.gif)

Morning star (candlestick pattern)

Encyclopedia

Candlestick chart

A candlestick chart is a style of bar-chart used primarily to describe price movements of a security, derivative, or currency over time.It is a combination of a line-chart and a bar-chart, in that each bar represents the range of price movement over a given time interval. It is most often used in...

, a type of chart used by stock analysts to describe and predict price movements of a security

Security

Security is the degree of protection against danger, damage, loss, and crime. Security as a form of protection are structures and processes that provide or improve security as a condition. The Institute for Security and Open Methodologies in the OSSTMM 3 defines security as "a form of protection...

, derivative

Derivative (finance)

A derivative instrument is a contract between two parties that specifies conditions—in particular, dates and the resulting values of the underlying variables—under which payments, or payoffs, are to be made between the parties.Under U.S...

, or currency

Currency

In economics, currency refers to a generally accepted medium of exchange. These are usually the coins and banknotes of a particular government, which comprise the physical aspects of a nation's money supply...

over time.

Description

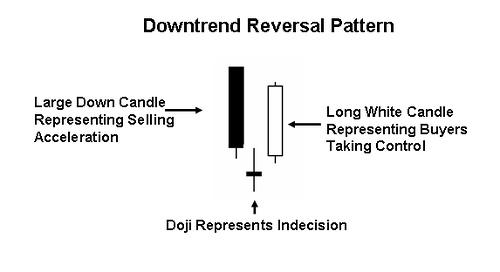

The pattern is made up of three candles: normally a long bearish candle, followed by a short bullish or bearish dojiDoji

The doji is a commonly found pattern in a candlestick chart of financially traded assets . It is characterized by being small in length—meaning a small trading range—with an opening and closing price that are virtually equal....

, which is then followed by a long bullish candle. In order to have a valid Morning Star formation, most traders will look for the top of the third candle to be at least half way up the body of the first candle in the pattern. Black candles indicate falling prices, and white candles indicate rising prices.

Interpretation

When found in a downtrend, this pattern can be an indication that a reversal in the price trend is going to take place. What the pattern represents from a supply and demandSupply and demand

Supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

point of view is a lot of selling in the period which forms the first black candle; then, a period of lower trading but with a reduced range, which indicates indecision in the market; this forms the second candle. This is followed by a large white candle, representing buyers taking control of the market. As the Morning Star is a three-candle pattern, traders oftentimes will not wait for confirmation from a fourth candle before buying the stock. High volumes on the third trading day confirm the pattern. Traders will look at the size of the candles for an indication of the size of the potential reversal. The larger the white and black candle, and the higher the white candle moves in relation to the black candle, the larger the potential reversal.

The chart below illustrates.

See also

- Technical analysisTechnical analysisIn finance, technical analysis is security analysis discipline for forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis incorporate technical analysis, which being an aspect of active management stands...

- Chart pattern

- Spinning top (chart pattern)Spinning top (chart pattern)Spinning top is a Japanese candlesticks pattern with a short body found in the middle of two long wicks. A spinning top is indicative of a situation where neither the buyers nor the sellers have won for that time period, as the market has closed relatively unchanged from where it opened; the market...