Discounted cash flow

Encyclopedia

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

, discounted cash flow (DCF) analysis is a method of valuing a project, company, or asset

Financial asset

A financial asset is an intangible asset that derives value because of a contractual claim. Examples include bank deposits, bonds, and stocks. Financial assets are usually more liquid than tangible assets, such as land or real estate, and are traded on financial markets....

using the concepts of the time value of money

Time value of money

The time value of money is the value of money figuring in a given amount of interest earned over a given amount of time. The time value of money is the central concept in finance theory....

. All future cash flow

Cash flow

Cash flow is the movement of money into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation.Cash flow...

s are estimated and discounted to give their present value

Present value

Present value, also known as present discounted value, is the value on a given date of a future payment or series of future payments, discounted to reflect the time value of money and other factors such as investment risk...

s (PVs) — the sum of all future cash flows, both incoming and outgoing, is the net present value

Net present value

In finance, the net present value or net present worth of a time series of cash flows, both incoming and outgoing, is defined as the sum of the present values of the individual cash flows of the same entity...

(NPV), which is taken as the value or price of the cash flows in question.

Using DCF analysis to compute the NPV takes as input cash flows and a discount rate and gives as output a price; the opposite process — taking cash flows and a price and inferring a discount rate, is called the yield

Yield (finance)

In finance, the term yield describes the amount in cash that returns to the owners of a security. Normally it does not include the price variations, at the difference of the total return...

.

Discounted cash flow analysis is widely used in investment finance, real estate development, and corporate financial management.

Discount rate

The most widely used method of discounting is exponential discounting, which values future cash flows as "how much money would have to be invested currently, at a given rate of return, to yield the cash flow in future." Other methods of discounting, such as hyperbolic discountingHyperbolic discounting

In behavioral economics, hyperbolic discounting is a time-inconsistent model of discounting.Given two similar rewards, humans show a preference for one that arrives sooner rather than later. Humans are said to discount the value of the later reward, by a factor that increases with the length of the...

, are studied in academia and said to reflect intuitive decision-making, but are not generally used in industry.

The discount rate used is generally the appropriate Weighted average cost of capital

Weighted average cost of capital

The weighted average cost of capital is the rate that a company is expected to pay on average to all its security holders to finance its assets....

(WACC), that reflects the risk of the cashflows. The discount rate reflects two things:

- The time value of money (risk-free rate) – according to the theory of time preferenceTime preferenceIn economics, time preference pertains to how large a premium a consumer places on enjoyment nearer in time over more remote enjoyment....

, investors would rather have cash immediately than having to wait and must therefore be compensated by paying for the delay. - A risk premiumRisk premiumA risk premium is the minimum amount of money by which the expected return on a risky asset must exceed the known return on a risk-free asset, in order to induce an individual to hold the risky asset rather than the risk-free asset...

– reflects the extra return investors demand because they want to be compensated for the risk that the cash flow might not materialize after all.

An alternative to including the risk in the discount rate is to use the risk free rate, but multiply the future cash flows by the estimated probability that they will occur (the success rate

Success rate

Success rate is the fraction or percentage of success among a number of attempts, and may refer to:* Opportunity success rate* When success refers to attempts to induce pregnancy, then pregnancy rate is used**Artificial insemination success rates...

). This method, widely used in drug development

Drug development

Drug development is a blanket term used to define the process of bringing a new drug to the market once a lead compound has been identified through the process of drug discovery...

, is referred to as rNPV

RNPV

In finance, rNPV or eNPV is a method to value risky future cash flows. rNPV modifies the standard NPV calculation of discounted cash flow analysis by adjusting each cash flow by the estimated probability that it occurs...

(risk-adjusted NPV), and similar methods are used to incorporate credit risk

Credit risk

Credit risk is an investor's risk of loss arising from a borrower who does not make payments as promised. Such an event is called a default. Other terms for credit risk are default risk and counterparty risk....

in the probability model of CDS valuation.

Oxera (2011)

reviews the selection of a discount rate suitable for the assessment of new and emerging energy technologies.

History

Discounted cash flow calculations have been used in some form since money was first lent at interest in ancient times. As a method of asset valuation it has often been opposed to accounting book value, which is based on the amount paid for the asset. Following the stock market crash of 1929, discounted cash flow analysis gained popularity as a valuation method for stocks. Irving FisherIrving Fisher

Irving Fisher was an American economist, inventor, and health campaigner, and one of the earliest American neoclassical economists, though his later work on debt deflation often regarded as belonging instead to the Post-Keynesian school.Fisher made important contributions to utility theory and...

in his 1930 book "The Theory of Interest" and John Burr Williams

John Burr Williams

John Burr Williams , one of the first economists to view stock prices as determined by “intrinsic value”, is recognised as a founder and developer of fundamental analysis. He is best known for his 1938 text "The Theory of Investment Value", based on his Ph.D...

's 1938 text 'The Theory of Investment Value' first formally expressed the DCF method in modern economic terms.

Discrete cash flows

The discounted cash flow formula is derived from the future valueFuture value

Future value is the value of an asset at a specific date. It measures the nominal future sum of money that a given sum of money is "worth" at a specified time in the future assuming a certain interest rate, or more generally, rate of return; it is the present value multiplied by the accumulation...

formula for calculating the time value of money

Time value of money

The time value of money is the value of money figuring in a given amount of interest earned over a given amount of time. The time value of money is the central concept in finance theory....

and compounding returns.

Thus the discounted present value (for one cash flow in one future period) is expressed as:

where

- DPV is the discounted present value of the future cash flow (FV), or FV adjusted for the delay in receipt;

- FV is the nominal value of a cash flow amount in a future period;

- i is the interest rate, which reflects the cost of tying up capital and may also allow for the risk that the payment may not be received in full;

- d is the discount rate, which is i/(1+i), i.e. the interest rate expressed as a deduction at the beginning of the year instead of an addition at the end of the year;

- n is the time in years before the future cash flow occurs.

Where multiple cash flows in multiple time periods are discounted, it is necessary to sum them as follows:

for each future cash flow (FV) at any time period (t) in years from the present time, summed over all time periods. The sum can then be used as a net present value

Net present value

In finance, the net present value or net present worth of a time series of cash flows, both incoming and outgoing, is defined as the sum of the present values of the individual cash flows of the same entity...

figure. If the amount to be paid at time 0 (now) for all the future cash flows is known, then that amount can be substituted for DPV and the equation can be solved for i, that is the internal rate of return

Internal rate of return

The internal rate of return is a rate of return used in capital budgeting to measure and compare the profitability of investments. It is also called the discounted cash flow rate of return or the rate of return . In the context of savings and loans the IRR is also called the effective interest rate...

.

All the above assumes that the interest rate remains constant throughout the whole period.

Continuous cash flows

For continuous cash flows, the summation in the above formula is replaced by an integration:

where FV(t) is now the rate of cash flow, and λ = log(1+i).

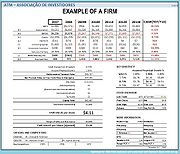

Example DCF

To show how discounted cash flow analysis is performed, consider the following simplified example.- John Doe buys a house for $100,000. Three years later, he expects to be able to sell this house for $150,000.

Simple subtraction suggests that the value of his profit on such a transaction would be $150,000 − $100,000 = $50,000, or 50%. If that $50,000 is amortized

Amortization (business)

In business, amortization refers to spreading payments over multiple periods. The term is used for two separate processes: amortization of loans and amortization of intangible assets.-Amortization of loans:...

over the three years, his implied annual return (known as the internal rate of return

Internal rate of return

The internal rate of return is a rate of return used in capital budgeting to measure and compare the profitability of investments. It is also called the discounted cash flow rate of return or the rate of return . In the context of savings and loans the IRR is also called the effective interest rate...

) would be about 14.5%. Looking at those figures, he might be justified in thinking that the purchase looked like a good idea.

1.1453 x 100000 = 150000 approximately.

However, since three years have passed between the purchase and the sale, any cash flow from the sale must be discounted accordingly. At the time John Doe buys the house, the 3-year US Treasury Note rate is 5% per annum. Treasury Notes are generally considered to be inherently less risky than real estate, since the value of the Note is guaranteed by the US Government and there is a liquid market for the purchase and sale of T-Notes. If he hadn't put his money into buying the house, he could have invested it in the relatively safe T-Notes instead. This 5% per annum can therefore be regarded as the risk-free interest rate

Risk-free interest rate

Risk-free interest rate is the theoretical rate of return of an investment with no risk of financial loss. The risk-free rate represents the interest that an investor would expect from an absolutely risk-free investment over a given period of time....

for the relevant period (3 years).

Using the DPV formula above (FV=$150,000, i=0.05, n=3), that means that the value of $150,000 received in three years actually has a present value

Present value

Present value, also known as present discounted value, is the value on a given date of a future payment or series of future payments, discounted to reflect the time value of money and other factors such as investment risk...

of $129,576 (rounded off). In other words we would need to invest $129,576 in a T-Bond now to get $150,000 in 3 years almost risk free. This is a quantitative way of showing that money in the future is not as valuable as money in the present ($150,000 in 3 years isn't worth the same as $150,000 now; it is worth $129,576 now).

Subtracting the purchase price of the house ($100,000) from the present value

Present value

Present value, also known as present discounted value, is the value on a given date of a future payment or series of future payments, discounted to reflect the time value of money and other factors such as investment risk...

results in the net present value

Net present value

In finance, the net present value or net present worth of a time series of cash flows, both incoming and outgoing, is defined as the sum of the present values of the individual cash flows of the same entity...

of the whole transaction, which would be $29,576 or a little more than 29% of the purchase price.

Another way of looking at the deal as the excess return achieved (over the risk-free rate) is (14.5%-5.0%)/(100%+5%) or approximately 9.0% (still very respectable).

But what about risk?

We assume that the $150,000 is John's best estimate of the sale price that he will be able to achieve in 3 years time (after deducting all expenses, of course). There is of course a lot of uncertainty about house prices, and the outcome may end up higher or lower than this estimate.

(The house John is buying is in a "good neighborhood," but market values have been rising quite a lot lately and the real estate market analysts in the media are talking about a slow-down and higher interest rates. There is a probability that John might not be able to get the full $150,000 he is expecting in three years due to a slowing of price appreciation, or that loss of liquidity in the real estate market might make it very hard for him to sell at all.)

Under normal circumstances, people entering into such transactions are risk-averse, that is to say that they are prepared to accept a lower expected return for the sake of avoiding risk. See Capital asset pricing model

Capital asset pricing model

In finance, the capital asset pricing model is used to determine a theoretically appropriate required rate of return of an asset, if that asset is to be added to an already well-diversified portfolio, given that asset's non-diversifiable risk...

for a further discussion of this. For the sake of the example (and this is a gross simplification), let's assume that he values this particular risk at 5% per annum (we could perform a more precise probabilistic analysis of the risk, but that is beyond the scope of this article). Therefore, allowing for this risk, his expected return is now 9.0% per annum (the arithmetic is the same as above).

And the excess return over the risk-free rate is now (9.0%-5.0%)/(100% + 5%) which comes to approximately 3.8% per annum.

That return rate may seem low, but it is still positive after all of our discounting, suggesting that the investment decision is probably a good one: it produces enough profit to compensate for tying up capital and incurring risk with a little extra left over. When investors and managers perform DCF analysis, the important thing is that the net present value of the decision after discounting all future cash flows at least be positive (more than zero). If it is negative, that means that the investment decision would actually lose money even if it appears to generate a nominal profit. For instance, if the expected sale price of John Doe's house in the example above was not $150,000 in three years, but $130,000 in three years or $150,000 in five years, then on the above assumptions buying the house would actually cause John to lose money in present-value terms (about $3,000 in the first case, and about $8,000 in the second). Similarly, if the house was located in an undesirable neighborhood and the Federal Reserve Bank

Federal Reserve Bank

The twelve Federal Reserve Banks form a major part of the Federal Reserve System, the central banking system of the United States. The twelve federal reserve banks together divide the nation into twelve Federal Reserve Districts, the twelve banking districts created by the Federal Reserve Act of...

was about to raise interest rates by five percentage points, then the risk factor would be a lot higher than 5%: it might not be possible for him to predict a profit in discounted terms even if he thinks he could sell the house for $200,000 in three years.

In this example, only one future cash flow was considered. For a decision which generates multiple cash flows in multiple time periods, all the cash flows must be discounted and then summed into a single net present value

Net present value

In finance, the net present value or net present worth of a time series of cash flows, both incoming and outgoing, is defined as the sum of the present values of the individual cash flows of the same entity...

.

Methods of appraisal of a company or project

This is necessarily a simple treatment of a complex subject: more detail is beyond the scope of this article.For these valuation purposes, a number of different DCF methods are distinguished today, some of which are outlined below. The details are likely to vary depending on the capital structure

Capital structure

In finance, capital structure refers to the way a corporation finances its assets through some combination of equity, debt, or hybrid securities. A firm's capital structure is then the composition or 'structure' of its liabilities. For example, a firm that sells $20 billion in equity and $80...

of the company. However the assumptions used in the appraisal (especially the equity discount rate and the projection of the cash flows to be achieved) are likely to be at least as important as the precise model used.

Both the income stream selected and the associated cost of capital

Cost of capital

The cost of capital is a term used in the field of financial investment to refer to the cost of a company's funds , or, from an investor's point of view "the shareholder's required return on a portfolio of all the company's existing securities"...

model determine the valuation result obtained with each method.

This is one reason these valuation methods are formally referred to as the Discounted Future Economic Income methods.

- Equity-Approach

- Flows to equityFlows to equityThe Flow to Equity-Approach is one of three commonly used discounted-cash-flow methods of corporate valuation, the other two are Adjusted Present Value and Weighted Average Cost of Capital ....

approach (FTE)

- Flows to equity

Discount the cash flows available to the holders of equity capital, after allowing for cost of servicing debt capital

Advantages: Makes explicit allowance for the cost of debt capital

Disadvantages: Requires judgement on choice of discount rate

- Entity-Approach:

- Adjusted present valueAdjusted present valueAdjusted Present Value is a business valuation method. APV is the net present value of a project if financed solely by ownership equity plus the present value of all the benefits of financing...

approach (APV)

- Adjusted present value

Discount the cash flows before allowing for the debt capital (but allowing for the tax relief obtained on the debt capital)

Advantages: Simpler to apply if a specific project is being valued which does not have earmarked debt capital finance

Disadvantages: Requires judgement on choice of discount rate; no explicit allowance for cost of debt capital, which may be much higher than a "risk-free" rate

-

- Weighted average cost of capitalWeighted average cost of capitalThe weighted average cost of capital is the rate that a company is expected to pay on average to all its security holders to finance its assets....

approach (WACC)

- Weighted average cost of capital

Derive a weighted cost of the capital obtained from the various sources and use that discount rate to discount the cash flows from the project

Advantages: Overcomes the requirement for debt capital finance to be earmarked to particular projects

Disadvantages: Care must be exercised in the selection of the appropriate income stream. The net cash flow to total invested capital is the generally accepted choice.

-

- Total cash flow approach (TCF)

This distinction illustrates that the Discounted Cash Flow method can be used to determine the value of various business ownership interests. These can include equity or debt holders.

Alternatively, the method can be used to value the company based on the value of total invested capital. In each case, the differences lie in the choice of the income stream and discount rate. For example, the

net cash flow to total invested capital and WACC are appropriate when valuing a company based on the market value of all invested capital.

Shortcomings

Commercial banks have widely used discounted cash flow as a method of valuing commercial real estate construction projects. This practice has two substantial shortcomings. 1) The discount rate assumption relies on the market for competing investments at the time of the analysis, which would likely change, perhaps dramatically, over time, and 2) straight line assumptions about income increasing over ten years are generally based upon historic increases in market rent but never factors in the cyclical nature of many real estate markets. Most loans are made during boom real estate markets and these markets usually last less than ten years. Using DCF to analyze commercial real estate during any but the early years of a boom market will lead to overvaluation of the asset.Discounted cash flow models are powerful, but they do have shortcomings. DCF is merely a mechanical valuation tool, which makes it subject to the principle "garbage in, garbage out

Garbage In, Garbage Out

Garbage in, garbage out is a phrase in the field of computer science or information and communication technology. It is used primarily to call attention to the fact that computers will unquestioningly process the most nonsensical of input data and produce nonsensical output...

". Small changes in inputs can result in large changes in the value of a company. Instead of trying to project the cash flows to infinity, terminal value techniques are often used. A simple annuity is used to estimate the terminal value past 10 years, for example. This is done because it is harder to come to a realistic estimate of the cash flows as time goes on involves calculating the period of time likely to recoup the initial outlay.

See also

- Adjusted present valueAdjusted present valueAdjusted Present Value is a business valuation method. APV is the net present value of a project if financed solely by ownership equity plus the present value of all the benefits of financing...

- Capital asset pricing modelCapital asset pricing modelIn finance, the capital asset pricing model is used to determine a theoretically appropriate required rate of return of an asset, if that asset is to be added to an already well-diversified portfolio, given that asset's non-diversifiable risk...

- Capital budgetingCapital budgetingCapital budgeting is the planning process used to determine whether an organization's long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are worth pursuing...

- Cost of capitalCost of capitalThe cost of capital is a term used in the field of financial investment to refer to the cost of a company's funds , or, from an investor's point of view "the shareholder's required return on a portfolio of all the company's existing securities"...

- Economic value addedEconomic value addedIn corporate finance, Economic Value Added or EVA, a registered trademark of Stern Stewart & Co., is an estimate of a firm's economic profit – being the value created in excess of the required return of the company's investors . Quite simply, EVA is the profit earned by the firm less the cost of...

- Enterprise valueEnterprise valueEnterprise value , Total enterprise value , or Firm value is an economic measure reflecting the market value of a whole business. It is a sum of claims of all the security-holders: debtholders, preferred shareholders, minority shareholders, common equity holders, and others...

- Internal rate of returnInternal rate of returnThe internal rate of return is a rate of return used in capital budgeting to measure and compare the profitability of investments. It is also called the discounted cash flow rate of return or the rate of return . In the context of savings and loans the IRR is also called the effective interest rate...

- Financial modelingFinancial modelingFinancial modeling is the task of building an abstract representation of a financial decision making situation. This is a mathematical model designed to represent the performance of a financial asset or a portfolio, of a business, a project, or any other investment...

- Flows to equityFlows to equityThe Flow to Equity-Approach is one of three commonly used discounted-cash-flow methods of corporate valuation, the other two are Adjusted Present Value and Weighted Average Cost of Capital ....

- Free cash flowFree cash flowIn corporate finance, free cash flow is cash flow available for distribution among all the securities holders of an organization. They include equity holders, debt holders, preferred stock holders, convertible security holders, and so on....

- Market value addedMarket value addedMarket Value Added is the difference between the current market value of a firm and the capital contributed by investors. If MVA is positive, the firm has added value. If it is negative, the firm has destroyed value...

- Net present valueNet present valueIn finance, the net present value or net present worth of a time series of cash flows, both incoming and outgoing, is defined as the sum of the present values of the individual cash flows of the same entity...

- Time value of moneyTime value of moneyThe time value of money is the value of money figuring in a given amount of interest earned over a given amount of time. The time value of money is the central concept in finance theory....

- Valuation using discounted cash flowsValuation using discounted cash flowsValuation using discounted cash flows is a method for determining the current value of a company using future cash flows adjusted for time value. The future cash flow set is made up of the cash flows within the determined forecast period and a continuing value that represents the cash flow stream...

- Weighted average cost of capitalWeighted average cost of capitalThe weighted average cost of capital is the rate that a company is expected to pay on average to all its security holders to finance its assets....

External links

- Continuous compounding/cash flows

- The Theory of Interest at the Library of Economics and LibertyLibrary of Economics and LibertyThe Library of Economics and Liberty is a free online library of economics books and articles from a libertarian view and is sponsored by the private Liberty Fund.-Content:...

. - Monography about DCF (including some lectures on DCF).

- Foolish Use of DCF. Motley FoolMotley FoolThe Motley Fool is a multimedia financial-services company that provides financial solutions for investors through various stock, investing, and personal finance products. The Alexandria, Virginia-based private company was founded in July 1993 by co-chairmen and brothers David and Tom Gardner, and...

. - Getting Started With Discounted Cash Flows. The StreetThe StreetThe Street may refer to:*The Street , a drama shown on BBC One in 2006, 2007 and 2009*"The Street" , by H. P. Lovecraft*The Street , a 1946 novel by Ann Petry...

. - International Good Practice: Guidance on Project Appraisal Using Discounted Cash Flow, International Federation of AccountantsInternational Federation of AccountantsInternational Federation of Accountants is the global organization for the accountancy profession. IFAC has 164 member and associates in 124 countries and jurisdictions, representing more than 2.5 million accountants employed in public practice, industry and commerce, government, and academe...

, June 2008, ISBN 978-1-934779-39-2 - Equivalence between Discounted Cash Flow (DCF) and Residual Income (RI) Working paper; Duke University - Center for Health Policy, Law and Management

Further reading

- International Association of CPAs, Attorneys, and Management (IACAM) (Free DCF Valuation E-Book Guidebook)