Caemi

Encyclopedia

Caemi Mineração e Metalurgia S.A. was a major Brazil

ian mining holding company

that ceased to exist in December 2006 after it was merged into Vale

. Caemi means Companhia Auxiliar de Empresas de Mineração.

, and kaolin mines in the northern states of Amapá

and Pará

. The company also owned a stake in MRS Logística, which owns a railway network in southeastern Brazil. Caemi's stock was traded on Bovespa

.

in 1965. MBR since 1971 had been the second biggest iron ore producer in Brazil

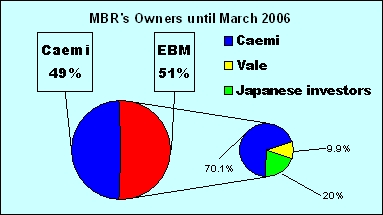

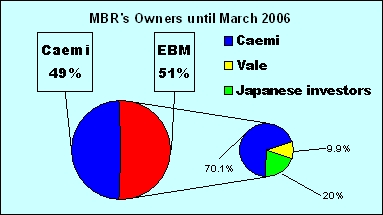

, mining in 2005 over 50 million tonnes of iron ore or around 25% of Brazilian production. MBR until Vale acquired 100% of Caemi's capital in 2006 was owned by two companies: Caemi and EBM (Empreendimentos Brasileiros de Mineração S.A.). Caemi had a 49% stake at MBR while EBM owned the other 51% of the company. The problem is that Caemi also owned 70.1% of EBM, this fact brings Caemi's total stake at MBR to 84.75%. Caemi's 84.75% participation at MBR is recognized at the company's 2005 Annual Report, which was Caemi's last.

MBR until Vale acquired 100% of Caemi's capital in 2006 was owned by two companies: Caemi and EBM (Empreendimentos Brasileiros de Mineração S.A.). Caemi had a 49% stake at MBR while EBM owned the other 51% of the company. The problem is that Caemi also owned 70.1% of EBM, this fact brings Caemi's total stake at MBR to 84.75%. Caemi's 84.75% participation at MBR is recognized at the company's 2005 Annual Report, which was Caemi's last.

EBM, besides Caemi had two other investors:

bought 100% of Caemi, Vale's stake at MBR reached 89.8%, that's because Vale became the owner of Caemi's 84.75% stake at MBR and Vale already indirectly owned 5.05% of MBR through its 9.9% stake at EBM.

This meant that Vale had only to acquire the remaining 20% of EBM at the hands of the japan

ese investors in order to become owner of 100% of MBR. This objective was achieved on May 2007 when Vale bought for $231 million 6.25% of EBM from the Japanese investors and simultaneously leased the 13.75% left from the japan

ese group in exhange for a down payment

of $60.5 million and annual fee of $48.1 million for the next 30 years. Vale now owns 100% of MBR.

company Vale

bought between 2001 and 2006 100% of Caemi's capital for a total cost of $3.2 billion.

Back in 2001 Vale

bought for $278.7 million 16.82% of Caemi's capital then in 2003 Vale

purchased Mitsui

's participation on Caemi for $426.4 million, raising Vale

's participation to 60.2% of Caemi's total capital.

Finally on March 31, 2006 Vale

purchased the remaining 39.8% of Caemi's capital in a stock swap

deal worth $2.5 billion. In May the company's shares stopped being negotiated at Bovespa

and then in December Caemi was merged into Vale

and ceased to exist.

Brazil

Brazil , officially the Federative Republic of Brazil , is the largest country in South America. It is the world's fifth largest country, both by geographical area and by population with over 192 million people...

ian mining holding company

Holding company

A holding company is a company or firm that owns other companies' outstanding stock. It usually refers to a company which does not produce goods or services itself; rather, its purpose is to own shares of other companies. Holding companies allow the reduction of risk for the owners and can allow...

that ceased to exist in December 2006 after it was merged into Vale

Companhia Vale do Rio Doce

Vale S.A. Vale S.A. Vale S.A. (BM&F Bovespa: / , / , / , / , is an Brazilian diversified mining multinational corporation and one of the largest logistics operators in Brazil. In addition to being the second-largest mining company in the world, Vale is also the largest producer of iron ore,...

. Caemi means Companhia Auxiliar de Empresas de Mineração.

Operations

The company owned iron ore mines in the so-called Iron Quadrangle region of the state of Minas GeraisMinas Gerais

Minas Gerais is one of the 26 states of Brazil, of which it is the second most populous, the third richest, and the fourth largest in area. Minas Gerais is the Brazilian state with the largest number of Presidents of Brazil, the current one, Dilma Rousseff, being one of them. The capital is the...

, and kaolin mines in the northern states of Amapá

Amapá

Amapá is one of the states of Brazil, located in the extreme north, bordering French Guiana and Suriname to the north. To the east is the Atlantic Ocean, and to the south and west is the Brazilian state of Pará. Perhaps one of the main features of the state is the River Oiapoque, as it was once...

and Pará

Pará

Pará is a state in the north of Brazil. It borders the Brazilian states of Amapá, Maranhão, Tocantins, Mato Grosso, Amazonas and Roraima. To the northwest it also borders Guyana and Suriname, and to the northeast it borders the Atlantic Ocean. The capital is Belém.Pará is the most populous state...

. The company also owned a stake in MRS Logística, which owns a railway network in southeastern Brazil. Caemi's stock was traded on Bovespa

Bovespa

The BM&FBOVESPA is a stock exchange located at São Paulo, Brazil. As of December 31, 2010 it had a market capitalization of US $1.54 Trillion, making it one of the largest in the world. On May 8, 2008, the São Paulo Stock Exchange and the Brazilian Mercantile and Futures Exchange merged,...

.

MBR - Minerações Brasileiras Reunidas

Caemi started MBR in a partnership with M. A. Hanna CompanyM. A. Hanna Company

M. A. Hanna Company was an iron ore processing company located in Cleveland, Ohio, United States.-Origin:The origins of the M. A. Hanna Co. are with Daniel F. Rhodes. In the 1840s Rhodes had founded Rhodes & Company which mined coal in the Mahoning Valley. Marcus Hanna, the national Republican...

in 1965. MBR since 1971 had been the second biggest iron ore producer in Brazil

Brazil

Brazil , officially the Federative Republic of Brazil , is the largest country in South America. It is the world's fifth largest country, both by geographical area and by population with over 192 million people...

, mining in 2005 over 50 million tonnes of iron ore or around 25% of Brazilian production.

EBM, besides Caemi had two other investors:

- ValeCompanhia Vale do Rio DoceVale S.A. Vale S.A. Vale S.A. (BM&F Bovespa: / , / , / , / , is an Brazilian diversified mining multinational corporation and one of the largest logistics operators in Brazil. In addition to being the second-largest mining company in the world, Vale is also the largest producer of iron ore,...

owned 9.9% of EBM since 2001, participation which was purchased from Bethlehem SteelBethlehem SteelThe Bethlehem Steel Corporation , based in Bethlehem, Pennsylvania, was once the second-largest steel producer in the United States, after Pittsburgh, Pennsylvania-based U.S. Steel. After a decline in the U.S... - Japanese investors owned the remaining 20% of EBM and in this group were included the following companies: MitsuiMitsuiis one of the largest corporate conglomerates in Japan and one of the largest publicly traded companies in the world.-History:Founded by Mitsui Takatoshi , who was the fourth son of a shopkeeper in Matsusaka, in what is now today's Mie prefecture...

, Nisshin Steel, Nippon SteelNippon Steel, also referred to as , was formed in 1970. Nippon Steel Corporation is the world's 4th largest steel producer by volume.-Early years:Nippon Steel was created by the merger of two giants, Yawata Iron & Steel and Fuji Iron & Steel...

, Mitsubishi CorporationMitsubishi Corporationis Japan's largest trading company , a member of the Mitsubishi keiretsu. Mitsubishi Corporation employs over 50,000 people and has seven business segments including finance, banking, energy, machinery, chemicals, food and more....

, JFE Steel, ItochuITOCHU, until 1992 "C. Itoh" in English, is a Japanese general trading concern based in Umeda, Kita-ku, Osaka and Aoyama, Minato, Tokyo. It has a common origin with Marubeni Corporation. Itochu is a Fortune 500 company.-History:...

, Sumitomo Group, MarubeniMarubeniis a Japanese trading company, one of the largest general trading companies in Japan.-Offices:*Head Office - 4-2, Otemachi 1-chome, Chiyoda, Tokyo, Japan*Head Office -20-6, Shiba 5-chome, Minato, Tokyo, Japan...

and Kobe SteelKobe Steel, operating worldwide under the brand Kobelco, is a major Japanese steel manufacturer headquartered in Chuo-ku, Kobe. Kobe Steel also has a stake in Osaka Titanium Technologies.It was formed on September 1, 1905...

.

Vale acquires MBR

After ValeCompanhia Vale do Rio Doce

Vale S.A. Vale S.A. Vale S.A. (BM&F Bovespa: / , / , / , / , is an Brazilian diversified mining multinational corporation and one of the largest logistics operators in Brazil. In addition to being the second-largest mining company in the world, Vale is also the largest producer of iron ore,...

bought 100% of Caemi, Vale's stake at MBR reached 89.8%, that's because Vale became the owner of Caemi's 84.75% stake at MBR and Vale already indirectly owned 5.05% of MBR through its 9.9% stake at EBM.

This meant that Vale had only to acquire the remaining 20% of EBM at the hands of the japan

Japan

Japan is an island nation in East Asia. Located in the Pacific Ocean, it lies to the east of the Sea of Japan, China, North Korea, South Korea and Russia, stretching from the Sea of Okhotsk in the north to the East China Sea and Taiwan in the south...

ese investors in order to become owner of 100% of MBR. This objective was achieved on May 2007 when Vale bought for $231 million 6.25% of EBM from the Japanese investors and simultaneously leased the 13.75% left from the japan

Japan

Japan is an island nation in East Asia. Located in the Pacific Ocean, it lies to the east of the Sea of Japan, China, North Korea, South Korea and Russia, stretching from the Sea of Okhotsk in the north to the East China Sea and Taiwan in the south...

ese group in exhange for a down payment

Down payment

Down payment is a payment used in the context of the purchase of expensive items such as a car and a house, whereby the payment is the initial upfront portion of the total amount due and it is usually given in cash at the time of finalizing the transaction.A loan is then required to make the full...

of $60.5 million and annual fee of $48.1 million for the next 30 years. Vale now owns 100% of MBR.

Vale acquires Caemi

The miningMining

Mining is the extraction of valuable minerals or other geological materials from the earth, from an ore body, vein or seam. The term also includes the removal of soil. Materials recovered by mining include base metals, precious metals, iron, uranium, coal, diamonds, limestone, oil shale, rock...

company Vale

Companhia Vale do Rio Doce

Vale S.A. Vale S.A. Vale S.A. (BM&F Bovespa: / , / , / , / , is an Brazilian diversified mining multinational corporation and one of the largest logistics operators in Brazil. In addition to being the second-largest mining company in the world, Vale is also the largest producer of iron ore,...

bought between 2001 and 2006 100% of Caemi's capital for a total cost of $3.2 billion.

Back in 2001 Vale

Companhia Vale do Rio Doce

Vale S.A. Vale S.A. Vale S.A. (BM&F Bovespa: / , / , / , / , is an Brazilian diversified mining multinational corporation and one of the largest logistics operators in Brazil. In addition to being the second-largest mining company in the world, Vale is also the largest producer of iron ore,...

bought for $278.7 million 16.82% of Caemi's capital then in 2003 Vale

Companhia Vale do Rio Doce

Vale S.A. Vale S.A. Vale S.A. (BM&F Bovespa: / , / , / , / , is an Brazilian diversified mining multinational corporation and one of the largest logistics operators in Brazil. In addition to being the second-largest mining company in the world, Vale is also the largest producer of iron ore,...

purchased Mitsui

Mitsui

is one of the largest corporate conglomerates in Japan and one of the largest publicly traded companies in the world.-History:Founded by Mitsui Takatoshi , who was the fourth son of a shopkeeper in Matsusaka, in what is now today's Mie prefecture...

's participation on Caemi for $426.4 million, raising Vale

Companhia Vale do Rio Doce

Vale S.A. Vale S.A. Vale S.A. (BM&F Bovespa: / , / , / , / , is an Brazilian diversified mining multinational corporation and one of the largest logistics operators in Brazil. In addition to being the second-largest mining company in the world, Vale is also the largest producer of iron ore,...

's participation to 60.2% of Caemi's total capital.

Finally on March 31, 2006 Vale

Companhia Vale do Rio Doce

Vale S.A. Vale S.A. Vale S.A. (BM&F Bovespa: / , / , / , / , is an Brazilian diversified mining multinational corporation and one of the largest logistics operators in Brazil. In addition to being the second-largest mining company in the world, Vale is also the largest producer of iron ore,...

purchased the remaining 39.8% of Caemi's capital in a stock swap

Stock swap

A stock swap, also known as a share swap, is a business takeover or acquisition in which the acquiring company uses its own stock to pay for the acquired company. Each shareholder of the newly acquired company receives a certain number of shares of the acquiring company's stock for each share of...

deal worth $2.5 billion. In May the company's shares stopped being negotiated at Bovespa

Bovespa

The BM&FBOVESPA is a stock exchange located at São Paulo, Brazil. As of December 31, 2010 it had a market capitalization of US $1.54 Trillion, making it one of the largest in the world. On May 8, 2008, the São Paulo Stock Exchange and the Brazilian Mercantile and Futures Exchange merged,...

and then in December Caemi was merged into Vale

Companhia Vale do Rio Doce

Vale S.A. Vale S.A. Vale S.A. (BM&F Bovespa: / , / , / , / , is an Brazilian diversified mining multinational corporation and one of the largest logistics operators in Brazil. In addition to being the second-largest mining company in the world, Vale is also the largest producer of iron ore,...

and ceased to exist.