Massachusetts health care reform

Encyclopedia

The Massachusetts health care insurance reform law, enacted in 2006, mandates that nearly every resident of Massachusetts

obtain a state-government-regulated minimum level of healthcare insurance coverage and provides free health care insurance for residents earning less than 150% of the federal poverty level (FPL) who are not eligible for Mass Health (Medicaid). The law also partially-subsidizes health care insurance for those earning up to 300% of the FPL. These subsidies and FPL-related calculations affect very few of the over 6,000,000 people (see Massachusetts Department of Healthcare Finance and Policy quarterly Key Indicators report) that had healthcare insurance prior to the enactment of the law.

The law established an independent public authority, the Commonwealth Health Insurance Connector Authority, also known as the Health Connector. Among other roles, the Connector acts as an insurance broker to offer private insurance plans to residents. The reform legislation also included tax penalties for failing to obtain an insurance plan. Massachusetts tax filers who failed to enroll in a health insurance plan which was deemed affordable for them lost the $219 personal exemption on their income tax. Beginning in 2008, penalties increased by monthly increments.

(Chapters 324 and 450 of the Acts of 2006, and chapter 205 of the Acts of 2007).

Estimates of the number of Massachusetts residents who were uninsured in 2006 prior to implementation of the reform law was about 6% of the population according to the Massachusetts DHCFP quarterly Key Indicators report (see its website), the most recent of which is dated May 2010 (although it was actually released on August 15, 2010). The number of people insured as of December 2009 is currently 5,473,000 not counting Medicare enrollees (see same report). Depending on population growth, now about 4% of the population is uninsured.

Allegedly because of their lack of health insurance, uninsured Massachusetts residents commonly utilize emergency rooms as a source of primary care

. The United States Congress

passed the Emergency Medical Treatment and Active Labor Act

(EMTALA) in 1986. EMTALA requires hospitals and ambulance services to provide care to anyone needing emergency treatment regardless of citizenship, legal status or ability to pay. EMTALA applies to virtually all hospitals in the U.S but includes no provisions for reimbursement. EMTALA is therefore considered an "unfunded safety net program" for patients seeking care at the nation's emergency rooms. As a result of the 1986 EMTALA legislation, hospitals across the country faced unpaid bills and mounting expenses to care for the uninsured. Data following enactment of mandatory insurance show total emergency visits and spending continued to increase, and low-severity emergency visits decreased less than 2%; researchers concluded, "To the extent that policymakers expected a substantial decrease in overall and low-severity ED visits, this study does not support those expectations."

In Massachusetts, a fund of approximately $700 million, known as the Uncompensated Care Pool (or "free care pool"), was used to partially reimburse hospitals and health centers for these expenses and the expenses of non-residents. The fund was created through an annual assessment on insurance providers and hospitals, plus state and federal contributions. It was predicted that implementation of the Massachusetts health reform law would result in a decrease in expenses incurred in providing services to the uninsured, as the number of covered Massachusetts residents increased. In 2006, an MIT economics professor Jonathan Gruber predicted that the amount of money in the "free care pool" would be sufficient to pay for reform legislation without requiring additional funding or taxes. In fact, the increased cost of subsidized insurance offset the reduction in "free care", while insurance premiums increased faster than the national average and became the highest in the country.

called for a plan to reduce the number of uninsured by half. A few days later, the Governor, Mitt Romney

, announced that he would propose a plan to cover virtually all of the uninsured.

At the same time, the ACT (Affordable Care Today) Coalition

introduced a bill that expanded MassHealth (Medicaid

and SCHIP) coverage and increased health coverage subsidy

programs and required employers to either provide coverage or pay an assessment to the state. The coalition began gathering signatures to place their proposal on the ballot in November 2006 if the legislature did not enact comprehensive health care reform, resulting in the collection of over 75,000 signatures on the MassACT ballot proposal. The Blue Cross Blue Shield Foundation also sponsored a study, "Roadmap to Coverage," to expand coverage to everyone in the Commonwealth.

Attention focused on the House when Massachusetts House Speaker Salvatore DiMasi

, speaking at a Blue Cross Blue Shield Foundation Roadmap To Coverage forum in October 2005, pledged to pass a bill through the House by the end of the session. At the forum, the Foundation issued a series of reports on reform options, all of which included an individual mandate

. At the end of the month, the Joint Committee on Health Care Financing approved a reform proposal crafted by House Speaker DiMasi, Committee co-chair Patricia Walrath and other House members.

Massachusetts also faced pressure from the federal government to make changes to the federal waiver that allows the state to operate an expanded Medicaid program. Under the existing waiver, the state was receiving $385 million in federal funds to reimburse hospitals for services provided to the uninsured. The free care pool had to be restructured so that individuals, rather than institutions, received the funding.

programs. The most controversial change was the addition of a provision which requires firms with 11 or more workers that do not provide "fair and reasonable" health coverage to their workers to pay an annual penalty. This contribution, initially $295 annually per worker, is intended to equalize the free care pool charges imposed on employers who do and do not cover their workers.

On April 12, 2006 Governor Mitt Romney

signed the health legislation. Romney vetoed 8 sections of the health care legislation, including the controversial employer assessment. Romney also vetoed provisions providing dental

benefits to poor residents on the Medicaid program, and providing health coverage to senior and disabled legal immigrants not eligible for federal Medicaid. The legislature promptly overrode six of the eight gubernatorial section vetoes, on May 4, 2006, and by mid-June 2006 had overridden the remaining two.

The legislation included a merger of the individual (non-group) insurance market into the small group market to allow individuals to get lower group insurance rates. The process of merging the two markets also froze the market for such insurance for a short period in April–May 2010 as the current government tried to keep the leading non-profit insurers, which insure over 90% of the residents, in the state from raising premiums for small businesses and individuals. Eventually the state's non-partisan insurance board ruled that the government did not have the acturarial data or right to freeze the premiums. Five of the non-profit insurers then settled for slightly lower premium increases than they had initially requested rather than litigate further. The sixth litigated and won the right to implement all its original increases retroactively. These findings only affect 2010 and the premium increase/review/litigation process will have to begin again for the insurance period beginning January 1, 2011.

Payment rates were supposed to be increased to hospitals and physicians under the statute but that has not happened. The statute also formed a "Health Care Quality and Cost Council" to issue quality standards and publicize provider performance. There has been some activity by this council. Chapter 58 also set up a Disparities Council, funds automated prescription ordering in hospitals, and implements changes to the public health council, state insurance laws, mandated benefit requirements, and other health-related programs.

, and is a key part of Health Care Insurance Reform in Massachusetts. It is designed primarily for income-eligible Massachusetts adult residents who are not otherwise eligible for MassHealth (Medicaid), who either do not work or who work for employers that do not offer health insurance. Specifically, it allows eligible residents access to certain subsidized private insurance health plans currently a choice of five plans for individuals without health insurance who make below 300% of the federal poverty level. There are no deductibles. For individuals below 150% of the federal poverty level, no premiums will be charged; for those below the poverty level, dental insurance is also provided. For those above 150% of the federal poverty level, a sliding scale premium schedule based on income is used to determine the amount of money a person contributes to their policy. Commonwealth Care for those below poverty has been available through the Connector since October 1, 2006. Plans for those between 100% and 300% of the poverty line have been available since January 1, 2007. As of June 2009, 177,000 people had enrolled in Commonwealth Care according to the Massachusetts Department of Healthcare Finance and Policy. The five Massachusetts health plans contracted with the state to serve the Commonwealth Care population as of April 2010 include: Boston Medical Center HealthNet Plan

, CeltiCare, Fallon Community Health Plan, Neighborhood Health Plan, and Network Health. Celticare is offered by a for-profit insurance company, Centene, of St. Louis, MO and the rest are offered by Massachusetts-based non-profits.

There is an additional Free Rider Surcharge that can be assessed to the employer. This surcharge is different from the fair share contribution. The surcharge is applied when an employer does not arrange for a pre-tax payroll deduction system for health insurance (a Section 125 plan, or a "cafeteria plan

"), and has employees who receive care that is paid from the uncompensated care pool, renamed in October 2007 as the Health Safety Net.

approved the state's waiver application on July 26, 2006, allowing the state to begin enrolling 10,500 people from the waitlist for the MassHealth Essential program, which provides Medicaid coverage to long-term unemployed adults below the poverty line. In 2006, the Division of Health Care Finance and Policy issued regulations defining "fair and reasonable" for the fair share assessment. The regulations provide that companies with 11 or more full-time equivalent employees will meet the “fair and reasonable” test if at least 25 percent of those employees are enrolled in that firm’s health plan and the company is making a contribution toward it. A business that fails that test may still be deemed to offer a "fair and reasonable" contribution if the company offers to pay at least 33 percent of an individual’s health insurance premium. Also in 2006, the Connector Board set premium levels and copayment

s for the state subsidized Commonwealth Care plans. Premiums will vary from $18 per month, for individuals with incomes 100%-150% of the poverty line, to $106 per month for individuals with incomes 250%-300% of poverty. The Connector approved two copayment schemes for plans for people 200%-300% of poverty. One plan will have higher premiums and lower copayments, while a second choice will have lower premiums and higher copayments. Four managed care plans began offering Commonwealth Care on November 1, 2006. Coverage for people above 100% of poverty up to 300% of poverty began on February 1, 2007. As of December 1, 2007, around 158,000 people were enrolled in Commonwealth Care plans. Initial bids received by the Connector showed a likely cost for the minimum insurance plan of about $380 per month. The Connector rejected those bids, and asked insurers to propose less expensive plans. New bids were announced on March 3, 2007. The Governor announced that "the average uninsured Massachusetts resident will be able to purchase health insurance for $175 per month." But plan costs will vary greatly depending on the plan selected, age and geographic location, ranging from just over $100 per month for plans for young adults with high copayments and deductibles to nearly $900 per month for comprehensive plans for older adults with low deductibles and copayments. Copayments, deductibles and out-of-pocket contributions may vary among plans. The proposed minimum creditable coverage plan would have a deductible no higher than $2,000 per individual, $4,000 per family, and would limit out-of-pocket expenses to a $5,000 maximum for an individual and $7,500 for a family. Before the deductible applies, the proposed plan includes preventive office visits with higher copayments, but would not include emergency room visits if the person was not admitted.

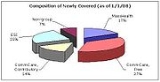

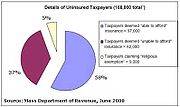

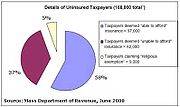

From 2006, the number of uninsured Massachusetts residents dropped from about 6% to 5.4%-5.7% in fall 2007, depending on the methodology used, to about 3% in June 2009 and back to 4% by December 2009 according to the Massachusetts Department of Healthcare Finance and Policy (DHCFP). Approximately 3% of taxpayers were determined by the Commonwealth to have had access to affordable insurance but paid an income tax penalty instead. Approximately 2% of those eligible were determined not to have had access to affordable insurance, and a small number opted for a religious exemption to the mandate.

From 2006, the number of uninsured Massachusetts residents dropped from about 6% to 5.4%-5.7% in fall 2007, depending on the methodology used, to about 3% in June 2009 and back to 4% by December 2009 according to the Massachusetts Department of Healthcare Finance and Policy (DHCFP). Approximately 3% of taxpayers were determined by the Commonwealth to have had access to affordable insurance but paid an income tax penalty instead. Approximately 2% of those eligible were determined not to have had access to affordable insurance, and a small number opted for a religious exemption to the mandate.

Comparing the first half of 2007 to the first half of 2009, spending from the Health Safety Net Fund dropped 38%-40% as more people became insured. The Fund—which replaced the Uncompensated Care Pool or Free Care—pays for medically necessary health care for those who do not have access to health insurance, and the underinsured. It is not clear if this was the result of healthcare reform law because the amount spent is limited by the money appropriated and other accounting issues. The reduced state payments anticipated that by reducing the number of uninsured people Commonwealth Care would reduce the amount of charity care provided by hospitals. In a subsequent story that same month the Globe reported that Commonwealth Care faced a short-term funding gap of $100 million and the need to obtain a new three-year funding commitment from the federal government of $1.5 billion. By June 2011 enrollment is projected to grow to 342,000 people at an annual expense of $1.35 billion. The original projections were for the program to ultimately cover approximately 215,000 people at a cost of $725 million.

Enrollment in the Commonwealth Choice Plans, offered through the Commonwealth Health Insurance Connector, fluctuates between 15,000-20000 according to the state.. According to the DHCFP's quarterly Key Indicator reports, 89,000 people bought healthcare insurance directly as of June 2009, up from 40,000 in June 2006. The number of people with group insurance in Massachusetts has held steady at around 4,400,000 since passage of the health care reform law, according to the DHCFP's quarterly Key Indicators reports available on its website.

A study published in The American Journal of Medicine, “Medical Bankruptcy in Massachusetts: Has Health Reform Made a Difference?”, compared bankruptcy filers from 2007, before reforms were implemented, to those filing in the post-reform 2009 environment to see what role medical costs played. The study found that: 1) From 2007 to 2009, the total number of medical bankruptcies in Massachusetts increased by more than one third, from 7,504 to 10,093; and 2) Illness and medical costs contributed to 59.3% of bankruptcies in 2007 and 52.9% in 2009. The researchers note that the financial crisis beginning in 2008 likely contributed to the increased number of bankruptcies, and Massachusetts' increase in medical bankruptcies over the 2007-2009 period was nevertheless below the national average rate of increase. Still, the researchers explain that health costs continued to go up over the period in question, and their overall findings are “incompatible with claims that health reform has cut medical bankruptcy filings significantly.”

Private health care spending per member in the state increased at an annual rate of 7.5% from 2006-08. Pricing was the largest contributor to the growth rate. However, individually purchased insurance grew more slowly, at an annual rate of 2.0%.

During the week of April 5, 2010, the Boston Globe

reported that more than a thousand people in Massachusetts had "gamed" the mandate/penalty provision of the law since implementation by choosing to be insured only a few months a year, typically when in need of a specific medical procedure. On the average, the Globe reported, these part-time enrolees were paying $1200–$1600 in premiums over a few months and receiving $10,000 or more in healthcare services before again dropping coverage.

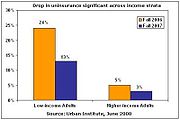

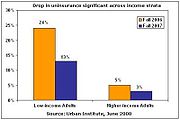

A study conducted by the Urban Institute

and released in December 2010 by the Massachusetts Division of Health Care Finance and Policy stated that as of June 2010, 98.1 percent of state residents had coverage. This compared to 97.3 percent having coverage in the state in 2009 and 83.3 percent having coverage nationwide. Among children and seniors the 2010 coverage rate was even higher, at 99.8 percent and 99.6 percent respectively. The breakdown of insurance coverage consisted of that 65.1 percent of state residents being covered by employers, 16.4 percent by Medicare, and 16.6 percent via public plans such as Commonwealth Care. The state's Secretary of Health and Human Services, JudyAnn Bigby

, said, “Massachusetts' achievements in health care reform have been nothing short of extraordinary. With employers, government and individuals all sharing the responsibility of reform, we continue to have the highest insurance rate in the nation.”

In June 2011 a Boston Globe review concluded that the healthcare overhaul "has, after five years, worked as well as or better than expected." A study by the Beacon Hill Institute

was of the view that the reform was "responsible for a dramatic increase in health care spending," however.

of Essex County

, contesting the fine imposed for a citizen's failure to get health insurance as well as the fine imposed for a failure to provide information on a tax return

as to whether that citizen had health insurance. These fines, which are detailed within MGL CH 111M Section 2, were described as "penalties" under that law and not as taxes

. The method of collection of the fines was by the forfeiture

of the personal tax exemption

for that tax year (2007). This method of collection was contested as a bill of attainder

, as the fines were to be collected through the income tax return without any charges ever being filed and the law did not provide for a trial in a court of law to determine guilt. Bills of attainder are prohibited by Article 1 Section 10 of the United States Constitution

. The method of collection was also contested as a violation of separation of powers

, as only the judicial branch

has the power to determine guilt or innocence and the punishment for guilt. In Massachusetts, separation of powers is enforced by Article XXX of the first part of the Massachusetts Constitution

. The fine for a failure to provide information was further contested as contrary to the right to remain silent

as protected by both the Fifth Amendment to the United States Constitution

as well as Article XII of the Massachusetts Constitution. Both fines were contested as a breach of the constitutional requirement for proportional taxation

, as required by the Massachusetts Constitution. The argument was that by taking the personal tax exemption away from some but not all taxpayers, the tax code becomes non-proportional. Massachusetts is a flat tax

state, and a number of constitutional amendment

s allowing a graduated income tax have been repeatedly rejected by Massachusetts voters. The judge dismissed the case upon a motion filed by the assistant to the State Attorney General

for failure to state a case upon which relief

can be granted. The relief requested included a statement that the enforcement provisions of the legislation

conflicted with the due process

provisions of both the United States and Massachusetts Constitution, and were therefore null and void

. Further relief requested was a statement that the legislation itself was contrary to the Article XVIII requirement that all Massachusetts laws uphold the principle of frugality

and was therefore also null and void, as well as a statement that the legislation was contrary to constitutional provisions requiring compensation for eminent domain

(the forced use of private property

for a public purpose

), as no provisions were made in that law to provide that compensation.

A petition for a writ of mandamus

to the Massachusetts Supreme Judicial Court

, ordering Essex Superior Court to vacate this dismissal on procedural grounds, the failure to provide trial by jury in a dispute over property as requested by the plaintiff, was denied by Massachusetts Supreme Court Justice J. Spina. An Appeal was then filed with the Massachusetts Appeal Court. A later petition for a writ of mandamus with the Massachusetts Supreme Court, ordering the Appeals Court to vacate the dismissal on procedural grounds, as above, and to return the case to Essex Superior Court for trial by jury, was also denied, this time by Justice J. Ireland. The Appeals Court then heard the appeal and declined to send the case back to Essex Superior Court for trial by jury based on their belief that no facts needed to be determined and therefore trial by jury in this case was not a protected right under either the US or Massachusetts Constitutions. It further declined to answer 14 questions posed to it "designed to focus its attention on the issues". An appeal to the Massachusetts Supreme Judicial Court contented that the Appeals Court manufactured at least one of the rulings (Fidelity & Deposit Co. of Md. v. US) it cited regarding the constitutional right to jury trial if the court regarded there to be no issue of material fact in dispute. The Supreme Judicial Court of Massachusetts however declined to hear any further appeals.

Massachusetts

The Commonwealth of Massachusetts is a state in the New England region of the northeastern United States of America. It is bordered by Rhode Island and Connecticut to the south, New York to the west, and Vermont and New Hampshire to the north; at its east lies the Atlantic Ocean. As of the 2010...

obtain a state-government-regulated minimum level of healthcare insurance coverage and provides free health care insurance for residents earning less than 150% of the federal poverty level (FPL) who are not eligible for Mass Health (Medicaid). The law also partially-subsidizes health care insurance for those earning up to 300% of the FPL. These subsidies and FPL-related calculations affect very few of the over 6,000,000 people (see Massachusetts Department of Healthcare Finance and Policy quarterly Key Indicators report) that had healthcare insurance prior to the enactment of the law.

The law established an independent public authority, the Commonwealth Health Insurance Connector Authority, also known as the Health Connector. Among other roles, the Connector acts as an insurance broker to offer private insurance plans to residents. The reform legislation also included tax penalties for failing to obtain an insurance plan. Massachusetts tax filers who failed to enroll in a health insurance plan which was deemed affordable for them lost the $219 personal exemption on their income tax. Beginning in 2008, penalties increased by monthly increments.

Background

The healthcare insurance reform law was enacted as Chapter 58 of the Acts of 2006 of the Massachusetts General Court; its long form title is An Act Providing Access to Affordable, Quality, Accountable Health Care. In October 2006, January 2007, and November 2007, bills were enacted that amended and made technical corrections to the statuteStatute

A statute is a formal written enactment of a legislative authority that governs a state, city, or county. Typically, statutes command or prohibit something, or declare policy. The word is often used to distinguish law made by legislative bodies from case law, decided by courts, and regulations...

(Chapters 324 and 450 of the Acts of 2006, and chapter 205 of the Acts of 2007).

Estimates of the number of Massachusetts residents who were uninsured in 2006 prior to implementation of the reform law was about 6% of the population according to the Massachusetts DHCFP quarterly Key Indicators report (see its website), the most recent of which is dated May 2010 (although it was actually released on August 15, 2010). The number of people insured as of December 2009 is currently 5,473,000 not counting Medicare enrollees (see same report). Depending on population growth, now about 4% of the population is uninsured.

Allegedly because of their lack of health insurance, uninsured Massachusetts residents commonly utilize emergency rooms as a source of primary care

Primary care

Primary care is the term for the health services by providers who act as the principal point of consultation for patients within a health care system...

. The United States Congress

United States Congress

The United States Congress is the bicameral legislature of the federal government of the United States, consisting of the Senate and the House of Representatives. The Congress meets in the United States Capitol in Washington, D.C....

passed the Emergency Medical Treatment and Active Labor Act

Emergency Medical Treatment and Active Labor Act

The Emergency Medical Treatment and Active Labor Act is a U.S. Act of Congress passed in 1986 as part of the Consolidated Omnibus Budget Reconciliation Act . It requires hospitals to provide care to anyone needing emergency healthcare treatment regardless of citizenship, legal status or ability to...

(EMTALA) in 1986. EMTALA requires hospitals and ambulance services to provide care to anyone needing emergency treatment regardless of citizenship, legal status or ability to pay. EMTALA applies to virtually all hospitals in the U.S but includes no provisions for reimbursement. EMTALA is therefore considered an "unfunded safety net program" for patients seeking care at the nation's emergency rooms. As a result of the 1986 EMTALA legislation, hospitals across the country faced unpaid bills and mounting expenses to care for the uninsured. Data following enactment of mandatory insurance show total emergency visits and spending continued to increase, and low-severity emergency visits decreased less than 2%; researchers concluded, "To the extent that policymakers expected a substantial decrease in overall and low-severity ED visits, this study does not support those expectations."

In Massachusetts, a fund of approximately $700 million, known as the Uncompensated Care Pool (or "free care pool"), was used to partially reimburse hospitals and health centers for these expenses and the expenses of non-residents. The fund was created through an annual assessment on insurance providers and hospitals, plus state and federal contributions. It was predicted that implementation of the Massachusetts health reform law would result in a decrease in expenses incurred in providing services to the uninsured, as the number of covered Massachusetts residents increased. In 2006, an MIT economics professor Jonathan Gruber predicted that the amount of money in the "free care pool" would be sufficient to pay for reform legislation without requiring additional funding or taxes. In fact, the increased cost of subsidized insurance offset the reduction in "free care", while insurance premiums increased faster than the national average and became the highest in the country.

Reform coalitions

In November 2004, political leaders began advocating for major reforms of the Massachusetts health care insurance system to expand coverage. First, the Senate President Robert TravagliniRobert Travaglini

Robert E. Travaglini is a former President of the Massachusetts Senate. He represented the First Middlesex and Suffolk senatorial district, encompassing portions of Boston, Revere, Winthrop and Cambridge....

called for a plan to reduce the number of uninsured by half. A few days later, the Governor, Mitt Romney

Mitt Romney

Willard Mitt Romney is an American businessman and politician. He was the 70th Governor of Massachusetts from 2003 to 2007 and is a candidate for the 2012 Republican Party presidential nomination.The son of George W...

, announced that he would propose a plan to cover virtually all of the uninsured.

At the same time, the ACT (Affordable Care Today) Coalition

Coalition

A coalition is a pact or treaty among individuals or groups, during which they cooperate in joint action, each in their own self-interest, joining forces together for a common cause. This alliance may be temporary or a matter of convenience. A coalition thus differs from a more formal covenant...

introduced a bill that expanded MassHealth (Medicaid

Medicaid

Medicaid is the United States health program for certain people and families with low incomes and resources. It is a means-tested program that is jointly funded by the state and federal governments, and is managed by the states. People served by Medicaid are U.S. citizens or legal permanent...

and SCHIP) coverage and increased health coverage subsidy

Subsidy

A subsidy is an assistance paid to a business or economic sector. Most subsidies are made by the government to producers or distributors in an industry to prevent the decline of that industry or an increase in the prices of its products or simply to encourage it to hire more labor A subsidy (also...

programs and required employers to either provide coverage or pay an assessment to the state. The coalition began gathering signatures to place their proposal on the ballot in November 2006 if the legislature did not enact comprehensive health care reform, resulting in the collection of over 75,000 signatures on the MassACT ballot proposal. The Blue Cross Blue Shield Foundation also sponsored a study, "Roadmap to Coverage," to expand coverage to everyone in the Commonwealth.

Attention focused on the House when Massachusetts House Speaker Salvatore DiMasi

Salvatore DiMasi

Salvatore F. "Sal" DiMasi is a former Democratic state representative in Massachusetts. The former Speaker of the Massachusetts House of Representatives originally joined the state legislature in 1979, as a member of the Democratic Party...

, speaking at a Blue Cross Blue Shield Foundation Roadmap To Coverage forum in October 2005, pledged to pass a bill through the House by the end of the session. At the forum, the Foundation issued a series of reports on reform options, all of which included an individual mandate

Individual mandate

An individual mandate is a requirement by a government that certain individual citizens purchase or otherwise obtain a good or service.In the United States, the United States Congress has enacted two individual mandates, the first was never federally enforced, while the second is not scheduled to...

. At the end of the month, the Joint Committee on Health Care Financing approved a reform proposal crafted by House Speaker DiMasi, Committee co-chair Patricia Walrath and other House members.

Massachusetts also faced pressure from the federal government to make changes to the federal waiver that allows the state to operate an expanded Medicaid program. Under the existing waiver, the state was receiving $385 million in federal funds to reimburse hospitals for services provided to the uninsured. The free care pool had to be restructured so that individuals, rather than institutions, received the funding.

Legislation

In fall 2005 the House and Senate each passed health care insurance reform bills. The legislature made a number of changes to Governor Romney's original proposal, including expanding MassHealth (Medicaid and SCHIP) coverage to low-income children and restoring funding for public healthPublic health

Public health is "the science and art of preventing disease, prolonging life and promoting health through the organized efforts and informed choices of society, organizations, public and private, communities and individuals" . It is concerned with threats to health based on population health...

programs. The most controversial change was the addition of a provision which requires firms with 11 or more workers that do not provide "fair and reasonable" health coverage to their workers to pay an annual penalty. This contribution, initially $295 annually per worker, is intended to equalize the free care pool charges imposed on employers who do and do not cover their workers.

On April 12, 2006 Governor Mitt Romney

Mitt Romney

Willard Mitt Romney is an American businessman and politician. He was the 70th Governor of Massachusetts from 2003 to 2007 and is a candidate for the 2012 Republican Party presidential nomination.The son of George W...

signed the health legislation. Romney vetoed 8 sections of the health care legislation, including the controversial employer assessment. Romney also vetoed provisions providing dental

Dental insurance

Dental insurance is a type of health insurance designed to pay a portion of the costs associated with dental care. There are several different types of individual, family, or group dental insurance plans grouped into three primary categories: Indemnity which allows you to see any dentist you want...

benefits to poor residents on the Medicaid program, and providing health coverage to senior and disabled legal immigrants not eligible for federal Medicaid. The legislature promptly overrode six of the eight gubernatorial section vetoes, on May 4, 2006, and by mid-June 2006 had overridden the remaining two.

Statute

The enacted statute, Chapter 58 of the Acts of 2006, established a system to require individuals, with a few exceptions, to obtain health insurance. Chapter 58 has several key provisions: the creation of the Health Connector; the establishment of the subsidized Commonwealth Care Health Insurance Program; the employer Fair Share Contribution and Free Rider Surcharge; and a requirement that each individual must show evidence of coverage on their income tax return or face a tax penalty, unless coverage was deemed unaffordable by the Health Connector. The statute also expands MassHealth (Medicaid and SCHIP) coverage for children of low income parents and restores MassHealth benefits like dental care and eyeglasses.The legislation included a merger of the individual (non-group) insurance market into the small group market to allow individuals to get lower group insurance rates. The process of merging the two markets also froze the market for such insurance for a short period in April–May 2010 as the current government tried to keep the leading non-profit insurers, which insure over 90% of the residents, in the state from raising premiums for small businesses and individuals. Eventually the state's non-partisan insurance board ruled that the government did not have the acturarial data or right to freeze the premiums. Five of the non-profit insurers then settled for slightly lower premium increases than they had initially requested rather than litigate further. The sixth litigated and won the right to implement all its original increases retroactively. These findings only affect 2010 and the premium increase/review/litigation process will have to begin again for the insurance period beginning January 1, 2011.

Payment rates were supposed to be increased to hospitals and physicians under the statute but that has not happened. The statute also formed a "Health Care Quality and Cost Council" to issue quality standards and publicize provider performance. There has been some activity by this council. Chapter 58 also set up a Disparities Council, funds automated prescription ordering in hospitals, and implements changes to the public health council, state insurance laws, mandated benefit requirements, and other health-related programs.

Commonwealth Health Insurance Connector Authority

The Health Connector is designed as a clearinghouse for insurance plans and payments. It performs the following functions:- It administers the Commonwealth Care program for low-income residents (up to 300% of the FPL) who do not qualify for MassHealth and who meet certain eligibility guidelines.

- It offers for purchase health insurance plans for individuals who:

- are not working

- are employed by a small business (less than 50 employees) that uses the Connector to offer health insurance. These residents will purchase insurance with pre-tax income.

- are not qualified under their large employer plan

- are self-employed, part-time workers, or work for multiple employers

- It sets premium subsidy levels for Commonwealth Care.

- It defines "affordability" for purposes of the individual mandate

Commonwealth Care Health Insurance Program

Commonwealth Care is one of the newest subsidized health insurance programs offered by the CommonwealthMassachusetts

The Commonwealth of Massachusetts is a state in the New England region of the northeastern United States of America. It is bordered by Rhode Island and Connecticut to the south, New York to the west, and Vermont and New Hampshire to the north; at its east lies the Atlantic Ocean. As of the 2010...

, and is a key part of Health Care Insurance Reform in Massachusetts. It is designed primarily for income-eligible Massachusetts adult residents who are not otherwise eligible for MassHealth (Medicaid), who either do not work or who work for employers that do not offer health insurance. Specifically, it allows eligible residents access to certain subsidized private insurance health plans currently a choice of five plans for individuals without health insurance who make below 300% of the federal poverty level. There are no deductibles. For individuals below 150% of the federal poverty level, no premiums will be charged; for those below the poverty level, dental insurance is also provided. For those above 150% of the federal poverty level, a sliding scale premium schedule based on income is used to determine the amount of money a person contributes to their policy. Commonwealth Care for those below poverty has been available through the Connector since October 1, 2006. Plans for those between 100% and 300% of the poverty line have been available since January 1, 2007. As of June 2009, 177,000 people had enrolled in Commonwealth Care according to the Massachusetts Department of Healthcare Finance and Policy. The five Massachusetts health plans contracted with the state to serve the Commonwealth Care population as of April 2010 include: Boston Medical Center HealthNet Plan

Boston Medical Center HealthNet Plan

is a health maintenance organization located in Massachusetts. Founded in 1997 by Boston Medical Center, the Plan manages healthcare coverage for Massachusetts residents participating in MassHealth , and Commonwealth Care -- subsidized health insurance programs for low-income individuals...

, CeltiCare, Fallon Community Health Plan, Neighborhood Health Plan, and Network Health. Celticare is offered by a for-profit insurance company, Centene, of St. Louis, MO and the rest are offered by Massachusetts-based non-profits.

Employer taxes

Employers with more than ten full-time equivalent employees (FTEs) must provide a "fair and reasonable contribution" to the premium of health insurance for employees. Employers who do not will be assessed an annual fair share contribution that will not exceed $295 per employee per year. The fair share contribution will be paid into the Commonwealth Care Trust Fund to fund Commonwealth Care and other health reform programs. The Division of Health Care Finance and Policy defined by regulation what contribution level meets the "fair and reasonable" test in the statute. The regulation imposes two tests. First, employers are deemed to have offered "fair and reasonable" coverage if at least 25% of their full-time workers are enrolled in the firm's health plan. Alternatively, a company meets the standard if it offers to pay at least 33% of the premium cost of an individual health plan. For employers with 50 or more FTEs, both standards must be met, or 75% of full-time workers must be enrolled in the firm's health plan. Regulatory and analytic information is available on the Division's website.There is an additional Free Rider Surcharge that can be assessed to the employer. This surcharge is different from the fair share contribution. The surcharge is applied when an employer does not arrange for a pre-tax payroll deduction system for health insurance (a Section 125 plan, or a "cafeteria plan

Cafeteria plan

A cafeteria plan is a type of employee benefit plan offered in the United States pursuant to Section 125 of the Internal Revenue Code. Its name comes from the earliest such plans that allowed employees to choose between different types of benefits, similar to the ability of a customer to choose...

"), and has employees who receive care that is paid from the uncompensated care pool, renamed in October 2007 as the Health Safety Net.

Individual taxes

Residents of Massachusetts must have health insurance coverage under Chapter 58. Residents must indicate on their tax forms if they had insurance on December 31 of that tax year, had a waiver for religious reasons, or had a waiver from the Connector. The Connector waiver can be obtained if the resident demonstrates that there is no available coverage that is defined by the Connector as affordable. In March 2007, the Connector adopted an affordability schedule that allows residents to seek a waiver. If a resident does not have coverage and does not have a waiver, the Department of Revenue will enforce the insurance requirement by imposing a penalty. In 2007, the penalty was the loss of the personal exemption. Beginning in 2008, the penalty will be up to half the cost of the lowest available yearly premium which will be enforced as an assessed addition to the individual's income tax, up to $912 a year.Young adult coverage

Beginning in July 2007, the Connector offers reduced benefit plans for young adults up to age 26 who do not have access to employer-based coverage.Implementation

The implementation of healthcare insurance reform began in June, 2006, with the appointment of members of the Connector board and the naming of Jon Kingsdale, a Tufts Health Plan official, as executive director of the Connector. On July 1, MassHealth began covering dental care and other benefits, and began enrolling children between 200% and 300% of the poverty level. The federal Centers for Medicare and Medicaid ServicesCenters for Medicare and Medicaid Services

The Centers for Medicare & Medicaid Services , previously known as the Health Care Financing Administration , is a federal agency within the United States Department of Health and Human Services that administers the Medicare program and works in partnership with state governments to administer...

approved the state's waiver application on July 26, 2006, allowing the state to begin enrolling 10,500 people from the waitlist for the MassHealth Essential program, which provides Medicaid coverage to long-term unemployed adults below the poverty line. In 2006, the Division of Health Care Finance and Policy issued regulations defining "fair and reasonable" for the fair share assessment. The regulations provide that companies with 11 or more full-time equivalent employees will meet the “fair and reasonable” test if at least 25 percent of those employees are enrolled in that firm’s health plan and the company is making a contribution toward it. A business that fails that test may still be deemed to offer a "fair and reasonable" contribution if the company offers to pay at least 33 percent of an individual’s health insurance premium. Also in 2006, the Connector Board set premium levels and copayment

Copayment

In the United States, the copayment or copay is a payment defined in the insurance policy and paid by the insured person each time a medical service is accessed. It is technically a form of coinsurance, but is defined differently in health insurance where a coinsurance is a percentage payment after...

s for the state subsidized Commonwealth Care plans. Premiums will vary from $18 per month, for individuals with incomes 100%-150% of the poverty line, to $106 per month for individuals with incomes 250%-300% of poverty. The Connector approved two copayment schemes for plans for people 200%-300% of poverty. One plan will have higher premiums and lower copayments, while a second choice will have lower premiums and higher copayments. Four managed care plans began offering Commonwealth Care on November 1, 2006. Coverage for people above 100% of poverty up to 300% of poverty began on February 1, 2007. As of December 1, 2007, around 158,000 people were enrolled in Commonwealth Care plans. Initial bids received by the Connector showed a likely cost for the minimum insurance plan of about $380 per month. The Connector rejected those bids, and asked insurers to propose less expensive plans. New bids were announced on March 3, 2007. The Governor announced that "the average uninsured Massachusetts resident will be able to purchase health insurance for $175 per month." But plan costs will vary greatly depending on the plan selected, age and geographic location, ranging from just over $100 per month for plans for young adults with high copayments and deductibles to nearly $900 per month for comprehensive plans for older adults with low deductibles and copayments. Copayments, deductibles and out-of-pocket contributions may vary among plans. The proposed minimum creditable coverage plan would have a deductible no higher than $2,000 per individual, $4,000 per family, and would limit out-of-pocket expenses to a $5,000 maximum for an individual and $7,500 for a family. Before the deductible applies, the proposed plan includes preventive office visits with higher copayments, but would not include emergency room visits if the person was not admitted.

Outcomes

Comparing the first half of 2007 to the first half of 2009, spending from the Health Safety Net Fund dropped 38%-40% as more people became insured. The Fund—which replaced the Uncompensated Care Pool or Free Care—pays for medically necessary health care for those who do not have access to health insurance, and the underinsured. It is not clear if this was the result of healthcare reform law because the amount spent is limited by the money appropriated and other accounting issues. The reduced state payments anticipated that by reducing the number of uninsured people Commonwealth Care would reduce the amount of charity care provided by hospitals. In a subsequent story that same month the Globe reported that Commonwealth Care faced a short-term funding gap of $100 million and the need to obtain a new three-year funding commitment from the federal government of $1.5 billion. By June 2011 enrollment is projected to grow to 342,000 people at an annual expense of $1.35 billion. The original projections were for the program to ultimately cover approximately 215,000 people at a cost of $725 million.

Enrollment in the Commonwealth Choice Plans, offered through the Commonwealth Health Insurance Connector, fluctuates between 15,000-20000 according to the state.. According to the DHCFP's quarterly Key Indicator reports, 89,000 people bought healthcare insurance directly as of June 2009, up from 40,000 in June 2006. The number of people with group insurance in Massachusetts has held steady at around 4,400,000 since passage of the health care reform law, according to the DHCFP's quarterly Key Indicators reports available on its website.

A study published in The American Journal of Medicine, “Medical Bankruptcy in Massachusetts: Has Health Reform Made a Difference?”, compared bankruptcy filers from 2007, before reforms were implemented, to those filing in the post-reform 2009 environment to see what role medical costs played. The study found that: 1) From 2007 to 2009, the total number of medical bankruptcies in Massachusetts increased by more than one third, from 7,504 to 10,093; and 2) Illness and medical costs contributed to 59.3% of bankruptcies in 2007 and 52.9% in 2009. The researchers note that the financial crisis beginning in 2008 likely contributed to the increased number of bankruptcies, and Massachusetts' increase in medical bankruptcies over the 2007-2009 period was nevertheless below the national average rate of increase. Still, the researchers explain that health costs continued to go up over the period in question, and their overall findings are “incompatible with claims that health reform has cut medical bankruptcy filings significantly.”

Private health care spending per member in the state increased at an annual rate of 7.5% from 2006-08. Pricing was the largest contributor to the growth rate. However, individually purchased insurance grew more slowly, at an annual rate of 2.0%.

During the week of April 5, 2010, the Boston Globe

The Boston Globe

The Boston Globe is an American daily newspaper based in Boston, Massachusetts. The Boston Globe has been owned by The New York Times Company since 1993...

reported that more than a thousand people in Massachusetts had "gamed" the mandate/penalty provision of the law since implementation by choosing to be insured only a few months a year, typically when in need of a specific medical procedure. On the average, the Globe reported, these part-time enrolees were paying $1200–$1600 in premiums over a few months and receiving $10,000 or more in healthcare services before again dropping coverage.

A study conducted by the Urban Institute

Urban Institute

The Urban Institute is a Washington, D.C.-based think tank that carries out nonpartisan economic and social policy research, collects data, evaluates social programs, educates the public on key domestic issues, and provides advice and technical assistance to developing governments abroad...

and released in December 2010 by the Massachusetts Division of Health Care Finance and Policy stated that as of June 2010, 98.1 percent of state residents had coverage. This compared to 97.3 percent having coverage in the state in 2009 and 83.3 percent having coverage nationwide. Among children and seniors the 2010 coverage rate was even higher, at 99.8 percent and 99.6 percent respectively. The breakdown of insurance coverage consisted of that 65.1 percent of state residents being covered by employers, 16.4 percent by Medicare, and 16.6 percent via public plans such as Commonwealth Care. The state's Secretary of Health and Human Services, JudyAnn Bigby

JudyAnn Bigby

JudyAnn Bigby is the current Secretary of the Executive Office of Health and Human Services of the Commonwealth of Massachusetts.Prior to becoming Secretary, Bigby was a primary care physician and medical director of Community Health Programs at Brigham and Women's Hospital...

, said, “Massachusetts' achievements in health care reform have been nothing short of extraordinary. With employers, government and individuals all sharing the responsibility of reform, we continue to have the highest insurance rate in the nation.”

In June 2011 a Boston Globe review concluded that the healthcare overhaul "has, after five years, worked as well as or better than expected." A study by the Beacon Hill Institute

Beacon Hill Institute

The Beacon Hill Institute is the research arm of the Department of Economics at Suffolk University in Boston. It was founded in 1991 by businessman and Republican politician Ray Shamie. The institute, considered to be fiscally conservative, draws on faculty and student resources to analyze issues...

was of the view that the reform was "responsible for a dramatic increase in health care spending," however.

Fountas v Dormitzer

A legal challenge was filed in the Superior CourtSuperior court

In common law systems, a superior court is a court of general competence which typically has unlimited jurisdiction with regard to civil and criminal legal cases...

of Essex County

Essex County, Massachusetts

-National protected areas:* Parker River National Wildlife Refuge* Salem Maritime National Historic Site* Saugus Iron Works National Historic Site* Thacher Island National Wildlife Refuge-Demographics:...

, contesting the fine imposed for a citizen's failure to get health insurance as well as the fine imposed for a failure to provide information on a tax return

Tax return (United States)

Tax returns in the United States are reports filed with the Internal Revenue Service or with the state or local tax collection agency containing information used to calculate income tax or other taxes...

as to whether that citizen had health insurance. These fines, which are detailed within MGL CH 111M Section 2, were described as "penalties" under that law and not as taxes

Tax

To tax is to impose a financial charge or other levy upon a taxpayer by a state or the functional equivalent of a state such that failure to pay is punishable by law. Taxes are also imposed by many subnational entities...

. The method of collection of the fines was by the forfeiture

Forfeiture (law)

Forfeiture is deprivation or destruction of a right in consequence of the non-performance of some obligation or condition. It can be accidental, and therefore is distinguished from waiver; see waiver and forfeiture....

of the personal tax exemption

Tax exemption

Various tax systems grant a tax exemption to certain organizations, persons, income, property or other items taxable under the system. Tax exemption may also refer to a personal allowance or specific monetary exemption which may be claimed by an individual to reduce taxable income under some...

for that tax year (2007). This method of collection was contested as a bill of attainder

Bill of attainder

A bill of attainder is an act of a legislature declaring a person or group of persons guilty of some crime and punishing them without benefit of a judicial trial.-English law:...

, as the fines were to be collected through the income tax return without any charges ever being filed and the law did not provide for a trial in a court of law to determine guilt. Bills of attainder are prohibited by Article 1 Section 10 of the United States Constitution

United States Constitution

The Constitution of the United States is the supreme law of the United States of America. It is the framework for the organization of the United States government and for the relationship of the federal government with the states, citizens, and all people within the United States.The first three...

. The method of collection was also contested as a violation of separation of powers

Separation of powers under the United States Constitution

Separation of powers is a political doctrine originating from the United States Constitution, according to which the legislative, executive, and judicial branches of the United States government are kept distinct in order to prevent abuse of power. This U.S...

, as only the judicial branch

Judiciary

The judiciary is the system of courts that interprets and applies the law in the name of the state. The judiciary also provides a mechanism for the resolution of disputes...

has the power to determine guilt or innocence and the punishment for guilt. In Massachusetts, separation of powers is enforced by Article XXX of the first part of the Massachusetts Constitution

Massachusetts Constitution

The Constitution of the Commonwealth of Massachusetts is the fundamental governing document of the Commonwealth of Massachusetts, one of the 50 individual state governments that make up the United States of America. It was drafted by John Adams, Samuel Adams, and James Bowdoin during the...

. The fine for a failure to provide information was further contested as contrary to the right to remain silent

Right to silence

The right to remain silent is a legal right of any person. This right is recognized, explicitly or by convention, in many of the world's legal systems....

as protected by both the Fifth Amendment to the United States Constitution

Fifth Amendment to the United States Constitution

The Fifth Amendment to the United States Constitution, which is part of the Bill of Rights, protects against abuse of government authority in a legal procedure. Its guarantees stem from English common law which traces back to the Magna Carta in 1215...

as well as Article XII of the Massachusetts Constitution. Both fines were contested as a breach of the constitutional requirement for proportional taxation

Proportional tax

A proportional tax is a tax imposed so that the tax rate is fixed. The amount of the tax is in proportion to the amount subject to taxation. "Proportional" describes a distribution effect on income or expenditure, referring to the way the rate remains consistent , where the marginal tax rate is...

, as required by the Massachusetts Constitution. The argument was that by taking the personal tax exemption away from some but not all taxpayers, the tax code becomes non-proportional. Massachusetts is a flat tax

Flat tax

A flat tax is a tax system with a constant marginal tax rate. Typically the term flat tax is applied in the context of an individual or corporate income that will be taxed at one marginal rate...

state, and a number of constitutional amendment

Constitutional amendment

A constitutional amendment is a formal change to the text of the written constitution of a nation or state.Most constitutions require that amendments cannot be enacted unless they have passed a special procedure that is more stringent than that required of ordinary legislation...

s allowing a graduated income tax have been repeatedly rejected by Massachusetts voters. The judge dismissed the case upon a motion filed by the assistant to the State Attorney General

Martha Coakley

Martha Mary Coakley is the Attorney General of the Commonwealth of Massachusetts. Prior to serving as Attorney General, she was District Attorney of Middlesex County, Massachusetts from 1999 to 2007....

for failure to state a case upon which relief

Legal remedy

A legal remedy is the means with which a court of law, usually in the exercise of civil law jurisdiction, enforces a right, imposes a penalty, or makes some other court order to impose its will....

can be granted. The relief requested included a statement that the enforcement provisions of the legislation

Legislation

Legislation is law which has been promulgated by a legislature or other governing body, or the process of making it...

conflicted with the due process

Due process

Due process is the legal code that the state must venerate all of the legal rights that are owed to a person under the principle. Due process balances the power of the state law of the land and thus protects individual persons from it...

provisions of both the United States and Massachusetts Constitution, and were therefore null and void

Void (law)

In law, void means of no legal effect. An action, document or transaction which is void is of no legal effect whatsoever: an absolute nullity - the law treats it as if it had never existed or happened....

. Further relief requested was a statement that the legislation itself was contrary to the Article XVIII requirement that all Massachusetts laws uphold the principle of frugality

Frugality

Frugality is the quality of being frugal, sparing, thrifty, prudent or economical in the use of consumable resources such as food, time or money, and avoiding waste, lavishness or extravagance....

and was therefore also null and void, as well as a statement that the legislation was contrary to constitutional provisions requiring compensation for eminent domain

Eminent domain

Eminent domain , compulsory purchase , resumption/compulsory acquisition , or expropriation is an action of the state to seize a citizen's private property, expropriate property, or seize a citizen's rights in property with due monetary compensation, but without the owner's consent...

(the forced use of private property

Private property

Private property is the right of persons and firms to obtain, own, control, employ, dispose of, and bequeath land, capital, and other forms of property. Private property is distinguishable from public property, which refers to assets owned by a state, community or government rather than by...

for a public purpose

Public use

Public use is a legal requirement under the takings clause of the Fifth Amendment of the U.S...

), as no provisions were made in that law to provide that compensation.

A petition for a writ of mandamus

Mandamus

A writ of mandamus or mandamus , or sometimes mandate, is the name of one of the prerogative writs in the common law, and is "issued by a superior court to compel a lower court or a government officer to perform mandatory or purely ministerial duties correctly".Mandamus is a judicial remedy which...

to the Massachusetts Supreme Judicial Court

Massachusetts Supreme Judicial Court

The Massachusetts Supreme Judicial Court is the highest court in the Commonwealth of Massachusetts. The SJC has the distinction of being the oldest continuously functioning appellate court in the Western Hemisphere.-History:...

, ordering Essex Superior Court to vacate this dismissal on procedural grounds, the failure to provide trial by jury in a dispute over property as requested by the plaintiff, was denied by Massachusetts Supreme Court Justice J. Spina. An Appeal was then filed with the Massachusetts Appeal Court. A later petition for a writ of mandamus with the Massachusetts Supreme Court, ordering the Appeals Court to vacate the dismissal on procedural grounds, as above, and to return the case to Essex Superior Court for trial by jury, was also denied, this time by Justice J. Ireland. The Appeals Court then heard the appeal and declined to send the case back to Essex Superior Court for trial by jury based on their belief that no facts needed to be determined and therefore trial by jury in this case was not a protected right under either the US or Massachusetts Constitutions. It further declined to answer 14 questions posed to it "designed to focus its attention on the issues". An appeal to the Massachusetts Supreme Judicial Court contented that the Appeals Court manufactured at least one of the rulings (Fidelity & Deposit Co. of Md. v. US) it cited regarding the constitutional right to jury trial if the court regarded there to be no issue of material fact in dispute. The Supreme Judicial Court of Massachusetts however declined to hear any further appeals.

See also

- Massachusetts general election, 2006Massachusetts general election, 2006A Massachusetts general election was held on November 7, 2006 in the Commonwealth of Massachusetts.The election included:* statewide elections for U.S. Senator, Governor, Lieutenant Governor, Attorney General, Secretary of the Commonwealth, Treasurer, and Auditor;* district elections for U.S...

- Patient Protection and Affordable Care ActPatient Protection and Affordable Care ActThe Patient Protection and Affordable Care Act is a United States federal statute signed into law by President Barack Obama on March 23, 2010. The law is the principal health care reform legislation of the 111th United States Congress...

Further reading

- Commonwealth of Massachusetts, Division of Health Care Finance and Policy (DHCFP) publications list

- Pulos, Vicky, MassHealth Advocacy Guide, Massachusetts Law Reform Institute (MLRI) and Massachusetts Continuing Legal Education, Inc. (MCLE), Massachusetts Legal Services, 2009 edition, updated again in 2010 (3/18/2010)

External links

- Commonwealth Health Insurance Connector Authority Official web site. Describes the Massachusetts health reform act, authorized health insurance plans, regulations issued, board members and board minutes.

- Health Reform Timeline Month-by-month chronology of the passage and implementation of the Massachusetts health reform law.

- About.com's Pros & Cons of Massachusetts' Mandatory Health Insurance Program

- EOHHS Health Reform Reports to Massachusetts legislature Bi-monthly progress reports on the implementation of Massachusetts health reform.

- The Massachusetts Health Reform Law: Public Opinion and Perception A Report for the Blue Cross Blue Shield of Massachusetts Foundation. November 2006.

- Lessons learned to date from the Massachusetts Healthcare Reform by Celia Wcislo (August 2007) (Celia Wcislo, is a Board Member of the Massachusetts Commonwealth Health Insurance Connector Authority) Publisher: Local 1199 Service Employees International Union (SEIU) United Healthcare Workers East.

- Presentation by Governor Mitt Romney, January 26, 2006 Massachusetts Health Care Reform. The Heritage Foundation, Washington D.C. (Using Power Point visuals. Available as video, or audio MP3)

- [Masshealth Customer Service Best Practices