Biopure

Encyclopedia

Biopure Corporation was a biopharmaceutical company that specialized in oxygen therapeutics for both human and veterinary use. The company developed, manufactured, and marketed blood substitutes which are designed to imitate the oxygen-carrying function of actual blood without the complications associated with transfusion of human donated blood

. The oxygen

technology uses hemoglobin-based oxygen carrying molecules in solution (HBOCs) to increase oxygen transfer to the tissues. The competing companies with Biopure are Allied Pharmaceutical, Northfield Laboratories, Baxter International

and Hemosol of Toronto. The company developed two products: Hemopure

(HBOC-1)[hemoglogin glutamer-250 (bovine)] for human use, and Oxyglobin

(HBOC-301)[hemoglobin glutamer-200 (bovine)] for veterinary use. As of April 2001, Hemopure was approved for commercial sale in South Africa for treatment of acute anemia in general surgery. However, Hemopure has not been able to gain approval in the U.K. or the U.S. because of safety and reliability concerns of the European Commission and the U.S. Food and Drug Administration (FDA) respectively. The company formed an agreement with the U.S. Navy to aid in preclinical testing of Hemopure for out-of-hospital treatment of trauma patients in hemorrhagic shock. Oxyglobin is the only oxygen therapeutic approved for treatment of canine anemia

in both Europe and the U.S. and has treated thousands of cases. Unable to obtain FDA approval for Hemopure to date, Biopure expected "to cease operations and sell the Company or its assets" by July 31, 2009. On July 16, 2009 Biopure announced it had filed for Chapter 11 Bankruptcy and entered into an agreement with OPK Biotech LLC for the sale of substantially all of its assets .

In Hemopure, the average oxygen content is maximized due to the reduced size of the stabilized HBOC molecules in comparison to red blood cells (RBCs). Oxyglobin primarily differs from Hemopure in molecule size of the stabilized HBOC. Oxyglobin is approved for oxygen fluid therapy and an alternative to RBC transfusion in dogs, and is administered intravenously as well. The stabilized HBOC then flows through the blood plasma

in the body, where oxygen transport takes place. Due to the reduced size of the HBOC in Hemopure, oxygen can be transported to restricted areas where normal RBCs fail to reach. Another advantage of this patented oxygen technology is the increased shelf life of 36 months through storage conditions at room temperature, while RBCs must be refrigerated and must be discarded after six weeks. However, these products are only indicated for temporary oxygen replenishment through the oxygen bridge, with an average half-life of 19 hours (specifically Hemopure), therefore long term oxygen support requires RBC blood transfusion.

(dark color feces) can also occur. Dogs with impaired cardiac function and other conditions that are prediposed to circulatory overload can have adverse events after Oxyglobin administration. Repeat administration requires careful monitoring.

In contrast, its Oxyglobin product enjoyed a fairly steady strategy, as Biopure consistently marketed the product mostly to small animal veterinarians. Unfortunately the small market size made turning a profit, especially ex-US, difficult.

had approved Oxyglobin for the treatment for anemic dogs. By April 2001, South Africa’s Medicine Control Council approved Hemopure for treatment of surgical patients who are acutely anemic, to help generate revenue for the company. However, Biopure’s global commercialization strategy of marketing Hemopure in the US and European countries was still in its infant stages. During this time, Hemopure was still in Phase III and the company faced many challenges over this period of time. With the IPO of stock in 2001, Biopure was prepared to revolutionize the oxygen therapeutic industry with Hemopure. The company was ready to scale up manufacturing with the impending approval of Hemopure. In December 2002, the company was also looking to add a large scale manufacturing facility that would produce 500,000 Hemopure units a year (2003 Biopure 10-K). Majority of the employees of the company were in the manufacturing department and was a one of the biggest cost to the company. By 2003, the company had to reduce the workforce to cut cost since Hemopure status was in a standstill in Phase III.

Biopure was forced into a position to continue raising money to fund the clinical trials in a variety of indications in hopes of getting Hemopure onto the market. Many of the clinical trials results were being revealed and in April 2003, the FDA put on a hold of a proposed clinical trial on Hemopure for the use in trauma patients in the hospital setting. The company did not disclose that their clinical trial was on hold to the public and tried to go for an in-hospital trauma trial designation as a separate investigational new drug

Biopure was forced into a position to continue raising money to fund the clinical trials in a variety of indications in hopes of getting Hemopure onto the market. Many of the clinical trials results were being revealed and in April 2003, the FDA put on a hold of a proposed clinical trial on Hemopure for the use in trauma patients in the hospital setting. The company did not disclose that their clinical trial was on hold to the public and tried to go for an in-hospital trauma trial designation as a separate investigational new drug

application(INDA) from the pending biologic license application

(BLA) for orthopedic surgery

indication. In July 2003, the FDA did not approve Hemopure for orthopedic surgery and had major concerns about the materials submitted to support the BLA and safety issues. In August 2003, Biopure announces to the street through public statements that the FDA was favorable and caused the stock to go up 20%. The company continued with its misleading statements and was able to raise $35 million by December 2003 from the sales of common stock. Information was leaked about the incomplete and misleading documents between late October and end of December 2003, which led to the stock to drop by 66% from the August 1, 2003 stock price.

The people indicted were: Thomas Moore, the former CEO, for making and approving misleading statements; Howard Richman, the former head of regulatory, did the same as Moore; and Kober, member of the General Counsel, for the drafting and approving misleading statements. The charge is for violating Section 17(a) of the Securities Act of 1933

and Section 10(b) of the Securities Exchange Act of 1934

("Exchange Act") and Rule 10b-5 thereunder and with directly or indirectly violating Section 13(a) of the Exchange Act and Rules 12b-20, 13a-1, 13a-11 and 13a-13 thereunder, and charges Moore with violating Rule 13a-14 thereunder. The Commission is seeking injunctive relief, civil penalties, and an order barring Moore, Richman and Kober from serving as officers or directors of any public company.

In April 2008, the Journal of the American Medical Association

(JAMA) published a paper "Cell-Free Hemoglobin

-Based Blood Substitutes

and Risk of Myocardial Infarction

and Death," which grouped clinical trials of Biopure, Baxter

, Hemosol Biopharma, Northfield Laboratories, and Sangart and argued that these clinical trials should have been stopped. The FDA received data from individual studies that demonstrated increasing risk and should have led to terminations of trials. The paper revealed that several artificial blood products increased the risk of death by 30% and almost tripled the risk of heart attacks in 16 clinical trials. The current rule is that the agency has the right to keep the information of new products confidential for competitive reasons. The JAMA paper wants Congress to review this policy for the safety of the public. Biopure refutes these findings and has been active in defending their position. On Biopure’s website, they have a section dedicated to commenting on the JAMA article.

On July 14, 2008, it was then published in the Wall Street Journal, that the National Institutes of Health

(NIH) investigator who was the lead author of the JAMA paper did not disclose the conflict of interest. Charles Natanson stated in the paper that he did receive a one-time fee of $10,000 from a blood substitute company, but did not reveal that he was a co-inventor on a patent for a competing technology from the NIH that could make the product safer. The patent is for the use of reducing the toxicity of blood substitute and the NIH has been looking to license the technology. Peers of Natanson still believe that his study was valid and went through a rigorous process. In September 2008, Howard Richman, the former head of regulatory affairs and under SEC investigation, was charged for obstruction of justice. The story behind this was that Richman allegedly forged a doctor’s letter about having been diagnosed with terminal colon cancer and had his lawyer defend him with this health condition. The judge stopped litigation by the end of 2007. A new indictment was charged for lying and if convicted faces 10 years in jail.

On March 11, 2009 Howard Richman pled guilty in U.S. District Court and admitted he had instructed his lawyers to tell a judge he was gravely ill with colon cancer. He also admitted to posing as his doctor in a phone call with his lawyer so that she would tell the judge that his cancer had spread and that he was undergoing chemotherapy. Richman faces up to 10 years in prison at sentencing, scheduled for June 10. There is no plea agreement.

By the end of November, 2008 Biopure Corp. had terminated all but four of its employees and "shut down its manufacturing facility in Cambridge and its processing facility in Pennsylvania". In the first quarter of 2009, it sold "substantially all of its inventory of Oxyglobin to distributors". Biopure "expects to cease operations and sell the Company or its assets" by July 31, 2009 .

Placing the company at the forefront, Biopure was at a disadvantage in proceeding into the animal market as well as the civilian and military markets. The animal market overseas had revenues of $278,000 in fiscal 2006, which means that they were basically breaking even from the venture. Although this gains exposure to the markets overseas, they would have benefitted in putting their resources toward the main markets in the United States where the market size was the largest. In the United States market Oxyglobin revenues were nearly $1 million in 2006, triple of the German and United Kingdom combined markets.

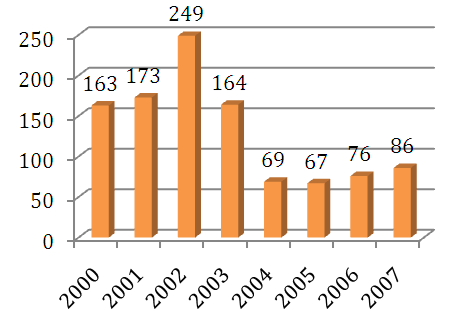

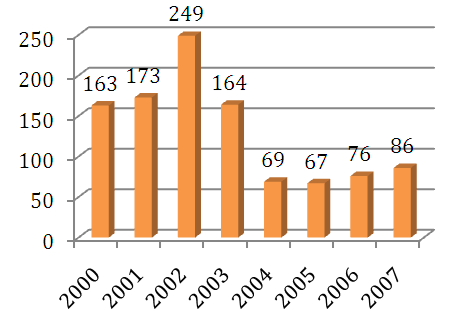

Scaling up before Biopure’s flagship product was approved in 2003 was a critical blow to its finances. This proved to be very costly to the company because it increased employees a total of 173 in 2001, to 249 in 2002. The burn rate increased significantly over this time, and subsequently, the workforce was decreased to 164 in 2003 as the Hemopure

Phase III trial was in a deadlock. Waiting for the clinical trial to receive approval or scaling up a few months ahead of time would have been a better option.

Ethical concerns plagued the company throughout its history. If the company would have disclosed information about the FDA concerns, instead of misleading the investors repeatedly, they would have more creditability. This directly relates to more investors willing to provide capital in a time when the company is struggling to survive. Not only did the some of the key management (CEO, former regulatory head, and general counselor) get indicted for misleading statements, these members would no longer be able to serve any public company.

The first signs of significantly increased risk of heart attack found through clinical trials should have been a warning sign to deter the start of several other trials. If Biopure had ethical concerns over the patients they were enrolling, they would have stopped the proliferation of these trials. If they put the patients they are caring for before the stock price, the deaths could have been avoided and Biopure would have been seen as a reliable company.

Blood

Blood is a specialized bodily fluid in animals that delivers necessary substances such as nutrients and oxygen to the cells and transports metabolic waste products away from those same cells....

. The oxygen

Oxygen

Oxygen is the element with atomic number 8 and represented by the symbol O. Its name derives from the Greek roots ὀξύς and -γενής , because at the time of naming, it was mistakenly thought that all acids required oxygen in their composition...

technology uses hemoglobin-based oxygen carrying molecules in solution (HBOCs) to increase oxygen transfer to the tissues. The competing companies with Biopure are Allied Pharmaceutical, Northfield Laboratories, Baxter International

Baxter International

Baxter International Inc. , is an American health care company with headquarters in Deerfield, Illinois. The company primarily focuses on products to treat hemophilia, kidney disease, immune disorders and other chronic and acute medical conditions...

and Hemosol of Toronto. The company developed two products: Hemopure

Hemopure

Hemopure, developed by Biopure , is an hemoglobin-based oxygen carrier based on chemically stabilized bovine hemoglobin. It has been developed for potential use in humans as an oxygen delivering bridge in cases when blood is not available or is not an option...

(HBOC-1)

Oxyglobin

Similar to Hemopure, Oxyglobin is also developed by Biopure and is an oxygen-therapeutic based on chemically stabilized bovine hemoglobin. However, unlike Hemopure, which is for human use, Oxyglobin is intended for the veterinary market, and is used to treat anemia in dogs...

(HBOC-301)

Anemia

Anemia is a decrease in number of red blood cells or less than the normal quantity of hemoglobin in the blood. However, it can include decreased oxygen-binding ability of each hemoglobin molecule due to deformity or lack in numerical development as in some other types of hemoglobin...

in both Europe and the U.S. and has treated thousands of cases. Unable to obtain FDA approval for Hemopure to date, Biopure expected "to cease operations and sell the Company or its assets" by July 31, 2009. On July 16, 2009 Biopure announced it had filed for Chapter 11 Bankruptcy and entered into an agreement with OPK Biotech LLC for the sale of substantially all of its assets .

Technology and lead products

As of October 31, 2007 the company holds 28 patents relating to its oxygen therapeutics. Their patented and proprietary oxygen technology utilizes blood from cattle to develop the "hemoglobin-based" blood substitute rather than blood from humans. Most importantly, the issue of blood type matching is eliminated due to the "universal" nature of this blood substitute. The products are administered intravenously to deliver oxygen to the body's tissue through the formulated composition of purified hemoglobin from cattle blood and a balanced salt solution.In Hemopure, the average oxygen content is maximized due to the reduced size of the stabilized HBOC molecules in comparison to red blood cells (RBCs). Oxyglobin primarily differs from Hemopure in molecule size of the stabilized HBOC. Oxyglobin is approved for oxygen fluid therapy and an alternative to RBC transfusion in dogs, and is administered intravenously as well. The stabilized HBOC then flows through the blood plasma

Blood plasma

Blood plasma is the straw-colored liquid component of blood in which the blood cells in whole blood are normally suspended. It makes up about 55% of the total blood volume. It is the intravascular fluid part of extracellular fluid...

in the body, where oxygen transport takes place. Due to the reduced size of the HBOC in Hemopure, oxygen can be transported to restricted areas where normal RBCs fail to reach. Another advantage of this patented oxygen technology is the increased shelf life of 36 months through storage conditions at room temperature, while RBCs must be refrigerated and must be discarded after six weeks. However, these products are only indicated for temporary oxygen replenishment through the oxygen bridge, with an average half-life of 19 hours (specifically Hemopure), therefore long term oxygen support requires RBC blood transfusion.

Side effects

According to clinical trails with Hemopure, the following adverse events occurred at greater than or equal to 5%: transient yellow skin discoloration, nausea, mild to moderate increase in blood pressure (10 to 20 mm/Hg), vomiting, low urine output, difficulty swallowing, flatulence, and low red blood cell count. The use of Oxyglobin has shown the following common side effects: discoloration of the skin, mucous membranes and urine. Adverse events such as vomiting and melenaMelena

In medicine, melena or melaena refers to the black, "tarry" feces that are associated with gastrointestinal hemorrhage. The black color is caused by oxidation of the iron in hemoglobin during its passage through the ileum and colon.-Melena vs...

(dark color feces) can also occur. Dogs with impaired cardiac function and other conditions that are prediposed to circulatory overload can have adverse events after Oxyglobin administration. Repeat administration requires careful monitoring.

Senior management

| Name | Title |

| Zafiris G. Zafirelis | Chairman, President and CEO |

| Jane Kober | Senior Vice President, General Counsel and Secretary |

| A. Gerson Greenburg | Vice President, Medical Affairs |

| W. Richard Light | Vice President, Technology Development |

| Virginia T. Rentko | Vice President, Preclinical Development |

| Barry L. Scott | Vice President, Business Development |

Product strategy

For Hemopure, Biopure took a long time to establish which medical indication upon which to focus the majority of its attention. This can be seen through its filings with the U.S. Securities and Exchange Commission (SEC), as the company changed Hemopure’s marketing and approval strategies over the seven years that the company was publicly traded.In contrast, its Oxyglobin product enjoyed a fairly steady strategy, as Biopure consistently marketed the product mostly to small animal veterinarians. Unfortunately the small market size made turning a profit, especially ex-US, difficult.

Challenges at Biopure

With such a promising technology, Biopure was faced with many issues that have led to the company’s current condition. By 1999, the US FDA and European CommissionEuropean Commission

The European Commission is the executive body of the European Union. The body is responsible for proposing legislation, implementing decisions, upholding the Union's treaties and the general day-to-day running of the Union....

had approved Oxyglobin for the treatment for anemic dogs. By April 2001, South Africa’s Medicine Control Council approved Hemopure for treatment of surgical patients who are acutely anemic, to help generate revenue for the company. However, Biopure’s global commercialization strategy of marketing Hemopure in the US and European countries was still in its infant stages. During this time, Hemopure was still in Phase III and the company faced many challenges over this period of time. With the IPO of stock in 2001, Biopure was prepared to revolutionize the oxygen therapeutic industry with Hemopure. The company was ready to scale up manufacturing with the impending approval of Hemopure. In December 2002, the company was also looking to add a large scale manufacturing facility that would produce 500,000 Hemopure units a year (2003 Biopure 10-K). Majority of the employees of the company were in the manufacturing department and was a one of the biggest cost to the company. By 2003, the company had to reduce the workforce to cut cost since Hemopure status was in a standstill in Phase III.

Investigational New Drug

The United States Food and Drug Administration's Investigational New Drug program is the means by which a pharmaceutical company obtains permission to ship an experimental drug across state lines before a marketing application for the drug has been approved...

application(INDA) from the pending biologic license application

Biologic License Application

As defined by the US FDA, a Biologic License Application is: Biological products are approved for marketing under the provisions of the Public Health Service Act. The Act requires a firm who manufactures a biologic for sale in interstate commerce to hold a license for the product...

(BLA) for orthopedic surgery

Orthopedic surgery

Orthopedic surgery or orthopedics is the branch of surgery concerned with conditions involving the musculoskeletal system...

indication. In July 2003, the FDA did not approve Hemopure for orthopedic surgery and had major concerns about the materials submitted to support the BLA and safety issues. In August 2003, Biopure announces to the street through public statements that the FDA was favorable and caused the stock to go up 20%. The company continued with its misleading statements and was able to raise $35 million by December 2003 from the sales of common stock. Information was leaked about the incomplete and misleading documents between late October and end of December 2003, which led to the stock to drop by 66% from the August 1, 2003 stock price.

The people indicted were: Thomas Moore, the former CEO, for making and approving misleading statements; Howard Richman, the former head of regulatory, did the same as Moore; and Kober, member of the General Counsel, for the drafting and approving misleading statements. The charge is for violating Section 17(a) of the Securities Act of 1933

Securities Act of 1933

Congress enacted the Securities Act of 1933 , in the aftermath of the stock market crash of 1929 and during the ensuing Great Depression...

and Section 10(b) of the Securities Exchange Act of 1934

Securities Exchange Act of 1934

The Securities Exchange Act of 1934 , , codified at et seq., is a law governing the secondary trading of securities in the United States of America. It was a sweeping piece of legislation...

("Exchange Act") and Rule 10b-5 thereunder and with directly or indirectly violating Section 13(a) of the Exchange Act and Rules 12b-20, 13a-1, 13a-11 and 13a-13 thereunder, and charges Moore with violating Rule 13a-14 thereunder. The Commission is seeking injunctive relief, civil penalties, and an order barring Moore, Richman and Kober from serving as officers or directors of any public company.

In April 2008, the Journal of the American Medical Association

Journal of the American Medical Association

The Journal of the American Medical Association is a weekly, peer-reviewed, medical journal, published by the American Medical Association. Beginning in July 2011, the editor in chief will be Howard C. Bauchner, vice chairman of pediatrics at Boston University’s School of Medicine, replacing ...

(JAMA) published a paper "Cell-Free Hemoglobin

Hemoglobin

Hemoglobin is the iron-containing oxygen-transport metalloprotein in the red blood cells of all vertebrates, with the exception of the fish family Channichthyidae, as well as the tissues of some invertebrates...

-Based Blood Substitutes

Blood substitutes

A blood substitute is a substance used to mimic and fulfill some functions of biological blood, usually in the oxygen-carrying sense...

and Risk of Myocardial Infarction

Myocardial infarction

Myocardial infarction or acute myocardial infarction , commonly known as a heart attack, results from the interruption of blood supply to a part of the heart, causing heart cells to die...

and Death," which grouped clinical trials of Biopure, Baxter

Baxter International

Baxter International Inc. , is an American health care company with headquarters in Deerfield, Illinois. The company primarily focuses on products to treat hemophilia, kidney disease, immune disorders and other chronic and acute medical conditions...

, Hemosol Biopharma, Northfield Laboratories, and Sangart and argued that these clinical trials should have been stopped. The FDA received data from individual studies that demonstrated increasing risk and should have led to terminations of trials. The paper revealed that several artificial blood products increased the risk of death by 30% and almost tripled the risk of heart attacks in 16 clinical trials. The current rule is that the agency has the right to keep the information of new products confidential for competitive reasons. The JAMA paper wants Congress to review this policy for the safety of the public. Biopure refutes these findings and has been active in defending their position. On Biopure’s website, they have a section dedicated to commenting on the JAMA article.

On July 14, 2008, it was then published in the Wall Street Journal, that the National Institutes of Health

National Institutes of Health

The National Institutes of Health are an agency of the United States Department of Health and Human Services and are the primary agency of the United States government responsible for biomedical and health-related research. Its science and engineering counterpart is the National Science Foundation...

(NIH) investigator who was the lead author of the JAMA paper did not disclose the conflict of interest. Charles Natanson stated in the paper that he did receive a one-time fee of $10,000 from a blood substitute company, but did not reveal that he was a co-inventor on a patent for a competing technology from the NIH that could make the product safer. The patent is for the use of reducing the toxicity of blood substitute and the NIH has been looking to license the technology. Peers of Natanson still believe that his study was valid and went through a rigorous process. In September 2008, Howard Richman, the former head of regulatory affairs and under SEC investigation, was charged for obstruction of justice. The story behind this was that Richman allegedly forged a doctor’s letter about having been diagnosed with terminal colon cancer and had his lawyer defend him with this health condition. The judge stopped litigation by the end of 2007. A new indictment was charged for lying and if convicted faces 10 years in jail.

On March 11, 2009 Howard Richman pled guilty in U.S. District Court and admitted he had instructed his lawyers to tell a judge he was gravely ill with colon cancer. He also admitted to posing as his doctor in a phone call with his lawyer so that she would tell the judge that his cancer had spread and that he was undergoing chemotherapy. Richman faces up to 10 years in prison at sentencing, scheduled for June 10. There is no plea agreement.

By the end of November, 2008 Biopure Corp. had terminated all but four of its employees and "shut down its manufacturing facility in Cambridge and its processing facility in Pennsylvania". In the first quarter of 2009, it sold "substantially all of its inventory of Oxyglobin to distributors". Biopure "expects to cease operations and sell the Company or its assets" by July 31, 2009 .

Alternatives

Biopure’s quick entry into the international market deem disastrous to the company because it did not have the proper knowledge or resources to pursue that particular segment. As a startup company trying to harness the power of operating cash flow profitability, Hemopure should have targeted the markets in which they had a better regulatory grasp. For example, in 2006 they wanted to go into the European orthopedic surgery, without pursuing the United States market. Too many clinical trials for several different indications were a result of too much ambition in [Hemopure products before proven efficacy. They needed to assess the market segments in which they had the best chance of gaining a foothold in approval. Once and if approval occurs, the tone would be set, and it would have been easier to start trials and gain approval in other segments. Currently, Hemopure is still not approved in either Europe or the United States.Placing the company at the forefront, Biopure was at a disadvantage in proceeding into the animal market as well as the civilian and military markets. The animal market overseas had revenues of $278,000 in fiscal 2006, which means that they were basically breaking even from the venture. Although this gains exposure to the markets overseas, they would have benefitted in putting their resources toward the main markets in the United States where the market size was the largest. In the United States market Oxyglobin revenues were nearly $1 million in 2006, triple of the German and United Kingdom combined markets.

Scaling up before Biopure’s flagship product was approved in 2003 was a critical blow to its finances. This proved to be very costly to the company because it increased employees a total of 173 in 2001, to 249 in 2002. The burn rate increased significantly over this time, and subsequently, the workforce was decreased to 164 in 2003 as the Hemopure

Hemopure

Hemopure, developed by Biopure , is an hemoglobin-based oxygen carrier based on chemically stabilized bovine hemoglobin. It has been developed for potential use in humans as an oxygen delivering bridge in cases when blood is not available or is not an option...

Phase III trial was in a deadlock. Waiting for the clinical trial to receive approval or scaling up a few months ahead of time would have been a better option.

Ethical concerns plagued the company throughout its history. If the company would have disclosed information about the FDA concerns, instead of misleading the investors repeatedly, they would have more creditability. This directly relates to more investors willing to provide capital in a time when the company is struggling to survive. Not only did the some of the key management (CEO, former regulatory head, and general counselor) get indicted for misleading statements, these members would no longer be able to serve any public company.

The first signs of significantly increased risk of heart attack found through clinical trials should have been a warning sign to deter the start of several other trials. If Biopure had ethical concerns over the patients they were enrolling, they would have stopped the proliferation of these trials. If they put the patients they are caring for before the stock price, the deaths could have been avoided and Biopure would have been seen as a reliable company.