Private equity in the 21st century

Encyclopedia

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital

. Within the broader private equity

industry, two distinct sub-industries, leveraged buyouts and venture capital

experienced growth along parallel although interrelated tracks.

The development of the private equity

and venture capital

asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble

and the tremendous growth in venture capital

that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new "Golden Age" of private equity ensued, as leveraged buyout

s reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering

of the Blackstone Group

in 2007.

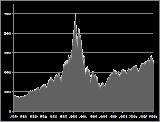

The Nasdaq

The Nasdaq

crash and technology slump that started in March 2000 shook virtually the entire venture capital industry as valuations for startup technology companies collapsed. Over the next two years, many venture firms had been forced to write-off large proportions of their investments and many funds were significantly "under water" (the values of the fund's investments were below the amount of capital invested). Venture capital investors sought to reduce size of commitments they had made to venture capital funds and in numerous instances, investors sought to unload existing commitments for cents on the dollar in the secondary market

. By mid-2003, the venture capital industry had shriveled to about half its 2001 capacity. Nevertheless, PricewaterhouseCoopers' MoneyTree Survey shows that total venture capital investments held steady at 2003 levels through the second quarter of 2005.

Although the post-boom years represent just a small fraction of the peak levels of venture investment reached in 2000, they still represent an increase over the levels of investment from 1980 through 1995. As a percentage of GDP, venture investment was 0.058% percent in 1994, peaked at 1.087% (nearly 19x the 1994 level) in 2000 and ranged from 0.164% to 0.182 % in 2003 and 2004. The revival of an Internet

-driven environment (thanks to deals such as eBay

's purchase of Skype

, the News Corporation

's purchase of MySpace.com, and the very successful Google.com and Salesforce.com

IPOs) have helped to revive the venture capital environment. However, as a percentage of the overall private equity market, venture capital has still not reached its mid-1990s level, let alone its peak in 2000.

. As a result, leveraged buyout activity ground to a halt. The major collapses of former high-fliers including WorldCom, Adelphia Communications, Global Crossing

and Winstar Communications

were among the most notable defaults in the market. In addition to the high rate of default, many investors lamented the low recovery rates achieved

through restructuring or bankruptcy.

Among the most affected by the bursting of the internet and telecom bubbles

were two of the largest and most active private equity firms of the 1990s: Tom Hicks

' Hicks Muse Tate & Furst and Ted Forstmann's Forstmann Little & Company

. These firms were often cited as the highest profile private equity casualties, having invested heavily in technology and telecommunications companies. Hicks Muse's reputation and market position were both damaged by the loss of over $1 billion from minority investments in six telecommunications and 13 Internet companies at the peak of the 1990s stock market bubble. Similarly, Forstmann suffered major losses from investments in McLeodUSA

and XO Communications

. Tom Hicks

resigned from Hicks Muse at the end of 2004 and Forstmann Little was unable to raise a new fund. The treasure of the State of Connecticut, sued Forstmann Little to return the state's $96 million investment to that point

and to cancel the commitment it made to take its total investment to $200 million. The humbling of these private equity titans could hardly have been predicted by their investors in the 1990s and forced fund investors to conduct due diligence

on fund managers more carefully and include greater controls on investments in partnership agreements.

Deals completed during this period tended to be smaller and financed less with high yield debt than in other periods. Private equity firms had to cobble together financing made up of bank loans and mezzanine debt, often with higher equity contributions than had been seen. Private equity firms benefited from the lower valuation multiples. As a result, despite the relatively limited activity, those funds that invested during the adverse market conditions delivered attractive returns to investors. Meanwhile, in Europe LBO activity began to increase as the market continued to mature. In 2001, for the first time, European buyout activity exceeded US activity with $44 billion of deals completed in Europe as compared with just $10.7 billion of deals completed in the US. This was a function of the fact that just six LBOs in excess of $500 million were completed in 2001, against 27 in 2000.

As investors sought to reduce their exposure to the private equity asset class, an area of private equity that was increasingly active in these years was the nascent secondary market

for private equity interests. Secondary transaction volume increased from historical levels of 2% or 3% of private equity commitments to 5% of the addressable market in the early years of the new decade. Many of the largest financial institutions (e.g., Deutsche Bank

, Abbey National

, UBS AG

) sold portfolios of direct investments and “pay-to-play” funds portfolios that were typically used as a means to gain entry to lucrative leveraged finance

and mergers and acquisitions

assignments but had created hundreds of millions of dollars of losses. Some of the most notable (publicly disclosed) secondary transactions, completed by financial institutions during this period, include:

s.

The combination of decreasing interest rates, loosening lending standards and regulatory changes for publicly traded companies would set the stage for the largest boom private equity had seen. The Sarbanes Oxley

legislation, officially the Public Company Accounting Reform and Investor Protection Act, passed in 2002, in the wake of corporate scandals at Enron

, WorldCom, Tyco

, Adelphia, Peregrine Systems

and Global Crossing

, Qwest Communications International, among others, would create a new regime of rules and regulations for publicly traded corporations. In addition to the existing focus on short term earnings rather than long term value creation, many public company executives lamented the extra cost and bureaucracy associated with Sarbanes-Oxley

compliance. For the first time, many large corporations saw private equity ownership as potentially more attractive than remaining public. Sarbanes-Oxley would have the opposite effect on the venture capital industry. The

increased compliance costs would make it nearly impossible for venture capitalists to bring young companies to the public markets and dramatically reduced the opportunities for exits via IPO. Instead, venture capitalists have been forced increasingly to rely on sales to strategic buyers for an exit of their investment.

Interest rates, which began a major series of decreases in 2002 would reduce the cost of borrowing and increase the ability of private equity firms to finance large acquisitions. Lower interest rates would encourage investors to return to relatively dormant high-yield debt

and leveraged loan

markets, making debt more readily available to finance buyouts. Additionally, alternative investments also became increasingly important as investors sought yield despite increases in risk. This search for higher yielding investments would fuel larger funds and in turn larger deals, never thought possible, became reality.

Certain buyouts were completed in 2001 and early 2002, particularly in Europe where financing was more readily available. In 2001, for example, BT Group

agreed to sell its international yellow pages directories business (Yell Group

) to Apax Partners

and Hicks, Muse, Tate & Furst for £2.14 billion (approximately $3.5 billion at the time), making it then the largest non-corporate LBO in European history. Yell later bought US directories publisher McLeodUSA for about $600 million, and floated on London's FTSE

in 2003.

at the end of 2002 and 2003, large multi-billion dollar U.S. buyouts could once again obtain significant high yield debt financing and larger transactions could be completed. The Carlyle Group, Welsh, Carson, Anderson & Stowe

, along with other private investors, led a $7.5 billion buyout of QwestDex. The buyout was the third largest corporate buyout since 1989. QwestDex's purchase occurred in two stages: a $2.75 billion acquisition of assets known as Dex Media East in November 2002 and a $4.30 billion acquisition of assets known as Dex Media West in 2003. R. H. Donnelley Corporation acquired Dex Media in 2006. Shortly after Dex Media, other larger buyouts would be completed signaling the resurgence in private equity was underway. The acquisitions included Burger King

(by Bain Capital

), Jefferson Smurfit

(by Madison Dearborn

), Houghton Mifflin

(by Bain Capital

, the Blackstone Group and Thomas H. Lee Partners

) and TRW Automotive

by the Blackstone Group

.

In 2006 USA Today reported retrospectively on the revival of private equity:

By 2004 and 2005, major buyouts were once again becoming common and market observers were stunned by the leverage levels and financing terms obtained by financial sponsor

s in their buyouts. Some of the notable buyouts of this period include:

As 2005 ended and 2006 began, new "largest buyout" records were set and surpassed several times with nine of the top ten buyouts at the end of 2007 having been announced in an 18-month window from the beginning of 2006 through the middle of 2007. Additionally, the buyout boom was not limited to the United States as industrialized countries in Europe and the Asia-Pacific region also saw new records set. In 2006, private equity firms bought 654 U.S. companies for $375 billion, representing 18 times the level of transactions closed in 2003. Additionally, U.S. based private equity firms raised $215.4 billion in investor commitments to 322 funds, surpassing the previous record set in 2000 by 22% and 33% higher than the 2005 fundraising total. However, venture capital funds, which were responsible for much of the fundraising volume in 2000 (the height of the dot-com bubble

As 2005 ended and 2006 began, new "largest buyout" records were set and surpassed several times with nine of the top ten buyouts at the end of 2007 having been announced in an 18-month window from the beginning of 2006 through the middle of 2007. Additionally, the buyout boom was not limited to the United States as industrialized countries in Europe and the Asia-Pacific region also saw new records set. In 2006, private equity firms bought 654 U.S. companies for $375 billion, representing 18 times the level of transactions closed in 2003. Additionally, U.S. based private equity firms raised $215.4 billion in investor commitments to 322 funds, surpassing the previous record set in 2000 by 22% and 33% higher than the 2005 fundraising total. However, venture capital funds, which were responsible for much of the fundraising volume in 2000 (the height of the dot-com bubble

), raised only $25.1 billion in 2006, a 2% percent decline from 2005 and a significant decline from its peak. The following year, despite the onset of turmoil in the credit markets in the summer, saw yet another record year of fundraising with $302 billion of investor commitments to 415 funds.

attracted significantly greater attention when several of the largest private equity firms pursued various options through the public markets. Taking private equity firms and private equity funds public appeared an unusual move since private equity funds often buy public companies listed on exchange and then take them private. Private equity firms are rarely subject to the quarterly reporting requirements of the public markets and tout this independence to prospective sellers as a key advantage of going private. Nevertheless, there are fundamentally two separate opportunities that private equity firms pursued in the public markets. These options involved a public listing of either:

In May 2006, Kohlberg Kravis Roberts raised $5 billion in an initial public offering for a new permanent investment vehicle (KKR Private Equity Investors or KPE) listing it on the Euronext

exchange in Amsterdam

(ENXTAM: KPE). KKR raised more than three times what it had expected at the outset as many of the investors in KPE were hedge funds seeking exposure to private equity but could not make long term commitments to private equity funds. Because private equity had been booming in the preceding years, the proposition of investing in a KKR fund appeared attractive to certain investors.

However, KPE's first-day performance was lackluster, trading down 1.7% and trading volume was limited. Initially, a handful of other private equity firms and hedge funds had planned to follow KKR's lead but shelved those plans when KPE's performance continued to falter after its IPO. KPE's stock declined from an IPO price of €25 per share to €18.16 (a 27% decline) at the end of 2007 and a low of €11.45 (a 54.2% decline) per share in Q1 2008. KPE disclosed in May 2008 that it had completed approximately $300 million of secondary sales

of selected limited

partnership interests in and undrawn commitments to certain KKR-managed funds in order to generate liquidity and repay borrowings.

On March 22, 2007, the Blackstone Group filed with the SEC to raise $4 billion in an initial public offering. On June 21, Blackstone swapped a 12.3% stake in its ownership for $4.13 billion in the largest U.S. IPO since 2002. Traded on the New York Stock Exchange under the ticker symbol BX, Blackstone priced at $31 per share on June 22, 2007.

On March 22, 2007, the Blackstone Group filed with the SEC to raise $4 billion in an initial public offering. On June 21, Blackstone swapped a 12.3% stake in its ownership for $4.13 billion in the largest U.S. IPO since 2002. Traded on the New York Stock Exchange under the ticker symbol BX, Blackstone priced at $31 per share on June 22, 2007.

Less than two weeks after the Blackstone Group IPO, rival firm Kohlberg Kravis Roberts filed with the SEC in July 2007 to raise $1.25 billion by selling an ownership interest in its management company. KKR had previously listed its KKR Private Equity Investors (KPE) private equity fund vehicle in 2006. The onset of the credit crunch and the shutdown of the IPO market would dampen the prospects of obtaining a valuation that would be attractive to KKR and the flotation was repeatedly postponed.

Meanwhile, other private equity investors were seeking to realize a portion of the value locked into their firms. In September 2007, the Carlyle Group

sold a 7.5% interest in its management company to Mubadala Development Company, which is owned by the Abu Dhabi Investment Authority

(ADIA) for $1.35 billion, which valued Carlyle at approximately $20 billion. Similarly, in January 2008, Silver Lake Partners

sold a 9.9% stake in its management company to the California Public Employees' Retirement System (CalPERS)

for $275 million.

Additionally, Apollo Global Management completed a private placement of shares in its management company in July 2007. By pursuing a private placement rather than a public offering, Apollo would be able to avoid much of the public scrutiny applied to Blackstone and KKR.

In April 2008, Apollo filed with the SEC to permit some holders of its privately traded stock to sell their shares on the New York Stock Exchange

. In April 2004, Apollo raised $930 million for a listed business development company

, Apollo Investment Corporation (NASDAQ: AINV), to invest primarily in middle-market companies in the form of mezzanine debt and senior secured loans

, as well as by making direct equity investments in

companies. The Company also invests in the securities of public companies.

Historically, in the United States, there had been a group of publicly traded private equity firms that were registered as business development companies (BDCs) under the Investment Company Act of 1940

. Typically, BDCs are structured similar to real estate investment trust

s (REITs) in that the BDC structure reduces or eliminates corporate income tax. In return, REITs are required to distribute

90% of their income

, which may be taxable to its investor

s. As of the end of 2007, among the largest BDCs (by market value, excluding Apollo Investment Corp, discussed earlier) are: American Capital Strategies

(NASDAQ:ACAS), Allied Capital Corp (NASDAQ:ALD), Ares Capital Corporation (NASDAQ:ARCC),

Gladstone Investment Corp (NASDAQ:GAIN) and Kohlberg Capital Corp

(NASDAQ:KCAP).

Beginning in 2004 and extending through 2007, the secondary market transformed into a more efficient market in which assets for the first time traded at or above their estimated fair values and liquidity increased dramatically. During these years, the secondary market transitioned from a niche sub-category in which the majority of sellers were distressed to an active market with ample supply of assets and numerous market participants. By 2006 active portfolio management had become far more common in the increasingly developed secondary market and an increasing number of investors had begun to pursue secondary sales to rebalance their private equity portfolios. The continued evolution of the private equity secondary market reflected the maturation and evolution of the larger private equity industry. Among the most notable publicly disclosed secondary transactions

(it is estimated that over two-thirds of secondary market activity is never disclosed publicly):

, spilled over into the leveraged finance

and high-yield debt

markets. The markets had been highly robust during the first six months of 2007, with highly issuer friendly developments including PIK and PIK Toggle

(interest is "Payable In Kind") and covenant light

debt widely available to finance large leveraged buyouts. July and August saw a notable slowdown in issuance levels in the high yield and leveraged loan markets with only few issuers accessing the market. Uncertain market

conditions led to a significant widening of yield spreads, which coupled with the typical summer slowdown led to many companies and investment banks to put their plans to issue debt on hold until the autumn. However, the expected rebound in the market after Labor Day

2007 did not materialize and the lack of market confidence prevented deals from pricing. By the end of September, the full extent of the credit situation became obvious as major lenders including Citigroup

and UBS AG

announced major writedowns due to credit losses. The leveraged finance markets came to a near standstill. As a result of the sudden change in the market, buyers would begin to withdraw from or renegotiate the deals completed at the top of the market:

Additionally, the credit crunch has prompted buyout firms to pursue a new group of transactions in order to deploy their massive investment funds. These transactions have included Private Investment in Public Equity

(or PIPE) transactions as well as purchases of debt in existing leveraged buyout transactions. Some of the most notable of these transactions completed in the depths of the credit crunch include:

2003 film Fahrenheit 9-11. The film suggested that The Carlyle Group exerted tremendous influence on U.S. government policy and contracts through their relationship with the president’s father, George H. W. Bush

, a former senior adviser to the Carlyle Group. Additionally, Moore cited relationships with the Bin Laden family. The movie quotes author Dan Briody claiming that the Carlyle Group "gained" from September 11 because it owned United Defense

, a military contractor, although the firm’s $11 billion Crusader artillery rocket system developed for the U.S. Army is one of the few weapons systems canceled by the Bush administration.

Over the next few years, attention intensified on private equity as the size of transactions and profile of the companies increased. The attention would increase significantly following a series of events involving The Blackstone Group: the firm's initial public offering and the birthday celebration of its CEO. The Wall Street Journal observing Blackstone Group's

Steve Schwarzman's 60th birthday celebration in February 2007 described the event as follows:

Schwarzman received a severe backlash from both critics of the private equity industry and fellow investors in private equity. The lavish event which reminded many of the excesses of notorious executives including Bernie Ebbers (WorldCom) and Dennis Kozlowski

(Tyco International

). David Rubenstein

, the founder of The Carlyle Group remarked, "We have all wanted to be private – at least until now. When Steve Schwarzman's biography with all the dollar signs is posted on the web site none of us will like the furor that results – and that's even if you like Rod Stewart."

Rubenstein's fears would be confirmed when in 2007, the Service Employees International Union

launched a campaign against private equity firms, specifically the largest buyout firms through public events, protests as well as leafleting and web campaigns. A number of leading private equity executives were targeted by the union members however the SEIU's campaign was not nearly as effective at slowing the buyout boom as the credit crunch of 2007 and 2008 would ultimately prove to be.

In 2008, the SEIU would shift part of its focus from attacking private equity firms directly toward the highlighting the role of sovereign wealth fund

s in private equity. The SEIU pushed legislation in California that would disallow investments by state agencies (particularly CalPERS

and CalSTRS

) in firms with ties to certain sovereign wealth funds. Additionally, the SEIU has attempted to criticize the treatment of taxation of carried interest

. The SEIU, and other critics, point out that many wealthy private equity investors pay taxes at lower rates (because the majority of their income is derived from carried interest

, payments received from the profits on a private equity fund

's investments) than many of the rank and file employees of a private equity

firm's portfolio companies.

In 2009, the Canadian regulatory bodies set up rigorous regulation for dealers in exempt (non-publicly traded) securities. Exempt-market dealers sell securities that are exempt from prospectus requirements and must register with the Ontario Securities Commission.

History of private equity and venture capital

The history of private equity and venture capital and the development of these asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital...

. Within the broader private equity

Private equity

Private equity, in finance, is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange....

industry, two distinct sub-industries, leveraged buyouts and venture capital

Venture capital

Venture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

experienced growth along parallel although interrelated tracks.

The development of the private equity

Private equity

Private equity, in finance, is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange....

and venture capital

Venture capital

Venture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble

Dot-com bubble

The dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more...

and the tremendous growth in venture capital

Venture capital

Venture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new "Golden Age" of private equity ensued, as leveraged buyout

Leveraged buyout

A leveraged buyout occurs when an investor, typically financial sponsor, acquires a controlling interest in a company's equity and where a significant percentage of the purchase price is financed through leverage...

s reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering

Initial public offering

An initial public offering or stock market launch, is the first sale of stock by a private company to the public. It can be used by either small or large companies to raise expansion capital and become publicly traded enterprises...

of the Blackstone Group

Blackstone Group

The Blackstone Group L.P. is an American-based alternative asset management and financial services company that specializes in private equity, real estate, and credit and marketable alternative investment strategies, as well as financial advisory services, such as mergers and acquisitions ,...

in 2007.

Bursting the Internet Bubble and the private equity crash (2000–2003)

NASDAQ

The NASDAQ Stock Market, also known as the NASDAQ, is an American stock exchange. "NASDAQ" originally stood for "National Association of Securities Dealers Automated Quotations". It is the second-largest stock exchange by market capitalization in the world, after the New York Stock Exchange. As of...

crash and technology slump that started in March 2000 shook virtually the entire venture capital industry as valuations for startup technology companies collapsed. Over the next two years, many venture firms had been forced to write-off large proportions of their investments and many funds were significantly "under water" (the values of the fund's investments were below the amount of capital invested). Venture capital investors sought to reduce size of commitments they had made to venture capital funds and in numerous instances, investors sought to unload existing commitments for cents on the dollar in the secondary market

Private equity secondary market

In finance, the private equity secondary market refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds....

. By mid-2003, the venture capital industry had shriveled to about half its 2001 capacity. Nevertheless, PricewaterhouseCoopers' MoneyTree Survey shows that total venture capital investments held steady at 2003 levels through the second quarter of 2005.

Although the post-boom years represent just a small fraction of the peak levels of venture investment reached in 2000, they still represent an increase over the levels of investment from 1980 through 1995. As a percentage of GDP, venture investment was 0.058% percent in 1994, peaked at 1.087% (nearly 19x the 1994 level) in 2000 and ranged from 0.164% to 0.182 % in 2003 and 2004. The revival of an Internet

Internet

The Internet is a global system of interconnected computer networks that use the standard Internet protocol suite to serve billions of users worldwide...

-driven environment (thanks to deals such as eBay

EBay

eBay Inc. is an American internet consumer-to-consumer corporation that manages eBay.com, an online auction and shopping website in which people and businesses buy and sell a broad variety of goods and services worldwide...

's purchase of Skype

Skype

Skype is a software application that allows users to make voice and video calls and chat over the Internet. Calls to other users within the Skype service are free, while calls to both traditional landline telephones and mobile phones can be made for a fee using a debit-based user account system...

, the News Corporation

News Corporation

News Corporation or News Corp. is an American multinational media conglomerate. It is the world's second-largest media conglomerate as of 2011 in terms of revenue, and the world's third largest in entertainment as of 2009, although the BBC remains the world's largest broadcaster...

's purchase of MySpace.com, and the very successful Google.com and Salesforce.com

Salesforce.com

Salesforce.com is an enterprise cloud computing company headquartered in San Francisco that distributes business software on a subscription basis. Salesforce.com hosts the applications off-site...

IPOs) have helped to revive the venture capital environment. However, as a percentage of the overall private equity market, venture capital has still not reached its mid-1990s level, let alone its peak in 2000.

Stagnation in the LBO market

Meanwhile, as the venture sector collapsed, the activity in the leveraged buyout market also declined significantly. Leveraged buyout firms had invested heavily in the telecommunications sector from 1996 to 2000 and profited from the boom which suddenly fizzled in 2001. In that year at least 27 major telecommunications companies, (i.e., with $100 million of liabilities or greater) filed for bankruptcy protection. Telecommunications, which made up a large portion of the overall high yield universe of issuers, dragged down the entire high yield market. Overall corporate default rates surged to levels unseen since the 1990 market collapse rising to 6.3% of high yield issuance in 2000 and 8.9% of issuance in 2001. Default rates on junk bonds peaked at 10.7 percent in January 2002 according to Moody'sMoody's

Moody's Corporation is the holding company for Moody's Analytics and Moody's Investors Service, a credit rating agency which performs international financial research and analysis on commercial and government entities. The company also ranks the credit-worthiness of borrowers using a standardized...

. As a result, leveraged buyout activity ground to a halt. The major collapses of former high-fliers including WorldCom, Adelphia Communications, Global Crossing

Global Crossing

Global Crossing Limited was a telecommunications company that provides computer networking services worldwide. It maintained a large backbone and offered transit and peering links, VPN, leased lines, audio and video conferencing, long distance telephone, managed services, dialup, colocation and...

and Winstar Communications

Winstar Communications

Winstar Communications is a former American telecommunications company that provided broadband services to business customers. Winstar owned and operated a broadband network in 60 major markets in the United States, including each of the top 30 U.S...

were among the most notable defaults in the market. In addition to the high rate of default, many investors lamented the low recovery rates achieved

through restructuring or bankruptcy.

Among the most affected by the bursting of the internet and telecom bubbles

Dot-com bubble

The dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more...

were two of the largest and most active private equity firms of the 1990s: Tom Hicks

Tom Hicks

Thomas Ollis Hicks, Sr. , is an American 'leveraged buyout' businessman living in Dallas, Texas. Despite Forbes Magazine estimating Hicks' wealth at USD 1 billion in 2009, Hicks was unable to pay off joint loans of circa £200 million the following year...

' Hicks Muse Tate & Furst and Ted Forstmann's Forstmann Little & Company

Forstmann Little & Company

Forstmann, Little & Company is a private equity firm, specializing in leveraged buyouts . At its peak in the late 1990s, Forstmann Little was among the largest private equity firms globally...

. These firms were often cited as the highest profile private equity casualties, having invested heavily in technology and telecommunications companies. Hicks Muse's reputation and market position were both damaged by the loss of over $1 billion from minority investments in six telecommunications and 13 Internet companies at the peak of the 1990s stock market bubble. Similarly, Forstmann suffered major losses from investments in McLeodUSA

McLeodUSA

McLeodUSA, based in Hiawatha, Iowa, is one of the nation’s largest independent competitive local exchange carriers . The company also has offices in Tulsa, Oklahoma, and The Woodlands, Texas....

and XO Communications

XO Communications

XO Communications is a telecommunications company owned by XO Holdings, Inc...

. Tom Hicks

Tom Hicks

Thomas Ollis Hicks, Sr. , is an American 'leveraged buyout' businessman living in Dallas, Texas. Despite Forbes Magazine estimating Hicks' wealth at USD 1 billion in 2009, Hicks was unable to pay off joint loans of circa £200 million the following year...

resigned from Hicks Muse at the end of 2004 and Forstmann Little was unable to raise a new fund. The treasure of the State of Connecticut, sued Forstmann Little to return the state's $96 million investment to that point

and to cancel the commitment it made to take its total investment to $200 million. The humbling of these private equity titans could hardly have been predicted by their investors in the 1990s and forced fund investors to conduct due diligence

Due diligence

"Due diligence" is a term used for a number of concepts involving either an investigation of a business or person prior to signing a contract, or an act with a certain standard of care. It can be a legal obligation, but the term will more commonly apply to voluntary investigations...

on fund managers more carefully and include greater controls on investments in partnership agreements.

Deals completed during this period tended to be smaller and financed less with high yield debt than in other periods. Private equity firms had to cobble together financing made up of bank loans and mezzanine debt, often with higher equity contributions than had been seen. Private equity firms benefited from the lower valuation multiples. As a result, despite the relatively limited activity, those funds that invested during the adverse market conditions delivered attractive returns to investors. Meanwhile, in Europe LBO activity began to increase as the market continued to mature. In 2001, for the first time, European buyout activity exceeded US activity with $44 billion of deals completed in Europe as compared with just $10.7 billion of deals completed in the US. This was a function of the fact that just six LBOs in excess of $500 million were completed in 2001, against 27 in 2000.

As investors sought to reduce their exposure to the private equity asset class, an area of private equity that was increasingly active in these years was the nascent secondary market

Private equity secondary market

In finance, the private equity secondary market refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds....

for private equity interests. Secondary transaction volume increased from historical levels of 2% or 3% of private equity commitments to 5% of the addressable market in the early years of the new decade. Many of the largest financial institutions (e.g., Deutsche Bank

Deutsche Bank

Deutsche Bank AG is a global financial service company with its headquarters in Frankfurt, Germany. It employs more than 100,000 people in over 70 countries, and has a large presence in Europe, the Americas, Asia Pacific and the emerging markets...

, Abbey National

Abbey National

Abbey National plc was a UK-based bank and former building society, which latterly traded under the Abbey brand name. It became a wholly owned subsidiary of Grupo Santander of Spain in 2004, and was rebranded as Santander in January 2010, forming Santander UK along with the savings business of the...

, UBS AG

UBS AG

UBS AG is a Swiss global financial services company headquartered in Basel and Zürich, Switzerland, which provides investment banking, asset management, and wealth management services for private, corporate, and institutional clients worldwide, as well as retail clients in Switzerland...

) sold portfolios of direct investments and “pay-to-play” funds portfolios that were typically used as a means to gain entry to lucrative leveraged finance

Leverage (finance)

In finance, leverage is a general term for any technique to multiply gains and losses. Common ways to attain leverage are borrowing money, buying fixed assets and using derivatives. Important examples are:* A public corporation may leverage its equity by borrowing money...

and mergers and acquisitions

Mergers and acquisitions

Mergers and acquisitions refers to the aspect of corporate strategy, corporate finance and management dealing with the buying, selling, dividing and combining of different companies and similar entities that can help an enterprise grow rapidly in its sector or location of origin, or a new field or...

assignments but had created hundreds of millions of dollars of losses. Some of the most notable (publicly disclosed) secondary transactions, completed by financial institutions during this period, include:

- Chase Capital PartnersChase (bank)JPMorgan Chase Bank, N.A., doing business as Chase, is a national bank that constitutes the consumer and commercial banking subsidiary of financial services firm JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000...

sold a $500 million portfolio of private equity funds interests in 2000.

- National Westminster BankNational Westminster BankNational Westminster Bank Plc, commonly known as NatWest, is the largest retail and commercial bank in the United Kingdom and has been part of The Royal Bank of Scotland Group Plc since 2000. The Royal Bank of Scotland Group is ranked as the second largest bank in the world by assets...

completed the sale of over 250 direct equity investments valued at nearly $1 billion in 2000.

- UBS AGUBS AGUBS AG is a Swiss global financial services company headquartered in Basel and Zürich, Switzerland, which provides investment banking, asset management, and wealth management services for private, corporate, and institutional clients worldwide, as well as retail clients in Switzerland...

sold a $1.3 billion portfolio of private equity fund interests in over 50 funds in 2003.

- Deutsche BankDeutsche BankDeutsche Bank AG is a global financial service company with its headquarters in Frankfurt, Germany. It employs more than 100,000 people in over 70 countries, and has a large presence in Europe, the Americas, Asia Pacific and the emerging markets...

sold a $2 billion investment portfolio as part of a spinout of MidOcean PartnersMidOcean PartnersMidOcean Partners is a private equity firm specializing in leveraged buyouts, recapitalizations and growth capital investments in middle-market companies...

, funded by a consortium of secondary investors, in 2003.

- Abbey NationalAbbey NationalAbbey National plc was a UK-based bank and former building society, which latterly traded under the Abbey brand name. It became a wholly owned subsidiary of Grupo Santander of Spain in 2004, and was rebranded as Santander in January 2010, forming Santander UK along with the savings business of the...

completed the sale of £748 million ($1.33 billion) of LP interests in 41 private equity funds and 16 interests in private European companies in early 2004.

- Bank One sold a $1 billion portfolio of private equity fund interests in 2004.

The third private equity boom and the Golden Age of Private Equity (2003–2007)

As 2002 ended and 2003 began, the private equity sector, had spent the previous two and a half years reeling from major losses in telecommunications and technology companies and had been severely constrained by tight credit markets. As 2003 got underway, private equity began a five year resurgence that would ultimately result in the completion of 13 of the 15 largest leveraged buyout transactions in history, unprecedented levels of investment activity and investor commitments and a major expansion and maturation of the leading private equity firmPrivate equity firm

A private equity firm is an investment manager that makes investments in the private equity of operating companies through a variety of loosely affiliated investment strategies including leveraged buyout, venture capital, and growth capital...

s.

The combination of decreasing interest rates, loosening lending standards and regulatory changes for publicly traded companies would set the stage for the largest boom private equity had seen. The Sarbanes Oxley

Sarbanes-Oxley Act

The Sarbanes–Oxley Act of 2002 , also known as the 'Public Company Accounting Reform and Investor Protection Act' and 'Corporate and Auditing Accountability and Responsibility Act' and commonly called Sarbanes–Oxley, Sarbox or SOX, is a United States federal law enacted on July 30, 2002, which...

legislation, officially the Public Company Accounting Reform and Investor Protection Act, passed in 2002, in the wake of corporate scandals at Enron

Enron

Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. Before its bankruptcy on December 2, 2001, Enron employed approximately 22,000 staff and was one of the world's leading electricity, natural gas, communications, and pulp and paper companies, with...

, WorldCom, Tyco

Tyco

Tyco may refer to:* Tyco International, a diversified industrial conglomerate* Tyco Electronics, a former segment of Tyco International* Tyco Toys, a division of Mattel...

, Adelphia, Peregrine Systems

Peregrine Systems

Peregrine Systems, Inc., an enterprise software company, was founded in 1981 and sold enterprise asset management, change management, and ITIL-based IT service management software. Following an accounting scandal and bankruptcy in 2003, Peregrine was acquired by Hewlett-Packard in 2005...

and Global Crossing

Global Crossing

Global Crossing Limited was a telecommunications company that provides computer networking services worldwide. It maintained a large backbone and offered transit and peering links, VPN, leased lines, audio and video conferencing, long distance telephone, managed services, dialup, colocation and...

, Qwest Communications International, among others, would create a new regime of rules and regulations for publicly traded corporations. In addition to the existing focus on short term earnings rather than long term value creation, many public company executives lamented the extra cost and bureaucracy associated with Sarbanes-Oxley

Sarbanes-Oxley Act

The Sarbanes–Oxley Act of 2002 , also known as the 'Public Company Accounting Reform and Investor Protection Act' and 'Corporate and Auditing Accountability and Responsibility Act' and commonly called Sarbanes–Oxley, Sarbox or SOX, is a United States federal law enacted on July 30, 2002, which...

compliance. For the first time, many large corporations saw private equity ownership as potentially more attractive than remaining public. Sarbanes-Oxley would have the opposite effect on the venture capital industry. The

increased compliance costs would make it nearly impossible for venture capitalists to bring young companies to the public markets and dramatically reduced the opportunities for exits via IPO. Instead, venture capitalists have been forced increasingly to rely on sales to strategic buyers for an exit of their investment.

Interest rates, which began a major series of decreases in 2002 would reduce the cost of borrowing and increase the ability of private equity firms to finance large acquisitions. Lower interest rates would encourage investors to return to relatively dormant high-yield debt

High-yield debt

In finance, a high-yield bond is a bond that is rated below investment grade...

and leveraged loan

Secured loan

A secured loan is a loan in which the borrower pledges some asset as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan...

markets, making debt more readily available to finance buyouts. Additionally, alternative investments also became increasingly important as investors sought yield despite increases in risk. This search for higher yielding investments would fuel larger funds and in turn larger deals, never thought possible, became reality.

Certain buyouts were completed in 2001 and early 2002, particularly in Europe where financing was more readily available. In 2001, for example, BT Group

BT Group

BT Group plc is a global telecommunications services company headquartered in London, United Kingdom. It is one of the largest telecommunications services companies in the world and has operations in more than 170 countries. Through its BT Global Services division it is a major supplier of...

agreed to sell its international yellow pages directories business (Yell Group

Yell Group

Yell Group plc is a multinational directories company headquartered in Reading, United Kingdom. As well as the United Kingdom, it has operations in the United States, Spain and some countries in Latin America...

) to Apax Partners

Apax Partners

Apax Partners LLP is a global private equity and venture capital firm, headquartered in London. The company also operates out of eight other offices in New York, Hong Kong, Mumbai, Tel-Aviv, Madrid, Stockholm, Milan and Munich. The firm, including its various predecessors, have raised...

and Hicks, Muse, Tate & Furst for £2.14 billion (approximately $3.5 billion at the time), making it then the largest non-corporate LBO in European history. Yell later bought US directories publisher McLeodUSA for about $600 million, and floated on London's FTSE

FTSE

FTSE may refer to:* The FTSE Group* Stock market indices published by the FTSE Group, particularly the FTSE 100 Index on the London Stock Exchange* The Fundamental theorem of software engineering...

in 2003.

Resurgence of the large buyout

Marked by the two-stage buyout of Dex MediaDex Media

Dex Media, Inc. was a print and interactive marketing company. It was acquired by R.H. Donnelley, which became Dex One Corporation in February 2010...

at the end of 2002 and 2003, large multi-billion dollar U.S. buyouts could once again obtain significant high yield debt financing and larger transactions could be completed. The Carlyle Group, Welsh, Carson, Anderson & Stowe

Welsh, Carson, Anderson & Stowe

Welsh, Carson, Anderson & Stowe is a private equity investment firm in the United States. Founded in 1979, it has organized 14 limited partnerships with total capital over $16 billion and is currently in the process of raising a new $4 billion private equity fund Welsh, Carson Anderson & Stowe XI...

, along with other private investors, led a $7.5 billion buyout of QwestDex. The buyout was the third largest corporate buyout since 1989. QwestDex's purchase occurred in two stages: a $2.75 billion acquisition of assets known as Dex Media East in November 2002 and a $4.30 billion acquisition of assets known as Dex Media West in 2003. R. H. Donnelley Corporation acquired Dex Media in 2006. Shortly after Dex Media, other larger buyouts would be completed signaling the resurgence in private equity was underway. The acquisitions included Burger King

Burger King

Burger King, often abbreviated as BK, is a global chain of hamburger fast food restaurants headquartered in unincorporated Miami-Dade County, Florida, United States. The company began in 1953 as Insta-Burger King, a Jacksonville, Florida-based restaurant chain...

(by Bain Capital

Bain Capital

Bain Capital LLC is a Boston-based private equity firm founded in 1984 by partners from the consulting firm Bain & Company. Originally conceived as an early-stage, growth-oriented investment fund, Bain Capital today manages approximately $65 billion in assets, and its strategies include private...

), Jefferson Smurfit

Jefferson Smurfit

Jefferson Smurfit can refer to:* Jefferson Smurfit , Irish businessman* Jefferson Smurfit plc, former Irish paper packaging company founded by Jefferson Smurfit...

(by Madison Dearborn

Madison Dearborn

Madison Dearborn Partners is a private equity firm specializing in leveraged buyouts of privately held or publicly traded companies, or divisions of larger companies; recapitalizations of family-owned or closely held companies; balance sheet restructurings; acquisition financings; and growth...

), Houghton Mifflin

Houghton Mifflin

Houghton Mifflin Harcourt is an educational and trade publisher in the United States. Headquartered in Boston's Back Bay, it publishes textbooks, instructional technology materials, assessments, reference works, and fiction and non-fiction for both young readers and adults.-History:The company was...

(by Bain Capital

Bain Capital

Bain Capital LLC is a Boston-based private equity firm founded in 1984 by partners from the consulting firm Bain & Company. Originally conceived as an early-stage, growth-oriented investment fund, Bain Capital today manages approximately $65 billion in assets, and its strategies include private...

, the Blackstone Group and Thomas H. Lee Partners

Thomas H. Lee Partners

Thomas H. Lee Partners is a private equity firm based in Boston, Massachusetts specializing in leveraged buyouts, growth capital, special situations, industry consolidations, and recapitalizations....

) and TRW Automotive

TRW Automotive

TRW Automotive , headquartered in Livonia, Michigan, USA, is a major global supplier of automotive systems, modules and components to automotive original equipment manufacturers and related aftermarkets....

by the Blackstone Group

Blackstone Group

The Blackstone Group L.P. is an American-based alternative asset management and financial services company that specializes in private equity, real estate, and credit and marketable alternative investment strategies, as well as financial advisory services, such as mergers and acquisitions ,...

.

In 2006 USA Today reported retrospectively on the revival of private equity:

- LBOs are back, only they've rebranded themselves private equity and vow a happier ending. The firms say this time it's completely different. Instead of buying companies and dismantling them, as was their rap in the '80s, private equity firms… squeeze more profit out of underperforming companies.

- But whether today's private equity firms are simply a regurgitation of their counterparts in the 1980s… or a kinder, gentler version, one thing remains clear: private equity is now enjoying a "Golden Age." And with returns that triple the S&P 500, it's no wonder they are challenging the public markets for supremacy.

By 2004 and 2005, major buyouts were once again becoming common and market observers were stunned by the leverage levels and financing terms obtained by financial sponsor

Financial sponsor

A financial sponsor is a term commonly used to refer to private equity investment firms, particularly those private equity firms that engage in leveraged buyout or LBO transactions....

s in their buyouts. Some of the notable buyouts of this period include:

- DollaramaDollaramaDollarama is a chain of over 690 dollar stores across Canada. The company is headquartered in Montreal and, since 2009, is Canada's largest retailer of items for 2 dollars or less. The first Dollarama store was created at the shopping centre "Les promenades du St-Laurent" in Matane...

, 2004

- The U.S. chain of "dollar stores" was sold for $850 million to Bain CapitalBain CapitalBain Capital LLC is a Boston-based private equity firm founded in 1984 by partners from the consulting firm Bain & Company. Originally conceived as an early-stage, growth-oriented investment fund, Bain Capital today manages approximately $65 billion in assets, and its strategies include private...

.

- Toys "R" Us, 2004

- A consortiumConsortiumA consortium is an association of two or more individuals, companies, organizations or governments with the objective of participating in a common activity or pooling their resources for achieving a common goal....

of Bain CapitalBain CapitalBain Capital LLC is a Boston-based private equity firm founded in 1984 by partners from the consulting firm Bain & Company. Originally conceived as an early-stage, growth-oriented investment fund, Bain Capital today manages approximately $65 billion in assets, and its strategies include private...

, Kohlberg Kravis Roberts and real estate development company Vornado Realty TrustVornado Realty TrustVornado Realty Trust is a New York based real estate investment trust. It is the inheritor of real estate formerly controlled by companies including Two Guys and Alexander's.- History :...

announced the $6.6 billion acquisition of the toy retailer. A month earlier, Cerberus Capital ManagementCerberus Capital ManagementCerberus Capital Management, L.P. is one of the largest private equity investment firms in the United States. The firm is based in New York City, and run by -year-old financier Steve Feinberg. Former U.S...

, made a $5.5 billion offer for both the toy and baby supplies businesses.

- The Hertz CorporationThe Hertz CorporationHertz Global Holdings Inc is an American car rental company with international locations in 145 countries worldwide.-Early years:The company was founded by Walter L. Jacobs in 1918, who started a car rental operation in Chicago with a dozen Model T Ford cars. In 1923, Jacobs sold it to John D...

, 2005

- Carlyle GroupCarlyle GroupThe Carlyle Group is an American-based global asset management firm, specializing in private equity, based in Washington, D.C. The Carlyle Group operates in four business areas: corporate private equity, real assets, market strategies and fund-of-funds, through its AlpInvest subsidiary...

, Clayton Dubilier & Rice and Merrill LynchMerrill LynchMerrill Lynch is the wealth management division of Bank of America. With over 15,000 financial advisors and $2.2 trillion in client assets it is the world's largest brokerage. Formerly known as Merrill Lynch & Co., Inc., prior to 2009 the firm was publicly owned and traded on the New York...

completed the $15.0 billion leveraged buyout of the largest car rental agency from Ford.

- Metro-Goldwyn-MayerMetro-Goldwyn-MayerMetro-Goldwyn-Mayer Inc. is an American media company, involved primarily in the production and distribution of films and television programs. MGM was founded in 1924 when the entertainment entrepreneur Marcus Loew gained control of Metro Pictures, Goldwyn Pictures Corporation and Louis B. Mayer...

, 2005

- A consortium led by SonySony, commonly referred to as Sony, is a Japanese multinational conglomerate corporation headquartered in Minato, Tokyo, Japan and the world's fifth largest media conglomerate measured by revenues....

and TPG Capital completed the $4.81 billion buyout of the film studio. The consortium also included media-focused firms Providence Equity PartnersProvidence Equity PartnersProvidence Equity Partners is a global private equity investment firm focused on media, entertainment, communications and information investments...

and Quadrangle GroupQuadrangle GroupQuadrangle Group is a private investment firm focused on private equity. The firm invests in middle-market companies within the media, communications and information-based sectors....

as well as DLJ Merchant Banking PartnersDLJ Merchant Banking PartnersDLJ Merchant Banking Partners is a private equity investment firm focused on leveraged buyout transactions. The firm is currently an affiliate of Credit Suisse and traces its roots to Donaldson, Lufkin & Jenrette, the investment bank acquired by Credit Suisse First Boston in 2000...

.

- SunGardSunGardSunGard is a multinational company based in Wayne, Pennsylvania, which provides software and services to education, financial services, and public sector organizations. It was formed in 1983, as a spin-off of the computer services division of Sun Oil Company, during a period of low crude oil...

, 2005

- SunGard was acquired by a consortium of seven private equity investment firms in a transaction valued at $11.3 billion. The partners in the acquisition were Silver Lake PartnersSilver Lake PartnersSilver Lake is a US-based private equity firm focused on leveraged buyout and growth capital investments in technology, technology-enabled and related industries...

, which led the deal as well as Bain CapitalBain CapitalBain Capital LLC is a Boston-based private equity firm founded in 1984 by partners from the consulting firm Bain & Company. Originally conceived as an early-stage, growth-oriented investment fund, Bain Capital today manages approximately $65 billion in assets, and its strategies include private...

, the Blackstone GroupBlackstone GroupThe Blackstone Group L.P. is an American-based alternative asset management and financial services company that specializes in private equity, real estate, and credit and marketable alternative investment strategies, as well as financial advisory services, such as mergers and acquisitions ,...

, Goldman Sachs Capital PartnersGoldman Sachs Capital PartnersGoldman Sachs Capital Partners is the private equity arm of Goldman Sachs, focused on leveraged buyout and growth capital investments globally....

, Kohlberg Kravis Roberts, Providence Equity PartnersProvidence Equity PartnersProvidence Equity Partners is a global private equity investment firm focused on media, entertainment, communications and information investments...

, and Texas Pacific GroupTexas Pacific GroupTPG Capital is one of the largest private equity investment firms globally, focused on leveraged buyout, growth capital and leveraged recapitalization investments in distressed companies and turnaround situations. TPG also manages investment funds specializing in growth capital, venture capital,...

. This represented the largest leveraged buyout completed since the takeover of RJR NabiscoRJR NabiscoRJR Nabisco, Inc., was an American conglomerate formed in 1985 by the merger of Nabisco Brands and R.J. Reynolds Tobacco Company. RJR Nabisco was purchased in 1988 by Kohlberg Kravis Roberts & Co...

at the end of the 1980s leveraged buyout boom. Also, at the time of its announcement, SunGard would be the largest buyout of a technology company in history, a distinction it would cede to the buyout of Freescale SemiconductorFreescale SemiconductorFreescale Semiconductor, Inc. is a producer and designer of embedded hardware, with 17 billion semiconductor chips in use around the world. The company focuses on the automotive, consumer, industrial and networking markets with its product portfolio including microprocessors, microcontrollers,...

. The SunGard transaction is also notable in the number of firms involved in the transaction. The involvement of seven firms in the consortium was criticized by investors in private equity who considered cross-holdings among firms to be generally unattractive.

Age of the mega-buyout

Dot-com bubble

The dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more...

), raised only $25.1 billion in 2006, a 2% percent decline from 2005 and a significant decline from its peak. The following year, despite the onset of turmoil in the credit markets in the summer, saw yet another record year of fundraising with $302 billion of investor commitments to 415 funds.

- Georgia-Pacific Corp, 2005

- In December 2005, Koch IndustriesKoch IndustriesKoch Industries, Inc. , is an American private energy conglomerate based in Wichita, Kansas, with subsidiaries involved in manufacturing, trading and investments. Koch also owns Invista, Georgia-Pacific, Flint Hills Resources, Koch Pipeline, Koch Fertilizer, Koch Minerals and Matador Cattle Company...

, a privately-owned company controlled by Charles G. KochCharles G. KochCharles de Ganahl Koch is co-owner, chairman of the board and chief executive officer of Koch Industries Inc., the second-largest privately held company by revenue in the United States according to a 2010 Forbes survey...

and David H. KochDavid H. KochDavid Hamilton Koch is an American businessman, philanthropist, political activist, and chemical engineer. He is a co-owner and an executive vice president of Koch Industries, a conglomerate that is the second-largest privately held company in the U.S...

, acquired pulp and paperPulp and paper industryThe global pulp and paper industry is dominated by North American , northern European and East Asian countries...

producer Georgia-PacificGeorgia-PacificGeorgia-Pacific LLC is an American pulp and paper company based in Atlanta, Georgia, and is one of the world's leading manufacturers and distributors of tissue, pulp, paper, packaging, building products and related chemicals. As of Fall 2010, the company employed more than 40,000 people at more...

for $21 billion. The acquisition marked the first buyout in excess of $20 billion and largest buyout overall since RJR NabiscoRJR NabiscoRJR Nabisco, Inc., was an American conglomerate formed in 1985 by the merger of Nabisco Brands and R.J. Reynolds Tobacco Company. RJR Nabisco was purchased in 1988 by Kohlberg Kravis Roberts & Co...

and pushed Koch IndustriesKoch IndustriesKoch Industries, Inc. , is an American private energy conglomerate based in Wichita, Kansas, with subsidiaries involved in manufacturing, trading and investments. Koch also owns Invista, Georgia-Pacific, Flint Hills Resources, Koch Pipeline, Koch Fertilizer, Koch Minerals and Matador Cattle Company...

ahead of CargillCargillCargill, Incorporated is a privately held, multinational corporation based in Minnetonka, Minnesota. Founded in 1865, it is now the largest privately held corporation in the United States in terms of revenue. If it were a public company, it would rank, as of 2011, number 13 on the Fortune 500,...

as the largest privately-held company in the US, based on revenue.

- Albertson'sAlbertsons LLCAlbertsons LLC is a North American grocery company based in Boise, Idaho, with over 240 supermarkets located in Arizona, New Mexico, Colorado, Texas, Louisiana, Arkansas, and Florida under the Albertson's and Super Saver Foods banners...

, 2006

- Albertson's accepted a $15.9 billion takeover offer ($9.8 billion in cash and stock and the assumption of $6.1 billion in debt) from SuperValuSupervalu (United States)SuperValu Inc. is a United States grocery retailer and distributor. The corporation, headquartered in Eden Prairie, Minnesota, has been in business for over a century. It is the third-largest food retailing company in the United States , and ranks #51 on the Fortune 100 list.On June 2, 2006,...

to buy most Albertson's grocery operations. The drugstore chain CVS CaremarkCVS CaremarkCVS Caremark Corporation is an integrated pharmacy services provider, combining a United States pharmaceutical services company with a U.S. pharmacy chain...

acquired 700 stand-alone Sav-On and Osco pharmacies and a distribution center, and a group including Cerberus Capital ManagementCerberus Capital ManagementCerberus Capital Management, L.P. is one of the largest private equity investment firms in the United States. The firm is based in New York City, and run by -year-old financier Steve Feinberg. Former U.S...

and the Kimco Realty CorporationKimco Realty CorporationKimco Realty Corporation, , a Real Estate Investment Trust , owns and operates North America’s largest portfolio of neighborhood and community shopping centers. As of September 30, 2011, the company owned interests in 937 shopping center properties comprising 137,100,000 sqft of leasable space...

acquired some 655 underperforming grocery stores and a number of distribution centers.

- Equity Office Properties, 2006 – Blackstone GroupBlackstone GroupThe Blackstone Group L.P. is an American-based alternative asset management and financial services company that specializes in private equity, real estate, and credit and marketable alternative investment strategies, as well as financial advisory services, such as mergers and acquisitions ,...

completes the $37.7 billion acquisition of one of the largest owners of commercial office properties in the US. At the time of its announcement, the Equity Office buyout became the largest in history, surpassing the buyout of HCAHospital Corporation of AmericaHospital Corporation of America is the largest private operator of health care facilities in the world, It is based in Nashville, Tennessee and is widely considered to be the single largest factor in making that city a hotspot for healthcare enterprise.-History:The founders of HCA include Jack C....

. It would later be surpassed by the buyouts of TXUTXUEnergy Future Holdings Corporation is an electric utility company headquartered in Energy Plaza in Downtown Dallas, Texas, United States. The company was known as TXU until its $45 billion leveraged buyout by Kohlberg Kravis Roberts, Texas Pacific Group and Goldman Sachs...

and BCEBell CanadaBell Canada is a major Canadian telecommunications company. Including its subsidiaries such as Bell Aliant, Northwestel, Télébec, and NorthernTel, it is the incumbent local exchange carrier for telephone and DSL Internet services in most of Canada east of Manitoba and in the northern territories,...

(announced but as of the end of the first quarter of 2008 not yet completed).

- Freescale SemiconductorFreescale SemiconductorFreescale Semiconductor, Inc. is a producer and designer of embedded hardware, with 17 billion semiconductor chips in use around the world. The company focuses on the automotive, consumer, industrial and networking markets with its product portfolio including microprocessors, microcontrollers,...

, 2006

- A consortium led by the Blackstone GroupBlackstone GroupThe Blackstone Group L.P. is an American-based alternative asset management and financial services company that specializes in private equity, real estate, and credit and marketable alternative investment strategies, as well as financial advisory services, such as mergers and acquisitions ,...

and including the Carlyle GroupCarlyle GroupThe Carlyle Group is an American-based global asset management firm, specializing in private equity, based in Washington, D.C. The Carlyle Group operates in four business areas: corporate private equity, real assets, market strategies and fund-of-funds, through its AlpInvest subsidiary...

, PermiraPermiraPermira is a United Kingdom-based private equity firm with global reach. The firm advises funds with a total committed capital of approximately €20 billion....

and the TPG Capital completed the $17.6 billion takeover of the semiconductor company. At the time of its announcement, Freescale would be the largest leveraged buyout of a technology company ever, surpassing the 2005 buyout of SunGardSunGardSunGard is a multinational company based in Wayne, Pennsylvania, which provides software and services to education, financial services, and public sector organizations. It was formed in 1983, as a spin-off of the computer services division of Sun Oil Company, during a period of low crude oil...

.

- GMAC, 2006

- General MotorsGeneral MotorsGeneral Motors Company , commonly known as GM, formerly incorporated as General Motors Corporation, is an American multinational automotive corporation headquartered in Detroit, Michigan and the world's second-largest automaker in 2010...

sold a 51% majority stake in its financing arm, GMAC Financial Services to a consortium led by Cerberus Capital ManagementCerberus Capital ManagementCerberus Capital Management, L.P. is one of the largest private equity investment firms in the United States. The firm is based in New York City, and run by -year-old financier Steve Feinberg. Former U.S...

, valuing the company at $16.8 billion. Separately, General MotorsGeneral MotorsGeneral Motors Company , commonly known as GM, formerly incorporated as General Motors Corporation, is an American multinational automotive corporation headquartered in Detroit, Michigan and the world's second-largest automaker in 2010...

sold a 78% stake in GMAC Commercial Holding Corporation, renamed Capmark Financial Group, its real estate venture, to a group of investors headed by Kohlberg Kravis Roberts and Goldman Sachs Capital PartnersGoldman Sachs Capital PartnersGoldman Sachs Capital Partners is the private equity arm of Goldman Sachs, focused on leveraged buyout and growth capital investments globally....

in a $1.5 billion deal. In June 2008, GMAC completed a $60 billion refinancing aimed at improving the liquidity of its struggling mortgage subsidiary, Residential Capital (ResCap) including $1.4 billion of additional equity contributions from the parent and Cerberus.

- HCAHospital Corporation of AmericaHospital Corporation of America is the largest private operator of health care facilities in the world, It is based in Nashville, Tennessee and is widely considered to be the single largest factor in making that city a hotspot for healthcare enterprise.-History:The founders of HCA include Jack C....

, 2006

- Kohlberg Kravis Roberts and Bain CapitalBain CapitalBain Capital LLC is a Boston-based private equity firm founded in 1984 by partners from the consulting firm Bain & Company. Originally conceived as an early-stage, growth-oriented investment fund, Bain Capital today manages approximately $65 billion in assets, and its strategies include private...

, together with Merrill LynchMerrill LynchMerrill Lynch is the wealth management division of Bank of America. With over 15,000 financial advisors and $2.2 trillion in client assets it is the world's largest brokerage. Formerly known as Merrill Lynch & Co., Inc., prior to 2009 the firm was publicly owned and traded on the New York...

and the Frist family (which had founded the company) completed a $31.6 billion acquisition of the hospital company, 17 years after it was taken private for the first time in a management buyout. At the time of its announcement, the HCA buyout would be the first of several to set new records for the largest buyout, eclipsing the 1989 buyout of RJR NabiscoRJR NabiscoRJR Nabisco, Inc., was an American conglomerate formed in 1985 by the merger of Nabisco Brands and R.J. Reynolds Tobacco Company. RJR Nabisco was purchased in 1988 by Kohlberg Kravis Roberts & Co...

. It would later be surpassed by the buyouts of Equity Office Properties, TXUTXUEnergy Future Holdings Corporation is an electric utility company headquartered in Energy Plaza in Downtown Dallas, Texas, United States. The company was known as TXU until its $45 billion leveraged buyout by Kohlberg Kravis Roberts, Texas Pacific Group and Goldman Sachs...

and BCEBell CanadaBell Canada is a major Canadian telecommunications company. Including its subsidiaries such as Bell Aliant, Northwestel, Télébec, and NorthernTel, it is the incumbent local exchange carrier for telephone and DSL Internet services in most of Canada east of Manitoba and in the northern territories,...

(announced but as of the end of the first quarter of 2008 not yet completed).

- Kinder MorganKinder MorganKinder Morgan, Inc. is an American energy company. It is also, through a subsidiary, the general partner of and owner of many of the interests in Kinder Morgan Energy Partners, a publicly traded pipeline and terminal limited partnership....

, 2006

- A consortium of private equity firms including Goldman Sachs Capital PartnersGoldman Sachs Capital PartnersGoldman Sachs Capital Partners is the private equity arm of Goldman Sachs, focused on leveraged buyout and growth capital investments globally....

, Carlyle GroupCarlyle GroupThe Carlyle Group is an American-based global asset management firm, specializing in private equity, based in Washington, D.C. The Carlyle Group operates in four business areas: corporate private equity, real assets, market strategies and fund-of-funds, through its AlpInvest subsidiary...

and Riverstone HoldingsRiverstone HoldingsRiverstone Holdings is a private equity firm focused on leveraged buyout and growth capital investments in the energy and power sectors. The firm focuses on oil and gas exploration, midstream pipeline, electric generation, energy and power services as well as energy and power technology...

completed a $27.5 billion (including assumed debt) acquisition of one of the largest pipeline operators in the US. The buyout was backed by Richard KinderRichard KinderRichard Kinder is the CEO and Chairman of the Board of Kinder Morgan Energy Partners, an energy and pipeline corporation.-Biography:...

, the company's co-founder and a former president of EnronEnronEnron Corporation was an American energy, commodities, and services company based in Houston, Texas. Before its bankruptcy on December 2, 2001, Enron employed approximately 22,000 staff and was one of the world's leading electricity, natural gas, communications, and pulp and paper companies, with...

who was ousted after a dispute with Enron’s founder, Kenneth L. Lay.

- Harrah's EntertainmentHarrah's EntertainmentCaesars Entertainment Corporation is a private gaming corporation that owns and operates over 50 casinos, hotels, and seven golf courses under several brands. The company, based in Paradise, Nevada, is the largest gaming company in the world, with yearly revenues $8.9 billion...

, 2006

- Apollo Global Management and TPG Capital completed the $27.39 billion (including purchase of the outstanding equity for $16.7 billion and assumption of $10.7 billion of outstanding debt) acquisition of the gaming company.

- TDC A/STDC A/STDC A/S is the former telecom monopoly in Denmark. It is now privatized. Thus, it is the biggest company in all aspects of telecommunications in Denmark with landline, mobile, Internet, VHF maritime borderline-radio etc.By the end of 2004, the TDC Group had more than 13.4 mil. customers in Europe:...

, 2006

- The Danish phone company was acquired by Kohlberg Kravis Roberts, Apax PartnersApax PartnersApax Partners LLP is a global private equity and venture capital firm, headquartered in London. The company also operates out of eight other offices in New York, Hong Kong, Mumbai, Tel-Aviv, Madrid, Stockholm, Milan and Munich. The firm, including its various predecessors, have raised...

, Providence Equity PartnersProvidence Equity PartnersProvidence Equity Partners is a global private equity investment firm focused on media, entertainment, communications and information investments...

and PermiraPermiraPermira is a United Kingdom-based private equity firm with global reach. The firm advises funds with a total committed capital of approximately €20 billion....

for €12.2 billion ($15.3 billion), which at the time made it the second largest European buyout in history.

- Sabre HoldingsSabre HoldingsSabre Holdings or Sabre, Inc. is an American privately held travel technology company, encompassing several brands in three global distribution system channels: travel agency, airline, and direct to consumer. These areas are serviced by TSG's three main business groups...

, 2006

- TPG CapitalTexas Pacific GroupTPG Capital is one of the largest private equity investment firms globally, focused on leveraged buyout, growth capital and leveraged recapitalization investments in distressed companies and turnaround situations. TPG also manages investment funds specializing in growth capital, venture capital,...

and Silver Lake PartnersSilver Lake PartnersSilver Lake is a US-based private equity firm focused on leveraged buyout and growth capital investments in technology, technology-enabled and related industries...

announced a deal to buy Sabre HoldingsSabre HoldingsSabre Holdings or Sabre, Inc. is an American privately held travel technology company, encompassing several brands in three global distribution system channels: travel agency, airline, and direct to consumer. These areas are serviced by TSG's three main business groups...

, which operates TravelocityTravelocityTravelocity is an online travel agency and wholly owned subsidiary of Sabre Holdings Corporation, which was a publicly traded company until taken private by Silver Lake Partners and Texas Pacific Group in March 2007...