Efficient Frontier

Encyclopedia

Modern portfolio theory

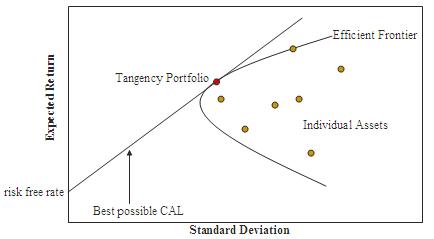

Modern portfolio theory is a theory of investment which attempts to maximize portfolio expected return for a given amount of portfolio risk, or equivalently minimize risk for a given level of expected return, by carefully choosing the proportions of various assets...

introduced by Harry Markowitz

Harry Markowitz

Harry Max Markowitz is an American economist and a recipient of the John von Neumann Theory Prize and the Nobel Memorial Prize in Economic Sciences....

and others. A combination of assets, i.e. a portfolio

Portfolio (finance)

Portfolio is a financial term denoting a collection of investments held by an investment company, hedge fund, financial institution or individual.-Definition:The term portfolio refers to any collection of financial assets such as stocks, bonds and cash...

, is referred to as "efficient" if it has the best possible expected

Expected value

In probability theory, the expected value of a random variable is the weighted average of all possible values that this random variable can take on...

level of return for its level of risk

Risk measure

A Risk measure is used to determine the amount of an asset or set of assets to be kept in reserve. The purpose of this reserve is to make the risks taken by financial institutions, such as banks and insurance companies, acceptable to the regulator...

(usually proxied by the standard deviation

Standard deviation

Standard deviation is a widely used measure of variability or diversity used in statistics and probability theory. It shows how much variation or "dispersion" there is from the average...

of the portfolio's return). Here, every possible combination of risky assets, without including any holdings of the risk-free asset

Risk-free interest rate

Risk-free interest rate is the theoretical rate of return of an investment with no risk of financial loss. The risk-free rate represents the interest that an investor would expect from an absolutely risk-free investment over a given period of time....

, can be plotted in risk-expected return space, and the collection of all such possible portfolios defines a region in this space. The upward-sloped part of the left boundary of this region, a hyperbola

Hyperbola

In mathematics a hyperbola is a curve, specifically a smooth curve that lies in a plane, which can be defined either by its geometric properties or by the kinds of equations for which it is the solution set. A hyperbola has two pieces, called connected components or branches, which are mirror...

, is then called the "efficient frontier". See further under Modern portfolio theory.

The efficient frontier is the positively sloped portion of the opportunity set that offers the highest expected return for a given level of risk. The efficient frontier lies at the top of the opportunity set or the feasible set.