Black Monday (1987)

Encyclopedia

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

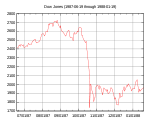

, Black Monday refers to Monday October 19, 1987, when stock market

Stock market

A stock market or equity market is a public entity for the trading of company stock and derivatives at an agreed price; these are securities listed on a stock exchange as well as those only traded privately.The size of the world stock market was estimated at about $36.6 trillion...

s around the world crashed

Stock market crash

A stock market crash is a sudden dramatic decline of stock prices across a significant cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic as much as by underlying economic factors...

, shedding a huge value

Value (economics)

An economic value is the worth of a good or service as determined by the market.The economic value of a good or service has puzzled economists since the beginning of the discipline. First, economists tried to estimate the value of a good to an individual alone, and extend that definition to goods...

in a very short time. The crash began in Hong Kong

Hong Kong

Hong Kong is one of two Special Administrative Regions of the People's Republic of China , the other being Macau. A city-state situated on China's south coast and enclosed by the Pearl River Delta and South China Sea, it is renowned for its expansive skyline and deep natural harbour...

and spread west to Europe

Europe

Europe is, by convention, one of the world's seven continents. Comprising the westernmost peninsula of Eurasia, Europe is generally 'divided' from Asia to its east by the watershed divides of the Ural and Caucasus Mountains, the Ural River, the Caspian and Black Seas, and the waterways connecting...

, hitting the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

after other markets had already declined by a significant margin. The Dow Jones Industrial Average

Dow Jones Industrial Average

The Dow Jones Industrial Average , also called the Industrial Average, the Dow Jones, the Dow 30, or simply the Dow, is a stock market index, and one of several indices created by Wall Street Journal editor and Dow Jones & Company co-founder Charles Dow...

(DJIA) dropped by 508 points to 1738.74 (22.61%).

Market effects

By the end of October, stock markets in Hong Kong had fallen 45.5%, AustraliaAustralia

Australia , officially the Commonwealth of Australia, is a country in the Southern Hemisphere comprising the mainland of the Australian continent, the island of Tasmania, and numerous smaller islands in the Indian and Pacific Oceans. It is the world's sixth-largest country by total area...

41.8%, Spain

Spain

Spain , officially the Kingdom of Spain languages]] under the European Charter for Regional or Minority Languages. In each of these, Spain's official name is as follows:;;;;;;), is a country and member state of the European Union located in southwestern Europe on the Iberian Peninsula...

31%, the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

26.45%, the United States 22.68%, and Canada

Canada

Canada is a North American country consisting of ten provinces and three territories. Located in the northern part of the continent, it extends from the Atlantic Ocean in the east to the Pacific Ocean in the west, and northward into the Arctic Ocean...

22.5%. New Zealand's market

New Zealand Exchange

NZX Limited is a stock exchange located in Wellington, New Zealand. Since July 2005 it has been located in NZX Centre, the renovated Odlins building on the Wellington waterfront...

was hit especially hard, falling about 60% from its 1987 peak, and taking several years to recover. (The terms Black Monday and Black Tuesday are also applied to October 28 and 29, 1929, which occurred after Black Thursday

Wall Street Crash of 1929

The Wall Street Crash of 1929 , also known as the Great Crash, and the Stock Market Crash of 1929, was the most devastating stock market crash in the history of the United States, taking into consideration the full extent and duration of its fallout...

on October 24, which started the Stock Market Crash of 1929. In

Australia and New Zealand the 1987 crash is also referred to as Black Tuesday because of the timezone difference.)

The Black Monday decline was the largest one-day percentage decline in the Dow Jones. (Saturday, December 12, 1914, is sometimes erroneously cited as the largest one-day percentage decline of the DJIA. In reality, the ostensible decline of 24.39% was created retroactively by a redefinition of the DJIA in 1916.)

Following the stock market crash, a group of 33 eminent economists from various nations met in Washington, D.C.

Washington, D.C.

Washington, D.C., formally the District of Columbia and commonly referred to as Washington, "the District", or simply D.C., is the capital of the United States. On July 16, 1790, the United States Congress approved the creation of a permanent national capital as permitted by the U.S. Constitution....

in December 1987, and collectively predicted that “the next few years could be the most troubled since the 1930s

Great Depression

The Great Depression was a severe worldwide economic depression in the decade preceding World War II. The timing of the Great Depression varied across nations, but in most countries it started in about 1929 and lasted until the late 1930s or early 1940s...

”. However, the DJIA was positive for the 1987 calendar year. It opened on January 2, 1987 at 1,897 points and closed on December 31, 1987 at 1,939 points. The DJIA did not regain its August 25, 1987 closing high of 2,722 points until almost two years later.

Timeline

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

economy began shifting from a rapidly growing recovery to a slower growing expansion, which resulted in a "soft landing" as the economy slowed and inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

dropped. The stock market advanced significantly, with the Dow peaking in August 1987 at 2722 points, or 44% over the previous year's closing of 1895 points.

On October 14, the DJIA dropped 95.46 points (a then record) to 2412.70, and fell another 58 points the next day, down over 12% from the August 25 all-time high. On Friday, October 16, when all the markets in London were unexpectedly closed due to the Great Storm of 1987

Great Storm of 1987

The Great Storm of 1987 occurred on the night of 15/16 October 1987, when an unusually strong weather system caused winds to hit much of southern England and northern France...

, the DJIA closed down another 108.35 points to close at 2246.74 on record volume. American Treasury Secretary James Baker

James Baker

James Addison Baker, III is an American attorney, politician and political advisor.Baker served as the Chief of Staff in President Ronald Reagan's first administration and in the final year of the administration of President George H. W. Bush...

stated concerns about the falling prices. That weekend many investors worried over their stock investments.

The crash began in Far Eastern markets the morning of October 19. Later that morning, two U.S. warships shelled an Iranian oil platform in the Persian Gulf in response to Iran's Silkworm missile attack on the U.S. flagged ship MV Sea Isle City

MV Sea Isle City

MV Sea Isle City, ex-Umm al Maradem, was a Kuwait Oil Company oil tanker that reflagged during Operation Earnest Will. The ship was completed in 1981 by Mitsubishi Heavy Industries, Japan, as hull number 1867, for the Kuwait Oil Tanker Company....

.

Causes

Potential causes for the decline include program tradingProgram trading

Program trading is a generic term used to describe a type of trading in securities, usually consisting of baskets of fifteen stocks or more that are executed by a computer program simultaneously based on predetermined conditions...

, overvaluation, illiquidity, and market psychology.

The most popular explanation for the 1987 crash was selling by program traders. U.S. Congressman Edward J. Markey, who had been warning about the possibility of a crash, stated that "Program trading was the principal cause."

In program trading, computers perform rapid stock executions based on external inputs, such as the price of related securities. Common strategies implemented by program trading involve an attempt to engage in arbitrage

Arbitrage

In economics and finance, arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices...

and portfolio insurance

Portfolio insurance

Portfolio insurance is a method of hedging a portfolio of stocks against the market risk by short selling stock index futures.This hedging technique is frequently used by institutional investors when the market direction is uncertain or volatile...

strategies. The trader Paul Tudor Jones

Paul Tudor Jones

Paul Tudor Jones II , is the founder of Tudor Investment Corporation, which is the management company for his various private investment partnerships, also referred to as hedge funds. As of March 2011, he was estimated to have a net worth of USD 3.3 billion by Forbes Magazine and ranked as 336th...

predicted and profited from the crash, attributing it to portfolio insurance derivatives which were "an accident waiting to happen" and that the "crash was something that was eminently forecastable". Once the market started going down, the writers of the derivatives were "forced to sell on every down-tick" so the "selling would actually cascade instead of dry up".

As computer technology became more available, the use of program trading grew dramatically within Wall Street

Wall Street

Wall Street refers to the financial district of New York City, named after and centered on the eight-block-long street running from Broadway to South Street on the East River in Lower Manhattan. Over time, the term has become a metonym for the financial markets of the United States as a whole, or...

firms. After the crash, many blamed program trading strategies for blindly selling stocks as markets fell, exacerbating the decline. Some economist

Economist

An economist is a professional in the social science discipline of economics. The individual may also study, develop, and apply theories and concepts from economics and write about economic policy...

s theorized the speculative

Speculation

In finance, speculation is a financial action that does not promise safety of the initial investment along with the return on the principal sum...

boom leading up to October was caused by program trading, and that the crash was merely a return to normalcy

Normalcy

"A return to normalcy" was United States presidential candidate Warren G. Harding’s campaign promise in the election of 1920...

. Either way, program trading ended up taking the majority of the blame in the public eye for the 1987 stock market crash.

New York University

New York University

New York University is a private, nonsectarian research university based in New York City. NYU's main campus is situated in the Greenwich Village section of Manhattan...

's Richard Sylla divides the causes into macroeconomic and internal reasons. Macroeconomic causes included international disputes about foreign exchange

Foreign exchange market

The foreign exchange market is a global, worldwide decentralized financial market for trading currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends...

and interest

Interest

Interest is a fee paid by a borrower of assets to the owner as a form of compensation for the use of the assets. It is most commonly the price paid for the use of borrowed money, or money earned by deposited funds....

rates, and fears about inflation.

The internal reasons included innovations with index futures and portfolio insurance. I've seen accounts that maybe roughly half the trading on that day was a small number of institutions with portfolio insurance. Big guys were dumping their stock. Also, the futures market in Chicago was even lower than the stock market, and people tried to arbitrage that. The proper strategy was to buy futures in Chicago and sell in the New York cash market. It made it hard -- the portfolio insurance people were also trying to sell their stock at the same time.

Economist Richard Roll

Richard Roll

Richard Roll is an American economist, best known for his work on portfolio theory and asset pricing, both theoretical and empirical....

believes the international nature of the stock market decline contradicts the argument that program trading was to blame. Program trading strategies were used primarily in the United States, Roll writes. Markets where program trading was not prevalent, such as Australia and Hong Kong, would not have declined as well, if program trading was the cause. These markets might have been reacting to excessive program trading in the United States, but Roll indicates otherwise. The crash began on October 19 in Hong Kong, spread west to Europe, and hit the United States only after Hong Kong and other markets had already declined by a significant margin.

Another common theory states that the crash was a result of a dispute in monetary policy between the G7 industrialized nations, in which the United States, wanting to prop up the dollar and restrict inflation, tightened policy faster than the Europeans. U.S. pressure on Germany to change its monetary policy was one of the factors that unnerved investors in the run-up to the crash. The crash, in this view, was caused when the dollar-backed Hong Kong stock exchange collapsed, and this caused a crisis in confidence.

Some technical analysts claim that the cause was the collapse of the US and European bond markets, which caused interest-sensitive stock groups like savings & loans and money center banks to plunge as well. This is a well documented inter-market relationship: turns in bond markets affect interest-rate-sensitive stocks, which in turn lead the general stock market turns.

See also

- Wall Street Crash of 1929Wall Street Crash of 1929The Wall Street Crash of 1929 , also known as the Great Crash, and the Stock Market Crash of 1929, was the most devastating stock market crash in the history of the United States, taking into consideration the full extent and duration of its fallout...

(Black Tuesday) - 2010 Flash Crash

- List of largest daily changes in the Dow Jones Industrial Average

- Stock disasters in Hong KongStock disasters in Hong KongMany stock disasters have occurred on the Hong Kong stock market since the 1960s. The major ones are:- Timeline :1960s* Stock disaster in 1965 * Stock disaster in 1967 1970s...

Further reading

- "Brady Report" Presidential Task Force on Market Mechanisms (1988): Report of the Presidential Task Force on Market Mechanisms. Nicholas F. BradyNicholas F. BradyNicholas Frederick Brady was United States Secretary of the Treasury under Presidents Ronald Reagan and George H. W. Bush, and is also known for articulating the Brady Plan in March 1989.-Early life:...

(Chairman), U.S. Government Printing Office. - Carlson, Mark (2007) "A Brief History of the 1987 Stock Market Crash with a Discussion of the Federal Reserve Response," Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.C.

- Securities and Exchange Commission (1988): The October 1987 Market Break. Washington: U.S. Securities and Exchange Commission (SEC). in

- Robert SobelRobert SobelRobert Sobel was an American professor of history at Hofstra University, and a well-known and prolific writer of business histories.- Biography :...

Panic on Wall Street: A Classic History of America's Financial Disasters-With a New Exploration of the Crash of 1987 (E P Dutton; Reprint edition, May 1988) ISBN 0-525-48404-3.

External links

- Robert Sobel