Insurance cycle

Encyclopedia

The tendency to swing between profitable and unprofitable periods over time is commonly known as the underwriting or insurance cycle.

All industries experience cycles of growth and decline, 'boom and bust'. These cycles are particularly important in the insurance and re-insurance

industry as they are especially unpredictable.

Lloyd's of London

research in 2006 revealed, for the second year running, that Lloyd’s underwriters see managing the insurance cycle as the top challenge for the insurance industry, and nearly two-thirds believe that the industry at large is not doing enough to respond to the challenge.

The Insurance Cycle affects all areas of insurance except life insurance

, where there is enough data and a large base of similar risks (i.e. people) to accurately predict claims, and therefore minimise the risk that the cycle poses to business. It is also important that soft market is hard and hard market is soft for reinsurance market.

More recently, insurers have attempted to model the cycle and base their policy pricing and risk exposure accordingly.

The next stage is precipitated by a catastrophe or similar significant loss, for example Hurricane Andrew

or the attacks on the World Trade Center

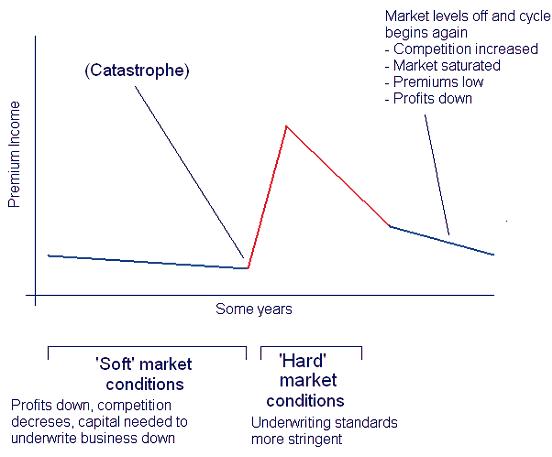

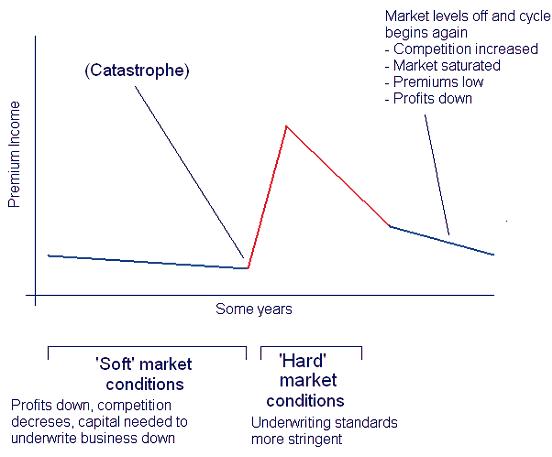

. The graph below shows the effect that these two events had on insurance premiums.

After a major claims burst, less stable companies are driven out of the market which decreases competition. In addition to this, large claims have left even larger companies with less capital. Therefore, premiums rise rapidly. The market hardens, and underwriters are less likely to take on risks.

In turn, this lack of competition and high rates looks suddenly very profitable, and more companies join the market whilst existing business begin to lower rates to compete. This causes a market saturation

and Insurance Cycle begins again.

1. Don’t follow the herd. Insurers need to be prepared to walk away from markets when prices fall below a prudent, risk-based premium.

2. Invest in the latest risk management tools. Insurers must push for continuous improvement of these tools based on the latest science around issues such as climate change

, and make full use of them to communicate their pricing and coverage decisions.

3. Don’t let surplus capital dictate your underwriting. An excess of capital available for underwriting can easily push an insurer to deploy the capital in unsustainable ways, rather than having that capital migrate to other uses such as hedge fund

s and equities, or returning it to shareholders.

4. Don’t be dazzled by higher investment returns. Don’t let higher investment returns replace disciplined underwriting as base rates creep up on both sides of the Atlantic. Notionally, splitting the business into insurance and asset management

operations, and monitoring each separately, is one way to achieve this.

5. Don’t rely on “the big one” to push prices upwards. The spectacular insured loss should not be used as an excuse to raise prices in unrelated lines of business. Regulators, rating agencies, and analysts - not to mention insurance buyers – are increasingly resisting such behaviour.

6. Redeploy capital from lines where margins are unsustainable. There is little that individual insurers can do to alter overall supply-and-demand

conditions. But insurers can set up internal monitoring systems to ensure that they scale back in lines in which margins have become unsustainable and migrate to other lines.

7. Get smarter with underwriter and manager incentives. Incentives for key staff should be structured to reward efficient deployment of capital, linking such rewards to target shareholder returns rather than volume growth.

The Lloyd’s Managing Cycle report has several problems. It focuses on the industry as a whole being able to work together to reduce the effect of market fluctuations. However, this is somewhat unrealistic, as if underwriters do not write business in a soft market (i.e. at cheap prices for the customer), it will be hard to win this business back in a hard market due to loyalty issues.

Rolf Tolle asserts that “There is nothing complex about the cycle. It is about having the courage of your convictions to act with strength.”. Swiss Re argue that instead of ‘beating’ the cycle, insurers should learn to anticipate it’s fluctuations. “Cycle management is essentially proper timing. Monitoring the market, predicting market trends

and accurately assessing prices play an important role”.

Swiss Re

give several examples of potential business strategies. One is to write risks at a roughly fixed rate. This is clearly not practicable as it does not allow for the cyclical nature of the market. Another is to fail to react fast enough to changes in the market, which leaves a company even more exposed. The recommended strategy is one that relies on prediction of the business cycle and setting premiums based on models and experience.

has not heeded the warnings of previous periods. Having said this, the insurance industry as a whole is several hundred years old and has survived several other softening and hardening periods.

What is the Insurance Cycle

Lloyd's Franchise Performance Director Rolf Tolle stated in 2007 that “mitigating the insurance cycle was the “biggest challenge” facing managing agents in the next few years”.All industries experience cycles of growth and decline, 'boom and bust'. These cycles are particularly important in the insurance and re-insurance

Reinsurance

Reinsurance is insurance that is purchased by an insurance company from another insurance company as a means of risk management...

industry as they are especially unpredictable.

Lloyd's of London

Lloyd's of London

Lloyd's, also known as Lloyd's of London, is a British insurance and reinsurance market. It serves as a partially mutualised marketplace where multiple financial backers, underwriters, or members, whether individuals or corporations, come together to pool and spread risk...

research in 2006 revealed, for the second year running, that Lloyd’s underwriters see managing the insurance cycle as the top challenge for the insurance industry, and nearly two-thirds believe that the industry at large is not doing enough to respond to the challenge.

The Insurance Cycle affects all areas of insurance except life insurance

Life insurance

Life insurance is a contract between an insurance policy holder and an insurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of the insured person. Depending on the contract, other events such as terminal illness or critical illness may also trigger...

, where there is enough data and a large base of similar risks (i.e. people) to accurately predict claims, and therefore minimise the risk that the cycle poses to business. It is also important that soft market is hard and hard market is soft for reinsurance market.

History

The insurance cycle is a phenomenon that been recognised since at least the 1920s. Since then it has been considered an insurance 'fact of life'. Most commentators believe that underwriting cycles are inevitable, primarily "because the uncertainty inherent in matching insurance prices to [future] losses creates an environment in which the motivations, ambitions, and fears of a complex cast of characters can play out." Lloyd's counters that this has become “a self-fulfilling prophecy”.More recently, insurers have attempted to model the cycle and base their policy pricing and risk exposure accordingly.

Description of the Cycle

For the sake of argument let's start from a 'soft' period in the cycle, that is a period in which premiums are low, capital base is high and competition is high. Premiums continue to fall as naive insurers offer cover at unrealistic rates, and established businesses are forced to compete or risk losing business in the long term.The next stage is precipitated by a catastrophe or similar significant loss, for example Hurricane Andrew

Hurricane Andrew

Hurricane Andrew was the third Category 5 hurricane to make landfall in the United States, after the Labor Day Hurricane of 1935 and Hurricane Camille in 1969. Andrew was the first named storm and only major hurricane of the otherwise inactive 1992 Atlantic hurricane season...

or the attacks on the World Trade Center

World Trade Center

The original World Trade Center was a complex with seven buildings featuring landmark twin towers in Lower Manhattan, New York City, United States. The complex opened on April 4, 1973, and was destroyed in 2001 during the September 11 attacks. The site is currently being rebuilt with five new...

. The graph below shows the effect that these two events had on insurance premiums.

After a major claims burst, less stable companies are driven out of the market which decreases competition. In addition to this, large claims have left even larger companies with less capital. Therefore, premiums rise rapidly. The market hardens, and underwriters are less likely to take on risks.

In turn, this lack of competition and high rates looks suddenly very profitable, and more companies join the market whilst existing business begin to lower rates to compete. This causes a market saturation

Market saturation

In economics, "market saturation" is a term used to describe a situation in which a product has become diffused within a market; the actual level of saturation can depend on consumer purchasing power; as well as competition, prices, and technology....

and Insurance Cycle begins again.

Dealing with the Insurance Cycle

While many underwriters believe that the cycle is out of their hands, Lloyd’s is trying to push for more proactive management of the ups and downs of the industry. In 2006 they published their ‘Seven Steps’ to managing the insurance cycle:1. Don’t follow the herd. Insurers need to be prepared to walk away from markets when prices fall below a prudent, risk-based premium.

2. Invest in the latest risk management tools. Insurers must push for continuous improvement of these tools based on the latest science around issues such as climate change

Climate change

Climate change is a significant and lasting change in the statistical distribution of weather patterns over periods ranging from decades to millions of years. It may be a change in average weather conditions or the distribution of events around that average...

, and make full use of them to communicate their pricing and coverage decisions.

3. Don’t let surplus capital dictate your underwriting. An excess of capital available for underwriting can easily push an insurer to deploy the capital in unsustainable ways, rather than having that capital migrate to other uses such as hedge fund

Hedge fund

A hedge fund is a private pool of capital actively managed by an investment adviser. Hedge funds are only open for investment to a limited number of accredited or qualified investors who meet criteria set by regulators. These investors can be institutions, such as pension funds, university...

s and equities, or returning it to shareholders.

4. Don’t be dazzled by higher investment returns. Don’t let higher investment returns replace disciplined underwriting as base rates creep up on both sides of the Atlantic. Notionally, splitting the business into insurance and asset management

Investment management

Investment management is the professional management of various securities and assets in order to meet specified investment goals for the benefit of the investors...

operations, and monitoring each separately, is one way to achieve this.

5. Don’t rely on “the big one” to push prices upwards. The spectacular insured loss should not be used as an excuse to raise prices in unrelated lines of business. Regulators, rating agencies, and analysts - not to mention insurance buyers – are increasingly resisting such behaviour.

6. Redeploy capital from lines where margins are unsustainable. There is little that individual insurers can do to alter overall supply-and-demand

Supply and demand

Supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good will vary until it settles at a point where the quantity demanded by consumers will equal the quantity supplied by producers , resulting in an...

conditions. But insurers can set up internal monitoring systems to ensure that they scale back in lines in which margins have become unsustainable and migrate to other lines.

7. Get smarter with underwriter and manager incentives. Incentives for key staff should be structured to reward efficient deployment of capital, linking such rewards to target shareholder returns rather than volume growth.

The Lloyd’s Managing Cycle report has several problems. It focuses on the industry as a whole being able to work together to reduce the effect of market fluctuations. However, this is somewhat unrealistic, as if underwriters do not write business in a soft market (i.e. at cheap prices for the customer), it will be hard to win this business back in a hard market due to loyalty issues.

Rolf Tolle asserts that “There is nothing complex about the cycle. It is about having the courage of your convictions to act with strength.”. Swiss Re argue that instead of ‘beating’ the cycle, insurers should learn to anticipate it’s fluctuations. “Cycle management is essentially proper timing. Monitoring the market, predicting market trends

Market trends

A market trend is a putative tendency of a financial market to move in a particular direction over time. These trends are classified as secular for long time frames, primary for medium time frames, and secondary for short time frames...

and accurately assessing prices play an important role”.

Swiss Re

Swiss Re

Swiss Reinsurance Company Ltd , generally known as Swiss Re, is a Swiss reinsurance company. It is the world’s second-largest reinsurer, after having acquired GE Insurance Solutions. The company has its headquarters in Zurich...

give several examples of potential business strategies. One is to write risks at a roughly fixed rate. This is clearly not practicable as it does not allow for the cyclical nature of the market. Another is to fail to react fast enough to changes in the market, which leaves a company even more exposed. The recommended strategy is one that relies on prediction of the business cycle and setting premiums based on models and experience.

The Future of the Insurance Cycle

The unpredictable nature of the insurance industry makes it very unlikely that the cycle can be eliminated. For several years Lloyd's have been urging caution in soft periods and restraint in hard periods. We are currently entering a soft period of high competition and falling premiums. This suggests that the free marketFree market

A free market is a competitive market where prices are determined by supply and demand. However, the term is also commonly used for markets in which economic intervention and regulation by the state is limited to tax collection, and enforcement of private ownership and contracts...

has not heeded the warnings of previous periods. Having said this, the insurance industry as a whole is several hundred years old and has survived several other softening and hardening periods.