Payment card

Encyclopedia

Payment

A payment is the transfer of wealth from one party to another. A payment is usually made in exchange for the provision of goods, services or both, or to fulfill a legal obligation....

.

Types

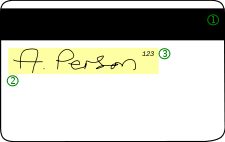

Typically a payment card is backed by an account holding funds belonging to the cardholder, or offering credit to the cardholder. Payment cards can be classified into types depending on how this account is managed. Different types of payment cards are described in following sections.Credit card

A credit card is part of a system of paymentPayment

A payment is the transfer of wealth from one party to another. A payment is usually made in exchange for the provision of goods, services or both, or to fulfill a legal obligation....

s named after the small plastic

Plastic

A plastic material is any of a wide range of synthetic or semi-synthetic organic solids used in the manufacture of industrial products. Plastics are typically polymers of high molecular mass, and may contain other substances to improve performance and/or reduce production costs...

card issued to users of the system. It is a card entitling its holder to buy goods and services based on the holder's promise to pay for these goods and services. The issuer of the card grants a line of credit

Line of credit

A line of credit is any credit source extended to a government, business or individual by a bank or other financial institution. A line of credit may take several forms, such as overdraft protection, demand loan, special purpose, export packing credit, term loan, discounting, purchase of...

to the consumer

Consumer

Consumer is a broad label for any individuals or households that use goods generated within the economy. The concept of a consumer occurs in different contexts, so that the usage and significance of the term may vary.-Economics and marketing:...

(or the user) from which the user can borrow money for payment to a merchant

Merchant

A merchant is a businessperson who trades in commodities that were produced by others, in order to earn a profit.Merchants can be one of two types:# A wholesale merchant operates in the chain between producer and retail merchant...

or as a cash advance

Cash advance

A cash advance is a service provided by most credit card and charge card issuers. The service allows cardholders to withdraw cash, either through an ATM or over the counter at a bank or other financial agency, up to a certain limit...

to the user.

A credit card is different from a charge card

Charge card

A charge card is a card that provides an alternative payment to cash when making purchases in which the issuer and the cardholder enter into an agreement that the debt incurred on the charge account will be paid in full and by due date or be subject to severe late fees and restrictions on card...

, where a charge card requires the balance to be paid in full each month. In contrast, credit cards allow the consumers to 'revolve' their balance, at the cost of having interest

Credit card interest

Credit card interest is the principal way in which credit card issuers generate revenue. A card issuer is a bank or credit union that gives a consumer a card or account number that can be used with various payees to make payments and borrow money from the bank simultaneously...

charged. Most credit cards are issued by local bank

Bank

A bank is a financial institution that serves as a financial intermediary. The term "bank" may refer to one of several related types of entities:...

s or credit union

Credit union

A credit union is a cooperative financial institution that is owned and controlled by its members and operated for the purpose of promoting thrift, providing credit at competitive rates, and providing other financial services to its members...

s, and are the shape and size specified by the ISO/IEC 7810 standard as ID-1. This is defined as 85.60 × 53.98 mm in size.

Debit card

Cash

In common language cash refers to money in the physical form of currency, such as banknotes and coins.In bookkeeping and finance, cash refers to current assets comprising currency or currency equivalents that can be accessed immediately or near-immediately...

when making purchases. Functionally, it can be called an electronic cheque, as the funds are withdrawn directly from either the bank account

Bank account

A Bank account is a financial account recording the financial transactions between the customer and the bank and the resulting financial position of the customer with the bank .-Account types:...

, or from the remaining balance on the card. In some cases, the cards are designed exclusively for use on the Internet, and so there is no physical card.

The use of debit cards has become widespread in many countries and has overtaken the cheque, and in some instances cash transactions by volume. Like credit card

Credit card

A credit card is a small plastic card issued to users as a system of payment. It allows its holder to buy goods and services based on the holder's promise to pay for these goods and services...

s, debit cards are used widely for telephone and Internet purchases, and unlike credit cards the funds are transferred from the bearer's bank account instead of having the bearer to pay back on a later date.

Debit cards can also allow for instant withdrawal of cash, acting as the ATM card

ATM card

An ATM card is a card issued by a bank, credit union or building society that can be used at an ATM for deposits, withdrawals, account information, and other types of transactions, often through interbank networks.Some ATM cards can also be used:* at a branch, as identification for in-person...

for withdrawing cash and as a cheque guarantee card. Merchants can also offer "cashback"/"cashout" facilities to customers, where a customer can withdraw cash along with their purchase.

Charge card

A charge card is a means of obtaining a very short term (usually around 1 month) loan for a purchase. It is similar to a credit cardCredit card

A credit card is a small plastic card issued to users as a system of payment. It allows its holder to buy goods and services based on the holder's promise to pay for these goods and services...

, except that the contract with the card issuer requires that the cardholder must each month pay charges made to it in full—there is no "minimum payment" other than the full balance. Since there is no loan, there is no official interest. A partial payment (or no payment) results in a severe late fee (as much as 5% of the balance) and the possible restriction of future transactions and risk of potential cancellation of the card.

Stored-value card

A stored-value card refers to monetary value on a card not in an externally recorded account and differs from prepaid cards where money is on deposit with the issuerIssuer

Issuer is a legal entity that develops, registers and sells securities for the purpose of financing its operations.Issuers may be domestic or foreign governments, corporations or investment trusts...

similar to a debit card

Debit card

A debit card is a plastic card that provides the cardholder electronic access to his or her bank account/s at a financial institution...

. One major difference between stored value cards and prepaid debit cards is that prepaid debit cards are usually issued in the name of individual account holders, while stored value cards are usually anonymous.

The term stored-value card means the funds and or data are physically stored on the card. With prepaid cards the data is maintained on computers affiliated with the card issuer. The value associated with the card can be accessed using a magnetic

Magnetism

Magnetism is a property of materials that respond at an atomic or subatomic level to an applied magnetic field. Ferromagnetism is the strongest and most familiar type of magnetism. It is responsible for the behavior of permanent magnets, which produce their own persistent magnetic fields, as well...

stripe embedded in the card, on which the card number is encoded; using radio-frequency identification (RFID); or by entering a code number, printed on the card, into a telephone

Telephone

The telephone , colloquially referred to as a phone, is a telecommunications device that transmits and receives sounds, usually the human voice. Telephones are a point-to-point communication system whose most basic function is to allow two people separated by large distances to talk to each other...

or other numeric keypad

Keypad

A keypad is a set of buttons arranged in a block or "pad" which usually bear digits, symbols and usually a complete set of alphabetical letters. If it mostly contains numbers then it can also be called a numeric keypad...

.

Fleet card

A fleet card is used as a payment card most commonly for gasoline, diesel and other fuels at gas stations. Fleet cards can also be used to pay for vehicle maintenance and expenses at the discretion of the fleet owner or manager. The use of a fleet card also eliminates the need for cash carrying, thus increasing the level of security felt by fleet drivers. The elimination of cash also makes it easier to prevent fraudulent transactions from occurring at a fleet owner or manager’s expense.Fleet cards are unique due to the convenient and comprehensive reporting that accompanies their use. Fleet cards enable fleet owners/managers to receive real time reports and set purchase controls with their cards helping them to stay informed of all business related expenses.

Magnetic stripe card

Data

The term data refers to qualitative or quantitative attributes of a variable or set of variables. Data are typically the results of measurements and can be the basis of graphs, images, or observations of a set of variables. Data are often viewed as the lowest level of abstraction from which...

by modifying the magnetism

Magnetism

Magnetism is a property of materials that respond at an atomic or subatomic level to an applied magnetic field. Ferromagnetism is the strongest and most familiar type of magnetism. It is responsible for the behavior of permanent magnets, which produce their own persistent magnetic fields, as well...

of tiny iron-based magnetic particles on a band of magnetic material on the card. The magnetic stripe, sometimes called a magstripe, is read by physical contact and swiping past a reading head. Magnetic stripe cards are commonly used in credit card

Credit card

A credit card is a small plastic card issued to users as a system of payment. It allows its holder to buy goods and services based on the holder's promise to pay for these goods and services...

s, identity cards, and transportation tickets. They may also contain an RFID tag, a transponder device

Transponder

In telecommunication, the term transponder has the following meanings:...

and/or a microchip

Integrated circuit

An integrated circuit or monolithic integrated circuit is an electronic circuit manufactured by the patterned diffusion of trace elements into the surface of a thin substrate of semiconductor material...

mostly used for business premises access control

Access control

Access control refers to exerting control over who can interact with a resource. Often but not always, this involves an authority, who does the controlling. The resource can be a given building, group of buildings, or computer-based information system...

or electronic payment.

A number of International Organization for Standardization

International Organization for Standardization

The International Organization for Standardization , widely known as ISO, is an international standard-setting body composed of representatives from various national standards organizations. Founded on February 23, 1947, the organization promulgates worldwide proprietary, industrial and commercial...

standards, ISO/IEC 7810, ISO/IEC 7811, ISO/IEC 7812, ISO/IEC 7813, ISO 8583

ISO 8583

ISO 8583 Financial transaction card originated messages — Interchange message specifications is the International Organization for Standardization standard for systems that exchange electronic transactions made by cardholders using payment cards...

, and ISO/IEC 4909, define the physical properties of the card, including size, flexibility, location of the magstripe, magnetic characteristics, and data formats. They also provide the standards for financial cards, including the allocation of card number ranges to different card issuing institutions.

Smart card

Integrated circuit

An integrated circuit or monolithic integrated circuit is an electronic circuit manufactured by the patterned diffusion of trace elements into the surface of a thin substrate of semiconductor material...

card (ICC), is any pocket-sized card with embedded integrated circuits which can process data. This implies that it can receive input which is processed — by way of the ICC applications — and delivered as an output. There are two broad categories of ICCs. Memory card

Memory card

A memory card or flash card is an electronic flash memory data storage device used for storing digital information. They are commonly used in many electronic devices, including digital cameras, mobile phones, laptop computers, MP3 players, and video game consoles...

s contain only non-volatile memory storage components, and perhaps some specific security logic. Microprocessor cards contain volatile memory and microprocessor components. The card is made of plastic, generally PVC

Polyvinyl chloride

Polyvinyl chloride, commonly abbreviated PVC, is a thermoplastic polymer. It is a vinyl polymer constructed of repeating vinyl groups having one hydrogen replaced by chloride. Polyvinyl chloride is the third most widely produced plastic, after polyethylene and polypropylene. PVC is widely used in...

, but sometimes ABS

Acrylonitrile butadiene styrene

Acrylonitrile butadiene styrene is a common thermoplastic. Its melting point is approximately 105 °C ....

. The card may embed a hologram

Holography

Holography is a technique that allows the light scattered from an object to be recorded and later reconstructed so that when an imaging system is placed in the reconstructed beam, an image of the object will be seen even when the object is no longer present...

to avoid counterfeit

Counterfeit

To counterfeit means to illegally imitate something. Counterfeit products are often produced with the intent to take advantage of the superior value of the imitated product...

ing. Using smart cards is also a form of strong security authentication for single sign-on

Single sign-on

Single sign-on is a property of access control of multiple related, but independent software systems. With this property a user logs in once and gains access to all systems without being prompted to log in again at each of them...

within large companies and organizations.

EMV

EMV

EMV stands for Europay, MasterCard and VISA, a global standard for inter-operation of integrated circuit cards and IC card capable point of sale terminals and automated teller machines , for authenticating credit and debit card transactions.It is a joint effort between Europay, MasterCard and...

is the standard adopted by all major issuers of smart payment cards.

Proximity card

Access control

Access control refers to exerting control over who can interact with a resource. Often but not always, this involves an authority, who does the controlling. The resource can be a given building, group of buildings, or computer-based information system...

or payment systems. It can refer to the older 125 kHz devices or the newer 13.56 MHz contactless RFID cards, most commonly known as contactless smartcards.

Modern proximity cards are covered by the ISO/IEC 14443 (proximity card) standard. There is also a related ISO/IEC 15693 (vicinity card) standard. Proximity cards are powered by resonant energy transfer

Resonant energy transfer

Resonant energy transfer may refer to:*Förster resonance energy transfer*Resonant inductive coupling...

and have a range of 0-3 inches in most instances. The user will usually be able to leave the card inside a wallet or purse. The price of the cards is also low, usually US$2–$5, allowing them to be used in applications such as identification cards, keycards, payment cards and public transit fare cards.

Credit card fraud

Credit card fraud is a wide-ranging term for theftTheft

In common usage, theft is the illegal taking of another person's property without that person's permission or consent. The word is also used as an informal shorthand term for some crimes against property, such as burglary, embezzlement, larceny, looting, robbery, shoplifting and fraud...

and fraud

Fraud

In criminal law, a fraud is an intentional deception made for personal gain or to damage another individual; the related adjective is fraudulent. The specific legal definition varies by legal jurisdiction. Fraud is a crime, and also a civil law violation...

committed using a credit card

Credit card

A credit card is a small plastic card issued to users as a system of payment. It allows its holder to buy goods and services based on the holder's promise to pay for these goods and services...

or any similar payment mechanism as a fraudulent source of funds in a transaction. The purpose may be to obtain goods without paying, or to obtain unauthorized funds from an account. Credit card fraud is also an adjunct to identity theft

Identity theft

Identity theft is a form of stealing another person's identity in which someone pretends to be someone else by assuming that person's identity, typically in order to access resources or obtain credit and other benefits in that person's name...

. According to the Federal Trade Commission, while identity theft had been holding steady for the last few years, it saw a 21 percent increase in 2008. However, credit card fraud, that crime which most people associate with ID theft, decreased as a percentage of all ID theft complaints for the sixth year in a row.

The cost of card fraud in 2006 were 7 cents per 100 dollars worth of transactions (7 basis point

Basis point

A basis point is a unit equal to 1/100 of a percentage point or one part per ten thousand...

s). Due to the high volume of transactions this translates to billions of dollars. In 2006, fraud in the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

alone was estimated at £535 million, or US$750–830 million at prevailing 2006 exchange rates.

International credit card data theft

Credit card data theft is often a crime of international scope. The cost of credit card fraudCredit card fraud

Credit card fraud is a wide-ranging term for theft and fraud committed using a credit card or any similar payment mechanism as a fraudulent source of funds in a transaction. The purpose may be to obtain goods without paying, or to obtain unauthorized funds from an account. Credit card fraud is also...

reaches into billions of dollars annually. In 2006, fraud in the United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

alone was estimated at £535 million, or US$750–830 million at prevailing 2006 exchange rates.