History of banking in China

Encyclopedia

The history of banking in China includes the business of dealing with money

and credit transactions in China

.

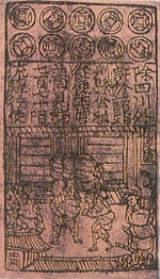

Chinese financial institutions were conducting all major banking functions, including the acceptance of deposits, the making of loans, issuing notes, money exchange, and long-distance remittance of money by the Song Dynasty

Chinese financial institutions were conducting all major banking functions, including the acceptance of deposits, the making of loans, issuing notes, money exchange, and long-distance remittance of money by the Song Dynasty

(960-1279). In 1024, the first paper currency was issued by the state in Sichuan. The institutions of piaohao (票號) and qianzhuang (錢莊) more often cooperated than competed in China's financial market.

. The first piaohao originated from the Xiyuecheng Dye Company of Pingyao

. To deal with the transfer of large amounts of cash from one branch to another, the company introduced drafts, cashable in the company's many branches around China. Although this new method was originally designed for business transactions within the Xiyuecheng Company, it became so popular that in 1823 the owner gave up the dye business altogether and reorganised the company as a special remittance firm, Rishengchang Piaohao. In the next thirty years, eleven piaohao were established in Shanxi province, in the counties of Qixian, Taigu, and Pingyao. By the end of the nineteenth century, thirty-two piaohao with 475 branches were in business covering most of China.

All piaohao were organised as single proprietaries

or partnership

s, where the owners carried unlimited liability. They concentrated on interprovincial remittances, and later on conducting government services. From the time of the Taiping Rebellion

, when transportation routes between the capital and the provinces were cut off, piaohao began involved with the delivery of government tax revenue. Piaohao grew by taking on a role in advancing funds and arranging foreign loans for provincial governments, issuing notes, and running regional treasuries.

, Ningbo

, and Shaoxing

. The first qianzhuang can be traced to at least the mid-eighteenth century. In 1776, several of these banks in Shanghai organised themselves into a guild under the name of qianye gongsuo. In contrast to piaohao, most qianzhuang were local and functioned as commercial banks by conducting local money exchange, issuing cash notes, exchanging bills and notes, and discounting for the local business community.

Qianzhuang maintained close relationships with Chinese merchants, and grew with the expansion of China's foreign trade. When Western banks first entered China, they issued "chop loans" (caipiao) to the qianzhuang, who would then lend this money to Chinese merchants who used it to purchase goods from foreign firms. It is estimated that there were around 10,000 qianzhuang in China in the early 1890s.

, established in 1865 in Hong Kong, later became the largest foreign bank in China.

In the early 1890s, Germany's Deutsch-Asiatische Bank

(德華銀行), Japan's Yokohama Specie Bank

(橫濱正金銀行), France's Banque de l'Indo-Chine (东方匯理银行), and Russia's Russo-Asiatic Bank (華俄道勝銀行) opened branches in China and challenged British ascendancy in China's financial market. By the end of the nineteenth century there were nine foreign banks with forty-five branches in China's treaty ports.

Foreign banks enjoyed extraterritorial rights. They also enjoyed complete control over China's international remittance and foreign trade financing. Being unregulated by the Chinese government, they were free to issue banknotes for circulation, accept deposits from Chinese citizens, and make loans to the qianzhuang.

, the Qing government began initiating large industrial projects which required large amounts of capital. Though the existing domestic financial institutions provided sufficient credit and transfer facilities to support domestic trade and worked well with small-scale enterprises, they could not meet China's new financial demands. China turned to foreign banks for large scale and long term finance. Following a series of military defeats, the Qing government was forced to borrow from foreign banks and syndicates to finance its indemnity payments to foreign powers.

A number of proposals were made by a modern Chinese banking institution from the 1860s onwards. Li Hongzhang

, one of the leaders of the self-strengthening movement, made serious efforts to create a foreign-Chinese joint bank in 1885 and again in 1887.

The Imperial Bank of China

(中国通商银行), China's first modern bank, opened for business in 1897. The bank was organised as a joint-stock firm. It adopted the internal regulations of HSBC, and its senior managers were foreign professionals. After the proclamation of the Republic of China, the bank changed its English name to the Commercial Bank of China in 1912. The name more accurately translated its Chinese name and removed any link to the Qing Dynasty.

In 1905, China's first central bank was established as the Bank of the Board of Revenue(大清户部银行). Three years later, its name was changed to the Great Qing Government Bank (大清銀行). Intended as a replacement for all existing banknotes, the Da Qing Bank's note was granted exclusive privilege to be used in all public and private fund transfers, including tax payments and debt settlement

s. Da Qing Bank was also given exclusive privilege to run the state treasury. The Board of Revenue that controlled most of the central government's revenue transferred most of its tax remittance through the bank and its branches. The government entrusted the bank with the transfer of the Salt Surplus Tax, diplomatic expenditures, the management of foreign loans, the payment of foreign indemnities, and the deposit and transfer of the customs tax in many treaty ports.

Following the Xinhai Revolution

of 1911, Daqing Bank was renamed the Bank of China

. This bank continues to exist today.

Another government bank, the Bank of Communications

(交通銀行), was organised in 1908 by the Ministry of Posts and Communications to raise money for the redemption of the Beijing-Hankou Railway

from Belgian contractors. The bank's aim was to unify funding for steamship lines, railways, as well as telegraph and post

al facilities.

s without state funding. The Xincheng Bank was established in Shanghai in 1906, followed by the National Commercial Bank in Hangzhou the following year, and the Ningbo Commercial and Savings Bank (四明銀行) in 1908. In that year, the Regulations of Banking Registration was issued by the Ministry of Revenue, which continued to have effect well after the fall of the Qing dynasty

.

A lion's share of the profitable official remittance business was taken by the Daqing Bank from the piaohao. The piaohao all but disappeared following the Xinhai Revolution

in 1911.

The same period saw the increasing power of private interests in modern Chinese banking and the concentration of banking capital. In Shanghai, the so-called "southern three banks" (南三行) were established. They were the Shanghai Commercial and Savings Bank (上海商業儲蓄銀行), the National Commercial Bank (浙江興業銀行), and the Zhejiang Industrial Bank (浙江實業銀行). Four other banks, known as the "northern four banks" (北四行) emerged later. They were the Yien Yieh Commercial Bank (鹽業銀行), the Kincheng Banking Corporation (金城銀行), the Continental Bank (大陸銀行), and the China & South Sea Bank (中南銀行). The first three were initiated by current and retired officials of the Beijing government, whilst the last was created by an overseas Chinese

.

. With the backing of the Mixed Court, the Shanghai Branch of the Bank of China successfully resisted the order.

The Bank of China's bylaws were revised in 1917 to restrict government intervention.

in 1937 has been described as a "golden decade" for China's modernisation as well as for its banking industry. Modern Chinese banks extended their business in scope, making syndicated industrial loans and offering loans to rural areas.

The Nationalist government created the Central Bank of China

in 1928, with Song Ziwen as its first president. The Bank of China was reorganised as a bank specialising in the management of foreign exchange

while the Bank of Communications focused on developing industry.

The Bureau of Financial Supervision was set up under the Ministry of Finance, to supervise financial affairs.

Confronted with imminent war with Japan, the Chinese government took control of over 70 percent of the assets of modern Chinese banks through the notorious banking coup.

and consolidation

of the country's banks received the highest priority in the earliest years of the People's Republic, and banking was the first sector to be completely socialized. In the period of recovery after the Chinese civil war

(1949-52), the People's Bank of China

moved very effectively to halt raging inflation

and bring the nation's finances under central control. Over the course of time, the banking organization was modified repeatedly to suit changing conditions and new policies.

The banking system was centralized early on under the Ministry of Finance

, which exercised firm control over all financial services

, credit

, and the money supply

. During the 1980s the banking system was expanded and diversified

to meet the needs of the reform program, and the scale of banking activity rose sharply. New budgetary

procedures required state enterprises to remit to the state only a tax on income and to seek investment funds in the form of bank loans. Between 1979 and 1985, the volume of deposits nearly tripled and the value of bank loans rose by 260 percent. By 1987 the banking system included the People's Bank of China

, Agricultural Bank of China

, Bank of China

(which handled foreign exchange matters), China Investment Bank, China Industrial and Commercial Bank, People's Construction Bank, Communications Bank, People's Insurance Company of China

, rural credit cooperatives, and urban credit cooperatives.

The People's Bank of China was the central bank

and the foundation of the banking system. Although the bank overlapped in function with the Ministry of Finance and lost many of its responsibilities during the Cultural Revolution

, in the 1970s it was restored to its leading position. As the central bank, the People's Bank of China had sole responsibility for issuing currency and controlling the money supply. It also served as the government treasury, the main source of credit for economic units, the clearing center for financial transactions, the holder of enterprise deposits, the national savings bank, and a ubiquitous monitor of economic activities.

Another financial institution, the Bank of China, handled all dealings in foreign exchange. It was responsible for allocating the country's foreign exchange reserves, arranging foreign loans, setting exchange rates for China's currency, issuing letters of credit, and generally carrying out all financial transactions with foreign firms and individuals. The Bank of China had offices in Beijing

and other cities engaged in foreign trade and maintained overseas offices in major international financial centers, including Hong Kong

, London

, New York

, Singapore

, and Luxembourg

.

The Agricultural Bank was created in the 1950s to facilitate financial operations in the rural areas. The Agricultural Bank provided financial support to agricultural units. It issued loans, handled state appropriations for agriculture, directed the operations of the rural credit cooperatives, and carried out overall supervision of rural financial affairs. The Agricultural Bank was headquartered in Beijing and had a network of branches throughout the country. It flourished in the late 1950s and mid-1960s but languished thereafter until the late 1970s, when the functions and autonomy of the Agricultural Bank were increased substantially to help promote higher agricultural production. In the 1980s it was restructured again and given greater authority in order to support the growth and diversification of agriculture under the responsibility system.

The People's Construction Bank managed state appropriations and loans for capital construction. It checked the activities of loan recipients to ensure that the funds were used for their designated construction purpose. Money was disbursed in stages as a project progressed. The reform policy shifted the main source of investment funding from the government budget to bank loans and increased the responsibility and activities of the People's Construction Bank.

Rural credit cooperatives were small, collectively owned savings and lending organizations that were the main source of small-scale financial services at the local level in the countryside. They handled deposits and short-term loans for individual farm families, villages, and cooperative organizations. Subject to the direction of the Agricultural Bank, they followed uniform state banking policies but acted as independent units for accounting purposes. In 1985 rural credit cooperatives held total deposits of ¥72.5 billion.

Urban credit cooperatives were a relatively new addition to the banking system in the mid-1980s, when they first began widespread operations. As commercial opportunities grew in the reform period, the thousands of individual and collective enterprises that sprang up in urban areas created a need for small-scale financial services that the formal banks were not prepared to meet. Bank officials therefore encouraged the expansion of urban credit cooperatives as a valuable addition to the banking system. In 1986 there were more than 1,100 urban credit cooperatives, which held a total of ¥3.7 billion in deposits and made loans worth ¥1.9 billion.

In the mid-1980s the banking system still lacked some of the services and characteristics that were considered basic in most countries. Interbank relations were very limited, and interbank borrowing and lending was virtually unknown. Checking accounts were used by very few individuals, and bank credit cards did not exist. In 1986 initial steps were taken in some of these areas. Interbank borrowing and lending networks were created among twenty-seven cities along the Yangtze River

and among fourteen cities in north China. Interregional financial networks were created to link banks in eleven leading cities all over China, including Shenyang

, Guangzhou

, Wuhan

, Chongqing

, and Xi'an

and also to link the branches of the Agricultural Bank. The first Chinese credit card, the Great Wall Card, was introduced in June 1986 to be used for foreign exchange transactions. Another financial innovation in 1986 was the opening of China's first stock exchange

s since 1949. Small stock exchanges began operations somewhat tentatively in Shenyang, Liaoning Province, in August 1986 and in Shanghai in September 1986.

Throughout the history of the People's Republic, the banking system has exerted close control over financial transactions and the money supply. All government departments, publicly and collectively owned economic units, and social, political, military, and educational organizations were required to hold their financial balances as bank deposits. They were also instructed to keep on hand only enough cash to meet daily expenses; all major financial transactions were to be conducted through banks. Payment for goods and services exchanged by economic units was accomplished by debiting the account of the purchasing unit and crediting that of the selling unit by the appropriate amount. This practice effectively helped to minimize the need for currency

.

Since 1949 China's leaders have urged the Chinese people to build up personal savings accounts to reduce the demand for consumer goods and increase the amount of capital available for investment. Small branch offices of savings banks were conveniently located throughout the urban areas. In the countryside savings were deposited with the rural credit cooperatives, which could be found in most towns and villages. In 1986 savings deposits for the entire country totaled over ¥223.7 billion.

Money

Money is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally in the past,...

and credit transactions in China

China

Chinese civilization may refer to:* China for more general discussion of the country.* Chinese culture* Greater China, the transnational community of ethnic Chinese.* History of China* Sinosphere, the area historically affected by Chinese culture...

.

Early Chinese banks

Song Dynasty

The Song Dynasty was a ruling dynasty in China between 960 and 1279; it succeeded the Five Dynasties and Ten Kingdoms Period, and was followed by the Yuan Dynasty. It was the first government in world history to issue banknotes or paper money, and the first Chinese government to establish a...

(960-1279). In 1024, the first paper currency was issued by the state in Sichuan. The institutions of piaohao (票號) and qianzhuang (錢莊) more often cooperated than competed in China's financial market.

Piaohao

An early Chinese banking institution was called the piaohao, also known as Shanxi banks because they were owned primarily by natives of ShanxiShanxi

' is a province in Northern China. Its one-character abbreviation is "晋" , after the state of Jin that existed here during the Spring and Autumn Period....

. The first piaohao originated from the Xiyuecheng Dye Company of Pingyao

Pingyao

Pingyao is a Chinese city and county in central Shanxi province, China. It lies about 715 km from Beijing and 80 km from the provincial capital, Taiyuan. During the Qing Dynasty, Pingyao was a financial center of China...

. To deal with the transfer of large amounts of cash from one branch to another, the company introduced drafts, cashable in the company's many branches around China. Although this new method was originally designed for business transactions within the Xiyuecheng Company, it became so popular that in 1823 the owner gave up the dye business altogether and reorganised the company as a special remittance firm, Rishengchang Piaohao. In the next thirty years, eleven piaohao were established in Shanxi province, in the counties of Qixian, Taigu, and Pingyao. By the end of the nineteenth century, thirty-two piaohao with 475 branches were in business covering most of China.

All piaohao were organised as single proprietaries

Sole proprietorship

A sole proprietorship, also known as the sole trader or simply a proprietorship, is a type of business entity that is owned and run by one individual and in which there is no legal distinction between the owner and the business. The owner receives all profits and has unlimited responsibility for...

or partnership

Partnership

A partnership is an arrangement where parties agree to cooperate to advance their mutual interests.Since humans are social beings, partnerships between individuals, businesses, interest-based organizations, schools, governments, and varied combinations thereof, have always been and remain commonplace...

s, where the owners carried unlimited liability. They concentrated on interprovincial remittances, and later on conducting government services. From the time of the Taiping Rebellion

Taiping Rebellion

The Taiping Rebellion was a widespread civil war in southern China from 1850 to 1864, led by heterodox Christian convert Hong Xiuquan, who, having received visions, maintained that he was the younger brother of Jesus Christ, against the ruling Manchu-led Qing Dynasty...

, when transportation routes between the capital and the provinces were cut off, piaohao began involved with the delivery of government tax revenue. Piaohao grew by taking on a role in advancing funds and arranging foreign loans for provincial governments, issuing notes, and running regional treasuries.

Qianzhuang

Independent of the nationwide network of piaohao there were a large number of small native banks, generally called qianzhuang. These institutions first appeared in the Yangzi Delta region, in ShanghaiShanghai

Shanghai is the largest city by population in China and the largest city proper in the world. It is one of the four province-level municipalities in the People's Republic of China, with a total population of over 23 million as of 2010...

, Ningbo

Ningbo

Ningbo is a seaport city of northeastern Zhejiang province, Eastern China. Holding sub-provincial administrative status, the municipality has a population of 7,605,700 inhabitants at the 2010 census whom 3,089,180 in the built up area made of 6 urban districts. It lies south of the Hangzhou Bay,...

, and Shaoxing

Shaoxing

Shaoxing is a prefecture-level city in northeastern Zhejiang province, People's Republic of China. Located on the south bank of the Qiantang River estuary, it borders Ningbo to the east, Taizhou to the southeast, Jinhua to the southwest, and Hangzhou to the west. It was once known as "越"...

. The first qianzhuang can be traced to at least the mid-eighteenth century. In 1776, several of these banks in Shanghai organised themselves into a guild under the name of qianye gongsuo. In contrast to piaohao, most qianzhuang were local and functioned as commercial banks by conducting local money exchange, issuing cash notes, exchanging bills and notes, and discounting for the local business community.

Qianzhuang maintained close relationships with Chinese merchants, and grew with the expansion of China's foreign trade. When Western banks first entered China, they issued "chop loans" (caipiao) to the qianzhuang, who would then lend this money to Chinese merchants who used it to purchase goods from foreign firms. It is estimated that there were around 10,000 qianzhuang in China in the early 1890s.

Entry of foreign banks

British and other European banks entered China around the middle of the nineteenth century to service the growing number of Western trade firms. The Chinese coined the term yinhang (銀行), meaning "silver institution", for the English word "bank". The first foreign bank in China was the Bombay-based British Oriental Bank (東藩匯理銀行), which opened branches in Hong Kong, Guangzhou and Shanghai in the 1840s. Other British banks followed suit and set up their branches in China one after another. The British enjoyed a virtual monopoly on modern banking for forty years. The Hong Kong and Shanghai Banking Corporation (香港上海匯丰銀行), now HSBCHSBC

HSBC Holdings plc is a global banking and financial services company headquartered in Canary Wharf, London, United Kingdom. it is the world's second-largest banking and financial services group and second-largest public company according to a composite measure by Forbes magazine...

, established in 1865 in Hong Kong, later became the largest foreign bank in China.

In the early 1890s, Germany's Deutsch-Asiatische Bank

Deutsch-Asiatische Bank

Deutsch-Asiatische Bank was a foreign bank in China. Its principal activity was trade financing; but together with English and French banks, it also played a role in the underwriting of bonds for the Chinese government and in the financing of railway construction in China.- History...

(德華銀行), Japan's Yokohama Specie Bank

Yokohama Specie Bank

is a Japanese bank founded in Yokohama, Japan in the year 1880. It later became The Bank of Tokyo, Ltd. in 1947. The bank played a significant role in Japanese trade with China...

(橫濱正金銀行), France's Banque de l'Indo-Chine (东方匯理银行), and Russia's Russo-Asiatic Bank (華俄道勝銀行) opened branches in China and challenged British ascendancy in China's financial market. By the end of the nineteenth century there were nine foreign banks with forty-five branches in China's treaty ports.

Foreign banks enjoyed extraterritorial rights. They also enjoyed complete control over China's international remittance and foreign trade financing. Being unregulated by the Chinese government, they were free to issue banknotes for circulation, accept deposits from Chinese citizens, and make loans to the qianzhuang.

Government banks

After the launch of the Self-strengthening movementSelf-Strengthening Movement

The Self-Strengthening Movement , c 1861–1895, was a period of institutional reforms initiated during the late Qing Dynasty following a series of military defeats and concessions to foreign powers....

, the Qing government began initiating large industrial projects which required large amounts of capital. Though the existing domestic financial institutions provided sufficient credit and transfer facilities to support domestic trade and worked well with small-scale enterprises, they could not meet China's new financial demands. China turned to foreign banks for large scale and long term finance. Following a series of military defeats, the Qing government was forced to borrow from foreign banks and syndicates to finance its indemnity payments to foreign powers.

A number of proposals were made by a modern Chinese banking institution from the 1860s onwards. Li Hongzhang

Li Hongzhang

Li Hongzhang or Li Hung-chang , Marquis Suyi of the First Class , GCVO, was a leading statesman of the late Qing Empire...

, one of the leaders of the self-strengthening movement, made serious efforts to create a foreign-Chinese joint bank in 1885 and again in 1887.

The Imperial Bank of China

Imperial Bank of China

The Imperial Bank of China was the first Chinese-owned bank modelled on Western banks and banking practices. It was founded in Shanghai by Mr. Sheng Xuanhuai in 1897 successfully operating until 1913 when it was renamed to the Commercial Bank of China...

(中国通商银行), China's first modern bank, opened for business in 1897. The bank was organised as a joint-stock firm. It adopted the internal regulations of HSBC, and its senior managers were foreign professionals. After the proclamation of the Republic of China, the bank changed its English name to the Commercial Bank of China in 1912. The name more accurately translated its Chinese name and removed any link to the Qing Dynasty.

In 1905, China's first central bank was established as the Bank of the Board of Revenue(大清户部银行). Three years later, its name was changed to the Great Qing Government Bank (大清銀行). Intended as a replacement for all existing banknotes, the Da Qing Bank's note was granted exclusive privilege to be used in all public and private fund transfers, including tax payments and debt settlement

Debt settlement

Debt settlement, also known as debt arbitration, debt negotiation or credit settlement, is an approach to debt reduction in which the debtor and creditor agree on a reduced balance that will be regarded as payment in full....

s. Da Qing Bank was also given exclusive privilege to run the state treasury. The Board of Revenue that controlled most of the central government's revenue transferred most of its tax remittance through the bank and its branches. The government entrusted the bank with the transfer of the Salt Surplus Tax, diplomatic expenditures, the management of foreign loans, the payment of foreign indemnities, and the deposit and transfer of the customs tax in many treaty ports.

Following the Xinhai Revolution

Xinhai Revolution

The Xinhai Revolution or Hsinhai Revolution, also known as Revolution of 1911 or the Chinese Revolution, was a revolution that overthrew China's last imperial dynasty, the Qing , and established the Republic of China...

of 1911, Daqing Bank was renamed the Bank of China

Bank of China

Bank of China Limited is one of the big four state-owned commercial banks of the People's Republic of China. It was founded in 1912 by the Government of the Republic of China, to replace the Government Bank of Imperial China. It is the oldest bank in China...

. This bank continues to exist today.

Another government bank, the Bank of Communications

Bank of Communications

Bank of Communications Limited , founded in 1908, is one of the largest banks in China.-Before 1949:The Bank of Communications was founded in 1908 and emerged as one of the first few major national and note-issuing banks in the early days of the Republic of China...

(交通銀行), was organised in 1908 by the Ministry of Posts and Communications to raise money for the redemption of the Beijing-Hankou Railway

Jinghan railway

The Beijing–Hankou or Jinghan Railway was a railway line extending from the Chinese capital Beijing to Hankou in Hubei province that was finished in 1905. It was originally known as the Peking–Hankow Railway. Across the Yangtze river in Wuchang was another line, the Canton–Hankow...

from Belgian contractors. The bank's aim was to unify funding for steamship lines, railways, as well as telegraph and post

Mail

Mail, or post, is a system for transporting letters and other tangible objects: written documents, typically enclosed in envelopes, and also small packages are delivered to destinations around the world. Anything sent through the postal system is called mail or post.In principle, a postal service...

al facilities.

Private banks

Three private banks appeared in the late Qing period, all created by private entrepreneurEntrepreneur

An entrepreneur is an owner or manager of a business enterprise who makes money through risk and initiative.The term was originally a loanword from French and was first defined by the Irish-French economist Richard Cantillon. Entrepreneur in English is a term applied to a person who is willing to...

s without state funding. The Xincheng Bank was established in Shanghai in 1906, followed by the National Commercial Bank in Hangzhou the following year, and the Ningbo Commercial and Savings Bank (四明銀行) in 1908. In that year, the Regulations of Banking Registration was issued by the Ministry of Revenue, which continued to have effect well after the fall of the Qing dynasty

Qing Dynasty

The Qing Dynasty was the last dynasty of China, ruling from 1644 to 1912 with a brief, abortive restoration in 1917. It was preceded by the Ming Dynasty and followed by the Republic of China....

.

A lion's share of the profitable official remittance business was taken by the Daqing Bank from the piaohao. The piaohao all but disappeared following the Xinhai Revolution

Xinhai Revolution

The Xinhai Revolution or Hsinhai Revolution, also known as Revolution of 1911 or the Chinese Revolution, was a revolution that overthrew China's last imperial dynasty, the Qing , and established the Republic of China...

in 1911.

The same period saw the increasing power of private interests in modern Chinese banking and the concentration of banking capital. In Shanghai, the so-called "southern three banks" (南三行) were established. They were the Shanghai Commercial and Savings Bank (上海商業儲蓄銀行), the National Commercial Bank (浙江興業銀行), and the Zhejiang Industrial Bank (浙江實業銀行). Four other banks, known as the "northern four banks" (北四行) emerged later. They were the Yien Yieh Commercial Bank (鹽業銀行), the Kincheng Banking Corporation (金城銀行), the Continental Bank (大陸銀行), and the China & South Sea Bank (中南銀行). The first three were initiated by current and retired officials of the Beijing government, whilst the last was created by an overseas Chinese

Overseas Chinese

Overseas Chinese are people of Chinese birth or descent who live outside the Greater China Area . People of partial Chinese ancestry living outside the Greater China Area may also consider themselves Overseas Chinese....

.

Note suspension incident

In 1916 the Republican government in Beijing ordered the suspension of paper note conversion to silverSilver

Silver is a metallic chemical element with the chemical symbol Ag and atomic number 47. A soft, white, lustrous transition metal, it has the highest electrical conductivity of any element and the highest thermal conductivity of any metal...

. With the backing of the Mixed Court, the Shanghai Branch of the Bank of China successfully resisted the order.

The Bank of China's bylaws were revised in 1917 to restrict government intervention.

Golden Age of Chinese banking

The decade from the Northern Expedition to the Second Sino-Japanese WarSecond Sino-Japanese War

The Second Sino-Japanese War was a military conflict fought primarily between the Republic of China and the Empire of Japan. From 1937 to 1941, China fought Japan with some economic help from Germany , the Soviet Union and the United States...

in 1937 has been described as a "golden decade" for China's modernisation as well as for its banking industry. Modern Chinese banks extended their business in scope, making syndicated industrial loans and offering loans to rural areas.

The Nationalist government created the Central Bank of China

Central Bank of China

The Central Bank of the Republic of China , known in English from 1924 to 2007 as the Central Bank of China, is the central bank of the Republic of China . Its legal and common name in Chinese is literally translated as the "Central Bank"...

in 1928, with Song Ziwen as its first president. The Bank of China was reorganised as a bank specialising in the management of foreign exchange

Foreign exchange market

The foreign exchange market is a global, worldwide decentralized financial market for trading currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends...

while the Bank of Communications focused on developing industry.

The Bureau of Financial Supervision was set up under the Ministry of Finance, to supervise financial affairs.

Confronted with imminent war with Japan, the Chinese government took control of over 70 percent of the assets of modern Chinese banks through the notorious banking coup.

After 1949

The history of the Chinese banking system has been somewhat checkered. NationalizationNationalization

Nationalisation, also spelled nationalization, is the process of taking an industry or assets into government ownership by a national government or state. Nationalization usually refers to private assets, but may also mean assets owned by lower levels of government, such as municipalities, being...

and consolidation

Consolidation (business)

Consolidation or amalgamation is the act of merging many things into one. In business, it often refers to the mergers and acquisitions of many smaller companies into much larger ones. In the context of financial accounting, consolidation refers to the aggregation of financial statements of a group...

of the country's banks received the highest priority in the earliest years of the People's Republic, and banking was the first sector to be completely socialized. In the period of recovery after the Chinese civil war

Chinese Civil War

The Chinese Civil War was a civil war fought between the Kuomintang , the governing party of the Republic of China, and the Communist Party of China , for the control of China which eventually led to China's division into two Chinas, Republic of China and People's Republic of...

(1949-52), the People's Bank of China

People's Bank of China

The People's Bank of China is the central bank of the People's Republic of China with the power to control monetary policy and regulate financial institutions in mainland China...

moved very effectively to halt raging inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

and bring the nation's finances under central control. Over the course of time, the banking organization was modified repeatedly to suit changing conditions and new policies.

The banking system was centralized early on under the Ministry of Finance

Ministry of Finance of the People's Republic of China

The Ministry of Finance of the People's Republic of China is the national executive agency of the Central People's Government which administers macroeconomic policies and the national annual budget. It also handles fiscal policy, economic regulations and government expenditure for the state.The...

, which exercised firm control over all financial services

Financial services in the People's Republic of China

Financial services in the People's Republic of China refers to the services provided in PRC by the finance industry: banks, investment banks, insurance companies, credit card companies, consumer finance companies, government sponsored enterprises, and stock brokerages.-Securities trading:The China...

, credit

Credit (finance)

Credit is the trust which allows one party to provide resources to another party where that second party does not reimburse the first party immediately , but instead arranges either to repay or return those resources at a later date. The resources provided may be financial Credit is the trust...

, and the money supply

Money supply

In economics, the money supply or money stock, is the total amount of money available in an economy at a specific time. There are several ways to define "money," but standard measures usually include currency in circulation and demand deposits .Money supply data are recorded and published, usually...

. During the 1980s the banking system was expanded and diversified

Diversification (marketing strategy)

Diversification is a form of corporate strategy for a company. It seeks to increase profitability through greater sales volume obtained from new products and new markets. Diversification can occur either at the business unit level or at the corporate level. At the business unit level, it is most...

to meet the needs of the reform program, and the scale of banking activity rose sharply. New budgetary

Government budget

A government budget is a legal document that is often passed by the legislature, and approved by the chief executive-or president. For example, only certain types of revenue may be imposed and collected...

procedures required state enterprises to remit to the state only a tax on income and to seek investment funds in the form of bank loans. Between 1979 and 1985, the volume of deposits nearly tripled and the value of bank loans rose by 260 percent. By 1987 the banking system included the People's Bank of China

People's Bank of China

The People's Bank of China is the central bank of the People's Republic of China with the power to control monetary policy and regulate financial institutions in mainland China...

, Agricultural Bank of China

Agricultural Bank of China

Agricultural Bank of China Limited , also known as AgBank, is one of the "Big Four" banks in the People's Republic of China. It was founded in 1951, and has its headquarters in Beijing...

, Bank of China

Bank of China

Bank of China Limited is one of the big four state-owned commercial banks of the People's Republic of China. It was founded in 1912 by the Government of the Republic of China, to replace the Government Bank of Imperial China. It is the oldest bank in China...

(which handled foreign exchange matters), China Investment Bank, China Industrial and Commercial Bank, People's Construction Bank, Communications Bank, People's Insurance Company of China

People's Insurance Company of China

People's Insurance Company of China Holdings Company is a state-owned company in the People's Republic of China. The holding company promotes its subsidiaries, PICC Asset Management Company Limited and PICC Property and Casualty Company Limited .PICC P&C is China's largest insurer of casualty...

, rural credit cooperatives, and urban credit cooperatives.

The People's Bank of China was the central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

and the foundation of the banking system. Although the bank overlapped in function with the Ministry of Finance and lost many of its responsibilities during the Cultural Revolution

Cultural Revolution

The Great Proletarian Cultural Revolution, commonly known as the Cultural Revolution , was a socio-political movement that took place in the People's Republic of China from 1966 through 1976...

, in the 1970s it was restored to its leading position. As the central bank, the People's Bank of China had sole responsibility for issuing currency and controlling the money supply. It also served as the government treasury, the main source of credit for economic units, the clearing center for financial transactions, the holder of enterprise deposits, the national savings bank, and a ubiquitous monitor of economic activities.

Another financial institution, the Bank of China, handled all dealings in foreign exchange. It was responsible for allocating the country's foreign exchange reserves, arranging foreign loans, setting exchange rates for China's currency, issuing letters of credit, and generally carrying out all financial transactions with foreign firms and individuals. The Bank of China had offices in Beijing

Beijing

Beijing , also known as Peking , is the capital of the People's Republic of China and one of the most populous cities in the world, with a population of 19,612,368 as of 2010. The city is the country's political, cultural, and educational center, and home to the headquarters for most of China's...

and other cities engaged in foreign trade and maintained overseas offices in major international financial centers, including Hong Kong

Hong Kong

Hong Kong is one of two Special Administrative Regions of the People's Republic of China , the other being Macau. A city-state situated on China's south coast and enclosed by the Pearl River Delta and South China Sea, it is renowned for its expansive skyline and deep natural harbour...

, London

London

London is the capital city of :England and the :United Kingdom, the largest metropolitan area in the United Kingdom, and the largest urban zone in the European Union by most measures. Located on the River Thames, London has been a major settlement for two millennia, its history going back to its...

, New York

New York

New York is a state in the Northeastern region of the United States. It is the nation's third most populous state. New York is bordered by New Jersey and Pennsylvania to the south, and by Connecticut, Massachusetts and Vermont to the east...

, Singapore

Singapore

Singapore , officially the Republic of Singapore, is a Southeast Asian city-state off the southern tip of the Malay Peninsula, north of the equator. An island country made up of 63 islands, it is separated from Malaysia by the Straits of Johor to its north and from Indonesia's Riau Islands by the...

, and Luxembourg

Luxembourg

Luxembourg , officially the Grand Duchy of Luxembourg , is a landlocked country in western Europe, bordered by Belgium, France, and Germany. It has two principal regions: the Oesling in the North as part of the Ardennes massif, and the Gutland in the south...

.

The Agricultural Bank was created in the 1950s to facilitate financial operations in the rural areas. The Agricultural Bank provided financial support to agricultural units. It issued loans, handled state appropriations for agriculture, directed the operations of the rural credit cooperatives, and carried out overall supervision of rural financial affairs. The Agricultural Bank was headquartered in Beijing and had a network of branches throughout the country. It flourished in the late 1950s and mid-1960s but languished thereafter until the late 1970s, when the functions and autonomy of the Agricultural Bank were increased substantially to help promote higher agricultural production. In the 1980s it was restructured again and given greater authority in order to support the growth and diversification of agriculture under the responsibility system.

The People's Construction Bank managed state appropriations and loans for capital construction. It checked the activities of loan recipients to ensure that the funds were used for their designated construction purpose. Money was disbursed in stages as a project progressed. The reform policy shifted the main source of investment funding from the government budget to bank loans and increased the responsibility and activities of the People's Construction Bank.

Rural credit cooperatives were small, collectively owned savings and lending organizations that were the main source of small-scale financial services at the local level in the countryside. They handled deposits and short-term loans for individual farm families, villages, and cooperative organizations. Subject to the direction of the Agricultural Bank, they followed uniform state banking policies but acted as independent units for accounting purposes. In 1985 rural credit cooperatives held total deposits of ¥72.5 billion.

Urban credit cooperatives were a relatively new addition to the banking system in the mid-1980s, when they first began widespread operations. As commercial opportunities grew in the reform period, the thousands of individual and collective enterprises that sprang up in urban areas created a need for small-scale financial services that the formal banks were not prepared to meet. Bank officials therefore encouraged the expansion of urban credit cooperatives as a valuable addition to the banking system. In 1986 there were more than 1,100 urban credit cooperatives, which held a total of ¥3.7 billion in deposits and made loans worth ¥1.9 billion.

In the mid-1980s the banking system still lacked some of the services and characteristics that were considered basic in most countries. Interbank relations were very limited, and interbank borrowing and lending was virtually unknown. Checking accounts were used by very few individuals, and bank credit cards did not exist. In 1986 initial steps were taken in some of these areas. Interbank borrowing and lending networks were created among twenty-seven cities along the Yangtze River

Yangtze River

The Yangtze, Yangzi or Cháng Jiāng is the longest river in Asia, and the third-longest in the world. It flows for from the glaciers on the Tibetan Plateau in Qinghai eastward across southwest, central and eastern China before emptying into the East China Sea at Shanghai. It is also one of the...

and among fourteen cities in north China. Interregional financial networks were created to link banks in eleven leading cities all over China, including Shenyang

Shenyang

Shenyang , or Mukden , is the capital and largest city of Liaoning Province in Northeast China. Currently holding sub-provincial administrative status, the city was once known as Shengjing or Fengtianfu...

, Guangzhou

Guangzhou

Guangzhou , known historically as Canton or Kwangchow, is the capital and largest city of the Guangdong province in the People's Republic of China. Located in southern China on the Pearl River, about north-northwest of Hong Kong, Guangzhou is a key national transportation hub and trading port...

, Wuhan

Wuhan

Wuhan is the capital of Hubei province, People's Republic of China, and is the most populous city in Central China. It lies at the east of the Jianghan Plain, and the intersection of the middle reaches of the Yangtze and Han rivers...

, Chongqing

Chongqing

Chongqing is a major city in Southwest China and one of the five national central cities of China. Administratively, it is one of the PRC's four direct-controlled municipalities , and the only such municipality in inland China.The municipality was created on 14 March 1997, succeeding the...

, and Xi'an

Xi'an

Xi'an is the capital of the Shaanxi province, and a sub-provincial city in the People's Republic of China. One of the oldest cities in China, with more than 3,100 years of history, the city was known as Chang'an before the Ming Dynasty...

and also to link the branches of the Agricultural Bank. The first Chinese credit card, the Great Wall Card, was introduced in June 1986 to be used for foreign exchange transactions. Another financial innovation in 1986 was the opening of China's first stock exchange

Stock exchange

A stock exchange is an entity that provides services for stock brokers and traders to trade stocks, bonds, and other securities. Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and...

s since 1949. Small stock exchanges began operations somewhat tentatively in Shenyang, Liaoning Province, in August 1986 and in Shanghai in September 1986.

Throughout the history of the People's Republic, the banking system has exerted close control over financial transactions and the money supply. All government departments, publicly and collectively owned economic units, and social, political, military, and educational organizations were required to hold their financial balances as bank deposits. They were also instructed to keep on hand only enough cash to meet daily expenses; all major financial transactions were to be conducted through banks. Payment for goods and services exchanged by economic units was accomplished by debiting the account of the purchasing unit and crediting that of the selling unit by the appropriate amount. This practice effectively helped to minimize the need for currency

Currency

In economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

.

Since 1949 China's leaders have urged the Chinese people to build up personal savings accounts to reduce the demand for consumer goods and increase the amount of capital available for investment. Small branch offices of savings banks were conveniently located throughout the urban areas. In the countryside savings were deposited with the rural credit cooperatives, which could be found in most towns and villages. In 1986 savings deposits for the entire country totaled over ¥223.7 billion.

See also

- History of economics

- Economy of the Song DynastyEconomy of the Song DynastyThe economy of China under the Song Dynasty of China was marked by commercial expansion, financial prosperity, increased international trade-contacts, and a revolution in agricultural productivity. Private finance grew, stimulating the development of a country-wide market network which linked the...

- Economy of the People's Republic of ChinaEconomy of the People's Republic of ChinaThe People's Republic of China ranks since 2010 as the world's second largest economy after the United States. It has been the world's fastest-growing major economy, with consistent growth rates of around 10% over the past 30 years. China is also the largest exporter and second largest importer of...

- Economic history of China (Pre-1911)

- Economic history of Modern ChinaEconomic history of modern ChinaThe economic history of modern China began with the fall of the Qing Dynasty in 1911. Following the Qing, China underwent a period of instability and disrupted economic activity. Under the Nanjing decade , China advanced several industries, in particular those related to the military, in an effort...

Further reading

- Linsun Cheng, Banking in Modern China: Entrepreneurs, Professional Managers, and the Development of Chinese Banks, 1897-1937 (Cambridge University Press, 2007). ISBN 0521032768

- Zhaojin Ji, A History of Modern Shanghai Banking: The Rise and Decline of China's Finance Capitalism (M. E. Sharpe, 2003). ISBN 0765610035