Madoff investment scandal

Encyclopedia

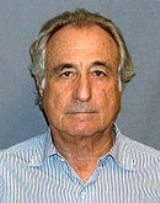

The Madoff investment scandal broke in December 2008 when former NASDAQ

chairman Bernard Madoff

admitted that the wealth management arm of his business was an elaborate Ponzi scheme

.

He founded the Wall Street

firm Bernard L. Madoff Investment Securities LLC in 1960, and was its chairman until his arrest. Alerted by his sons, federal authorities arrested Madoff on December 11, 2008. On March 12, 2009, Madoff pled guilty to 11 federal crimes and admitted to operating what has been the largest Ponzi scheme in history. On June 29, 2009, he was sentenced to 150 years in prison with restitution of $170 billion. According to the original federal charges, Madoff said that his firm had "liabilities of approximately US$

50 billion". Prosecutors estimated the size of the fraud to be $64.8 billion, based on the amounts in the accounts of Madoff's 4,800 clients as of November 30, 2008. Ignoring opportunity cost

s and taxes paid on fictitious profits, half of Madoff's direct investors lost no money.

Investigators have determined others were involved in the scheme. The U.S. Securities and Exchange Commission (SEC) has also come under fire for not investigating Madoff more thoroughly; questions about his firm had been raised as early as 1999. Madoff's business, in the process of liquidation

, was one of the top market maker

s on Wall Street

and in 2008, the sixth-largest.

Madoff's personal and business asset freeze has created a chain reaction throughout the world's business and philanthropic community, forcing many organizations to at least temporarily close, including the Robert I. Lappin Charitable Foundation

, the Picower Foundation, and the JEHT Foundation

.

trader with $5,000, earned from working as a lifeguard

and sprinkler installer. His fledgling business began to grow with the assistance of his father-in-law, accountant Saul Alpern, who referred a circle of friends and their families.

Initially, the firm made markets (quoted bid and ask

prices) via the National Quotation Bureau's Pink Sheets

. In order to compete with firms that were members of the New York Stock Exchange

trading on the stock exchange's floor, his firm began using innovative computer information technology to disseminate its quotes. After a trial run, the technology that the firm helped develop became the NASDAQ

. At one point, Madoff Securities was the largest buying-and-selling "market maker

" at the NASDAQ.

He was active in the National Association of Securities Dealers (NASD), a self-regulatory securities industry organization, serving as the Chairman of the Board of Directors

and on the Board of Governors

.

In 1992, The Wall Street Journal

described him:

Several family members worked for him. His younger brother, Peter, was Senior Managing Director and Chief Compliance Officer, and Peter's daughter, Shana, was the compliance attorney. Madoff’s sons, Mark and Andrew, worked in the trading section, along with Charles Weiner, Madoff’s nephew. Andrew Madoff had invested his own money in his father's fund, but Mark stopped in about 2001.

Federal investigators believe the fraud in the investment management division and advisory division may have begun in the 1970s. However, Madoff himself stated his fraudulent activities began in the 1990s.

In the 1980s, Madoff's market-maker division traded up to 5% of the total volume made on the New York Stock Exchange

. Madoff was "the first prominent practitioner" who paid a broker to execute a customer's order through his brokerage, called a "legal kickback

", which gave Madoff the reputation of being the largest dealer in NYSE-listed stocks in the U.S., trading about 15% of transaction volume. Academics have questioned the ethics of these payments. Madoff has argued that these payments did not alter the price that the customer received. He viewed the payments as a normal business practice: "If your girlfriend goes to buy stockings at a supermarket, the racks that display those stockings are usually paid for by the company that manufactured the stockings. Order flow is an issue that attracted a lot of attention but is grossly overrated."

By 2000, Madoff Securities, one of the top traders of US securities, held approximately $300 million in assets. The business occupied three floors of the Lipstick Building

, with the investment management division, referred to as the "hedge fund

", employing a staff of approximately 24. Madoff ran a branch office in London, separate from Madoff Securities, which employed 28, handling investments for his family of approximately £

80 million. Two remote cameras installed in the London office permitted Madoff to monitor events from New York.

consisting of purchasing blue-chip stocks and taking options

contracts on them, sometimes called a split-strike conversion or a collar

. "Typically, a position will consist of the ownership of 30–35 S&P 100 stocks, most correlated to that index, the sale of out-of-the-money 'calls' on the index and the purchase of out-of-the-money 'puts' on the index. The sale of the 'calls' is designed to increase the rate of return

, while allowing upward movement of the stock portfolio to the strike price

of the 'calls'. The 'puts', funded in large part by the sales of the 'calls', limit the portfolio's downside."

In his 1992, "Avellino and Bienes" interview with The Wall Street Journal, Madoff discussed his supposed methods: In the 1970s, he had placed invested funds in "convertible arbitrage

positions in large-cap stocks, with promised investment returns of 18% to 20%", and in 1982, he began using futures contracts on the stock index, and then placed put option

s on futures during the 1987 stock market crash. A few analysts performing due diligence

had been unable to replicate the Madoff fund's past returns using historic price data for U.S. stocks and options on the indexes. Barron's raised the possibility that Madoff's returns were most likely due to front running

his firm's brokerage clients.

Mitchell Zuckoff, professor of journalism at Boston University

and author of Ponzi's Scheme: The True Story of a Financial Legend, says that "the 5% payout rule", a federal law requiring private foundations

to pay out 5% of their funds each year, allowed Madoff's Ponzi scheme to go undetected for a long period since he managed money mainly for charities. Zuckoff notes, "For every $1 billion in foundation investment, Madoff was effectively on the hook for about $50 million in withdrawals a year. If he was not making real investments, at that rate the principal would last 20 years. By targeting charities, Madoff could avoid the threat of sudden or unexpected withdrawals.

In his guilty plea, Madoff admitted that he hadn't actually traded since the mid-1990s, and all of his returns since then had been fabricated. However, David Sheehan, principal investigator for Picard, believes the wealth management arm of Madoff's business had always been fraudulent.

Madoff's operation differed from a typical Ponzi scheme. While most Ponzis are based on nonexistent businesses, Madoff's brokerage operation was very real.

s closely guarded.

The New York Post

reported that Madoff "worked the so-called 'Jewish circuit' of well-heeled Jews he met at country club

s on Long Island

and in Palm Beach

". The New York Times

reported that Madoff courted many prominent Jewish executives and organizations; according to the Associated Press

, they "trusted [Madoff] because he is Jewish". One of the most prominent promoters was J. Ezra Merkin

, whose fund Ascot Partners steered $1.8 billion towards Madoff's firm. A scheme that targets members of a particular religious or ethnic community is a type of affinity fraud

, and a Newsweek

article identified Madoff's scheme as "an affinity Ponzi".

Madoff was a "master marketer", and his fund was considered exclusive, giving the appearance of a "velvet rope". He generally refused to meet directly with investors, which gave him an "Oz" aura and increased the allure of the investment. Some Madoff investors were wary of removing their money from his fund, in case they could not get back in later.

Madoff's annual returns were "unusually consistent", around 10%, and were a key factor in perpetuating the fraud. Ponzi schemes typically pay returns of 20% or higher, and collapse quickly. One Madoff fund, which described its "strategy" as focusing on shares in the Standard & Poor's 100-stock index, reported a 10.5% annual return during the previous 17 years. Even at the end of November 2008, amid a general market collapse, the same fund reported that it was up 5.6%, while the same year-to-date total return on the S&P 500-stock index had been negative 38%. An unnamed investor remarked, "The returns were just amazing and we trusted this guy for decades — if you wanted to take money out, you always got your check in a few days. That’s why we were all so stunned."

The Swiss bank, Union Bancaire Privée

, explained that because of Madoff's huge volume as a broker-dealer

, the bank believed he had a perceived edge on the market because his trades were timed well, suggesting they believed he was front running

.

(SIFMA), the primary securities industry organization.

Bernard Madoff sat on the Board of Directors of the Securities Industry Association, which merged with the Bond Market Association in 2006 to form SIFMA. Madoff's brother Peter then served two terms as a member of SIFMA’s Board of Directors. Peter's resignation as the scandal broke in December 2008 came amid growing criticism of the Madoff firm’s links to Washington, and how those relationships may have contributed to the Madoff fraud. Over the years 2000–08, the two Madoff brothers gave $56,000 to SIFMA, and tens of thousands of dollars more to sponsor SIFMA industry meetings.

In addition, Bernard Madoff's niece Shana Madoff was active on the Executive Committee of SIFMA's Compliance & Legal Division, but resigned her SIFMA position shortly after her uncle's arrest. She married an SEC compliance official, Eric Swanson, after an SEC investigation concluded in 2005. A spokesman for Swanson, who has left the SEC, said he "did not participate in any inquiry of Bernard Madoff Securities or its affiliates while involved in a relationship" with Shana Madoff.

s, Avellino & Bienes, the principals being Frank Avellino, Michael Bienes and his wife Dianne Bienes. Bienes began his career working as an accountant for Madoff's father-in-law, Saul Alpern. Then, he became a partner in the accounting firm Alpern, Avellino and Bienes. In 1962, the firm began advising its clients about investing all of their money with a mystery man, a highly successful and controversial figure on Wall Street,

but until this episode, not known as an ace money manager, Madoff. When Alpern retired at the end of 1974, the firm became Avellino and Bienes and continued to invest solely with Madoff.

Represented by Ira Sorkin

, Madoff's present attorney, Avellino & Bienes were accused of selling unregistered securities, and in its report the SEC mentioned the fund's "curiously steady" yearly returns to investors of 13.5% to 20%. However, the SEC did not look any more deeply into the matter, and never publicly disclosed Madoff. Through Sorkin, who once oversaw the SEC’s New York office, Avellino & Bienes agreed to return the money to investors, shut down their firm, undergo an audit, and pay a fine of $350,000. Avellino complained to the presiding Federal Judge, John E. Sprizzo

, that Price Waterhouse fees were excessive, but the judge ordered him to pay the bill of $428,679 in full. Madoff said that he did not realize the feeder fund was operating illegally, and that his own investment returns tracked the previous 10 years of the S&P 500

. The SEC investigation came right in the middle of Madoff's three terms as the chairman of the NASDAQ

stock market board.

The size of the pools mushroomed by word-of-mouth, and investors grew to 3,200 in nine accounts with Madoff. Regulators feared it all might be just a huge scam. "We went into this thinking it could be a major catastrophe. They took in nearly a half a billion dollars in investor money, totally outside the system that we can monitor and regulate. That's pretty frightening." said Richard Walker, at the time, the SEC's New York regional administrator.

Bienes, 72, recently discussed that he deposited $454 million of investors' money with Madoff, and until 2007, continued to invest several million dollars of his own money, saying, "Doubt Bernie Madoff? Doubt Bernie? No. You doubt God. You can doubt God, but you don't doubt Bernie. He had that aura about him."

at their Boston regional office and reviewed his allegations of Madoff's fraudulent practices. The SEC claimed it conducted two other inquiries into Madoff in the last several years, but did not find any violations or major issues of concern.

In 2004, after published articles appeared accusing the firm of front running, the SEC's Washington office cleared Madoff. The SEC detailed that inspectors had examined Madoff's brokerage operation in 2005, checking for three kinds of violations: the strategy he used for customer accounts; the requirement of brokers to obtain the best possible price for customer orders; and operating as an unregistered investment adviser. Madoff was registered as a broker-dealer

, but doing business as an asset manager

. "The staff found no evidence of fraud". In September, 2005 Madoff agreed to register his business, but the SEC kept its findings confidential. During the 2005 investigation, Meaghan Cheung, a branch head of the SEC's New York's Enforcement Division, was the person responsible for the oversight and blunder, according to Harry Markopolos

, who testified on February 4, 2009, at a hearing held by a House Financial Services Subcommittee on Capital Markets.

In 2007, SEC enforcement completed an investigation which began on January 6, 2006, into a Ponzi scheme allegation which resulted in neither a finding of fraud, nor a referral to the SEC Commissioners for legal action.

(FINRA), the industry-run watchdog for brokerage firms, reported without explanation that parts of Madoff's firm had no customers. "At this point in time we are uncertain of the basis for FINRA's conclusion in this regard," SEC staff wrote shortly after Madoff was arrested.

As a result, the SEC's chairman Christopher Cox stated that an investigation will delve into "all staff contact and relationships with the Madoff family and firm, and their impact, if any, on decisions by staff regarding the firm". A former SEC compliance officer, Eric Swanson, married Madoff's niece Shana, a Madoff firm compliance attorney.

Harry Markopolos

complained to the SEC's Boston office in May 2000, telling the SEC staff they should investigate Madoff because it was impossible to legally make the profits Madoff claimed using the investment strategies that he claimed to use. Markopolos' bosses at options trader Rampart Investment Management had asked him to try to replicate Madoff's numbers. However, Markopolos concluded almost immediately that Madoff's numbers didn't add up, and the only plausible explanation for them was fraud. This was confirmed after four hours of failed attempts to reproduce Madoff's numbers. Markopolos told the SEC that in all likelihood, Madoff was either running a Ponzi scheme (by paying old clients with newer clients' money) or front running (by trading for his own account using knowledge of his clients' orders).

In 2005, Markopolos sent a detailed 17-page memo to the SEC, entitled The World's Largest Hedge Fund is a Fraud. He had also approached The Wall Street Journal about the existence of the Ponzi scheme in 2005, but its editors decided not to pursue the story. The paper specified 30 numbered red flags based on 174 months (a little over 14 years) of Madoff trades. The biggest red flag was that Madoff reported only seven losing months during this time, and those losses were almost statistically insignificant. Later, Markopolos testified before Congress that this was like a baseball player batting .966 for the season "and no one suspecting a cheat."

In part, the memo concluded: "Bernie Madoff is running the world's largest unregistered hedge fund. He's organized this business as a 'hedge fund of funds

privately labeling their own hedge funds which Bernie Madoff secretly runs for them using a split-strike conversion strategy getting paid only trading commissions which are not disclosed.' If this is not a regulatory dodge, I do not know what is." Markopolos considered if Madoff's "unsophisticated portfolio management

" was either a Ponzi scheme or front running (buying stock for his own account based on knowledge of his clients' orders), and concluded it was most likely a Ponzi scheme.

In 2001, financial journalist Erin Arvedlund

wrote an article for Barron's entitled "Don't Ask, Don't Tell," questioning Madoff's secrecy and wondering how he obtained such consistent returns. She reported that "Madoff's investors rave about his performance – even though they don't understand how he does it. 'Even knowledgeable people can't really tell you what he's doing,' one very satisfied investor told Barron's."

The Barron's article and one in MarHedge

suggested Madoff was front-running to achieve his gains. Hedge funds investing with him were not permitted to name him as money manager in their marketing prospectus. When high volume investors who were considering participation wanted to review Madoff's records for purposes of due diligence

, he refused, convincing them of his desire that proprietary strategies remain confidential.

By selling its holdings for cash at the end of each period, Madoff avoided filing disclosures of its holdings with the SEC, an unusual tactic. Madoff rejected any call for an outside audit

"for reasons of secrecy", claiming that was the exclusive responsibility of his brother, Peter, the company's chief compliance officer

".

Markopolos later testified to Congress

that to deliver 12% annual returns to the investor, Madoff needed to earn 16% gross, so as to distribute a 4% fee to the feeder fund managers, who would secure new victims, be "willfully blind, and not get too intrusive".

Concerns were also raised that Madoff's auditor of record was Friehling & Horowitz, a two-person accounting firm based in suburban Rockland County that had only one active accountant, David G. Friehling

. David Friehling was a close Madoff family friend and an investor in Madoff's fund, which is a blatant conflict of interest.In 2007, hedge fund consultant Aksia LLC advised its clients not to invest with Madoff, saying it was inconceivable that a tiny firm could adequately service such a massive operation.

Typically, hedge funds hold their portfolio at a securities firm (a major bank or brokerage) acting as the fund's prime broker, which allows an outside investigator to verify their holdings. Madoff's firm was its own broker-dealer and allegedly processed all of its trades.

Ironically, Madoff, a pioneer in electronic trading

, refused to provide his clients online access to their accounts. He sent out account statements by mail, unlike most hedge funds which email

statements to be downloaded for convenience and investor personal analysis.

Madoff operated as a broker-dealer who also ran an asset management division. In 2003, Joe Aaron, a hedge fund professional, also found the structure suspicious and warned a colleague to avoid investing in the fund, "Why would a good businessman work his magic for pennies on the dollar?" he concluded. Also in 2003, Renaissance Technologies

, "arguably the most successful hedge fund in the world", reduced its exposure to Madoff's fund first by 50 percent and eventually completely because of suspicions about the consistency of returns, the fact that Madoff charged very little compared to other hedge funds and the impossibility of the strategy Madoff claimed to use because options volume had no relation to the amount of money Madoff was said to administer. The options volume implied that Madoff's fund had $ 750 million, while he was believed to be managing $ 15 billion. And only if Madoff was assumed to be responsible for all the options traded in the most liquid strike price

.

Charles Gradante, co-founder of hedge-fund research firm Hennessee Group, observed that Madoff "only had five down months since 1996", and commented on Madoff's investment performance: "You can't go 10 or 15 years with only three or four down months. It's just impossible."

In 2001, Michael Ocrant, editor-in-chief of MARHedge wrote a story in which he interviewed traders who were incredulous that Madoff had 72 consecutive gaining months, an unlikely possibility.

Clients such as Fairfield Greenwich Group

and Union Bancaire Privée

claimed that they had been given an "unusual degree of access" to evaluate and analyze Madoff's funds and found nothing unusual with his investment portfolio.

. In his book, Markopolos wrote that this was a sign Madoff was running out of cash and needed to increase his promised returns to keep the scheme going.

As the market's decline accelerated, investors tried to withdraw $7 billion from the firm. To pay off those investors, Madoff needed new money from other investors. Even with a rush of new investors who believed Madoff was one of the few funds that was still doing well, it still wasn't enough to keep up with the avalanche of withdrawals.

In the weeks prior to his arrest, Madoff struggled to keep the scheme afloat. In November 2008, Madoff Securities International (MSIL) in London, made two fund transfers to Bernard Madoff Investment Securities of approximately $164 million. MSIL had neither customers nor clients, and there is no evidence that it conducted any trades on behalf of third parties.

Madoff received $250 million around December 1 from Carl J. Shapiro

, a 95-year-old Boston philanthropist

and entrepreneur who was one of Madoff's oldest friends and biggest financial backers. On December 5, he accepted $10 million from Martin Rosenman, president of Rosenman Family LLC, who wanted to recover a never-invested $10 million, deposited in a Madoff account at JPMorgan, wired six days before Madoff's arrest. Bankruptcy Judge Lifland ruled that Rosenman was "indistinguishable" from any other Madoff client, so there was no basis for giving him special treatment to recover funds. The judge separately declined to dismiss a lawsuit brought by Hadleigh Holdings, which claims it entrusted $1 million to the Madoff firm three days before his arrest.

Madoff asked others for money in the final weeks before his arrest, including Wall Street financier Kenneth Langone

, whose office was sent a 19-page pitch book, allegedly created by the staff at the Fairfield Greenwich Group. Madoff said he was raising money for a new investment vehicle, between $500 million and $1 billion for exclusive clients, was moving quickly on the venture, and wanted an answer by the following week. Langone declined.

On December 10, 2008, he suggested to his sons, Mark and Andrew, that the firm pay out over $170 million in bonuses two months ahead of schedule, from $200 million in assets that the firm still had. According to the complaint, Mark and Andrew, reportedly unaware of the firm's pending insolvency

, confronted their father, asking him how the firm could pay bonuses to employees if it could not pay investors. Madoff then admitted that he was "finished," and that the asset management arm of the firm was in fact a Ponzi scheme – as he put it, "one big lie." Mark and Andrew then reported him to the authorities.

said, “In order for him to have done this by himself, he would have had to have been at work night and day, no vacation and no time off. He would have had to nurture the Ponzi scheme daily. What happened when he was gone? Who handled it when somebody called in while he was on vacation and said, ‘I need access to money’?”

“Simply from an administrative perspective, the act of putting together the various account statements, which did show trading activity, has to involve a number of people. ... You would need office and support personnel, people who actually knew what the market price

s were for the securities that were being traded. You would need accountants so that the internal documents reconcile with the documents being sent to customers at least on a superficial basis,” said Tom Dewey, a securities lawyer.

The SEC case is Securities and Exchange Commission v. Madoff, 1:08-cv- 10791, both U.S. District Court, Southern District of New York (Manhattan). The cases against Fairfield Greenwich Group et al. are consolidated as 09-118 in U.S. District Court for the Southern District of New York (Manhattan).

While awaiting sentencing, Madoff has met with the SEC's Inspector General

, H. David Kotz

, who is conducting an investigation into how regulators failed to detect the fraud despite numerous red flags. Former SEC Chairman Harvey Pitt

estimated the actual net fraud to be between $10 and $17 billion, because it does not include the fictional returns credited to the Madoff's customer accounts.

The original criminal complaint estimated that investors lost $50 billion through the scheme, though The Wall Street Journal reports "that figure includes the alleged false profits that Mr. Madoff's firm reported to its customers for decades. It is unclear exactly how much investors deposited into the firm." He was originally charged with a single count of securities fraud and faced up to 20 years in prison, and a fine of $5 million if convicted.

Court papers indicate that Madoff's firm had about 4,800 investment client accounts as of November 30, 2008, and issued statements for that month reporting that client accounts held a total balance of about $65 billion, but actually "held only a small fraction" of that balance for clients.

Madoff was arrested by the Federal Bureau of Investigation

(FBI) on December 11, 2008, on a criminal charge

of securities fraud

. According to the criminal complaint, the previous day he had told his sons that his business was "a giant Ponzi scheme". They called a friend for advice, Martin Flumenbaum, a lawyer, who called federal prosecutors and the SEC on their behalf. FBI Agent Theodore Cacioppi made a house call. "We are here to find out if there is an innocent explanation," Cacioppi said quietly. The 70-year-old financier

paused, then said: "There is no innocent explanation." He had "paid investors with money that was not there". Madoff was released on the same day of his arrest after posting $10 million bail

. Madoff and his wife surrendered their passports, and he was subject to travel restrictions, a 7 p.m. curfew

at his co-op, and electronic monitoring as a condition of bail. Although Madoff only had two co-signers for his $10 million bail, his wife and his brother Peter, rather than the four required, a judge allowed him free on bail but ordered him confined to his apartment. Madoff has reportedly received death threat

s that have been referred to the FBI, and the SEC referred to fears of "harm or flight" in its request for Madoff to be confined to his Upper East Side apartment. Cameras monitored his apartment's doors, its communication devices sent signals to the FBI, and his wife was required to pay for additional security.

Apart from 'Bernard L. Madoff' and 'Bernard L. Madoff Investment Securities LLC ("BMIS")', the order to freeze all activities also forbade trading from the companies Madoff Securities International Ltd. ("Madoff International") and Madoff Ltd.

On January 5, 2009, prosecutors had requested that the Court revoke his bail, after Madoff and his wife allegedly violated the court-ordered asset freeze by mailing jewelry worth up to $1 million to relatives, including their sons and Madoff's brother. It was also noted that $173 million in signed checks had been found in Madoff's office desk after he had been arrested. His sons reported the mailings to prosecutors. Previously, Madoff was thought to be cooperating with prosecutors. The following week, Judge Ellis refused the government's request to revoke Madoff's bail, but required as a condition of bail that Madoff make an inventory of personal items and that his mail be searched.

On March 10, 2009, the United States Attorney for the Southern District of New York filed an 11-count criminal information, or complaint, charging Madoff with 11 federal crimes: securities fraud

, investment adviser fraud, mail fraud, wire fraud

, three counts of money laundering

, false statements

, perjury

, making false filings with the SEC, and theft from an employee benefit plan. The complaint stated that Madoff had defrauded his clients of almost $65 billion – thus spelling out the largest Ponzi scheme in history, as well as the largest investor fraud committed by a single person.

Madoff pleaded guilty to three counts of money laundering

. Prosecutors allege that he used the London Office, Madoff Securities International Ltd. to launder more than $250 million of client money by transferring client money from the investment-advisory business in New York to London and then back to the U.S. to support the U.S. trading operation of Bernard L. Madoff Investment Securities LLC. Madoff gave the appearance that he was trading in Europe for his clients.

of indictment

. The charges carried a maximum sentence of 150 years in prison, as well as mandatory restitution

and fines up to twice the gross gain or loss derived from the offenses. If the government's estimate is correct, Madoff will have to pay $7.2 billion in restitution.

In his pleading allocution

, Madoff admitted to running a Ponzi scheme and expressed regret for his "criminal acts". He stated that he had begun his scheme some time in the early 1990s. He wished to satisfy his clients' expectations of high returns he had promised, even though it was during an economic recession. He admitted that he hadn't invested any of his clients' money since the inception of his scheme. Instead, he merely deposited the money into his business account at Chase Manhattan Bank

. He admitted to false trading activities masked by foreign transfers and false SEC returns. When clients requested account withdrawals, he paid them from the Chase account, claiming the profits were the result of his own unique "split-strike conversion strategy". He said he had every intention of terminating the scheme, but it proved "difficult, and ultimately impossible" to extricate himself. He eventually reconciled himself to being exposed as a fraud.

Only two of at least 25 victims who had requested to be heard at the hearing spoke in open court

against accepting Madoff's plea of guilt.

Judge Denny Chin

accepted his guilty plea and remanded him to incarceration at the Manhattan Metropolitan Correctional Center until sentencing. Chin said that Madoff was now a substantial flight risk given his age, wealth and the possibility of spending the rest of his life in prison.

Madoff's attorney, Ira Sorkin

filed an appeal

, to return him back to his "penthouse arrest", await sentencing, and to reinstate his bail conditions, declaring he would be more amenable to cooperate with the government's investigation, and prosecutors filed a notice in opposition. On March 20, 2009, the appellate court denied his request.

On June 26, 2009, Chin ordered Madoff to forfeit $170 million in assets. His wife Ruth will relinquish her claim to $80 million worth of assets, leaving her with $2.5 million in cash. The settlement does not prevent the SEC and Picard to continue making claims against Mrs. Madoff's funds in the future. Madoff had earlier requested to shield $70 million in assets for Ruth, arguing that it was unconnected to the fraud scheme.

, bankruptcy trustee has indicated that "Mr. Madoff has not provided meaningful cooperation or assistance." The Bureau of US Prisons had recommended 50 years, while defense lawyer Ira Sorkin

had recommended 12 years, arguing that Madoff had confessed. The judge granted Madoff permission to wear his personal clothing at sentencing.

On June 29, Judge Chin sentenced Madoff to 150 years in prison, as recommended by the prosecution. Chin said he had not received any mitigating letters from friends or family testifying to Madoff's good deeds, describing that "the absence of such support is telling". Commentators noted that this was in contrast to other high-profile white collar trials such as that of Andrew Fastow

, Jeffrey Skilling

, and Bernard Ebbers

who were known for their philanthropy and/or cooperation to help victims; however Madoff's victims included several charities and foundations, and the only person that pleaded for mercy was defense lawyer Ira Sorkin. Chin called the fraud "unprecedented" and "staggering", and stated that the sentence would deter others from committing similar frauds. "Here the message must be sent that Mr. Madoff's crimes were extraordinarily evil." Many victims, some of whom had lost their life savings, applauded the sentence. Chin agreed with prosecutors' contention that the fraud began at some point in the 1980s. He also noted Madoff's crimes were "off the charts" since federal sentencing guidelines for fraud only go up to $400 million in losses, and Madoff bilked his marks of 162 times that.

Chin said "I have a sense Mr. Madoff has not done all that he could do or told all that he knows," noting that Madoff failed to identify accomplices, making it more difficult for prosecutors to build cases against others. Chin dismissed Sorkin's plea for leniency, stating that Madoff made substantial loans to family members and moved $15 million from the firm to his wife's account shortly before confessing. The court-appointed receiver of the Madoff firm, Irving Picard

, has also said that Madoff had not provided substantial assistance, complicating efforts to locate assets. A former federal prosecutor suggested Madoff would have had the possibility of a sentence with parole if he fully cooperated with investigators, but Madoff's silence implied that there were other accomplices in the fraud which led the judge to impose the maximum sentence. Chin also ordered Madoff to pay $170 billion in restitution.

Madoff apologized to his victims at the sentencing, saying, "I have left a legacy of shame, as some of my victims have pointed out, to my family and my grandchildren. This is something I will live in for the rest of my life. I'm sorry. ... I know that doesn't help you."

Madoff was incarcerated at Butner Federal Correctional Complex outside Raleigh, North Carolina

. His inmate number is #61727-054.

On July 28, 2009, he gave his first jailhouse interview to Joseph Cotchett and Nancy Fineman, attorneys from San Francisco, because they threatened to sue his wife, Ruth, on behalf of several investors who lost fortunes. During the 4 and 1/2 hour session, he was described as arrogant and cocky, and upon query, apologized to all his clients.

s, no 401(k)

, no Keogh plan, no other pension plan and no annuities

. He owned less than a combined $200,000 in securities in Lehman Brothers

, Morgan Stanley

, Fidelity

, Bear Stearns

, and M&T. No offshore or Swiss Bank accounts were listed.

On March 17, 2009, prosecutor filed a document listing more assets including $2.6 million in jewelry and about 35 sets of watches and cufflinks, more than $30 million in loans owed to the couple by their sons, and Ruth Madoff's interest in real estate funds sponsored by Sterling Equities, whose partners include Fred Wilpon

. Ruth Madoff, and Peter Madoff, invested as “passive limited partners” in real estate funds sponsored by the company, as well as other venture investments. Assets also include the Madoffs' interest in Hoboken Radiology LLC. in Hoboken, New Jersey; Delivery Concepts LLC, an online food ordering service in midtown Manhattan that operates as "delivery.com"; an interest in Madoff La Brea LLC; an interest in the restaurant, PJ Clarke’s on the Hudson LLC; and Boca Raton, Florida-based Viager II LLC.

On March 2, 2009, Judge Louis Stanton modified an existing freeze order to surrender assets Madoff owns: his securities firm, real estate, artwork, and entertainment tickets, and granted a request by prosecutors that the existing freeze remain in place for the Manhattan apartment, and vacation homes in Montauk, New York

, and Palm Beach, Florida

. He has also agreed to surrender his interest in Primex Holdings LLC, a joint venture

between Madoff Securities and several large brokerages, designed to replicate the auction process on the New York Stock Exchange

. Madoff's April 14, 2009 opening day New York Mets

tickets were sold for $7,500 on ebay

.

On April 13, 2009, a Connecticut judge dissolved the temporary asset freeze from March 30, 2009, and issued an order for Fairfield Greenwich Group executive Walter Noel to post property pledges of $10 million against his Greenwich home and $2 million against Jeffrey Tucker's. Noel agreed to the attachment on his house "with no findings, including no finding of liability or wrongdoing". Andres Piedrahita's assets continue to remain temporarily frozen because he was never served with the complaint. The principals are all involved in a lawsuit filed by the town of Fairfield

, Connecticut

, pension funds, which lost $42 million. The pension fund case is Retirement Program for Employees of the Town of Fairfield v. Madoff, FBT-CV-09-5023735-S, Superior Court of Connecticut (Bridgeport). Maxam Capital and other firms that allegedly fed Madoff's fund, which could allow Fairfield to recover up to $75 million were also part of the dissolution and terms.

Professor John Coffee

, of Columbia University Law School, said that much of Madoff's money may be in offshore fund

s. The SEC believed keeping the assets secret would prevent them from being seized by foreign regulators and foreign creditors.

The Montreal Gazette reported on January 12, 2010 that there are unrecovered Madoff assets in Canada.

In December 2010 Barbara Picower

and others reached an agreement with Irving Picard

to return 7.2 billion dollars from the estate of her deceased husband Jeffrey Picower to other investors in the fraud.

Clients included banks, hedge funds, charities, universities, and wealthy individuals who have disclosed about $41 billion invested with Bernard L. Madoff Investment Securities LLC, according to a Bloomberg News tally, which may include double counting of investors in feeder funds.

Although Madoff filed a report with the SEC in 2008 stating that his advisory business had only 11–25 clients and about $17.1 billion in assets, thousands of investors have reported losses, and Madoff estimated the fund's assets at $50 billion.

Other notable clients included former Salomon Brothers

economist Henry Kaufman

, Steven Spielberg

, Jeffrey Katzenberg

, actors Kevin Bacon

, Kyra Sedgwick

, John Malkovich

, and Zsa Zsa Gabor

, Mortimer Zuckerman

, Baseball Hall of Fame pitcher Sandy Koufax

, the Wilpon family (owners of the New York Mets

), broadcaster Larry King

and World Trade Center

developer Larry Silverstein

. The Elie Wiesel

Foundation for Humanity lost $15.2 million, and Wiesel and his wife, Marion, lost their life savings.

The potential losses of these eight investors total $21.32 billion.

Eleven investors had potential losses between $100 million and $1 billion:

Twenty-three investors with potential losses of $500,000 to $100 million were also listed, with a total potential loss of $540 million. The grand total potential loss in The Wall Street Journal table is $26.9 billion.

Some investors have amended their initial estimates of losses to include only their original investment, since the profits Madoff reported to them which they were including were most likely fraudulent. Yeshiva University

, for instance, said its actual incurred loss was its invested $14.5 million, not the $110 million initially estimated, which included falsified profits reported to the university by Madoff.

Although foundations are exempt from federal income taxes, they are subject to an excise tax, for failing to vet Madoff's proposed investments properly, to heed red flags, or to diversify prudently. Penalties may range from 10% of the amount invested during a tax year, to 25% if they fail to try to recover the funds. The foundation’s officers, directors, and trustees face up to a 15% penalty, with up to $20,000 fines for individual managers, per investment.

who invested with Madoff through the Spanish bank Grupo Santander

, filed a class action against Santander in Miami. Santander proposed a settlement that would give the clients $2 billion worth of preferred stock

in Santander based on each client's original investment. The shares pay a 2% dividend. Seventy percent of the Madoff/Santander investors accepted the offer.

, invested less than $1.08 billion (of its $124.5 billion in assets) in Madoff funds.

In March 2009, Geneva-based wealth manager, Union Bancaire Privée

, offered to partially compensate investors 50% of the money they initially invested with Madoff if they agree to stay with the bank for the next five years and promise not to sue.

On May 8, 2009, a lawsuit was filed against the bank on behalf of New York investor Andrea Barron in the United States District Court for the Southern District of New York

. The lawsuit is seeking class-action status for investors in UBP Funds as of December 11, 2008, and damages, including the return of management fees.

-based wealth manager, Notz Stucki's Plaza Fund, will compensate up to $103.2 million to those clients who did not specifically request access to Madoff. Compensation would be with an issue of a note payable over five years, which would be held by a separate legal entity.

is an Austria

n bank founded by Sonja Kohn

, who met Madoff in 1985 while living in New York. Ninety percent of the bank's income was generated from Madoff investments. In December 2008, Medici reported that two of its funds—Herald USA Fund and Herald Luxemburg Fund—were exposed to Madoff losses. On January 2, 2009, FMA, the Austria banking regulator, took control of Bank Medici and appointed a supervisor to control the bank. Bank Medici, and its Austrian banking license is now for sale and has been sued by its customers both in the United States and in Austria. The Vienna State Prosecutor has launched a criminal investigation of Bank Medici and Kohn, who had invested an estimated $2.1 billion with Madoff. On May 28, 2009, Bank Medici lost its Austrian banking license. Kohn and the Bank are under investigation.

was partly funded by the JEHT Foundation, a private charity backed by a wealthy couple, Ken and Jeanne Levy-Church, financed with Madoff's mythical money. Jeanne Levy-Church's losses forced her to shut down both her foundation, and that of her parents, the Betty and Norman F. Levy Foundation, lost $244 million. JEH helped the less fortunate, especially ex-convicts. (See Participants in the Madoff investment scandal

: Norman F. Levy) Madoff's corruption has deprived it of necessary funds to secure the release of others. The organization uses the latest DNA

techniques to prove the innocence of the wrongfully imprisoned. On November 25, 2008, Steven Barnes was set free from jail with the evidence gained from the DNA tests, after serving 20 years for crimes he did not commit (rape and murder).

sued the Westport National Bank and Robert L. Silverman for "effectively aiding and abetting" Madoff's fraud. The suit seeks recovery of $16.2 million, including the fees that the bank collected as custodian of customers' holding in Madoff investments. Silverman's 240 clients invested about $10 million with Madoff using the Bank as the custodian. The Bank denies any wrongdoing.

, was found dead in his company office on Madison Avenue in New York City. His left wrist was slit and de la Villehuchet had taken sleeping pills, in what appeared to be suicide

.

He lived in New Rochelle, New York

and came from a very prominent French

family. Although no suicide note

was found at the scene, his brother Bertrand in France received a note shortly after his death in which he expressed remorse and a feeling of responsibility. The FBI

and SEC do not believe de la Villehuchet was involved in the fraud.

Harry Markopolos

said he met de La Villehuchet several years before, and warned him that Madoff might be breaking the law. In 2002, Access invested about 45% of its $1.2 billion under management with Madoff. By 2008, it managed $3 billion and raised the proportion of funds with Madoff to about 75%. De la Villehuchet had also invested all of his wealth and 20% of his brother, Bertrand's, with Madoff. Bertrand said that René-Thierry did not know Madoff but the connection was through René-Thierry's partner in AIA, French banker, Patrick Littaye.

s for Madoff from Bank Medici

in Austria.

Mark had unsuccessfully sought a Wall Street trading job after the scandal broke, and it was reported that he was distraught over the possibility of criminal charges, as federal prosecutors were making criminal tax-fraud probes. Among the many Madoff family members being sued by the court-appointed trustee Irving Picard were Mark's two children.

In his lawsuit, Picard stated that Mark and other Madoff family members improperly earned tens of millions of dollars, through "fictitious and backdated transactions" investment transactions, and falsely documented loans to buy real estate that weren't repaid. Picard also argued that Mark certainly was in a position to recognize the fraud of his father's firm, as Mark was a co-director of trading, was the designated head of the firm in his father's absence, and he held several securities licenses—series 7, 24 and 55 with the Financial Industry Regulatory Authority.

June 3 2011

Letter to Gene L. Dodaro Comptroller General of the United States Government Accountability Office from Congress requesting probe http://www.scribd.com/doc/57140364/Investigation-of-SIPC-Trustee-SEC

June 3 2011

Madoff Trustee, SEC Should be Probed -US Reps http://www.reuters.com/article/2011/06/03/madoff-probe-idUSN0318200920110603

July 27 2011

Madoff Trustee’s Actions to Be Probed by GAO, Representative Garrett Says

http://www.bloomberg.com/news/2011-07-27/madoff-trustee-s-actions-to-be-probed-by-gao-representative-garrett-says.html

NASDAQ

The NASDAQ Stock Market, also known as the NASDAQ, is an American stock exchange. "NASDAQ" originally stood for "National Association of Securities Dealers Automated Quotations". It is the second-largest stock exchange by market capitalization in the world, after the New York Stock Exchange. As of...

chairman Bernard Madoff

Bernard Madoff

Bernard Lawrence "Bernie" Madoff is a former American businessman, stockbroker, investment advisor, and financier. He is the former non-executive chairman of the NASDAQ stock market, and the admitted operator of a Ponzi scheme that is considered to be the largest financial fraud in U.S...

admitted that the wealth management arm of his business was an elaborate Ponzi scheme

Ponzi scheme

A Ponzi scheme is a fraudulent investment operation that pays returns to its investors from their own money or the money paid by subsequent investors, rather than from any actual profit earned by the individual or organization running the operation...

.

He founded the Wall Street

Wall Street

Wall Street refers to the financial district of New York City, named after and centered on the eight-block-long street running from Broadway to South Street on the East River in Lower Manhattan. Over time, the term has become a metonym for the financial markets of the United States as a whole, or...

firm Bernard L. Madoff Investment Securities LLC in 1960, and was its chairman until his arrest. Alerted by his sons, federal authorities arrested Madoff on December 11, 2008. On March 12, 2009, Madoff pled guilty to 11 federal crimes and admitted to operating what has been the largest Ponzi scheme in history. On June 29, 2009, he was sentenced to 150 years in prison with restitution of $170 billion. According to the original federal charges, Madoff said that his firm had "liabilities of approximately US$

United States dollar

The United States dollar , also referred to as the American dollar, is the official currency of the United States of America. It is divided into 100 smaller units called cents or pennies....

50 billion". Prosecutors estimated the size of the fraud to be $64.8 billion, based on the amounts in the accounts of Madoff's 4,800 clients as of November 30, 2008. Ignoring opportunity cost

Opportunity cost

Opportunity cost is the cost of any activity measured in terms of the value of the best alternative that is not chosen . It is the sacrifice related to the second best choice available to someone, or group, who has picked among several mutually exclusive choices. The opportunity cost is also the...

s and taxes paid on fictitious profits, half of Madoff's direct investors lost no money.

Investigators have determined others were involved in the scheme. The U.S. Securities and Exchange Commission (SEC) has also come under fire for not investigating Madoff more thoroughly; questions about his firm had been raised as early as 1999. Madoff's business, in the process of liquidation

Liquidation

In law, liquidation is the process by which a company is brought to an end, and the assets and property of the company redistributed. Liquidation is also sometimes referred to as winding-up or dissolution, although dissolution technically refers to the last stage of liquidation...

, was one of the top market maker

Market maker

A market maker is a company, or an individual, that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. From a market microstructure theory standpoint, market makers are net sellers of an option to be...

s on Wall Street

Wall Street

Wall Street refers to the financial district of New York City, named after and centered on the eight-block-long street running from Broadway to South Street on the East River in Lower Manhattan. Over time, the term has become a metonym for the financial markets of the United States as a whole, or...

and in 2008, the sixth-largest.

Madoff's personal and business asset freeze has created a chain reaction throughout the world's business and philanthropic community, forcing many organizations to at least temporarily close, including the Robert I. Lappin Charitable Foundation

Robert I. Lappin Charitable Foundation

The Robert I. Lappin Charitable Foundation is a Jewish non-profit organization that operates programs for Jewish youth. Its activities reflects the group's mission of "helping to keep our Jewish children Jewish, thus reversing the trend of assimilation and intermarriage." It is based in Salem,...

, the Picower Foundation, and the JEHT Foundation

JEHT Foundation

The JEHT Foundation was a grant-making nonprofit foundation based in New York City. The Foundation’s name was an acronym that stood for the core values that underlay the Foundation's mission: "Justice, Equality, Human dignity and Tolerance." The Foundation's programs reflected these interests and...

.

Background

Madoff started his firm in 1960 as a penny stockPenny stock

In the United States, penny stocks are common shares of small public companies that trade at less than $1.00. In some countries, similar shares of stock are known as cent stocks.-Concerns for investors:...

trader with $5,000, earned from working as a lifeguard

Lifeguard

A lifeguard supervises the safety and rescue of swimmers, surfers, and other water sports participants such as in a swimming pool, water park, or beach. Lifeguards are strong swimmers and trained in first aid, certified in water rescue using a variety of aids and equipment depending on...

and sprinkler installer. His fledgling business began to grow with the assistance of his father-in-law, accountant Saul Alpern, who referred a circle of friends and their families.

Initially, the firm made markets (quoted bid and ask

Bid and ask

Price mechanism is an economic term that refers to the buyers and sellers who negotiate prices of goods or services depending on demand and supply. A price mechanism or market-based mechanism refers to a wide variety of ways to match up buyers and sellers through price rationing.An example of a...

prices) via the National Quotation Bureau's Pink Sheets

Pink Sheets

OTC Markets Group, Inc., informally known as "Pink Sheets", is a private company that provides services to the U.S. over-the-counter securities market including electronic quotations, trading, messaging, and information platforms. According to the U.S. Securities and Exchange Commission, OTC...

. In order to compete with firms that were members of the New York Stock Exchange

New York Stock Exchange

The New York Stock Exchange is a stock exchange located at 11 Wall Street in Lower Manhattan, New York City, USA. It is by far the world's largest stock exchange by market capitalization of its listed companies at 13.39 trillion as of Dec 2010...

trading on the stock exchange's floor, his firm began using innovative computer information technology to disseminate its quotes. After a trial run, the technology that the firm helped develop became the NASDAQ

NASDAQ

The NASDAQ Stock Market, also known as the NASDAQ, is an American stock exchange. "NASDAQ" originally stood for "National Association of Securities Dealers Automated Quotations". It is the second-largest stock exchange by market capitalization in the world, after the New York Stock Exchange. As of...

. At one point, Madoff Securities was the largest buying-and-selling "market maker

Market maker

A market maker is a company, or an individual, that quotes both a buy and a sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. From a market microstructure theory standpoint, market makers are net sellers of an option to be...

" at the NASDAQ.

He was active in the National Association of Securities Dealers (NASD), a self-regulatory securities industry organization, serving as the Chairman of the Board of Directors

Board of directors

A board of directors is a body of elected or appointed members who jointly oversee the activities of a company or organization. Other names include board of governors, board of managers, board of regents, board of trustees, and board of visitors...

and on the Board of Governors

Board of governors

Board of governors is a term sometimes applied to the board of directors of a public entity or non-profit organization.Many public institutions, such as public universities, are government-owned corporations. The British Broadcasting Corporation was managed by a board of governors, though this role...

.

In 1992, The Wall Street Journal

The Wall Street Journal

The Wall Street Journal is an American English-language international daily newspaper. It is published in New York City by Dow Jones & Company, a division of News Corporation, along with the Asian and European editions of the Journal....

described him:

..."one of the masters of the off-exchange "third market"

and the bane of the New York Stock Exchange. He has built a highly

profitable securities firm, Bernard L. Madoff Investment Securities,

which siphons a huge volume of stock trades away from the Big Board.

The $740 million average daily volume of trades executed

electronically by the Madoff firm off the exchange equals 9% of the

New York exchange's. Mr. Madoff's firm can execute trades so quickly and cheaply that it

actually pays other brokerage firms a penny a share to execute their

customers' orders, profiting from the spread between bid and asked

prices that most stocks trade for."

Several family members worked for him. His younger brother, Peter, was Senior Managing Director and Chief Compliance Officer, and Peter's daughter, Shana, was the compliance attorney. Madoff’s sons, Mark and Andrew, worked in the trading section, along with Charles Weiner, Madoff’s nephew. Andrew Madoff had invested his own money in his father's fund, but Mark stopped in about 2001.

Federal investigators believe the fraud in the investment management division and advisory division may have begun in the 1970s. However, Madoff himself stated his fraudulent activities began in the 1990s.

In the 1980s, Madoff's market-maker division traded up to 5% of the total volume made on the New York Stock Exchange

New York Stock Exchange

The New York Stock Exchange is a stock exchange located at 11 Wall Street in Lower Manhattan, New York City, USA. It is by far the world's largest stock exchange by market capitalization of its listed companies at 13.39 trillion as of Dec 2010...

. Madoff was "the first prominent practitioner" who paid a broker to execute a customer's order through his brokerage, called a "legal kickback

Bribery

Bribery, a form of corruption, is an act implying money or gift giving that alters the behavior of the recipient. Bribery constitutes a crime and is defined by Black's Law Dictionary as the offering, giving, receiving, or soliciting of any item of value to influence the actions of an official or...

", which gave Madoff the reputation of being the largest dealer in NYSE-listed stocks in the U.S., trading about 15% of transaction volume. Academics have questioned the ethics of these payments. Madoff has argued that these payments did not alter the price that the customer received. He viewed the payments as a normal business practice: "If your girlfriend goes to buy stockings at a supermarket, the racks that display those stockings are usually paid for by the company that manufactured the stockings. Order flow is an issue that attracted a lot of attention but is grossly overrated."

By 2000, Madoff Securities, one of the top traders of US securities, held approximately $300 million in assets. The business occupied three floors of the Lipstick Building

Lipstick Building

The Lipstick Building is a 453 foot tall skyscraper located at 885 Third Avenue, between East 53rd Street and 54th Street, across from the Citigroup Center in Manhattan, New York City, United States. It was completed in 1986 and has 34 floors. The building was designed by John Burgee Architects...

, with the investment management division, referred to as the "hedge fund

Hedge fund

A hedge fund is a private pool of capital actively managed by an investment adviser. Hedge funds are only open for investment to a limited number of accredited or qualified investors who meet criteria set by regulators. These investors can be institutions, such as pension funds, university...

", employing a staff of approximately 24. Madoff ran a branch office in London, separate from Madoff Securities, which employed 28, handling investments for his family of approximately £

Pound sterling

The pound sterling , commonly called the pound, is the official currency of the United Kingdom, its Crown Dependencies and the British Overseas Territories of South Georgia and the South Sandwich Islands, British Antarctic Territory and Tristan da Cunha. It is subdivided into 100 pence...

80 million. Two remote cameras installed in the London office permitted Madoff to monitor events from New York.

Modus operandi

In 1992, Bernard Madoff explained his purported strategy to The Wall Street Journal. He said the returns were really nothing special, given that the Standard & Poors 500-stock index generated an average annual return of 16.3% between November 1982 and November 1992. "I would be surprised if anybody thought that matching the S&P over 10 years was anything outstanding." The majority of money managers actually trailed the S&P 500 during the 1980s. The Journal concluded Madoff's use of futures and options helped cushion the returns against the market's ups and downs. Madoff said he made up for the cost of the hedges, which could have caused him to trail the stock market's returns, with stock-picking and market timing.Purported strategy

Madoff's sales pitch was an investment strategyInvestment strategy

In finance, an investment strategy is a set of rules, behaviors or procedures, designed to guide an investor's selection of an investment portfolio...

consisting of purchasing blue-chip stocks and taking options

Option (finance)

In finance, an option is a derivative financial instrument that specifies a contract between two parties for a future transaction on an asset at a reference price. The buyer of the option gains the right, but not the obligation, to engage in that transaction, while the seller incurs the...

contracts on them, sometimes called a split-strike conversion or a collar

Collar (finance)

In finance, a collar is an option strategy that limits the range of possible positive or negative returns on an underlying to a specific range.-Structure:A collar is created by an investor being:* Long the underlying...

. "Typically, a position will consist of the ownership of 30–35 S&P 100 stocks, most correlated to that index, the sale of out-of-the-money 'calls' on the index and the purchase of out-of-the-money 'puts' on the index. The sale of the 'calls' is designed to increase the rate of return

Rate of return

In finance, rate of return , also known as return on investment , rate of profit or sometimes just return, is the ratio of money gained or lost on an investment relative to the amount of money invested. The amount of money gained or lost may be referred to as interest, profit/loss, gain/loss, or...

, while allowing upward movement of the stock portfolio to the strike price

Strike price

In options, the strike price is a key variable in a derivatives contract between two parties. Where the contract requires delivery of the underlying instrument, the trade will be at the strike price, regardless of the spot price of the underlying instrument at that time.Formally, the strike...

of the 'calls'. The 'puts', funded in large part by the sales of the 'calls', limit the portfolio's downside."

In his 1992, "Avellino and Bienes" interview with The Wall Street Journal, Madoff discussed his supposed methods: In the 1970s, he had placed invested funds in "convertible arbitrage

Arbitrage

In economics and finance, arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of matching deals that capitalize upon the imbalance, the profit being the difference between the market prices...

positions in large-cap stocks, with promised investment returns of 18% to 20%", and in 1982, he began using futures contracts on the stock index, and then placed put option

Put option

A put or put option is a contract between two parties to exchange an asset, the underlying, at a specified price, the strike, by a predetermined date, the expiry or maturity...

s on futures during the 1987 stock market crash. A few analysts performing due diligence

Due diligence

"Due diligence" is a term used for a number of concepts involving either an investigation of a business or person prior to signing a contract, or an act with a certain standard of care. It can be a legal obligation, but the term will more commonly apply to voluntary investigations...

had been unable to replicate the Madoff fund's past returns using historic price data for U.S. stocks and options on the indexes. Barron's raised the possibility that Madoff's returns were most likely due to front running

Front running

Front running is the illegal practice of a stock broker executing orders on a security for its own account while taking advantage of advance knowledge of pending orders from its customers...

his firm's brokerage clients.

Mitchell Zuckoff, professor of journalism at Boston University

Boston University

Boston University is a private research university located in Boston, Massachusetts. With more than 4,000 faculty members and more than 31,000 students, Boston University is one of the largest private universities in the United States and one of Boston's largest employers...

and author of Ponzi's Scheme: The True Story of a Financial Legend, says that "the 5% payout rule", a federal law requiring private foundations

Private foundation (United States)

A private foundation is a charitable organization recognized by the US Tax Code at and section 501. It is defined by a negative definition, in other words, it is defined by what it is not...

to pay out 5% of their funds each year, allowed Madoff's Ponzi scheme to go undetected for a long period since he managed money mainly for charities. Zuckoff notes, "For every $1 billion in foundation investment, Madoff was effectively on the hook for about $50 million in withdrawals a year. If he was not making real investments, at that rate the principal would last 20 years. By targeting charities, Madoff could avoid the threat of sudden or unexpected withdrawals.

In his guilty plea, Madoff admitted that he hadn't actually traded since the mid-1990s, and all of his returns since then had been fabricated. However, David Sheehan, principal investigator for Picard, believes the wealth management arm of Madoff's business had always been fraudulent.

Madoff's operation differed from a typical Ponzi scheme. While most Ponzis are based on nonexistent businesses, Madoff's brokerage operation was very real.

Sales methods

Rather than offer high returns to all comers, Madoff offered modest but steady returns to an exclusive clientele. The investment method was marketed as "too complicated for outsiders to understand". He was secretive about the firm’s business, and kept his financial statementFinancial statement

A financial statement is a formal record of the financial activities of a business, person, or other entity. In British English—including United Kingdom company law—a financial statement is often referred to as an account, although the term financial statement is also used, particularly by...

s closely guarded.

The New York Post

New York Post

The New York Post is the 13th-oldest newspaper published in the United States and is generally acknowledged as the oldest to have been published continuously as a daily, although – as is the case with most other papers – its publication has been periodically interrupted by labor actions...

reported that Madoff "worked the so-called 'Jewish circuit' of well-heeled Jews he met at country club

Country club

A country club is a private club, often with a closed membership, that typically offers a variety of recreational sports facilities and is located in city outskirts or rural areas. Activities may include, for example, any of golf, tennis, swimming or polo...

s on Long Island

Long Island

Long Island is an island located in the southeast part of the U.S. state of New York, just east of Manhattan. Stretching northeast into the Atlantic Ocean, Long Island contains four counties, two of which are boroughs of New York City , and two of which are mainly suburban...

and in Palm Beach

Palm Beach, Florida

The Town of Palm Beach is an incorporated town in Palm Beach County, Florida, United States. The Intracoastal Waterway separates it from the neighboring cities of West Palm Beach and Lake Worth...

". The New York Times

The New York Times

The New York Times is an American daily newspaper founded and continuously published in New York City since 1851. The New York Times has won 106 Pulitzer Prizes, the most of any news organization...

reported that Madoff courted many prominent Jewish executives and organizations; according to the Associated Press

Associated Press

The Associated Press is an American news agency. The AP is a cooperative owned by its contributing newspapers, radio and television stations in the United States, which both contribute stories to the AP and use material written by its staff journalists...

, they "trusted [Madoff] because he is Jewish". One of the most prominent promoters was J. Ezra Merkin

J. Ezra Merkin

Jacob Ezra Merkin is a former money manager and financier. He was a close business associate of Bernard Madoff, and is alleged to have played a significant part in the Madoff fraud. He served as the Non-executive Chairman of GMAC until his resignation on January 9, 2009, at the insistence of the...

, whose fund Ascot Partners steered $1.8 billion towards Madoff's firm. A scheme that targets members of a particular religious or ethnic community is a type of affinity fraud

Affinity fraud

Affinity fraud includes investment frauds that prey upon members of identifiable groups, such as religious or ethnic communities, language minorities, the elderly, or professional groups. The fraudsters who promote affinity scams frequently are – or pretend to be – members of the group...

, and a Newsweek

Newsweek

Newsweek is an American weekly news magazine published in New York City. It is distributed throughout the United States and internationally. It is the second-largest news weekly magazine in the U.S., having trailed Time in circulation and advertising revenue for most of its existence...

article identified Madoff's scheme as "an affinity Ponzi".

Madoff was a "master marketer", and his fund was considered exclusive, giving the appearance of a "velvet rope". He generally refused to meet directly with investors, which gave him an "Oz" aura and increased the allure of the investment. Some Madoff investors were wary of removing their money from his fund, in case they could not get back in later.

Madoff's annual returns were "unusually consistent", around 10%, and were a key factor in perpetuating the fraud. Ponzi schemes typically pay returns of 20% or higher, and collapse quickly. One Madoff fund, which described its "strategy" as focusing on shares in the Standard & Poor's 100-stock index, reported a 10.5% annual return during the previous 17 years. Even at the end of November 2008, amid a general market collapse, the same fund reported that it was up 5.6%, while the same year-to-date total return on the S&P 500-stock index had been negative 38%. An unnamed investor remarked, "The returns were just amazing and we trusted this guy for decades — if you wanted to take money out, you always got your check in a few days. That’s why we were all so stunned."

The Swiss bank, Union Bancaire Privée

Union Bancaire Privée

Union Bancaire Privée was founded in 1969 by Edgar de Picciotto. UBP, one of the most highly capitalized private banks, is a major player in the field of asset management in Switzerland with over $75 billion of assets under management....

, explained that because of Madoff's huge volume as a broker-dealer

Broker-dealer

A broker-dealer is a term used in United States financial services regulations. It is a natural person, a company or other organization that trades securities for its own account or on behalf of its customers....

, the bank believed he had a perceived edge on the market because his trades were timed well, suggesting they believed he was front running

Front running

Front running is the illegal practice of a stock broker executing orders on a security for its own account while taking advantage of advance knowledge of pending orders from its customers...

.

Access to Washington

The Madoff family gained unusual access to Washington's lawmakers and regulators through the industry's top trade group. The Madoff family has long-standing, high-level ties to the Securities Industry and Financial Markets AssociationSecurities Industry and Financial Markets Association

The Securities Industry and Financial Markets Association is a leading securities industry trade group representing securities firms, banks, and asset management companies in the U.S. and Hong Kong. SIFMA was formed on November 1, 2006, from the merger of The Bond Market Association and the...

(SIFMA), the primary securities industry organization.

Bernard Madoff sat on the Board of Directors of the Securities Industry Association, which merged with the Bond Market Association in 2006 to form SIFMA. Madoff's brother Peter then served two terms as a member of SIFMA’s Board of Directors. Peter's resignation as the scandal broke in December 2008 came amid growing criticism of the Madoff firm’s links to Washington, and how those relationships may have contributed to the Madoff fraud. Over the years 2000–08, the two Madoff brothers gave $56,000 to SIFMA, and tens of thousands of dollars more to sponsor SIFMA industry meetings.

In addition, Bernard Madoff's niece Shana Madoff was active on the Executive Committee of SIFMA's Compliance & Legal Division, but resigned her SIFMA position shortly after her uncle's arrest. She married an SEC compliance official, Eric Swanson, after an SEC investigation concluded in 2005. A spokesman for Swanson, who has left the SEC, said he "did not participate in any inquiry of Bernard Madoff Securities or its affiliates while involved in a relationship" with Shana Madoff.

Previous investigations

Madoff Securities LLC was investigated at least eight times over a 16-year period by the U.S. Securities and Exchange Commission (SEC) and other regulatory authorities.Avellino and Bienes

In 1992, the SEC investigated one of Madoff's feeder fundFeeder fund

A feeder fund is an investment fund which does almost all of its investments through a master fund via a master-feeder relationship.It is a situation similar to a fund of funds, except that the master fund performs all the investments....

s, Avellino & Bienes, the principals being Frank Avellino, Michael Bienes and his wife Dianne Bienes. Bienes began his career working as an accountant for Madoff's father-in-law, Saul Alpern. Then, he became a partner in the accounting firm Alpern, Avellino and Bienes. In 1962, the firm began advising its clients about investing all of their money with a mystery man, a highly successful and controversial figure on Wall Street,

but until this episode, not known as an ace money manager, Madoff. When Alpern retired at the end of 1974, the firm became Avellino and Bienes and continued to invest solely with Madoff.

Represented by Ira Sorkin

Ira Sorkin

Ira Lee Sorkin is an American attorney. He is best known for representing Bernard Madoff, the American businessman who has pleaded guilty to perpetrating the largest investor fraud ever committed by a single person.-Education and career:...

, Madoff's present attorney, Avellino & Bienes were accused of selling unregistered securities, and in its report the SEC mentioned the fund's "curiously steady" yearly returns to investors of 13.5% to 20%. However, the SEC did not look any more deeply into the matter, and never publicly disclosed Madoff. Through Sorkin, who once oversaw the SEC’s New York office, Avellino & Bienes agreed to return the money to investors, shut down their firm, undergo an audit, and pay a fine of $350,000. Avellino complained to the presiding Federal Judge, John E. Sprizzo

John E. Sprizzo

John Emilio Sprizzo was a federal judge for the United States District Court for the Southern District of New York.-Early life:...

, that Price Waterhouse fees were excessive, but the judge ordered him to pay the bill of $428,679 in full. Madoff said that he did not realize the feeder fund was operating illegally, and that his own investment returns tracked the previous 10 years of the S&P 500

S&P 500

The S&P 500 is a free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock...

. The SEC investigation came right in the middle of Madoff's three terms as the chairman of the NASDAQ

NASDAQ

The NASDAQ Stock Market, also known as the NASDAQ, is an American stock exchange. "NASDAQ" originally stood for "National Association of Securities Dealers Automated Quotations". It is the second-largest stock exchange by market capitalization in the world, after the New York Stock Exchange. As of...

stock market board.

The size of the pools mushroomed by word-of-mouth, and investors grew to 3,200 in nine accounts with Madoff. Regulators feared it all might be just a huge scam. "We went into this thinking it could be a major catastrophe. They took in nearly a half a billion dollars in investor money, totally outside the system that we can monitor and regulate. That's pretty frightening." said Richard Walker, at the time, the SEC's New York regional administrator.

Bienes, 72, recently discussed that he deposited $454 million of investors' money with Madoff, and until 2007, continued to invest several million dollars of his own money, saying, "Doubt Bernie Madoff? Doubt Bernie? No. You doubt God. You can doubt God, but you don't doubt Bernie. He had that aura about him."

Bernard L. Madoff Securities LLC: 1999, 2000, 2004, 2005, and 2006

The SEC investigated Madoff in 1999 and 2000 about concerns that the firm was hiding its customers' orders from other traders, for which Madoff then took corrective measures. In 2001, an SEC official met with Harry MarkopolosHarry Markopolos