A

private equity firm is an investment manager that makes investments in the

private equityPrivate equity, in finance, is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange....

of operating companies through a variety of loosely affiliated investment strategies including

leveraged buyoutA leveraged buyout occurs when an investor, typically financial sponsor, acquires a controlling interest in a company's equity and where a significant percentage of the purchase price is financed through leverage...

,

venture capitalVenture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

, and

growth capitalGrowth capital is a type of private equity investment, most often a minority investment, in relatively mature companies that are looking for capital to expand or restructure operations, enter new markets or finance a significant acquisition without a change of control of the business.Companies...

. Often described as a

financial sponsorA financial sponsor is a term commonly used to refer to private equity investment firms, particularly those private equity firms that engage in leveraged buyout or LBO transactions....

, each firm will raise

fundsA private equity fund is a collective investment scheme used for making investments in various equity securities according to one of the investment strategies associated with private equity....

that will be invested in accordance with one or more specific investment strategies.

Typically, a private equity firm will raise pools of capital, or private equity funds that supply the

equityIn accounting and finance, equity is the residual claim or interest of the most junior class of investors in assets, after all liabilities are paid. If liability exceeds assets, negative equity exists...

contributions for these transactions. Private equity firms will receive a periodic

management feeIn the investment advisory industry, a management fee is a periodic payment that is paid by investors in a pooled investment fund to the fund's investment adviser for investment and portfolio management services.-Mutual funds:...

as well as a share in the profits earned (

carried interestCarried interest or carry, in finance, specifically in alternative investment management, is a share of the profits of a successful investment partnership that is paid to the investment manager of the partnership as a form of compensation that is designed as an incentive to the manager to maximize...

) from each

private equity fundA private equity fund is a collective investment scheme used for making investments in various equity securities according to one of the investment strategies associated with private equity....

managed.

Private equity firms, with their investors, will acquire a controlling or substantial minority position in a company and then look to maximize the value of that investment. Private equity firms generally receive a return on their investments through one of the following avenues:

- an Initial Public Offering

An initial public offering or stock market launch, is the first sale of stock by a private company to the public. It can be used by either small or large companies to raise expansion capital and become publicly traded enterprises...

(IPO) — shares of the company are offered to the public, typically providing a partial immediate realization to the financial sponsor as well as a public market into which it can later sell additional shares;

- a merger or acquisition

In business, a takeover is the purchase of one company by another . In the UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to the acquisition of a private company.- Friendly takeovers :Before a bidder makes an offer for another...

— the company is sold for either cash or shares in another company;

- a Recapitalization — cash is distributed to the shareholders (in this case the financial sponsor) and its private equity funds either from cash flow generated by the company or through raising debt

A debt is an obligation owed by one party to a second party, the creditor; usually this refers to assets granted by the creditor to the debtor, but the term can also be used metaphorically to cover moral obligations and other interactions not based on economic value.A debt is created when a...

or other securities to fund the distribution.

Ranking private equity firms

According to an updated 2008 ranking created by industry magazine Private Equity International (The PEI 50), the

largest private equity firms include

The Carlyle GroupThe Carlyle Group is an American-based global asset management firm, specializing in private equity, based in Washington, D.C. The Carlyle Group operates in four business areas: corporate private equity, real assets, market strategies and fund-of-funds, through its AlpInvest subsidiary...

, Kohlberg Kravis Roberts,

Goldman Sachs Principal Investment GroupThe Goldman Sachs Group, Inc. is an American multinational bulge bracket investment banking and securities firm that engages in global investment banking, securities, investment management, and other financial services primarily with institutional clients...

,

The Blackstone GroupThe Blackstone Group L.P. is an American-based alternative asset management and financial services company that specializes in private equity, real estate, and credit and marketable alternative investment strategies, as well as financial advisory services, such as mergers and acquisitions ,...

,

Bain CapitalBain Capital LLC is a Boston-based private equity firm founded in 1984 by partners from the consulting firm Bain & Company. Originally conceived as an early-stage, growth-oriented investment fund, Bain Capital today manages approximately $65 billion in assets, and its strategies include private...

and TPG Capital. These firms are typically direct investors in companies rather than investors in the private equity asset class and for the most part the largest private equity investment firms focused primarily on

leveraged buyoutA leveraged buyout occurs when an investor, typically financial sponsor, acquires a controlling interest in a company's equity and where a significant percentage of the purchase price is financed through leverage...

s rather than

venture capitalVenture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

.

PreqinPreqin is a research and consultancy firm focusing on alternative asset classes. The company covers private equity, real estate, infrastructure, and hedge funds and is headquartered in London, UK, with additional offices in New York and Singapore. Preqin maintains a number of publications and...

ltd (formerly known as Private Equity Intelligence), an independent data providers provides a ranking of the 25 largest private equity investment managers. Among the largest firms in that ranking were

AlpInvest PartnersAlpInvest Partners is a private equity investment manager and at the end of 2009 globally managed over €42 billion ....

,

AXA Private EquityAXA Private Equity is a diversified private equity firm with $ 25 billion of assets managed or advised and with an international reach across Europe, North America and Asia...

,

AIG InvestmentsAIG is American International Group, a major American insurance corporation.AIG may also refer to:* And-inverter graph, a concept in computer theory* Answers in Genesis, a creationist organization in the U.S.* Arta Industrial Group in Iran...

,

Goldman Sachs Private Equity GroupThe Goldman Sachs Group, Inc. is an American multinational bulge bracket investment banking and securities firm that engages in global investment banking, securities, investment management, and other financial services primarily with institutional clients...

and

Pantheon VenturesPantheon is a private equity investment manager, operating through a series of fund of funds as well as a publicly traded private equity vehicle, Pantheon International Participations. Pantheon invests through new private equity funds as well as secondary market purchases of existing private...

.

Because private equity firms are continuously in the process of raising, investing and distributing their private equity funds, capital raised can often be the easiest to measure. Other metrics can include the total value of companies purchased by a firm or an estimate of the size of a firm's active portfolio plus capital available for new investments. As with any list that focuses on size, the list does not provide any indication as to relative investment performance of these funds or managers.

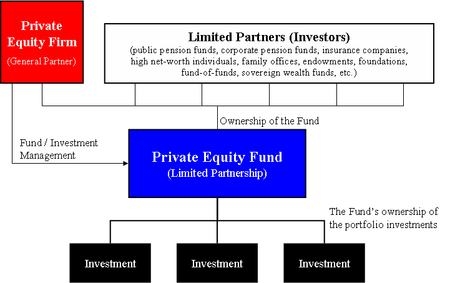

Private equity firms and private equity funds: an Illustration

The following is an illustration of the difference between a private equity firm and a

private equity fundA private equity fund is a collective investment scheme used for making investments in various equity securities according to one of the investment strategies associated with private equity....

:

style='mso-cellspacing:2.0pt;mso-yfti-tbllook:480;mso-padding-alt:0in 5.4pt 0in 5.4pt;

mso-border-insideh:.75pt outset windowtext;mso-border-insidev:.75pt outset windowtext'>

Private Equity Firm

|

Private Equity Fund

|

Private Equity Portfolio Investments (Partial List)

|

Kohlberg Kravis Roberts & Co. (KKR)

|

KKR 2006 Fund, L.P.

($17.6 billion of commitments)

|

Alliance BootsAlliance Boots GmbH is a leading international, pharmacy-led health and beauty group. It has two core business activities - pharmacy-led health and beauty retailing, and pharmaceutical wholesaling and distribution - and has a presence in more than 25 countries...

|

|

|

Dollar GeneralDollar General Corp. is a U.S. chain of variety stores headquartered in Goodlettsville, Tennessee. As of January 2011, Dollar General operated over 9,300 stores in 35 U.S. states....

|

|

|

Energy Future Holdings Corporation |

|

|

First Data Corp

|

|

|

Hospital Corporation of AmericaHospital Corporation of America is the largest private operator of health care facilities in the world, It is based in Nashville, Tennessee and is widely considered to be the single largest factor in making that city a hotspot for healthcare enterprise.-History:The founders of HCA include Jack C....

(HCA)

|

|

|

Nielsen Company

|

|

|

NXP Semiconductors

|

See also

- Private equity

Private equity, in finance, is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange....

- Private equity fund

A private equity fund is a collective investment scheme used for making investments in various equity securities according to one of the investment strategies associated with private equity....

- List of private equity firms

- Leveraged buyout

A leveraged buyout occurs when an investor, typically financial sponsor, acquires a controlling interest in a company's equity and where a significant percentage of the purchase price is financed through leverage...

- Management buyout

A management buyout is a form of acquisition where a company's existing managers acquire a large part or all of the company.- Overview :Management buyouts are similar in all major legal aspects to any other acquisition of a company...

- History of private equity and venture capital

The history of private equity and venture capital and the development of these asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital...

The source of this article is

wikipedia, the free encyclopedia. The text of this article is licensed under the

GFDL.