Internal rate of return

Overview

Rate of return

In finance, rate of return , also known as return on investment , rate of profit or sometimes just return, is the ratio of money gained or lost on an investment relative to the amount of money invested. The amount of money gained or lost may be referred to as interest, profit/loss, gain/loss, or...

used in capital budgeting

Capital budgeting

Capital budgeting is the planning process used to determine whether an organization's long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are worth pursuing...

to measure and compare the profitability

Profit (economics)

In economics, the term profit has two related but distinct meanings. Normal profit represents the total opportunity costs of a venture to an entrepreneur or investor, whilst economic profit In economics, the term profit has two related but distinct meanings. Normal profit represents the total...

of investment

Investment

Investment has different meanings in finance and economics. Finance investment is putting money into something with the expectation of gain, that upon thorough analysis, has a high degree of security for the principal amount, as well as security of return, within an expected period of time...

s. It is also called the discounted cash flow

Discounted cash flow

In finance, discounted cash flow analysis is a method of valuing a project, company, or asset using the concepts of the time value of money...

rate of return (DCFROR) or the rate of return (ROR). In the context of savings and loans the IRR is also called the effective interest rate

Effective interest rate

The effective interest rate, effective annual interest rate, annual equivalent rate or simply effective rate is the interest rate on a loan or financial product restated from the nominal interest rate as an interest rate with annual compound interest payable in arrears.It is used to compare the...

. The term internal refers to the fact that its calculation does not incorporate environmental factors (e.g., the interest rate

Interest rate

An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for...

or inflation).

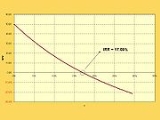

The internal rate of return on an investment or project is the "annualized effective compounded return rate" or "rate of return" that makes the net present value

Net present value

In finance, the net present value or net present worth of a time series of cash flows, both incoming and outgoing, is defined as the sum of the present values of the individual cash flows of the same entity...

(NPV as NET*1/(1+IRR)^year) of all cash flows (both positive and negative) from a particular investment equal to zero.

In more specific terms, the IRR of an investment is the discount rate

Discount rate

The discount rate can mean*an interest rate a central bank charges depository institutions that borrow reserves from it, for example for the use of the Federal Reserve's discount window....

at which the net present value

Net present value

In finance, the net present value or net present worth of a time series of cash flows, both incoming and outgoing, is defined as the sum of the present values of the individual cash flows of the same entity...

of costs (negative cash flows) of the investment equals the net present value

Net present value

In finance, the net present value or net present worth of a time series of cash flows, both incoming and outgoing, is defined as the sum of the present values of the individual cash flows of the same entity...

of the benefits (positive cash flows) of the investment.

Internal rates of return are commonly used to evaluate the desirability of investments or projects.