Excess reserves

Encyclopedia

In banking, excess reserves are bank reserves

in excess of the reserve requirement

set by a central bank

. They are reserves of cash more than the required amounts. Holding excess reserves is generally considered costly and uneconomical as no interest is earned on the excess amount. Therefore, many banks minimize their excess reserve amounts by putting them to more productive use.

For banks in the U.S. Federal Reserve System, this is accomplished by making short-term (usually overnight) loans on the federal funds

market to banks who may be short of their reserve requirements. However, some banks may choose to hold their excess reserves in order to facilitate upcoming transactions or meet contractual clearing balance requirements.

The minimum reserves and the excess reserves of private (commercial) banks are held as FRB (Federal Reserve Bank) credit in FRB accounts. The total amount of FRB credit held by private banks and the amount of FRB credit that the US government holds in its FRB account, together with all currency and vault cash form the monetary base

.

. They began doing so three days later. Banks had already begun increasing the amount of their money on deposit with the Fed at the beginning of September, up from about $10 billion total at the end of August, 2008, to $880 billion by the end of the second week of January, 2009. In comparison, the increase in reserve balances reached only $65 billion after September 11, 2001 before falling back to normal levels within a month. Former U.S. Treasury Secretary

Henry Paulson

's original bailout proposal under which the government would acquire up to $700 billion worth of mortgage-backed securities contained no provision to begin paying interest on reserve balances.

The day before the change was announced, on October 7, Fed Chairman Ben Bernanke

expressed some confusion about it, saying, "We're not quite sure what we have to pay in order to get the market rate, which includes some credit risk, up to the target. We're going to experiment with this and try to find what the right spread is." The Fed adjusted the rate on October 22, after the initial rate they set October 6 failed to keep the benchmark U.S. overnight interest rate close to their policy target, and again on November 5 for the same reason.

The Congressional Budget Office

estimated that payment of interest on reserve balances would cost the American taxpayers about one tenth of the present 0.25% interest rate on $800 billion in deposits:

0.25% simple interest on $800 billion is $2 billion, not $202 million as shown for 2009. But those expenditures pale in comparison to the lost tax revenues worldwide resulting from decreased economic activity from damage to the short-term commercial paper

and associated credit markets.

Beginning December 18, the Fed directly established interest rates paid on required reserve balances and excess balances instead of specifying them with a formula based on the target federal funds rate

. On January 13, Ben Bernanke

said, "In principle, the interest rate the Fed pays on bank reserves should set a floor on the overnight interest rate, as banks should be unwilling to lend reserves at a rate lower than they can receive from the Fed. In practice, the federal funds rate has fallen somewhat below the interest rate on reserves in recent months, reflecting the very high volume of excess reserves, the inexperience of banks with the new regime, and other factors. However, as excess reserves decline, financial conditions normalize, and banks adapt to the new regime, we expect the interest rate paid on reserves to become an effective instrument for controlling the federal funds rate."

Also on January 13, Financial Week said Mr. Bernanke admitted that a huge increase in banks' excess reserves is stifling the Fed's monetary policy moves and its efforts to revive private sector lending. On January 7, 2009, the Federal Open Market Committee

had decided that, "the size of the balance sheet and level of excess reserves would need to be reduced." On January 15, Chicago Fed

president and Federal Open Market Committee member Charles Evans said, "once the economy recovers and financial conditions stabilize, the Fed will return to its traditional focus on the federal funds rate. It also will have to scale back the use of emergency lending programs and reduce the size of the balance sheet and level of excess reserves. 'Some of this scaling back will occur naturally as market conditions improve on account of how these programs have been designed. Still, financial market participants need to be prepared for the eventual dismantling of the facilities that have been put in place during the financial turmoil,' he said."

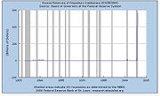

At the end of January, 2009, excess reserve balances at the Fed stood at $793 billion but less than two weeks later on February 11, total reserve balances had fallen to $603 billion. On April 1, reserve balances had again increased to $806 billion, and on February 10, 2010, they stood at $1.154 trillion. By August 2011, they reached $1.6 trillion.

Bank reserves

Bank reserves are banks' holdings of deposits in accounts with their central bank , plus currency that is physically held in the bank's vault . The central banks of some nations set minimum reserve requirements...

in excess of the reserve requirement

Reserve requirement

The reserve requirement is a central bank regulation that sets the minimum reserves each commercial bank must hold of customer deposits and notes...

set by a central bank

Central bank

A central bank, reserve bank, or monetary authority is a public institution that usually issues the currency, regulates the money supply, and controls the interest rates in a country. Central banks often also oversee the commercial banking system of their respective countries...

. They are reserves of cash more than the required amounts. Holding excess reserves is generally considered costly and uneconomical as no interest is earned on the excess amount. Therefore, many banks minimize their excess reserve amounts by putting them to more productive use.

For banks in the U.S. Federal Reserve System, this is accomplished by making short-term (usually overnight) loans on the federal funds

Federal funds

In the United States, federal funds are overnight borrowings by banks to maintain their bank reserves at the Federal Reserve. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clear financial transactions...

market to banks who may be short of their reserve requirements. However, some banks may choose to hold their excess reserves in order to facilitate upcoming transactions or meet contractual clearing balance requirements.

The minimum reserves and the excess reserves of private (commercial) banks are held as FRB (Federal Reserve Bank) credit in FRB accounts. The total amount of FRB credit held by private banks and the amount of FRB credit that the US government holds in its FRB account, together with all currency and vault cash form the monetary base

Monetary base

In economics, the monetary base is a term relating to the money supply , the amount of money in the economy...

.

Emergency Economic Stabilization Act of 2008

On October 3, 2008, Section 128 of the Emergency Economic Stabilization Act of 2008 allowed the Fed to begin paying interest on excess reserve balances as well as required reservesReserve requirement

The reserve requirement is a central bank regulation that sets the minimum reserves each commercial bank must hold of customer deposits and notes...

. They began doing so three days later. Banks had already begun increasing the amount of their money on deposit with the Fed at the beginning of September, up from about $10 billion total at the end of August, 2008, to $880 billion by the end of the second week of January, 2009. In comparison, the increase in reserve balances reached only $65 billion after September 11, 2001 before falling back to normal levels within a month. Former U.S. Treasury Secretary

United States Secretary of the Treasury

The Secretary of the Treasury of the United States is the head of the United States Department of the Treasury, which is concerned with financial and monetary matters, and, until 2003, also with some issues of national security and defense. This position in the Federal Government of the United...

Henry Paulson

Henry Paulson

Henry Merritt "Hank" Paulson, Jr. is an American banker who served as the 74th United States Secretary of the Treasury. He previously served as the Chairman and Chief Executive Officer of Goldman Sachs.-Early life and family:...

's original bailout proposal under which the government would acquire up to $700 billion worth of mortgage-backed securities contained no provision to begin paying interest on reserve balances.

The day before the change was announced, on October 7, Fed Chairman Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

expressed some confusion about it, saying, "We're not quite sure what we have to pay in order to get the market rate, which includes some credit risk, up to the target. We're going to experiment with this and try to find what the right spread is." The Fed adjusted the rate on October 22, after the initial rate they set October 6 failed to keep the benchmark U.S. overnight interest rate close to their policy target, and again on November 5 for the same reason.

The Congressional Budget Office

Congressional Budget Office

The Congressional Budget Office is a federal agency within the legislative branch of the United States government that provides economic data to Congress....

estimated that payment of interest on reserve balances would cost the American taxpayers about one tenth of the present 0.25% interest rate on $800 billion in deposits:

| Year | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Millions of dollars | 0 | -192 | -192 | -202 | -212 | -221 | -242 | -253 | -266 | -293 | -308 |

| (Negative numbers represent expenditures; losses in revenue not included.) | |||||||||||

0.25% simple interest on $800 billion is $2 billion, not $202 million as shown for 2009. But those expenditures pale in comparison to the lost tax revenues worldwide resulting from decreased economic activity from damage to the short-term commercial paper

Commercial paper

In the global money market, commercial paper is an unsecured promissory note with a fixed maturity of 1 to 270 days. Commercial Paper is a money-market security issued by large banks and corporations to get money to meet short term debt obligations , and is only backed by an issuing bank or...

and associated credit markets.

Beginning December 18, the Fed directly established interest rates paid on required reserve balances and excess balances instead of specifying them with a formula based on the target federal funds rate

Federal funds rate

In the United States, the federal funds rate is the interest rate at which depository institutions actively trade balances held at the Federal Reserve, called federal funds, with each other, usually overnight, on an uncollateralized basis. Institutions with surplus balances in their accounts lend...

. On January 13, Ben Bernanke

Ben Bernanke

Ben Shalom Bernanke is an American economist, and the current Chairman of the Federal Reserve, the central bank of the United States. During his tenure as Chairman, Bernanke has overseen the response of the Federal Reserve to late-2000s financial crisis....

said, "In principle, the interest rate the Fed pays on bank reserves should set a floor on the overnight interest rate, as banks should be unwilling to lend reserves at a rate lower than they can receive from the Fed. In practice, the federal funds rate has fallen somewhat below the interest rate on reserves in recent months, reflecting the very high volume of excess reserves, the inexperience of banks with the new regime, and other factors. However, as excess reserves decline, financial conditions normalize, and banks adapt to the new regime, we expect the interest rate paid on reserves to become an effective instrument for controlling the federal funds rate."

Also on January 13, Financial Week said Mr. Bernanke admitted that a huge increase in banks' excess reserves is stifling the Fed's monetary policy moves and its efforts to revive private sector lending. On January 7, 2009, the Federal Open Market Committee

Federal Open Market Committee

The Federal Open Market Committee , a committee within the Federal Reserve System, is charged under United States law with overseeing the nation's open market operations . It is the Federal Reserve committee that makes key decisions about interest rates and the growth of the United States money...

had decided that, "the size of the balance sheet and level of excess reserves would need to be reduced." On January 15, Chicago Fed

Federal Reserve System

The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913 with the enactment of the Federal Reserve Act, largely in response to a series of financial panics, particularly a severe panic in 1907...

president and Federal Open Market Committee member Charles Evans said, "once the economy recovers and financial conditions stabilize, the Fed will return to its traditional focus on the federal funds rate. It also will have to scale back the use of emergency lending programs and reduce the size of the balance sheet and level of excess reserves. 'Some of this scaling back will occur naturally as market conditions improve on account of how these programs have been designed. Still, financial market participants need to be prepared for the eventual dismantling of the facilities that have been put in place during the financial turmoil,' he said."

At the end of January, 2009, excess reserve balances at the Fed stood at $793 billion but less than two weeks later on February 11, total reserve balances had fallen to $603 billion. On April 1, reserve balances had again increased to $806 billion, and on February 10, 2010, they stood at $1.154 trillion. By August 2011, they reached $1.6 trillion.

Potential Inflationary Effects of Excess Reserve Balances

For the better part of 2009, throughout the great expansion in excess reserves, the potential inflationary effects have been amply debated. It is conceivable that since the Fed now pays interest on the excess reserves, that the excess reserves themselves place an effective cap on the Fed Funds before the Fed begins to lose money on interest payment mismatches between its liabilities and assets. This could curtail the Fed's ability to maintain inflation expectations well-anchored.See also

- Keynesian endpointKeynesian endpointKeynesian endpoint is a phrase coined by PIMCO's Anthony Crescenzi in an email note to clients in June 2010 to describe the point where governments can no longer stimulate and rescue their economies through increased government spending due to endemic levels of pre-existing government debt."Time,...

- Liquidity trapLiquidity trapA liquidity trap is a situation described in Keynesian economics in which injections of cash into an economy by a central bank fail to lower interest rates and hence to stimulate economic growth. A liquidity trap is caused when people hoard cash because they expect an adverse event such as...

- Negative interest rate

- Quantitative easingQuantitative easingQuantitative easing is an unconventional monetary policy used by central banks to stimulate the national economy when conventional monetary policy has become ineffective. A central bank buys financial assets to inject a pre-determined quantity of money into the economy...

- Real interest rateReal interest rateThe "real interest rate" is the rate of interest an investor expects to receive after allowing for inflation. It can be described more formally by the Fisher equation, which states that the real interest rate is approximately the nominal interest rate minus the inflation rate...

- StagflationStagflationIn economics, stagflation is a situation in which the inflation rate is high and the economic growth rate slows down and unemployment remains steadily high...

- ZIRP