Project finance

Encyclopedia

Project finance is the long term financing

of infrastructure

and industrial projects based upon the projected cash flows of the project rather than the balance sheets of the project sponsors. Usually, a project financing structure involves a number of equity

investors, known as sponsors, as well as a syndicate of bank

s or other lending institutions that provide loan

s to the operation. The loans are most commonly non-recourse loans

, which are secured

by the project assets and paid entirely from project cash flow, rather than from the general assets or creditworthiness of the project sponsors, a decision in part supported by financial modeling

. The financing is typically secured by all of the project assets, including the revenue-producing contracts. Project lenders are given a lien

on all of these assets, and are able to assume control of a project if the project company has difficulties complying with the loan terms.

Generally, a special purpose entity

is created for each project, thereby shielding other assets owned by a project sponsor from the detrimental effects of a project failure

. As a special purpose entity, the project company has no assets other than the project. Capital contribution commitments by the owners of the project company are sometimes necessary to ensure that the project is financially sound, or to assure the lenders of the sponsors' commitment. Project finance is often more complicated than alternative financing methods. Traditionally, project financing has been most commonly used in the extractive (mining

), transportation, telecommunication

s and energy

industries. More recently, particularly in Europe, project financing principles have been applied to other types of public infrastructure under public–private partnerships (PPP) or, in the UK, Private Finance Initiative

(PFI) transactions (e.g., school facilities) as well as sports and entertainment venues.

Risk identification and allocation is a key component of project finance. A project may be subject to a number of technical, environmental, economic and political risks, particularly in developing countries and emerging markets. Financial institution

s and project sponsors may conclude that the risks inherent in project development and operation are unacceptable (unfinanceable). To cope with these risks, project sponsors in these industries (such as power plants or railway lines) are generally completed by a number of specialist companies operating in a contractual network with each other that allocates risk in a way that allows financing to take place. "Several long-term contracts such as construction, supply, off-take and concession agreements, along with a variety of joint-ownership structures, are used to align incentives and deter opportunistic behaviour by any

party involved in the project." The various patterns of implementation are sometimes referred to as "project delivery method

s." The financing of these projects must also be distributed among multiple parties, so as to distribute the risk associated with the project while simultaneously ensuring profits

for each party involved.

A riskier or more expensive project may require limited recourse financing secured by a surety

from sponsors. A complex project finance structure may incorporate corporate finance

, securitization

, options (derivatives)

, insurance

provisions or other types of collateral enhancement to mitigate unallocated risk.

Project finance shares many characteristics with maritime finance and aircraft finance

; however, the latter two are more specialized fields within the area of asset finance.

and Rome

. Its use in infrastructure projects dates to the development of the Panama Canal

, and was widespread in the US oil and gas industry during the early 20th century. However, project finance for high-risk infrastructure schemes originated with the development of the North Sea

oil fields in the 1970s and 1980s. For such investments, newly created Special Purpose Corporations (SPCs) were created for each project, with multiple owners and complex schemes distributing insurance, loans, management, and project operations. Such projects were previously accomplished through utility or government bond issuances, or other traditional corporate finance structures.

Project financing in the developing world peaked around the time of the Asian financial crisis, but the subsequent downturn in industrializing countries was offset by growth in the OECD

countries, causing worldwide project financing to peak around 2000. The need for project financing remains high throughout the world as more countries require increasing supplies of public utilities and infrastructure. In recent years, project finance schemes have become increasingly common in the Middle East

, some incorporating Islamic finance.

The new project finance structures emerged primarily in response to the opportunity presented by long term power purchase contracts available from utilities and government entities. These long term revenue streams were required by rules implementing PURPA, the Public Utilities Regulatory Policies Act of 1978. Originally envisioned as an energy initiative designed to encourage domestic renewable resources and conservation, the Act and the industry it created lead to further deregulation of electric generation and, significantly, international privatization following amendments to the Public Utilities Holding Company Act in 1994. The structure has evolved and forms the basis for energy and other projects throughout the world.

1. Project company

2. Sponsor

3. Borrower

4. Financial Adviser

5. Technical Adviser

6. Lawyer

7. Debt financiers

8. Equity Investors

8. Regulatory agencies

9. Multilateral Agencies

10. Host government / grantor

An EPC contract generally provides for the obligation of the contractor to build and deliver the project facilities on a turnkey basis, i.e. at a certain pre-determined fixed price, by a certain date, in accordance with certain specifications, and with certain performance warranties. EPC contract is quite complicated in terms of legal issue therefore the project company the EPC contractor shall have enough experiences and knowledge about the nature of project in order to avoid their faults and minimize the risks during the contract execution.

Other alternative forms of construction contract are project management approach and alliance contracting.

Basic contents of an EPC contract are:

The project company delegates the operation, maintenance and often performance management of the project to a reputable operator with expertise in the industry under the terms of the Operations and Maintenance (O&M) agreement. The operator could be one of the sponsors of the project company or third party operator. In other cases the project company may carry out by itself the operation and maintenance of the project and may eventually arrange for the technical assistance of an experienced company under a technical assistance agreement.

Basic contents of a O&M contracts are:

The concession agreement concedes the use of a government asset (such as a plot of land or river crossing) to the Project Company for a specified period of time.

A concession deed would be found in most projects which involve Government such as in infrastructure projects. The concession agreement may be signed by a national / regional government, a municipality, or a special purpose entity set up by the state to grant the concession.

Examples of concession agreements include contracts for the following:

This is an agreement between the sponsors and deals with:

In a project financing the revenue is often contracted (rather to the sold on a merchant basis). The off-take agreement governs mechanism of price and volume which make up revenue. The intention of this agreement is to provide the project company with stable and sufficient revenue to pay its project debt obligation, cover the operating costs and provide certain required return to the sponsors.

The main off-take agreements are:

If a project company has an off-take contract, the supply contract is usually structured to match the general terms of the off-take contract such as the length of the contract, force majeure provisions, etc.

The volume of input supplies required by the project company is usually linked to the project’s output. Example under a PPA the power purchaser who does not require power can ask the project to shut down the power plant and continue to pay the capacity payment – in such case the project company needs to ensure its obligations to buy fuel can be reduced in parallel.

The main supply agreemnts are:

The degree of commitment by the supplier can vary.

supply between an agreed maximum and minimum. The supply may be under a take-or-pay or take-and-pay.

Loan agreement governs relationship between the lenders and the borrowers. It determines the basis on which the loan can be drawn and repaid, and contains the usual provisions found in a corporate loan agreement. It also contains the additional clauses to cover specific requirements of the project and project documents.

Basic terms of a loan agreement include the following provisions.

This is the agreement between the main creditors in connection with the project financing. The main creditors often enter into the Intercreditor Agreement to govern the common terms and relationships among the lenders in respect of the borrower’s obligations.

Intercreditor agreement will specify provisions including the following.

through the use of a tripartite deed (sometimes called a consent deed, direct agreement or side agreement).

The tripartite deed sets out the circumstances in which the financiers may “step in” under the project contracts in order to remedy any default.

A tripartite deed would normally contain the following provision.

project contracts.

relevant contract.

Tripartite deed can give rise to difficult issues for negotiation but is a critical document in project financing.

The term sheet outlines the key terms and conditions of the financing. The term sheet provides the basis for the lead arrangers to complete the credit approval to underwrite the debt, usually by signing the agreed term sheet. Generally the final term sheet is attached to the mandate letter and is used by the lead arrangers to syndicate the debt.

The commitment by the lenders is usually subject to further detailed due diligence and negotiation of project agreements and finance documents including the security documents. The next phase in the financing is the negotiation of finance documents and the term sheet will eventually be replaced by

the definitive finance documents when the project reaches financial close.

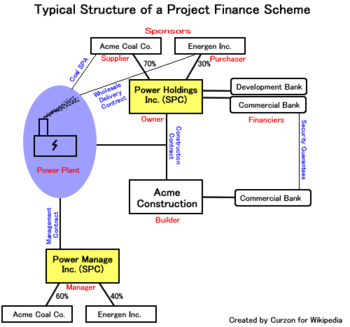

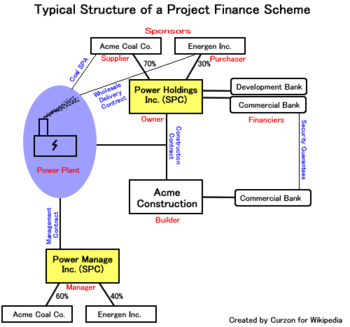

Acme Coal Co. imports coal. Energen Inc. supplies energy to consumers. The two companies agree to build a power plant to accomplish their respective goals. Typically, the first step would be to sign a memorandum of understanding

Acme Coal Co. imports coal. Energen Inc. supplies energy to consumers. The two companies agree to build a power plant to accomplish their respective goals. Typically, the first step would be to sign a memorandum of understanding

to set out the intentions of the two parties. This would be followed by an agreement to form a joint venture

.

Acme Coal and Energen form an SPC (Special Purpose Corporation) called Power Holdings Inc. and divide the shares between them according to their contributions. Acme Coal, being more established, contributes more capital

and takes 70% of the shares. Energen is a smaller company and takes the remaining 30%. The new company has no assets.

Power Holdings then signs a construction contract with Acme Construction to build a power plant. Acme Construction is an affiliate of Acme Coal and the only company with the know-how to construct a power plant in accordance with Acme's delivery specification.

A power plant can cost hundreds of millions of dollars. To pay Acme Construction, Power Holdings receives financing from a development bank

and a commercial bank

. These banks provide a guarantee to Acme Construction's financier that the company can pay for the completion of construction. Payment for construction is generally paid as such: 10% up front, 10% midway through construction, 10% shortly before completion, and 70% upon transfer of title to Power Holdings, which becomes the owner of the power plant.

Acme Coal and Energen form Power Manage Inc., another SPC, to manage the facility. The ultimate purpose of the two SPCs (Power Holding and Power Manage) is primarily to protect Acme Coal and Energen. If a disaster happens at the plant, prospective plaintiffs cannot sue Acme Coal or Energen and target their assets because neither company owns or operates the plant.

A Sale and Purchase Agreement (SPA) between Power Manage and Acme Coal supplies raw materials to the power plant. Electricity is then delivered to Energen using a wholesale delivery contract. The cashflow of both Acme Coal and Energen from this transaction will be used to repay the financiers.

the roads and collect the revenues, while providing a guaranteed annual sum

(along with clearly specified upside and downside conditions) to the project. This serves to minimise or eliminate the risks associated with traffic demand for the project investors and the lenders.

Minority owners of a project may wish to use "off-balance-sheet

" financing, in which they disclose their participation in the project as an investment, and excludes the debt from financial statements by disclosing it as a footnote related to the investment. In the United States, this eligibility is determined by the Financial Accounting Standards Board

. Many projects in developing countries must also be covered with war risk insurance

, which covers acts of hostile attack, derelict mines and torpedoes, and civil unrest which are not generally included in "standard" insurance policies. Today, some altered policies that include terrorism are called Terrorism Insurance or Political Risk Insurance. In many cases, an outside insurer will issue a performance bond

to guarantee timely completion of the project by the contractor.

Publicly-funded projects may also use additional financing methods such as tax increment financing

or Private Finance Initiative

(PFI). Such projects are often governed by a Capital Improvement Plan

which adds certain auditing capabilities and restrictions to the process.

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

of infrastructure

Infrastructure

Infrastructure is basic physical and organizational structures needed for the operation of a society or enterprise, or the services and facilities necessary for an economy to function...

and industrial projects based upon the projected cash flows of the project rather than the balance sheets of the project sponsors. Usually, a project financing structure involves a number of equity

Stock

The capital stock of a business entity represents the original capital paid into or invested in the business by its founders. It serves as a security for the creditors of a business since it cannot be withdrawn to the detriment of the creditors...

investors, known as sponsors, as well as a syndicate of bank

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

s or other lending institutions that provide loan

Loan

A loan is a type of debt. Like all debt instruments, a loan entails the redistribution of financial assets over time, between the lender and the borrower....

s to the operation. The loans are most commonly non-recourse loans

Nonrecourse debt

Non-recourse debt or a non-recourse loan is a secured loan that is secured by a pledge of collateral, typically real property, but for which the borrower is not personally liable. If the borrower defaults, the lender/issuer can seize the collateral, but the lender's recovery is limited to the...

, which are secured

Security interest

A security interest is a property interest created by agreement or by operation of law over assets to secure the performance of an obligation, usually the payment of a debt. It gives the beneficiary of the security interest certain preferential rights in the disposition of secured assets...

by the project assets and paid entirely from project cash flow, rather than from the general assets or creditworthiness of the project sponsors, a decision in part supported by financial modeling

Financial modeling

Financial modeling is the task of building an abstract representation of a financial decision making situation. This is a mathematical model designed to represent the performance of a financial asset or a portfolio, of a business, a project, or any other investment...

. The financing is typically secured by all of the project assets, including the revenue-producing contracts. Project lenders are given a lien

Lien

In law, a lien is a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation...

on all of these assets, and are able to assume control of a project if the project company has difficulties complying with the loan terms.

Generally, a special purpose entity

Special purpose entity

A special purpose entity is a legal entity created to fulfill narrow, specific or temporary objectives...

is created for each project, thereby shielding other assets owned by a project sponsor from the detrimental effects of a project failure

Bankruptcy

Bankruptcy is a legal status of an insolvent person or an organisation, that is, one that cannot repay the debts owed to creditors. In most jurisdictions bankruptcy is imposed by a court order, often initiated by the debtor....

. As a special purpose entity, the project company has no assets other than the project. Capital contribution commitments by the owners of the project company are sometimes necessary to ensure that the project is financially sound, or to assure the lenders of the sponsors' commitment. Project finance is often more complicated than alternative financing methods. Traditionally, project financing has been most commonly used in the extractive (mining

Mining

Mining is the extraction of valuable minerals or other geological materials from the earth, from an ore body, vein or seam. The term also includes the removal of soil. Materials recovered by mining include base metals, precious metals, iron, uranium, coal, diamonds, limestone, oil shale, rock...

), transportation, telecommunication

Telecommunication

Telecommunication is the transmission of information over significant distances to communicate. In earlier times, telecommunications involved the use of visual signals, such as beacons, smoke signals, semaphore telegraphs, signal flags, and optical heliographs, or audio messages via coded...

s and energy

Energy

In physics, energy is an indirectly observed quantity. It is often understood as the ability a physical system has to do work on other physical systems...

industries. More recently, particularly in Europe, project financing principles have been applied to other types of public infrastructure under public–private partnerships (PPP) or, in the UK, Private Finance Initiative

Private Finance Initiative

The private finance initiative is a way of creating "public–private partnerships" by funding public infrastructure projects with private capital...

(PFI) transactions (e.g., school facilities) as well as sports and entertainment venues.

Risk identification and allocation is a key component of project finance. A project may be subject to a number of technical, environmental, economic and political risks, particularly in developing countries and emerging markets. Financial institution

Financial institution

In financial economics, a financial institution is an institution that provides financial services for its clients or members. Probably the most important financial service provided by financial institutions is acting as financial intermediaries...

s and project sponsors may conclude that the risks inherent in project development and operation are unacceptable (unfinanceable). To cope with these risks, project sponsors in these industries (such as power plants or railway lines) are generally completed by a number of specialist companies operating in a contractual network with each other that allocates risk in a way that allows financing to take place. "Several long-term contracts such as construction, supply, off-take and concession agreements, along with a variety of joint-ownership structures, are used to align incentives and deter opportunistic behaviour by any

party involved in the project." The various patterns of implementation are sometimes referred to as "project delivery method

Project Delivery Method

A project delivery method is a system used by an agency or owner for organizing and financing design, construction, operations, and maintenance services for a structure or facility by entering into legal agreements with one or more entities or parties....

s." The financing of these projects must also be distributed among multiple parties, so as to distribute the risk associated with the project while simultaneously ensuring profits

Profit (economics)

In economics, the term profit has two related but distinct meanings. Normal profit represents the total opportunity costs of a venture to an entrepreneur or investor, whilst economic profit In economics, the term profit has two related but distinct meanings. Normal profit represents the total...

for each party involved.

A riskier or more expensive project may require limited recourse financing secured by a surety

Surety

A surety or guarantee, in finance, is a promise by one party to assume responsibility for the debt obligation of a borrower if that borrower defaults...

from sponsors. A complex project finance structure may incorporate corporate finance

Corporate finance

Corporate finance is the area of finance dealing with monetary decisions that business enterprises make and the tools and analysis used to make these decisions. The primary goal of corporate finance is to maximize shareholder value while managing the firm's financial risks...

, securitization

Securitization

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or Collateralized mortgage obligation , to...

, options (derivatives)

Option (finance)

In finance, an option is a derivative financial instrument that specifies a contract between two parties for a future transaction on an asset at a reference price. The buyer of the option gains the right, but not the obligation, to engage in that transaction, while the seller incurs the...

, insurance

Insurance

In law and economics, insurance is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. Insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for payment. An insurer is a company selling the...

provisions or other types of collateral enhancement to mitigate unallocated risk.

Project finance shares many characteristics with maritime finance and aircraft finance

Aircraft finance

Aircraft finance refers to financing for the purchase and operation of aircraft. Complex aircraft finance shares many characteristics with maritime finance, and to a lesser extent with project finance....

; however, the latter two are more specialized fields within the area of asset finance.

History

Limited recourse lending was used to finance maritime voyages in ancient GreeceAncient Greece

Ancient Greece is a civilization belonging to a period of Greek history that lasted from the Archaic period of the 8th to 6th centuries BC to the end of antiquity. Immediately following this period was the beginning of the Early Middle Ages and the Byzantine era. Included in Ancient Greece is the...

and Rome

Ancient Rome

Ancient Rome was a thriving civilization that grew on the Italian Peninsula as early as the 8th century BC. Located along the Mediterranean Sea and centered on the city of Rome, it expanded to one of the largest empires in the ancient world....

. Its use in infrastructure projects dates to the development of the Panama Canal

Panama Canal

The Panama Canal is a ship canal in Panama that joins the Atlantic Ocean and the Pacific Ocean and is a key conduit for international maritime trade. Built from 1904 to 1914, the canal has seen annual traffic rise from about 1,000 ships early on to 14,702 vessels measuring a total of 309.6...

, and was widespread in the US oil and gas industry during the early 20th century. However, project finance for high-risk infrastructure schemes originated with the development of the North Sea

North Sea

In the southwest, beyond the Straits of Dover, the North Sea becomes the English Channel connecting to the Atlantic Ocean. In the east, it connects to the Baltic Sea via the Skagerrak and Kattegat, narrow straits that separate Denmark from Norway and Sweden respectively...

oil fields in the 1970s and 1980s. For such investments, newly created Special Purpose Corporations (SPCs) were created for each project, with multiple owners and complex schemes distributing insurance, loans, management, and project operations. Such projects were previously accomplished through utility or government bond issuances, or other traditional corporate finance structures.

Project financing in the developing world peaked around the time of the Asian financial crisis, but the subsequent downturn in industrializing countries was offset by growth in the OECD

Organisation for Economic Co-operation and Development

The Organisation for Economic Co-operation and Development is an international economic organisation of 34 countries founded in 1961 to stimulate economic progress and world trade...

countries, causing worldwide project financing to peak around 2000. The need for project financing remains high throughout the world as more countries require increasing supplies of public utilities and infrastructure. In recent years, project finance schemes have become increasingly common in the Middle East

Middle East

The Middle East is a region that encompasses Western Asia and Northern Africa. It is often used as a synonym for Near East, in opposition to Far East...

, some incorporating Islamic finance.

The new project finance structures emerged primarily in response to the opportunity presented by long term power purchase contracts available from utilities and government entities. These long term revenue streams were required by rules implementing PURPA, the Public Utilities Regulatory Policies Act of 1978. Originally envisioned as an energy initiative designed to encourage domestic renewable resources and conservation, the Act and the industry it created lead to further deregulation of electric generation and, significantly, international privatization following amendments to the Public Utilities Holding Company Act in 1994. The structure has evolved and forms the basis for energy and other projects throughout the world.

Parties to a Project Financing

There are several parties in a project financing depending on the type and the scale of a project. The most usual parties to a project financing are;1. Project company

2. Sponsor

3. Borrower

4. Financial Adviser

5. Technical Adviser

6. Lawyer

7. Debt financiers

8. Equity Investors

8. Regulatory agencies

9. Multilateral Agencies

10. Host government / grantor

Contractual Framework

The typical project finance documentation can be reconducted to four main types- Shareholder/sponsor documents

- Project documents

- Finance documents

- Other project documents

Engineering, Procurement and Construction Contract - (EPC Contract)

The most common project finance construction contract is the EPC Contract.An EPC contract generally provides for the obligation of the contractor to build and deliver the project facilities on a turnkey basis, i.e. at a certain pre-determined fixed price, by a certain date, in accordance with certain specifications, and with certain performance warranties. EPC contract is quite complicated in terms of legal issue therefore the project company the EPC contractor shall have enough experiences and knowledge about the nature of project in order to avoid their faults and minimize the risks during the contract execution.

Other alternative forms of construction contract are project management approach and alliance contracting.

Basic contents of an EPC contract are:

-

- Description of the project

- Price

- Payment

- Completion date

- Completion guarantee and Liquidated Damages (LDs):

- Performance guarantee and LDs

- Cap under LDs

Operation and Maintenance Agreement - (O&M Agreement)

An agreement between the project company and the operator.The project company delegates the operation, maintenance and often performance management of the project to a reputable operator with expertise in the industry under the terms of the Operations and Maintenance (O&M) agreement. The operator could be one of the sponsors of the project company or third party operator. In other cases the project company may carry out by itself the operation and maintenance of the project and may eventually arrange for the technical assistance of an experienced company under a technical assistance agreement.

Basic contents of a O&M contracts are:

-

- Definition of the service

- Operator responsibility

- Provision regarding the services rendered

- Liquidated damages

- Fee provisions

Concession Deed

Agreement between the project company and a public-sector entity (the contracting authority).The concession agreement concedes the use of a government asset (such as a plot of land or river crossing) to the Project Company for a specified period of time.

A concession deed would be found in most projects which involve Government such as in infrastructure projects. The concession agreement may be signed by a national / regional government, a municipality, or a special purpose entity set up by the state to grant the concession.

Examples of concession agreements include contracts for the following:

-

- A toll-road or tunnel for which the concession agreement giving a right to collect tolls / fares from public or where payments are made by the contracting authority based on usage by the public.

- A transportation system (e.g. a railway / metro) for which the public pays fares to a private company)

- Utility projects where payments are made by a municipality or by end-users.

- Ports and airports where payments are usually made by airlines or shipping companies.

- Other public sector projects such as schools, hospitals, government buildings, where payments are made by the contracting authority.

Shareholders Agreement - (SHA Agreement)

The agreement between the project sponsors to form a special purpose company (“SPC”) in relation to the project development. This is the most basic of structure held by the sponsors in project finance transaction.This is an agreement between the sponsors and deals with:

-

- Injection of share capital

- Voting requirements

- Resolution of disputes

- Dividend policyDividend policyDividend policy is concerned with taking a decision regarding paying cash dividend in the present or paying an increased dividend at a later stage. The firm could also pay in the form of stock dividends which unlike cash dividends do not provide liquidity to the investors, however, it ensures...

- Management of the SPV

- Disposal and pre-emption rights

Off-Take Agreement

An agreement between the project company and the offtaker (the party who is buying the product / service the project produces / delivers).In a project financing the revenue is often contracted (rather to the sold on a merchant basis). The off-take agreement governs mechanism of price and volume which make up revenue. The intention of this agreement is to provide the project company with stable and sufficient revenue to pay its project debt obligation, cover the operating costs and provide certain required return to the sponsors.

The main off-take agreements are:

- Take-or-pay contract: under this contract the off-taker – on an agreed price basis – is obligated to pay for product on a regular basis whether or not the off-taker actually takes the product.

- Power purchase agreement: commonly used in power projects in emerging markets. The purchasing entity is usually a government entity.

- Take-and-pay contract: the off-taker only pays for the product taken on an agreed price basis.

- Long-term sales contract: the off-taker agrees to take agreed-upon quantities of the product from the project. The price is however paid based on market prices at the time of purchase or an agreed market index, subject to certain floor (minimum) price. Commonly used in mining, oil and gas, and petrochemical projects where the project company wants to ensure that its product can easily be sold in international markets, but off-takers not willing to take the price risk

- Hedging contract: found in the commodity markets such as in an oilfield project.

- Contract for Differences: the project company sells its product into the market and not to the off-taker or hedging counterpart. If however the market price is below an agreed level, the offtaker pays the difference to the project company, and vice versa if it is above an agreed level.

- Throughput contract: a user of the pipeline agrees to use it to carry not less than a certain volume of product and to pay a minimum price for this.

Supply Agreement

An agreement between the project company and the supplier of the required feedstock / fuel.If a project company has an off-take contract, the supply contract is usually structured to match the general terms of the off-take contract such as the length of the contract, force majeure provisions, etc.

The volume of input supplies required by the project company is usually linked to the project’s output. Example under a PPA the power purchaser who does not require power can ask the project to shut down the power plant and continue to pay the capacity payment – in such case the project company needs to ensure its obligations to buy fuel can be reduced in parallel.

The main supply agreemnts are:

The degree of commitment by the supplier can vary.

- Fixed or variable supply: the supplier agrees to provide a fixed quantity of supplies to the project company on an agreed schedule, or a variable

supply between an agreed maximum and minimum. The supply may be under a take-or-pay or take-and-pay.

- Output / reserve dedication: the supplier dedicates the entire output from a specific source, e.g. a coal mine, its own plant. However the supplier may have no obligation to produce any output unless agreed otherwise. The supply can also be under a take-or-pay or take-and-pay

- Interruptible supply: some supplies such as gas are offered on a lower cost interruptible basis – often via a pipeline also supplying other users.

- Tolling contract: the supplier has no commitment to supply at all, and may choose not to do so if the supplies can be used more profitably elsewhere. However the availability charge must be paid to the project company.

Loan Agreement

An agreement between the project company (borrower) and the lenders.Loan agreement governs relationship between the lenders and the borrowers. It determines the basis on which the loan can be drawn and repaid, and contains the usual provisions found in a corporate loan agreement. It also contains the additional clauses to cover specific requirements of the project and project documents.

Basic terms of a loan agreement include the following provisions.

- General conditions precedent

- Conditions precedent to each drawdown

- Availability period, during which the borrower is obliged to pay a commitment fee

- Drawdown mechanics

- An interest clause, charged at a margin over base rate

- A repayment clause

- Financial covenants - calculation of key project metrics / ratios and covenants

- Dividend restrictions

- Representations and warranties

- The illegality clause

Intercreditor Agreement

Intercreditor agreement is agreed between the main creditors of the project company.This is the agreement between the main creditors in connection with the project financing. The main creditors often enter into the Intercreditor Agreement to govern the common terms and relationships among the lenders in respect of the borrower’s obligations.

Intercreditor agreement will specify provisions including the following.

- Common terms

- Order of drawdown

- Cashflow waterfall

- Limitation on ability of creditors to vary their rights

- Voting rights

- Notification of defaults

- Order of applying the proceeds of debt recovery

- If there is a mezzanine funding component, the terms of subordination and other principles to apply as between the senior debt providers and the mezzanine debt providers.

Tripartite Deed

The financiers will usually require that a direct relationship between itself and the counterparty to that contract be established which is achievedthrough the use of a tripartite deed (sometimes called a consent deed, direct agreement or side agreement).

The tripartite deed sets out the circumstances in which the financiers may “step in” under the project contracts in order to remedy any default.

A tripartite deed would normally contain the following provision.

- Acknowledgement of security: confirmation by the contractor or relevant party that it consents to the financier taking security over the relevant

project contracts.

- Notice of default: obligation on the relevant project counterparty to notify the lenders directly of defaults by the project company under the

relevant contract.

- Step-in rights and extended periods: to ensure that the lenders will have sufficient notice /period to enable it to remedy any breach by the borrower.

- Receivership: acknowledgement by the relevant party regarding the appointment of a receiver by the lenders under the relevant contract and that the receiver may continue the borrower’s performance under the contract

- Sale of asset: terms and conditions upon which the lenders may transfer the borrower’s entitlements under the relevant contract.

Tripartite deed can give rise to difficult issues for negotiation but is a critical document in project financing.

Terms Sheet

Agreement between the borrower and the lender for the cost, provision and repayment of debt.The term sheet outlines the key terms and conditions of the financing. The term sheet provides the basis for the lead arrangers to complete the credit approval to underwrite the debt, usually by signing the agreed term sheet. Generally the final term sheet is attached to the mandate letter and is used by the lead arrangers to syndicate the debt.

The commitment by the lenders is usually subject to further detailed due diligence and negotiation of project agreements and finance documents including the security documents. The next phase in the financing is the negotiation of finance documents and the term sheet will eventually be replaced by

the definitive finance documents when the project reaches financial close.

Basic scheme

Memorandum of understanding

A memorandum of understanding is a document describing a bilateral or multilateral agreement between parties. It expresses a convergence of will between the parties, indicating an intended common line of action. It is often used in cases where parties either do not imply a legal commitment or in...

to set out the intentions of the two parties. This would be followed by an agreement to form a joint venture

Joint venture

A joint venture is a business agreement in which parties agree to develop, for a finite time, a new entity and new assets by contributing equity. They exercise control over the enterprise and consequently share revenues, expenses and assets...

.

Acme Coal and Energen form an SPC (Special Purpose Corporation) called Power Holdings Inc. and divide the shares between them according to their contributions. Acme Coal, being more established, contributes more capital

Financial capital

Financial capital can refer to money used by entrepreneurs and businesses to buy what they need to make their products or provide their services or to that sector of the economy based on its operation, i.e. retail, corporate, investment banking, etc....

and takes 70% of the shares. Energen is a smaller company and takes the remaining 30%. The new company has no assets.

Power Holdings then signs a construction contract with Acme Construction to build a power plant. Acme Construction is an affiliate of Acme Coal and the only company with the know-how to construct a power plant in accordance with Acme's delivery specification.

A power plant can cost hundreds of millions of dollars. To pay Acme Construction, Power Holdings receives financing from a development bank

Development bank

The phrase development bank may refer to:* Community development banks fund low-income areas in the United States* Multilateral Development Bank provide financing for international development...

and a commercial bank

Commercial bank

After the implementation of the Glass–Steagall Act, the U.S. Congress required that banks engage only in banking activities, whereas investment banks were limited to capital market activities. As the two no longer have to be under separate ownership under U.S...

. These banks provide a guarantee to Acme Construction's financier that the company can pay for the completion of construction. Payment for construction is generally paid as such: 10% up front, 10% midway through construction, 10% shortly before completion, and 70% upon transfer of title to Power Holdings, which becomes the owner of the power plant.

Acme Coal and Energen form Power Manage Inc., another SPC, to manage the facility. The ultimate purpose of the two SPCs (Power Holding and Power Manage) is primarily to protect Acme Coal and Energen. If a disaster happens at the plant, prospective plaintiffs cannot sue Acme Coal or Energen and target their assets because neither company owns or operates the plant.

A Sale and Purchase Agreement (SPA) between Power Manage and Acme Coal supplies raw materials to the power plant. Electricity is then delivered to Energen using a wholesale delivery contract. The cashflow of both Acme Coal and Energen from this transaction will be used to repay the financiers.

Complicating factors

The above is a simple explanation which does not cover the mining, shipping, and delivery contracts involved in importing the coal (which in itself could be more complex than the financing scheme), nor the contracts for delivering the power to consumers. In developing countries, it is not unusual for one or more government entities to be the primary consumers of the project, undertaking the "last mile distribution" to the consuming population. The relevant purchase agreements between the government agencies and the project may contain clauses guaranteeing a minimum offtake and thereby guarantee a certain level of revenues. In other sectors including road transportation, the government may tollToll road

A toll road is a privately or publicly built road for which a driver pays a toll for use. Structures for which tolls are charged include toll bridges and toll tunnels. Non-toll roads are financed using other sources of revenue, most typically fuel tax or general tax funds...

the roads and collect the revenues, while providing a guaranteed annual sum

Annuity (finance theory)

The term annuity is used in finance theory to refer to any terminating stream of fixed payments over a specified period of time. This usage is most commonly seen in discussions of finance, usually in connection with the valuation of the stream of payments, taking into account time value of money...

(along with clearly specified upside and downside conditions) to the project. This serves to minimise or eliminate the risks associated with traffic demand for the project investors and the lenders.

Minority owners of a project may wish to use "off-balance-sheet

Off-balance-sheet

Off-balance sheet usually means an asset or debt or financing activity not on the company's balance sheet.Some companies may have significant amounts of off-balance sheet assets and liabilities. For example, financial institutions often offer asset management or brokerage services to their clients...

" financing, in which they disclose their participation in the project as an investment, and excludes the debt from financial statements by disclosing it as a footnote related to the investment. In the United States, this eligibility is determined by the Financial Accounting Standards Board

Financial Accounting Standards Board

The Financial Accounting Standards Board is a private, not-for-profit organization whose primary purpose is to develop generally accepted accounting principles within the United States in the public's interest...

. Many projects in developing countries must also be covered with war risk insurance

War risk insurance

War risk insurance is a type of insurance which covers damage due to acts of war, including invasion, insurrection, rebellion and hijacking. Some policies also cover damage due to weapons of mass destruction. It is most commonly used in the shipping and aviation industries...

, which covers acts of hostile attack, derelict mines and torpedoes, and civil unrest which are not generally included in "standard" insurance policies. Today, some altered policies that include terrorism are called Terrorism Insurance or Political Risk Insurance. In many cases, an outside insurer will issue a performance bond

Performance bond

A performance bond is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor.A job requiring a payment & performance bond will usually require a bid bond, to bid the job...

to guarantee timely completion of the project by the contractor.

Publicly-funded projects may also use additional financing methods such as tax increment financing

Tax increment financing

Tax Increment Financing, or TIF, is a public financing method which has been used as a subsidy for redevelopment and community improvement projects in many countries including the United States for more than 50 years...

or Private Finance Initiative

Private Finance Initiative

The private finance initiative is a way of creating "public–private partnerships" by funding public infrastructure projects with private capital...

(PFI). Such projects are often governed by a Capital Improvement Plan

Capital Improvement Plan

A Capital Improvement Plan , or CIP, is a short-range plan, usually four to ten years, which identifies capital projects and equipment purchases, provides a planning schedule and identifies options for financing the plan...

which adds certain auditing capabilities and restrictions to the process.

See also

- Escrow AccountEscrowAn escrow is:* an arrangement made under contractual provisions between transacting parties, whereby an independent trusted third party receives and disburses money and/or documents for the transacting parties, with the timing of such disbursement by the third party dependent on the fulfillment of...

- Madate Letter

- Mandated Lead ArrangerMandated Lead ArrangerFinancing for a major project financed project will be arranged by a bank or group of banks termed the “lead arranger”.The mandated lead arranger generally has the leading role in this financing stage of a project. He often underwrites the financing, then handles syndication or builds up a group...

- European PPP Expertise Centre (EPEC)

- Project finance modelProject finance modelProject finance is only possible when the project is capable of producing enough cash to cover all operating and debt-servicing expenses over the whole tenor of the debt. A financial model is needed to assess economic feasibility of the project....