Capital asset pricing model

Encyclopedia

Finance

"Finance" is often defined simply as the management of money or “funds” management Modern finance, however, is a family of business activity that includes the origination, marketing, and management of cash and money surrogates through a variety of capital accounts, instruments, and markets created...

, the capital asset pricing model (CAPM) is used to determine a theoretically appropriate required rate of return

Rate of return

In finance, rate of return , also known as return on investment , rate of profit or sometimes just return, is the ratio of money gained or lost on an investment relative to the amount of money invested. The amount of money gained or lost may be referred to as interest, profit/loss, gain/loss, or...

of an asset

Asset

In financial accounting, assets are economic resources. Anything tangible or intangible that is capable of being owned or controlled to produce value and that is held to have positive economic value is considered an asset...

, if that asset is to be added to an already well-diversified portfolio

Portfolio (finance)

Portfolio is a financial term denoting a collection of investments held by an investment company, hedge fund, financial institution or individual.-Definition:The term portfolio refers to any collection of financial assets such as stocks, bonds and cash...

, given that asset's non-diversifiable

Diversification (finance)

In finance, diversification means reducing risk by investing in a variety of assets. If the asset values do not move up and down in perfect synchrony, a diversified portfolio will have less risk than the weighted average risk of its constituent assets, and often less risk than the least risky of...

risk. The model takes into account the asset's sensitivity to non-diversifiable risk

Risk

Risk is the potential that a chosen action or activity will lead to a loss . The notion implies that a choice having an influence on the outcome exists . Potential losses themselves may also be called "risks"...

(also known as systematic risk

Systematic risk

In finance, systematic risk, sometimes called market risk, aggregate risk, or undiversifiable risk, is the risk associated with aggregate market returns....

or market risk

Market risk

Market risk is the risk that the value of a portfolio, either an investment portfolio or a trading portfolio, will decrease due to the change in value of the market risk factors. The four standard market risk factors are stock prices, interest rates, foreign exchange rates, and commodity prices...

), often represented by the quantity beta (β) in the financial industry, as well as the expected return

Expected return

The expected return is the weighted-average outcome in gambling, probability theory, economics or finance.It isthe average of a probability distribution of possible returns, calculated by using the following formula:...

of the market and the expected return of a theoretical risk-free

Risk-free interest rate

Risk-free interest rate is the theoretical rate of return of an investment with no risk of financial loss. The risk-free rate represents the interest that an investor would expect from an absolutely risk-free investment over a given period of time....

asset.

The model was introduced by Jack Treynor

Jack L. Treynor

Jack L. Treynor is the President of Treynor Capital Management, Palos Verdes Estates, CA. He is a Senior Editor and Advisory Board member of the Journal of Investment Management, and is a Senior Fellow of the Institute for Quantitative Research in Finance...

(1961, 1962), William Sharpe

William Forsyth Sharpe

William Forsyth Sharpe is the STANCO 25 Professor of Finance, Emeritus at Stanford University's Graduate School of Business and the winner of the 1990 Nobel Memorial Prize in Economic Sciences....

(1964), John Lintner

John Lintner

John Virgil Lintner, Jr. was a professor at the Harvard Business School in the 1960s and one of the co-creators of the Capital Asset Pricing Model....

(1965a,b) and Jan Mossin

Jan Mossin

Jan Mossin was a Norwegian economist. Born in Oslo, he graduated with a siv.øk. degree from the Norwegian School of Economics in 1959...

(1966) independently, building on the earlier work of Harry Markowitz

Harry Markowitz

Harry Max Markowitz is an American economist and a recipient of the John von Neumann Theory Prize and the Nobel Memorial Prize in Economic Sciences....

on diversification

Diversification (finance)

In finance, diversification means reducing risk by investing in a variety of assets. If the asset values do not move up and down in perfect synchrony, a diversified portfolio will have less risk than the weighted average risk of its constituent assets, and often less risk than the least risky of...

and modern portfolio theory

Modern portfolio theory

Modern portfolio theory is a theory of investment which attempts to maximize portfolio expected return for a given amount of portfolio risk, or equivalently minimize risk for a given level of expected return, by carefully choosing the proportions of various assets...

. Sharpe, Markowitz and Merton Miller

Merton Miller

Merton Howard Miller was the co-author of the Modigliani-Miller theorem which proposed the irrelevance of debt-equity structure. He shared the Nobel Memorial Prize in Economic Sciences in 1990, along with Harry Markowitz and William Sharpe...

jointly received the Nobel Memorial Prize in Economics

Nobel Memorial Prize in Economic Sciences

The Nobel Memorial Prize in Economic Sciences, commonly referred to as the Nobel Prize in Economics, but officially the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel , is an award for outstanding contributions to the field of economics, generally regarded as one of the...

for this contribution to the field of financial economics

Financial economics

Financial Economics is the branch of economics concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment"....

.

The formula

|

The CAPM is a model for pricing an individual security or a portfolio. For individual securities, we make use of the security market line

Security market line

Security market line is the graphical representation of the Capital asset pricing model. It displays the expected rate of return of an individual security as a function of systematic, non-diversifiable risk .-See also:...

(SML) and its relation to expected return and systematic risk

Systematic risk

In finance, systematic risk, sometimes called market risk, aggregate risk, or undiversifiable risk, is the risk associated with aggregate market returns....

(beta) to show how the market must price individual securities in relation to their security risk class. The SML enables us to calculate the reward-to-risk ratio for any security in relation to that of the overall market. Therefore, when the expected rate of return for any security is deflated by its beta coefficient, the reward-to-risk ratio for any individual security in the market is equal to the market reward-to-risk ratio, thus:

The market reward-to-risk ratio is effectively the market risk premium and by rearranging the above equation and solving for E(Ri), we obtain the Capital Asset Pricing Model (CAPM).

where:

-

is the expected return on the capital asset

is the expected return on the capital asset -

is the risk-free rate of interest such as interest arising from government bonds

is the risk-free rate of interest such as interest arising from government bonds -

(the beta) is the sensitivitySensitivity and specificitySensitivity and specificity are statistical measures of the performance of a binary classification test, also known in statistics as classification function. Sensitivity measures the proportion of actual positives which are correctly identified as such Sensitivity and specificity are statistical...

(the beta) is the sensitivitySensitivity and specificitySensitivity and specificity are statistical measures of the performance of a binary classification test, also known in statistics as classification function. Sensitivity measures the proportion of actual positives which are correctly identified as such Sensitivity and specificity are statistical...

of the expected excess asset returns to the expected excess market returns, or also ,

, -

is the expected return of the market

is the expected return of the market -

is sometimes known as the market premium (the difference between the expected market rate of return and the risk-free rate of return).

is sometimes known as the market premium (the difference between the expected market rate of return and the risk-free rate of return). -

is also known as the risk premium

is also known as the risk premium

Restated, in terms of risk premium, we find that:

which states that the individual risk premium equals the market premium times β.

Note 1: the expected market rate of return is usually estimated by measuring the Geometric Average of the historical returns on a market portfolio (e.g. S&P 500).

Note 2: the risk free rate of return used for determining the risk premium is usually the arithmetic average of historical risk free rates of return and not the current risk free rate of return.

For the full derivation see Modern portfolio theory

Modern portfolio theory

Modern portfolio theory is a theory of investment which attempts to maximize portfolio expected return for a given amount of portfolio risk, or equivalently minimize risk for a given level of expected return, by carefully choosing the proportions of various assets...

.

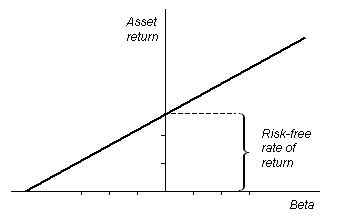

Security market line

The SMLSecurity market line

Security market line is the graphical representation of the Capital asset pricing model. It displays the expected rate of return of an individual security as a function of systematic, non-diversifiable risk .-See also:...

essentially graphs the results from the capital asset pricing model (CAPM) formula. The x-axis represents the risk (beta), and the y-axis represents the expected return. The market risk premium is determined from the slope of the SML.

The relationship between β and required return is plotted on the securities market line (SML) which shows expected return as a function of β. The intercept is the nominal risk-free rate available for the market, while the slope is the market premium, E(Rm)− Rf. The securities market line can be regarded as representing a single-factor model of the asset price, where Beta is exposure to changes in value of the Market. The equation of the SML is thus:

It is a useful tool in determining if an asset being considered for a portfolio offers a reasonable expected return for risk. Individual securities are plotted on the SML graph. If the security's expected return versus risk is plotted above the SML, it is undervalued since the investor can expect a greater return for the inherent risk. And a security plotted below the SML is overvalued since the investor would be accepting less return for the amount of risk assumed.

Asset pricing

Once the expected/required rate of return, , is calculated using CAPM, we can compare this required rate of return to the asset's estimated rate of return over a specific investment horizon to determine whether it would be an appropriate investment. To make this comparison, you need an independent estimate of the return outlook for the security based on either fundamental or technical analysis techniques, including P/E, M/B etc.

, is calculated using CAPM, we can compare this required rate of return to the asset's estimated rate of return over a specific investment horizon to determine whether it would be an appropriate investment. To make this comparison, you need an independent estimate of the return outlook for the security based on either fundamental or technical analysis techniques, including P/E, M/B etc.Assuming that the CAPM is correct, an asset is correctly priced when its estimated price is the same as the present value of future cash flows of the asset, discounted at the rate suggested by CAPM. If the observed price is higher than the CAPM valuation, then the asset is undervalued (and overvalued when the estimated price is below the CAPM valuation). When the asset does not lie on the SML, this could also suggest mis-pricing. Since the expected return of the asset at time

is

is  , a higher expected return than what CAPM suggests indicates that

, a higher expected return than what CAPM suggests indicates that  is too low (the asset is currently undervalued), assuming that at time

is too low (the asset is currently undervalued), assuming that at time  the asset returns to the CAPM suggested price.

the asset returns to the CAPM suggested price.The asset price

using CAPM, sometimes called the certainty equivalent pricing formula, is a linear relationship given by

using CAPM, sometimes called the certainty equivalent pricing formula, is a linear relationship given by

where

is the payoff of the asset or portfolio.

is the payoff of the asset or portfolio.Asset-specific required return

The CAPM returns the asset-appropriate required return or discount rate—i.e. the rate at which future cash flows produced by the asset should be discounted given that asset's relative riskiness. Betas exceeding one signify more than average "riskiness"; betas below one indicate lower than average. Thus, a more risky stock will have a higher beta and will be discounted at a higher rate; less sensitive stocks will have lower betas and be discounted at a lower rate. Given the accepted concave utility function, the CAPM is consistent with intuition—investors (should) require a higher return for holding a more risky asset.Since beta reflects asset-specific sensitivity to non-diversifiable, i.e. market risk

Risk

Risk is the potential that a chosen action or activity will lead to a loss . The notion implies that a choice having an influence on the outcome exists . Potential losses themselves may also be called "risks"...

, the market as a whole, by definition, has a beta of one. Stock market indices are frequently used as local proxies for the market—and in that case (by definition) have a beta of one. An investor in a large, diversified portfolio (such as a mutual fund

Mutual fund

A mutual fund is a professionally managed type of collective investment scheme that pools money from many investors to buy stocks, bonds, short-term money market instruments, and/or other securities.- Overview :...

), therefore, expects performance in line with the market.

Risk and diversification

The risk of a portfolioPortfolio (finance)

Portfolio is a financial term denoting a collection of investments held by an investment company, hedge fund, financial institution or individual.-Definition:The term portfolio refers to any collection of financial assets such as stocks, bonds and cash...

comprises systematic risk

Systematic risk

In finance, systematic risk, sometimes called market risk, aggregate risk, or undiversifiable risk, is the risk associated with aggregate market returns....

, also known as undiversifiable risk, and unsystematic risk which is also known as idiosyncratic risk or diversifiable risk. Systematic risk refers to the risk common to all securities—i.e. market risk

Market risk

Market risk is the risk that the value of a portfolio, either an investment portfolio or a trading portfolio, will decrease due to the change in value of the market risk factors. The four standard market risk factors are stock prices, interest rates, foreign exchange rates, and commodity prices...

. Unsystematic risk is the risk associated with individual assets. Unsystematic risk can be diversified

Diversification (finance)

In finance, diversification means reducing risk by investing in a variety of assets. If the asset values do not move up and down in perfect synchrony, a diversified portfolio will have less risk than the weighted average risk of its constituent assets, and often less risk than the least risky of...

away to smaller levels by including a greater number of assets in the portfolio (specific risks "average out"). The same is not possible for systematic risk within one market. Depending on the market, a portfolio of approximately 30-40 securities in developed markets such as UK or US will render the portfolio sufficiently diversified such that risk exposure is limited to systematic risk only. In developing markets a larger number is required, due to the higher asset volatilities.

A rational investor should not take on any diversifiable risk, as only non-diversifiable risks are rewarded within the scope of this model. Therefore, the required return

Return on investment

Return on investment is one way of considering profits in relation to capital invested. Return on assets , return on net assets , return on capital and return on invested capital are similar measures with variations on how “investment” is defined.Marketing not only influences net profits but also...

on an asset, that is, the return that compensates for risk taken, must be linked to its riskiness in a portfolio context—i.e. its contribution to overall portfolio riskiness—as opposed to its "stand alone riskiness." In the CAPM context, portfolio risk is represented by higher variance

Variance

In probability theory and statistics, the variance is a measure of how far a set of numbers is spread out. It is one of several descriptors of a probability distribution, describing how far the numbers lie from the mean . In particular, the variance is one of the moments of a distribution...

i.e. less predictability. In other words the beta of the portfolio is the defining factor in rewarding the systematic exposure taken by an investor.

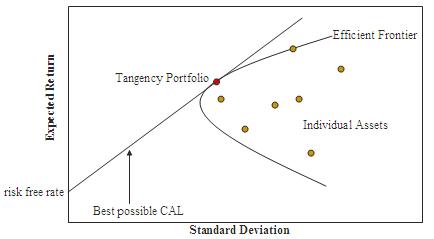

The efficient frontier

Infinite divisibility

The concept of infinite divisibility arises in different ways in philosophy, physics, economics, order theory , and probability theory...

). All such optimal portfolios, i.e., one for each level of return, comprise the efficient frontier.

Because the unsystematic risk is diversifiable

Diversification (finance)

In finance, diversification means reducing risk by investing in a variety of assets. If the asset values do not move up and down in perfect synchrony, a diversified portfolio will have less risk than the weighted average risk of its constituent assets, and often less risk than the least risky of...

, the total risk of a portfolio can be viewed as beta

Beta coefficient

In finance, the Beta of a stock or portfolio is a number describing the relation of its returns with those of the financial market as a whole.An asset has a Beta of zero if its returns change independently of changes in the market's returns...

.

The market portfolio

An investor might choose to invest a proportion of his or her wealth in a portfolio of risky assets with the remainder in cash—earning interest at the risk free rate (or indeed may borrow money to fund his or her purchase of risky assets in which case there is a negative cash weighting). Here, the ratio of risky assets to risk free asset does not determine overall return—this relationship is clearly linear. It is thus possible to achieve a particular return in one of two ways:- By investing all of one's wealth in a risky portfolio,

- or by investing a proportion in a risky portfolio and the remainder in cash (either borrowed or invested).

For a given level of return, however, only one of these portfolios will be optimal (in the sense of lowest risk). Since the risk free asset is, by definition, uncorrelated

Correlation

In statistics, dependence refers to any statistical relationship between two random variables or two sets of data. Correlation refers to any of a broad class of statistical relationships involving dependence....

with any other asset, option 2 will generally have the lower variance and hence be the more efficient of the two.

This relationship also holds for portfolios along the efficient frontier: a higher return portfolio plus cash is more efficient than a lower return portfolio alone for that lower level of return. For a given risk free rate, there is only one optimal portfolio which can be combined with cash to achieve the lowest level of risk for any possible return. This is the market portfolio

Market portfolio

Market portfolio is a portfolio consisting of a weighted sum of every asset in the market, with weights in the proportions that they exist in the market, with the necessary assumption that these assets are infinitely divisible....

.

Assumptions of CAPM

All investors:- Aim to maximize economic utilities.

- Are rational and risk-averse.

- Are broadly diversified across a range of investments.

- Are price takers, i.e., they cannot influence prices.

- Can lend and borrow unlimited amounts under the risk free rate of interest.

- Trade without transaction or taxation costs.

- Deal with securities that are all highly divisible into small parcels.

- Assume all information is available at the same time to all investors.

Further, the model assumes that standard deviation of past returns is a perfect proxy for the future risk associated with a given security.

Problems of CAPM

- The model assumes that either asset returns are (jointly) normally distributed random variableRandom variableIn probability and statistics, a random variable or stochastic variable is, roughly speaking, a variable whose value results from a measurement on some type of random process. Formally, it is a function from a probability space, typically to the real numbers, which is measurable functionmeasurable...

s or that active and potential shareholders employ a quadratic form of utility. It is, however, frequently observed that returns in equity and other markets are not normally distributed. As a result, large swings (3 to 6 standard deviations from the mean) occur in the market more frequently than the normal distribution assumption would expect. - The model assumes that the variance of returns is an adequate measurement of risk. This might be justified under the assumption of normally distributed returns, but for general return distributions other risk measures (like coherent risk measureCoherent risk measureIn the field of financial economics there are a number of ways that risk can be defined; to clarify the concept theoreticians have described a number of properties that a risk measure might or might not have...

s) will likely reflect the active and potential shareholders' preferences more adequately. Indeed risk in financial investments is not variance in itself, rather it is the probability of losing: it is asymmetric in nature. - The model assumes that all active and potential shareholders have access to the same information and agree about the risk and expected return of all assets (homogeneous expectations assumption).

- The model assumes that the probability beliefs of active and potential shareholders match the true distribution of returns. A different possibility is that active and potential shareholders' expectations are biased, causing market prices to be informationally inefficient. This possibility is studied in the field of behavioral financeBehavioral financeBehavioral economics and its related area of study, behavioral finance, use social, cognitive and emotional factors in understanding the economic decisions of individuals and institutions performing economic functions, including consumers, borrowers and investors, and their effects on market...

, which uses psychological assumptions to provide alternatives to the CAPM such as the overconfidence-based asset pricing model of Kent Daniel, David HirshleiferDavid HirshleiferDavid Hirshleifer is a prominent American economist. He is a professor of finance and currently holds the Merage chair in Business Growth at the University of California at Irvine. He previously held tenured positions at the University of Michigan, The Ohio State University, and UCLA. His work...

, and Avanidhar Subrahmanyam (2001). - The model does not appear to adequately explain the variation in stock returns. Empirical studies show that low beta stocks may offer higher returns than the model would predict. Some data to this effect was presented as early as a 1969 conference in Buffalo, New YorkBuffalo, New YorkBuffalo is the second most populous city in the state of New York, after New York City. Located in Western New York on the eastern shores of Lake Erie and at the head of the Niagara River across from Fort Erie, Ontario, Buffalo is the seat of Erie County and the principal city of the...

in a paper by Fischer BlackFischer BlackFischer Sheffey Black was an American economist, best known as one of the authors of the famous Black–Scholes equation.-Background:...

, Michael JensenMichael JensenMichael Cole "Mike" Jensen is an American economist working in the area of financial economics. He is currently the managing director in charge of organizational strategy at Monitor Group, a strategy consulting firm, and the Jesse Isidor Straus Professor of Business Administration, Emeritus at...

, and Myron ScholesMyron ScholesMyron Samuel Scholes is a Canadian-born American financial economist who is best known as one of the authors of the Black–Scholes equation. In 1997 he was awarded the Nobel Memorial Prize in Economic Sciences for a method to determine the value of derivatives...

. Either that fact is itself rational (which saves the efficient-market hypothesis but makes CAPM wrong), or it is irrational (which saves CAPM, but makes the EMH wrong – indeed, this possibility makes volatility arbitrageVolatility arbitrageIn finance, volatility arbitrage is a type of statistical arbitrage that is implemented by trading a delta neutral portfolio of an option and its underlier. The objective is to take advantage of differences between the implied volatility of the option, and a forecast of future realized volatility...

a strategy for reliably beating the market). - The model assumes that given a certain expected return, active and potential shareholders will prefer lower risk (lower variance) to higher risk and conversely given a certain level of risk will prefer higher returns to lower ones. It does not allow for active and potential shareholders who will accept lower returns for higher risk. Casino gamblers pay to take on more risk, and it is possible that some stock traders will pay for risk as well.

- The model assumes that there are no taxes or transaction costs, although this assumption may be relaxed with more complicated versions of the model.

- The market portfolio consists of all assets in all markets, where each asset is weighted by its market capitalization. This assumes no preference between markets and assets for individual active and potential shareholders, and that active and potential shareholders choose assets solely as a function of their risk-return profile. It also assumes that all assets are infinitely divisible as to the amount which may be held or transacted.

- The market portfolio should in theory include all types of assets that are held by anyone as an investment (including works of art, real estate, human capital...) In practice, such a market portfolio is unobservable and people usually substitute a stock index as a proxy for the true market portfolio. Unfortunately, it has been shown that this substitution is not innocuous and can lead to false inferences as to the validity of the CAPM, and it has been said that due to the inobservability of the true market portfolio, the CAPM might not be empirically testable. This was presented in greater depth in a paper by Richard RollRichard RollRichard Roll is an American economist, best known for his work on portfolio theory and asset pricing, both theoretical and empirical....

in 1977, and is generally referred to as Roll's critique. - The model assumes just two dates, so that there is no opportunity to consume and rebalance portfolios repeatedly over time. The basic insights of the model are extended and generalized in the intertemporal CAPM (ICAPM) of Robert Merton, and the consumption CAPM (CCAPM) of Douglas Breeden and Mark Rubinstein.

- CAPM assumes that all active and potential shareholders will consider all of their assets and optimize one portfolio. This is in sharp contradiction with portfolios that are held by individual shareholders: humans tend to have fragmented portfolios or, rather, multiple portfolios: for each goal one portfolio — see behavioral portfolio theoryBehavioral portfolio theoryBehavioral portfolio theory was published by Shefrin and Statman. This theory essentially tries to provide a contrast to the fact that the ultimate motivation for investors is the maximization of the value of their portfolios...

and Maslowian Portfolio TheoryMaslowian Portfolio TheoryMaslowian Portfolio Theory creates a normative portfolio theory based on human needs as described by Abraham Maslow. It is in general agreement with behavioral portfolio theory, and is explained in Maslowian Portfolio Theory: An alternative formulation of the Behavioural Portfolio Theory, and was...

.

See also

- Arbitrage pricing theoryArbitrage pricing theoryIn finance, arbitrage pricing theory is a general theory of asset pricing that holds that the expected return of a financial asset can be modeled as a linear function of various macro-economic factors or theoretical market indices, where sensitivity to changes in each factor is represented by a...

(APT) - Consumption betaConsumption betaIn finance, consumption beta refers to a concept in an asset pricing model where the reward-to-risk ratio of an asset is dependent not on its sensitivity to overall market risk, as it is in the classical Capital Asset Pricing Model, but rather on its sensitivity to overall aggregate consumption....

(C-CAPM) - Efficient market hypothesisEfficient market hypothesisIn finance, the efficient-market hypothesis asserts that financial markets are "informationally efficient". That is, one cannot consistently achieve returns in excess of average market returns on a risk-adjusted basis, given the information available at the time the investment is made.There are...

- Fama–French three-factor model

- Hamada's equationHamada's EquationIn corporate finance, Hamada’s equation, named after Professor Robert Hamada, is used to separate the financial risk of a levered firm from its business risk. The equation combines the Modigliani-Miller theorem with the capital asset pricing model...

- ICAPM

- Modern portfolio theoryModern portfolio theoryModern portfolio theory is a theory of investment which attempts to maximize portfolio expected return for a given amount of portfolio risk, or equivalently minimize risk for a given level of expected return, by carefully choosing the proportions of various assets...

- RiskRiskRisk is the potential that a chosen action or activity will lead to a loss . The notion implies that a choice having an influence on the outcome exists . Potential losses themselves may also be called "risks"...

- Risk management toolsRisk management toolsRisk Management is a non-intuitive field of study, where the most simple of models consist of a probability multiplied by an impact. Even understanding individual risks is difficult as multiple probabilities can contribute to Risk total probability, and impacts can be "units" of cost, time, events...

- Roll's critique

- Valuation (finance)Valuation (finance)In finance, valuation is the process of estimating what something is worth. Items that are usually valued are a financial asset or liability. Valuations can be done on assets or on liabilities...