics, philosophy, statistics, economics, finance, insurance, psychology, sociology, engineering, and information science...

and complexity

Complexity

In general usage, complexity tends to be used to characterize something with many parts in intricate arrangement. The study of these complex linkages is the main goal of complex systems theory. In science there are at this time a number of approaches to characterizing complexity, many of which are...

, especially for unwise and inexperienced stock traders/investors seeking an easy way to make money

Money

Money is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally in the past,...

quickly. In addition, trading activities are not free. Stock traders/investors face several costs such as commissions, taxes and fees to be paid for the brokerage and other services, like the buying/selling orders placed at the stock exchange

Stock exchange

A stock exchange is an entity that provides services for stock brokers and traders to trade stocks, bonds, and other securities. Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and...

. Depending on the nature of each national or state legislation involved, a large array of fiscal obligations must be respected, and taxes are charged by jurisdictions over those transactions, dividend

Dividend

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business , or it can be distributed to...

s and capital gain

Capital gain

A capital gain is a profit that results from investments into a capital asset, such as stocks, bonds or real estate, which exceeds the purchase price. It is the difference between a higher selling price and a lower purchase price, resulting in a financial gain for the investor...

s that fall within their scope. However, these fiscal obligations will vary from jurisdiction to jurisdiction. Among other reasons, there could be some instances where taxation is already incorporated into the stock price through the differing legislation that companies have to comply with in their respective jurisdictions; or that tax free stock market

Stock market

A stock market or equity market is a public entity for the trading of company stock and derivatives at an agreed price; these are securities listed on a stock exchange as well as those only traded privately.The size of the world stock market was estimated at about $36.6 trillion...

operations are useful to boost economic growth

Economic growth

In economics, economic growth is defined as the increasing capacity of the economy to satisfy the wants of goods and services of the members of society. Economic growth is enabled by increases in productivity, which lowers the inputs for a given amount of output. Lowered costs increase demand...

. Beyond these costs are the opportunity cost

Opportunity cost

Opportunity cost is the cost of any activity measured in terms of the value of the best alternative that is not chosen . It is the sacrifice related to the second best choice available to someone, or group, who has picked among several mutually exclusive choices. The opportunity cost is also the...

s of money and time, currency

Currency

In economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

risk, financial risk

Financial risk

Financial risk an umbrella term for multiple types of risk associated with financing, including financial transactions that include company loans in risk of default. Risk is a term often used to imply downside risk, meaning the uncertainty of a return and the potential for financial loss...

, and internet, data and news agency services and electricity

Electricity

Electricity is a general term encompassing a variety of phenomena resulting from the presence and flow of electric charge. These include many easily recognizable phenomena, such as lightning, static electricity, and the flow of electrical current in an electrical wire...

consumption expenses - all of which must be accounted for.

Noted cases - examples

Both Jerome Kerviel

Jérôme Kerviel

Jérôme Kerviel is a French trader who has a pending appeal of his conviction in the January 2008 Société Générale trading loss incident for breach of trust, forgery and unauthorized use of the bank's computers, resulting in losses valued at €4.9 billion.Société Générale characterizes Kerviel...

(Société Générale

Société Générale

Société Générale S.A. is a large European Bank and a major Financial Services company that has a substantial global presence. Its registered office is on Boulevard Haussmann in the 9th arrondissement of Paris, while its head office is in the Tours Société Générale in the business district of La...

) and Kweku Adoboli (UBS), two rogue trader

Rogue trader

A rogue trader is an authorised employee making unauthorised trades on behalf of their employer. It is most often applicable to financial trading, and as such is a term used to describe persons - professional traders - making unapproved financial transactions....

s, worked on the same type of position, the Delta One

Delta One

Delta One products are a class of financial derivative that have no optionality and as such have a delta of one - that is to say that for a given percentage move in the price of the underlying asset there will be a near identical move in the price of the derivative...

desk - a table where one does not exchange single stocks or bonds but derivatives. That operations are relatively simple and often reserved for novice traders, who also specialize in ETFs (exchange traded funds), financial products that mimic the performance of an index, upward or downward. Easy to use, they can diversify their portfolio by buying such contracts backed by a stock index or industry (eg commodities). Those two traders were very familiar to control procedures. They made a passage through the back office, the administrative body of the bank that controls the regularity of operations, before moving to trading. In 2005 and 2006, Kerviel had "led" by taking 100 to 150 million euros in positions on the shares of Solarworld AG listed in Germany, according to the report of the Inspector General of Societe Generale. Moreover – as Kerviel – the "unauthorized trading" of Kweku Adoboli did not date back a long way. Adoboli would have made some operations since October 2008 - his failure and subsequent arrest was in 2011.

Adolf Merckle

Adolf Merckle

Adolf Merckle was a businessman, and one of the richest people in Germany.Merckle was born in Dresden, Germany into a wealthy family. Most of his wealth came from inheritance. He developed his Bohemian grandfather's chemical wholesale company into Germany's largest pharmaceutical wholesaler,...

, a German heir of a large business, stock investor and stock trader, a large stockholder of Phoenix Pharmahandel

Phoenix Pharmahandel

PHOENIX Pharmahandel Aktiengesellschaft & Co KG , based in Mannheim, is the largest pharmaceutical wholesaler in Germany, and the second largest in Europe with about 20 distribution centers across the country delivering drugs to some 12,000 independent pharmacies...

, generic drug

Generic drug

A generic drug is a drug defined as "a drug product that is comparable to brand/reference listed drug product in dosage form, strength, route of administration, quality and performance characteristics, and intended use." It has also been defined as a term referring to any drug marketed under its...

manufacturer Ratiopharm

Ratiopharm

Ratiopharm is a German pharmaceutical company that is Europe's leading generics brand.Ratiopharm was owned by Adolf Merckle and makes generic Pharmaceuticals. They are based in Ulm, Germany and products being distributed in over 35 countries worldwide....

, and large parts of cement company HeidelbergCement

HeidelbergCement

HeidelbergCement is a German cement and building materials company. It is currently the world's third largest cement producer, the market leader in aggregates and fourth in ready-mix concrete. In 2010 the company produced around 78 million tonnes of cement...

as well as vehicle manufacturer Kässbohrer

Kässbohrer

Kässbohrer Fahrzeugwerke was a German vehicle manufacturer in Ulm. Its products were buses, coaches, vehicle transporters, trailers and special vehicles like snow groomer vehicles....

, spent most of his time investing. In December 2008, believing that Porsche

Porsche

Porsche Automobil Holding SE, usually shortened to Porsche SE a Societas Europaea or European Public Company, is a German based holding company with investments in the automotive industry....

could not complete its takeover of Volkswagen

Volkswagen

Volkswagen is a German automobile manufacturer and is the original and biggest-selling marque of the Volkswagen Group, which now also owns the Audi, Bentley, Bugatti, Lamborghini, SEAT, and Škoda marques and the truck manufacturer Scania.Volkswagen means "people's car" in German, where it is...

and would have to sell its shares, Merckle and others bet against Volkswagen stock. But Porsche had quietly and effectively cornered Volkswagen stock, so short-sellers such as Merckle could not buy enough Volkswagen stock to cover their short positions. Volkswagen stock therefore quintupled in value in a single day, causing billions in losses for those who had bet against Volkswagen's share price. Faced with such losses, Merckle's cement company was unable to make payments on a huge loan taken out to purchase an English competitor, Hanson

Hanson plc

Hanson plc is a British based international building materials company, headquartered in Maidenhead. Traded on the London Stock Exchange and a constituent of the FTSE 100 Index for many years, the company was acquired by a division of German rival Heidelberg Cement in August 2007.-History:Hanson...

.

In 2006, he was the world's 44th richest man, dropping to 96th place by December 2008, but still one of Germany's five richest men. He committed suicide on 5 January 2009.

Methodology

Stock traders/investors usually need a stock brokerStock broker

A stock broker or stockbroker is a regulated professional broker who buys and sells shares and other securities through market makers or Agency Only Firms on behalf of investors...

such as a bank

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

or a brokerage firm to access the stock market. Since the advent of Internet banking, an Internet connection is commonly used to manage positions. Using the Internet

Internet

The Internet is a global system of interconnected computer networks that use the standard Internet protocol suite to serve billions of users worldwide...

, specialized software, and a personal computer

Personal computer

A personal computer is any general-purpose computer whose size, capabilities, and original sales price make it useful for individuals, and which is intended to be operated directly by an end-user with no intervening computer operator...

, stock traders/investors make use of technical

Technical analysis

In finance, technical analysis is security analysis discipline for forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis incorporate technical analysis, which being an aspect of active management stands...

and fundamental

Fundamental analysis

Fundamental analysis of a business involves analyzing its financial statements and health, its management and competitive advantages, and its competitors and markets. When applied to futures and forex, it focuses on the overall state of the economy, interest rates, production, earnings, and...

analysis to help them in making decisions. They may use several information resources, some of which are strictly technical. Using the pivot points calculated from a previous day's trading, they attempt to predict the buy and sell points of the current day's trading session. These points give a cue to traders as to where prices will head for the day, prompting each trader where to enter his trade, and where to exit. An added tool for the stock picker is the use of "stock screens". Stock screens allow the user to input specific parameters, based on technical and/or fundamental conditions, that he or she deems desirable. Primary benefits associated with stock screens is its ability to return a small group of stocks for further analysis, among tens of thousands, that fit the requirements requested. There is criticism on the validity of using these technical indicators in analysis, and many professional stock traders do not use them. Many full-time stock traders and stock investors, as well as most other people in finance, have a formal education and training in fields such as economics

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

, finance

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

, mathematics

Mathematics

Mathematics is the study of quantity, space, structure, and change. Mathematicians seek out patterns and formulate new conjectures. Mathematicians resolve the truth or falsity of conjectures by mathematical proofs, which are arguments sufficient to convince other mathematicians of their validity...

and computer science

Computer science

Computer science or computing science is the study of the theoretical foundations of information and computation and of practical techniques for their implementation and application in computer systems...

, which are particularly relevant to this occupation.

The efficient-market hypothesis

Although many companies offer courses in stock picking, and numerous experts report success through technical analysisTechnical analysis

In finance, technical analysis is security analysis discipline for forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis incorporate technical analysis, which being an aspect of active management stands...

and fundamental analysis

Fundamental analysis

Fundamental analysis of a business involves analyzing its financial statements and health, its management and competitive advantages, and its competitors and markets. When applied to futures and forex, it focuses on the overall state of the economy, interest rates, production, earnings, and...

, many economists and academics state that because of the efficient-market hypothesis (EMH) it is unlikely that any amount of analysis can help an investor make any gains above the stock market itself. In the distribution

Distribution (economics)

Distribution in economics refers to the way total output, income, or wealth is distributed among individuals or among the factors of production .. In general theory and the national income and product accounts, each unit of output corresponds to a unit of income...

of investors, many academics believe that the richest are simply outliers in such a distribution (i.e. in a game of chance, they have flipped heads twenty times in a row). When money is put into the stock market, it is done with the aim of generating a return on the capital invested. Many investor

Investor

An investor is a party that makes an investment into one or more categories of assets --- equity, debt securities, real estate, currency, commodity, derivatives such as put and call options, etc...

s try not only to make a profitable return, but also to outperform, or beat, the market. However, market efficiency - championed in the EMH formulated by Eugene Fama

Eugene Fama

Eugene Francis "Gene" Fama is an American economist, known for his work on portfolio theory and asset pricing, both theoretical and empirical. He is currently Robert R...

in 1970, suggests that at any given time, prices fully reflect all available information on a particular stock and/or market. Thus, according to the EMH, no investor has an advantage in predicting a return on a stock price because no one has access to information not already available to everyone else. In efficient markets, prices become not predictable but random, so no investment pattern can be discerned. A planned approach to investment, therefore, cannot be successful. This "random walk" of prices, commonly spoken about in the EMH school of thought, results in the failure of any investment strategy that aims to beat the market consistently. In fact, the EMH suggests that given the transaction costs involved in portfolio management, it would be more profitable for an investor to put his or her money into an index fund.

At the academic level, the very concept of market timing (the act of attempting to predict the future direction of the market, typically through the use of technical indicators or economic data) is called into question by those who believe in the efficient market theory. This theory is based on the premise that, at any given time, prices fully reflect all available information on a particular stock and/or market. Thus, no investor has an advantage in predicting a return on a stock price because no one has access to information not already available to everyone else.

Beating the market, fraud and scams

Insider trading

Insider trading is the trading of a corporation's stock or other securities by individuals with potential access to non-public information about the company...

, accounting fraud, embezzlement

Embezzlement

Embezzlement is the act of dishonestly appropriating or secreting assets by one or more individuals to whom such assets have been entrusted....

and pump and dump

Pump and dump

"Pump and dump" is a form of microcap stock fraud that involves artificially inflating the price of an owned stock through false and misleading positive statements, in order to sell the cheaply purchased stock at a higher price....

strategies are factors that hamper an efficient, rational, fair and transparent investing, because they may create fictitious company's financial statements and data, leading to inconsistent stock prices.

Day trading sits at the extreme end of the investing spectrum from conventional buy-and-hold wisdom. It is the ultimate market-timing strategy. While all the attention that day trading attracts seems to suggest that the theory is sound, critics argue that, if that were so, at least one famous money manager would have mastered the system and claimed the title of "the Warren Buffet of day trading". The long list of successful investors that have become legends in their own time does not include a single individual that built his or her reputation by day trading.

Even Michael Steinhardt

Michael Steinhardt

Michael H. Steinhardt is an American investor and philanthropist active in Jewish causes. He was one of the first prominent hedge fund managers, and is a graduate of the Wharton School of the University of Pennsylvania. He founded Steinhardt, Fine, Berkowitz & Co., a hedge fund, in 1967...

, who made his fortune trading in time horizons ranging from 30 minutes to 30 days, claimed to take a long-term perspective on his investment decisions. From an economic perspective, many professional money managers and financial advisors shy away from day trading, arguing that the reward simply does not justify the risk. Despite the controversy, market timing is neither illegal nor unethical. Attempting to make a profit is the reason investors invest, and buy low and sell high is the general goal of most investors (although short-selling and arbitrage take a different approach, the success or failure of these strategies still depends on timing).

The problems with mutual fund

Mutual fund

A mutual fund is a professionally managed type of collective investment scheme that pools money from many investors to buy stocks, bonds, short-term money market instruments, and/or other securities.- Overview :...

trading that cast market timing in a negative light occurred because the prospectuses written by the mutual fund companies strictly forbid short-term trading. Despite this prohibition, special clients were allowed to do it anyway. So, the problem was not with the trading strategy but rather with the unethical and unfair implementation of that strategy, which permitted some investors to engage in it while excluding others. All of the world's greatest investors rely, to some extent, on market timing for their success. Whether they base their buy/sell decisions on fundamental analysis of the markets, technical analysis of individual companies, personal intuition, or all of the above, the ultimate reason for their success involves making the right trades at the right time. In most cases, those decisions involve extended periods of time and are based on buy-and-hold investment strategies. Value investing

Value investing

Value investing is an investment paradigm that derives from the ideas on investment and speculation that Ben Graham and David Dodd began teaching at Columbia Business School in 1928 and subsequently developed in their 1934 text Security Analysis...

is a clear example, as the strategy is based on buying stocks that trade for less than their intrinsic values and selling them when their value is recognized in the marketplace. Most value investors are known for their patience, as undervalued stocks often remain undervalued for significant periods of time.

Some investors choose a blend of technical, fundamental and environmental factors to influence where and when they invest. These strategists reject the 'chance' theory of investing, and attribute their higher level of returns to both insight and discipline.

Day trading

Day trading refers to the practice of buying and selling financial instruments within the same trading day such that all positions are usually closed before the market close for the trading day...

strategies. One reason for this high failure rate is that most new traders start out with too little capital, and the expectation of being able to pay their bills with their trading profits. Another big reason for this high failure rate is that most new traders start without a coherent game plan or strategy to trade. Other major reasons are the unpredictability of the markets, especially in the short-term, the large number of corporate and financial scams and frauds among listed companies, and out-of-control erroneous advertisement and biased aggressive advertising campaigns related with trading, brokerage, stock picking strategies, and so on. Every year, a lot of money is wasted in non-peer-reviewed (and largely unregulated) publications and courses attended by credulous people that get persuaded and take the bill, hoping getting rich by trading on the markets. This allow wide-spread promotion of inaccurate and unproven trading methods for stocks, bonds, commodities, or Forex, while generating sizable revenues for unscrupulous authors, advisers and self-titled trading gurus.

Trading stocks is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators

Financial regulation

Financial regulation is a form of regulation or supervision, which subjects financial institutions to certain requirements, restrictions and guidelines, aiming to maintain the integrity of the financial system...

are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants

Financial market participants

There are two basic financial market participant categories, Investor vs. Speculator and Institutional vs. Retail. Action in financial markets by central banks is usually regarded as intervention rather than participation.-Supply Side vs...

. In addition, the financial markets are usually subjected to speculation

Speculation

In finance, speculation is a financial action that does not promise safety of the initial investment along with the return on the principal sum...

. This does not invalidate the well documented true and genuine stories of large success and consistent profitability of many individual stock investors and stock investing organizations along the history.

Famous stock traders or stock investors

- Bernard BaruchBernard BaruchBernard Mannes Baruch was an American financier, stock-market speculator, statesman, and political consultant. After his success in business, he devoted his time toward advising U.S. Presidents Woodrow Wilson and Franklin D. Roosevelt on economic matters and became a philanthropist.-Early life...

- José BerardoJosé BerardoJosé Manuel Rodrigues Berardo, GCIH, more commonly known as Joe Berardo , is a Portuguese businessman, stock investor, speculator, and art collector. According to Portuguese magazine Exame, he has an estimated net worth of €598 million...

- Warren BuffettWarren BuffettWarren Edward Buffett is an American business magnate, investor, and philanthropist. He is widely regarded as one of the most successful investors in the world. Often introduced as "legendary investor, Warren Buffett", he is the primary shareholder, chairman and CEO of Berkshire Hathaway. He is...

- Steven A. CohenSteven A. CohenSteven "Steve" A. Cohen is an American hedge fund manager. He is the founder of SAC Capital Advisors, a Stamford, Connecticut-based hedge fund focusing primarily on equity market strategies....

- Jim Cramer

- Nicolas DarvasNicolas DarvasNicolas Darvas was a world famous dancer, self-taught investor and well-known author.-Escape from Hungary:Hungarian by birth, Nicolas Darvas trained as an economist at the University of Budapest...

- Alexander ElderAlexander ElderAlexander Elder, M.D., is a professional stock trader, living in New York. He is the author of Trading for a Living, Come Into My Trading Room and Entries & Exits, best-selling and well known among traders. First published in 1993, these books have been translated into Czech, Chinese, Dutch,...

- Philip Arthur FisherPhilip Arthur FisherPhilip Arthur Fisher was an American stock investor best known as the author of Common Stocks and Uncommon Profits, a guide to investing that has remained in print ever since it was first published in 1958. Fisher studied business at Stanford University...

- Benjamin GrahamBenjamin GrahamBenjamin Graham was an American economist and professional investor. Graham is considered the first proponent of value investing, an investment approach he began teaching at Columbia Business School in 1928 and subsequently refined with David Dodd through various editions of their famous book...

- John W. HenryJohn W. HenryJohn William Henry II is a futures and foreign exchange trading advisor who founded John W. Henry & Company . He is the principal owner of the Boston Red Sox and Liverpool F.C., and co-owner of Roush Fenway Racing. In March 2006, Boston Magazine estimated his net worth at $1.1 billion, but noted...

- Rakesh JhunjhunwalaRakesh JhunjhunwalaRakesh Jhunjhunwala is an Indian Chartered Accountant by qualification but an investor / trader by profession. In 2010, Forbes rated him India's 51st and the world's #1062 richest man with wealth of billion. He is a famous equity investor in India and manages his own portfolio as a partner in his...

- John Maynard KeynesJohn Maynard KeynesJohn Maynard Keynes, Baron Keynes of Tilton, CB FBA , was a British economist whose ideas have profoundly affected the theory and practice of modern macroeconomics, as well as the economic policies of governments...

- Edward LampertEdward LampertEdward S. "Eddie" Lampert is an American businessman and investor. He is the chairman of Sears Holdings Corporation and founder, chairman, and CEO of ESL Investments. Until May, 2007 he was a director of AutoNation, Inc. He previously served as a director of AutoZone, Inc...

- Jesse Lauriston LivermoreJesse Lauriston LivermoreJesse Lauriston Livermore , also known as the Boy Plunger and "Great Bear of Wall Street", was an early 20th century stock trader...

- Peter LynchPeter LynchPeter Lynch is a Wall Street stock investor. He is currently a research consultant at Fidelity Investments. Lynch graduated from Boston College in 1965 and earned a Master of Business Administration from the Wharton School of the University of Pennsylvania in 1968.-Fidelity:Lynch was hired as an...

- William O'NeilWilliam O'NeilWilliam J. O'Neil is an American entrepreneur, stockbroker and writer, who founded the business newspaper Investor's Business Daily and the stock brokerage firm William O'Neil + Co. Inc...

- Sebastián PiñeraSebastián PiñeraMiguel Juan Sebastián Piñera Echenique is a Chilean businessman and politician. He was elected President of Chile in January 2010, taking office in March 2010.- Education :...

- David RicardoDavid RicardoDavid Ricardo was an English political economist, often credited with systematising economics, and was one of the most influential of the classical economists, along with Thomas Malthus, Adam Smith, and John Stuart Mill. He was also a member of Parliament, businessman, financier and speculator,...

- Jim RogersJim RogersJames Beeland Rogers, Jr. is an American investor, author, and occasional financial commentator. He is currently based in Singapore. Rogers is the Chairman of Rogers Holdings and Beeland Interests, Inc...

- Martin SchwartzMartin SchwartzMartin S. Schwartz is a Wall Street trader who made his fortune successfully trading stocks, futures and options. He received national attention when he won the U.S. Investing Championship in 1984...

- Jim SlaterJim SlaterJames Derrick Slater is an investor.Trained as a chartered accountant, he worked for Leyland Motors and became famous for writing an investment column in The Sunday Telegraph under the nom de plume of The Capitalist, where he described his own portfolio...

- George SorosGeorge SorosGeorge Soros is a Hungarian-American business magnate, investor, philosopher, and philanthropist. He is the chairman of Soros Fund Management. Soros supports progressive-liberal causes...

- John TempletonJohn TempletonSir John Marks Templeton was an American-born British stock investor, businessman and philanthropist.-Biography:...

- Martin ZweigMartin ZweigMartin E. Zweig is an American stock investor, investment advisor, and financial analyst. He is, according to Forbes Magazine renowned for his "eccentric and lavish lifestyle" as well having the most expensive residence in the United States. It was listed on the New York City real estate market a...

See also

- Day traderDay traderA day trader is a trader who buys and sells financial instruments within the same trading day such that all positions will usually be closed before the market close of the trading day. This trading style is called day trading...

- Dead cat bounceDead cat bounceIn economics, a dead cat bounce is a small, brief recovery in the price of a declining stock. Derived from the idea that "even a dead cat will bounce if it falls from a great height", the phrase, which originated on Wall Street, is also popularly used to any case where a subject experiences a brief...

- Don't fight the tapeDon't fight the tapeDon't fight the tape is a term used in finance. It means do not bet or trade against the trend in the financial markets, e.g. if the broad market is moving up, do not bet on a downward move. The term tape here refers to the ticker tape used to transmit the price of stocks....

- Fundamental analysisFundamental analysisFundamental analysis of a business involves analyzing its financial statements and health, its management and competitive advantages, and its competitors and markets. When applied to futures and forex, it focuses on the overall state of the economy, interest rates, production, earnings, and...

- Option (finance)Option (finance)In finance, an option is a derivative financial instrument that specifies a contract between two parties for a future transaction on an asset at a reference price. The buyer of the option gains the right, but not the obligation, to engage in that transaction, while the seller incurs the...

- Paper tradingPaper tradingPaper trading is a simulated trading process in which would-be investors can 'practice' investing without committing real money....

- ShareholderShareholderA shareholder or stockholder is an individual or institution that legally owns one or more shares of stock in a public or private corporation. Shareholders own the stock, but not the corporation itself ....

- Slippage (finance)

- StockStockThe capital stock of a business entity represents the original capital paid into or invested in the business by its founders. It serves as a security for the creditors of a business since it cannot be withdrawn to the detriment of the creditors...

- Stock brokerStock brokerA stock broker or stockbroker is a regulated professional broker who buys and sells shares and other securities through market makers or Agency Only Firms on behalf of investors...

- Stock exchangeStock exchangeA stock exchange is an entity that provides services for stock brokers and traders to trade stocks, bonds, and other securities. Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and...

- Stock marketStock marketA stock market or equity market is a public entity for the trading of company stock and derivatives at an agreed price; these are securities listed on a stock exchange as well as those only traded privately.The size of the world stock market was estimated at about $36.6 trillion...

- Stock market data systemsStock market data systemsStock market data systems communicated market data—information about securities and stock trades—from stock exchanges to stock brokers and stock traders.-History:...

- Technical analysisTechnical analysisIn finance, technical analysis is security analysis discipline for forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis incorporate technical analysis, which being an aspect of active management stands...

- Technical Analysis Software (Finance)

- Trader (finance)Trader (finance)A trader is someone in finance who buys and sells financial instruments such as stocks, bonds, commodities and derivatives. A broker who simply fills buy or sell orders is not a trader, as they are merely executing instructions given to them. According to the Wall Street Journal in 2004, a managing...

- Value investingValue investingValue investing is an investment paradigm that derives from the ideas on investment and speculation that Ben Graham and David Dodd began teaching at Columbia Business School in 1928 and subsequently developed in their 1934 text Security Analysis...