Natural gas storage

Encyclopedia

Natural gas

, like many other commodities

, can be stored for an indefinite period of time in natural gas storage facilities for later consumption.

and withdrawn from storage during periods of peak demand. It is also used for a variety of secondary purposes, including:

The measurements above are not fixed for a given storage facility. For example, deliverability depends on several factors including the amount of gas in the reservoir and the pressure etc. Generally, a storage facility’s deliverability rate varies directly with the total amount of gas in the reservoir. It is at its highest when the reservoir is full and declines as gas is withdrawn. The injection capacity of a storage facility is also variable and depends on factors similar to those that affect deliverability. The injection rate varies inversely with the total amount of gas in storage. It is at its highest when the reservoir is nearly empty and declines as more gas is injected. The storage facility operator may also change operational parameters. This would allow, for example, the storage capacity maximum to be increased, the withdrawal of base gas during very high demand or reclassifying base gas to working gas if technological advances or engineering procedures allow.

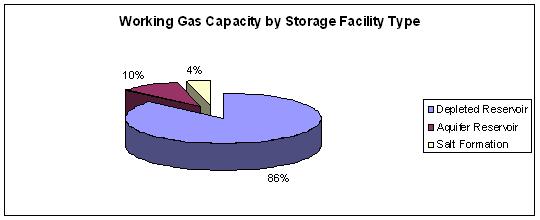

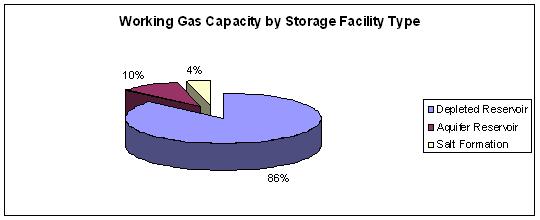

reservoirs and salt cavern reservoirs. Each of these types possesses distinct physical and economic characteristics which govern the suitability of a particular type of storage type for a given application.

s and petroleum engineers

and are usually well known. Consequently, depleted reservoirs are generally the cheapest and easiest to develop, operate, and maintain of the three types of underground storage.

In order to maintain working pressures in depleted reservoirs, about 50 percent of the natural gas in the formation must be kept as cushion gas. However, since depleted reservoirs were previously filled with natural gas and hydrocarbon

s, they do not require the injection of gas that will become physically unrecoverable as this is already present in the formation. This provides a further economic boost for this type of facility, particularly when the cost of gas is high.

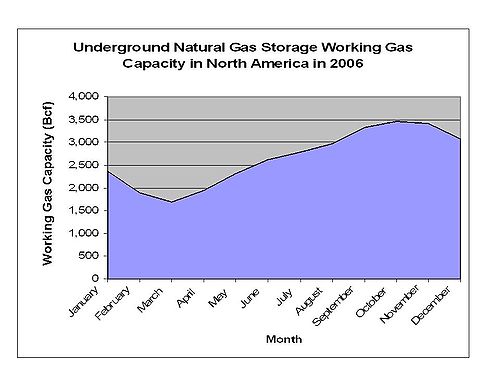

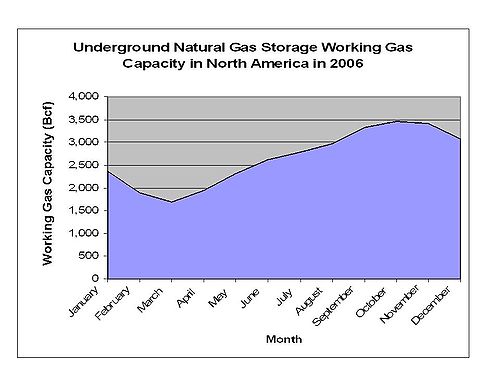

Typically, these facilities are operated on a single annual cycle; gas is injected during the off-peak summer months and withdrawn during the winter months of peak demand.

A number of factors determine whether or not a depleted gas field will make an economically viable storage facility. Geographically, depleted reservoirs should be relatively close to gas markets and to transportation infrastructure (pipelines and distribution systems) which will connect them to that market. Since the fields were at one time productive and connected to infrastructure distance from market is the dominant geographical factor. Geologically, it is preferred that depleted reservoir formations have high porosity

and permeability

. The porosity of the formation is one of the factors that determines the amount of natural gas the reservoir is able to hold. Permeability is a measure of the rate at which natural gas flows through the formation and ultimately determines the rate of injection and withdrawal of gas from storage.

s are underground, porous and permeable rock formations that act as natural water reservoirs. In some cases they can be used for natural gas storage. Usually these facilities are operated on a single annual cycle as with depleted reservoirs. The geological and physical characteristics of aquifer formation are not known ahead of time and a significant investment has to go into investigating these and evaluating the aquifer’s suitability for natural gas storage.

If the aquifer is suitable, all of the associated infrastructure must be developed from scratch, increasing the development costs compared to depleted reservoirs. This includes installation of wells, extraction equipment, pipelines, dehydration facilities, and possibly compression equipment. Since the aquifer initially contains water there is little or no naturally occurring gas in the formation and of the gas injected some will be physically unrecoverable. As a result, aquifer storage typically requires significantly more cushion gas than depleted reservoirs; up to 80% of the total gas volume. Most aquifer storage facilities were developed when the price of natural gas was low, meaning this cushion gas was inexpensive to sacrifice. With rising gas prices aquifer storage becomes more expensive to develop.

A consequence of the above factors is that developing an aquifer storage facility is usually time consuming and expensive. Aquifers are generally the least desirable and most expensive type of natural gas storage facility.

formations are well suited to natural gas storage. Salt caverns allow very little of the injected natural gas to escape from storage unless specifically extracted. The walls of a salt cavern are strong and impervious to gas over the lifespan of the storage facility.

Once a suitable salt feature is discovered and found to be suitable for the development of a gas storage facility a cavern is created within the salt feature. This is done by the process of cavern leaching. Fresh water is pumped down a borehole

into the salt. Some of the salt is dissolved

leaving a void and the water, now saline

, is pumped back to the surface. The process continues until the cavern is the desired size. Once created, a salt cavern offers an underground natural gas storage vessel with very high deliverability. Cushion gas requirements are low, typically about 33 percent of total gas capacity.

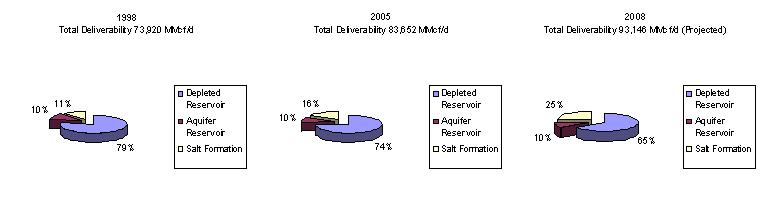

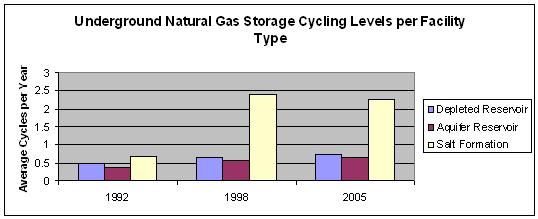

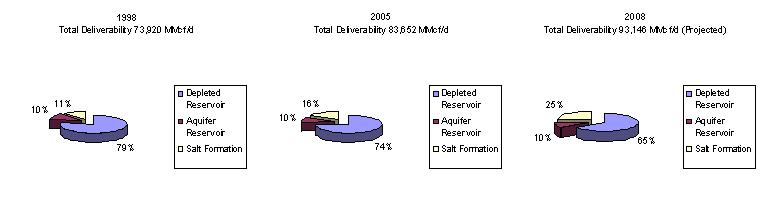

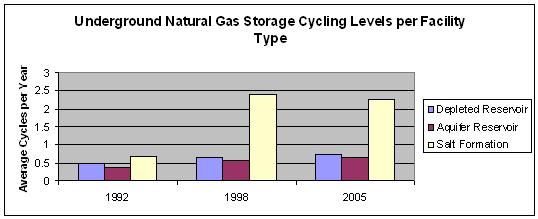

Salt caverns are usually much smaller than depleted gas reservoir and aquifer

storage facilities. A salt cavern facility may occupy only one one-hundredth of the area taken up by a depleted gas reservoir facility. Consequently, salt caverns cannot hold the large volumes of gas necessary to meet base load storage requirements. Deliverability from salt caverns is, however, much higher than for either aquifers or depleted reservoirs. This allows the gas stored in a salt cavern to be withdrawn and replenished more readily and quickly. This quick cycle-time is useful in emergency situations or during short periods of unexpected demand surges.

Although construction is more costly than depleted field conversions when measured on the basis of dollars per thousand cubic feet of working gas, the ability to perform several withdrawal and injection cycles each year reduces the effective cost.

facilities provide delivery capacity during peak periods when market demand exceeds pipeline deliverability. LNG storage tank

s possess a number of advantages over underground storage. As a liquid at approximately −163 °C (−260 °F), it occupies about 600 times less space than gas stored underground, and it provides high deliverability at very short notice because LNG storage facilities are generally located close to market and can be trucked to some customers avoiding pipeline

tolls. There is no requirement for cushion gas and it allows access to a global supply. LNG facilities are, however, more expensive to build and maintain than developing new underground storage facilities.

Gas can be stored above ground in a gasholder (or gasometer), largely for balancing, not long-term storage, and this has been done since Victorian times. These store gas at district pressure, meaning that they can provide extra gas very quickly at peak times. Gasholders are perhaps most used in the United Kingdom

Gas can be stored above ground in a gasholder (or gasometer), largely for balancing, not long-term storage, and this has been done since Victorian times. These store gas at district pressure, meaning that they can provide extra gas very quickly at peak times. Gasholders are perhaps most used in the United Kingdom

and Germany

. There are two kinds of gasholder — column guided, which are guided up by a large frame that is always visible, regardless of the position of the holder, and spiral guided, which have no frame and are guided up by concentric runners in the previous lift.

Perhaps the most famous gasholder is a large column guided gasholder overlooking The Oval cricket ground

in London

. Gasholders were built in the United Kingdom from early Victorian times; many, such as Kings Cross in London and St. Marks Street in Kingston upon Hull

are so old that they are entirely riveted, as their construction predates the use of welding in construction. The last to be built in the UK was in 1983.

on their long-haul transmission lines. FERC regulations though demand that these companies open up the remainder of their capacity not used for that purpose to third parties. Twenty-five interstate companies currently operate 172 underground natural gas storage facilities. In 2005, their facilities accounted for about 43 percent of overall storage deliverability and 55 percent of working gas capacity in the US. These operators include the Columbia Gas Transmission Company, Dominion Gas Transmission Company, The National Fuel Gas Supply Company, Natural Gas Pipeline of America, Texas Gas Transmission Company, Southern Star Central Pipeline Company, TransCanada Corporation.

), in the US and Enbridge and Union Gas in Canada.

activity in the underground gas storage arena has attracted independent storage service providers to develop storage facilities. The capacity made available would then be leased to third-party customers such as marketers and electricity generators. It is expected that in the future, this group would take more market share, as more deregulation takes place. Currently in the US, this group accounts for 18 percent of overall storage deliverability and 13 percent of working gas capacity in the US.

(FERC). Prior to 1992, these companies owned all the gas that flowed through their systems. This also included gas in their storage facility, over which they had complete control. Then FERC Order 636 was implemented. This required the companies to operate their facilities, including gas storage on an open access basis. For gas storage, this meant that these companies could only reserve the capacity needed to maintain system integrity. The rest of the capacity would be available for leasing to third parties on a nondiscriminatory basis. Open access has opened a wide variety of application for gas storage, particularly for marketers which can now exploit price arbitrage

opportunities. Any storage capacity would be priced at cost-based pricing

, unless the provider can demonstrate to FERC that it lacks market power, in which case it may be allowed to price at market-based rates to gain market share. FERC defines market power as "..the ability of a seller profitably to maintain prices above competitive levels for a significant period of time.". The underlying pricing structure for storage has discouraged development in the gas storage sector, which has not seen many new storage facilities constructed, besides current ones being expanded. In 2005, FERC announced a new Order 678 targeted particularly to gas storage. This rule is intended to stimulate the development of new gas storage facility in the ultimate goal of reducing natural gas price volatility

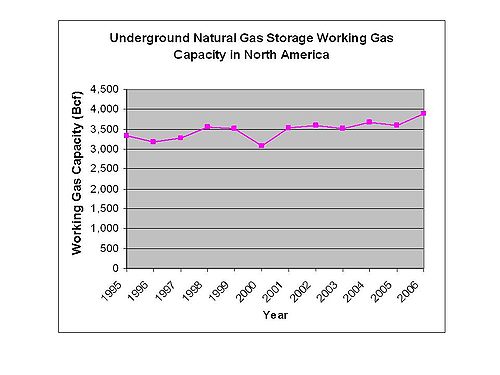

. Commission Chairman Joseph T. Kelliher

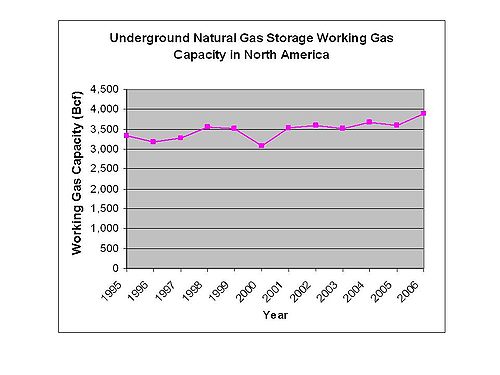

observed: "Since 1988, natural gas demand in the United States has risen 24 percent. Over the same period, gas storage capacity has increased only 1.4 percent. While construction of storage capacity has lagged behind the demand for natural gas, we have seen record levels of price volatility. This suggests that current storage capacity is inadequate. Further, this year, what storage capacity exists may be full far earlier than in any previous year. According to some analysts, that raises the prospect that some domestic gas production may be shut-in. Our final rule should help reduce price volatility and expand storage capacity."

This ruling aims at opening up two approaches for developers of natural gas storage, to be able to charge market-based rates. The first one is the redefinition of the relevant product market for storage that includes alternatives for storage such as available pipeline capacity, local gas production and LNG terminals. The second approach aims at implementing section 312 of the Energy Policy Act. It would allow an applicant to request authority to charge "market-based rates even if a lack of market power has not been demonstrated, in circumstances where market-based rates are in the public interest and necessary to encourage the construction of storage capacity in the area needing storage service and that customers are adequately protected," the

Commission said. It is expected that this new order will entice developers, especially independent storage operators, to develop new facilities in the near future.

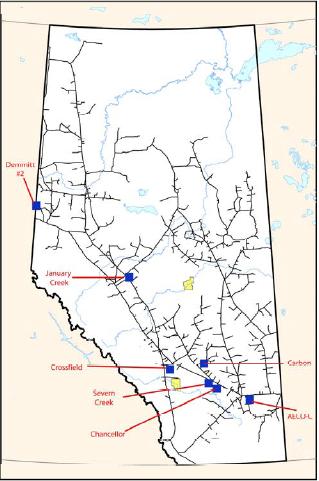

, gas storage rates are not regulated and providers negotiate rates with their customers on a contract-by-contract basis. However the Carbon facility which is owned by ATCO gas is regulated, since ATCO is a utility company. Therefore ATCO Gas has to charge cost-based rates for its customers, and can market any additional capacities at market-based rates.

In Ontario

, gas storage is regulated by the Ontario Energy Board. Currently all the available storage is owned by vertically integrated utilities. The utility companies have to price their storage capacity sold to their customers at cost-based rates, but can market any remaining capacity at market-based rates. Storage developed by independent storage developers can charge market-based rates.

In British Columbia

, gas storage is not regulated. All available storage capacity is marketed at market-based rates.

), however the national network has now largely been broken down into regional networks, owned by different companies, they are however all still answerable to OFGEM.

The capital expenditure to build the facility mostly depends on the physical characteristics of the reservoir. First of all, the development cost of a storage facility largely depends on the type of the storage field. As a general rule of thumb

, salt caverns are the most expensive to develop on a Bcf of Working Gas Capacity Basis. However one should keep in mind that because the gas in such facilities can be cycled repeatedly, on a Deliverability basis, they may be less costly. A Salt Cavern facility might cost anywhere from $10 million to $25 million/Bcf of working gas capacity. The wide price range is because of region difference which dictates the geological requirements. These factors include the amount of compressive horsepower required, the type of surface and the quality of the geologic structure to name a few. A depleted reservoir costs between $5 million to $6 million/Bcf of Working Gas Capacity. Finally another major cost incurred when building new storage facilities is that of base gas. The amount of base gas in a reservoir could be as high as 80% for aquifers making them very unattractive to develop when gas prices are high. On the other hand salt caverns require the least amount of base gas. The high cost of base gas is what drives the expansion of current sites vs the development of new ones. This is because expansions require little addition to base gas.

The expected cash flows from such projects depend on a number of factors. These include the services the facility provides as well as the regulatory regime

under which it operates. Facilities that operate primarily to take advantage of commodity

arbitrage opportunities are expected to have different cash flow benefits than ones primarily used to ensure seasonal supply reliability. Rules set by regulators can on one hand restrict the profit made by storage facility owners or on the other hand guarantee profit

, depending on the market model.

The different valuation modes co-exist in the real world and are not mutually exclusive. Buyers and sellers typically use a combination of the different prices to come up with the true value of storage. An example of the different valuations and the price they generate can be found in the table below.

. It is evaluated as the difference between the two prices in a pair of forward prices. The idea being that one can lock-in a forward spread, either physically or financially. For developers seeking to study the feasibility of building a storage facility, they would typically look at the long-term price spreads.

. Intrinsic valuation of storage does not take the cycling ability of high-deliverability storage. The extrinsic valuation reflects the fact that in such facilities, say salt cavern formations, a proportion of the space can be used more than once, thus increasing value. Such high-deliverability storage facility allows its user to respond to variations in demand/price within a season or during a given day rather than just seasonal variations as was the case with single cycle facilities.

are typically associated to low storage periods. Usually when prices are high during the early months of the refill season (April–October), many users of storage adopt a wait and see attitude. They limit their gas intake in anticipation that the prices will drop before the heating season begins (November–March). However when that decrease does not occur, they are forced to buy natural gas at high prices. This is particularly true for Local Distribution and other operators who rely on storage to meet the seasonal demand for their customers. On the other hand, other storage users, who use storage for as a marketing tool (hedging or speculating) will hold off storing a lot of gas when the prices are high.

Research being conducted by the US Energy department is showing that salt formations can be chilled allowing for more gas to be stored. This will reduce the size of the formation needed to be treated, and have salt extracted from it. This will lead to cheaper development costs for salt formation storage facility type.

Another aspect being looked at, are other formations that may hold gas. These include hard rock formations such as granite, in areas where such formations exists and other types currently used for gas storage do not.

In Sweden a new type of storage facility has been built, called "lined rock cavern". This storage facility consists of installing a steel tank in a cavern in the rock of a hill and surrounding it with concrete. Although the development cost of such facility is quite expensive, its ability to cycle gas multiple times compensates for it, similar to salt formation facilities.

Finally, another research project sponsored by the Department of Energy, is that of hydrates. Hydrates are compounds formed when natural gas is frozen in the presence of water. The advantage being that as much as 181 standard cubic feet of natural gas could be stored in a single cubic foot of hydrate.

Natural gas

Natural gas is a naturally occurring gas mixture consisting primarily of methane, typically with 0–20% higher hydrocarbons . It is found associated with other hydrocarbon fuel, in coal beds, as methane clathrates, and is an important fuel source and a major feedstock for fertilizers.Most natural...

, like many other commodities

Commodity

In economics, a commodity is the generic term for any marketable item produced to satisfy wants or needs. Economic commodities comprise goods and services....

, can be stored for an indefinite period of time in natural gas storage facilities for later consumption.

Usage

Gas storage is principally used to meet load variations. Gas injected into storage during periods of low demandDemand

- Economics :*Demand , the desire to own something and the ability to pay for it*Demand curve, a graphic representation of a demand schedule*Demand deposit, the money in checking accounts...

and withdrawn from storage during periods of peak demand. It is also used for a variety of secondary purposes, including:

- Balancing the flow in pipelinePipeline transportPipeline transport is the transportation of goods through a pipe. Most commonly, liquids and gases are sent, but pneumatic tubes that transport solid capsules using compressed air are also used....

systems. This is performed by mainline transmission pipeline companies to maintain operational integrity of the pipelines, by ensuring that the pipeline pressures are kept within design parameters. - Maintaining contractual balance. Shippers use stored gas to maintain the volume they deliver to the pipeline system and the volume they withdraw. Without access to such storage facilities, any imbalance situation would result in a hefty penalty.

- Leveling production over periods of fluctuating demand. Producers use storage to store any gas that is not immediately marketable, typically over the summer when demand is low and deliver it when in the winter months when the demand is high.

- Market speculationSpeculationIn finance, speculation is a financial action that does not promise safety of the initial investment along with the return on the principal sum...

. Producers and marketers use gas storage as a speculative tool, storing gas when they believe that prices will increase in the future and then selling it when it does reach those levels. - Insuring against any unforeseen accidents. Gas storage can be used as an insurance that may affect either production or delivery of natural gas. These may include natural factors such as hurricanes, or malfunction of production or distribution systems.

- Meeting regulatory obligations. Gas storage ensures to some extent the reliability of gas supply to the consumer at the lowest cost, as required by the regulatory body. This is why the regulatory body is monitors storage inventory levels.

- Reducing price volatility. Gas storage ensures commodity liquidity at the market centers. This helps contain natural gas price volatilityVolatility (finance)In finance, volatility is a measure for variation of price of a financial instrument over time. Historic volatility is derived from time series of past market prices...

and uncertainty. - Offsetting changes in natural gas demands. Gas storage facilities are gaining more importance due changes in natural gas demands. First, traditional supplies that once met the winter peak demand are now unable to keep pace. Second, there is a growing summer peak demand on natural gas, due to electricElectricityElectricity is a general term encompassing a variety of phenomena resulting from the presence and flow of electric charge. These include many easily recognizable phenomena, such as lightning, static electricity, and the flow of electrical current in an electrical wire...

generation via gas fired power plantsPower stationA power station is an industrial facility for the generation of electric energy....

.

Measures and definitions

Characteristics of underground storage facilities need to be defined and measured. A number of volumetric measures have been put in place for that purpose:- Total gas storage capacity: It is the maximum volumeVolumeVolume is the quantity of three-dimensional space enclosed by some closed boundary, for example, the space that a substance or shape occupies or contains....

of natural gas that can be stored at the storage facility. It is determined by several physical factors such as the reservoir volume, and also on the operating procedures and engineering methods used. - Total gas in storage: It is the total volume of gas in storage at the facility at a particular time.

- Base gas (also referred to as cushion gas): It is the volume of gas that is intended as permanent inventory in a storage reservoir to maintain adequate pressure and deliverability rates throughout the withdrawal season.

- Working gas capacity: It is the total gas storage capacity minus the base gas.

- Working gas: It is the total gas in storage minus the base gas. Working gas is the volume of gas available to the market place at a particular time.

- Physically unrecoverable gas: The amount of gas that becomes permanently embedded in the formation of the storage facility and that can never be extracted.

- Cycling rate: It is the average number of times a reservoir’s working gas volume can be turned over during a specific period of time. Typically the period of time used is one year.

- Deliverability: It is a measure of the amount of gas that can be delivered (withdrawn) from a storage facility on a daily basis. It is also referred to as the deliverability rate, withdrawal rate, or withdrawal capacity and is usually expressed in terms of millions of cubic feet of gas per day (MMcf/day) that can be delivered.

- Injection capacity (or rate): It is the amount of gas that can be injected into a storage facility on a daily basis. It can be thought of as the complement of the deliverability. Injection rate is also typically measured in millions of cubic feet of gas that can be delivered per day (MMcf/day).

The measurements above are not fixed for a given storage facility. For example, deliverability depends on several factors including the amount of gas in the reservoir and the pressure etc. Generally, a storage facility’s deliverability rate varies directly with the total amount of gas in the reservoir. It is at its highest when the reservoir is full and declines as gas is withdrawn. The injection capacity of a storage facility is also variable and depends on factors similar to those that affect deliverability. The injection rate varies inversely with the total amount of gas in storage. It is at its highest when the reservoir is nearly empty and declines as more gas is injected. The storage facility operator may also change operational parameters. This would allow, for example, the storage capacity maximum to be increased, the withdrawal of base gas during very high demand or reclassifying base gas to working gas if technological advances or engineering procedures allow.

Types

The most important type of gas storage is in underground reservoirs. There are three principal types — depleted gas reservoirs, aquiferAquifer

An aquifer is a wet underground layer of water-bearing permeable rock or unconsolidated materials from which groundwater can be usefully extracted using a water well. The study of water flow in aquifers and the characterization of aquifers is called hydrogeology...

reservoirs and salt cavern reservoirs. Each of these types possesses distinct physical and economic characteristics which govern the suitability of a particular type of storage type for a given application.

Depleted gas reservoir

These are the most prominent and common form of underground storage. They are the reservoir formations of natural gas fields that have produced all their economically recoverable gas. The depleted reservoir formation is readily capable of holding injected natural gas. Using such a facility is economically attractive because it allows the re-use, with suitable modification, of the extraction and distribution infrastructure remaining from the productive life of the gas field which reduces the start-up costs. Depleted reservoirs are also attractive because their geological and physical characteristics have already been studied by geologistGeologist

A geologist is a scientist who studies the solid and liquid matter that constitutes the Earth as well as the processes and history that has shaped it. Geologists usually engage in studying geology. Geologists, studying more of an applied science than a theoretical one, must approach Geology using...

s and petroleum engineers

Petroleum engineering

Petroleum engineering is an engineering discipline concerned with the activities related to the production of hydrocarbons, which can be either crude oil or natural gas. Subsurface activities are deemed to fall within the upstream sector of the oil and gas industry, which are the activities of...

and are usually well known. Consequently, depleted reservoirs are generally the cheapest and easiest to develop, operate, and maintain of the three types of underground storage.

In order to maintain working pressures in depleted reservoirs, about 50 percent of the natural gas in the formation must be kept as cushion gas. However, since depleted reservoirs were previously filled with natural gas and hydrocarbon

Hydrocarbon

In organic chemistry, a hydrocarbon is an organic compound consisting entirely of hydrogen and carbon. Hydrocarbons from which one hydrogen atom has been removed are functional groups, called hydrocarbyls....

s, they do not require the injection of gas that will become physically unrecoverable as this is already present in the formation. This provides a further economic boost for this type of facility, particularly when the cost of gas is high.

Typically, these facilities are operated on a single annual cycle; gas is injected during the off-peak summer months and withdrawn during the winter months of peak demand.

A number of factors determine whether or not a depleted gas field will make an economically viable storage facility. Geographically, depleted reservoirs should be relatively close to gas markets and to transportation infrastructure (pipelines and distribution systems) which will connect them to that market. Since the fields were at one time productive and connected to infrastructure distance from market is the dominant geographical factor. Geologically, it is preferred that depleted reservoir formations have high porosity

Porosity

Porosity or void fraction is a measure of the void spaces in a material, and is a fraction of the volume of voids over the total volume, between 0–1, or as a percentage between 0–100%...

and permeability

Permeability (fluid)

Permeability in fluid mechanics and the earth sciences is a measure of the ability of a porous material to allow fluids to pass through it.- Units :...

. The porosity of the formation is one of the factors that determines the amount of natural gas the reservoir is able to hold. Permeability is a measure of the rate at which natural gas flows through the formation and ultimately determines the rate of injection and withdrawal of gas from storage.

Aquifer reservoir

AquiferAquifer

An aquifer is a wet underground layer of water-bearing permeable rock or unconsolidated materials from which groundwater can be usefully extracted using a water well. The study of water flow in aquifers and the characterization of aquifers is called hydrogeology...

s are underground, porous and permeable rock formations that act as natural water reservoirs. In some cases they can be used for natural gas storage. Usually these facilities are operated on a single annual cycle as with depleted reservoirs. The geological and physical characteristics of aquifer formation are not known ahead of time and a significant investment has to go into investigating these and evaluating the aquifer’s suitability for natural gas storage.

If the aquifer is suitable, all of the associated infrastructure must be developed from scratch, increasing the development costs compared to depleted reservoirs. This includes installation of wells, extraction equipment, pipelines, dehydration facilities, and possibly compression equipment. Since the aquifer initially contains water there is little or no naturally occurring gas in the formation and of the gas injected some will be physically unrecoverable. As a result, aquifer storage typically requires significantly more cushion gas than depleted reservoirs; up to 80% of the total gas volume. Most aquifer storage facilities were developed when the price of natural gas was low, meaning this cushion gas was inexpensive to sacrifice. With rising gas prices aquifer storage becomes more expensive to develop.

A consequence of the above factors is that developing an aquifer storage facility is usually time consuming and expensive. Aquifers are generally the least desirable and most expensive type of natural gas storage facility.

Salt formation

Underground saltSalt dome

A salt dome is a type of structural dome formed when a thick bed of evaporite minerals found at depth intrudes vertically into surrounding rock strata, forming a diapir....

formations are well suited to natural gas storage. Salt caverns allow very little of the injected natural gas to escape from storage unless specifically extracted. The walls of a salt cavern are strong and impervious to gas over the lifespan of the storage facility.

Once a suitable salt feature is discovered and found to be suitable for the development of a gas storage facility a cavern is created within the salt feature. This is done by the process of cavern leaching. Fresh water is pumped down a borehole

Borehole

A borehole is the generalized term for any narrow shaft bored in the ground, either vertically or horizontally. A borehole may be constructed for many different purposes, including the extraction of water or other liquid or gases , as part of a geotechnical investigation, environmental site...

into the salt. Some of the salt is dissolved

Solvation

Solvation, also sometimes called dissolution, is the process of attraction and association of molecules of a solvent with molecules or ions of a solute...

leaving a void and the water, now saline

Saline water

Saline water is a general term for water that contains a significant concentration of dissolved salts . The concentration is usually expressed in parts per million of salt....

, is pumped back to the surface. The process continues until the cavern is the desired size. Once created, a salt cavern offers an underground natural gas storage vessel with very high deliverability. Cushion gas requirements are low, typically about 33 percent of total gas capacity.

Salt caverns are usually much smaller than depleted gas reservoir and aquifer

Aquifer

An aquifer is a wet underground layer of water-bearing permeable rock or unconsolidated materials from which groundwater can be usefully extracted using a water well. The study of water flow in aquifers and the characterization of aquifers is called hydrogeology...

storage facilities. A salt cavern facility may occupy only one one-hundredth of the area taken up by a depleted gas reservoir facility. Consequently, salt caverns cannot hold the large volumes of gas necessary to meet base load storage requirements. Deliverability from salt caverns is, however, much higher than for either aquifers or depleted reservoirs. This allows the gas stored in a salt cavern to be withdrawn and replenished more readily and quickly. This quick cycle-time is useful in emergency situations or during short periods of unexpected demand surges.

Although construction is more costly than depleted field conversions when measured on the basis of dollars per thousand cubic feet of working gas, the ability to perform several withdrawal and injection cycles each year reduces the effective cost.

| Type | Cushion Gas | Injection Period (Days) | Withdrawal Period (Days) |

|---|---|---|---|

| Depleted Reservoir | 50% | 200-250 | 100-150 |

| Aquifer Reservoir | 50%-80% | 200-250 | 100-150 |

| Salt Formation | 20%-30% | 20-40 | 10-20 |

LNG

LNGLiquefied natural gas

Liquefied natural gas or LNG is natural gas that has been converted temporarily to liquid form for ease of storage or transport....

facilities provide delivery capacity during peak periods when market demand exceeds pipeline deliverability. LNG storage tank

LNG storage tank

A liquefied natural gas storage tank or LNG storage tank is a specialized type of storage tank used for the storage of Liquefied Natural Gas. LNG storage tanks can be found in ground, above ground or in LNG carriers. The common characteristic of LNG Storage tanks is the ability to store LNG at the...

s possess a number of advantages over underground storage. As a liquid at approximately −163 °C (−260 °F), it occupies about 600 times less space than gas stored underground, and it provides high deliverability at very short notice because LNG storage facilities are generally located close to market and can be trucked to some customers avoiding pipeline

Pipeline transport

Pipeline transport is the transportation of goods through a pipe. Most commonly, liquids and gases are sent, but pneumatic tubes that transport solid capsules using compressed air are also used....

tolls. There is no requirement for cushion gas and it allows access to a global supply. LNG facilities are, however, more expensive to build and maintain than developing new underground storage facilities.

Gas can be temporarily stored in the pipeline system itself, through a process called line packing. This is done by packing more gas into the pipeline via an increase in the pressure. During periods of high demand, greater quantities of gas can be withdrawn from the pipeline in the market area, than is injected at the production area. The process of line packing is usually performed during off peak times to meet the next-day’s peaking demands. This method, however, only provides a temporary short-term substitute for traditional underground storage.

Gasholders

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

and Germany

Germany

Germany , officially the Federal Republic of Germany , is a federal parliamentary republic in Europe. The country consists of 16 states while the capital and largest city is Berlin. Germany covers an area of 357,021 km2 and has a largely temperate seasonal climate...

. There are two kinds of gasholder — column guided, which are guided up by a large frame that is always visible, regardless of the position of the holder, and spiral guided, which have no frame and are guided up by concentric runners in the previous lift.

Perhaps the most famous gasholder is a large column guided gasholder overlooking The Oval cricket ground

The Oval

The Kia Oval, still commonly referred to by its original name of The Oval, is an international cricket ground in Kennington, in the London Borough of Lambeth. In the past it was also sometimes called the Kennington Oval...

in London

London

London is the capital city of :England and the :United Kingdom, the largest metropolitan area in the United Kingdom, and the largest urban zone in the European Union by most measures. Located on the River Thames, London has been a major settlement for two millennia, its history going back to its...

. Gasholders were built in the United Kingdom from early Victorian times; many, such as Kings Cross in London and St. Marks Street in Kingston upon Hull

Kingston upon Hull

Kingston upon Hull , usually referred to as Hull, is a city and unitary authority area in the ceremonial county of the East Riding of Yorkshire, England. It stands on the River Hull at its junction with the Humber estuary, 25 miles inland from the North Sea. Hull has a resident population of...

are so old that they are entirely riveted, as their construction predates the use of welding in construction. The last to be built in the UK was in 1983.

Interstate pipeline companies

Interstate pipeline companies rely heavily on underground storage to perform load balancing and system supply managementSupply management

The term supply management describes the methods and processes of modern corporate or institutional buying. This may be for the purchasing of supplies for internal use referred to as indirect goods and services, purchasing raw materials for the consumption during the manufacturing process, or for...

on their long-haul transmission lines. FERC regulations though demand that these companies open up the remainder of their capacity not used for that purpose to third parties. Twenty-five interstate companies currently operate 172 underground natural gas storage facilities. In 2005, their facilities accounted for about 43 percent of overall storage deliverability and 55 percent of working gas capacity in the US. These operators include the Columbia Gas Transmission Company, Dominion Gas Transmission Company, The National Fuel Gas Supply Company, Natural Gas Pipeline of America, Texas Gas Transmission Company, Southern Star Central Pipeline Company, TransCanada Corporation.

Intrastate pipeline companies and local distribution companies

Intrastate pipeline companies use storage facilities for operational balancing and system supply as well as to meet the energy demand of end-use customers. LDCs generally use gas from storage to serve customers directly. This group operates 148 underground storage sites and account for 40 percent of overall storage deliverability and 32 percent of working gas capacity in the US. These operators include Consumers Energy Company and the Northern Illinois Gas Company (NicorNicor

Nicor, Inc. is an energy and shipping company headquartered in Naperville, Illinois. Its largest subsidiary, Nicor Gas, is a natural gas distribution company. Founded in 1954, the company serves more than two million customers in a service territory that encompasses most of the northern third of...

), in the US and Enbridge and Union Gas in Canada.

Independent storage service providers

The deregulationDeregulation

Deregulation is the removal or simplification of government rules and regulations that constrain the operation of market forces.Deregulation is the removal or simplification of government rules and regulations that constrain the operation of market forces.Deregulation is the removal or...

activity in the underground gas storage arena has attracted independent storage service providers to develop storage facilities. The capacity made available would then be leased to third-party customers such as marketers and electricity generators. It is expected that in the future, this group would take more market share, as more deregulation takes place. Currently in the US, this group accounts for 18 percent of overall storage deliverability and 13 percent of working gas capacity in the US.

| Type of Owner | Number of Sites | Working Gas Capacity (Bcf) | Daily Deliverability (MMcf) |

|---|---|---|---|

| Interstate Pipeline | 172 | 2,197 | 35,830 |

| Intrastate & LDC | 148 | 1,292 | 33,121 |

| Independent | 74 | 521 | 14,681 |

United States

The United States is typically broken out into three main regions when it comes to gas consumption and production. These are the consuming East, the consuming West and the producing South.

Consuming East

The consuming east region, particularly the states in the northern part, heavily rely on stored gas to meet the peak demand during the cold winter months. Due to the prevailing cold winters, large population centers and developed infrastructure, it is not surprising that this region has the highest level of working gas storage capacity of the other regions and the largest number of storage sites, mainly in depleted reservoirs. In addition to underground storage, LNG is increasingly playing a crucial role in providing supplemental backup and/or peaking supply to LDCs on a short term basis. Although the total capacity for these LNG facilities does not match those of underground storage in scale, the short term high deliverability makes up for that.Consuming West

The consuming west region has the smallest share of gas storage both in terms of the number of sites as well as gas capacity/deliverability. Storage in this area is mostly used to allow domestic and Albertan gas, coming from Canada, to flow at a rather constant rate.Producing South

The producing south's storage facilities are linked to the market centers and play a crucial role in the efficient export, transmission and distribution of natural gas produced to the consuming regions. These storage facilities allow the storage of gas that is not immediately marketable to be stored for later use.| Region | Number of Sites | Working Gas Capacity (Bcf) | Daily Deliverability (MMcf) |

|---|---|---|---|

| East | 280 | 2,045 | 39,643 |

| West | 37 | 628 | 9,795 |

| South | 98 | 1,226 | 28,296 |

Canada

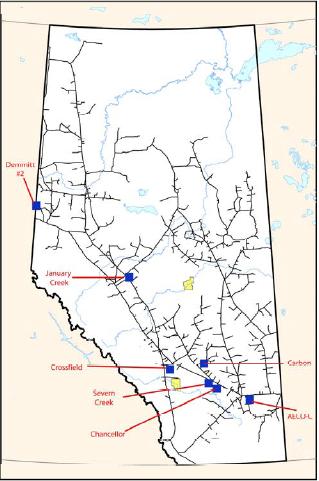

In Canada, the total working gas capacity was approximated to be 456 Gcuft in 2006. Alberta storage accounts for 47.5 percent of the total working gas volume. It is followed by Ontario which accounts for 39.1 percent, British Columbia which accounts for 7.6 percent, Saskatchewan which accounts for 5.1 percent and finally Quebec which accounts for 0.9 percent.

United States

Interstate pipeline companies in the US are subject to the jurisdiction of the Federal Energy Regulatory CommissionFederal Energy Regulatory Commission

The Federal Energy Regulatory Commission is the United States federal agency with jurisdiction over interstate electricity sales, wholesale electric rates, hydroelectric licensing, natural gas pricing, and oil pipeline rates...

(FERC). Prior to 1992, these companies owned all the gas that flowed through their systems. This also included gas in their storage facility, over which they had complete control. Then FERC Order 636 was implemented. This required the companies to operate their facilities, including gas storage on an open access basis. For gas storage, this meant that these companies could only reserve the capacity needed to maintain system integrity. The rest of the capacity would be available for leasing to third parties on a nondiscriminatory basis. Open access has opened a wide variety of application for gas storage, particularly for marketers which can now exploit price arbitrage

Arbitrage

In economics and finance, arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices...

opportunities. Any storage capacity would be priced at cost-based pricing

Pricing

Pricing is the process of determining what a company will receive in exchange for its products. Pricing factors are manufacturing cost, market place, competition, market condition, and quality of product. Pricing is also a key variable in microeconomic price allocation theory. Pricing is a...

, unless the provider can demonstrate to FERC that it lacks market power, in which case it may be allowed to price at market-based rates to gain market share. FERC defines market power as "..the ability of a seller profitably to maintain prices above competitive levels for a significant period of time.". The underlying pricing structure for storage has discouraged development in the gas storage sector, which has not seen many new storage facilities constructed, besides current ones being expanded. In 2005, FERC announced a new Order 678 targeted particularly to gas storage. This rule is intended to stimulate the development of new gas storage facility in the ultimate goal of reducing natural gas price volatility

Volatility (finance)

In finance, volatility is a measure for variation of price of a financial instrument over time. Historic volatility is derived from time series of past market prices...

. Commission Chairman Joseph T. Kelliher

Joseph T. Kelliher

Joseph Timothy Kelliher is an American energy executive and former chairman of the Federal Energy Regulatory Commission ....

observed: "Since 1988, natural gas demand in the United States has risen 24 percent. Over the same period, gas storage capacity has increased only 1.4 percent. While construction of storage capacity has lagged behind the demand for natural gas, we have seen record levels of price volatility. This suggests that current storage capacity is inadequate. Further, this year, what storage capacity exists may be full far earlier than in any previous year. According to some analysts, that raises the prospect that some domestic gas production may be shut-in. Our final rule should help reduce price volatility and expand storage capacity."

This ruling aims at opening up two approaches for developers of natural gas storage, to be able to charge market-based rates. The first one is the redefinition of the relevant product market for storage that includes alternatives for storage such as available pipeline capacity, local gas production and LNG terminals. The second approach aims at implementing section 312 of the Energy Policy Act. It would allow an applicant to request authority to charge "market-based rates even if a lack of market power has not been demonstrated, in circumstances where market-based rates are in the public interest and necessary to encourage the construction of storage capacity in the area needing storage service and that customers are adequately protected," the

Commission said. It is expected that this new order will entice developers, especially independent storage operators, to develop new facilities in the near future.

Canada

In AlbertaAlberta

Alberta is a province of Canada. It had an estimated population of 3.7 million in 2010 making it the most populous of Canada's three prairie provinces...

, gas storage rates are not regulated and providers negotiate rates with their customers on a contract-by-contract basis. However the Carbon facility which is owned by ATCO gas is regulated, since ATCO is a utility company. Therefore ATCO Gas has to charge cost-based rates for its customers, and can market any additional capacities at market-based rates.

In Ontario

Ontario

Ontario is a province of Canada, located in east-central Canada. It is Canada's most populous province and second largest in total area. It is home to the nation's most populous city, Toronto, and the nation's capital, Ottawa....

, gas storage is regulated by the Ontario Energy Board. Currently all the available storage is owned by vertically integrated utilities. The utility companies have to price their storage capacity sold to their customers at cost-based rates, but can market any remaining capacity at market-based rates. Storage developed by independent storage developers can charge market-based rates.

In British Columbia

British Columbia

British Columbia is the westernmost of Canada's provinces and is known for its natural beauty, as reflected in its Latin motto, Splendor sine occasu . Its name was chosen by Queen Victoria in 1858...

, gas storage is not regulated. All available storage capacity is marketed at market-based rates.

United Kingdom

The regulation of gas storage, transportation and sale is overseen by OFGEM (a government regulator). This has been the case since the gas industry was privatised in 1986. Most forms of gas storage were owned by Transco (now part of National Grid plcNational Grid plc

National Grid plc is a multinational electricity and gas utility company headquartered in London, United Kingdom. Its principal activities are in the United Kingdom and northeastern United States and it is one of the largest investor-owned energy companies in the world.National Grid is listed on...

), however the national network has now largely been broken down into regional networks, owned by different companies, they are however all still answerable to OFGEM.

Storage development cost

As with all infrastructural investments in the energy sector, developing storage facilities is capital intensive. Investors usually use the return on investment as a financial measure for the viability of such projects. It has been estimated that investors require a rate or return between 12 percent to 15 percent for regulated projects, and close to 20 percent for unregulated projects. The higher expected return from unregulated projects is due to the higher perceived market risk. In addition significant expenses are accumulated during the planning and location of potential storage sites to determine its suitability, which further increases the risk.The capital expenditure to build the facility mostly depends on the physical characteristics of the reservoir. First of all, the development cost of a storage facility largely depends on the type of the storage field. As a general rule of thumb

Rule of thumb

A rule of thumb is a principle with broad application that is not intended to be strictly accurate or reliable for every situation. It is an easily learned and easily applied procedure for approximately calculating or recalling some value, or for making some determination...

, salt caverns are the most expensive to develop on a Bcf of Working Gas Capacity Basis. However one should keep in mind that because the gas in such facilities can be cycled repeatedly, on a Deliverability basis, they may be less costly. A Salt Cavern facility might cost anywhere from $10 million to $25 million/Bcf of working gas capacity. The wide price range is because of region difference which dictates the geological requirements. These factors include the amount of compressive horsepower required, the type of surface and the quality of the geologic structure to name a few. A depleted reservoir costs between $5 million to $6 million/Bcf of Working Gas Capacity. Finally another major cost incurred when building new storage facilities is that of base gas. The amount of base gas in a reservoir could be as high as 80% for aquifers making them very unattractive to develop when gas prices are high. On the other hand salt caverns require the least amount of base gas. The high cost of base gas is what drives the expansion of current sites vs the development of new ones. This is because expansions require little addition to base gas.

The expected cash flows from such projects depend on a number of factors. These include the services the facility provides as well as the regulatory regime

Regime

The word regime refers to a set of conditions, most often of a political nature.-Politics:...

under which it operates. Facilities that operate primarily to take advantage of commodity

Commodity

In economics, a commodity is the generic term for any marketable item produced to satisfy wants or needs. Economic commodities comprise goods and services....

arbitrage opportunities are expected to have different cash flow benefits than ones primarily used to ensure seasonal supply reliability. Rules set by regulators can on one hand restrict the profit made by storage facility owners or on the other hand guarantee profit

Profit (economics)

In economics, the term profit has two related but distinct meanings. Normal profit represents the total opportunity costs of a venture to an entrepreneur or investor, whilst economic profit In economics, the term profit has two related but distinct meanings. Normal profit represents the total...

, depending on the market model.

Storage valuation

To understand the economics of gas storage, it is crucial to be able to value it. Several approaches have been proposed. They include :- Cost of Service Valuation

- Least Cost Planning

- Seasonal Valuation

- Option-Based Valuation

The different valuation modes co-exist in the real world and are not mutually exclusive. Buyers and sellers typically use a combination of the different prices to come up with the true value of storage. An example of the different valuations and the price they generate can be found in the table below.

| Type | Dollars/Mcf of Working Gas |

|---|---|

| Median Cost-of-Service | $0.64 |

| Intrinsic Value for Winter 05/06 as of August 2004 | $0.47-$0.62 |

| Least Cost Planning (Depleted Reservoir) | $0.70-$1.10 |

| Hypothetical Cost of Service of Salt Cavern | $2.93 |

| Intrinsic and Extrinsic Value of Salt Cavern (Depleted Reservoir) | $1.60-$1.90 |

Cost of Service Valuation

This valuation mode is typically used to value regulated storage, for instance storage operated by interstate pipeline companies. These companies are regulated by FERC. This pricing method allows the developers to recover their cost and an agreed upon return on investment. The regulatory body requires that the rates and tariffs are maintained and publicly published. The services provided by these companies include firm and interruptible storage as well as no-notice storage services. Usually, cost of service pricing is used for depleted reservoir facilities. If it is used to price, say salt cavern formations, the cost would be very high, due to the high cost of development of such facilities.Least cost planning

This valuation mode is typically used by local distribution companies (LDCs). It is based on pricing storage, according to the savings resulting from not having to resort to other more expensive options. This pricing mode depends on the consumer and their respective load profile/shape.Seasonal valuation

The seasonal valuation of storage is also referred to as the intrinsic valueIntrinsic value

Intrinsic value can refer to:*Intrinsic value , of an option or stock.*Intrinsic value , of a coin.*Intrinsic value , in ethics and philosophy.*Intrinsic value , in philosophy....

. It is evaluated as the difference between the two prices in a pair of forward prices. The idea being that one can lock-in a forward spread, either physically or financially. For developers seeking to study the feasibility of building a storage facility, they would typically look at the long-term price spreads.

Option-based valuation

In addition to possessing an intrinsic value, storage may also have extrinsic valueExtrinsic value

Extrinsic value is value which arises because of an agreement: Although the intrinsic value of a €100 note is not much more than the value of any similar piece of paper with a comparable graphic on it, it has a practical value of €100. This type of value is regularly associated with Representative...

. Intrinsic valuation of storage does not take the cycling ability of high-deliverability storage. The extrinsic valuation reflects the fact that in such facilities, say salt cavern formations, a proportion of the space can be used more than once, thus increasing value. Such high-deliverability storage facility allows its user to respond to variations in demand/price within a season or during a given day rather than just seasonal variations as was the case with single cycle facilities.

Effects of natural gas prices on storage

In general as we see in the graph below, high gas pricesNatural gas prices

Natural gas prices, as with other commodity prices, are mainly driven by supply and demand fundamentals. However, natural gas prices may also be linked to the price of crude oil and/or petroleum products, especially in continental Europe.-U.S...

are typically associated to low storage periods. Usually when prices are high during the early months of the refill season (April–October), many users of storage adopt a wait and see attitude. They limit their gas intake in anticipation that the prices will drop before the heating season begins (November–March). However when that decrease does not occur, they are forced to buy natural gas at high prices. This is particularly true for Local Distribution and other operators who rely on storage to meet the seasonal demand for their customers. On the other hand, other storage users, who use storage for as a marketing tool (hedging or speculating) will hold off storing a lot of gas when the prices are high.

Future of storage technology

Research is being conducted on many fronts in the gas storage field to help identify new improved and more economical ways to store gas.Research being conducted by the US Energy department is showing that salt formations can be chilled allowing for more gas to be stored. This will reduce the size of the formation needed to be treated, and have salt extracted from it. This will lead to cheaper development costs for salt formation storage facility type.

Another aspect being looked at, are other formations that may hold gas. These include hard rock formations such as granite, in areas where such formations exists and other types currently used for gas storage do not.

In Sweden a new type of storage facility has been built, called "lined rock cavern". This storage facility consists of installing a steel tank in a cavern in the rock of a hill and surrounding it with concrete. Although the development cost of such facility is quite expensive, its ability to cycle gas multiple times compensates for it, similar to salt formation facilities.

Finally, another research project sponsored by the Department of Energy, is that of hydrates. Hydrates are compounds formed when natural gas is frozen in the presence of water. The advantage being that as much as 181 standard cubic feet of natural gas could be stored in a single cubic foot of hydrate.

See also

- Natural gasNatural gasNatural gas is a naturally occurring gas mixture consisting primarily of methane, typically with 0–20% higher hydrocarbons . It is found associated with other hydrocarbon fuel, in coal beds, as methane clathrates, and is an important fuel source and a major feedstock for fertilizers.Most natural...

- Natural gas pricesNatural gas pricesNatural gas prices, as with other commodity prices, are mainly driven by supply and demand fundamentals. However, natural gas prices may also be linked to the price of crude oil and/or petroleum products, especially in continental Europe.-U.S...

- Natural gas processingNatural gas processingNatural-gas processing is a complex industrial process designed to clean raw natural gas by separating impurities and various non-methane hydrocarbons and fluids to produce what is known as pipeline quality dry natural gas.-Background:...

- Carbon dioxideCarbon dioxideCarbon dioxide is a naturally occurring chemical compound composed of two oxygen atoms covalently bonded to a single carbon atom...

(CO2) - Compressed natural gasCompressed natural gasCompressed natural gas is a fossil fuel substitute for gasoline , diesel, or propane/LPG. Although its combustion does produce greenhouse gases, it is a more environmentally clean alternative to those fuels, and it is much safer than other fuels in the event of a spill...

(CNG) - Fuel station

- Future energy development

- Gasholder

- Hydrogen storageHydrogen storageHydrogen storage describes the methods for storing H2 for subsequent use. The methods span many approaches, including high pressures, cryogenics, and chemical compounds that reversibly release H2 upon heating...

- Liquefied natural gasLiquefied natural gasLiquefied natural gas or LNG is natural gas that has been converted temporarily to liquid form for ease of storage or transport....

(LNG) - List of North American natural gas pipelines

- Underground hydrogen storageUnderground hydrogen storageUnderground hydrogen storage is the practice of hydrogen storage in underground caverns, salt domes and depleted oil/gas fields. Large quantities of gaseous hydrogen have been stored in underground caverns by ICI for many years without any difficulties...

- Steam reformingSteam reformingFossil fuel reforming is a method of producing hydrogen or other useful products from fossil fuels such as natural gas. This is achieved in a processing device called a reformer which reacts steam at high temperature with the fossil fuel. The steam methane reformer is widely used in industry to...

- World energy resources and consumptionWorld energy resources and consumption]World energy consumption in 2010: over 5% growthEnergy markets have combined crisis recovery and strong industry dynamism. Energy consumption in the G20 soared by more than 5% in 2010, after the slight decrease of 2009. This strong increase is the result of two converging trends...