Option time value

Encyclopedia

In finance

, the time value (TV) (extrinsic or instrumental value) of an option

is the premium a rational investor would pay over its current exercise value (intrinsic value

), based on its potential to increase in value before expiring. This probability is always greater than zero, thus an option is always worth more than its current exercise value. As an option can be thought of as ‘price insurance’ (e.g. an airline insuring against unexpected soaring fuel costs caused by a hurricane), TV can be thought of as the risk premium the option seller charges the buyer — the higher the expected risk (volatility • time), the higher the premium. Conversely, TV can be thought of as the price an investor is willing to pay for potential upside.

TV decays exponentially to zero at expiration, with a general rule that it will lose ⅓ of its value during the first half of its life and ⅔ in the second half. As an option moves closer to expiry, moving its price requires an increasingly larger move in the price of the underlying security.

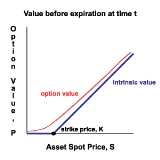

As seen on the graph, the IV of a call option is positive when the underlying asset's spot price

S exceeds the option's strike price

K.

Option value (i.e. price) is estimated via a predictive formula

Option value (i.e. price) is estimated via a predictive formula

such as Black-Scholes or using a numerical method such as the Binomial model. This price incorporates the expected probability of the option finishing "in-the-money". For an out-of-the-money option, the further in the future the expiration date - i.e. the longer the time to exercise - the higher the chance of this occurring, and thus the higher the option price; for an in-the-money option the chance of being in the money decreases; however the fact that the option cannot have negative value also works in the owner's favor. The sensitivity of the option value to the amount of time to expiry is known as the option's theta. The option value will never be lower than its IV.

As seen on the graph, the full call option value (IV + TV), at a given time t, is the red line.

More specifically, TV reflects the probability that the option will gain in IV — become (more) profitable to exercise before it expires. An important factor is the option's volatility

. Volatile prices of the underlying instrument can stimulate option demand, enhancing the value. Numerically, this value depends on the time until the expiration date

and the volatility

of the underlying instrument's price. TV cannot be negative (because the option value is never lower than IV), and converges to zero at expiration. Prior to expiration, the change in TV with time is non-linear, being a function of the option price.

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

, the time value (TV) (extrinsic or instrumental value) of an option

Option (finance)

In finance, an option is a derivative financial instrument that specifies a contract between two parties for a future transaction on an asset at a reference price. The buyer of the option gains the right, but not the obligation, to engage in that transaction, while the seller incurs the...

is the premium a rational investor would pay over its current exercise value (intrinsic value

Intrinsic value (finance)

In finance, intrinsic value refers to the value of a security which is intrinsic to or contained in the security itself. It is also frequently called fundamental value. It is ordinarily calculated by summing the future income generated by the asset, and discounting it to the present value...

), based on its potential to increase in value before expiring. This probability is always greater than zero, thus an option is always worth more than its current exercise value. As an option can be thought of as ‘price insurance’ (e.g. an airline insuring against unexpected soaring fuel costs caused by a hurricane), TV can be thought of as the risk premium the option seller charges the buyer — the higher the expected risk (volatility • time), the higher the premium. Conversely, TV can be thought of as the price an investor is willing to pay for potential upside.

TV decays exponentially to zero at expiration, with a general rule that it will lose ⅓ of its value during the first half of its life and ⅔ in the second half. As an option moves closer to expiry, moving its price requires an increasingly larger move in the price of the underlying security.

Intrinsic value

The intrinsic value (IV) of an option is the value of exercising it now. If the option has a positive monetary value, it is referred to as being in-the-money, otherwise it is referred to as being out-of-the-money. If an option is out-of-the-money at expiration, its holder will simply abandon the option and it will expire worthless. Because no rational investor would choose to exercise out-of-the-money, an option can never have a negative value.- Value of a call optionCall optionA call option, often simply labeled a "call", is a financial contract between two parties, the buyer and the seller of this type of option. The buyer of the call option has the right, but not the obligation to buy an agreed quantity of a particular commodity or financial instrument from the seller...

: , or

, or

- Value of a put optionPut optionA put or put option is a contract between two parties to exchange an asset, the underlying, at a specified price, the strike, by a predetermined date, the expiry or maturity...

: , or

, or

As seen on the graph, the IV of a call option is positive when the underlying asset's spot price

Spot price

The spot price or spot rate of a commodity, a security or a currency is the price that is quoted for immediate settlement . Spot settlement is normally one or two business days from trade date...

S exceeds the option's strike price

Strike price

In options, the strike price is a key variable in a derivatives contract between two parties. Where the contract requires delivery of the underlying instrument, the trade will be at the strike price, regardless of the spot price of the underlying instrument at that time.Formally, the strike...

K.

Option value

Formula

In mathematics, a formula is an entity constructed using the symbols and formation rules of a given logical language....

such as Black-Scholes or using a numerical method such as the Binomial model. This price incorporates the expected probability of the option finishing "in-the-money". For an out-of-the-money option, the further in the future the expiration date - i.e. the longer the time to exercise - the higher the chance of this occurring, and thus the higher the option price; for an in-the-money option the chance of being in the money decreases; however the fact that the option cannot have negative value also works in the owner's favor. The sensitivity of the option value to the amount of time to expiry is known as the option's theta. The option value will never be lower than its IV.

As seen on the graph, the full call option value (IV + TV), at a given time t, is the red line.

Time value

Time value is, as above, the difference between option value and intrinsic value, i.e.Time Value = Option Value - Intrinsic Value.

More specifically, TV reflects the probability that the option will gain in IV — become (more) profitable to exercise before it expires. An important factor is the option's volatility

Volatility (finance)

In finance, volatility is a measure for variation of price of a financial instrument over time. Historic volatility is derived from time series of past market prices...

. Volatile prices of the underlying instrument can stimulate option demand, enhancing the value. Numerically, this value depends on the time until the expiration date

Expiration date

Expiration date can refer to:*The shelf life of a grocery item*Expiration *Copyright expiration*Expiration Date , a 2006 comedy* Expiration Date, a novel by Tim Powers...

and the volatility

Volatility (finance)

In finance, volatility is a measure for variation of price of a financial instrument over time. Historic volatility is derived from time series of past market prices...

of the underlying instrument's price. TV cannot be negative (because the option value is never lower than IV), and converges to zero at expiration. Prior to expiration, the change in TV with time is non-linear, being a function of the option price.

External links and references

- Basic Options Concepts: Intrinsic Value and Time Value, biz.yahoo.com

External links

- Time Premium examples