Mechanism design

Encyclopedia

Game theory

Game theory is a mathematical method for analyzing calculated circumstances, such as in games, where a person’s success is based upon the choices of others...

studying solution concept

Solution concept

In game theory, a solution concept is a formal rule for predicting how the game will be played. These predictions are called "solutions", and describe which strategies will be adopted by players, therefore predicting the result of the game...

s for a class of private information games. The distinguishing features of these games are:

- that a game "designer" chooses the game structure rather than inheriting one

- that the designer is interested in the game's outcome

Such a game is called a "game of mechanism design" and is usually solved by motivating agents to disclose their private information. The 2007 Nobel Memorial Prize in Economic Sciences

Nobel Memorial Prize in Economic Sciences

The Nobel Memorial Prize in Economic Sciences, commonly referred to as the Nobel Prize in Economics, but officially the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel , is an award for outstanding contributions to the field of economics, generally regarded as one of the...

was awarded to Leonid Hurwicz

Leonid Hurwicz

Leonid "Leo" Hurwicz was a Russian-born American economist and mathematician. His nationality of origin was Polish. He was Jewish. He originated incentive compatibility and mechanism design, which show how desired outcomes are achieved in economics, social science and political science...

, Eric Maskin

Eric Maskin

Eric Stark Maskin is an American economist and Nobel laureate recognized with Leonid Hurwicz and Roger Myerson "for having laid the foundations of mechanism design theory." He is the Albert O...

, and Roger Myerson

Roger Myerson

Roger Bruce Myerson is an American economist and Nobel laureate recognized with Leonid Hurwicz and Eric Maskin for "having laid the foundations of mechanism design theory." A professor at the University of Chicago, he has made contributions as an economist, as an applied mathematician, and as a...

"for having laid the foundations of mechanism design theory".

Intuition

In an interesting class of Bayesian gameBayesian game

In game theory, a Bayesian game is one in which information about characteristics of the other players is incomplete. Following John C. Harsanyi's framework, a Bayesian game can be modelled by introducing Nature as a player in a game...

s, one player, called the “principal,” would like to condition his behavior on information privately known to other players. For example, the principal would like to know the true quality of a used car a salesman is pitching. He cannot learn anything simply by asking the salesman because it is in his interest to distort the truth. Fortunately, in mechanism design the principal does have one advantage. He may design a game whose rules can influence others to act the way he would like.

Absent mechanism design theory the principal's problem would be difficult to solve. He would have to consider all the possible games and choose the one that best influences other players' tactics. In addition the principal would have to draw conclusions from agents who may lie to him. Thanks to mechanism design, and particularly the revelation principle, the principal need only consider games in which agents truthfully report their private information.

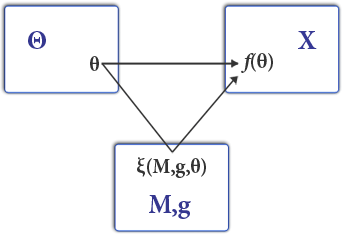

Mechanism

A game of mechanism design is a game of private information in which one of the agents, called the principal, chooses the payoff structure. Following HarsanyiJohn Harsanyi

John Charles Harsanyi was a Hungarian-Australian-American economist and Nobel Memorial Prize in Economic Sciences winner....

(1967), the agents receive secret "messages" from nature containing information relevant to payoffs. For example, a message may contain information about their preferences or the quality of a good for sale. We call this information the agent's "type" (usually noted

and accordingly the space of types

and accordingly the space of types  ). Agents then report a type to the principal (usually noted with a hat

). Agents then report a type to the principal (usually noted with a hat  ) that can be a strategic lie. After the report, the principal and the agents are paid according to the payoff structure the principal chose.

) that can be a strategic lie. After the report, the principal and the agents are paid according to the payoff structure the principal chose.The timing of the game is:

- The principal commits to a mechanism

that grants an outcome

that grants an outcome  as a function of reported type

as a function of reported type - The agents report, possibly dishonestly, a type profile

- The mechanism is executed (agents receive outcome

)

)

In order to understand who gets what, it is common to divide the outcome

into a goods allocation and a money transfer,

into a goods allocation and a money transfer,  where

where  stands for an allocation of goods rendered or received as a function of type, and

stands for an allocation of goods rendered or received as a function of type, and  stands for a monetary transfer as a function of type.

stands for a monetary transfer as a function of type.As a benchmark the designer often defines what would happen under full information. Define a social choice function

mapping the (true) type profile directly to the allocation of goods received or rendered,

mapping the (true) type profile directly to the allocation of goods received or rendered,

In contrast a mechanism maps the reported type profile to an outcome (again, both a goods allocation

and a money transfer

and a money transfer  )

)

Revelation principle

A proposed mechanism constitutes a Bayesian game (a game of private information), and if it is well-behaved the game has a Bayesian Nash equilibrium. At equilibrium agents choose their reports strategically as a function of type

It is difficult to solve for Bayesian equilibria in such a setting because it involves solving for agents' best-response strategies and for the best inference from a possible strategic lie. Thanks to a sweeping result called the revelation principle, no matter the mechanism a designer can confine attention to equilibria in which agents truthfully report type. The revelation principle states: "For any Bayesian Nash equilibrium there corresponds a Bayesian game with the same equilibrium outcome but in which players truthfully report type."

This is extremely useful. The principle allows one to solve for a Bayesian equilibrium by assuming all players truthfully report type (subject to an incentive compatibility

Incentive compatibility

In mechanism design, a process is said to be incentive-compatible if all of the participants fare best when they truthfully reveal any private information asked for by the mechanism. As an illustration, voting systems which create incentives to vote dishonestly lack the property of incentive...

constraint). In one blow it eliminates the need to consider either strategic behavior or lying.

Its proof is quite direct. Assume a Bayesian game in which the agent's strategy and payoff are functions of its type and what others do,

. By definition agent is equilibrium strategy

. By definition agent is equilibrium strategy  is Nash in expected utility:

is Nash in expected utility:

Simply define a mechanism that would induce agents to choose the same equilibrium. The easiest one to define is for the mechanism to commit to playing the agents' equilibrium strategies for them.

Under such a mechanism the agents of course find it optimal to reveal type since the mechanism plays the strategies they found optimal anyway. Formally, choose

such that

such that

Implementability

The designer of a mechanism generally hopes either- to design a mechanism

that "implements" a social choice function

that "implements" a social choice function - to find the mechanism

that maximizes some value criterion (e.g. profit)

that maximizes some value criterion (e.g. profit)

To implement a social choice function

is to find some

is to find some  transfer function that motivates agents to pick outcome

transfer function that motivates agents to pick outcome  . Formally, if the equilibrium strategy profile under the mechanism maps to the same goods allocation as a social choice function,

. Formally, if the equilibrium strategy profile under the mechanism maps to the same goods allocation as a social choice function,

we say the mechanism implements the social choice function.

Thanks to the revelation principle, the designer can usually find a transfer function

to implement a social choice by solving an associated truthtelling game. If agents find it optimal to truthfully report type,

to implement a social choice by solving an associated truthtelling game. If agents find it optimal to truthfully report type,

we say such a mechanism is truthfully implementable (or just "implementable"). The task is then to solve for a truthfully implementable

and impute this transfer function to the original game. An allocation

and impute this transfer function to the original game. An allocation  is truthfully implementable if there exists a transfer function

is truthfully implementable if there exists a transfer function  such that

such that

which is also called the incentive compatibility (IC) constraint.

In applications, the IC condition is the key to describing the shape of

in any useful way. Under certain conditions it can even isolate the transfer function analytically! Additionally, a participation (individual rationality) constraint is sometimes added if agents have the option of not playing.

in any useful way. Under certain conditions it can even isolate the transfer function analytically! Additionally, a participation (individual rationality) constraint is sometimes added if agents have the option of not playing.Necessity

Consider a setting in which all agents have a type-contingent utility function . Consider also a goods allocation

. Consider also a goods allocation  that is vector-valued and size

that is vector-valued and size  (which permits

(which permits  number of goods) and assume it is piecewise continuous with respect to its arguments.

number of goods) and assume it is piecewise continuous with respect to its arguments.The function

is implementable only if

is implementable only if

whenever

and

and  and x is continuous at

and x is continuous at  . This is a necessary condition and is derived from the first- and second-order conditions of the agent's optimization problem assuming truth-telling.

. This is a necessary condition and is derived from the first- and second-order conditions of the agent's optimization problem assuming truth-telling.Its meaning can be understood in two pieces. The first piece says the agent's marginal rate of substitution

Marginal rate of substitution

In economics, the marginal rate of substitution is the rate at which a consumer is ready to give up one good in exchange for another good while maintaining the same level of utility.-Marginal rate of substitution as the slope of indifference curve:...

increases as a function of the type,

In short, agents will not tell the truth if the mechanism does not offer higher agent types a better deal. Otherwise, higher types facing any mechanism that punishes high types for reporting will lie and declare they are lower types, violating the truthtelling IC constraint. The second piece is a monotonicity condition waiting to happen,

which, to be positive, means higher types must be given more of the good.

There is potential for the two pieces to interact. If for some type range the contract offered less quantity to higher types

, it is possible the mechanism could compensate by giving higher types a discount. But such a contract already exists for low-type agents, so this solution is pathological. Such a solution sometimes occurs in the process of solving for a mechanism. In these cases it must be "ironed." In a multiple-good environment it is also possible for the designer to reward the agent with more of one good to substitute for less of another (e.g. butter

, it is possible the mechanism could compensate by giving higher types a discount. But such a contract already exists for low-type agents, so this solution is pathological. Such a solution sometimes occurs in the process of solving for a mechanism. In these cases it must be "ironed." In a multiple-good environment it is also possible for the designer to reward the agent with more of one good to substitute for less of another (e.g. butterButter

Butter is a dairy product made by churning fresh or fermented cream or milk. It is generally used as a spread and a condiment, as well as in cooking applications, such as baking, sauce making, and pan frying...

for margarine

Margarine

Margarine , as a generic term, can indicate any of a wide range of butter substitutes, typically composed of vegetable oils. In many parts of the world, the market share of margarine and spreads has overtaken that of butter...

). Multiple-good mechanisms are an ongoing problem in mechanism design theory.

Sufficiency

Mechanism design papers usually make two assumptions to ensure implementability:

This is known by several names: the single-crossing condition, the sorting condition and the Spence-Mirrlees condition. It means the utility function is of such a shape that the agent's MRS is increasing in type.

This is a technical condition bounding the rate of growth of the MRS.

These assumptions are sufficient to provide that any monotonic

is implementable (a

is implementable (a  exists that can implement it). In addition, in the single-good setting the single-crossing condition is sufficient to provide that only a monotonic

exists that can implement it). In addition, in the single-good setting the single-crossing condition is sufficient to provide that only a monotonic  is implementable, so the designer can confine his search to a monotonic

is implementable, so the designer can confine his search to a monotonic  .

.Revenue equivalence theorem

Vickrey (1961) gives a celebrated result that any member of a large class of auctions assures the seller of the same expected revenue and that the expected revenue is the best the seller can do. This is the case if- The buyers have identical valuation functions (which may be a function of type)

- The buyers' types are independently distributed

- The buyers types are drawn from a continuous distribution

- The type distribution bears the monotone hazard rate property

- The mechanism sells the good to the buyer with the highest valuation

The last condition is crucial to the theorem. An implication is that for the seller to achieve higher revenue he must take a chance on giving the item to an agent with a lower valuation. Usually this means he must risk not selling the item at all.

Vickrey–Clarke–Groves mechanisms

The Vickrey (1961) auction model was later expanded by Clarke (1971) and Groves (1973) to treat a public choice problem in which a public project's cost is borne by all agents, e.g. whether to build a municipal bridge. The resulting "Vickrey–Clarke–Groves" mechanism can motivate agents to choose the socially efficient allocation of the public good even if agents have privately known valuations. In other words, it can solve the "tragedy of the commonsTragedy of the commons

The tragedy of the commons is a dilemma arising from the situation in which multiple individuals, acting independently and rationally consulting their own self-interest, will ultimately deplete a shared limited resource, even when it is clear that it is not in anyone's long-term interest for this...

"—under certain conditions, in particular quasilinear utility or if budget balance is not required.

Consider a setting in which

number of agents have quasilinear utility with private valuations

number of agents have quasilinear utility with private valuations  where the currency

where the currency  is valued linearly. The VCG designer designs an incentive compatible (hence truthfully implementable) mechanism to obtain the true type profile, from which the designer implements the socially optimal allocation

is valued linearly. The VCG designer designs an incentive compatible (hence truthfully implementable) mechanism to obtain the true type profile, from which the designer implements the socially optimal allocation

The cleverness of the VCG mechanism is the way it motivates truthful revelation. It eliminates incentives to misreport by penalizing any agent by the cost of the distortion he causes. Among the reports the agent may make, the VCG mechanism permits a "null" report saying he is indifferent to the public good and cares only about the money transfer. This effectively removes the agent from the game. If an agent does choose to report a type, the VCG mechanism charges the agent a fee if his report is pivotal, that is if his report changes the optimal allocation x so as to harm other agents. The payment is calculated

which sums the distortion in the utilities of the other agents (and not his own) caused by one agent reporting.

Gibbard-Satterthwaite theorem

Gibbard (1973) and Satterthwaite (1975) give an impossibility result similar in spirit to Arrow's impossibility theoremArrow's impossibility theorem

In social choice theory, Arrow’s impossibility theorem, the General Possibility Theorem, or Arrow’s paradox, states that, when voters have three or more distinct alternatives , no voting system can convert the ranked preferences of individuals into a community-wide ranking while also meeting a...

. For a very general class of games, only "dictatorial" social choice functions can be implemented.

A social choice function f is dictatorial if one agent always receives his most-favored goods allocation,

The theorem states that under general conditions any truthfully implementable social choice function must be dictatorial,

- X finite and contains at least three elements

- Preferences are rational

-

Myerson-Satterthwaite theorem

Myerson and Satterthwaite (1983) show there is no efficient way for two parties to trade a good when they each have secret and probabilistically varying valuations for it, without the risk of forcing one party to trade at a loss. It is among the most remarkable negative results in economics—a kind of negative mirror to the fundamental theorems of welfare economicsFundamental theorems of welfare economics

There are two fundamental theorems of welfare economics. The first states that any competitive equilibrium or Walrasian equilibrium leads to a Pareto efficient allocation of resources. The second states the converse, that any efficient allocation can be sustainable by a competitive equilibrium...

.

Price discrimination

Mirrlees (1971) introduces a setting in which the transfer function t is easy to solve for. Due to its relevance and tractability it is a common setting in the literature. Consider a single-good, single-agent setting in which the agent has quasilinear utilityQuasilinear utility

In economics and consumer theory, quasilinear utility functions are linear in one argument, generally the numeraire. This utility function has the representation U = x_1 + \theta...

with an unknown type parameter

and in which the principal has a prior CDF

Cumulative distribution function

In probability theory and statistics, the cumulative distribution function , or just distribution function, describes the probability that a real-valued random variable X with a given probability distribution will be found at a value less than or equal to x. Intuitively, it is the "area so far"...

over the agent's type

. The principal can produce goods at a convex marginal cost c(x) and wants to maximize the expected profit from the transaction

. The principal can produce goods at a convex marginal cost c(x) and wants to maximize the expected profit from the transaction

subject to IC and IR conditions

The principal here is a monopolist trying to set a profit-maximizing price scheme in which it cannot identify the type of the customer. A common example is an airline setting fares for business, leisure and student travelers. Due to the IR condition it has to give every type enough a good enough deal to induce participation. Due to the IC condition it has to give every type a good enough deal that the type prefers its deal to that of any other.

A trick given by Mirrlees (1971) is to use the envelope theorem

Envelope theorem

The envelope theorem is a theorem about optimization problems in microeconomics. It may be used to prove Hotelling's lemma, Shephard's lemma, and Roy's identity...

to eliminate the transfer function from the expectation to be maximized,

Integrating,

where

is some index type. Replacing the incentive-compatible

is some index type. Replacing the incentive-compatible  in the maximand,

in the maximand,

after an integration by parts. This function can be maximized pointwise, a fantastic result because it dispenses with the need to use the calculus of variations

Calculus of variations

Calculus of variations is a field of mathematics that deals with extremizing functionals, as opposed to ordinary calculus which deals with functions. A functional is usually a mapping from a set of functions to the real numbers. Functionals are often formed as definite integrals involving unknown...

.

Because

is incentive-compatible already the designer can drop the IC constraint. If the utility function satisfies the Spence-Mirrlees condition then a monotonic

is incentive-compatible already the designer can drop the IC constraint. If the utility function satisfies the Spence-Mirrlees condition then a monotonic  function exists. The IR constraint can be checked at equilibrium and the fee schedule raised or lowered accordingly. Additionally, note the presence of a hazard rate in the expression. If the type distribution bears the monotone hazard ratio property, the FOC is sufficient to solve for t. If not, then it is necessary to check whether the monotonicity constraint (see sufficiency, above) is satisfied everywhere along the allocation and fee schedules. If not, then the designer must use Myerson ironing.

function exists. The IR constraint can be checked at equilibrium and the fee schedule raised or lowered accordingly. Additionally, note the presence of a hazard rate in the expression. If the type distribution bears the monotone hazard ratio property, the FOC is sufficient to solve for t. If not, then it is necessary to check whether the monotonicity constraint (see sufficiency, above) is satisfied everywhere along the allocation and fee schedules. If not, then the designer must use Myerson ironing.Myerson ironing

Intuitively, what is going on is the designer finds it optimal to bunch certain types together and give them the same contract. Normally the designer motivates higher types to distinguish themselves by giving them a better deal. If there are insufficiently few higher types on the margin the designer does not find it worthwhile to grant lower types a concession (called their information rent) in order to charge higher types a type-specific contract.

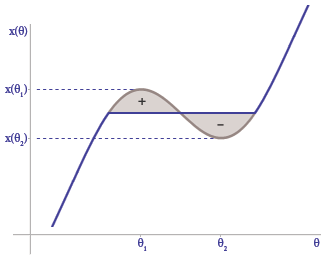

Consider a monopolist principal selling to agents with quasilinear utility, the example above. Suppose the allocation schedule

satisfying the first-order conditions has a single interior peak at

satisfying the first-order conditions has a single interior peak at  and a single interior trough at

and a single interior trough at  , illustrated at right.

, illustrated at right.- Following Myerson (1981) flatten it by choosing

satisfying

satisfying

- where

is the inverse function of x mapping to

is the inverse function of x mapping to  and

and  is the inverse function of x mapping to

is the inverse function of x mapping to  . That is,

. That is,  returns a

returns a  before the interior peak and

before the interior peak and  returns a

returns a  after the interior trough.

after the interior trough.

- If the nonmonotonic region of

borders the edge of the type space, simply set the appropriate

borders the edge of the type space, simply set the appropriate  function (or both) to the boundary type. If there are multiple regions, see a textbook for an iterative procedure; it may be that more than one troughs should be ironed together.

function (or both) to the boundary type. If there are multiple regions, see a textbook for an iterative procedure; it may be that more than one troughs should be ironed together.

Proof

The proof uses the theory of optimal control. It considers the set of intervals in the nonmonotonic region of

in the nonmonotonic region of  over which it might flatten the schedule. It then writes a Hamiltonian to obtain necessary conditions for a

over which it might flatten the schedule. It then writes a Hamiltonian to obtain necessary conditions for a  within the intervals

within the intervals

- that does satisfy monotonicity

- for which the monotonicity constraint is not binding on the boundaries of the interval

Condition two ensures that the

satisfying the optimal control problem reconnects to the schedule in the original problem at the interval boundaries (no jumps). Any

satisfying the optimal control problem reconnects to the schedule in the original problem at the interval boundaries (no jumps). Any  satisfying the necessary conditions must be flat because it must be monotonic and yet reconnect at the boundaries.

satisfying the necessary conditions must be flat because it must be monotonic and yet reconnect at the boundaries.As before maximize the principal's expected payoff, but this time subject to the monotonicity constraint

and use a Hamiltonian to do it, with shadow price

where

is a state variable and

is a state variable and  the control. As usual in optimal control the costate evolution equation must satisfy

the control. As usual in optimal control the costate evolution equation must satisfy

Taking advantage of condition 2, note the monotonicity constraint is not binding at the boundaries of the

interval,

interval,

meaning the costate variable condition can be integrated and also equals 0

The average distortion of the principal's surplus must be 0. To flatten the schedule, find an

such that its inverse image maps to a

such that its inverse image maps to a  interval satisfying the condition above.

interval satisfying the condition above.See also

- Algorithmic mechanism designAlgorithmic mechanism designAlgorithmic mechanism design lies at the intersection of economic game theory and computer science.Noam Nisan and Amir Ronen, from the Hebrew University of Jerusalem, first coined "Algorithmic mechanism design" in a research paper published in 2001....

- Contract theoryContract theoryIn economics, contract theory studies how economic actors can and do construct contractual arrangements, generally in the presence of asymmetric information. Because of its connections with both agency and incentives, contract theory is often categorized within a field known as Law and economics...

- Implementation theoryImplementation theoryImplementation theory is an area of game theory closely related to mechanism design where an attempt is made to add into a game a mechanism such that the equilibrium of the game conforms to some concept of social optimality ....

- Incentive compatibilityIncentive compatibilityIn mechanism design, a process is said to be incentive-compatible if all of the participants fare best when they truthfully reveal any private information asked for by the mechanism. As an illustration, voting systems which create incentives to vote dishonestly lack the property of incentive...

- Revelation principleRevelation principleThe revelation principle of economics can be stated as, "To any Bayesian Nash equilibrium of a game of incomplete information, there exists a payoff-equivalent revelation mechanism that has an equilibrium where the players truthfully report their types."...

- Smart marketSmart marketA "smart market" is a periodic auction which is cleared by the operations research technique of mathematical optimization, such as linear programming. The smart market is operated by a market manager. Trades are not bilateral, between pairs of people, but rather to or from a pool...

- Metagame