Options arbitrage

Encyclopedia

Options arbitrage trades are commonly performed by floor trader

s in the option

s market to earn small profits with very little or zero risk.

Traders perform conversions when options are relatively overpriced by purchasing stock and selling the equivalent options position. When the options are relatively underpriced, traders will do reverse conversions or reversals. In practice, actionable option arbitrage opportunities have decreased with the advent of automated trading strategies.

The call and put have the same strike value and expiration

date. The resulting portfolio is delta neutral

.

One reason a trader may take this position would be to extend the holding period of the underlying position for capital gains tax

purposes, while locking in the current price.

The call and put have the same strike value and expiration

date. The resulting portfolio is delta neutral

.

The value of a reversal using at-the-money options is determined by calculating the benefits of the positions, and subtracting off the cost

The value of a reversal using at-the-money options is determined by calculating the benefits of the positions, and subtracting off the cost

s.

Benefits

Costs

Floor trader

A floor trader is a member of a stock or commodities exchange who trades on the floor of that exchange for his or her own account. The floor trader must abide by trading rules similar to those of the exchange specialists who trade on behalf of others. The term should not be confused with floor broker...

s in the option

Option (finance)

In finance, an option is a derivative financial instrument that specifies a contract between two parties for a future transaction on an asset at a reference price. The buyer of the option gains the right, but not the obligation, to engage in that transaction, while the seller incurs the...

s market to earn small profits with very little or zero risk.

Traders perform conversions when options are relatively overpriced by purchasing stock and selling the equivalent options position. When the options are relatively underpriced, traders will do reverse conversions or reversals. In practice, actionable option arbitrage opportunities have decreased with the advent of automated trading strategies.

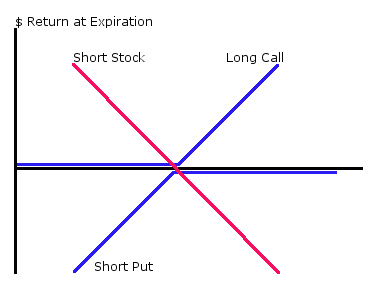

Conversion

A conversion position is:- short a callCall optionA call option, often simply labeled a "call", is a financial contract between two parties, the buyer and the seller of this type of option. The buyer of the call option has the right, but not the obligation to buy an agreed quantity of a particular commodity or financial instrument from the seller...

, - longLong (finance)In finance, a long position in a security, such as a stock or a bond, or equivalently to be long in a security, means the holder of the position owns the security and will profit if the price of the security goes up. Going long is the more conventional practice of investing and is contrasted with...

a putPut optionA put or put option is a contract between two parties to exchange an asset, the underlying, at a specified price, the strike, by a predetermined date, the expiry or maturity...

, and - long the underlyingUnderlyingIn finance, the underlying of a derivative is an asset, basket of assets, index, or even another derivative, such that the cash flows of the derivative depend on the value of this underlying...

The call and put have the same strike value and expiration

Expiration (options)

For an option contract, expiration is the date on which the contract expires. The option holder must elect to exercise the option or allow it to expire worthless.Typically, option contracts expire according to a pre-determined calendar. For instance, for U.S...

date. The resulting portfolio is delta neutral

Delta neutral

In finance, delta neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security...

.

One reason a trader may take this position would be to extend the holding period of the underlying position for capital gains tax

Capital gains tax

A capital gains tax is a tax charged on capital gains, the profit realized on the sale of a non-inventory asset that was purchased at a lower price. The most common capital gains are realized from the sale of stocks, bonds, precious metals and property...

purposes, while locking in the current price.

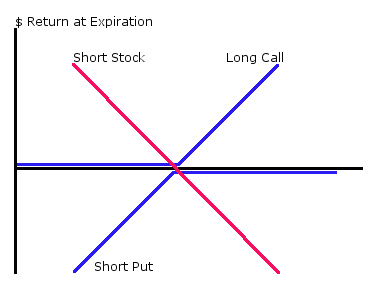

Reversal

A reverse conversion or reversal is an option strategy that involves being- longLong (finance)In finance, a long position in a security, such as a stock or a bond, or equivalently to be long in a security, means the holder of the position owns the security and will profit if the price of the security goes up. Going long is the more conventional practice of investing and is contrasted with...

a callCall optionA call option, often simply labeled a "call", is a financial contract between two parties, the buyer and the seller of this type of option. The buyer of the call option has the right, but not the obligation to buy an agreed quantity of a particular commodity or financial instrument from the seller...

, - short a putPut optionA put or put option is a contract between two parties to exchange an asset, the underlying, at a specified price, the strike, by a predetermined date, the expiry or maturity...

, and - short the underlyingUnderlyingIn finance, the underlying of a derivative is an asset, basket of assets, index, or even another derivative, such that the cash flows of the derivative depend on the value of this underlying...

.

The call and put have the same strike value and expiration

Expiration

Expiration is an independent feature film written, directed and starring Gavin Heffernan. It was the winner of the Grand Jury Prize and Best Film at the Canadian Filmmakers' Festival....

date. The resulting portfolio is delta neutral

Delta neutral

In finance, delta neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security...

.

Valuation of Reversals

Cost

In production, research, retail, and accounting, a cost is the value of money that has been used up to produce something, and hence is not available for use anymore. In business, the cost may be one of acquisition, in which case the amount of money expended to acquire it is counted as cost. In this...

s.

Benefits

- Receive short interest on the short position in the underlier.

- Receive long interest on the proceeds of selling the put.

Costs

- Pay long interest on the funds required to purchase the call.

- Pay any dividends or other obligations that accrue as a result of the short underlier position.