Natural gas prices

Encyclopedia

Supply and demand

Supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

fundamentals. However, natural gas prices may also be linked to the price of crude oil

Price of petroleum

The price of petroleum as quoted in news generally refers to the spot price per barrel of either WTI/light crude as traded on the New York Mercantile Exchange for delivery at Cushing, Oklahoma, or of Brent as traded on the Intercontinental Exchange for delivery at Sullom Voe.The price...

and/or petroleum products, especially in continental Europe.

U.S. market mechanisms

The natural gas market in the United States is split between the financial (futures) market, based on the NYMEX futures contract, and the physical market, the price paid for actual deliveries of natural gas and individual delivery points around the United States. Market mechanisms in Europe and other parts of the world are similar, but not as well developed or complex as in the United States.Futures market

The standardized NYMEX natural gas futures contractFutures contract

In finance, a futures contract is a standardized contract between two parties to exchange a specified asset of standardized quantity and quality for a price agreed today with delivery occurring at a specified future date, the delivery date. The contracts are traded on a futures exchange...

is for delivery of 10,000 mmbtu's of energy (approximately 10000000 cubic feet (283,168.5 m³) of gas) per day at Henry Hub

Henry Hub

]The Henry hub is the pricing point for natural gas futures contracts traded on the New York Mercantile Exchange . It is a point on the natural gas pipeline system in Erath, Louisiana...

in Louisiana over a given delivery month consisting of a varying amount of days. Monthly contracts expire 3–5 days in advance of the first day of the delivery month, at which points traders may either settle their positions financially with other traders in the market (if they have not done so already) or choose to "go physical" and accept delivery of physical natural gas (which is actually quite rare in the financial market).

It should be noted that most financial transactions for natural gas actually take place off exchange in the over-the-counter

Over-the-counter (finance)

Within the derivatives markets, many products are traded through exchanges. An exchange has the benefit of facilitating liquidity and also mitigates all credit risk concerning the default of a member of the exchange. Products traded on the exchange must be well standardised to transparent trading....

("OTC") markets using "look alike" contracts that match the general terms and characteristics of the NYMEX futures contract and settle against the final NYMEX contract value, but that are not subject to the regulations and market rules required on the actual exchange.

It is also important to note that nearly all participants in the financial gas market, whether on or off exchange, participate solely as a financial exercise in order to profit from the net cash flows that occur when financial contracts are settled among counterparties at the expiration of a trading contract. This practice allows for the hedging of financial exposure to transactions in the physical market by allowing physical suppliers and users of natural gas to net their gains in the financial market against the cost of their physical transactions that will occur later on. It also allows individuals and organizations with no need or exposure to large quantities of physical natural gas to participate in the natural gas market for the sole purpose of gaining from trading activities.

Physical market

Generally speaking, physical prices at the beginning of any calendar month at any particular delivery location are based on the final settled forward financial price for a given delivery period, plus the settled "basis" value for that location (see below). Once a forward contract period has expired, gas is then traded daily in a "day ahead market" wherein prices for any particular day (or occasional 2-3 day period when weekends and holidays are involved) are determined on the preceding day by traders using localized supply and demand conditions, in particular weather forecasts, at a particular delivery location. The average of all of the individual daily markets in a given month is then referred to as the "index" price for that month at that particular location, and it is not uncommon for the index price for a particular month to vary greatly from the settled futures price (plus basis) from a month earlier.Many market participants, especially those transacting in gas at the wellhead stage, then add or subtract a small amount to the nearest physical market price to arrive at their ultimate final transaction price.

Once a particular day's gas obligations are finalized in the day-ahead market, traders (or more commonly lower-level personnel in the organization known as, "schedulers") will work together with counterparties and pipeline representatives to "schedule" the flows of gas into ("injections") and out of ("withdrawals") individual pipelines and meters. Because, in general, injections must equal withdrawals (i.e. the net volume injected and withdrawn on the pipeline should equal zero), pipeline scheduling and regulations are a major driver of trading activities, and quite often the financial penalties inflicted by pipelines onto shippers who violate their terms of service are well in excess of losses a trader may otherwise incur in the market correcting the problem.

Basis market

Because market conditions vary between Henry Hub and the roughly 40 or so physical trading locations around United States, financial traders also usually transact simultaneously in financial "basis" contracts intended to approximate these difference in geography and local market conditions. The rules around these contracts - and the conditions under which they are traded - are nearly identical to those for the underlying gas futures contract.Derivatives and market instruments

Because the U.S. natural gas market is so large and well developed and has many independent parts, it enables many market participants to transact under complex structures and to use market instruments that are not otherwise available in a simple commodity market where the only transactions available are to purchase or sell the underlying product. For instance, options and other derivative transactions are very common, especially in the OTC market, as are "swap" transactions where participants exchange rights to future cash flows based on underlying index prices or delivery obligations or time periods. Participants use these tools to further hedge their financial exposure to the underlying price of natural gas.Natural gas demand

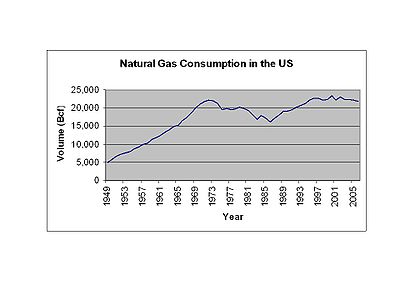

The demand for natural gasNatural gas

Natural gas is a naturally occurring gas mixture consisting primarily of methane, typically with 0–20% higher hydrocarbons . It is found associated with other hydrocarbon fuel, in coal beds, as methane clathrates, and is an important fuel source and a major feedstock for fertilizers.Most natural...

is mainly driven by the following factors:

- Weather

- Demographics

- Economic growth

- Fuel competition

- Storage

- Exports

Natural gas demand in North America for 2005 Sector 2005 (Bcf) US residential 4,838 US commercial 3,057 US industrial 6,608 US electric power 5,797 US other 1,650 Total US demand 21,950 US LNG exports 65 US exports to Mexico 305 Total US gas disposition 22,320 Canada residential 602 Canada commercial 442 Canada industrial/power 1,428 Total Canadian demand 2,472 Total N.A. demand 24,421 Total N.A. disposition 24,791

Weather

Weather conditions can have a major impact on natural gas demand and supply. Cold temperatures in the winter increase the demand for space heating with natural gas in commercial and residential buildings. Alternatively, hot temperatures in the summer increase the demand for space cooling with air conditioning, which also increase the demand for natural gas at electrical utilities because the utilities provide the electric power that fuels most residential air conditioners.Natural gas demand usually peaks during the coldest months of the year (December–February) and is lowest during the "shoulder" months (May–June and September–October). During the warmest summer months (July–August), demand increases again. Due to the shift in population in the United States toward the sun belt, summer demand for natural gas is rising faster than winter demand.

Temperature impacts are measured in terms of 'heating degree days' (HDD) during the winter, and 'cooling degree days'(CDD) during the summer. HDDs are calculated by subtracting the average temperature for a day from 65 degrees. Thus, if the average temperature for a day is 50 degrees, there are 15 HDDs. If the average temperature is above 65 degrees, HDD is zero.

Cooling degree days are also measured by the difference between the average temperature and 65 degrees. Thus, if the average temperature is 80 degrees, there are 15 CDDs. If the average temperature is below 65 degrees, CDD is zero.

Hurricanes can impact both the supply of and demand for natural gas. For example, as hurricanes approach the Gulf of Mexico, offshore natural gas platforms are shut down as workers evacuate, thereby shutting in production. In addition, hurricanes can also cause severe destruction to offshore (and onshore) production facilities. For example, Hurricane Katrina (2005) resulted in massive shut-ins of natural gas production.

Hurricane damage can also reduce natural gas demand. The destruction of power lines interrupting electricity produced by natural gas can result in significant reduction in demand for a given area (e.g., Florida).

Demographics

Changing demographics also affects the demand for natural gas, especially for core residential customers. In the US for instance, recent demographic trends indicate an increased population movement to the Southern and Western states. These areas are generally characterized by warmer weather, thus we could expect a decrease in demand for heating in the winter, but an increase in demand for cooling in the summer. As electricity currently supplies most of the cooling energy requirements, and natural gas supplies most of the energy used for heating, population movement may decrease the demand for natural gas for these customers. However, as more power plants are fueled by natural gas, natural gas demand could in fact increase.Economic growth

The state of the economy can have a considerable effect on the demand for natural gas in the short term. This is particularly true for industrial and to a lesser extent the commercial customers. When the economy is booming, output from the industrial sectors generally increases. On the other hand, when the economy is experiencing a recession, output from industrial sectors drops. These fluctuations in industrial output accompanying the economy affects the amount of natural gas needed by these industrial users. For instance, during the economic recession of 2001, U.S. natural gas consumption by the industrial sector fell by 6 percent.Fuel competition

As we stated previously, supply and demand dynamics in the marketplace determine the short term price for natural gas. However, this can work in reverse as well. The price of natural gas can, for certain consumers, affect its demand. This is particularly true for those consumers who have the ability to switch the fuel which they consume. In general the core customers (residential and commercial) do not have this ability, however, a number of industrial and electric generation consumers have the capacity to switch between fuels. For instance, when natural gas prices are extremely high, electric generators may switch from using natural gas to using cheaper coal or fuel oil. This fuel switching then leads to a decrease for the demand of natural gas, which usually tends to drop its price.Storage

North American natural gas injections (positive) represent additional demand and compete with alternative uses such as gas for heating or for power generation. Natural gas storageNatural gas storage

Natural gas, like many other commodities, can be stored for an indefinite period of time in natural gas storage facilities for later consumption.- Usage :...

levels have a significant impact on the commodity’s price. When the storage levels are low, a signal is being sent to the market indicating that there is a smaller supply cushion and prices will be rising. On the other hand, when storage levels are high, this sends a signal to the market that there is greater supply flexibility and prices will tend to drop.

Exports

Exports are another source of demand. In North America, gas is exported within its forming countries, Canada, the US and Mexico as well as abroad to countries such as Japan.

Natural gas supply

The supply for natural gas is mainly driven by the following factors:- Pipeline capacity

- Storage

- Gas drilling rates

- Natural phenomena

- Technical issues

- Imports

Natural gas supply in North America for 2005 2005 (Bcf) Total US production 18,243 Total Canada production 6,022 Total N.A. production 24,265 US imports and supplementals 340 Total N.A. supply 24,605

Pipeline capacity

The ability to transport natural gas from the well heads of the producing regions to the consuming regions affects the availability of supply in the marketplace. The interstate and intrastate pipeline infrastructure has limited capacity and can only transport so much natural gas at any one time. This has the effect of limiting the maximum amount of natural gas that can reach the market. The current pipeline infrastructure is quite developed, with the EIA estimating that the daily delivery capacity of the grid is 119 Gcuft. However, natural gas pipeline companies should continue to expand the pipeline infrastructure in order to meet growing future demand.Storage

As natural gas injections (positive) represent additional demand, withdrawals (negative) represent an additional source of supply which can be accessed quickly.Gas drilling rates

The amount of natural gas produced both from associated and non-associated sources can be controlled to some extent by the producers. The drilling rates and gas prices form a feedback loop. When supply is low, demand and thus prices are high; this gives a market signal to the producer to increase the number of rigs drilling for natural gas. The increased supply will then lead to decrease the pricing.Natural phenomena

Natural phenomena can have a significant impact on natural gas production and thus supply. Hurricanes, for example, can have an impact on the offshore production and exploitation of natural gas. This is because safety requirements may mandate the temporary shut down of offshore production platforms. Tornadoes can have a similar effect on onshore production facilities.Technical Issues

Equipment malfunction, although not frequent, could temporarily disrupt the flow across a given pipeline at an important market center. This would ultimately decrease the supply available in that market. On the other hand, technical developments in engineering methods can lead to more abundant supply.Imports

Imports are a source of supply. In North America, gas is imported within its forming countries, Canada and the US as well as abroad in the form of LNG from countries such as Trinidad, Algeria and Nigeria.

Trends in natural gas prices

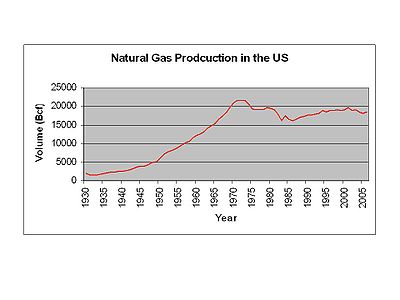

The chart shows a 75-year history of annual United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

natural gas

Natural gas

Natural gas is a naturally occurring gas mixture consisting primarily of methane, typically with 0–20% higher hydrocarbons . It is found associated with other hydrocarbon fuel, in coal beds, as methane clathrates, and is an important fuel source and a major feedstock for fertilizers.Most natural...

production and average

Average

In mathematics, an average, or central tendency of a data set is a measure of the "middle" value of the data set. Average is one form of central tendency. Not all central tendencies should be considered definitions of average....

wellhead

Wellhead

A wellhead is a general term used to describe the component at the surface of an oil or gas well that provides the structural and pressure-containing interface for the drilling and production equipment....

price

Price

-Definition:In ordinary usage, price is the quantity of payment or compensation given by one party to another in return for goods or services.In modern economies, prices are generally expressed in units of some form of currency...

s from 1930 through 2005. Prices paid by consumers were increased above those levels by processing

Business process

A business process or business method is a collection of related, structured activities or tasks that produce a specific service or product for a particular customer or customers...

and distribution

Downstream (oil industry)

The petroleum industry is usually divided into three major components: Upstream, midstream and downstream. Midstream operations are usually included in the downstream category....

costs. Production is shown in billions of cubic meters per year, and average wellhead pricing is shown in United States dollar

Dollar

The dollar is the name of the official currency of many countries, including Australia, Belize, Canada, Ecuador, El Salvador, Hong Kong, New Zealand, Singapore, Taiwan, and the United States.-Etymology:...

s per thousand cubic meters, adjusted to spring, 2006, by the U.S. Consumer Price Index

Consumer price index

A consumer price index measures changes in the price level of consumer goods and services purchased by households. The CPI, in the United States is defined by the Bureau of Labor Statistics as "a measure of the average change over time in the prices paid by urban consumers for a market basket of...

.

Through the 1960s the U.S. was self-sufficient in natural gas

Natural gas

Natural gas is a naturally occurring gas mixture consisting primarily of methane, typically with 0–20% higher hydrocarbons . It is found associated with other hydrocarbon fuel, in coal beds, as methane clathrates, and is an important fuel source and a major feedstock for fertilizers.Most natural...

and wasted large parts of its withdrawals by venting and flaring

Gas flare

A gas flare, alternatively known as a flare stack, is an elevated vertical conveyance found accompanying the presence of oil wells, gas wells, rigs, refineries, chemical plants, natural gas plants, and landfills....

. Gas flares were common sights in oilfields

Oil field

An oil field is a region with an abundance of oil wells extracting petroleum from below ground. Because the oil reservoirs typically extend over a large area, possibly several hundred kilometres across, full exploitation entails multiple wells scattered across the area...

and at refineries

Oil refinery

An oil refinery or petroleum refinery is an industrial process plant where crude oil is processed and refined into more useful petroleum products, such as gasoline, diesel fuel, asphalt base, heating oil, kerosene, and liquefied petroleum gas...

. U.S. natural gas prices were relatively stable at around (2006 US) $30/Mcm in both the 1930s and the 1960s. Prices reached a low of around (2006 US) $17/Mcm in the late 1940s, when more than 20 percent of the natural gas being withdrawn from U.S. reserves

Oil reserves

The total estimated amount of oil in an oil reservoir, including both producible and non-producible oil, is called oil in place. However, because of reservoir characteristics and limitations in petroleum extraction technologies, only a fraction of this oil can be brought to the surface, and it is...

was vented or flared.

While supply

Supply and demand

Supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

interruptions have caused repeated spikes in pricing

Energy crisis

An energy crisis is any great bottleneck in the supply of energy resources to an economy. In popular literature though, it often refers to one of the energy sources used at a certain time and place, particularly those that supply national electricity grids or serve as fuel for vehicles...

since 1990, longer range price trends respond to limitations in resources

Natural resource

Natural resources occur naturally within environments that exist relatively undisturbed by mankind, in a natural form. A natural resource is often characterized by amounts of biodiversity and geodiversity existent in various ecosystems....

and their rates of development. As of 2006 the U.S. Interior Department

United States Department of the Interior

The United States Department of the Interior is the United States federal executive department of the U.S. government responsible for the management and conservation of most federal land and natural resources, and the administration of programs relating to Native Americans, Alaska Natives, Native...

estimated that the Outer Continental Shelf

Continental shelf

The continental shelf is the extended perimeter of each continent and associated coastal plain. Much of the shelf was exposed during glacial periods, but is now submerged under relatively shallow seas and gulfs, and was similarly submerged during other interglacial periods. The continental margin,...

of the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

held more than 15 trillion cubic meters of recoverable natural gas

Natural gas

Natural gas is a naturally occurring gas mixture consisting primarily of methane, typically with 0–20% higher hydrocarbons . It is found associated with other hydrocarbon fuel, in coal beds, as methane clathrates, and is an important fuel source and a major feedstock for fertilizers.Most natural...

, equivalent to about 25 years of domestic consumption

Consumption (economics)

Consumption is a common concept in economics, and gives rise to derived concepts such as consumer debt. Generally, consumption is defined in part by comparison to production. But the precise definition can vary because different schools of economists define production quite differently...

at present rates. Total U.S. natural gas reserves

Oil reserves

The total estimated amount of oil in an oil reservoir, including both producible and non-producible oil, is called oil in place. However, because of reservoir characteristics and limitations in petroleum extraction technologies, only a fraction of this oil can be brought to the surface, and it is...

were then estimated at 30 to 50 trillion cubic meters, or about 40 to 70 years consumption.

Natural gas prices in Europe

Prices of natural gas for end-consumers vary greatly throughout Europe. One of the main objectives of the projected single EU energy market, is a common pricing structure for gas products.Europe's main natural gas supplier is Russia. Since the major pipelines pass through Ukraine there is an ever arising dispute on the supply and transition prices between Ukraine and Russia.

During the negotiations in 2008 Ukraine proposed that the price of natural gas for Ukraine should increase by $21.5 to $201 per 1,000 cubic meters, and the transit fee by $0.3 to $2 per 1,000 cubic meters pumped 100 kilometres (62.1 mi). Gazprom proposed that Naftohaz should buy its natural gas at $250 per 1,000 cubic meters starting from 2009. Prime Minister of Russia

Prime Minister of Russia

The Chairman of the Government of the Russian Federation The use of the term "Prime Minister" is strictly informal and is not allowed for by the Russian Constitution and other laws....

Vladimir Putin said that the $250 per 1000 cubic meters price was a "humanitarian gesture" to Ukraine considering that Russia buys gas from Central Asia for $340 and that the European price level is $500 per 1000 cubic meters. Later, Naftohaz said it was ready to pay $235. Negotiations between Gazprom and Naftohaz were interrupted on 31 December 2008. While Gazprom claimed that Naftohaz would not negotiate, Ukraine said that the negotiations were interrupted at Gazprom's initiative.

Natural gas prices in South America

In South America, the second largest supplier of natural gas is Bolivia.The price which Bolivia is paid for its natural gas is roughly US$ 3.25 to Brazil and $US 3.18 to Argentina. Other sources state that Brazil pays between US$ 3.15/MMBtu and US$ 3.60/MMBtu (not including US$ 1.50/MMBtu in Petrobras

Petrobras

Petróleo Brasileiro or Petrobras is a semi-public Brazilian multinational energy corporation headquartered in Rio de Janeiro, Brazil. It is the largest company in Latin America by market capitalization and revenue, and the largest company headquartered in the Southern Hemisphere by market...

extraction and transportation costs). The price of gas in the US as a whole is between US$ 5.85/MMBtu (May 21, 2006), US$ 7.90/MMBtu (April 2006) & US$6.46/MMBtu (June 2006). Though several years ago the price of natural gas spiked at $14 in California

California

California is a state located on the West Coast of the United States. It is by far the most populous U.S. state, and the third-largest by land area...

due to lack of pipeline capacity to and within California, and also due to electricity outages. While according to Le Monde

Le Monde

Le Monde is a French daily evening newspaper owned by La Vie-Le Monde Group and edited in Paris. It is one of two French newspapers of record, and has generally been well respected since its first edition under founder Hubert Beuve-Méry on 19 December 1944...

, Brazil

Brazil

Brazil , officially the Federative Republic of Brazil , is the largest country in South America. It is the world's fifth largest country, both by geographical area and by population with over 192 million people...

and Argentina

Argentina

Argentina , officially the Argentine Republic , is the second largest country in South America by land area, after Brazil. It is constituted as a federation of 23 provinces and an autonomous city, Buenos Aires...

pay US$2 per thousand cubic meter of gas, which costs between $12 to $15 in California

California

California is a state located on the West Coast of the United States. It is by far the most populous U.S. state, and the third-largest by land area...

.

See also

- Natural gas storageNatural gas storageNatural gas, like many other commodities, can be stored for an indefinite period of time in natural gas storage facilities for later consumption.- Usage :...

- Liquified natural gasLiquefied natural gasLiquefied natural gas or LNG is natural gas that has been converted temporarily to liquid form for ease of storage or transport....

- Energy economicsEnergy economicsEnergy economics is a broad scientific subject area which includes topics related to supply and use of energy in societies. Due to diversity of issues and methods applied and shared with a number of academic disciplines, energy economics does not present itself as a self contained academic...

- Energy crisisEnergy crisisAn energy crisis is any great bottleneck in the supply of energy resources to an economy. In popular literature though, it often refers to one of the energy sources used at a certain time and place, particularly those that supply national electricity grids or serve as fuel for vehicles...

- Henry HubHenry Hub]The Henry hub is the pricing point for natural gas futures contracts traded on the New York Mercantile Exchange . It is a point on the natural gas pipeline system in Erath, Louisiana...