Private equity secondary market

Encyclopedia

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity

and other alternative investment

funds.

Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors. For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.

Driven by strong demand for private equity exposure, a significant amount of capital has been committed to dedicated secondary market funds from investors looking to increase and diversify their private equity exposure.

, AXA Private Equity

, Coller Capital

, HarbourVest Partners

, Lexington Partners

, Pantheon Ventures

, Partners Group

, Neuberger Berman

, and Paul Capital

.

Other major independent secondary firms with circa $1–3 billion of current dedicated capital to secondaries include Adams Street Partners, Greenpark Capital, Landmark Partners

, LGT Capital Partners, Newbury Partners, Pomona Capital, Saints Capital, and W Capital Partners.

Additionally, major investment banking firms including Credit Suisse

, Deutsche Bank

, Goldman Sachs

, JPMorgan Chase, Morgan Stanley

have active secondary investment programs. Other institutional investors typically have appetite for secondary interests. More and more primary investors, whether private equity funds-of-funds or other institutional investors, also allocate some of their primary program to secondaries.

Within the secondary arena, certain smaller specialized firms, including Industry Ventures, Lake Street Capital, Nova Capital Management, Saints Capital, Sobera Capital, Verdane Capital, Vision Capital and W Capital, focus on purchasing portfolios of direct investments in operating companies, referred to as secondary directs. Other niches within the secondary market include purchases of interests in fund-of-funds and secondary funds (Montauk Triguard) and purchases of interests in real estate funds (Liquid Realty and Madison Harbor Capital).

While intermediation in the secondary market is still not as pervasive as in corporate mergers and acquisitions

, leading advisors to secondary market sellers include investments banks (Houlihan Lokey

, Credit Suisse

, Lazard

, and UBS

), dedicated boutique firms (Cogent Partners

), electronic exchanges (NYPPEX, SecondMarket

), as well as established fund placement agents (Campbell Lutyens

, Park Hill Group, Probitas Partners

, and Triago

). Since 2008, there have been a significant number of new entrants to this space, hoping to capitalize on what is perceived to be a growing market opportunity.

Secondary transactions can be generally split into two basic categories:

Secondary transactions can be generally split into two basic categories:

of direct investments in operating companies, rather than limited partnership interests in investment funds. These portfolios historically have originated from either corporate development programs or large financial institutions. Typically, this category can be subdivided as follows:

, was likely the first investment firm to begin purchasing private equity interests in existing venture capital, leveraged buyout and mezzanine funds, as well as direct secondary interests in private companies. Early pioneers in the secondary market include Jeremy Coller

, the founder of UK-based Coller Capital

, Arnaud Isnard, who worked with Carr at VCFA and would later form ARCIS, a secondary firm based in France as well as Stanley Alfeld, founder of Landmark Partners

.

In the years immediately following the dot-com crash

, many investors sought an early exit from their outstanding commitments to the private equity asset class, particularly venture capital. As a result, the nascent secondary market became an increasingly active sector within private equity in these years. Secondary transaction volume increased from historical levels of 2% or 3% of private equity commitments to 5% of the addressable market. Many of the largest financial institutions (e.g., Deutsche Bank

, Abbey National

, UBS AG

) sold portfolios of direct investments and “pay-to-play” funds portfolios that were typically used as a means to gain entry to lucrative leveraged finance

and mergers and acquisitions

assignments but had created hundreds of millions of dollars of losses.

and other private equity investments worsened. Financial institutions, including Citigroup

and ABN AMRO

as well as affiliates of AIG

and Macquarie were prominent sellers.

With the crash in global markets from in the fall of 2008, more sellers entered the market including publicly traded private equity vehicles

, endowments, foundations and pension funds. Many sellers were facing significant overcommittments to their private equity programs and in certain cases significant unfunded commitments to new private equity funds were prompting liquidity concerns. With the dramatic increase in the number of distressed sellers entering the market at the same time, the pricing level in the secondary market dropped rapidly. In these transactions, sellers were willing to accept major discounts to current valuations (typically in reference to the previous quarterly net asset value published by the underlying private equity

fund manager) as they faced the prospect of further asset write-downs in their existing portfolios or as they had to achieve liquidity under a limited amount of time.

At the same time, the outlook for buyers became more uncertain and a number of prominent secondary players were slow to purchase assets. In certain cases, buyers that had agreed to secondary purchases began to exercise material adverse change

(MAC) clauses in their contracts to walk away from deals that they had agreed to only weeks before.

Private equity fund managers published their December 2008 valuations with substantial write-downs to reflect the falling value of the underlying companies. As a result, the discount to Net Asset Value offered by buyers to sellers of such assets was reduced. However, activity in the secondary market fell dramatically from 2008 levels as market participants continued to struggle to agree on price. Reflecting the gains in the public equity markets

since the end of the first quarter, the dynamics in the secondary market continued to evolve. Certain buyers that had been reluctant to invest earlier in the year began to return and non-traditional investors were more active, particularly for unfunded commitments, than they had been in previous years.

Since mid-2010, the secondary market has seen increased levels of activity resulting from improved pricing conditions. Through the middle of 2011, the level of activity has continued to remain at elevated levels as sellers have entered the market with large portfolios. Also, since middle of 2009, secondary

investment firms have been one of the key recipient of the improved private equity fundraising market conditions. Several fund managers have raised dedicated secondary funds, sometimes exceeding their fundraising targets.

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1994

1992

1991

1989

1982

Private equity

Private equity, in finance, is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange....

and other alternative investment

Alternative investment

An alternative investment is an investment product other than the traditional investments of stocks, bonds, cash, or property. The term is a relatively loose one and includes tangible assets such as art, wine, antiques, coins, or stamps and some financial assets such as commodities, private equity,...

funds.

Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors. For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.

Driven by strong demand for private equity exposure, a significant amount of capital has been committed to dedicated secondary market funds from investors looking to increase and diversify their private equity exposure.

Secondary market participants

As of 2009, it was estimated that there are dozens of dedicated firms and institutional investors that engage in the purchase of private equity interests in the secondary market with upwards of $30 billion of capital available for such transactions. The market for secondary interests is still highly fragmented. Leading secondary investment firms with current dedicated secondary capital in excess of circa $3 billion include: AlpInvest PartnersAlpInvest Partners

AlpInvest Partners is a private equity investment manager and at the end of 2009 globally managed over €42 billion ....

, AXA Private Equity

AXA Private Equity

AXA Private Equity is a diversified private equity firm with $ 25 billion of assets managed or advised and with an international reach across Europe, North America and Asia...

, Coller Capital

Coller Capital

Coller Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

, HarbourVest Partners

HarbourVest Partners

HarbourVest Partners is a private equity fund of funds and one of the largest private equity investment managers globally. The firm invests in all types of private equity funds, including venture capital and leveraged buyout funds, and also directly in operating companies...

, Lexington Partners

Lexington Partners

Lexington Partners, is a leading independent manager of secondary private equity and co-Investment funds, founded in 1994. Lexington Partners manages approximately $18 billion of which $3.8 billion was committed to the firm's sixth and latest fund .Lexington was founded by former investment...

, Pantheon Ventures

Pantheon Ventures

Pantheon is a private equity investment manager, operating through a series of fund of funds as well as a publicly traded private equity vehicle, Pantheon International Participations. Pantheon invests through new private equity funds as well as secondary market purchases of existing private...

, Partners Group

Partners Group

Partners Group is a global private markets management firm with over EUR 20 billion in investment programs under management in private equity, private debt, private real estate, private infrastructure and absolute return strategies...

, Neuberger Berman

Neuberger Berman

Neuberger Berman Group LLC, through its subsidiaries is an investment management firm that provides financial services for high net worth individuals and institutional investors. With approximately $200 billion in asset under management, it is among the largest private employee-controlled asset...

, and Paul Capital

Paul Capital

Paul Capital is a private equity investment firm made up of a fund of funds, secondary investments and a healthcare direct investment business...

.

Other major independent secondary firms with circa $1–3 billion of current dedicated capital to secondaries include Adams Street Partners, Greenpark Capital, Landmark Partners

Landmark Partners

Landmark Partners, founded in 1989, is a leading investor in the Private equity secondary market . It is based in Simsbury, Connecticut.The firm was founded by Stanley Alfeld.-Investment Program:...

, LGT Capital Partners, Newbury Partners, Pomona Capital, Saints Capital, and W Capital Partners.

Additionally, major investment banking firms including Credit Suisse

Credit Suisse

The Credit Suisse Group AG is a Swiss multinational financial services company headquartered in Zurich, with more than 250 branches in Switzerland and operations in more than 50 countries.-History:...

, Deutsche Bank

Deutsche Bank

Deutsche Bank AG is a global financial service company with its headquarters in Frankfurt, Germany. It employs more than 100,000 people in over 70 countries, and has a large presence in Europe, the Americas, Asia Pacific and the emerging markets...

, Goldman Sachs

Goldman Sachs

The Goldman Sachs Group, Inc. is an American multinational bulge bracket investment banking and securities firm that engages in global investment banking, securities, investment management, and other financial services primarily with institutional clients...

, JPMorgan Chase, Morgan Stanley

Morgan Stanley

Morgan Stanley is a global financial services firm headquartered in New York City serving a diversified group of corporations, governments, financial institutions, and individuals. Morgan Stanley also operates in 36 countries around the world, with over 600 offices and a workforce of over 60,000....

have active secondary investment programs. Other institutional investors typically have appetite for secondary interests. More and more primary investors, whether private equity funds-of-funds or other institutional investors, also allocate some of their primary program to secondaries.

Within the secondary arena, certain smaller specialized firms, including Industry Ventures, Lake Street Capital, Nova Capital Management, Saints Capital, Sobera Capital, Verdane Capital, Vision Capital and W Capital, focus on purchasing portfolios of direct investments in operating companies, referred to as secondary directs. Other niches within the secondary market include purchases of interests in fund-of-funds and secondary funds (Montauk Triguard) and purchases of interests in real estate funds (Liquid Realty and Madison Harbor Capital).

While intermediation in the secondary market is still not as pervasive as in corporate mergers and acquisitions

Mergers and acquisitions

Mergers and acquisitions refers to the aspect of corporate strategy, corporate finance and management dealing with the buying, selling, dividing and combining of different companies and similar entities that can help an enterprise grow rapidly in its sector or location of origin, or a new field or...

, leading advisors to secondary market sellers include investments banks (Houlihan Lokey

Houlihan Lokey

Houlihan Lokey, Inc. is the largest private investment bank in the world. Headquartered in Los Angeles, California, the firm advises middle-market and large public and private companies. Its main service lines include mergers and acquisitions, capital markets, restructuring, fairness opinions,...

, Credit Suisse

Credit Suisse

The Credit Suisse Group AG is a Swiss multinational financial services company headquartered in Zurich, with more than 250 branches in Switzerland and operations in more than 50 countries.-History:...

, Lazard

Lazard

Lazard Ltd is the parent company of Lazard Group LLC, a global, independent investment bank with approximately 2,300 employees in 42 cities across 27 countries throughout Europe, North America, Asia, Australia, Central and South America...

, and UBS

UBS AG

UBS AG is a Swiss global financial services company headquartered in Basel and Zürich, Switzerland, which provides investment banking, asset management, and wealth management services for private, corporate, and institutional clients worldwide, as well as retail clients in Switzerland...

), dedicated boutique firms (Cogent Partners

Cogent Partners

Cogent Partners is a boutique, private equity-focused investment bank and advisory firm and was one of the first advisory firms dedicated to transactions in the private equity secondary market . The firm, which was founded in 2002, provides an array of sell-side advisory services such as secondary...

), electronic exchanges (NYPPEX, SecondMarket

SecondMarket

SecondMarket is an online marketplace for buying and selling illiquid assets, including auction‐rate securities, bankruptcy claims, limited partnership interests, private company stock, restricted securities in public companies, structured products, and whole loans.SecondMarket's participants...

), as well as established fund placement agents (Campbell Lutyens

Campbell Lutyens

Campbell Lutyens is an independent private equity advisory firm exclusively focused on primary fundraising and secondary transactions in the private equity and infrastructure markets...

, Park Hill Group, Probitas Partners

Probitas Partners

Probitas Partners is a global investment bank focused on raising capital as a placement agent for private equity fund sponsors as well as providing portfolio management and liquidity solutions, through the private equity secondary market, for investors in private equity. The firm operates through...

, and Triago

Triago

Triago is a leading global placement agent, specializing in raising capital for private equity investment firms from a range of institutional investors...

). Since 2008, there have been a significant number of new entrants to this space, hoping to capitalize on what is perceived to be a growing market opportunity.

Types of secondary transactions

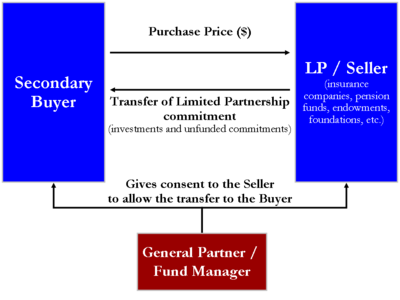

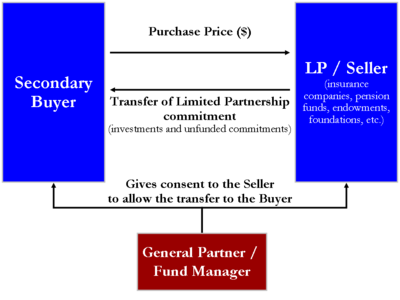

Sale of limited partnership interests

The most common secondary transaction, this category includes the sale of an investor's interest in a private equity fund or portfolio of interests in various funds through the transfer of the investor's limited partnership interest in the fund(s). Nearly all type of private equity funds (e.g., including buyout, growth equity, venture capital, mezzanine, distressed and real estate) can be sold in the secondary market. The transfer of the limited partnership interest typically will allow the investor to receive some liquidity for the funded investments as well as a release from any remaining unfunded obligations to the fund. In addition to traditional cash sales, sales of limited partnership interests are being consummated through a number of structured transactions:- Structured joint ventures — Includes a wide variety of negotiated transactions between the buyer and seller that typically is customized to the specific needs of the buyer and seller. Typically, the buyer and seller agree on an economic arrangement that is more complex than a simple transfer of 100% ownership of the limited partnership interest.

- SecuritizationSecuritizationSecuritization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or Collateralized mortgage obligation , to...

— An investor contributes its limited partnership interests into a new vehicle (a collateralized fund obligationCollateralized Fund ObligationA collateralized fund obligation is a form of securitization involving private equity fund or hedge fund assets, similar to collateralized debt obligations...

vehicle) which in turn issues notes and generates partial liquidity for the seller. Typically, the investor will also sell a portion of the equity in the leveraged vehicle. Also referred to as a collateralized fund obligation vehicle.

- Stapled transactions — (commonly referred to as "stapled secondaries") Occurs when a private equity firm (the GP) is raising a new fund. A secondary buyer purchases an interest in an existing fund from a current investor and makes a new commitment to the new fund being raised by the GP. These transactions are often initiated by private equity firms during the fundraising process. They had become less and less frequent during 2008 and 2009 as the appetite for primary investments shrunk. Since 2009, a limited number of spinout transactions have been completed involving captive teams within financial institutions.

Sale of direct interests

Secondary directs or synthetic secondaries — This category refers to the sale of portfoliosPortfolio (finance)

Portfolio is a financial term denoting a collection of investments held by an investment company, hedge fund, financial institution or individual.-Definition:The term portfolio refers to any collection of financial assets such as stocks, bonds and cash...

of direct investments in operating companies, rather than limited partnership interests in investment funds. These portfolios historically have originated from either corporate development programs or large financial institutions. Typically, this category can be subdivided as follows:

- Secondary direct — The sale of a captive portfolio of direct investments to a secondary buyer that will either manage the investments themselves or arrange for a new manager for the investments. One of the most notable example of a corporate seller engaging into a direct portfolios sale is the two consecutive sales of direct portfolios from AEA Technology to Coller Capital and Vision Capital in 2005 and 2006 respectively.

- Synthetic secondary / spinout — Under a synthetic secondary transaction, secondary investors acquire an interest in a new limited partnership that is formed specifically to hold a portfolio of direct investments. Typically the manager of the new fund had historically managed the assets as a captive portfolio. The most notable example of this type of transaction is the spinout of MidOcean PartnersMidOcean PartnersMidOcean Partners is a private equity firm specializing in leveraged buyouts, recapitalizations and growth capital investments in middle-market companies...

from Deutsche BankDeutsche BankDeutsche Bank AG is a global financial service company with its headquarters in Frankfurt, Germany. It employs more than 100,000 people in over 70 countries, and has a large presence in Europe, the Americas, Asia Pacific and the emerging markets...

in 2003.

- Tail-end — This category typically refers to the sale of the remaining assets in a private equity fund that is approaching, or has exceeded, its anticipated life. A tail-end transaction allows the manager of the fund to achieve liquidity for the fund's investors.

- Structured secondary — This category typically refers to the structured sale of a portfolio of private equity fund interests whereby the seller keeps some/all of the fund interests on its balance sheet but the buyer agrees to fund all future capital calls of the seller's portfolio in exchange for a preferred return secured against future distributions of the seller's portfolio. These type of secondary transactions have becoming increasingly explored since mid 2008 and throughout 2009 as many sellers did not want to take a loss through a straight sale of their portfolio at a steep discount but instead were ready to abandon some of the future upside in exchange for a bridge of the uncalled capital commitments.

History

Early history

The Venture Capital Fund of America (today VCFA Group), founded in 1982 by Dayton CarrDayton Carr

Dayton Carr is the founder of Venture Capital Fund of America a private equity firm that is credited with inventing the Private equity secondary market....

, was likely the first investment firm to begin purchasing private equity interests in existing venture capital, leveraged buyout and mezzanine funds, as well as direct secondary interests in private companies. Early pioneers in the secondary market include Jeremy Coller

Jeremy Coller

Jeremy Coller is a British financial executive. He is CEO and CIO of Coller Capital, a British private equity firm, which he founded in 1990.For 20 years, Jeremy Coller has played a key role in the evolution of the secondary market for private equity...

, the founder of UK-based Coller Capital

Coller Capital

Coller Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

, Arnaud Isnard, who worked with Carr at VCFA and would later form ARCIS, a secondary firm based in France as well as Stanley Alfeld, founder of Landmark Partners

Landmark Partners

Landmark Partners, founded in 1989, is a leading investor in the Private equity secondary market . It is based in Simsbury, Connecticut.The firm was founded by Stanley Alfeld.-Investment Program:...

.

In the years immediately following the dot-com crash

Dot-com bubble

The dot-com bubble was a speculative bubble covering roughly 1995–2000 during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more...

, many investors sought an early exit from their outstanding commitments to the private equity asset class, particularly venture capital. As a result, the nascent secondary market became an increasingly active sector within private equity in these years. Secondary transaction volume increased from historical levels of 2% or 3% of private equity commitments to 5% of the addressable market. Many of the largest financial institutions (e.g., Deutsche Bank

Deutsche Bank

Deutsche Bank AG is a global financial service company with its headquarters in Frankfurt, Germany. It employs more than 100,000 people in over 70 countries, and has a large presence in Europe, the Americas, Asia Pacific and the emerging markets...

, Abbey National

Abbey National

Abbey National plc was a UK-based bank and former building society, which latterly traded under the Abbey brand name. It became a wholly owned subsidiary of Grupo Santander of Spain in 2004, and was rebranded as Santander in January 2010, forming Santander UK along with the savings business of the...

, UBS AG

UBS AG

UBS AG is a Swiss global financial services company headquartered in Basel and Zürich, Switzerland, which provides investment banking, asset management, and wealth management services for private, corporate, and institutional clients worldwide, as well as retail clients in Switzerland...

) sold portfolios of direct investments and “pay-to-play” funds portfolios that were typically used as a means to gain entry to lucrative leveraged finance

Leverage (finance)

In finance, leverage is a general term for any technique to multiply gains and losses. Common ways to attain leverage are borrowing money, buying fixed assets and using derivatives. Important examples are:* A public corporation may leverage its equity by borrowing money...

and mergers and acquisitions

Mergers and acquisitions

Mergers and acquisitions refers to the aspect of corporate strategy, corporate finance and management dealing with the buying, selling, dividing and combining of different companies and similar entities that can help an enterprise grow rapidly in its sector or location of origin, or a new field or...

assignments but had created hundreds of millions of dollars of losses.

2004 to 2007

The surge in activity in the secondary market, between 2004 and 2007, prompted new entrants to the market. It was during this time that the market evolved from what had previously been a relatively small niche into a functioning and important area of the private equity industry. Prior to 2004, the market was still characterized by limited liquidity and distressed prices with private equity funds trading at significant discounts to fair value. Beginning in 2004 and extending through 2007, the secondary market transformed into a more efficient market in which assets for the first time traded at or above their estimated fair values and liquidity increased dramatically. During these years, the secondary market transitioned from a niche sub-category in which the majority of sellers were distressed to an active market with ample supply of assets and numerous market participants. By 2006, active portfolio management had become far more common in the increasingly developed secondary market, and an increasing number of investors had begun to pursue secondary sales to rebalance their private equity portfolios. The continued evolution of the private equity secondary market reflected the maturation and evolution of the larger private equity industry.Since 2008 and the credit crisis

The secondary market for private equity interests has entered a new phase in 2008 with the onset and acceleration of the credit crunch. Pricing in the market fell steadily throughout 2008 as the supply of interests began to greatly outstrip demand and the outlook for leveraged buyoutLeveraged buyout

A leveraged buyout occurs when an investor, typically financial sponsor, acquires a controlling interest in a company's equity and where a significant percentage of the purchase price is financed through leverage...

and other private equity investments worsened. Financial institutions, including Citigroup

Citigroup

Citigroup Inc. or Citi is an American multinational financial services corporation headquartered in Manhattan, New York City, New York, United States. Citigroup was formed from one of the world's largest mergers in history by combining the banking giant Citicorp and financial conglomerate...

and ABN AMRO

ABN AMRO

ABN AMRO Bank N.V. is a Dutch state-owned bank with headquarters in Amsterdam. It was re-established, in its current form, in 2009 following the acquisition and break up of ABN AMRO Group by a banking consortium consisting of Royal Bank of Scotland Group, Santander and Fortis...

as well as affiliates of AIG

AIG

AIG is American International Group, a major American insurance corporation.AIG may also refer to:* And-inverter graph, a concept in computer theory* Answers in Genesis, a creationist organization in the U.S.* Arta Industrial Group in Iran...

and Macquarie were prominent sellers.

With the crash in global markets from in the fall of 2008, more sellers entered the market including publicly traded private equity vehicles

Publicly traded private equity

Publicly traded private equity refers to an investment firm or investment vehicle, which makes investments conforming to one of the various private equity strategies, and is listed on a public stock exchange.There are fundamentally two separate opportunities that private equity firms...

, endowments, foundations and pension funds. Many sellers were facing significant overcommittments to their private equity programs and in certain cases significant unfunded commitments to new private equity funds were prompting liquidity concerns. With the dramatic increase in the number of distressed sellers entering the market at the same time, the pricing level in the secondary market dropped rapidly. In these transactions, sellers were willing to accept major discounts to current valuations (typically in reference to the previous quarterly net asset value published by the underlying private equity

Private equity

Private equity, in finance, is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange....

fund manager) as they faced the prospect of further asset write-downs in their existing portfolios or as they had to achieve liquidity under a limited amount of time.

At the same time, the outlook for buyers became more uncertain and a number of prominent secondary players were slow to purchase assets. In certain cases, buyers that had agreed to secondary purchases began to exercise material adverse change

Material adverse change

A material adverse change - also formulated as a Material adverse event or Material adverse effect - contingency is a legal provision often found in mergers and acquisitions contracts and venture financing agreements that enables the acquirer to refuse to complete the acquisition or merger or...

(MAC) clauses in their contracts to walk away from deals that they had agreed to only weeks before.

Private equity fund managers published their December 2008 valuations with substantial write-downs to reflect the falling value of the underlying companies. As a result, the discount to Net Asset Value offered by buyers to sellers of such assets was reduced. However, activity in the secondary market fell dramatically from 2008 levels as market participants continued to struggle to agree on price. Reflecting the gains in the public equity markets

Stock market

A stock market or equity market is a public entity for the trading of company stock and derivatives at an agreed price; these are securities listed on a stock exchange as well as those only traded privately.The size of the world stock market was estimated at about $36.6 trillion...

since the end of the first quarter, the dynamics in the secondary market continued to evolve. Certain buyers that had been reluctant to invest earlier in the year began to return and non-traditional investors were more active, particularly for unfunded commitments, than they had been in previous years.

Since mid-2010, the secondary market has seen increased levels of activity resulting from improved pricing conditions. Through the middle of 2011, the level of activity has continued to remain at elevated levels as sellers have entered the market with large portfolios. Also, since middle of 2009, secondary

Secondary

Secondary is an adjective meaning "second" or "second hand". It may refer to:* The group of defensive backs in American football and Canadian football* An obsolete name for the Mesozoic in geosciences...

investment firms have been one of the key recipient of the improved private equity fundraising market conditions. Several fund managers have raised dedicated secondary funds, sometimes exceeding their fundraising targets.

Milestones

The following is a timeline of some of the most notable secondary transactions and other milestones:2011

- AXA Private EquityAXA Private EquityAXA Private Equity is a diversified private equity firm with $ 25 billion of assets managed or advised and with an international reach across Europe, North America and Asia...

completes a series of large portfolio purchases including $1.7 billion of private equity fund assets from CitigroupCitigroupCitigroup Inc. or Citi is an American multinational financial services corporation headquartered in Manhattan, New York City, New York, United States. Citigroup was formed from one of the world's largest mergers in history by combining the banking giant Citicorp and financial conglomerate...

and $740 million of fund assets from Barclays. - CalPERSCalPERSThe California Public Employees' Retirement System or CalPERS is an agency in the California executive branch that "manages pension and health benefits for more than 1.6 million California public employees, retirees, and their families"...

sells an $800 million portfolio of private equity funds to AlpInvest PartnersAlpInvest PartnersAlpInvest Partners is a private equity investment manager and at the end of 2009 globally managed over €42 billion ....

.

2010

- Lloyds sells a portfolio comprising 33 funds interests, primarily European mid-market funds, for a value of $730m to Lexington PartnersLexington PartnersLexington Partners, is a leading independent manager of secondary private equity and co-Investment funds, founded in 1994. Lexington Partners manages approximately $18 billion of which $3.8 billion was committed to the firm's sixth and latest fund .Lexington was founded by former investment...

. In a separate transaction Lloyds sells a £480 million portfolio to Coller CapitalColler CapitalColler Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

through a joint venture.

- CitigroupCitigroupCitigroup Inc. or Citi is an American multinational financial services corporation headquartered in Manhattan, New York City, New York, United States. Citigroup was formed from one of the world's largest mergers in history by combining the banking giant Citicorp and financial conglomerate...

sells a $1 billion portfolio of funds interests and co-investments to Lexington PartnersLexington PartnersLexington Partners, is a leading independent manager of secondary private equity and co-Investment funds, founded in 1994. Lexington Partners manages approximately $18 billion of which $3.8 billion was committed to the firm's sixth and latest fund .Lexington was founded by former investment...

. As part of the deal, StepStone Group will take over management of a portfolio of funds-of-funds and buyout co-investments previously run by Citi Private Equity . - Bank of AmericaBank of AmericaBank of America Corporation, an American multinational banking and financial services corporation, is the second largest bank holding company in the United States by assets, and the fourth largest bank in the U.S. by market capitalization. The bank is headquartered in Charlotte, North Carolina...

sells a portfolio comprising 60 funds interests for a value of $1.9 billion to AXA Private EquityAXA Private EquityAXA Private Equity is a diversified private equity firm with $ 25 billion of assets managed or advised and with an international reach across Europe, North America and Asia...

.

2009

- 3i3i3i Group plc is a multinational private equity and venture capital company headquartered in London, United Kingdom. It has offices in 13 countries across Asia, Europe and the Americas and had total assets under management of £12.7 billion as at 31 March 2011...

sells its European venture capital portfolio comprising interests in 30 companies for $220m to DFJ Esprit, a venture capital fund backed by two global private equity investors - HarbourVest PartnersHarbourVest PartnersHarbourVest Partners is a private equity fund of funds and one of the largest private equity investment managers globally. The firm invests in all types of private equity funds, including venture capital and leveraged buyout funds, and also directly in operating companies...

and Coller CapitalColler CapitalColler Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

. - APEN (fka AIGAIGAIG is American International Group, a major American insurance corporation.AIG may also refer to:* And-inverter graph, a concept in computer theory* Answers in Genesis, a creationist organization in the U.S.* Arta Industrial Group in Iran...

Private Equity) refinances its private equity fund portfolio through a $225m structured secondary transaction led by Fortress Investment GroupFortress Investment GroupFortress Investment Group LLC is an investment management firm based in New York, New York. The company went public on February 9, 2007.-History:...

.

2008

- ABN AMROABN AMROABN AMRO Bank N.V. is a Dutch state-owned bank with headquarters in Amsterdam. It was re-established, in its current form, in 2009 following the acquisition and break up of ABN AMRO Group by a banking consortium consisting of Royal Bank of Scotland Group, Santander and Fortis...

sells a portfolio of private equity interests in 32 European companies managed by AAC Capital Partners to a consortium comprising Goldman SachsGoldman SachsThe Goldman Sachs Group, Inc. is an American multinational bulge bracket investment banking and securities firm that engages in global investment banking, securities, investment management, and other financial services primarily with institutional clients...

, AlpInvest PartnersAlpInvest PartnersAlpInvest Partners is a private equity investment manager and at the end of 2009 globally managed over €42 billion ....

, and CPPCanada Pension PlanThe Canada Pension Plan is a contributory, earnings-related social insurance program. It forms one of the two major components of Canada's public retirement income system, the other component being Old Age Security...

for $1.5 billion.

- Macquarie Capital Alliance, in June 2008, announced a takeoverTakeoverIn business, a takeover is the purchase of one company by another . In the UK, the term refers to the acquisition of a public company whose shares are listed on a stock exchange, in contrast to the acquisition of a private company.- Friendly takeovers :Before a bidder makes an offer for another...

offer from a consortium of private equity secondary firms including AlpInvest PartnersAlpInvest PartnersAlpInvest Partners is a private equity investment manager and at the end of 2009 globally managed over €42 billion ....

, HarbourVest PartnersHarbourVest PartnersHarbourVest Partners is a private equity fund of funds and one of the largest private equity investment managers globally. The firm invests in all types of private equity funds, including venture capital and leveraged buyout funds, and also directly in operating companies...

, Pantheon VenturesPantheon VenturesPantheon is a private equity investment manager, operating through a series of fund of funds as well as a publicly traded private equity vehicle, Pantheon International Participations. Pantheon invests through new private equity funds as well as secondary market purchases of existing private...

, Partners GroupPartners GroupPartners Group is a global private markets management firm with over EUR 20 billion in investment programs under management in private equity, private debt, private real estate, private infrastructure and absolute return strategies...

, Paul CapitalPaul CapitalPaul Capital is a private equity investment firm made up of a fund of funds, secondary investments and a healthcare direct investment business...

, Portfolio Advisors, and Procific (a subsidiary of the Abu Dhabi Investment AuthorityAbu Dhabi Investment AuthorityThe Abu Dhabi Investment Authority is a sovereign wealth fund owned by Abu Dhabi, United Arab Emirates founded for the purpose of investing funds on behalf of the Government of Abu Dhabi....

) in one of the first public to private transactions of a publicly traded private equity company completed by secondary market investors.

2007

- California Public Employees' Retirement System (CalPERS)CalPERSThe California Public Employees' Retirement System or CalPERS is an agency in the California executive branch that "manages pension and health benefits for more than 1.6 million California public employees, retirees, and their families"...

agrees to the sale of $2.1 billion portfolio of legacy private equity funds at the end of 2007, after a process that had lasted more than a year. The buying group included Oak Hill Investment Management, Conversus Capital, Lexington PartnersLexington PartnersLexington Partners, is a leading independent manager of secondary private equity and co-Investment funds, founded in 1994. Lexington Partners manages approximately $18 billion of which $3.8 billion was committed to the firm's sixth and latest fund .Lexington was founded by former investment...

, HarbourVest, Coller CapitalColler CapitalColler Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

, and Pantheon VenturesPantheon VenturesPantheon is a private equity investment manager, operating through a series of fund of funds as well as a publicly traded private equity vehicle, Pantheon International Participations. Pantheon invests through new private equity funds as well as secondary market purchases of existing private...

. - Coller CapitalColler CapitalColler Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

completes $4.8 billion fundraising and Lexington PartnersLexington PartnersLexington Partners, is a leading independent manager of secondary private equity and co-Investment funds, founded in 1994. Lexington Partners manages approximately $18 billion of which $3.8 billion was committed to the firm's sixth and latest fund .Lexington was founded by former investment...

completes $3.8 billion fundraising for their newest funds, the largest and second largest funds raised to date in the secondary market - Ohio Bureau of Workers' CompensationOhio Bureau of Workers' CompensationThe Ohio Bureau of Workers' Compensation provides workers' compensation insurance coverage for employers and employees in the State of Ohio through a $22 billion fund...

sells a $400 million portfolio of private equity fund interests to Pomona Capital - MetLife sells a $400 million portfolio of private equity fund interests to CSFB Strategic PartnersCredit SuisseThe Credit Suisse Group AG is a Swiss multinational financial services company headquartered in Zurich, with more than 250 branches in Switzerland and operations in more than 50 countries.-History:...

- Bank of AmericaBank of AmericaBank of America Corporation, an American multinational banking and financial services corporation, is the second largest bank holding company in the United States by assets, and the fourth largest bank in the U.S. by market capitalization. The bank is headquartered in Charlotte, North Carolina...

completes the spin-out of BA Venture Partners to form Scale Venture Partners, which was funded by an undisclosed consortium of secondary investors

2006

- Goldman Sachs Vintage FundsGoldman SachsThe Goldman Sachs Group, Inc. is an American multinational bulge bracket investment banking and securities firm that engages in global investment banking, securities, investment management, and other financial services primarily with institutional clients...

purchases a $1.4 billion private equity portfolio (fund and direct interests) from Mellon Financial Corporation, following the announcement of Mellon's merger with Bank of New YorkBank of New YorkThe Bank of New York was a global financial services company established in 1784 by the American Founding Father Alexander Hamilton. It existed until its merger with the Mellon Financial Corporation on July 2, 2007... - American Capital StrategiesAmerican Capital StrategiesAmerican Capital is an alternative asset management company based in Bethesda, Maryland. Founded in 1986 and publicly traded since 1997, American Capital is the largest U.S. publicly traded private equity fund and one of the largest publicly traded alternative asset managers...

sells a $1 billion portfolio of investments to a consortium of secondary buyers including HarbourVest Partners, Lexington PartnersLexington PartnersLexington Partners, is a leading independent manager of secondary private equity and co-Investment funds, founded in 1994. Lexington Partners manages approximately $18 billion of which $3.8 billion was committed to the firm's sixth and latest fund .Lexington was founded by former investment...

and Partners GroupPartners GroupPartners Group is a global private markets management firm with over EUR 20 billion in investment programs under management in private equity, private debt, private real estate, private infrastructure and absolute return strategies... - Bank of AmericaBank of AmericaBank of America Corporation, an American multinational banking and financial services corporation, is the second largest bank holding company in the United States by assets, and the fourth largest bank in the U.S. by market capitalization. The bank is headquartered in Charlotte, North Carolina...

completes the spin-out of BA Capital Europe to form Argan Capital, which was funded by an undisclosed consortium of secondary investors - JPMorgan Chase completes the sale of a $900 million interest in JPMP Global Fund to a consortium of secondary investors

- Temasek HoldingsTemasek HoldingsTemasek Holdings is an investment company owned by the government of Singapore. With an international staff of 380 people, it manages a portfolio of about S$193 billion at end of March 2011, focused primarily in Asia...

completes $810 million securitization of a portfolio of 46 private equity funds - The Equitable Life Assurance Society completes the £435 million sale of a portfolio of 10 real estate secondaries to Liquid Realty Partners

2005

- Dresdner BankDresdner BankDresdner Bank AG was one of Germany's largest banking corporations and was based in Frankfurt. It was acquired by competitor Commerzbank in December 2009.- 19th century :...

sells a $1.4 billion private equity funds portfolio to AIGAIGAIG is American International Group, a major American insurance corporation.AIG may also refer to:* And-inverter graph, a concept in computer theory* Answers in Genesis, a creationist organization in the U.S.* Arta Industrial Group in Iran... - Lexington PartnersLexington PartnersLexington Partners, is a leading independent manager of secondary private equity and co-Investment funds, founded in 1994. Lexington Partners manages approximately $18 billion of which $3.8 billion was committed to the firm's sixth and latest fund .Lexington was founded by former investment...

and AlpInvest PartnersAlpInvest PartnersAlpInvest Partners is a private equity investment manager and at the end of 2009 globally managed over €42 billion ....

acquired a portfolio of private equity fund interests from Dayton Power & LightDPL Inc.DPL Inc. through its subsidiary The Dayton Power and Light Company is a public utility that sells electricity to residential, commercial, industrial, and governmental customers in a area of West Central Ohio....

, an Ohio-based electric utility - Merrill LynchMerrill LynchMerrill Lynch is the wealth management division of Bank of America. With over 15,000 financial advisors and $2.2 trillion in client assets it is the world's largest brokerage. Formerly known as Merrill Lynch & Co., Inc., prior to 2009 the firm was publicly owned and traded on the New York...

completes the sale of a 20 fund portfolio of private equity funds to Lexington PartnersLexington PartnersLexington Partners, is a leading independent manager of secondary private equity and co-Investment funds, founded in 1994. Lexington Partners manages approximately $18 billion of which $3.8 billion was committed to the firm's sixth and latest fund .Lexington was founded by former investment...

2004

- Bank One sells a $1 billion portfolio of private equity fund interests to Landmark PartnersLandmark PartnersLandmark Partners, founded in 1989, is a leading investor in the Private equity secondary market . It is based in Simsbury, Connecticut.The firm was founded by Stanley Alfeld.-Investment Program:...

- The State of Connecticut Retirement and Trust completes the sale of a portfolio of private equity funds interests to Coller CapitalColler CapitalColler Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

, representing one of the first secondary market sales by a US pension fund - Abbey NationalAbbey NationalAbbey National plc was a UK-based bank and former building society, which latterly traded under the Abbey brand name. It became a wholly owned subsidiary of Grupo Santander of Spain in 2004, and was rebranded as Santander in January 2010, forming Santander UK along with the savings business of the...

plc completes the sale of £748m ($1.33 billion) of LP interests in 41 private equity funds and 16 interests private European companies, to Coller CapitalColler CapitalColler Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market .... - Swiss LifeSwiss LifeThe Swiss Life Group is the largest life insurance company of Switzerland. The firm is headquartered is in Zurich. The Swiss Life Group has 7,500 employees and had assets under management of approximately CHF 133 billion in 2010.-Foundation and growth:...

sold more than 40 fund and direct investments to Pantheon VenturesPantheon VenturesPantheon is a private equity investment manager, operating through a series of fund of funds as well as a publicly traded private equity vehicle, Pantheon International Participations. Pantheon invests through new private equity funds as well as secondary market purchases of existing private...

2003

- HarbourVest acquires a $1.3 billion of private equity fund interests in over 50 funds from UBS AGUBS AGUBS AG is a Swiss global financial services company headquartered in Basel and Zürich, Switzerland, which provides investment banking, asset management, and wealth management services for private, corporate, and institutional clients worldwide, as well as retail clients in Switzerland...

through a joint venture transaction - Deutsche BankDeutsche BankDeutsche Bank AG is a global financial service company with its headquarters in Frankfurt, Germany. It employs more than 100,000 people in over 70 countries, and has a large presence in Europe, the Americas, Asia Pacific and the emerging markets...

sells a $2 billion investment portfolio to a consortium of secondary investors that would become MidOcean PartnersMidOcean PartnersMidOcean Partners is a private equity firm specializing in leveraged buyouts, recapitalizations and growth capital investments in middle-market companies...

2002

- W Capital, first fund developed to purchase direct company positions on a secondary basis, formed

2001

- Coller CapitalColler CapitalColler Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

acquires 27 companies owned by Lucent TechnologiesLucent TechnologiesAlcatel-Lucent USA, Inc., originally Lucent Technologies, Inc. is a French-owned technology company composed of what was formerly AT&T Technologies, which included Western Electric and Bell Labs...

, kick-starting the evolution of the market for "secondary direct" or "synthetic secondary" interests.

2000

- Lexington PartnersLexington PartnersLexington Partners, is a leading independent manager of secondary private equity and co-Investment funds, founded in 1994. Lexington Partners manages approximately $18 billion of which $3.8 billion was committed to the firm's sixth and latest fund .Lexington was founded by former investment...

and Hamilton LaneHamilton LaneHamilton Lane is a private, independent private equity firm with more than $150 billion in total assets under management and supervision...

acquire $500 million portfolio of private equity funds interests from Chase Capital PartnersChase (bank)JPMorgan Chase Bank, N.A., doing business as Chase, is a national bank that constitutes the consumer and commercial banking subsidiary of financial services firm JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000... - Coller CapitalColler CapitalColler Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

and Lexington PartnersLexington PartnersLexington Partners, is a leading independent manager of secondary private equity and co-Investment funds, founded in 1994. Lexington Partners manages approximately $18 billion of which $3.8 billion was committed to the firm's sixth and latest fund .Lexington was founded by former investment...

complete the purchase of over 250 direct equity investments valued at nearly $1 billion from National Westminster BankNational Westminster BankNational Westminster Bank Plc, commonly known as NatWest, is the largest retail and commercial bank in the United Kingdom and has been part of The Royal Bank of Scotland Group Plc since 2000. The Royal Bank of Scotland Group is ranked as the second largest bank in the world by assets...

1999

- The Crossroads GroupCrossroads GroupThe Crossroads Group was a Dallas-based private equity fund of funds firm focusing on venture capital investments. The firm was founded in 1981 and acquired by Lehman Brothers in October 2003...

, which was subsequently acquired by Lehman BrothersLehman BrothersLehman Brothers Holdings Inc. was a global financial services firm. Before declaring bankruptcy in 2008, Lehman was the fourth largest investment bank in the USA , doing business in investment banking, equity and fixed-income sales and trading Lehman Brothers Holdings Inc. (former NYSE ticker...

, acquired a $340 million portfolio of direct investments in large- to mid-cap companies from Electronic Data SystemsElectronic Data SystemsHP Enterprise Services is the global business and technology services division of Hewlett Packard's HP Enterprise Business strategic business unit. It was formed by the combination of HP's legacy services consulting and outsourcing business and the integration of acquired Electronic Data Systems,...

(EDS)

1998

- Coller CapitalColler CapitalColler Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

launches the first globally focused secondaries fund

1997

- Secondary volume estimated to exceed $1 billion for first time

1994

- Lexington PartnersLexington PartnersLexington Partners, is a leading independent manager of secondary private equity and co-Investment funds, founded in 1994. Lexington Partners manages approximately $18 billion of which $3.8 billion was committed to the firm's sixth and latest fund .Lexington was founded by former investment...

founded by former Landmark PartnersLandmark PartnersLandmark Partners, founded in 1989, is a leading investor in the Private equity secondary market . It is based in Simsbury, Connecticut.The firm was founded by Stanley Alfeld.-Investment Program:...

professionals Brent Nicklas and Richard Lichter (currently Newbury Partners) - Coller CapitalColler CapitalColler Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

launches Europe's first secondary fund

1992

- Landmark PartnersLandmark PartnersLandmark Partners, founded in 1989, is a leading investor in the Private equity secondary market . It is based in Simsbury, Connecticut.The firm was founded by Stanley Alfeld.-Investment Program:...

acquires $157 million of LBO fund interests from Westinghouse Credit Corporation

1991

- Paul CapitalPaul CapitalPaul Capital is a private equity investment firm made up of a fund of funds, secondary investments and a healthcare direct investment business...

founded and acquires $85 million venture portfolio from Hillman Ventures

1989

- Coller CapitalColler CapitalColler Capital, founded in 1990 by Jeremy Coller, is one of the leading global investors in the Private equity secondary market ....

founded by Jeremy CollerJeremy CollerJeremy Coller is a British financial executive. He is CEO and CIO of Coller Capital, a British private equity firm, which he founded in 1990.For 20 years, Jeremy Coller has played a key role in the evolution of the secondary market for private equity... - Landmark PartnersLandmark PartnersLandmark Partners, founded in 1989, is a leading investor in the Private equity secondary market . It is based in Simsbury, Connecticut.The firm was founded by Stanley Alfeld.-Investment Program:...

founded by Stanley Alfeld, John A. Griner III and Brent Nicklas

1982

- Venture Capital Fund of America founded by Dayton CarrDayton CarrDayton Carr is the founder of Venture Capital Fund of America a private equity firm that is credited with inventing the Private equity secondary market....

See also

- Private equityPrivate equityPrivate equity, in finance, is an asset class consisting of equity securities in operating companies that are not publicly traded on a stock exchange....

- List of private equity firms

- Venture capitalVenture capitalVenture capital is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries, such as...

- History of private equity and venture capitalHistory of private equity and venture capitalThe history of private equity and venture capital and the development of these asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital...