Purchasing power parity

Encyclopedia

Economics

Economics is the social science that analyzes the production, distribution, and consumption of goods and services. The term economics comes from the Ancient Greek from + , hence "rules of the house"...

, purchasing power parity (PPP) is a condition between countries where an amount of money has the same purchasing power

Purchasing power

Purchasing power is the number of goods/services that can be purchased with a unit of currency. For example, if you had taken one dollar to a store in the 1950s, you would have been able to buy a greater number of items than you would today, indicating that you would have had a greater purchasing...

in different countries. The prices of the goods between the countries would only reflect the exchange rate

Exchange rate

In finance, an exchange rate between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency...

s. The idea originated with the School of Salamanca

School of Salamanca

The School of Salamanca is the renaissance of thought in diverse intellectual areas by Spanish and Portuguese theologians, rooted in the intellectual and pedagogical work of Francisco de Vitoria...

in the 16th century and was developed in its modern form by Gustav Cassel

Gustav Cassel

Karl Gustav Cassel was a Swedish economist and professor of economics at Stockholm University.Cassel's perspective on economic reality, and especially on the role of interest, was rooted in British neoclassicism and in the nascent Swedish schools...

in 1918.

The concept is based on the law of one price

Law of one price

The law of one price is an economic law stated as: "In an efficient market, all identical goods must have only one price."-Intuition:The intuition for this law is that all sellers will flock to the highest prevailing price, and all buyers to the lowest current market price. In an efficient market...

, where in the absence of transaction costs and official trade barrier

Trade barrier

Trade barriers are government-induced restrictions on international trade. The barriers can take many forms, including the following:* Tariffs* Non-tariff barriers to trade** Import licenses** Export licenses** Import quotas** Subsidies...

s, identical goods will have the same price in different markets when the prices are expressed in the same currency.

Another interpretation is that the difference in the rate of change in prices at home and abroad—the difference in the inflation rates—is equal to the percentage depreciation or appreciation of the exchange rate.

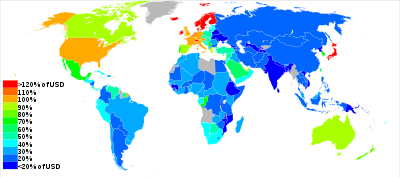

Deviations from parity imply differences in purchasing power of a "basket of goods" across countries, which means that for the purposes of many international comparisons, countries' GDPs or other national income statistics need to be "PPP adjusted" and converted into common units. The best-known purchasing power adjustment is the Geary–Khamis dollar (the "international dollar"). The real exchange rate is then equal to the nominal exchange rate, adjusted for differences in price levels. If purchasing power parity held exactly, then the real exchange rate would always equal one. However, in practice the real exchange rates exhibit both short run and long run deviations from this value, for example due to reasons illuminated in the Balassa–Samuelson theorem.

There can be marked differences between purchasing power adjusted incomes and those converted via market exchange rates. For example, the World Bank's

World Bank

The World Bank is an international financial institution that provides loans to developing countries for capital programmes.The World Bank's official goal is the reduction of poverty...

World Development Indicators 2005 estimated that in 2003, one Geary-Khamis dollar

Geary-Khamis dollar

The Geary-Khamis dollar, more commonly known as the international dollar, is a hypothetical unit of currency that has the same purchasing power that the U.S. dollar had in the United States at a given point in time. It is widely used in economics. The years 1990 or 2000 are often used as a...

was equivalent to about 1.8 Chinese yuan

Renminbi

The Renminbi is the official currency of the People's Republic of China . Renminbi is legal tender in mainland China, but not in Hong Kong or Macau. It is issued by the People's Bank of China, the monetary authority of the PRC...

by purchasing power parity—considerably different from the nominal exchange rate. This discrepancy has large implications; for instance, when converted via the nominal exchange rates GDP per capita in India

India

India , officially the Republic of India , is a country in South Asia. It is the seventh-largest country by geographical area, the second-most populous country with over 1.2 billion people, and the most populous democracy in the world...

is about US$

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

1,704.063 while on a PPP basis it is about US$3,608.196. This means that if calculated at nominal exchange rates, India has the tenth largest economy, while at PPP-adjusted rates, it has the fourth largest economy in the world. At the other extreme, Denmark's

Denmark

Denmark is a Scandinavian country in Northern Europe. The countries of Denmark and Greenland, as well as the Faroe Islands, constitute the Kingdom of Denmark . It is the southernmost of the Nordic countries, southwest of Sweden and south of Norway, and bordered to the south by Germany. Denmark...

nominal GDP per capita is around US$62,100, but its PPP figure is only US$37,304.

PPP measurement

The PPP exchange-rate calculation is controversial because of the difficulties of finding comparable baskets of goodsMarket basket

The term market basket or commodity bundle refers to a fixed list of items used specifically to track the progress of inflation in an economy or specific market....

to compare purchasing power across countries.

Estimation of purchasing power parity is complicated by the fact that countries do not simply differ in a uniform price level

Price level

A price level is a hypothetical measure of overall prices for some set of goods and services, in a given region during a given interval, normalized relative to some base set...

; rather, the difference in food prices may be greater than the difference in housing prices, while also less than the difference in entertainment prices. People in different countries typically consume different baskets of goods. It is necessary to compare the cost of baskets of goods and services using a price index

Price index

A price index is a normalized average of prices for a given class of goods or services in a given region, during a given interval of time...

. This is a difficult task because purchasing patterns and even the goods available to purchase differ across countries. Thus, it is necessary to make adjustments for differences in the quality of goods and services. Additional statistical difficulties arise with multilateral comparisons when (as is usually the case) more than two countries are to be compared.

For example, in 2005 the price of a gallon of gasoline in Saudi Arabia was $0.91 USD, and in Norway the price was $6.27 USD. The significant differences in price wouldn't contribute to accuracy in a PPP analysis, despite all of the variables that contribute to the significant differences in price. Further comparisons have to be made and utilized as variables in the overall formulation of the PPP.

When PPP comparisons are to be made over some interval of time, proper account needs to be made of inflation

Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a...

ary effects.

The Relationship Between PPP and the Law of One Price

Although it may seem as if PPP and the law of one price are the same, there is in fact a difference: the law of one price applies to individual commodities whereas PPP applies to the general price level. If the law of one price is true for all commodities then PPP is also therefore true; however, when discussing the validity of PPP, some argue that the law of one price does not need to be true exactly for PPP to be valid. If the law of one price is not true for a certain commodity, the price levels will not differ enough from the level predicted by PPP.The purchasing power parity theory states that the exchange rate between one currency and another currency is in equlibirium when their domestic purchasing powers at that rate of exchange are equivalent.

Big Mac Index

An example of one measure of law of one price

Law of one price

The law of one price is an economic law stated as: "In an efficient market, all identical goods must have only one price."-Intuition:The intuition for this law is that all sellers will flock to the highest prevailing price, and all buyers to the lowest current market price. In an efficient market...

, which underlies purchasing power parity, is the Big Mac Index

Big Mac index

The Big Mac Index is published by The Economist as an informal way of measuring the purchasing power parity between two currencies and provides a test of the extent to which market exchange rates result in goods costing the same in different countries...

popularized by The Economist

The Economist

The Economist is an English-language weekly news and international affairs publication owned by The Economist Newspaper Ltd. and edited in offices in the City of Westminster, London, England. Continuous publication began under founder James Wilson in September 1843...

, which looks at the prices of a Big Mac

Big Mac

The Big Mac is a hamburger sold by McDonald's, an international fast food restaurant chain. It is one of the company's signature products...

burger in McDonald's restaurants in different countries. By determining whether a currency is undervalued or overvalued, the index should give a guide to the direction in which currencies should move. The Big Mac Index is presumably useful because it is based on a well-known food whose final price, easily tracked in many countries, includes input costs from a wide range of sectors in the local economy, such as agricultural commodities (beef, bread, lettuce, cheese), labor (blue and white collar), advertising, rent and real estate costs, transportation, etc. This index provides a test of the law of one price, but the dollar prices of Big Macs are actually different in different countries. This can be explained by a number of factors: transportation costs and government regulations, product differentiation, and prices of nonfood inputs. Furthermore, in some emerging economies, western fast food represents an expensive niche product price well above the price of traditional staples—i.e. the Big Mac

Big Mac

The Big Mac is a hamburger sold by McDonald's, an international fast food restaurant chain. It is one of the company's signature products...

is not a mainstream 'cheap' meal as it is in the West, but a luxury import for the middle classes and foreigners. This relates back to the idea of product differentiation: few substitutes for the Big Mac allows McDonald's to have market power. Countries like Argentina make sure the Big Mac is underpriced in an attempt to control the index and make sure it doesn't contradict the official statistics.

Starbucks tall latte index

The StarbucksStarbucks

Starbucks Corporation is an international coffee and coffeehouse chain based in Seattle, Washington. Starbucks is the largest coffeehouse company in the world, with 17,009 stores in 55 countries, including over 11,000 in the United States, over 1,000 in Canada, over 700 in the United Kingdom, and...

tall latte index is a variant of the Big Mac Index; it can give information regarding exchange rates similar to the Big Mac Index. The tall latte index was compiled in 2004, during which time both a Big Mac and tall latte cost $2.80. The measures told the same story in most cases with the notable exception of Asia. According to the Big Mac index, the yen was 12% undervalued against the dollar, whereas it was 13% overvalued according to the tall latte index. Furthermore, the Chinese yuan was 56% undervalued based on the Big Mac index but neither significantly undervalued nor overvalued according to the Starbucks index.

The following table, based on data from The Economists 2004 calculations, shows the under (-) and over (+) valuation of the local currency against the dollar in %, according to the Starbucks tall latte index and the Big Mac index.

| Country | Starbucks tall latte index | McDonald's Big Mac Index |

|---|---|---|

| Australia | -4 | -17 |

| Britain | +17 | +23 |

| Canada | -16 | -16 |

| China | -1 | -56 |

| Euro area | +33 | +24 |

| Hong Kong | +15 | -45 |

| Japan | +13 | -12 |

| Malaysia | -25 | -53 |

| Mexico | -15 | -21 |

| New Zealand | -12 | -4 |

| Singapore | +2 | -31 |

| South Korea | +6 | 0 |

| Switzerland | +62 | +82 |

| Taiwan | -5 | -21 |

| Thailand | -31 | -46 |

| Turkey | +6 | +5 |

OECD Comparative Price Levels

Each month, the Organisation for Economic Co-operation and DevelopmentOrganisation for Economic Co-operation and Development

The Organisation for Economic Co-operation and Development is an international economic organisation of 34 countries founded in 1961 to stimulate economic progress and world trade...

measures the difference in price levels between its member countries by calculating the ratios of PPPs for private final consumption expenditure

Household final consumption expenditure

is a transaction of the national account's use of income account representing consumer spending. It consists of the expenditure incurred by households on individual consumption goods and services, including those sold at prices that are not economically significant...

to exchange rates. The OECD table below indicates the number of US dollars needed, as of September 2011, in each of the countries listed to buy the same representative basket of consumer goods and services that would cost 100 USD in the United States. According to the table, an American living on a US dollar income in Switzerland in September 2011 would find that country to one of the most expensive in world, having to spend almost double the US dollars to maintain a comparable standard of living to the USA in terms of consumption

Consumption (economics)

Consumption is a common concept in economics, and gives rise to derived concepts such as consumer debt. Generally, consumption is defined in part by comparison to production. But the precise definition can vary because different schools of economists define production quite differently...

.

| Country | Price level (USA = 100) |

|---|---|

| Australia | 162 |

| Austria | 122 |

| Belgium | 127 |

| Canada | 130 |

| Chile | 75 |

| Czech Republic | 83 |

| Denmark | 162 |

| Estonia | 94 |

| Finland | 138 |

| France | 126 |

| Germany | 117 |

| Greece | 109 |

| Hungary | 75 |

| Iceland | 125 |

| Ireland | 137 |

| Israel | 122 |

| Italy | 109 |

| Japan | 156 |

| (South) Korea | 84 |

| Luxembourg | 134 |

| Mexico | 67 |

| Netherlands | 121 |

| New Zealand | 132 |

| Norway | 170 |

| Poland | 64 |

| Portugal | 106 |

| Slovak Republic | 82 |

| Slovenia | 98 |

| Spain | 110 |

| Sweden | 135 |

| Switzerland | 193 |

| Turkey | 58 |

| United Kingdom | 124 |

Measurement Issues

In addition to methodological issues presented by the selection of a basket of goods, PPP estimates can also vary based on the statistical capacity of participating countries. The International Comparison Program, which PPP estimates are based on, require the disaggregation of national accounts into production, expenditure or (in some cases) income, and not all participating countries routinely disaggregate their data into such categories.Some aspects of PPP comparison are theoretically impossible or unclear. For example, there is no basis for comparison between the Ethiopian laborer who lives on teff with the Thai laborer who lives on rice, because teff is impossible to find in Thailand and vice versa, so the price of rice in Ethiopia or teff in Thailand cannot be determined. As a general rule, the more similar the price structure between countries, the more valid the PPP comparison.

PPP levels will also vary based on the formula used to calculate price matrices. Different possible formulas include GEKS-Fisher, Geary-Khamis, IDB, and the superlative method. Each has advantages and disadvantages.

Linking regions presents another methodological difficulty. In the 2005 ICP round, regions were compared by using a list of some 1,000 identical items for which a price could be found for 18 countries, selected so that at least two countries would be in each region. While this was superior to earlier "bridging" methods, which is not fully take into account differing quality between goods, it may serve to overstate the PPP basis of poorer countries, because the price indexing on which PPP is based will assign to poorer countries the greater weight of goods consumed in greater shares in richer countries.

2005 ICP

The 2005 ICP round resulted in large downward adjustments of PPP (or upward adjustments of price level) for several Asian countries, including China (-40%), India (-36%), Bangladesh (-42%) and the Philippines (-43%). Surjit Bhalla has argued that these adjustments are unrealistic. For example, in the case of China, backward extrapolation of 2005 ICP PPP based on Chinese annual growth rates would yield a 1952 PPP per capita of $153 1985 International dollars, but Pritchett has persuasively argued that $250 1985 dollars is the minimum required to sustain a population, or has ever been observed for more than a short period. Therefore, both the 2005 ICP PPP for China and China's growth rates cannot both be correct. Angus Maddison has calculated somewhat slower growth rates for China than official figures, but even under his calculations, the 1952 PPP per capita comes to only $229.Angus Deaton

Angus Deaton

Angus Stewart Deaton is a leading microeconomist. He was educated at Fettes College in Edinburgh, where he was a Foundation Scholar, and earned his B.A., M.A., and Ph.D...

and Alan Heston

Alan Heston

Alan W. Heston is an American economist best known for his collaborative work with fellow economist Robert Summers and the development of the Penn World Table .-Education and early life:...

have suggested that the discrepancy can be explained by the fact that the 2005 ICP examined only urban prices, which overstate the national price level for Asian countries, and also the fact that Asian countries adjusted for productivity across noncomparable goods such as government services, whereas non-Asian countries did not make such an adjustment. Each of these two factors, according to him, would lead to an underestimation of GDP by PPP of about 12%.

Need for PPP adjustments to GDP

Capital asset

The term capital asset has three unrelated technical definitions, and is also used in a variety of non-technical ways.*In financial economics, it refers to any asset used to make money, as opposed to assets used for personal enjoyment or consumption...

s whose prices vary more than those of physical goods. Also, different interest rate

Interest rate

An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for...

s, speculation

Speculation

In finance, speculation is a financial action that does not promise safety of the initial investment along with the return on the principal sum...

, hedging

Hedge (finance)

A hedge is an investment position intended to offset potential losses that may be incurred by a companion investment.A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, many types of...

or interventions by central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

s can influence the foreign-exchange market

Foreign exchange market

The foreign exchange market is a global, worldwide decentralized financial market for trading currencies. Financial centers around the world function as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the exception of weekends...

.

The PPP method is used as an alternative to correct for possible statistical bias. The Penn World Table

Penn World Table

The Penn World Table is a set of national-accounts data developed and maintained by scholars at the University of Pennsylvania to measure real GDP from the corresponding relative price levels across countries and over time...

is a widely cited source of PPP adjustments, and the so-called Penn effect

Penn effect

The Penn effect is the economic finding associated with what became the Penn World Table that real income ratios between high and low income countries are systematically exaggerated by gross domestic product conversion at market exchange rates...

reflects such a systematic bias in using exchange rates to outputs among countries.

For example, if the value of the Mexican peso

Mexican peso

The peso is the currency of Mexico. Modern peso and dollar currencies have a common origin in the 15th–19th century Spanish dollar, most continuing to use its sign, "$". The Mexican peso is the 12th most traded currency in the world, the third most traded in the Americas, and by far the most...

falls by half compared to the U.S. dollar

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

, the Mexican Gross Domestic Product

Gross domestic product

Gross domestic product refers to the market value of all final goods and services produced within a country in a given period. GDP per capita is often considered an indicator of a country's standard of living....

measured in dollars will also halve. However, this exchange rate results from international trade and financial markets. It does not necessarily mean that Mexicans are poorer by a half; if incomes and prices measured in pesos stay the same, they will be no worse off assuming that imported goods are not essential to the quality of life of individuals. Measuring income in different countries using PPP exchange rates helps to avoid this problem.

PPP exchange rates are especially useful when official exchange rates are artificially manipulated by governments. Countries with strong government control of the economy sometimes enforce official exchange rates that make their own currency artificially strong. By contrast, the currency's black market exchange rate is artificially weak. In such cases a PPP exchange rate is likely the most realistic basis for economic comparison.

Difficulties

There are a number of reasons why different measures do not perfectly reflect standards of living.Range and quality of goods

The goods that the currency has the "power" to purchase are a basket of goods of different types:- Local, non-tradable goods and services (like electric power) that are produced and sold domestically.

- Tradable goods such as non-perishable commodities that can be sold on the international market (e.g. diamondDiamondIn mineralogy, diamond is an allotrope of carbon, where the carbon atoms are arranged in a variation of the face-centered cubic crystal structure called a diamond lattice. Diamond is less stable than graphite, but the conversion rate from diamond to graphite is negligible at ambient conditions...

s).

The more a product falls into category 1 the further its price will be from the currency exchange rate

Exchange rate

In finance, an exchange rate between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency...

. (Moving towards the PPP exchange rate.) Conversely, category 2 products tend to trade close to the currency exchange rate. (For more details of why, see: Penn effect

Penn effect

The Penn effect is the economic finding associated with what became the Penn World Table that real income ratios between high and low income countries are systematically exaggerated by gross domestic product conversion at market exchange rates...

).

More processed and expensive products are likely to be tradable

Tradable

Tradability is the property of a good or service that can be sold in another location distant from where it was produced. A good that is not tradable is called non-tradable. Different goods have differing levels of tradability: the higher the cost of transportation and the shorter the shelf life,...

, falling into the second category, and drifting from the PPP exchange rate to the currency exchange rate. Even if the PPP "value" of the Ethiopian currency is three times stronger than the currency exchange rate, it won't buy three times as much of internationally traded goods like steel, cars and microchips, but non-traded goods like housing, services ("haircuts"), and domestically produced crops. The relative price differential between tradables and non-tradables from high-income to low-income countries is a consequence of the Balassa-Samuelson effect

Balassa-Samuelson effect

The Balassa–Samuelson effect, also known as Harrod–Balassa–Samuelson effect , the Ricardo–Viner–Harrod–Balassa–Samuelson–Penn–Bhagwati effect , productivity biased purchasing power parity and the rule of five eights is either of two related things:#The observation that consumer price levels...

, and gives a big cost advantage to labour intensive production of tradable goods in low income countries (like Ethiopia

Ethiopia

Ethiopia , officially known as the Federal Democratic Republic of Ethiopia, is a country located in the Horn of Africa. It is the second-most populous nation in Africa, with over 82 million inhabitants, and the tenth-largest by area, occupying 1,100,000 km2...

), as against high income countries (like Switzerland

Switzerland

Switzerland name of one of the Swiss cantons. ; ; ; or ), in its full name the Swiss Confederation , is a federal republic consisting of 26 cantons, with Bern as the seat of the federal authorities. The country is situated in Western Europe,Or Central Europe depending on the definition....

). The corporate cost advantage is nothing more sophisticated than access to cheaper workers, but because the pay of those workers goes further in low-income countries than high, the relative pay differentials (inter-country) can be sustained for longer than would be the case otherwise. (This is another way of saying that the wage rate is based on average local productivity, and that this is below the per capita productivity that factories selling tradable goods to international markets can achieve.) An equivalent cost

Cost

In production, research, retail, and accounting, a cost is the value of money that has been used up to produce something, and hence is not available for use anymore. In business, the cost may be one of acquisition, in which case the amount of money expended to acquire it is counted as cost. In this...

benefit comes from non-traded goods that can be sourced locally (nearer the PPP-exchange rate than the nominal exchange rate in which receipts are paid). These act as a cheaper factor of production than is available to factories in richer countries.

The Bhagwati-Kravis-Lipsey view provides a somewhat different explanation from the Balassa-Samuelson theory. This view states that price levels for nontradables are lower in poorer countries because of differences in endowment of labor and capital, not because of lower levels of productivity. Poor countries have more labor relative to capital, so marginal productivity of labor is greater in rich countries than in poor countries. Nontradables tend to be labor-intensive; therefore, because labor is less expensive in poor countries and is used mostly for nontradables, nontradables are cheaper in poor countries. Wages are high in rich countries, so nontradables are relatively more expensive.

PPP calculations tend to overemphasise the primary sectoral contribution, and underemphasise the industrial and service sectoral contributions to the economy of a nation.

Trade Barriers and Nontradables

The law of one price, the underlying mechanism behind PPP, is weakened by transport costs and governmental trade restrictions, which make it expensive to move goods between markets located in different countries. Transport costs sever the link between exchange rates and the prices of goods implied by the law of one price. As transport costs increase, the larger the range of exchange rate fluctuations. The same is true for official trade restrictions because the customs fees affect importers' profits in the same way as shipping fees. According to Krugman and Obstfeld, "Either type of trade impediment weakens the basis of PPP by allowing the purchasing power of a given currency to differ more widely from country to country." They cite the example that a dollar in London should purchase the same goods as a dollar in Chicago, which is certainly not the case.Nontradables are primarily services and the output of the construction industry. Nontradables also lead to deviations in PPP because the prices of nontradables are not linked internationally. The prices are determined by domestic supply and demand, and shifts in those curves lead to changes in the market basket of some goods relative to the foreign price of the same basket. If the prices of nontradables rise, the purchasing power of any given currency will fall in that country.

Departures from Free Competition

Linkages between national price levels are also weakened when trade barriers and imperfectly competitive market structures occur together. Pricing to market occurs when a firm sells the same product for different prices in different markets. This is a reflection of differing demand conditions between countries. According to Krugman and Obstfeld, this occurrence of product differentiation and segmented markets results in violations of the law of one price and absolute PPP. Overtime, shifts in market structure and demand will occur, which may invalidate relative PPP.Differences in Consumption Patterns and Price Level Measurement

Measurement of price levels differ from country to country. Inflation data from different countries are based on different commodity baskets; therefore, exchange rate changes do not offset official measures of inflation differences. Because it makes predictions about price changes rather than price levels, relative PPP is still a useful concept. However, change in the relative prices of basket components can cause relative PPP to fail tests that are based on official price indexes.PPP and Global Poverty Lines

The global poverty line is a worldwide count of people who live below an international poverty line, referred to as the dollar-a-day line. This line represents an average of the national poverty lines of the world's poorest countries, expressed in international dollars. These national poverty lines are converted to international currency and the global line is converted back to local currency using the PPP exchange rates from the ICP.The primary problem associated with this calculation lies in the fact that price indexes are weighted averages of prices, and both weights and prices could be incorrect. Individuals living at the poverty line may face prices that are different from the average national prices, but the ICP bases calculations on the average national prices. Furthermore, the expenditure patterns at the poverty line are substantially different from national expenditure patterns, and these expenditure patterns in the National Accounts provide the weights used for the consumption PPPs described by the ICP.

A recent study published in the American Economic Journal sought to address this issue by using poverty-weighted purchasing power parities, PPPPs or P4s. Household surveys are the distinguishing difference between P4s and P3s. The study found that the substitution of poverty weights for national accounts does not make a large difference to global poverty counts. It did find, however, that the method of calculating the global poverty line does make a large differences. When the global poverty line was calculated using the weighted average of fifty national poverty lines, the global poverty count was significantly lower than when the poverty lines from the fifteen poorest countries were used, which is the method used by the World Bank to calculate the global poverty line. Because the numbers of people in poverty are used as weights, this difference in outcomes based on calculation-method is explained by countries, such as India, with a large number of people living in poverty that are included in the fifty but not in the fifteen poorest. India has a large number of poor people and, by international standards, a low national poverty line. The global poverty line is much lower when India is included than when it is excluded.

The study explains dollars were not used to calculate poverty lines because the structure of advanced economies is different from the structure of economies where the global poor live. For this reason, rupees were more appropriate. The study makes recommendations to others who wish to make international comparisons of living standards for how to measure different indexes for the 2005 calendar year and also how to update these indexes when the results of the 2011 ICP become available. Among these recommendations include methods of converting rupees to dollars (which may be done because many people would want to read this information in terms of dollars).

See also

- Big Mac IndexBig Mac indexThe Big Mac Index is published by The Economist as an informal way of measuring the purchasing power parity between two currencies and provides a test of the extent to which market exchange rates result in goods costing the same in different countries...

- International dollar

- Relative Purchasing Power ParityRelative Purchasing Power ParityRelative Purchasing Power Parity is an economic theory which predicts a relationship between the inflation rates of two countries over a specified period and the movement in the exchange rate between their two currencies over the same period...

- List of cities by GDP

- List of countries by GDP (PPP)

- List of countries by GDP (PPP) per capita

- List of countries by future GDP (PPP) estimates

- List of countries by future GDP (PPP) per capita estimates

- Measures of national income and outputMeasures of national income and outputA variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product , gross national product , and net national income . All are specially concerned with counting the total amount of goods and...

- Penn effectPenn effectThe Penn effect is the economic finding associated with what became the Penn World Table that real income ratios between high and low income countries are systematically exaggerated by gross domestic product conversion at market exchange rates...

- Karl Gustav Cassel

- Geary-Khamis dollarGeary-Khamis dollarThe Geary-Khamis dollar, more commonly known as the international dollar, is a hypothetical unit of currency that has the same purchasing power that the U.S. dollar had in the United States at a given point in time. It is widely used in economics. The years 1990 or 2000 are often used as a...

External links

- Penn World Table

- Explanations from the U. of British Columbia (also provides daily updated PPP charts)

- OECD Purchasing Power Parity estimates updated annually by the Organization for Economic Co-Operation and Development (OECD)

- Purchasing power parities as example of international statistical cooperation from Eurostat - Statistics Explained

- World Bank International Comparison Project provides PPP estimates for a large number of countries

- UBS's "Prices and Earnings" Report 2006 Good report on purchasing power containing a Big Mac index as well as for staples such as bread and rice for 71 world cities.

- "Understanding PPPs and PPP based national accounts" provides an overview of methodological issues in calculating PPP and in designing the ICP under which the main PPP tables (Maddison, Penn World Tables, and World Bank WDI) are based