International taxation

Encyclopedia

International taxation is the study or determination of tax

on a person or business subject to the tax law

s of different countries or the international

aspects of an individual country's tax laws. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial

income. The manner of limitation generally takes the form of a territorial, residency, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more.

Many governments tax individuals and/or enterprises on income. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation

(where the same income is taxed by different countries) and no taxation (where income is not taxed by any country). Income tax systems may impose tax on local income only or on worldwide income. Generally, where worldwide income is taxed, reductions of tax

or foreign credits

are provided for taxes paid to other jurisdiction

s. Limits are almost universally imposed on such credits. Multinational corporation

s usually employ international tax specialists, a specialty among both lawyers and accountants, to decrease their worldwide tax liabilities.

With any system of taxation, it is possible to shift or re-characterize income in a manner that reduces taxation

. Jurisdictions often impose rules relating to shifting income among commonly controlled parties, often referred to as transfer pricing

rules. Residency based systems are subject to taxpayer attempts to defer recognition of income

through use of related parties. A few jurisdictions impose rules limiting such deferral

(“anti-deferral” regimes). Deferral is also specifically authorized by some governments for particular social purposes or other grounds. Agreements among governments (treaties) often attempt to determine who should be entitled to tax what. Most tax treaties provide for at least a skeleton mechanism for resolution of disputes between the parties.

under local accounting concepts, gross receipts

, gross margin

s (sales less costs of sale), or specific categories of receipts less specific categories of reductions

. Unless otherwise specified, the term “income” should be read broadly.

Jurisdictions often impose different income based levies on enterprises than on individuals. Entities are often taxed in a unified manner on all types of income while individuals are taxed in differing manners depending on the nature or source of the income. Many jurisdictions impose tax at both an entity level and at the owner level on one or more types of enterprises. These jurisdictions often rely on the company law of that jurisdiction or other jurisdictions in determining whether an entity’s owners are to be taxed directly on the entity income. However, there are notable exceptions, including U.S. rules characterizing entities independently of legal form.

In order to simplify administration or for other agendas, some governments have imposed “deemed” income regimes. These regimes tax some class of taxpayers according to tax system applicable to other taxpayers but based on a deemed level of income, as if earned by the taxpayer. Disputes can arise regarding what levy is proper. Procedures for dispute resolution vary widely and enforcement issues are far more complicated in the international arena. The ultimate dispute resolution for a taxpayer is to leave the jurisdiction, taking all property that could be seized. For governments, the ultimate resolution may be confiscation of property

, dissolution of the entity, or even the death penalty.

Other major conceptual differences can exist between tax systems. These include, but are not limited to, assessment vs. self-assessment means of determining and collecting tax; methods of imposing sanctions for violation; sanctions unique to international aspects of the system; mechanisms for enforcement and collection of tax; and reporting mechanisms.

Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more. For example, they may tax based on residency but provide a specific amount of exclusion for certain foreign income. Alternatively, they may tax income sourced in the country as well as that remitted to the country. Most countries tax gains on dispositions of realty within the country, regardless of residency or their system of taxation.

A few countries tax only income earned within their borders. For example, the Hong Kong Inland Revenue Ordinance imposes income tax only on income earned from a business or source within Hong Kong. Such systems tend to tax residents and nonresidents alike. The key problem argued for this type of territorial system is the ability to avoid taxation on portable income by moving it offshore. This has led governments to enact hybrid systems to recover lost revenue.

A few countries tax only income earned within their borders. For example, the Hong Kong Inland Revenue Ordinance imposes income tax only on income earned from a business or source within Hong Kong. Such systems tend to tax residents and nonresidents alike. The key problem argued for this type of territorial system is the ability to avoid taxation on portable income by moving it offshore. This has led governments to enact hybrid systems to recover lost revenue.

and taxation in the United Kingdom

. Residency based systems face the daunting tasks of defining resident and characterizing the income of nonresidents. Such definitions vary by country and type of taxpayer. Examples include:

Many systems allow for fiscal transparency of certain forms of enterprise. For example, most countries tax partners of a partnership, rather than the partnership itself, on income of the partnership. A common feature of income taxation is imposition of a levy

on certain enterprises in certain forms followed by an additional levy on owners of the enterprise upon distribution of such income. Thus, many countries tax corporations under company tax rules and tax individual shareholders upon corporate distributions. Various countries have tried (and some still maintain) attempts at partial or full “integration” of the enterprise and owner taxation. Where a two level system is present but allows for fiscal transparency of some entities, definitional issues become very important.

received from a non-Hong Kong corporation. Source of income is also important in residency systems that grant credits for taxes of other jurisdictions. Such credit is often limited either by jurisdiction or to the local tax on overall income from other jurisdictions.

Source of income is where the income is considered to arise under the relevant tax system. The manner of determining the source of income is generally dependent on the nature of income. Income from the performance of services (e.g., wages) is generally treated as arising where the services are performed. Financing income (e.g., interest, dividends) is generally treated as arising where the user of the financing resides. Income related to use of tangible property

(e.g., rents) is generally treated as arising where the property is situated. Income related to use of intangible property

(e.g., royalties) is generally treated as arising where the property is used. Gains on sale of realty are generally treated as arising where the property is situated.

Gains from sale of tangible personal property are sourced differently in different jurisdictions. The U.S. treats such gains in three distinct manners: a) gain from sale of purchased inventory is sourced based on where title to the goods passes; b) gain from sale of inventory produced by the person (or certain related persons) is sourced 50% based on title passage and 50% based on location of production and certain assets; c) other gains are sourced based on the residence of the seller.

Where differing characterizations of an item of income can result in differing tax results, it is necessary to determine the characterization. Some systems have rules for resolving characterization issues, but in many cases resolution requires judicial intervention. Note that some systems which allow a credit for foreign taxes source income by reference to foreign law.

as determined under financial accounting concepts of that jurisdiction, with few, if any, modifications. Other jurisdictions determine taxable income

without regard to income reported in financial statements

. Some jurisdictions compute taxable income by reference to financial statement income with specific categories of adjustments, which can be significant.

A jurisdiction relying on financial statement income

tends to place reliance on the judgment of local accountants for determinations of income under locally accepted accounting principles. Often such jurisdictions have a requirement that financial statements be audited by registered accountants who must opine thereon. Some jurisdictions extend the audit requirements to include opining on such tax issues as transfer pricing

. Jurisdictions not relying on financial statement income must attempt to define principles of income and expense recognition

, asset cost recovery

, matching

, and other concepts within the tax law. These definitional issues can become very complex. Some jurisdictions following this approach also require business taxpayers to provide a reconciliation of financial statement and taxable incomes.

must provide for rules for allocating such expenses between classes of income. Such classes may be taxable versus non-taxable, or may relate to computations of credits for taxes of other systems (foreign taxes). A system which does not provide such rules is subject to manipulation by potential taxpayers. The manner of allocation of expenses varies. U.S. rules provide for allocation of an expense to a class of income if the expense directly relates to such class, and apportionment of an expense related to multiple classes. Specific rules are provided for certain categories of more fungible expenses, such as interest. By their nature, rules for allocation and apportionment of expenses may become complex. They may incorporate cost accounting

or branch accounting principles, or may define new principles.

s rather than capital

. Many jurisdictions have adopted "thin capitalization" rules to limit such charges. Various approaches include limiting deductibility of interest expense to a portion of cash flow

, disallowing interest expense on debt

in excess of a certain ratio, and other mechanisms.

from other jurisdictions. Such computations tend to rely heavily on the source of income and allocation of expense rules of the system.

Tax treaties exist between many countries on a bilateral basis to prevent double taxation

Tax treaties exist between many countries on a bilateral basis to prevent double taxation

(tax

es levied twice on the same income

, profit

, capital gain

, inheritance

or other item). In some countries they are also known as double taxation agreements, double tax treaties, or tax information exchange agreements (TIEA).

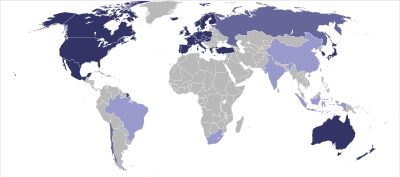

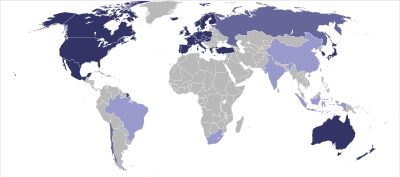

Most developed countries have a large number of tax treaties, while developing countries are less well represented in the worldwide tax treaty network. The United Kingdom

has treaties with more than 110 countries and territories. The United States

has treaties with 56 countries (as of February 2007). Tax treaties tend not to exist, or to be of limited application, when either party regards the other as a tax haven

. There are a number of model tax treaties published by various national and international bodies, such as the United Nations

and the OECD.

Treaties tend to provide reduced rates of taxation on dividends, interest

, and royalties

. They tend to impose limits on each treaty country in taxing business profits, permitting taxation only in the presence of a permanent establishment

in the country. Treaties tend to impose limits on taxation of salaries and other income for performance of services. They also tend to have “tie breaker” clauses for resolving conflicts between residency rules. Nearly all treaties have at least skeletal mechanisms for resolving disputes, generally negotiated between the “competent authority” section of each country’s taxing authority.

offshore income without shifting it to a subsidiary enterprise due to the potential for manipulation of such rules. Where owners of an enterprise are taxed separately from the enterprise, portable income may be shifted from a taxpayer to a subsidiary enterprise to accomplish deferral or elimination of tax. Such systems tend to have rules to limit such deferral through controlled foreign corporation

s. Several different approaches have been used by countries for their anti-deferral rules.

In the United States

, rules provides that U.S. shareholders of a Controlled Foreign Corporation

(CFC) must include their shares of income or investment of E&P by the CFC in U.S. property. U.S. shareholders are U.S. persons owning 10% or more (after the application of complex attribution of ownership rules) of a foreign corporation. Such persons may include individuals, corporations, partnerships, trusts, estates, and other juridical persons. A CFC is a foreign corporation more than 50% owned by U.S. shareholders. This income includes several categories of portable income, including most investment income, certain resale income, and certain services income. Certain exceptions apply, including the exclusion from Subpart F income of CFC income subject to an effective foreign tax rate of 90% or more of the top U.S. tax rate.

The United Kingdom

provides that a UK company is taxed currently on the income of its controlled subsidiary companies managed and controlled outside the UK which are subject to “low” foreign taxes. Low tax is determined as actual tax of less than three-fourths of the corresponding UK tax that would be due on the income determined under UK principles. Complexities arise in computing the corresponding UK tax. Further, there are certain exceptions which may permit deferral, including a “white list” of permitted countries and a 90% earnings distribution policy of the controlled company. Further, anti-deferral does not apply where there is no tax avoidance motive.

Rules in Germany

provide that a German individual or company shareholder of a foreign corporation may be subject to current German tax on certain passive income earned by the foreign corporation. This provision applies if the foreign corporation is taxed at less than 25% of the passive income, as defined. Japan

and some other countries have followed a “black list

” approach, where income of subsidiaries in countries identified as tax haven

s is subject to current tax to the shareholder. Sweden

has adopted a “white list

” of countries in which subsidiaries may be organized so that the shareholder is not subject to current tax.

Arm's length principle

: a key concept of most transfer pricing rules is that prices charged between related enterprises should be those which would be charged between unrelated parties dealing at arm’s length. Most sets of rules prescribe methods for testing whether prices charged should be considered to meet this standard. Such rules generally involve comparison of related party transactions to similar transactions of unrelated parties (comparable prices or transactions). Various surrogates for such transactions may be allowed. Most guidelines allow the following methods for testing prices: Comparable uncontrolled transaction prices, resale prices based on comparable markups, cost plus a markup, and an enterprise profitability method.

Tax

To tax is to impose a financial charge or other levy upon a taxpayer by a state or the functional equivalent of a state such that failure to pay is punishable by law. Taxes are also imposed by many subnational entities...

on a person or business subject to the tax law

Tax law

Tax law is the codified system of laws that describes government levies on economic transactions, commonly called taxes.-Major issues:Primary taxation issues facing the governments world over include;* taxes on income and wealth...

s of different countries or the international

International

----International mostly means something that involves more than one country. The term international as a word means involvement of, interaction between or encompassing more than one nation, or generally beyond national boundaries...

aspects of an individual country's tax laws. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial

Extraterritorial jurisdiction

Extraterritorial jurisdiction is the legal ability of a government to exercise authority beyond its normal boundaries.Any authority can, of course, claim ETJ over any external territory they wish...

income. The manner of limitation generally takes the form of a territorial, residency, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more.

Many governments tax individuals and/or enterprises on income. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation

Double taxation

Double taxation is the systematic imposition of two or more taxes on the same income , asset , or financial transaction . It refers to taxation by two or more countries of the same income, asset or transaction, for example income paid by an entity of one country to a resident of a different country...

(where the same income is taxed by different countries) and no taxation (where income is not taxed by any country). Income tax systems may impose tax on local income only or on worldwide income. Generally, where worldwide income is taxed, reductions of tax

Tax shield

A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. For example, because interest on debt is a tax-deductible expense, taking on debt creates a tax shield...

or foreign credits

Foreign tax credit

Income tax systems that tax residents on worldwide income generally offer a foreign tax credit to mitigate the potential for double taxation. The credit may also be granted in those systems taxing residents on income that may have been taxed in another jurisdiction...

are provided for taxes paid to other jurisdiction

Jurisdiction

Jurisdiction is the practical authority granted to a formally constituted legal body or to a political leader to deal with and make pronouncements on legal matters and, by implication, to administer justice within a defined area of responsibility...

s. Limits are almost universally imposed on such credits. Multinational corporation

Multinational corporation

A multi national corporation or enterprise , is a corporation or an enterprise that manages production or delivers services in more than one country. It can also be referred to as an international corporation...

s usually employ international tax specialists, a specialty among both lawyers and accountants, to decrease their worldwide tax liabilities.

With any system of taxation, it is possible to shift or re-characterize income in a manner that reduces taxation

Tax avoidance

Tax avoidance is the legal utilization of the tax regime to one's own advantage, to reduce the amount of tax that is payable by means that are within the law. The term tax mitigation is a synonym for tax avoidance. Its original use was by tax advisors as an alternative to the pejorative term tax...

. Jurisdictions often impose rules relating to shifting income among commonly controlled parties, often referred to as transfer pricing

Transfer pricing

Transfer pricing refers to the setting, analysis, documentation, and adjustment of charges made between related parties for goods, services, or use of property . Transfer prices among components of an enterprise may be used to reflect allocation of resources among such components, or for other...

rules. Residency based systems are subject to taxpayer attempts to defer recognition of income

Revenue recognition

The revenue recognition principle is a cornerstone of accrual accounting together with matching principle. They both determine the accounting period, in which revenues and expenses are recognized...

through use of related parties. A few jurisdictions impose rules limiting such deferral

Deferral

Deferred, in accrual accounting, is any account where the asset or liability is not realized until a future date , e.g. annuities, charges, taxes, income, etc. The deferred item may be carried, dependent on type of deferral, as either an asset or liability...

(“anti-deferral” regimes). Deferral is also specifically authorized by some governments for particular social purposes or other grounds. Agreements among governments (treaties) often attempt to determine who should be entitled to tax what. Most tax treaties provide for at least a skeleton mechanism for resolution of disputes between the parties.

Introduction

Systems of taxation vary among governments, making generalization difficult. Specifics are intended as examples, and relate to particular governments and not broadly recognized multinational rules. Taxes may be levied on varying measures of income, including but not limited to net incomeNet income

Net income is the residual income of a firm after adding total revenue and gains and subtracting all expenses and losses for the reporting period. Net income can be distributed among holders of common stock as a dividend or held by the firm as an addition to retained earnings...

under local accounting concepts, gross receipts

Gross receipts tax

A gross receipts tax or gross excise tax is a tax on the total gross revenues of a company, regardless of their source. A gross receipts tax is similar to a sales tax, but it is levied on the seller of goods or service consumers...

, gross margin

Gross margin

Gross margin is the difference between revenue and cost before accounting for certain other costs...

s (sales less costs of sale), or specific categories of receipts less specific categories of reductions

Tax shield

A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. For example, because interest on debt is a tax-deductible expense, taking on debt creates a tax shield...

. Unless otherwise specified, the term “income” should be read broadly.

Jurisdictions often impose different income based levies on enterprises than on individuals. Entities are often taxed in a unified manner on all types of income while individuals are taxed in differing manners depending on the nature or source of the income. Many jurisdictions impose tax at both an entity level and at the owner level on one or more types of enterprises. These jurisdictions often rely on the company law of that jurisdiction or other jurisdictions in determining whether an entity’s owners are to be taxed directly on the entity income. However, there are notable exceptions, including U.S. rules characterizing entities independently of legal form.

In order to simplify administration or for other agendas, some governments have imposed “deemed” income regimes. These regimes tax some class of taxpayers according to tax system applicable to other taxpayers but based on a deemed level of income, as if earned by the taxpayer. Disputes can arise regarding what levy is proper. Procedures for dispute resolution vary widely and enforcement issues are far more complicated in the international arena. The ultimate dispute resolution for a taxpayer is to leave the jurisdiction, taking all property that could be seized. For governments, the ultimate resolution may be confiscation of property

Search and seizure

Search and seizure is a legal procedure used in many civil law and common law legal systems whereby police or other authorities and their agents, who suspect that a crime has been committed, do a search of a person's property and confiscate any relevant evidence to the crime.Some countries have...

, dissolution of the entity, or even the death penalty.

Other major conceptual differences can exist between tax systems. These include, but are not limited to, assessment vs. self-assessment means of determining and collecting tax; methods of imposing sanctions for violation; sanctions unique to international aspects of the system; mechanisms for enforcement and collection of tax; and reporting mechanisms.

Taxation Systems

Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes one of three forms:- Territorial: taxation only of in-country income

- Residency: taxation of all income of residents and/or citizens

- Exclusionary: specific inclusion or exclusion of certain amounts, classes, or items of income in/from the base of taxation

Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more. For example, they may tax based on residency but provide a specific amount of exclusion for certain foreign income. Alternatively, they may tax income sourced in the country as well as that remitted to the country. Most countries tax gains on dispositions of realty within the country, regardless of residency or their system of taxation.

Territorial

Residency

Most income tax systems impose tax on the worldwide income of residents, and impose tax on the income of nonresidents from certain sources within the country. Prime examples of such residency taxation in the United StatesTaxation in the United States

The United States is a federal republic with autonomous state and local governments. Taxes are imposed in the United States at each of these levels. These include taxes on income, property, sales, imports, payroll, estates and gifts, as well as various fees.Taxes are imposed on net income of...

and taxation in the United Kingdom

Taxation in the United Kingdom

Taxation in the United Kingdom may involve payments to a minimum of two different levels of government: The central government and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty...

. Residency based systems face the daunting tasks of defining resident and characterizing the income of nonresidents. Such definitions vary by country and type of taxpayer. Examples include:

- The U.S. provides lengthy, detailed rules for individual residency covering:

- Periods establishing residency (including a formulary calculation involving three years)

- Start and end date of residency

- Exceptions for transitory visits, medical conditions, etc.

- UK establishes three categories: non-resident, resident, and resident but not ordinarily resident.

- Switzerland residency may be established by having a permit to be employed in Switzerland for an individual who is so employed.

Exclusion

Many systems provide for specific exclusions from taxable (chargeable) income. For example, several countries, notably Cyprus, Netherlands and Spain, have enacted holding company regimes that exclude from income dividends from certain foreign subsidiaries of corporations. These systems generally impose tax on other sorts of income, such as interest or royalties, from the same subsidiaries. They also typically have requirements for portion and time of ownership in order to qualify for exclusion. The Netherlands offers a “participation exemption” for dividends from subsidiaries of Netherlands companies. Dividends from all Dutch subsidiaries automatically qualify. For other dividends to qualify, the Dutch shareholder or affiliates must own at least 5% and the subsidiary must be subject to a certain level of income tax locally.Hybrid

Some governments have chosen, for all or only certain classes of taxpayers, to adopt systems that are a combination of territorial, residency, or exclusionary. There is no pattern to these hybrids. Following are examples:- The U.S. allows individuals earning income from their personal services outside the U.S. — an exclusion of up to US$80,000 (indexed for inflation from a key date) from compensation for such services. Compensation income in excess of this amount is fully taxable to citizens and residents.

- The UK imposes a charge to tax on individuals “resident but not ordinarily resident” in the UK based on income earned in or remitted to the UK.

- Singapore imposes income tax on resident individuals and companies on all income earned in or remitted to Singapore.

Individuals vs. enterprises

Many tax systems tax individuals in one manner and entities that are not considered fiscally transparent in another. The differences may be as simple as differences in tax rates, and are often motivated by concerns unique to either individuals or corporations. For example, many systems allow taxable income of an individual to be reduced by a fixed amount allowance for other persons supported by the individual (dependents). Such a concept is not relevant for enterprises.Many systems allow for fiscal transparency of certain forms of enterprise. For example, most countries tax partners of a partnership, rather than the partnership itself, on income of the partnership. A common feature of income taxation is imposition of a levy

Tax

To tax is to impose a financial charge or other levy upon a taxpayer by a state or the functional equivalent of a state such that failure to pay is punishable by law. Taxes are also imposed by many subnational entities...

on certain enterprises in certain forms followed by an additional levy on owners of the enterprise upon distribution of such income. Thus, many countries tax corporations under company tax rules and tax individual shareholders upon corporate distributions. Various countries have tried (and some still maintain) attempts at partial or full “integration” of the enterprise and owner taxation. Where a two level system is present but allows for fiscal transparency of some entities, definitional issues become very important.

Source of income

Determining the source of income is of critical importance in a territorial system, as source often determines whether or not the income is taxed. For example, Hong Kong does not tax residents on dividend incomeDividend

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business , or it can be distributed to...

received from a non-Hong Kong corporation. Source of income is also important in residency systems that grant credits for taxes of other jurisdictions. Such credit is often limited either by jurisdiction or to the local tax on overall income from other jurisdictions.

Source of income is where the income is considered to arise under the relevant tax system. The manner of determining the source of income is generally dependent on the nature of income. Income from the performance of services (e.g., wages) is generally treated as arising where the services are performed. Financing income (e.g., interest, dividends) is generally treated as arising where the user of the financing resides. Income related to use of tangible property

Tangible property

Tangible property in law is, literally, anything which can be touched, and includes both real property and personal property , and stands in distinction to intangible property....

(e.g., rents) is generally treated as arising where the property is situated. Income related to use of intangible property

Intangible property

Intangible property, also known as incorporeal property, describes something which a person or corporation can have ownership of and can transfer ownership of to another person or corporation, but has no physical substance. It generally refers to statutory creations such as copyright, trademarks,...

(e.g., royalties) is generally treated as arising where the property is used. Gains on sale of realty are generally treated as arising where the property is situated.

Gains from sale of tangible personal property are sourced differently in different jurisdictions. The U.S. treats such gains in three distinct manners: a) gain from sale of purchased inventory is sourced based on where title to the goods passes; b) gain from sale of inventory produced by the person (or certain related persons) is sourced 50% based on title passage and 50% based on location of production and certain assets; c) other gains are sourced based on the residence of the seller.

Where differing characterizations of an item of income can result in differing tax results, it is necessary to determine the characterization. Some systems have rules for resolving characterization issues, but in many cases resolution requires judicial intervention. Note that some systems which allow a credit for foreign taxes source income by reference to foreign law.

Definitions of income

Some jurisdictions tax net incomeNet income

Net income is the residual income of a firm after adding total revenue and gains and subtracting all expenses and losses for the reporting period. Net income can be distributed among holders of common stock as a dividend or held by the firm as an addition to retained earnings...

as determined under financial accounting concepts of that jurisdiction, with few, if any, modifications. Other jurisdictions determine taxable income

Taxable income

Taxable income refers to the base upon which an income tax system imposes tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. The amounts included as income, expenses, and other deductions vary by country or system. Many systems provide that...

without regard to income reported in financial statements

Financial statements

A financial statement is a formal record of the financial activities of a business, person, or other entity. In British English—including United Kingdom company law—a financial statement is often referred to as an account, although the term financial statement is also used, particularly by...

. Some jurisdictions compute taxable income by reference to financial statement income with specific categories of adjustments, which can be significant.

A jurisdiction relying on financial statement income

Income statement

Income statement is a company's financial statement that indicates how the revenue Income statement (also referred to as profit and loss statement (P&L), statement of financial performance, earnings statement, operating statement or statement of operations) is a company's financial statement that...

tends to place reliance on the judgment of local accountants for determinations of income under locally accepted accounting principles. Often such jurisdictions have a requirement that financial statements be audited by registered accountants who must opine thereon. Some jurisdictions extend the audit requirements to include opining on such tax issues as transfer pricing

Transfer pricing

Transfer pricing refers to the setting, analysis, documentation, and adjustment of charges made between related parties for goods, services, or use of property . Transfer prices among components of an enterprise may be used to reflect allocation of resources among such components, or for other...

. Jurisdictions not relying on financial statement income must attempt to define principles of income and expense recognition

Revenue recognition

The revenue recognition principle is a cornerstone of accrual accounting together with matching principle. They both determine the accounting period, in which revenues and expenses are recognized...

, asset cost recovery

Cost basis

Basis , as used in United States tax law, is the original cost of property, adjusted for factors such as depreciation. When property is sold, the taxpayer pays/ taxes on a capital gain/ that equals the amount realized on the sale minus the sold property's basis.The taxpayer deserves a tax-free...

, matching

Matching principle

The matching principle is a culmination of accrual accounting and the revenue recognition principle. They both determine the accounting period, in which revenues and expenses are recognized. According to the principle, expenses are recognized when obligations are incurred The matching principle...

, and other concepts within the tax law. These definitional issues can become very complex. Some jurisdictions following this approach also require business taxpayers to provide a reconciliation of financial statement and taxable incomes.

Deductions

Systems that allow a tax deduction of expenses in computing taxable incomeTaxable income

Taxable income refers to the base upon which an income tax system imposes tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. The amounts included as income, expenses, and other deductions vary by country or system. Many systems provide that...

must provide for rules for allocating such expenses between classes of income. Such classes may be taxable versus non-taxable, or may relate to computations of credits for taxes of other systems (foreign taxes). A system which does not provide such rules is subject to manipulation by potential taxpayers. The manner of allocation of expenses varies. U.S. rules provide for allocation of an expense to a class of income if the expense directly relates to such class, and apportionment of an expense related to multiple classes. Specific rules are provided for certain categories of more fungible expenses, such as interest. By their nature, rules for allocation and apportionment of expenses may become complex. They may incorporate cost accounting

Cost accounting

Cost accounting information is designed for managers. Since managers are taking decisions only for their own organization, there is no need for the information to be comparable to similar information from other organizations...

or branch accounting principles, or may define new principles.

Thin capitalization

Most jurisdictions provide that taxable income may be reduced by amounts expended as interest on loans. By contrast, most do not provide tax relief for distributions to owners. Thus, an enterprise is motivated to finance its subsidiary enterprises through loanLoan

A loan is a type of debt. Like all debt instruments, a loan entails the redistribution of financial assets over time, between the lender and the borrower....

s rather than capital

Financial capital

Financial capital can refer to money used by entrepreneurs and businesses to buy what they need to make their products or provide their services or to that sector of the economy based on its operation, i.e. retail, corporate, investment banking, etc....

. Many jurisdictions have adopted "thin capitalization" rules to limit such charges. Various approaches include limiting deductibility of interest expense to a portion of cash flow

Cash flow

Cash flow is the movement of money into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation.Cash flow...

, disallowing interest expense on debt

Debt

A debt is an obligation owed by one party to a second party, the creditor; usually this refers to assets granted by the creditor to the debtor, but the term can also be used metaphorically to cover moral obligations and other interactions not based on economic value.A debt is created when a...

in excess of a certain ratio, and other mechanisms.

Enterprise restructure

The organization or reorganization of portions of a multinational enterprise often gives rise to events that, absent rules to the contrary, may be taxable in a particular system. Most systems contain rules preventing recognition of income or loss from certain types of such events. In the simplest form, contribution of business assets to a subsidiary enterprise may, in certain circumstances, be treated as a nontaxable event. Rules on structuring and restructuring tend to be highly complex.Credits for taxes of other jurisdictions

Systems that tax income earned outside the system’s jurisdiction tend to provide for a unilateral credit or offset for taxes paid to other jurisdictions. Such other jurisdiction taxes are generally referred to within the system as “foreign” taxes. Tax treaties often require this credit. A credit for foreign taxes is subject to manipulation by planners if there are no limits, or weak limits, on such credit. Generally, the credit is at least limited to the tax within the system that the taxpayer would pay on income earned outside the jurisdiction. The credit may be limited by category of income, by other jurisdiction or country, based on an effective tax rate, or otherwise. Where the foreign tax credit is limited, such limitation may involve computation of taxable incomeTaxable income

Taxable income refers to the base upon which an income tax system imposes tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. The amounts included as income, expenses, and other deductions vary by country or system. Many systems provide that...

from other jurisdictions. Such computations tend to rely heavily on the source of income and allocation of expense rules of the system.

Withholding tax

Many jurisdictions require persons paying amounts to nonresidents to collect tax due from a nonresident with respect to certain income by withholding such tax from such payments and remitting the tax to the government. Such levies are generally referred to as withholding taxes. These requirements are induced because of potential difficulties in collection of the tax from nonresidents. Withholding taxes are often imposed at rates differing from the prevailing income tax rates. Further, the rate of withholding may vary by type of income or type of recipient. Generally, withholding taxes are reduced or eliminated under income tax treaties (see below). Generally, withholding taxes are imposed on the gross amount of income, unreduced by expenses. Such taxation provides for great simplicity of administration but can also reduce the taxpayer's awareness of the amount of tax being collected.Treaties

Double taxation

Double taxation is the systematic imposition of two or more taxes on the same income , asset , or financial transaction . It refers to taxation by two or more countries of the same income, asset or transaction, for example income paid by an entity of one country to a resident of a different country...

(tax

Tax

To tax is to impose a financial charge or other levy upon a taxpayer by a state or the functional equivalent of a state such that failure to pay is punishable by law. Taxes are also imposed by many subnational entities...

es levied twice on the same income

Income

Income is the consumption and savings opportunity gained by an entity within a specified time frame, which is generally expressed in monetary terms. However, for households and individuals, "income is the sum of all the wages, salaries, profits, interests payments, rents and other forms of earnings...

, profit

Profit (accounting)

In accounting, profit can be considered to be the difference between the purchase price and the costs of bringing to market whatever it is that is accounted as an enterprise in terms of the component costs of delivered goods and/or services and any operating or other expenses.-Definition:There are...

, capital gain

Capital gain

A capital gain is a profit that results from investments into a capital asset, such as stocks, bonds or real estate, which exceeds the purchase price. It is the difference between a higher selling price and a lower purchase price, resulting in a financial gain for the investor...

, inheritance

Inheritance

Inheritance is the practice of passing on property, titles, debts, rights and obligations upon the death of an individual. It has long played an important role in human societies...

or other item). In some countries they are also known as double taxation agreements, double tax treaties, or tax information exchange agreements (TIEA).

Most developed countries have a large number of tax treaties, while developing countries are less well represented in the worldwide tax treaty network. The United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

has treaties with more than 110 countries and territories. The United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

has treaties with 56 countries (as of February 2007). Tax treaties tend not to exist, or to be of limited application, when either party regards the other as a tax haven

Tax haven

A tax haven is a state or a country or territory where certain taxes are levied at a low rate or not at all while offering due process, good governance and a low corruption rate....

. There are a number of model tax treaties published by various national and international bodies, such as the United Nations

United Nations

The United Nations is an international organization whose stated aims are facilitating cooperation in international law, international security, economic development, social progress, human rights, and achievement of world peace...

and the OECD.

Treaties tend to provide reduced rates of taxation on dividends, interest

Interest

Interest is a fee paid by a borrower of assets to the owner as a form of compensation for the use of the assets. It is most commonly the price paid for the use of borrowed money, or money earned by deposited funds....

, and royalties

Royalties

Royalties are usage-based payments made by one party to another for the right to ongoing use of an asset, sometimes an intellectual property...

. They tend to impose limits on each treaty country in taxing business profits, permitting taxation only in the presence of a permanent establishment

Permanent establishment

A permanent establishment is a fixed place of business which generally gives rise to income or value added tax liability in a particular jurisdiction. The term is defined in many income tax treaties and most European Union Value Added Tax systems. The tax systems in some civil law countries...

in the country. Treaties tend to impose limits on taxation of salaries and other income for performance of services. They also tend to have “tie breaker” clauses for resolving conflicts between residency rules. Nearly all treaties have at least skeletal mechanisms for resolving disputes, generally negotiated between the “competent authority” section of each country’s taxing authority.

Anti-deferral measures

Residency systems may provide that residents are not subject to tax on income outside the jurisdiction until that income is remitted to the jurisdiction. Taxpayers in such systems have significant incentives to shift income offshore. Depending on the rules of the system, the shifting may occur by changing the location of activities generating income or by shifting income to separate enterprises owned by the taxpayer. Most residency systems have avoided rules which permit deferringDeferral

Deferred, in accrual accounting, is any account where the asset or liability is not realized until a future date , e.g. annuities, charges, taxes, income, etc. The deferred item may be carried, dependent on type of deferral, as either an asset or liability...

offshore income without shifting it to a subsidiary enterprise due to the potential for manipulation of such rules. Where owners of an enterprise are taxed separately from the enterprise, portable income may be shifted from a taxpayer to a subsidiary enterprise to accomplish deferral or elimination of tax. Such systems tend to have rules to limit such deferral through controlled foreign corporation

Foreign corporation

A foreign corporation is a term used in the United States for an existing corporation that is registered to do business in a state or other jurisdiction other than where it was originally incorporated...

s. Several different approaches have been used by countries for their anti-deferral rules.

In the United States

United States

The United States of America is a federal constitutional republic comprising fifty states and a federal district...

, rules provides that U.S. shareholders of a Controlled Foreign Corporation

Controlled Foreign Corporation

Controlled foreign corporation rules are features of an income tax system designed to limit artificial deferral of tax by using offshore low taxed entities. The rules are needed only with respect to income of entities that is not currently taxed to the owners of the entity. The basic mechanism and...

(CFC) must include their shares of income or investment of E&P by the CFC in U.S. property. U.S. shareholders are U.S. persons owning 10% or more (after the application of complex attribution of ownership rules) of a foreign corporation. Such persons may include individuals, corporations, partnerships, trusts, estates, and other juridical persons. A CFC is a foreign corporation more than 50% owned by U.S. shareholders. This income includes several categories of portable income, including most investment income, certain resale income, and certain services income. Certain exceptions apply, including the exclusion from Subpart F income of CFC income subject to an effective foreign tax rate of 90% or more of the top U.S. tax rate.

The United Kingdom

United Kingdom

The United Kingdom of Great Britain and Northern IrelandIn the United Kingdom and Dependencies, other languages have been officially recognised as legitimate autochthonous languages under the European Charter for Regional or Minority Languages...

provides that a UK company is taxed currently on the income of its controlled subsidiary companies managed and controlled outside the UK which are subject to “low” foreign taxes. Low tax is determined as actual tax of less than three-fourths of the corresponding UK tax that would be due on the income determined under UK principles. Complexities arise in computing the corresponding UK tax. Further, there are certain exceptions which may permit deferral, including a “white list” of permitted countries and a 90% earnings distribution policy of the controlled company. Further, anti-deferral does not apply where there is no tax avoidance motive.

Rules in Germany

Germany

Germany , officially the Federal Republic of Germany , is a federal parliamentary republic in Europe. The country consists of 16 states while the capital and largest city is Berlin. Germany covers an area of 357,021 km2 and has a largely temperate seasonal climate...

provide that a German individual or company shareholder of a foreign corporation may be subject to current German tax on certain passive income earned by the foreign corporation. This provision applies if the foreign corporation is taxed at less than 25% of the passive income, as defined. Japan

Japan

Japan is an island nation in East Asia. Located in the Pacific Ocean, it lies to the east of the Sea of Japan, China, North Korea, South Korea and Russia, stretching from the Sea of Okhotsk in the north to the East China Sea and Taiwan in the south...

and some other countries have followed a “black list

Black List

Black List is the second of two L.A. Guns compilation albums featuring their third singer Paul Black.-Track listing:#"Stranded in L.A."#"L.A.P.D."#"Show No Mercy"#"One More Reason to Die"#"Looking Over My Shoulder"#"Love & Hate"#"On And On"...

” approach, where income of subsidiaries in countries identified as tax haven

Tax haven

A tax haven is a state or a country or territory where certain taxes are levied at a low rate or not at all while offering due process, good governance and a low corruption rate....

s is subject to current tax to the shareholder. Sweden

Sweden

Sweden , officially the Kingdom of Sweden , is a Nordic country on the Scandinavian Peninsula in Northern Europe. Sweden borders with Norway and Finland and is connected to Denmark by a bridge-tunnel across the Öresund....

has adopted a “white list

White list

Whitelist is a term used to describe a list or register of entities that, for one reason or another, are being provided a particular privilege, service, mobility, access or recognition. As a verb, to whitelist can mean to authorize access or grant membership...

” of countries in which subsidiaries may be organized so that the shareholder is not subject to current tax.

Transfer pricing

The setting of the amount of related party charges is commonly referred to as transfer pricing. Many jurisdictions have become sensitive to the potential for shifting profits with transfer pricing, and have adopted rules regulating setting or testing of prices or allowance of deductions or inclusion of income for related party transactions. Many jurisdictions have adopted broadly similar transfer pricing rules. The OECD has adopted (subject to specific country reservations) fairly comprehensive guidelines. These guidelines have been adopted with little modification by many countries. Notably, the U.S. and Canada have adopted rules which depart in some material respects from OECD guidelines, generally by providing more detailed rules.Arm's length principle

Arm's length principle

The arm's length principle is the condition or the fact that the parties to a transaction are independent and on an equal footing. Such a transaction is known as an "arm's-length transaction"...

: a key concept of most transfer pricing rules is that prices charged between related enterprises should be those which would be charged between unrelated parties dealing at arm’s length. Most sets of rules prescribe methods for testing whether prices charged should be considered to meet this standard. Such rules generally involve comparison of related party transactions to similar transactions of unrelated parties (comparable prices or transactions). Various surrogates for such transactions may be allowed. Most guidelines allow the following methods for testing prices: Comparable uncontrolled transaction prices, resale prices based on comparable markups, cost plus a markup, and an enterprise profitability method.

See also

- Public financePublic financePublic finance is the revenue and expenditure of public authoritiesThe purview of public finance is considered to be threefold: governmental effects on efficient allocation of resources, distribution of income, and macroeconomic stabilization.-Overview:The proper role of government provides a...

- Tax rates around the worldTax rates around the worldComparison of tax rates around the world is difficult and somewhat subjective. Tax laws in most countries are extremely complex, and tax burden falls differently on different groups in each country and sub-national unit. The graph below gives an indication by rank of some raw...

- Tax equalizationTax EqualizationWhen one is a taxpayer in one country, but works in another, one may be subject to different taxation from if one had worked in one's home country, or even to double taxation, even taking account of tax treaties between countries. Tax equalization is the offsetting of any such difference so that...

- Tax treatyTax treatyMany countries have agreed with other countries in treaties to mitigate the effects of double taxation . Tax treaties may cover income taxes, inheritance taxes, value added taxes, or other taxes...

- Functional currencyFunctional currencyFunctional currency refers to the main currency used by a business or unit of a business. It is the monetary unit of account of the principal economic environment in which an economic entity operates....

External links

- Hong Kong IRD

- India Income Tax Department

- UK HM Revenue & Customs (formerly Inland Revenue)

- UK International Manual (non-technical guidance)

- U.S. law by code section

- U.S. regs

- USTC post-94 decisions

- USSC cases 1937-1975