Silver as an investment

Overview

Silver

Silver is a metallic chemical element with the chemical symbol Ag and atomic number 47. A soft, white, lustrous transition metal, it has the highest electrical conductivity of any element and the highest thermal conductivity of any metal...

, like other precious metal

Precious metal

A precious metal is a rare, naturally occurring metallic chemical element of high economic value.Chemically, the precious metals are less reactive than most elements, have high lustre, are softer or more ductile, and have higher melting points than other metals...

s, may be used as an investment

Investment

Investment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

. For more than four thousand years, silver has been regarded as a form of money

Money

Money is any object or record that is generally accepted as payment for goods and services and repayment of debts in a given country or socio-economic context. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, occasionally in the past,...

and store of value

Store of value

A recognized form of exchange can be a form of money or currency, a commodity like gold, or financial capital. To act as a store of value, these forms must be able to be saved and retrieved at a later time, and be predictably useful when retrieved....

. However, since the end of the silver standard

Silver standard

The silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. The silver specie standard was widespread from the fall of the Byzantine Empire until the 19th century...

, silver has lost its role as legal tender

Legal tender

Legal tender is a medium of payment allowed by law or recognized by a legal system to be valid for meeting a financial obligation. Paper currency is a common form of legal tender in many countries....

in many developed countries

Developed country

A developed country is a country that has a high level of development according to some criteria. Which criteria, and which countries are classified as being developed, is a contentious issue...

such as the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

. In 2009, the main demand for silver was for industrial applications (40%), jewellery

Jewellery

Jewellery or jewelry is a form of personal adornment, such as brooches, rings, necklaces, earrings, and bracelets.With some exceptions, such as medical alert bracelets or military dog tags, jewellery normally differs from other items of personal adornment in that it has no other purpose than to...

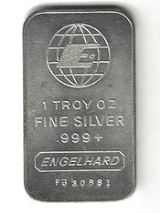

, bullion coin

Bullion coin

A bullion coin is a coin struck from precious metal and kept as a store of value or an investment, rather than used in day-to-day commerce. Investment coins are generally coins that have been minted after 1800, have a purity of not less than 900 thousandths and are or have been a legal tender in...

s and exchange-traded products.

Like most commodities, the price of silver is driven by speculation

Speculation

In finance, speculation is a financial action that does not promise safety of the initial investment along with the return on the principal sum...

and supply and demand

Supply and demand

Supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

. Compared to gold, the silver price is notoriously volatile

Volatility (finance)

In finance, volatility is a measure for variation of price of a financial instrument over time. Historic volatility is derived from time series of past market prices...

.