Throughput accounting

Encyclopedia

Throughput Accounting is a principle-based and comprehensive management accounting approach that provides managers with decision support information for enterprise profitability improvement. TA is relatively new in management accounting. It is an approach that identifies factors that limit an organization from reaching its goal, and then focuses on simple measures that drive behavior in key areas towards reaching organizational goals. TA was proposed by the late Eliyahu M. Goldratt

(deceased 11 June 2011) as an alternative to traditional cost accounting

. As such, Throughput Accounting is neither cost accounting

nor costing because it is cash focused and does not allocate all costs (variable and fixed expenses, including overheads) to products and services sold or provided by an enterprise. Considering the laws of variation, only costs that vary totally with units of output (see definition of T below for TVC) e.g. raw materials, are allocated to products and services which are deducted from sales to determine Throughput. Throughput Accounting is a management accounting

technique used as the performance measure in the Theory of Constraints

(TOC). It is the business intelligence used for maximizing profits, however, unlike cost accounting that primarily focuses on 'cutting costs' and reducing expenses to make a profit, Throughput Accounting primarily focuses on generating more throughput. Conceptually, Throughput Accounting seeks to increase the speed or rate at which throughput (see definition of T below) is generated by products and services with respect to an organization's constraint, whether the constraint is internal or external to the organization. Throughput Accounting is the only management accounting methodology that considers constraints as factors limiting the performance of organizations.

Management accounting is an organization's internal set of techniques and methods used to maximize shareholder wealth. Throughput Accounting is thus part of the management accountants' toolkit, ensuring efficiency where it matters as well as the overall effectiveness of the organization. It is an internal reporting tool. Outside or external parties to a business depend on accounting reports prepared by financial (public) accountants who apply Generally Accepted Accounting Principles(GAAP

) issued by the Financial Accounting Standards Board

(FASB) and enforced by the U.S. Securities and Exchange Commission (SEC) and other local and international regulatory agencies and bodies such as International Financial Reporting Standards

(IFRS).

Throughput Accounting improves profit performance with better management decisions by using measurements that more closely reflect the effect of decisions on three critical monetary variables (throughput

, investment

(AKA inventory

), and operating expense

— defined below).

Goldratt argues that, under current conditions, labor efficiencies lead to decisions that harm rather than help organizations. Throughput Accounting, therefore, removes standard cost accounting's reliance on efficiencies in general, and labor efficiency in particular, from management practice. Many cost and financial accountants agree with Goldratt's critique, but they have not agreed on a replacement of their own and there is enormous inertia in the installed base of people trained to work with existing practices.

Constraints accounting, which is a development in the Throughput Accounting field, emphasizes the role of the constraint

, (referred to as the Archemedian constraint) in decision making.

Throughput Accounting also pays particular attention to the concept of 'bottleneck' (referred to as constraint in the Theory of Constraints) in the manufacturing or servicing processes.

Throughput Accounting uses three measures of income and expense:

Organizations that wish to increase their attainment of The Goal

should therefore require managers to test proposed decisions against three questions. Will the proposed change:

The answers to these questions determine the effect of proposed changes on system wide measurements:

These relationships between financial ratios as illustrated by Goldratt are very similar to a set of relationships defined by DuPont

and General Motors financial executive Donaldson Brown

about 1920. Brown did not advocate changes in management accounting methods, but instead used the ratios to evaluate traditional financial accounting data.

Throughput Accounting is an important development in modern accounting that allows managers to understand the contribution of constrained resources to the overall profitability of the enterprise. See cost accounting

for practical examples and a detailed description of the evolution of Throughput Accounting.

Eliyahu M. Goldratt

Eliyahu Moshe Goldratt was an Israeli physicist who became a business management guru. He was the originator of the Optimized Production Technology, the Theory of Constraints , the Thinking Processes, Drum-Buffer-Rope, Critical Chain Project Management and other TOC derived tools.He authored...

(deceased 11 June 2011) as an alternative to traditional cost accounting

Cost accounting

Cost accounting information is designed for managers. Since managers are taking decisions only for their own organization, there is no need for the information to be comparable to similar information from other organizations...

. As such, Throughput Accounting is neither cost accounting

Cost accounting

Cost accounting information is designed for managers. Since managers are taking decisions only for their own organization, there is no need for the information to be comparable to similar information from other organizations...

nor costing because it is cash focused and does not allocate all costs (variable and fixed expenses, including overheads) to products and services sold or provided by an enterprise. Considering the laws of variation, only costs that vary totally with units of output (see definition of T below for TVC) e.g. raw materials, are allocated to products and services which are deducted from sales to determine Throughput. Throughput Accounting is a management accounting

Management accounting

Management accounting or managerial accounting is concerned with the provisions and use of accounting information to managers within organizations, to provide them with the basis to make informed business decisions that will allow them to be better equipped in their management and control...

technique used as the performance measure in the Theory of Constraints

Theory of Constraints

The theory of constraints adopts the common idiom "A chain is no stronger than its weakest link" as a new management paradigm. This means that processes, organizations, etc., are vulnerable because the weakest person or part can always damage or break them or at least adversely affect the...

(TOC). It is the business intelligence used for maximizing profits, however, unlike cost accounting that primarily focuses on 'cutting costs' and reducing expenses to make a profit, Throughput Accounting primarily focuses on generating more throughput. Conceptually, Throughput Accounting seeks to increase the speed or rate at which throughput (see definition of T below) is generated by products and services with respect to an organization's constraint, whether the constraint is internal or external to the organization. Throughput Accounting is the only management accounting methodology that considers constraints as factors limiting the performance of organizations.

Management accounting is an organization's internal set of techniques and methods used to maximize shareholder wealth. Throughput Accounting is thus part of the management accountants' toolkit, ensuring efficiency where it matters as well as the overall effectiveness of the organization. It is an internal reporting tool. Outside or external parties to a business depend on accounting reports prepared by financial (public) accountants who apply Generally Accepted Accounting Principles(GAAP

Gaap

In demonology, Gaap is a mighty Prince and Great President of Hell, commanding sixty-six legions of demons. He is, according to The Lesser Key of Solomon, the king and prince of the southern region of Hell and Earth, and according to the Pseudomonarchia Daemonum the king of the western region and...

) issued by the Financial Accounting Standards Board

Financial Accounting Standards Board

The Financial Accounting Standards Board is a private, not-for-profit organization whose primary purpose is to develop generally accepted accounting principles within the United States in the public's interest...

(FASB) and enforced by the U.S. Securities and Exchange Commission (SEC) and other local and international regulatory agencies and bodies such as International Financial Reporting Standards

International Financial Reporting Standards

International Financial Reporting Standards are principles-based standards, interpretations and the framework adopted by the International Accounting Standards Board ....

(IFRS).

Throughput Accounting improves profit performance with better management decisions by using measurements that more closely reflect the effect of decisions on three critical monetary variables (throughput

Throughput (business)

Throughput is the movement of inputs and outputs through a production process. Without access and assurance of a supply of inputs, a successful business enterprise would not be possible....

, investment

Investment

Investment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

(AKA inventory

Inventory

Inventory means a list compiled for some formal purpose, such as the details of an estate going to probate, or the contents of a house let furnished. This remains the prime meaning in British English...

), and operating expense

Operating expense

An operating expense, operating expenditure, operational expense, operational expenditure or OPEX is an ongoing cost for running a product, business, or system . Its counterpart, a capital expenditure , is the cost of developing or providing non-consumable parts for the product or system...

— defined below).

History

When cost accounting was developed in the 1890s, labor was the largest fraction of product cost and could be considered a variable cost. Workers often did not know how many hours they would work in a week when they reported on Monday morning because time-keeping systems were rudimentary. Cost accountants, therefore, concentrated on how efficiently managers used labor since it was their most important variable resource. Now however, workers who come to work on Monday morning almost always work 40 hours or more; their cost is fixed rather than variable. However, today, many managers are still evaluated on their labor efficiencies, and many "downsizing," "rightsizing," and other labor reduction campaigns are based on them.Goldratt argues that, under current conditions, labor efficiencies lead to decisions that harm rather than help organizations. Throughput Accounting, therefore, removes standard cost accounting's reliance on efficiencies in general, and labor efficiency in particular, from management practice. Many cost and financial accountants agree with Goldratt's critique, but they have not agreed on a replacement of their own and there is enormous inertia in the installed base of people trained to work with existing practices.

Constraints accounting, which is a development in the Throughput Accounting field, emphasizes the role of the constraint

Constraint (mathematics)

In mathematics, a constraint is a condition that a solution to an optimization problem must satisfy. There are two types of constraints: equality constraints and inequality constraints...

, (referred to as the Archemedian constraint) in decision making.

The concepts of Throughput Accounting

Goldratt's alternative begins with the idea that each organization has a goal and that better decisions increase its value. The goal for a profit maximizing firm is easily stated, to increase profit now and in the future. Throughput Accounting applies to not-for-profit organizations too, but they have to develop a goal that makes sense in their individual cases.Throughput Accounting also pays particular attention to the concept of 'bottleneck' (referred to as constraint in the Theory of Constraints) in the manufacturing or servicing processes.

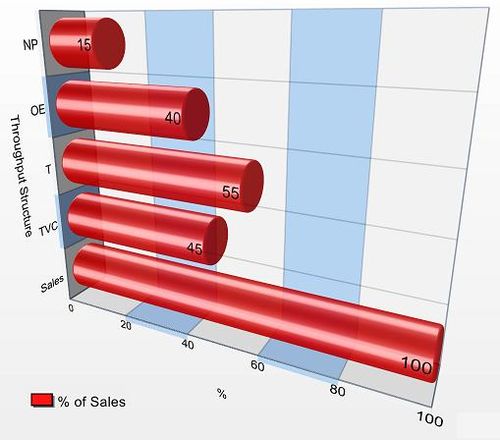

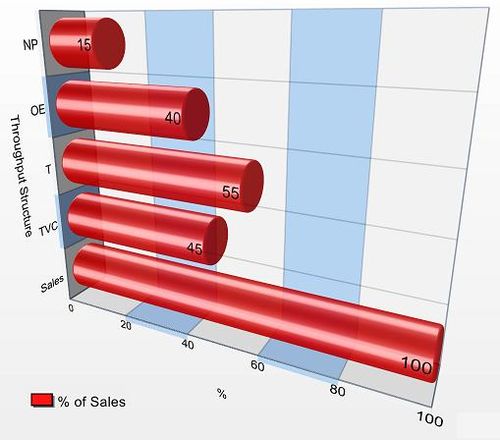

Throughput Accounting uses three measures of income and expense:

- ThroughputThroughput (business)Throughput is the movement of inputs and outputs through a production process. Without access and assurance of a supply of inputs, a successful business enterprise would not be possible....

(T) is the rate at which the system produces "goal units." When the goal units are money (in for-profit businesses), throughput is net sales (S) less totally variable cost (TVC), generally the cost of the raw materials (T = S - TVC). Note that T only exists when there is a sale of the product or service. Producing materials that sit in a warehouse does not form part of throughput but rather investment. ("Throughput" is sometimes referred to as "throughput contribution" and has similarities to the concept of "contribution" in marginal costing which is sales revenues less "variable" costs - "variable" being defined according to the marginal costing philosophy.) - InvestmentInvestmentInvestment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

(I) is the money tied up in the system. This is money associated with inventory, machinery, buildings, and other assets and liabilities. In earlier Theory of ConstraintsTheory of ConstraintsThe theory of constraints adopts the common idiom "A chain is no stronger than its weakest link" as a new management paradigm. This means that processes, organizations, etc., are vulnerable because the weakest person or part can always damage or break them or at least adversely affect the...

(TOC) documentation, the "I" was interchanged between "inventory" and "investment." The preferred term is now only "investment." Note that TOC recommends inventory be valued strictly on totally variable cost associated with creating the inventory, not with additional cost allocations from overhead. - Operating expenseOperating expenseAn operating expense, operating expenditure, operational expense, operational expenditure or OPEX is an ongoing cost for running a product, business, or system . Its counterpart, a capital expenditure , is the cost of developing or providing non-consumable parts for the product or system...

(OE) is the money the system spends in generating "goal units." For physical products, OE is all expenses except the cost of the raw materials. OE includes maintenance, utilities, rent, taxes and payroll.

Organizations that wish to increase their attainment of The Goal

The Goal

The Goal is a management-oriented novel by Dr. Eliyahu M. Goldratt, a business consultant whose Theory of Constraints has become a model for systems management. It was originally published in 1984 and has since been revised and republished every few years, once in 1992 and again in 2004...

should therefore require managers to test proposed decisions against three questions. Will the proposed change:

- Increase throughput? How?

- Reduce investment (inventoryInventoryInventory means a list compiled for some formal purpose, such as the details of an estate going to probate, or the contents of a house let furnished. This remains the prime meaning in British English...

) (money that cannot be used)? How? - Reduce operating expenseOperating expenseAn operating expense, operating expenditure, operational expense, operational expenditure or OPEX is an ongoing cost for running a product, business, or system . Its counterpart, a capital expenditure , is the cost of developing or providing non-consumable parts for the product or system...

? How?

The answers to these questions determine the effect of proposed changes on system wide measurements:

- Net profitNet profitNet profit or net revenue is a measure of the profitability of a venture after accounting for all costs. In a survey of nearly 200 senior marketing managers, 91 percent responded that they found the "net profit" metric very useful...

(NP) = throughput - operating expense = T-OE - Return on investmentReturn on investmentReturn on investment is one way of considering profits in relation to capital invested. Return on assets , return on net assets , return on capital and return on invested capital are similar measures with variations on how “investment” is defined.Marketing not only influences net profits but also...

(ROI) = net profit / investment = NP/I - TA ProductivityProductivityProductivity is a measure of the efficiency of production. Productivity is a ratio of what is produced to what is required to produce it. Usually this ratio is in the form of an average, expressing the total output divided by the total input...

= throughput / operating expense = T/OE - Investment turns (IT) = throughput / investment = T/I

These relationships between financial ratios as illustrated by Goldratt are very similar to a set of relationships defined by DuPont

DuPont

E. I. du Pont de Nemours and Company , commonly referred to as DuPont, is an American chemical company that was founded in July 1802 as a gunpowder mill by Eleuthère Irénée du Pont. DuPont was the world's third largest chemical company based on market capitalization and ninth based on revenue in 2009...

and General Motors financial executive Donaldson Brown

Donaldson Brown

Frank Donaldson Brown was a financial executive and corporate director with both DuPont and General Motors Corporation. He graduated from Virginia Tech in 1902 with a Bachelor of Science degree in Electrical Engineering...

about 1920. Brown did not advocate changes in management accounting methods, but instead used the ratios to evaluate traditional financial accounting data.

Throughput Accounting is an important development in modern accounting that allows managers to understand the contribution of constrained resources to the overall profitability of the enterprise. See cost accounting

Cost accounting

Cost accounting information is designed for managers. Since managers are taking decisions only for their own organization, there is no need for the information to be comparable to similar information from other organizations...

for practical examples and a detailed description of the evolution of Throughput Accounting.